Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

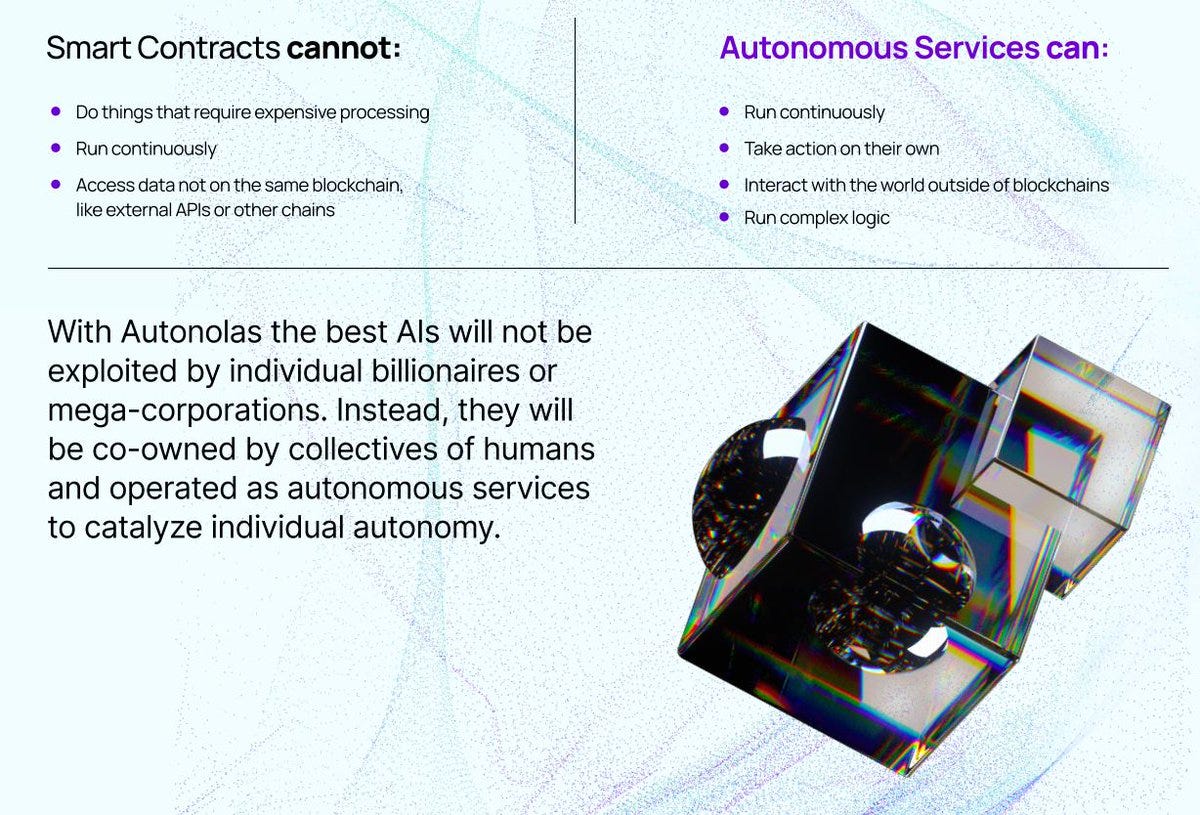

In this conversation, we chat with David Minarsch - Co-founder and the CEO of Valory, a team focused on providing research, products, and services at the intersection of multi-agent systems (MAS) and distributed ledger technology (DLT), one of them being Autonolas - a platform that offers an open-source software stack and an on-chain protocol, facilitating secure operations and incentivizing autonomous application development. In 2019, David served as the Lead Economist at Fetch.ai, focusing on research projects, software development, and team management. His work centered on the consensus and governance mechanisms of Fetch.ai's smart ledger and the design and implementation of an autonomous agent framework.

David is also the Founder of Centrality Labs - a company focusing on researching and developing products at the nexus of blockchain and multi-agent systems - Azembly, and UCL FINDS; and a Co-founder of Panopy.co.

Additionally, David has founding experience via Entrepreneur First and a PhD in Applied Game Theory from the University of Cambridge.

Topics: DLT, Distributed ledger technology, ai, blockchain, smart contract, game theory, autonomation, DAO, generative AI, crypto, economics

Tags: Valory, Autonolas, Fetch.ai, OLAS, Gnosis, Cosmos

In Partnership

Fintech Meetup (March 3-6) is less than 60 days away! Don’t miss Fintech’s new BIG show with “the highest ROI” for attendees & sponsors. Ticket prices go up Friday 1/12 at midnight. Don’t miss out!

👑See related coverage👑

Artificial Intelligence: Broadridge deploys OpsGPT to improve trade lifecycle support

[PREMIUM]: Hype vs. Reality: The impact of Generative AI in financial services on jobs, investing, and services

[PREMIUM]: Long Take: What would AGI do to the economy and financial industry?

Timestamp

1’34: Mathematics to Game Theory: A Journey Through Academia and the Intricacies of Human Behavior

4’03: Network Games and Equilibria: Exploring Graph Theory and Game Theory in Economics at Cambridge

7’31: Quantitative Abstractions and Intuition: Navigating the Complexity of Equilibria in Economic Systems

12’08: From Academic Theory to Real-World Application: The Impact of Crypto Networks on Economic Modeling and Experimentation

16’17: Mathematics in Governance: Transforming Data for Constituency Insights and Political Decision-Making

19’04: From Human Insights to Blockchain Innovation: The Evolution of Fetch.ai and the Role of Autonomous Agents

23’36: Defining Autonomous Agents: The Evolution and Impact of AI-Driven Software Agents in Complex Systems

30’48: Agent Ownership and Automation: Exploring the Spectrum and Implications of Autonomous AI Systems

35’16: Autonolas Protocol and Valory Launch: Revolutionizing Autonomous Services and DAO Governance on the Gnosis Chain

39’44: Governance Through AI: Understanding the Role of Autonomous Agents in DAO Decision-Making and Proposal Analysis

43’34: OLAS Protocol on Gnosis Chain: Pioneering Autonomous Agents in Prediction Markets and DAO Governance

50’15: Envisioning the Future: The Rise of Autonomous Agents and AI in Crypto and Economic Systems

55’01: The channels used to connect with David & learn more about Valory

Sneak Peek:

David Minarsch:

…on the micro level, if you look at crypto specifically, I think there's this huge opportunity from really doing a total perspective shift, or what role crypto tech can play. I think that we naturally tend to be very tied to our presence, where we often want these interactions to be immobile or some sort of nice CI, where I then manage my portfolio or do some other thing, crypto analysis, some social game which basically just a money game.But the problem I see is that a lot of people don't even want to do that. I know a lot of people who don't want to manage their finances, or who will not be very excited about having yet another social network which is even more focused on points earning of some kind of or another. And so I think there's this huge opportunity for people in crypto to embrace autonomous agents, autonomous systems, and think about how can they offer a totally new UX to end users, where I can, yeah, get my granny her roboadvisor which she actually owns as an autonomous agent, which actually takes care of her funds, without her having to sit there in front of an interface and doing really anything. It just delivers that as an outcome.

So, I think it makes a lot of sense for protocols to seek their next billion users, not just with actual humans, but autonomous agents who like in the example of the prediction markets, can often use…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions