Long Take: How the Machine Economy combining AI, blockchain, and Fintech is growing

Examples of deeply innovative projects pushing at the frontier

Gm Fintech Architects —

Over the last 6 months, I (Lex) have been running Generative Ventures with my partner Will.

Aside from the usual pleasure of building something from nothing, it has also been an opportunity to sharpen our attention on the next thing — novelty search across finance, AI, and Web3. Below I share more deeply from our investment thesis, and invite you to write back with ideas and ways to collaborate. An abridged version of this write-up appeared as an OpEd on Coindesk.

Long live the machine economy!

Long Take

Crypto is Internet money, and the Internet is for robots.

We humans barely recognize their gears and sockets — the crypto arbitrage and MEV bots, social media bot armies and algorithmic content feeds, generative code art and AI illustrations, and the various Zapier agents and automations that run in the background of our experience.

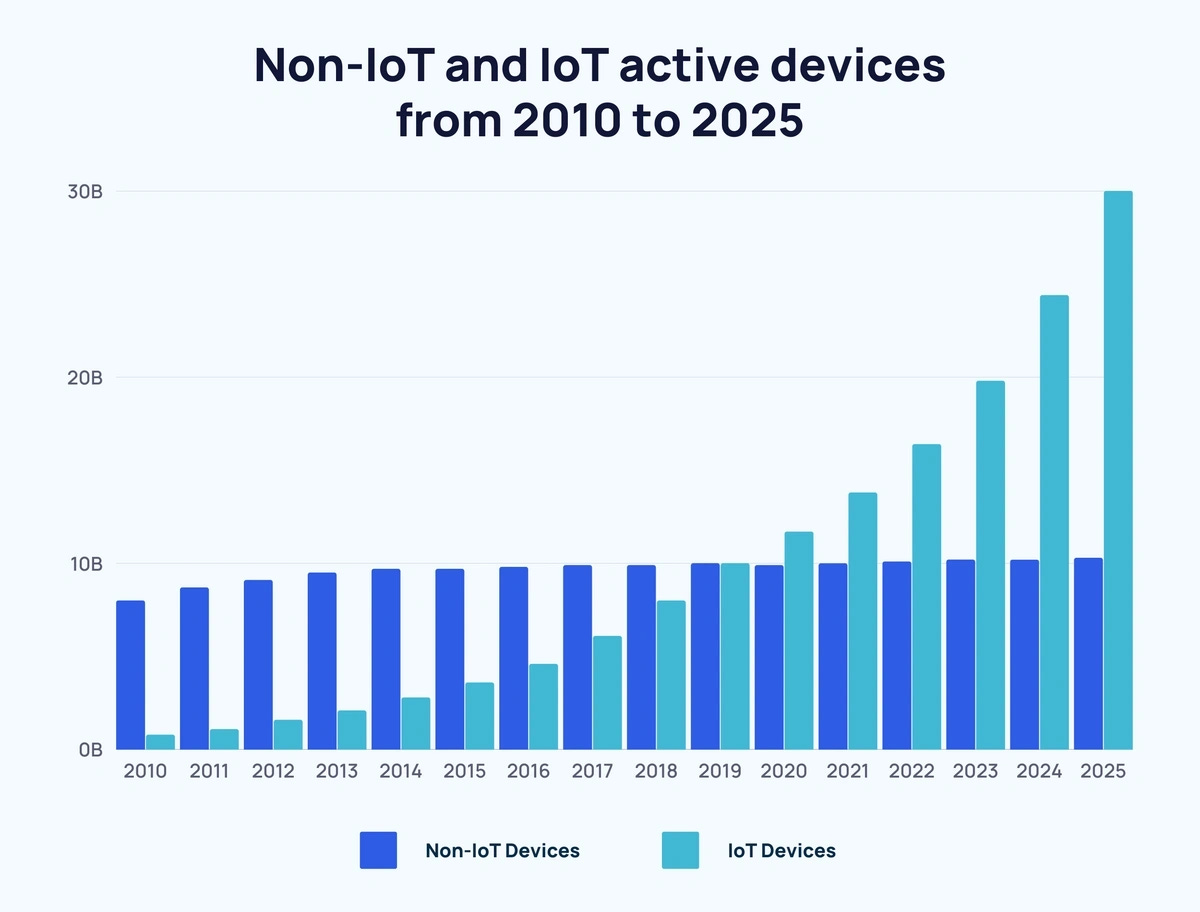

In my previous article, I discussed how there will be only more robots, and that Web3 is the correct economic and financial venue for their emerging machine economy. Of course, many of us are using so much software that we qualify as software cyborgs too.

