Hi Fintech Architects,

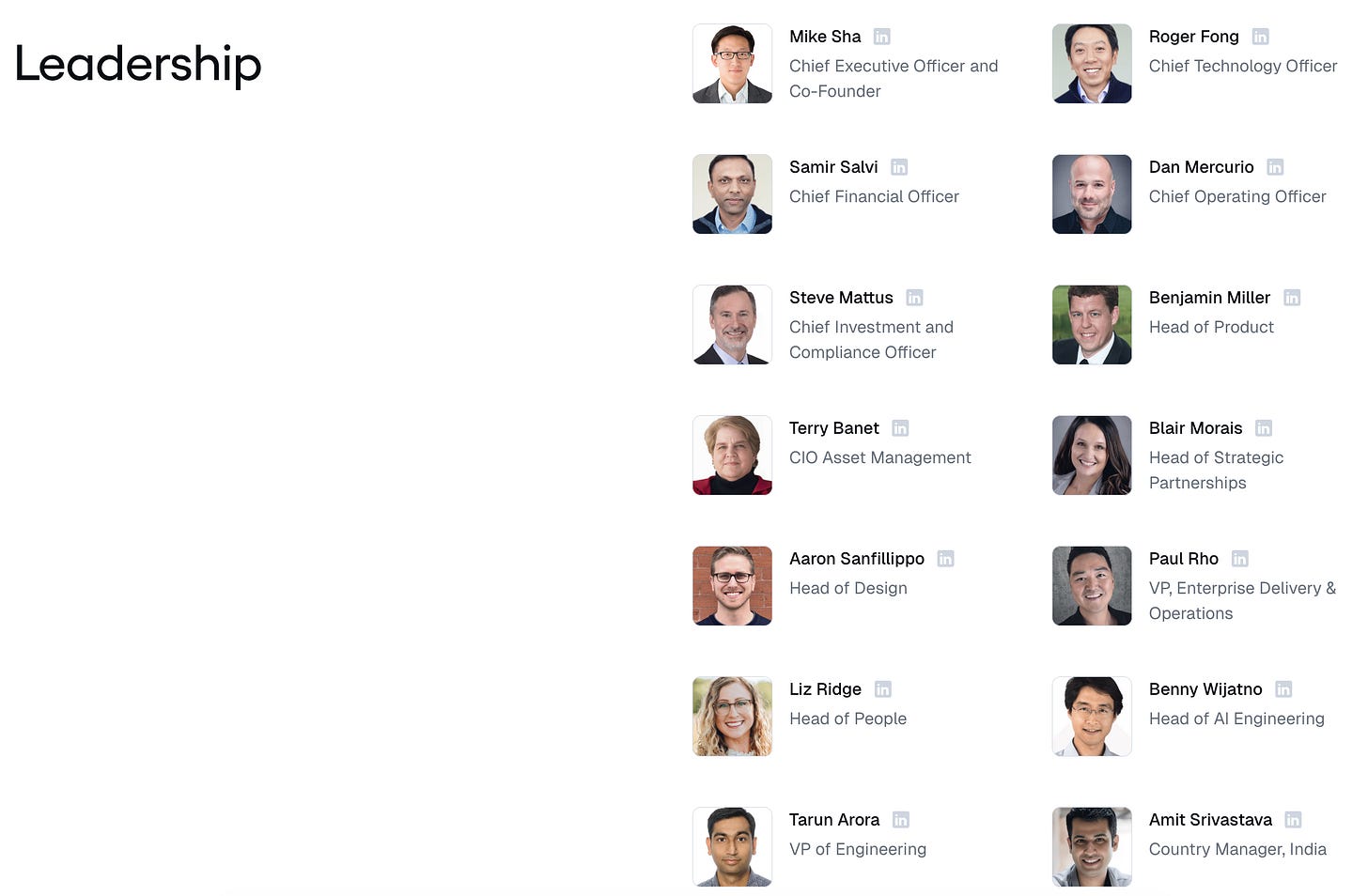

In this episode, Lex speaks with Mike Sha - the CEO and co-founder of Tandems (formerly SigFig), a leading provider of AI-powered software for wealth management firms and financial institutions.

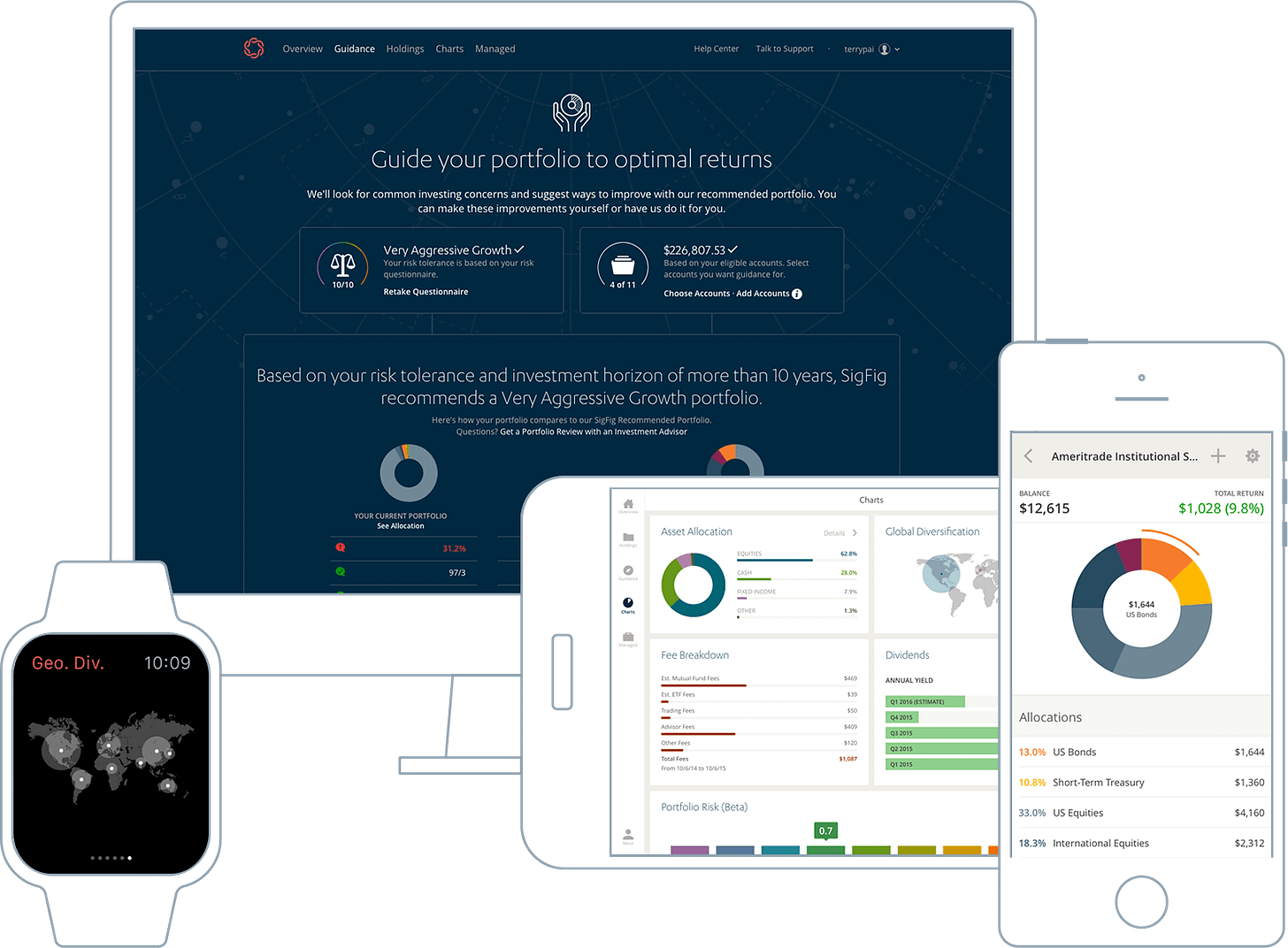

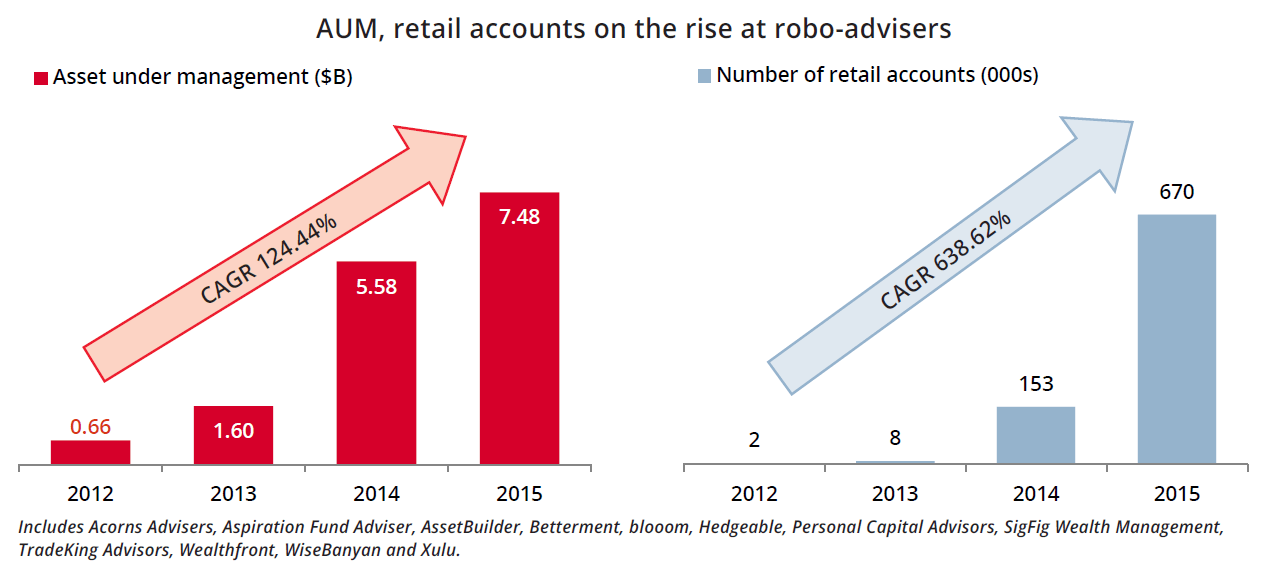

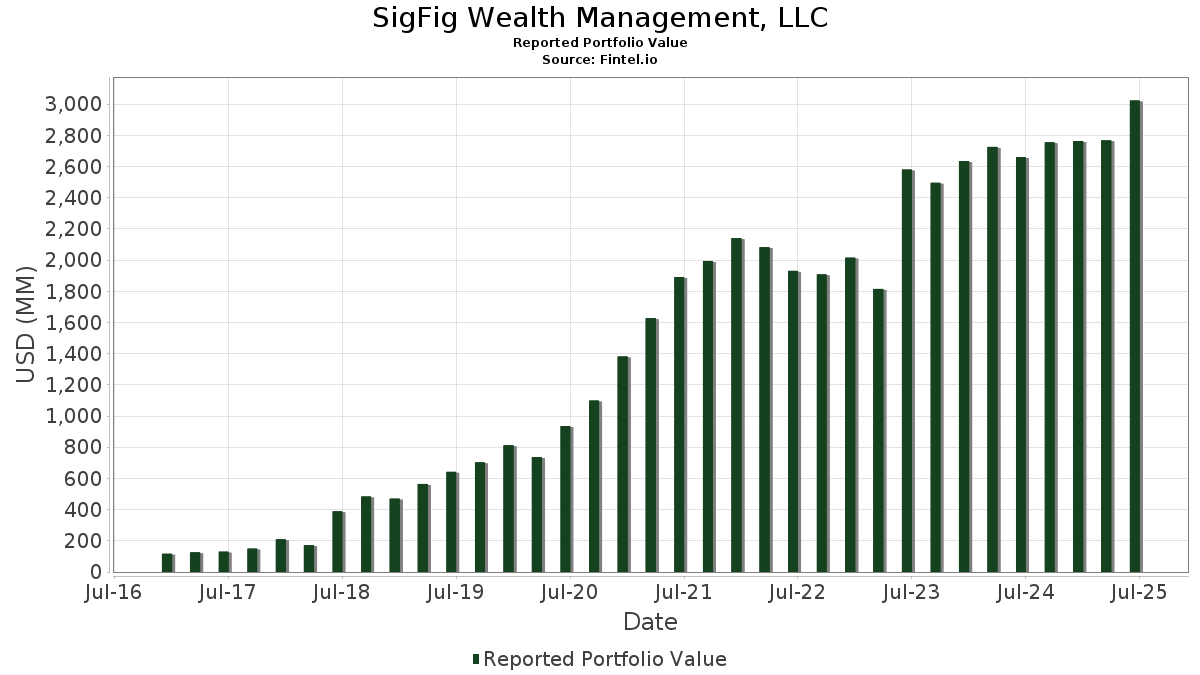

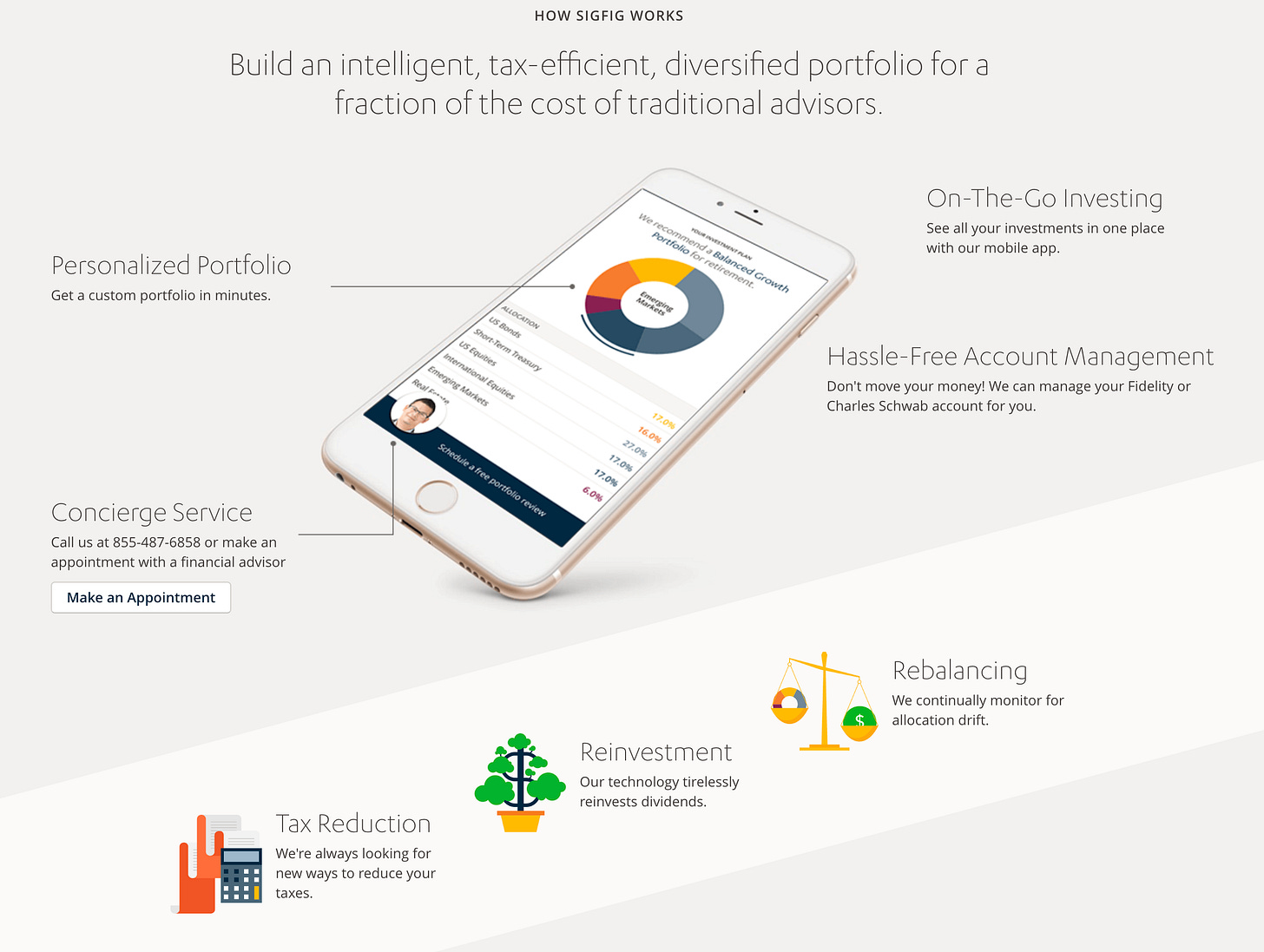

Together, Lex and Mike discuss the evolution of wealth technology through the lens of Mike’s entrepreneurial journey from founding Wikinvest in 2006 to building Tandems. Wikinvest pivoted to portfolio tracking and then to a B2B model, powering major portals like Yahoo Finance and managing over $500 billion in tracked assets. The team’s insights into poor retail investment behavior led to building SigFig, a B2B robo-advisor, eventually serving banks like UBS and Wells Fargo.

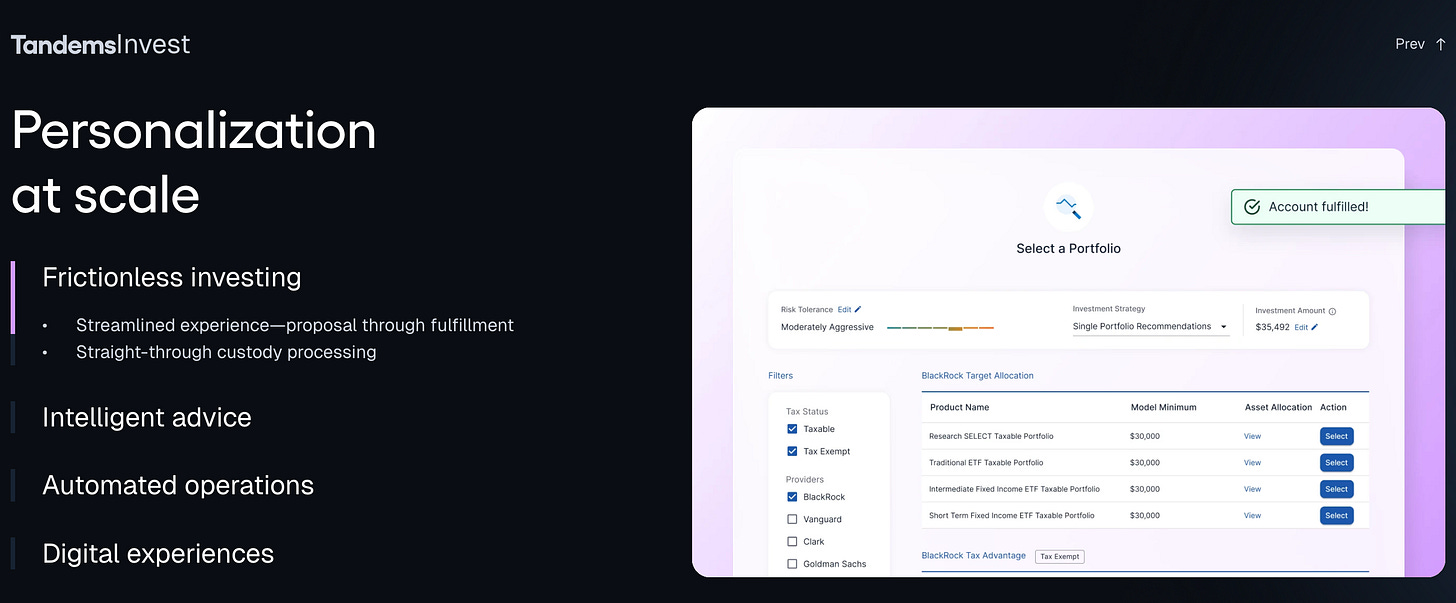

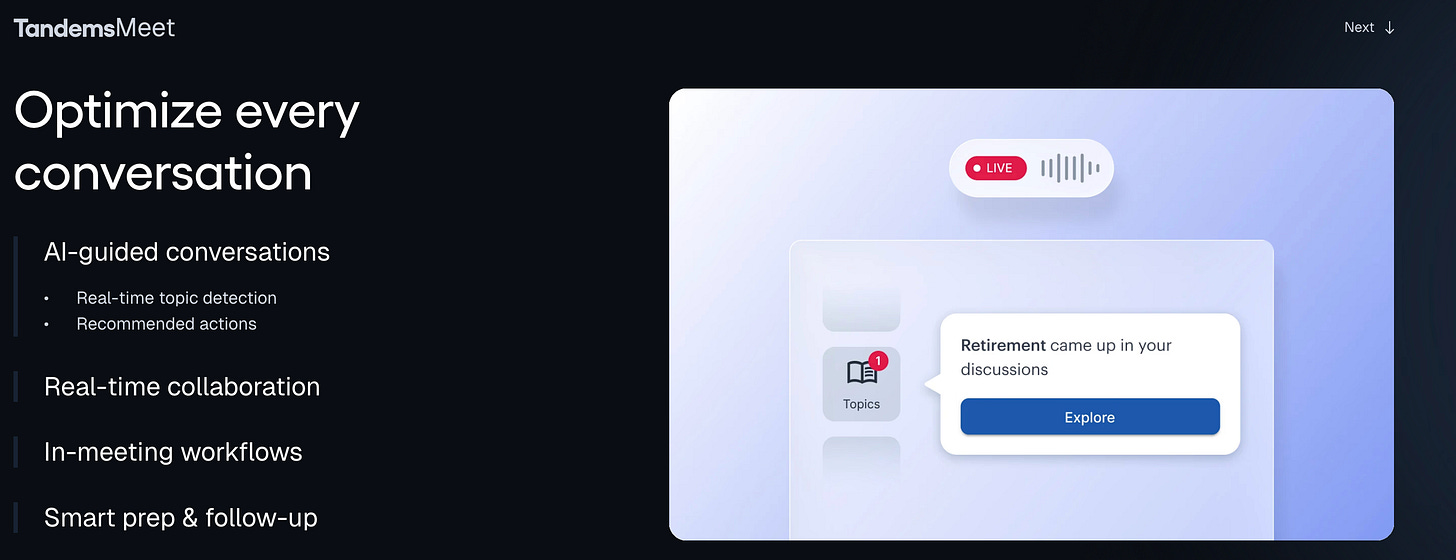

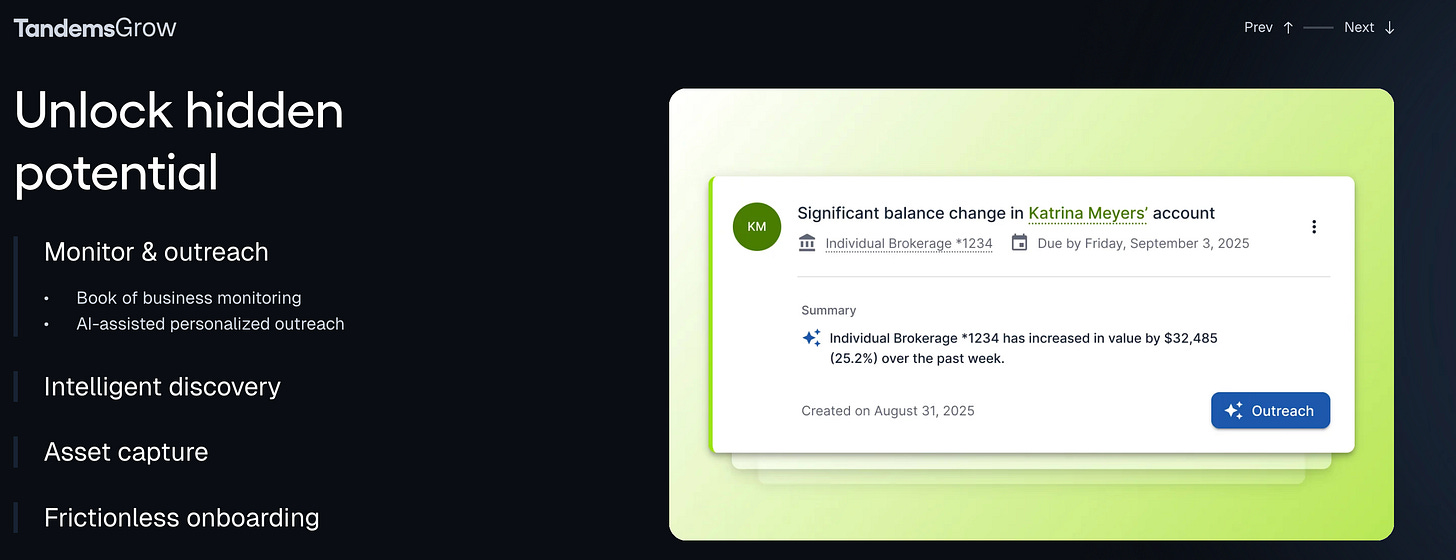

Today, rebranded as Tandems, the firm offers AI-powered tools for advisors across three key areas: meetings, asset gathering, and investment management, with AI integrated via a modular “wealth OS” platform. Tandems uses an open architecture for AI, prioritizing trust, configurability, and high accuracy tailored to the specific workflows of financial advisors.

For those that want to subscribe to the podcast in your app of choice, you can now find us at Apple, Spotify, or on RSS. Or to support this writing and access our full archive of IPO primers, financial analyses, and guides to building in the Fintech & DeFi industries, see subscription options here. Our current price point is only $2/week.

Thanks for your time and attention,

Matt Low

Key discussion points:

The Realization That Most Investors Struggle on Their Own Sparked the Robo-Advisory Movement

Mike Sha’s early data from tracking $400–500 billion in retail portfolios across Yahoo!, CNN, and other finance portals revealed that most individuals consistently underperform when managing their own investments. This insight directly led to the creation of SigFig, one of the first robo-advisors, designed to make high-quality investment advice affordable and automated. It shows how data-driven observation of user behavior can uncover market inefficiencies and spark new product categories.

Distribution and Integration Trumps Pure Innovation in Fintech Partnerships

Tandem’s evolution from a consumer-facing platform to a B2B software provider for major banks underscored a critical lesson: distribution and trust are the hardest parts of scaling in financial services. Rather than trying to replace institutions, Sha’s team embedded within them - learning that success requires deep integration with legacy systems and respect for the bank’s compliance and operational frameworks. The “secret” to working with large financial institutions, Sha notes, is understanding their old infrastructure and designing around it - not fighting it.

AI’s Real Impact in Wealth Management Will Begin with Eliminating Repetitive Work

Tandem’s current strategy focuses on AI automation for financial advisors, not as a replacement but as an assistant. Sha highlights that over 90% of an advisor’s day involves repetitive administrative work - meeting prep, paperwork, compliance, follow-ups. Tandem’s “Wealth OS” connects legacy systems and uses AI to automate these tasks first, freeing advisors to focus on human relationship-building and advice. It’s a practical and near-term vision of AI in finance: efficiency before intelligence.

Background

Before co-founding Tandems, Mike Sha built a foundation at the intersection of technology, product development, and analytical thinking. He began his career at Amazon, where he worked on product and customer experience, gaining hands-on exposure to building scalable software systems in a high-growth environment. His time at Amazon shaped his understanding of how technology could be applied to improve complex, data-driven industries - a mindset that would later prove essential in fintech.

Mike holds a degree in Applied Mathematics and Computer Science from Harvard University, where he met his future co-founder, Parker Conrad. The pair shared an early interest in startups during the original dot-com boom, which eventually led them to launch their first venture together. Mike’s academic background and early work experience equipped him with both the technical rigor and product intuition that continue to drive his approach to building financial technology.

👑Related coverage👑

Topics:

Tandems, SigFig, Wikinvest, wealthtech, wealth management, fintech, ai, artificial intelligence, investment, roboadvisors, finance, financial management, banking, bank partnerships

Timestamps

1’31: From Wikis to Wealth Tech: Mike Sha on How 401(k)s and “Investing-as-a-Chore” Shaped Tandems

7’05: Building a Fintech from the First Dot-Com Boom: The Origins of Tandem’s Founding Partnership

10’46: Turning Drive-By Traffic into Real Investors: The SEO Strategy That Sparked a $500B Fintech Shift

16’25: Following the Money: How Tandems Scaled Through Bank Partnerships and the Hidden Art of Integrating Legacy Systems

21’58: Inside the Fintech–Bank Power Dynamic: Lessons from Partnering with UBS and Navigating the Enterprise Maze

25’36: Scaling Smart: How Tandems Grew from 25 to 100 People by Blending Finance, Software, and Global Talent

29’55: Beyond Robo-Advisors: How Tandems Rebranded to Tackle Wealth Management’s “Unsexy” Problems with AI

34’02: AI for Advisors: Automating the 90% of Work They Don’t Want to Do

39’32: Open Architecture, Not One Model: How Tandem Builds Reliable AI for Financial Institutions

43’53: The channels used to connect with Mike & learn more about Tandems

Illustrated Transcript

Lex Sokolin:

Hi, everybody. Welcome to today’s conversation. I’m absolutely thrilled to have with us Mike Sha, who is the CEO and co-founder at Tandems, one of the earliest and most important wealth technology companies. We’re going to have a fascinating conversation about the history of investment technology, and I’m really excited to have Mike on the podcast. Welcome.

Mike Sha:

Great to be here Lex. Looking forward to it.

Lex Sokolin:

Oh man, I’m really excited for this conversation. And you know, I want to start at the beginning, which is, for me at least, having come from the old robo advisor days of New York City, you know, 2006,7,8,9,10 the original project that you started, which was Wikinvest. Can you tell us what that was about? And then what was the world like when you were just starting out?

Mike Sha:

Oh, it’s a whole other world. So I think you got to put yourself in 2006 and what’s going on in 2006. This is pre-iPhone. Wikipedia had basically just started to get real traction. People were still asking like oh can you really trust Wikipedia. Like it’s like edited by random people on the internet. You know, I think for us, you know, when we started the company, we basically started around the idea that people need help with their investments. You know, without going on too long of a tangent here, if you look at investing in the US on the historical arc, basically, modern investing where retail investors are engaged in the stock market is really just about 40 years old. So about 40 years ago, 40 plus now, you know, the world has no internet and everybody was not saving for their own retirement because people didn’t really even have 401(k)s at the time.

They primarily save for retirement by either hoping that Social Security would cover them or they would have pension plans. You know, by working for a company for a really, really, really long time. And about 40 ish years ago, the modern 401(k) became kind of legislated into place. And as a result of that, over the last 40 years, you know, most of this country has turned to basically save for your own retirement, you know. Hopefully Social Security will be there for some of us in some limited form. But for the vast majority of the folks who do not have pension plans, they’re told to save for their own retirement. You know, a lot of people think that it’s always been that way, but it’s actually somewhat recent over the last few decades. This is not like 100 year history. The other part of this problem is that, you know, people don’t really know how to do that. And so what we set out with Wikinvest was to build kind of a free portal where people could kind of share stock analysis, stock research, kind of Wikipedia style, but specifically focused on investment analysis.

That was a long time ago. Obviously, a lot of things changed since then. And, you know, if you’re curious, I can tell you the winding story of how we kind of twisted and turned over the years. But I think that initial hope to build a resource that would help people make better investment decisions has actually continued through all of our iterations and product evolutions, but it was a fun, humble start to a to the world of investment advice.

Lex Sokolin:

Yeah, so I absolutely do want to tease out the story and all of its turns, but I also can’t help myself because it’s 15 to 20 years later in fintech, and there are so many ideas that our generation had about what to do that have come to fruition in some really weird ways. So, for example, like the idea that a community would create the intelligence or the research about like investment selection and then crowdsource data to help other people do it, and then maybe like transform that into investment advice that people would then action, you know, like in 2025, you’ve got things like Dune Analytics, where people pull out analytics out of blockchains for everybody to see where you’ve got, you know, DAOs, where communities come together to analyze things and then create information and then make collective investment decisions.

And now they’ve got like all of these super science fiction vehicles in order to do the actual implementation and effectuate it. And I feel like some of these themes that we identified early on, they are here, like people are doing it at just completely different ways.

Mike Sha:

Yeah. No, totally. You know, it’s interesting back in the day, you know, Yahoo Finance used to be like the big finance portal. And I kind of grew up really interested in investing, which is probably how I ended up starting a company in the investing space. But one thing that I did not realize until starting the company was that actually, for 90% of people, you know, investing is a chore, not a hobby. And the types of solutions you build for people who enjoy investing versus people who kind of hate investing are actually quite different. And, you know, I think that realization actually did help shape, you know, how the company evolved over the years is to try to, you know, instead of serve the hobbyists, serve the masses who need and rely on investments to help fund their retirements and their homes and their college education funds and all those different things that people have as their financial hopes and dreams.

And that’s not to discount the whole world of people who enjoy investing. And it’s their hobby. And they could kind of geek out on it, just like some people geek out on sports or music or whatever it is. But the world, I think, really does bifurcate to like people, where investing is kind of a means to an end versus where investing is like something they really enjoy doing.

Lex Sokolin:

The sort of Wikinvest idea. In the early days, you had partnered up with Parker Conrad, who’s been a very successful entrepreneur in his own right, building a few very large companies. What kind of brought you together, and then how did you transition from this information data company to the first or I guess, the second iteration of Tandems, which was SigFig.

Mike Sha:

So Parker and I have known each other since we were probably, what, 17 years old? The freshman dorm of the college we went to. It was fate that they put us together. We were kind of roommates throughout most of college and, you know, had always joked about starting a startup together.

