Long Take: Is Finance asking *interesting* questions? Exploring startups, industries, and the nature of work.

Hi Fintech futurists --

This week, we look at:

What it means to ask questions and find answers

From asking simple questions that result in neobanks and roboadvisors. Who will win — Schwab or Robinhood?

To asking macro questions about the finance / high-tech competition. Who will win — Goldman Sachs or Google?

To asking profound questions about the nature of the work, and the art of finding your own questions.

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.

Long Take

In a moment of complete political and global upheaval, is Finance asking any interesting questions? Are we capable of anything truly profound?

We scan the news every week to see what is happening next. We spend hours, days, months, and years building frameworks and laying the pipes. We dedicate our careers, personal stress, and anxiety to this slice of human activity.

Maybe this week is slow for news. Maybe the shadow of the Trump/Biden debate is too long.

Maybe the tenor of the US/China tech war is too loud.

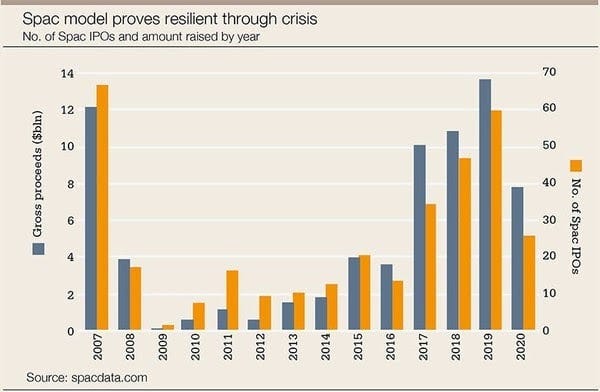

Maybe the stock market and the crypto market and the private markets and the SPAC markets are too overheated.

Maybe its COVID. It's all moving at crazy pace of course. There are hundreds of things happening that could be the anchor for a weekly write up.

Asking the Obvious Questions

But for some reason, it seems like too much of the same thing. And the reason for that is fairly straightforward. What we are witnessing in the industry is an evolving set of answers to a set of embedded questions. The questions we chose to answer will be responsible for the answers that we get. The questions we ignore -- or think are outside the bounds of our "work" -- those questions will go quietly into the night.

For example, a simple question might be -- how can banks help regular people save for retirement? If you ask that question through the financial system, as a vector of thought amongst the multitude, you get this answer in the shape of robo-advisors.

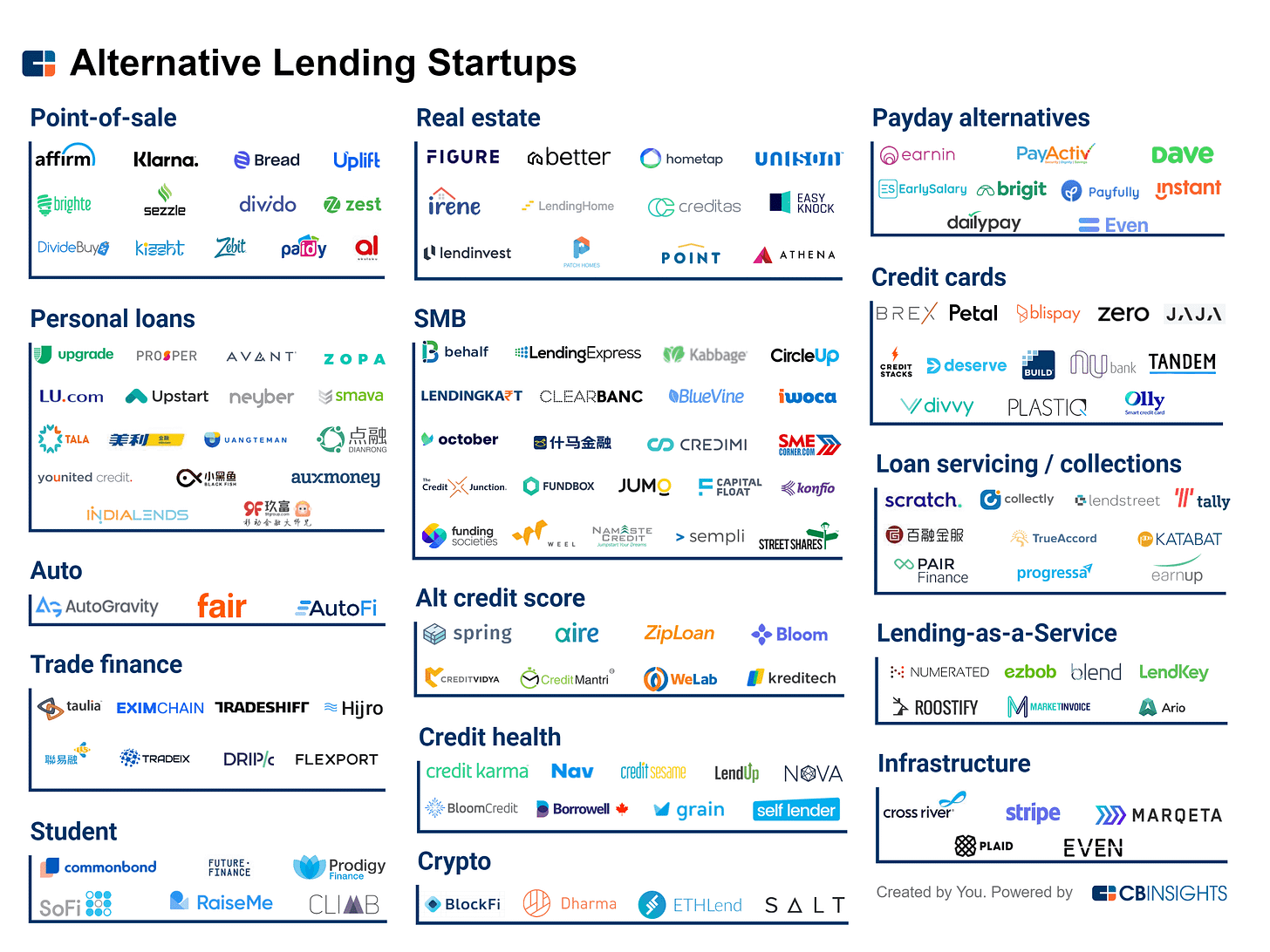

You might ask another simple question -- given that most people don't have very much saved up, how can they afford the lifestyle their parents had? And the financial system, spliced with the tech start-up world, will generate for you a plethora of digital lenders.

You can keep asking these questions, and getting these sets of logo-based answers. Given that people have little in savings and low political power, but are very tech savvy, how can they generate financial assets? Crypto assets, and crypto capital markets. Given that small businesses are run by the same people that have personal financial apps, what tools can be replicated for SMEs? Various neobanks, lenders, payments companies. Given a rise in global labor markets and the difference in national financial systems, how should moneys travel between individuals and their families? Payment technologies and KYC/AML startups. And so on. The problems and questions we ask are the mana for the answers we see.

Asking the Second Order Questions

There are a set of more interesting, second order questions we can ask.

For example, what is the emerging frontier of financial service technology? What is being made that is novel and new? That question brings us to the platform shifts that the high-tech sector generated for finance to play in. Those platforms shifts are the technology vectors of cloud and software-as-a-service, artificial intelligence, blockchain, and augmented reality. To answer the question of how such platform shifts re-package our industry, we have to engage with the technology themes themselves.

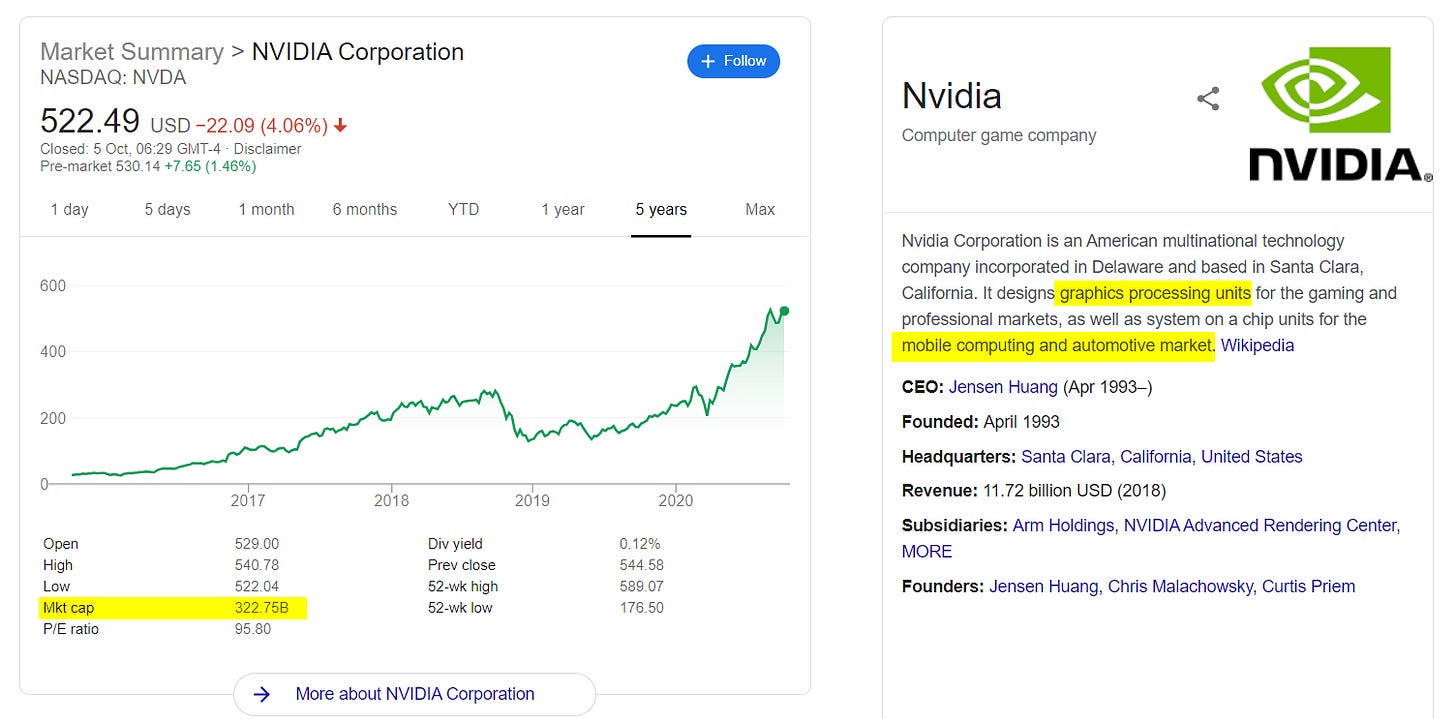

Take AI. Why is machine learning taking hold now? Sufficient processing power in graphics chips, and big data from the web. What kind of problems can it solve that could not be solved before? Generating human intuition mathematically from large structured data sets. Which applications in finance map to such problems? Fraud, trading, underwriting, client experience. What are the second order implications for the industry? A loss in operating performance against AI-native companies composed primarily of technologists and mathematicians.

We have to churn through the platform questions. For example, many finance practitioners don't think that virtual and augmented reality is worth understanding. It is with the same disinterest that banks looked at the Internet and the mobile phone. Rather, they should be trying to understand the Tencent strategy, and why it is invested both in the software companies that create virtual worlds, as well as one of the largest chat-enabled payments processors in the world.

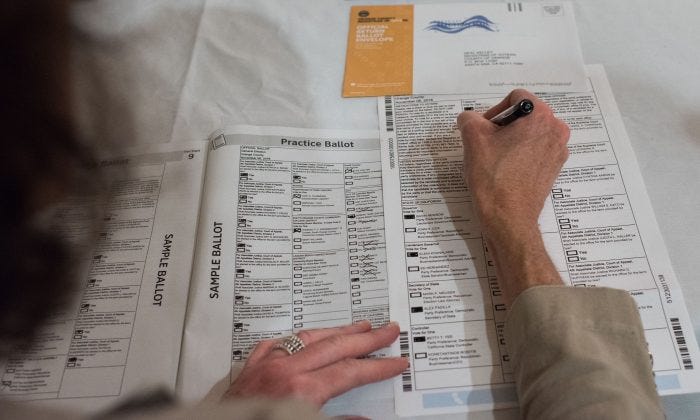

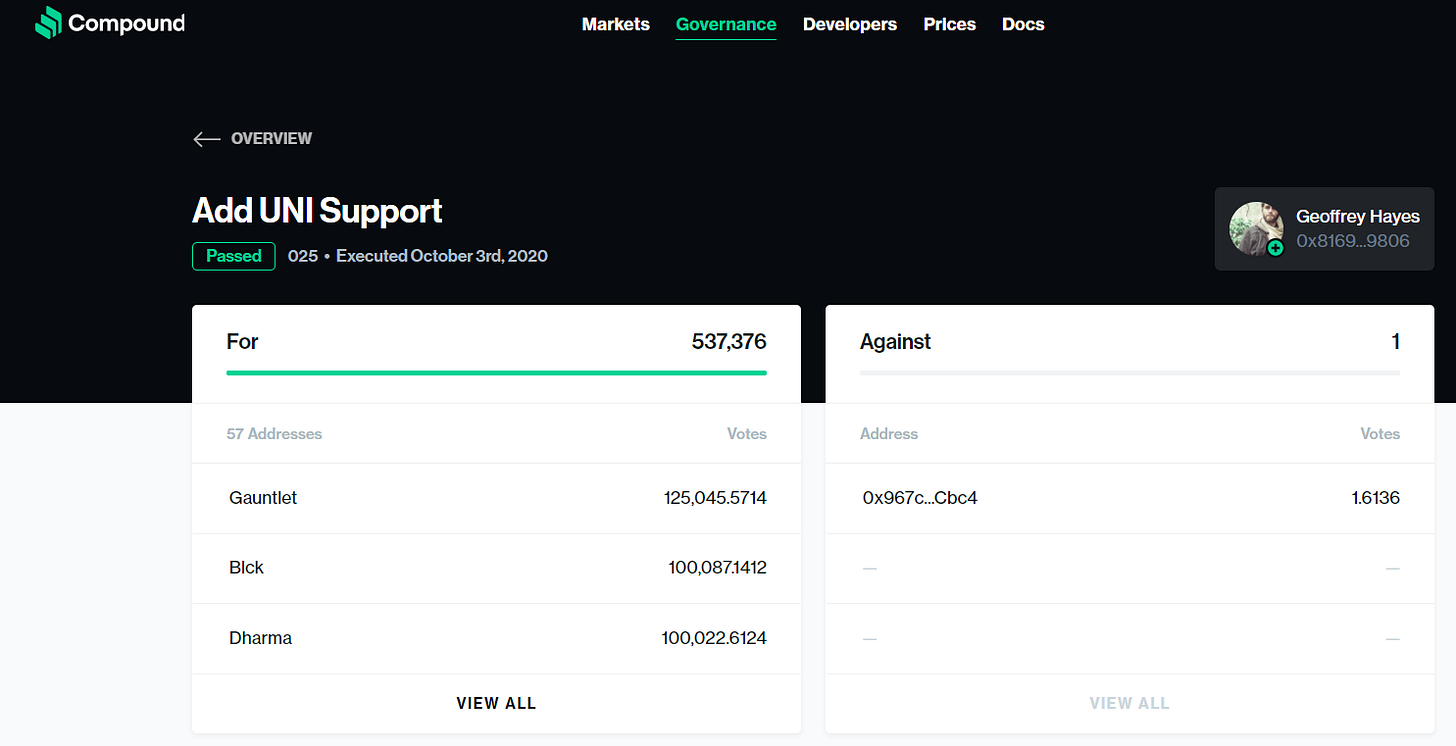

Similarly, we need to parse through enterprise blockchain and decentralized finance to get to some truth of what the underlying innovation looks like. Moving past the speculation and asset classes, past Crypto-Twitter and the Internet's popularity games, we get to a financial infrastructure for decentralized autonomous organizations. We find a chassis to run both an economy and a polity on a software, and a fit-for-purpose money that travels along with it. In a world of mail-in-ballots to save the American election from a process break-down, a DAO feels like a saving grace.

We also find all of the faults and breaks that come from trying to reconcile one would with another. We find the CFTC going after BitMEX for operating an unregistered derivatives exchange through a series of shell companies. We find the SEC going after KIK for its now irrelevant Initial Coin Offering, raising capital that will never results in a transformative financial messenger.

We find Facebook, China, and the European Central Bank looking right back at us with CBDCs on their mind.

It helps to ask these frontier questions. They are fun. They are hard. They are engaging. What they lack, however, is a relation to the lived experience of most people and companies. By focusing on the slice of life which is just the edge change, we miss what is happening to what was there before.

Asking the Macro Questions

Knowing what we do about both the directed point-solutions against particular use-case problems, and the broader phase changes of the economy, we can start answering the types of questions that macro thinkers find compelling.

For example, will the banks, or more broadly the financial incumbents, beat the Fintechs? Generally yes, by capturing them through corporate venture capital and copying their best features. See Schwab, Goldman, and BlackRock. But the ones they don't beat will become technology companies and attention platforms, and end up unassailable. Thus Monzo is not an existential danger, but Transferwise is.

What are the follow-on effects of this battle? One effect is the destruction of financial services revenue pool through over-competition, i.e., the over-supply of commodity services, which will render venture capital returns negative and wipe out a number of business models. See Robinhood, and the impact the company has had on transforming American stock brokerage into mere information sold to market makers as order flow. This reveals that cash equities are a spread business, not a commission-based one.

What are the follow-on effects of that? Venture investors that bet heavily on Fintech 1.0 will have spent billions on brand building, and need a way to monetize non-economic holdings. Expect a number of IPOs and SPACs that find ways to pay out private investors while collapsing on public investors. Expect players like SoftBank to take increasingly deranged and strange positions, like spending $10 billion on levered options invested in Apple, Alphabet, Facebook, and the other tech giants.

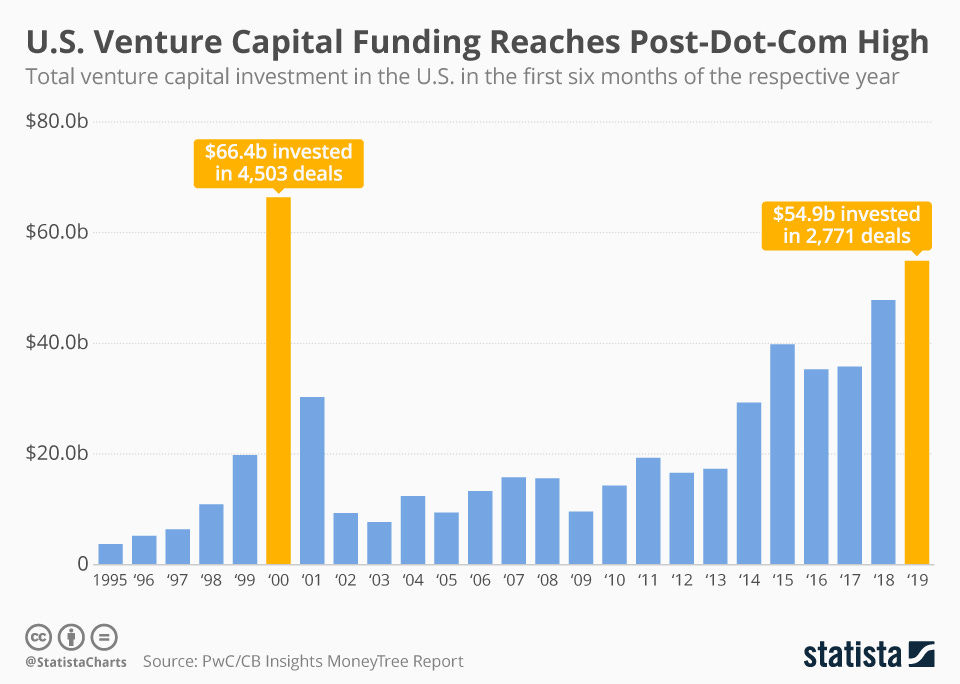

What is the purpose of venture investors and why is the industry structured to create such strange outcomes? While at its core, venture is about seeding early stage companies to try exploring new frontiers, it has recently absorbed record institutional funds looking for returns. If stocks and bonds are both hollow, manipulated financial machines propped up by a political monetary policy, then the large asset managers have to direct flows to alternative asset classes. As the capital base balloons, so has the time it takes private companies to go public, and so does the wealth inequality created by having access to private investments.

What other questions can we ask? Will the financial incumbents or the high-tech companies win in the long run? Easy answer. The tech companies are doing a full-out dance around the slower moving banks, and the distance between the two will only increase. The banks think regulation in the West will be their competitive advantage. It will instead be their coffin. The US tech companies are deep in providing actual financial services -- payments, banking, investments, insurance -- all across the non-US world, including Brazil, India, and elsewhere. Within the US, they are disempowering the banks from having meaningful customer relationships by transforming the customer engagement layer.

Non-American tech companies all have finance as a pillar, whether looking at the Chinese super-apps of Ant Financial and WeChat, or the Russian Yandex/Tinkoff acquisition, or the Ubers and Amazons of the Middle East and South America.

Will the East beat the West?

Now we are getting somewhere hot.

The battle takes places along the axis of billion-person customer acquisition, machine learning and augmented reality, IoT and 5G capabilities, and blockchain-based infrastructure networks. The US is incumbent, and is using its power to block the progress of others through its political tentactles. The TikTok debacle, as well as tensions with Huawei, visualize for many of us what that applied power looks like -- no matter how wrapped in rhetorical cloak the rationales for divestitures have become.

Will the West beat the East?

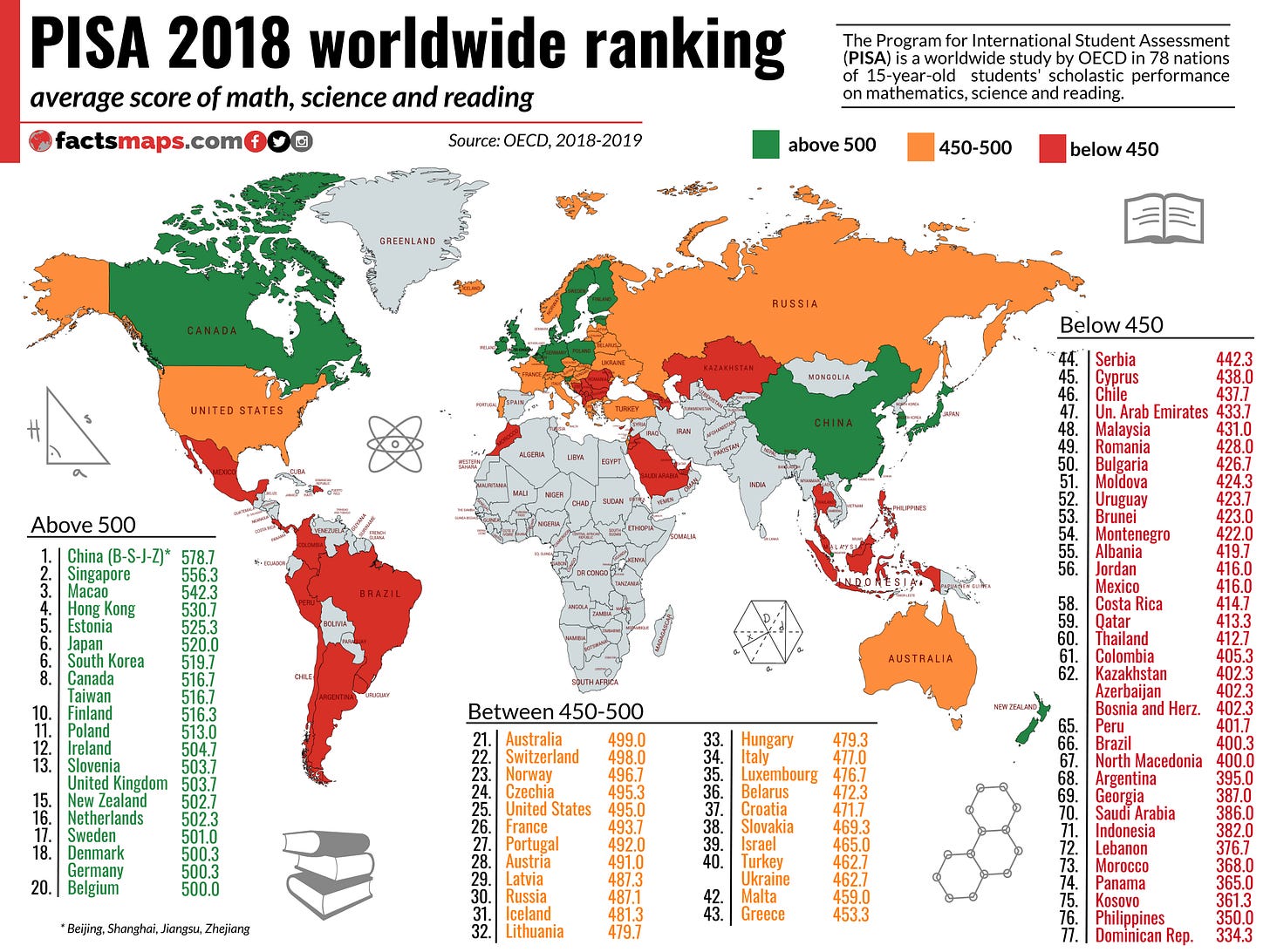

What is the timeline, and what are the dimensions of victory? This takes us to the Ray Dalio model of empire growth and collapse, and the importance of education as a precedent to innovation and technology competitiveness, which are precedent to commercial and economic success, precedent to the crowning achievement of having your currency be the reserve currency of the world. While it all takes decades to unwind, history is long.