Generative Ventures has been investing in frontier companies since mid-2023, focused at the intersection of crypto, AI, and fintech. Our macro thesis was compelling enough to get started, but there is reality on the ground and its patterns are starting to become more clear. Today, we want to dive more deeply into how this is already happening and describe the AI and DePIN trends driving the sector forward.

The Dividing Line

The first observation is that some things happen on-chain, and some things happen off-chain. This is obvious, but worth pointing out. In the case of money, dollar bank deposits are off-chain, DAI is on-chain. Tokenized real world assets are off-chain, wrapped tokens or liquid staking are on-chain. National passports and driving licenses off-chain, while POAPs and NFTs are on-chain. The same concepts – money, financial instruments, identity – can be manufactured in different places.

The same thing is true for Artificial Intelligence.

We can have a world where AI is off-chain, but occasionally crosses over to Web3 to take action. In such a case, we need services that function like oracles or On/Off ramps for machine intelligence. The same logic that drove fintech into creating every permutation of an embedded financial product (e.g., Plaid, Stripe) could give GPTs the API software tentacles they need to float around in crypto markets. Who is the Moonpay for ChatGPT? And, if we do pull AI into our trustless environments, how do we keep it honest and verify its outputs?

Some teams in the market are working on inserting crypto technologies, like ZK proofs, into the computational process of machine learning models. This would prove that some particular robot indeed did what it was supposed to do, that you were not fooled by Bernie Madoff with a spreadsheet. Today, the approach is still in its infancy. However, in the future we can understand the value of verifying that you are interacting with the correct black box.

Others are thinking about how to move the entire LLM and neural network stack onto decentralized infrastructure. Since much of the generative AI movement is open source, like crypto, it is conceptually possible to deploy and maintain the multitude of open source models on protocols that decentralize the computational load, and create incentives to provide best-in-class machine intelligence services.

This, despite several talented teams pursuing the strategy, is still largely science fiction. Even centralized AI teams have yet to figure out the shape of demand and profitable unit economics. Splintering the provision of such services into protocols and DAOs at this stage, in our view, is early.