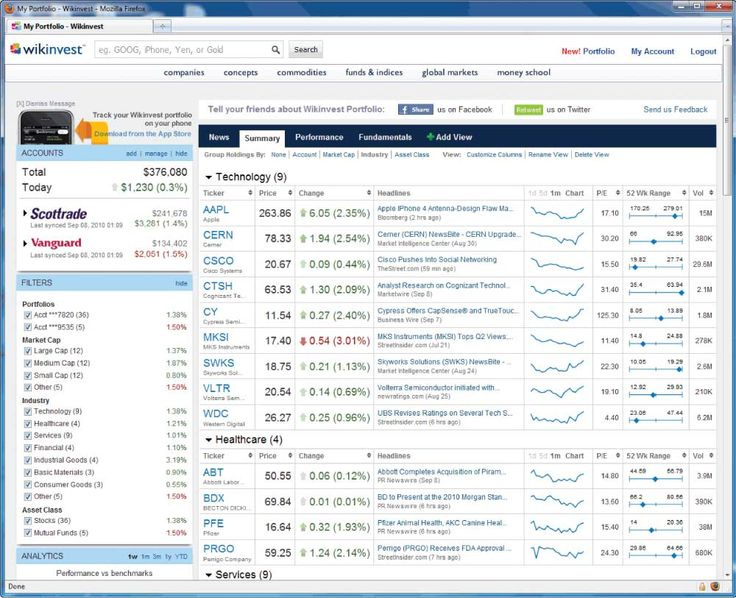

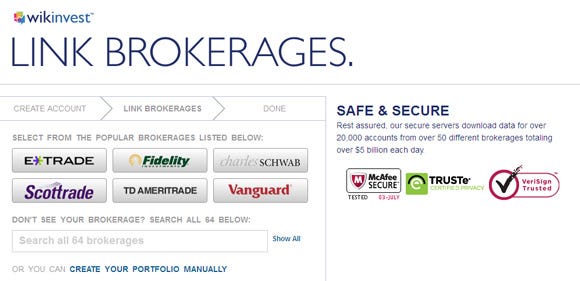

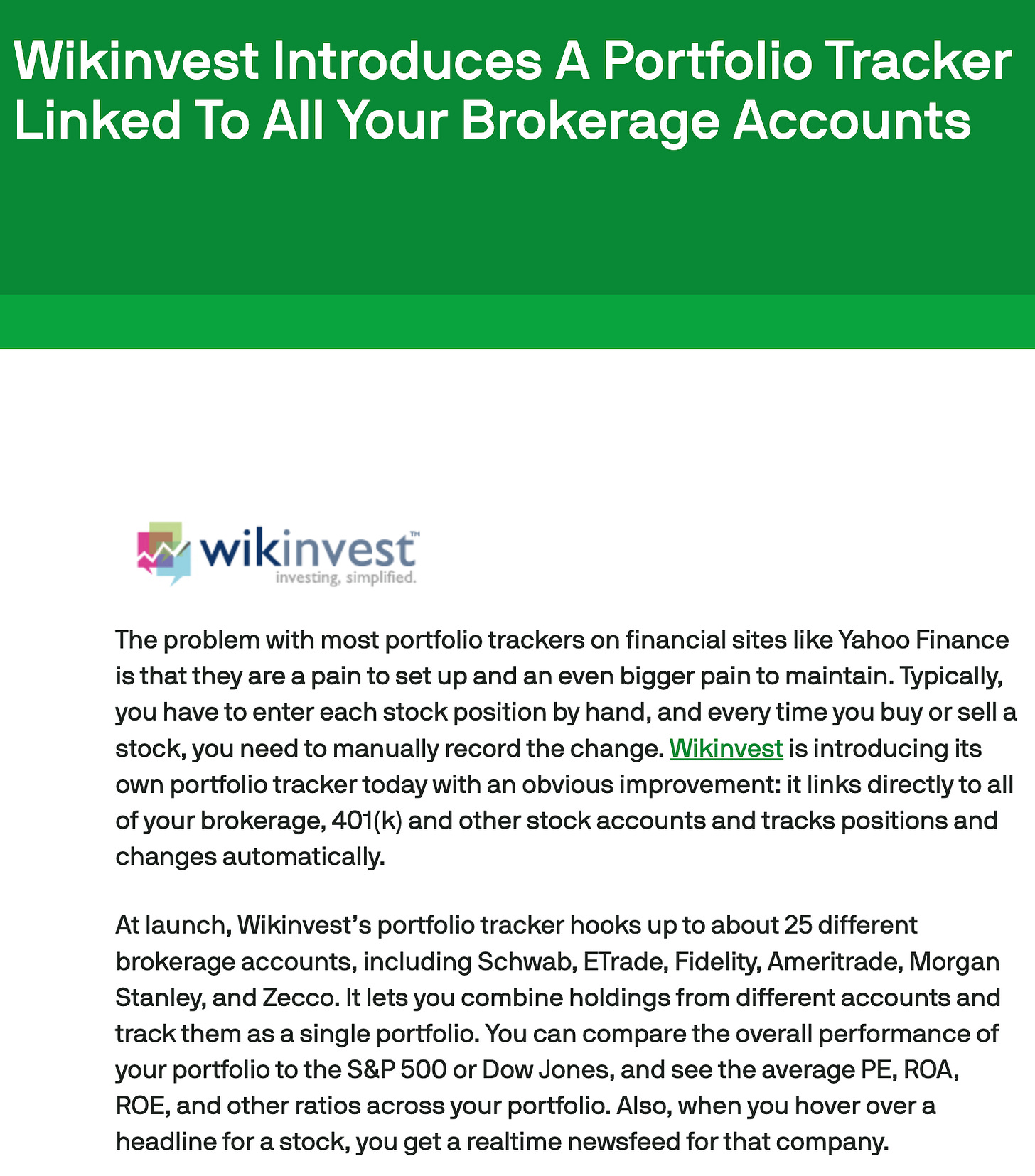

You know, we went to college in the kind of 1998 to 2002 ish time frame and that, as you may recall, was kind of the first dotcom boom. And so people were starting companies out of their dorm rooms. They were day-trading. I mean, it was wild, wild, wild times. You know, internet 1.0, you know, after school, we both went off and had real jobs for a while. I went off to Amazon, he I think went off to Amgen and then kind of reunited back in 2006 to kind of start things off. And then, you know, the Wikinvest evolution of Tandems actually was like a multi-step hop. So where we started with Wikinvest, this kind of investment research portal, we evolved to actually this kind of portfolio tracking tool. And it was kind of an interesting twist on how that happened. You know, when we first started Wikinvest, you know, the business model was unclear. So at the time, you know, we’re like, well, you know, wikis are very capital efficient.

We don’t need to raise a ton of capital to kind of get this off the ground. And so we don’t necessarily need to have immediate plans for kind of monetization. But what basically happened is, you know, the first product we built was very SEO friendly. So we started getting a ton of free traffic from Google and all the search engines. You know, we didn’t we didn’t really pay anything for our audience. But, you know, for a site that kind of gets its traffic from Google. It was very, you know, what? What I would call, like drive by traffic. You know, people type a search term into Google. We happen to pop up really high. People click on the link, they check out our article, and then they go right back to Google. And you know, look at results two, three, four and five. And what we wanted to do was try to build a stickier product.

Lex Sokolin:

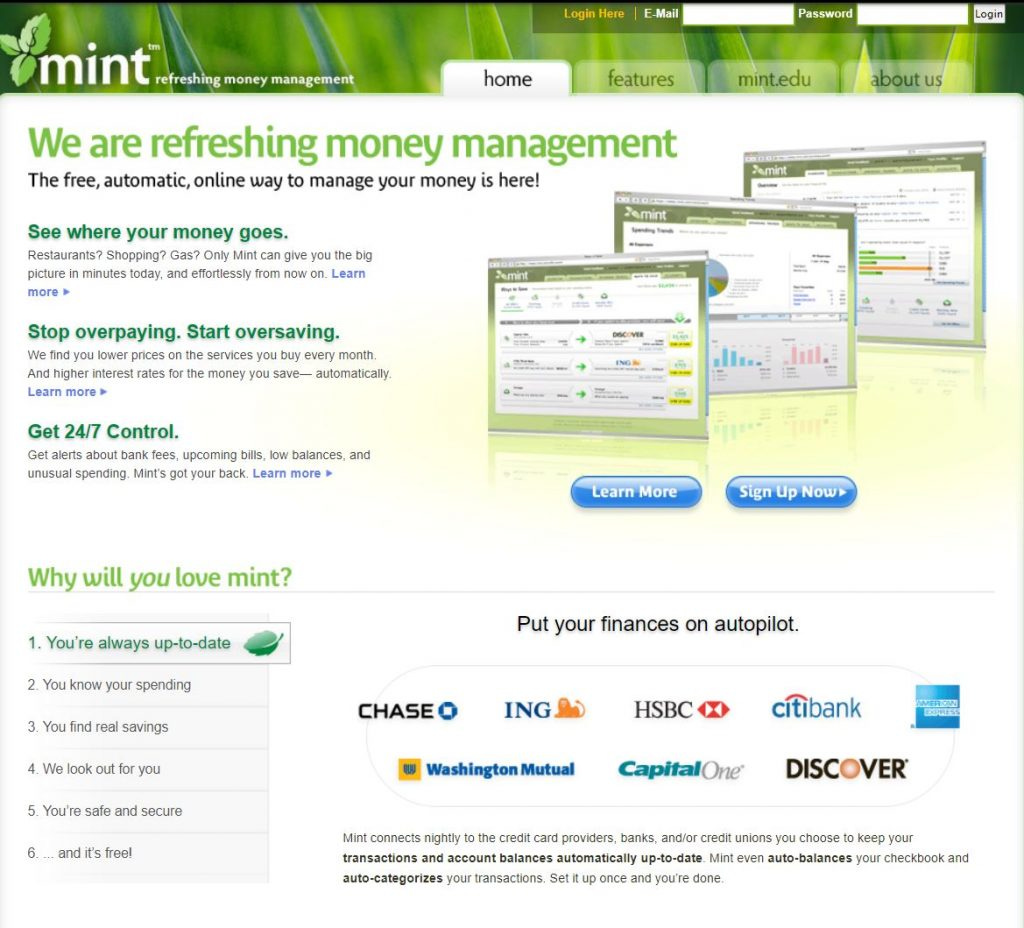

Can I interrupt you with a reminiscence? I think you guys were absolutely spectacular at building traffic at the time. I think it was really hard. And the one story that stands out at me, because I think probably for both you and me at like mint com was a big inspiration. I remember mint com had a heavy SEO strategy at the time to get to sort of consumer investors or like the sort of very mass market person who’s like, how do I budget? Like, what do I do with my money? And they had this industrial farm. They were the first, I think, to really do it. Well, this industrial farm of content for people who are searching for personal finance stuff. One of their articles, and I swear I will never forget it, was should I buy cat food or make cat food out of my own leftovers?

And this article was like one of their like, viral hits, you know, again, early on in the early internet. And I think it’s just such an amazing, like symptom of somebody who understands what people search for, you know, or like the consumer psychology of the time of like, somebody is budgeting, you know, and is trying to figure out, like, things are tight, you know, am I going to buy more cat food or am I just going to mush up like my leftovers? And I think for you guys like that long tail of search was a genius move to bring in traffic.

Mike Sha:

Yeah. You know, wikis are extremely search engine friendly. You know, they have a lot of text, a lot of keywords. And at the time, there was, like, not a lot of competition for, you know, websites with investment research. You know, beyond just like, obviously the big journalism sites. And so we it was very quick that we started getting, you know, meaningful traffic from Google. You know, as I was kind of saying, a lot of that was kind of non loyal customers, you know, people who probably even know what the website was. They just you know, we just happened to be like the first or second link on Google. And so the first twist in the product was okay now we get all this drive by traffic. How do we turn it into sticky traffic as we talk to our audience? And, you know, kind of did user research. One of the things that they said was like, hey, I have a portfolio.

It spread across a bunch of different places, probably because they have, you know, for one case from a bunch of jobs. But it’s like really annoying to kind of track it all. You know, there are no tools that make that easy. You know, Mint.com, as you mentioned at the time, was really kind of banking focused. It was not investment focused at all. All the finance portals, they had these like stock tracking tools, but you had to manually enter in all your data. So like literally you’d like type in your ticker symbol, the holdings, the number of shares, the date you bought it, the price you bought it. And it was just like totally laborious work. So only the most diehard, you know, kind of, on top of it, people were really using those tools to any meaningful level. And so that’s what led us to portfolio tracking, which is then, you know, led us to two important kind of insights. One is we went B2B, so we were like, well, we had this portfolio tracking tool.

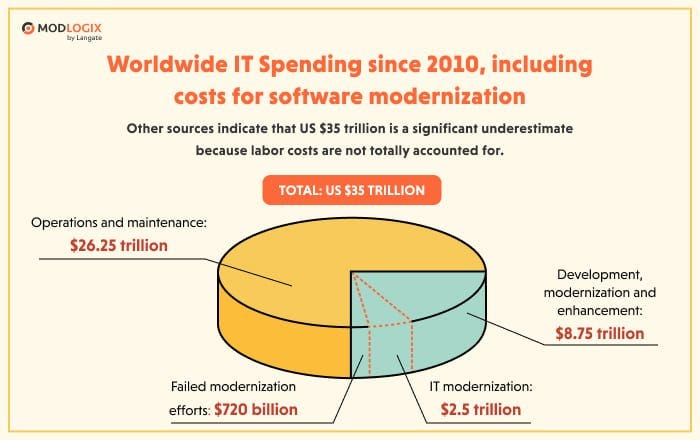

We get some nice audience from Google. But you know, we don’t have like 20 million people a month, you know, using this tool. And so we started actually reaching out to all the finance portals offering to replace their portfolio tracking tools with ours, and that actually worked out great. We signed up. Yahoo! The biggest portal. CNN, AOL, NPR. you know, a ton of different sites, USA today, actually over a pretty short period of time. We started tracking. I think it was like 4 or $500 billion of assets. That, to us sounded like a huge number. But what was actually more interesting than the amount of assets on the platform was we were able to kind of actually see, like, what do people invest in? You know, because like we’re tracking their portfolios. So we had all this aggregate data about what stocks people buy and how concentrated their portfolios are and how often they trade and the fees that they pay and all this stuff. And we basically when we looked at that data, we came to one really, really clear conclusion, which is most people are really not good at managing their own portfolios.

And that ultimately is what caused us to become an investment advisor, right? The whole early days of roboadvice and using software to manage portfolios and democratizing access to good investment advice and making it affordable and accessible like that whole thing was kind of proven out by the data that we had, which is left on your own. You know, the average retail investor is really not doing a good job managing the portfolio. And so, going back to what I was saying earlier about investing being a hobby versus investing be a chore, we’re like, well, for a lot of people, investing is a chore. How do we make it less of a chore for them? And that led us to building, you know, what we used to call SigFig.

Lex Sokolin:

Yeah. So I remember at the time there were three go to market strategies that made sense to me. And there are good companies in each of them. One was a straight B2C play where you are trying to get people to buy investment product from you.

And end of the day, I think. Betterment, Wealthfront, Personal Capital ended up eating that opportunity. I think there was sort of a limited size for that opportunity for de novo investment managers, but it certainly was there. And then the second one, which is sort of where you started, was more of a top of funnel media business. I’m surprised by what has happened to that, you know, and I kind of the media business to me includes also the data aggregation piece in the sense that it’s pretty high up in the top of funnel. You’re not necessarily converting into investment product for a lot of stuff, and then you’re paying for investment and Yoli and all that stuff. And you could make the argument that Plaid got stuck there, even though obviously they’ve got lots of other products and authentication and all the stuff. But you know, there’s sort of a top of funnel. I think it was Credit Karma that built one of the better businesses in that space in terms of being able to monetize. You know, I forget who it is that into it kept instead of mint when they shut mint down.

But like in the budgeting credit space, I feel like there are a couple of companies that got to the $100 million revenue range, and they had to do it based on a very different path than converting into investment product. And then, you know, the third path is B2B is I’m going to help whoever it is, asset managers, wealth managers, RIAs brands operates a digital investment experience. And then, you know, that can go wider. It can go deeper, it can go to investment banks, it can go to smaller players. And so I’d love to hear a little bit more about your decision and how you followed the money. And then sort of the early experiences that you had with the larger players that were your partners?

Mike Sha:

Yeah, it was actually not a hard decision for us. I think it came down to two things. One is we had that early experience from working with finance portals, and I think those partnerships clearly proved that distribution makes a big difference. You know, we went from having I think it was probably half of a million to 1 million, you know, monthly uniques from Google to being exposed to websites that reached, I think like 100 million people.

You know, over the course of a year. And so there’s no way we would have gotten to tracking $500 billion of assets if we had just been kind of doing it on our own. When you can get in front of big audiences and you have the right kinds of partnerships, you know that that can really work in driving scale quickly. And then the other thing was thinking about the investment advice space. You know, when we thought about it, we were like, well, you know, would the average consumer turn their life savings over to a startup that they’ve never heard of, that they, you know, happen to just kind of stumble across? Or are they more likely to turn to large scale, trusted financial institutions with whom they already have relationships, and our conclusion was that they were more likely to turn to institutions they knew and trusted. And then, you know, we didn’t know, you know, much at the time about, you know, the state of technology and software inside these firms.