The new open systems we are seeing develop that allow for finance, media, and technology to meld together into software worlds will be brought to full potential by today's young students. The cultural food they consume and the video games they play will be the world in which we age together. There is little point in displaying dismay and resistance, and all the upside in trying to redirect their energy into productive use to power our innovation machines.

There.

We solved it all.

Asking the Profound Questions

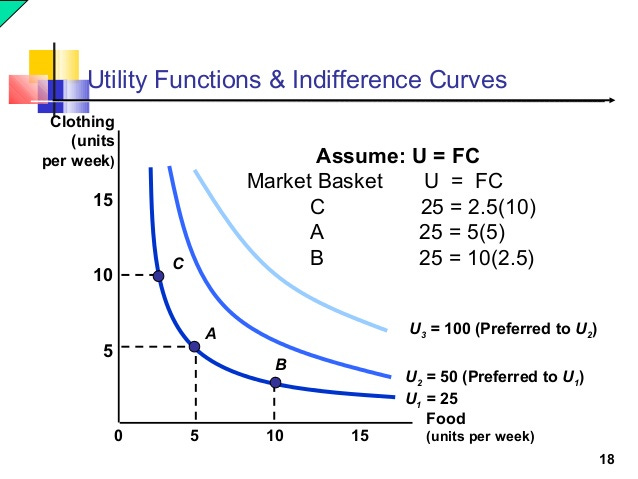

Let's say you accept the narrative above as sufficiently reasoned to be a mental framework for what is happening in the world. You can see how it is largely a reaction to the underlying preferences of actors in our social systems. That's not a profound realization -- all commercial activity results from some indifference function of a person or corporation in the human hive.

We can play the science-fiction game, and say that over time many of these utility functions will be built into autonomous agents, and that these autonomous agents will outnumber the Homo Sapien, and that their chaotic interactions will create complex systems for new economies. Blockchain and AI are laying the groundwork for such exciting dangers. The abandon with which the human nations are racing to beat each other in creating robots will feed all sorts of Black Swan monstrosities about which we can only now dream.

In this case, we can get to thinking about the computational nature of the universe, and how enormously complex things arise from unbelievably simple rules. See our write-up on Wolfram's Physics Project.

And we can get lost in the distinction between art as a creative pursuit, or a metaphor for how people bring new things of any kind into existence and the nature of creativity itself. Can it be computationally reduced to an algorithm? See our write up on neural networks as compared to generative algorithms here.

Do we dive into the philosophy of existentialism to resolve why people create, and what shapes the nature of our economies? See our write up on Albert Camus and absurdity emerging out of technological progress and the transparency of financial systems.

These things that we find, is this trivia, or is it meaning?