Intelligence Infrastructure

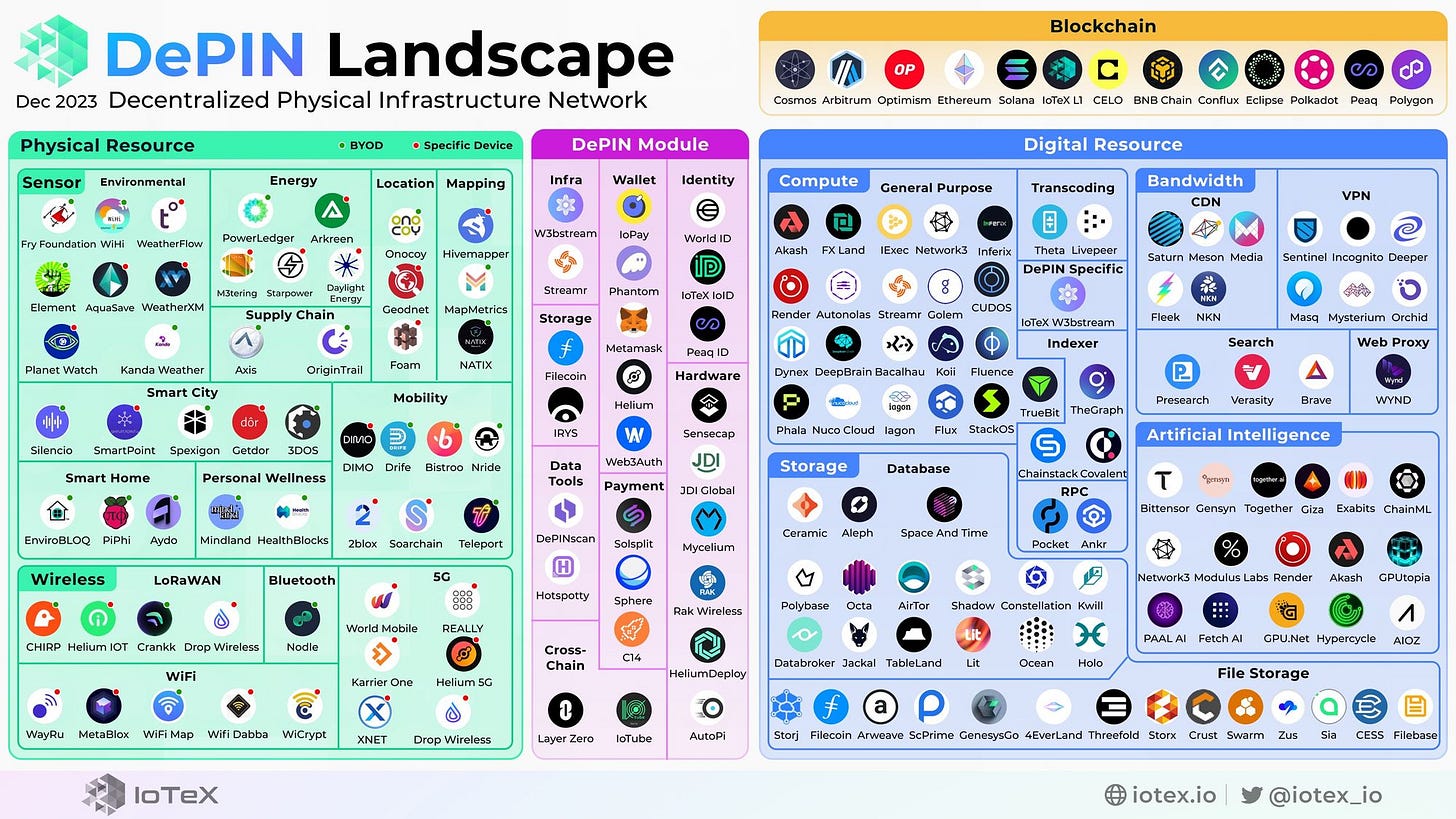

Lower down the stack is DePIN, decentralized physical infrastructure. The simplest DePINs use coin-protocol incentives, rather than more modern tokenomics approaches. For example — nodes provide hardware storage, compute, GPU, or training data into a network, and get rewarded for work done on their device, akin to Bitcoin PoW mining. We think that, like Helium, most DePINs will move away from functioning like a coin, and more towards like a dApp running on top of a computational blockchain like Peaq, Solana, or an EVM rollup.

Web3 leveraged centralized cloud services to deploy decentralized networks, but we are not sure if that will work for decentralized AI given the cost and demand. Centralized AI providers are simply more efficient, better organized, and compute hungry than their protocol-first competitors. Therefore we think that scalable DePINs would be a material resource unlock for onchain crypto-AI.

The other part of DePIN we like is that it onboards machines into Web3, and machines will need DeFi and its automated financial products, as well as access to intelligence as a service. In a some far flung future, various decentralized fleets of cars may download the latest self-driving models from DePIN AI networks, maintained by various DAOs and incentivized by tokens. Small experiments in this direction exist already.

Further, frameworks for connecting, standardizing, and managing populations of AI agents with various goals have started to emerge. Autonolas is one such project, generating bots for trading market participation, as well as deployment in governance procedures. If you want to understand a single agent, remember Botto, a generative AI model that outputs art curated by a DAO, incentivized by a token feedback loop. Or consider Numerai, a hedge fund that runs a token-incentivized competition for data scientists to build AI algorithms for a trading software brain.

There will be many such creatures — some simple, some complex, and some unfathomable.

The Intelligence Interface

One last distinction we want to bring up is the scope of AI services. In one scenario, it is just a narrow feature to improve applications. Take for example a digital wallet, which now sports the ability for conversation about the tokens and investments that it holds. Or, some 10-K company filing on a website that you can interrogate with a custom financial GPT. While convenient, no industry structural transformation has occurred.

Alternately, there is a world where OpenAI becomes the new iOS and its GPT store is the new app store. Then, the tech company becomes the main conversational interface for accessing machine intelligence applications, which are embedded in its website. AI is not just a feature, but the new platform distributing solutions to a variety of general problems. In this scenario, crypto is subsumed as one of the many AI functionalities.

In this case, one concern is that the AI agents are fundamentally centralized and custodied with a single provider, creating massive personal risk across data, privacy, and finance. Custody always leads to a principal / agent problem, where the agent has an incentive to steal from the principal, and therefore law and regulation must enforce fiduciary duty. In the big tech world, AI regulation that protects the individual in some form is inevitable.

The Web3 counterweight to this danger is self-custody of information, and self-custody of our AI agents. Perhaps we generate the GPTs on a centralized platform, but are able to pull those trained models into a crypto wallet for ownership. In a world where multiple successful open source models exist, and some are run well on decentralized infrastructure, we expect that crypto custody and control of AI agents becomes a core value proposition of Web3.

Today, projects like OpenOrigins, which focus on provenance of digital media in the AI age come close to this idea. Things should be real and beyond manipulation. Another example would be NFT minters attached to image generation or LLM engines (e.d., Eden.art), which support the fruits of machine labor with the market venues of Web3 DeFi.

However, commerce around such objects is still negligible today – whether due to the sorry state of the NFT markets, the quality of machine labor, or low utility of such digital assets.

In all cases, this is an absolutely fascinating design space for entrepreneurs. Since launching Generative Ventures, we remain surprised by the creative variety and energy of technologists exploring the possible and charting a way forward.

Postscript

Read our Disclaimer here — this newsletter does not provide investment advice

Another friendly reminder to share this post so that others can learn: