Hi Fintech futurists --

This week, we look at:

Where the $90 million of revenues for Robinhood comes from

Why gambling isn’t the best for you

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.

Long Take

On Consumerism

Like many of us, I am at home a lot now. That means the fridge is RIGHT THERE. And pretty much every time I go to the fridge to get a healthy, vegetable snack -- crunch crunch carrot -- I end up eating something sweeter and more addictive instead. My mind knows this, and warns me every time I get up. Don't do it. Don't get the chocolate. Get the cucumber. Willpower is high on the way, willpower is high when I open the door. And then the willpower evaporates.

After the requisite guilt-squats, I ponder human nature and the illusion of will. We have experienced millennia of evolution, wrapping ganglia upon ganglia around the lizard spine and mammalian brain. We think we can choose. We think that because we think *we think*, that we can choose. We know it is bad for us. And we choose it anyway.

Looking into the statistics of gambling is illuminating and depressing. The UK, where gambling is more widely accepted than in the US, sees rates of 40-60% across all adults according to 2016 research. Revenues for casinos are over $100 billion annually, and global gambling revenues, including sports betting and the national lotteries, amount to over $400 billion. That's like the equivalent of the entire software cloud industry. And it asymmetrically addicts and disadvantages the already disadvantaged (see academic research here, here, and here).

But we don't have to get righteous about gambling -- at the end of the day, this an isolated highlight of what comprises the human genome. We gamble, putting at risk our capital and reputation, in line with the hormonal reward mechanisms driving our utility functions. We gamble when we pick up Instagram or Tinder, when we upload our profiles and reinforce our social status with likes and comments, when we buy clothes and signal fashions, when we utter conversations and signal politics and allegiances. This is how the machine of our flesh makes decisions and takes risks. But it is also how our machine can break down and drive itself into the ground. Remember, no conceptual construct (e.g., a corporation, a nation, a social network) cares about you as an individual agent and will fix your broken utility function -- constructs care only for their own survival and perpetuation.

To that end, it is up to you to snap out of being a statistic pressing the pleasure button for pennies at a time.

This warning is a roundabout way to look at systems, and to see just how the House always wins. And if you think that only casinos are casinos, think again. Our capital markets, our labor markets, our political system, each of these in turn is a reflection of how we humans form superorganisms.

We started our discussion with the behavioral gap, using a customer-centric approach. Let's now shift our view to the Rube Goldberg machine that is institutional capital markets for equities, and then decentralized finance.

The Money Button

For someone who thinks a lot about packaging and purchasing, looking into how the sausage is made in the factory can be a bit yucky. And it can also be a bit boring. Take for example this gem on the SEC Rule 606 from the law firm Davis Polk:

"Rule 606 of Regulation NMS is intended to provide investors with transparency into broker-dealers’ order handling and routing practices, and to promote competition by allowing investors to evaluate the quality of broker-dealers’ performance, including order handling and conflicts of interest management. Currently, Rule 606(a) requires broker-dealers to provide a publicly available quarterly report regarding routing of non-directed orders, while Rule 606(b) requires broker-dealers to provide customers, upon request, information about the routing of their orders. However, the SEC noted that broker-dealer practices and strategies have become increasingly “automated, dispersed and complex” since the original version of Rule 606 was adopted in 2000"What may seem arcane and uninteresting is actually profoundly powerful and exciting. In response to high frequency trading and the prevalence of winner-take-all market making robots on Wall Street, the SEC has forced broker/dealers to disclose where trading orders are actually sent, and who executes them. Now in 2020 (two years after the SEC made the change), data is starting to flow out and tell a story. For most of this narrative, I rely on Alphacution, a research conservatory focused on quantitative trading that has parsed 606 data to give us juicy bits about the industry.

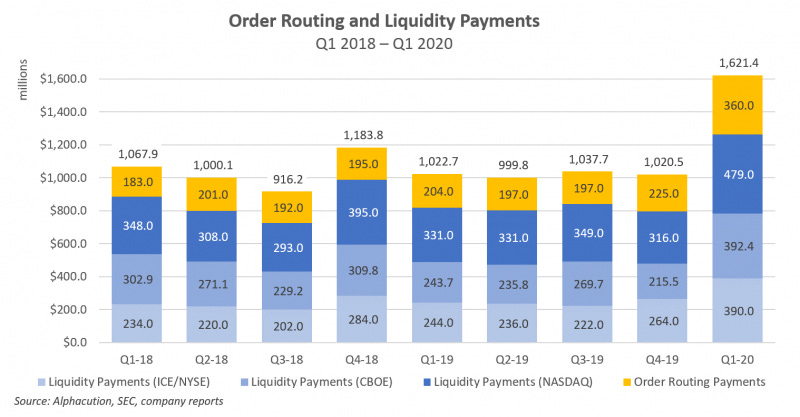

What we see is that there is a $1 billion quarterly price being paid for the functioning of markets. Maybe you buy a share of AAPL on Robinhood or TD Ameritrade, and that's all you see. In reality, there are numerous layers of software and intermediation between the investment advisor, broker, exchange, custodian, and central securities depository -- not to mention the market participants that provide you with the liquidity and best-execution to have a trade matched nearly immediately.

Order routing payments make up as much as $500 million per quarter, split largerly between TD Ameritrade (now Schwab), E*Trade (now Morgan Stanley), and Robinhood. The parties paying for the orders are Virtu, Citadel, Susquehanna International, and a longer tail of quantitative trading shops. Is this good? Bad? Why do we care?

Wikipedia tells us that Bernie Madoff "pioneered" payment for order flow as a way for market-makers to lead generate opposite sides of a trade. Bernie knew how to do lead gen pretty well! But there's nothing inherently wrong with the description as it stands. A market-maker is there to open and close positions while minimizing exposure to the underlying securities, and thus needs flow for its activities. It makes money through spread. The quant firms are the oligopolistic winners because they won the algorithm wars for best execution, which is a legally mandated condition.

However, remember also that best execution is a function of supply and demand, and that sending all demand to Citadel may have some negative implications of where prices are matched. If you don't see it as a commission, you could see it as slippage.

Here are my favorite charts from Alphacution:

We can now start to see some of the underlying dynamics that have allowed Robinhood (and Silicon Valley) to claim $100 million in revenue and a $9 billion valuation for free mobile trading. As the industry flipped into free trading at the end of 2019, trading volumes literally sky-rocket across Schwab, E*Trade, and TD Ameritrade. This, in turn, drives liquidity and order flow revenues -- and while it does not fully compensate for commissions (maybe 30-50% of prior revenues), it does help. Primarily, it helps market-makers benefit from trading activity generally. Notably, most of the order flow payments are for Options, for which there is less volume than listed equities and which are levered up versions of exposure.

When everything else is a trillion dollar Vanguard or BlackRock beta ETF behemoth, squeezing water from a stone requires the dopamine receptors lighting up for millions of people. What you are seeing here, while technical, is the mathematics for the House side of the casino. We power the casino with our emotions. It makes markets and takes an economic rent along the way. We buy its IPO.

Decentralize the Money Button

Let’s switch tracks to decentralized finance, or DeFi. Given it is one of our favorite topics, we will try to leave bias behind and bring a similar amount of critical thinking to the topic. ConsenSys just published a 50 page analysis of the space here, and that will be the source for most of this section. DeFi Pulse and DeFi Rate are two other sources you can use for sanity checking the data.

The amount of dollar equivalents now traveling the DeFi ecosystem is around $10 billion, of which nearly $3 billion are “locked” as collateral in various protocols. Using human language, this just means the money is in a *sort of* savings account which lends out the underlying for some other use. A variety of withdrawal penalties and collateral management systems are interconnected around these assets.

The last quarter has been all about market makers, and we think this fits nicely into the comparison with Robinhood’s order flow economics that we described above. Crypto networks don’t have enough trading volume aggregated in a decentralized manner (i.e., excluding a Coinbase or Binance) to build deep order books. Instead, the industry innovated on and applied the idea of automated market makers, which use an algorithm to create price changes without needing the presence of a human crowd to validate market demand. Fun fact: AMMs were first built by Lehman Brothers in the early 1990s.

When we look at the core projects driving the space, Maker behaves like a mix of a credit card and a margin desk, allowing you to commit a volatile asset and withdraw a cash equivalent subject to liquidation. Compound further allows you build leverage in your positions by clearing interest rates for borrowing and lending of assets. Uniswap allows for decentralized exchange, and is the first AMM we hit in the chart above. There are now various permutations of these services, including aggregators of AMMs that attempt to provide best execution.

We hope by now you are starting to see the analogy. These best execution engines get paid with spread, and accrue value to a variety of token models that then get distributed back to the community. In some cases it gets muddy. Market makers, like Balancer, do not explicitly pay fees to user aggregator projects like Zapper. Instead, they reward users with token distributions for bringing their money to Balancer “liquidity pools”, which are sort of like a custodian account that can participate in market making. So the concept of lead generation fees is certainly there, but those fees are going to users in addition to interface layers analogous to Robinhood.

Unlike the millions of people gambling on APPL stock, there are only about ten thousand people that understand that DeFi exists, and the alpha opportunity it presents. However, almost 2,000 of those (or 20%) are super users that perform 100 trades or more per quarter, including buying insurance options to protect downside. We interpret this as a sign of both (1) institutional crypto fund activity, as well as (2) prosumers that are gambling on an emerging asset class.

A couple of final observations. First, leverage is increasing in the system. Many of the new protocols allow for the use of structured or synthetic assets within the machine in order to power additional issuance. That means you can have assets you receive on margin in one project be used as collateral for margin in another project, and so on, thereby creating stacking systemic risk. ConsenSys Codefi is working on measuring that metric on a global basis, and it will be imperative for the industry to understand how such global DeFi leverage develops.

And second, the types of attributes we observe in the mature cash equities business will migrate into DeFi. Best execution is a no brainer. But we will also replicate the industry structure of a few highly-technical market makers capturing most of the trading activity through relationships with free front-ends. If anything, software development strength is the key determinant of victory in an industry where time is measured by block propagation, and where arbitrage robots can manipulate a market in between such units of time to generate half $500K in profits (see BZRX debacle).

However, we are encouraged that most economics are shared with users, and that transparency is woven into the nature of blockchains. It doesn’t quire a Rule 606 to compute revenues and valuations — just look in your crypto wallet.

Heavy Reading