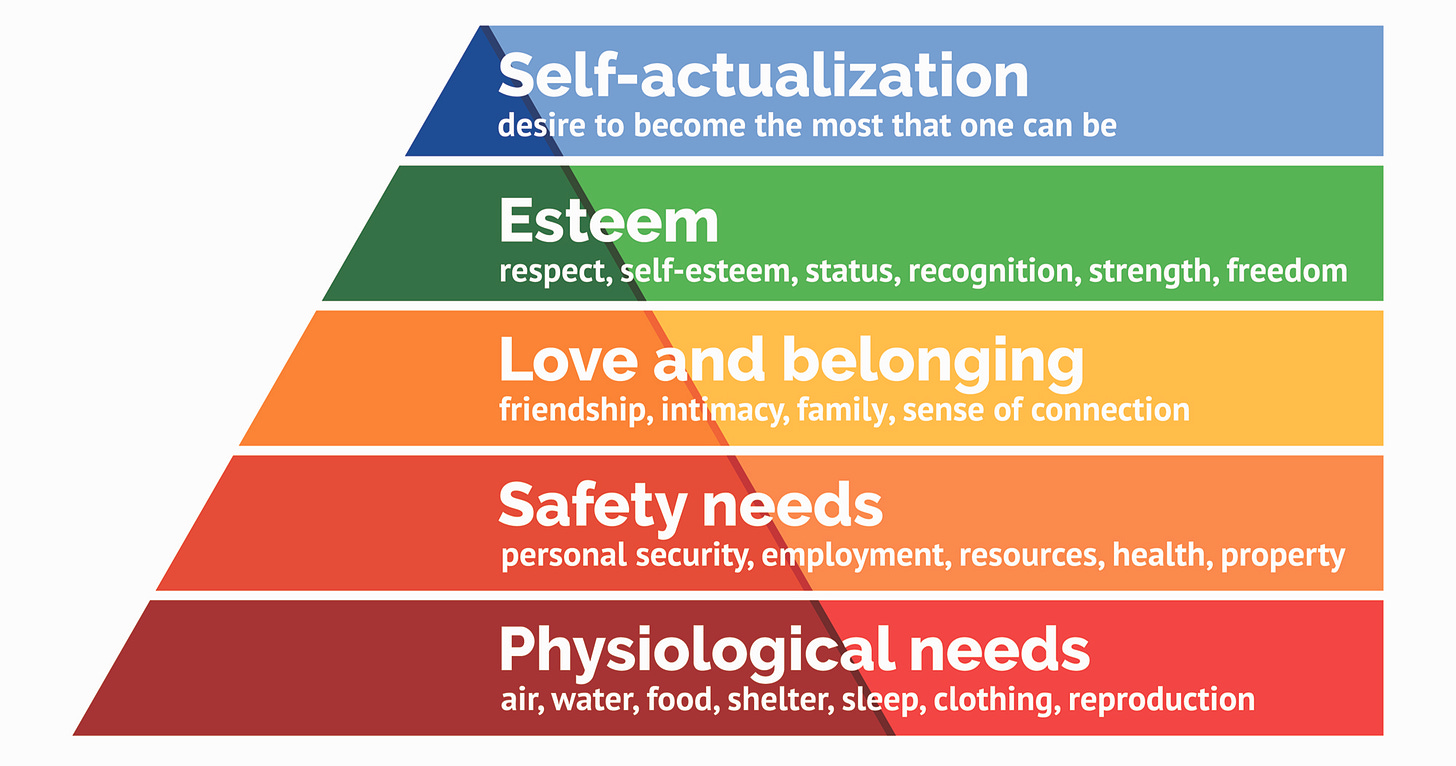

It comes back to you. What are you here to do? Let's say -- what are you here to do narrowly, in financial services. Maybe you are helping maintain or upgrade some large, systemic machines. Perhaps you are trying to grow some novel fintech plant in the soil of an unwelcoming garden. Maybe you are an investor looking to direct capital for the best risk-adjusted mathematical outcome. Or you see financial suffering among your peers, and are looking for a way to help.

We can't formulate the questions for you. But we can give you a framework of needs for both the individual, and the organization.

The questions that you ask are the answers that you will get.

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.