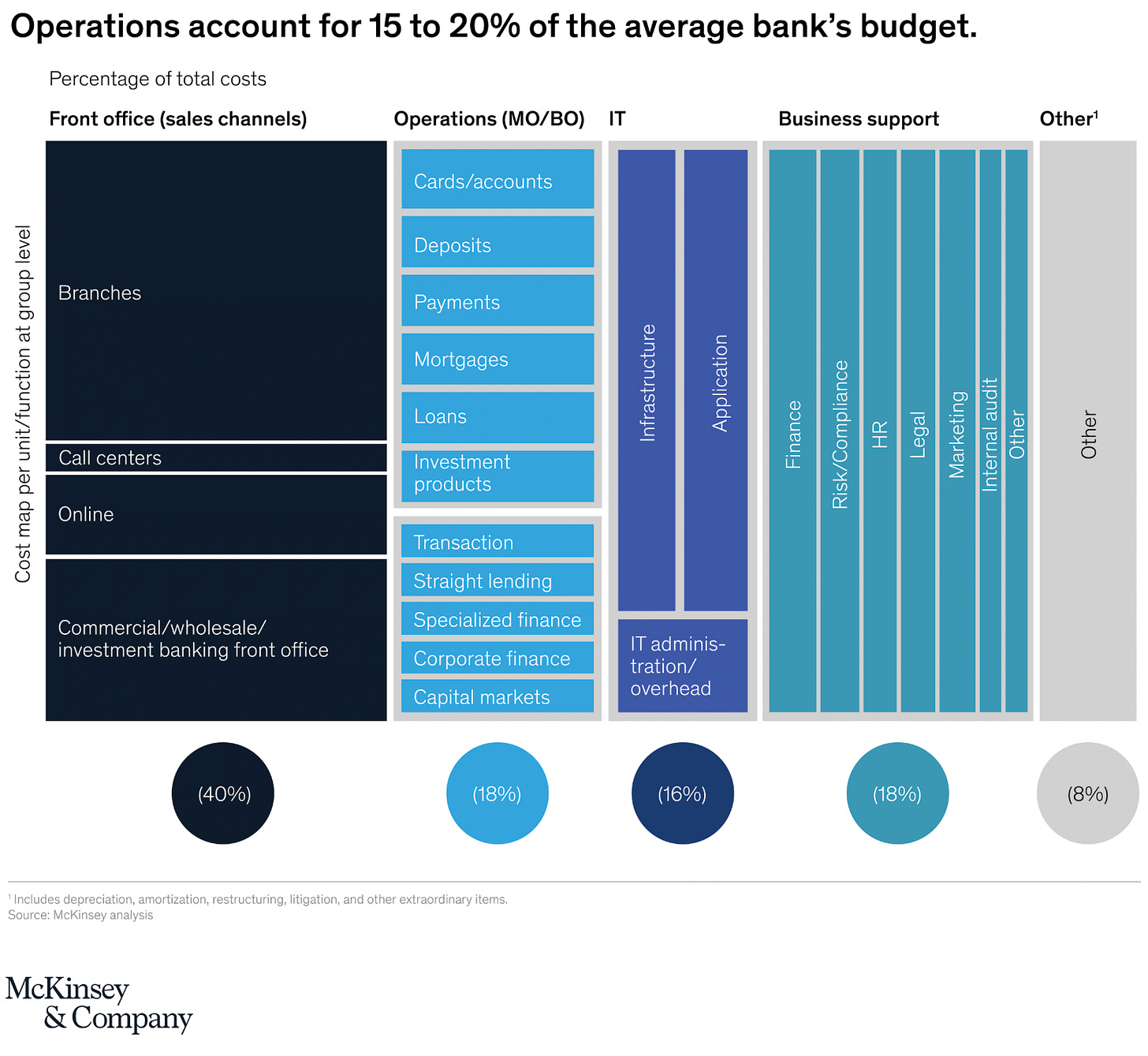

But, you know, we’ve obviously since learned a ton. When we thought about it, we were like, well, most of these companies are financial institutions. They’re not software companies. You know, I came from Amazon, our CTO came from Amazon. We came from like real software companies. And I think our thesis was, you know, for the typical financial institution, it’s building software is not their core competency and focus. They have lots of teams and lots of resources that are supporting their technology infrastructure. But, you know, building kind of unique product experiences from scratch is not really where most of that money gets spent. And so it felt like a really good match made in heaven where like we could build the product and the software, they could provide the audience and the brand. And you know, those are the four ingredients you really need to have kind of an awesome experience that is adopted at scale. And so that led us to really kind of going down the B2B route. Now it was kind of interesting.

Like when I look back, you know, most enterprise software companies that sell to banks, they probably start with like small banks and then try to work their way up to big banks. I think somehow we just got lucky. You know, we were kind of in the right place at the right moment with the right product. And we were able to land, you know, some really large financial institutions in the early days that really kind of catapulted the company. We ended up hiring a ton of people and growing a lot. And, you know, kind of building out the obviously the product suite. But more than anything, I think what was kind of interesting was we got a front row seat to what the software environment inside of is actually like.

Lex Sokolin:

Which is, by the way, why I left roboadvice and went into crypto.

Mike Sha:

Yeah. You know, it’s all kind of painfully obvious in hindsight, but you know, you kind of learn these lessons along the way. You know, I think again, we came from I would call them modern software environments, you know, where, Amazon built basically all of its software in the last, you know, whatever it was at that time, it was probably in the last 10 or 15 years.

I mean, banks have software that is like 50 years old, you know, in languages that people don’t even really understand anymore. And as a result, they’ve got all these old legacy systems. They’ve been around forever. And I think that the dirty little secret on kind of how to be successful in building software for banks is to actually try to understand, like, what do you do with all that old software? How do you play well with it? How do you integrate your software with that existing software? Because most of the time that software is not going anywhere, you know. And so, you know, I think that’s a lot of the lessons we learned is, you know, how to integrate our product well with the existing tech stack of, you know, the bank that we’re working with and not have that turned into like a professional services business where, you know, we’re just doing a ton of custom software development, like we still believed in the enterprise software business model and the whole SaaS mindset.

And so, you know, navigating that is tricky but doable. And, you know, over the years we kind of figure it out, our little kind of formula for how to do that well.

Lex Sokolin:

Let’s meditate on that a little bit. And I’ll just ask you like what’s the secret. Right. And I think you guys were involved with UBS among others. You know, I think that is public information as far as I know. If you imagine as a fintech startup in the early 20 tens, working with UBS, you know, the power dynamic is way different. We’re not in a place where, like you say the word stripe and everyone is afraid. you didn’t have, like Coinbase, which has stolen the attention of an entire generation from the private banks. So the way that a company like UBS shows up is with 20 people, lots of committees, a whole bunch of things that you have to do, like you can deploy your software, but it has to be on our machines.

And you got to give us, you know, 20 people that we can call on as part of the project team. And by the way, we own all the IP that you develop for us internally, you know, what do you do as an entrepreneur when you’re faced with that? Like, how do you even navigate that?

Mike Sha:

It’s amusing to look back on, you know, some of those early meetings we had with the big banks, I mean, the company was probably like 25 people at the time, and we would show up with, like, you know, 2 or 3 people and they would show up with like 80 people. Like, I kid you not. And so it was it was kind of interesting early days. I think you have to really appreciate and respect the fact, the way banks work and all the different functions and all the control functions, you know, security and regulatory and risk and compliance and thankfully, you know, I credit our investors and board. You know, many of our investors and board had deep, deep, deep experiences from the financial services industry.

And so they gave us good counsel on like how to actually be successful in working with banks. You learn a lot by, you know, doing your first few deals. And, you know, I think they were. Really great to work with really. All of our partners were great to work with. Sometimes they’re slow, sometimes they take a long time to do things, but it’s all in the interest of doing the right thing and doing it, doing it the right way. And so, you know, you just have to be ready for that. Yeah. You know, like when I think back about those early partnerships, you know, I think it was fortunate that we really did understand, like what was important to a bank and how to be successful in working with them. Because I even to this day, you know, when when fintechs work with banks, you know, and have been for a long time, there’s still a ton of young companies who really just get frustrated about, you know, the way that financial institutions operate and the way they work and, you know, find it extremely challenging.

I think we’re seeing a second wind of that with the whole kind of AI wave. You know, there’s obviously a ton of small young companies sprouting up wanting to work with banks. But, you know, one thing I hear a ton from, you know, the partners that we work with is that not only are those companies kind of young and a little bit like starry eyed and don’t quite really understand the way banks work, but they actually even don’t really deeply understand the problems that are faced by the industry. And so, you know, my hope is that, you know, some of those startups can get the crash course that we did because there’s a ton of help needed across the industry. And, you know, we’re obviously big believers that AI is going to play a big role in, in, you know, the next decade here.

Lex Sokolin:

Yeah. Oh, it’s so much easier these days. So much easier than when we did it. You know, between embedded finance and stablecoins and all that, it’s I’m curious as to you building an organization in that growth moment.

You know, and I want to transition also to what the modern version, the current version of Tandems looks like. And but I want to do that through the lens of people like you get to 25 people, you are inserted into a couple of banks where you’re starting to have some more predictable revenue, and you have a path to being kind of relevant in the market, even though that I think UBS was doing some silly things like launching competitive products in different jurisdictions. So I’m sure that was very stressful. Like, who do you hire? How does that change your culture as you’re getting from 25 to like 100 people when you look back? Like, where do you find yourself once these new people are in the company, where do you find yourself? You look around and you say, okay, I’ve changed things around me. How do you reflect on that?

Mike Sha:

Yeah, it’s a great question. I think there were kind of two themes that we followed. I don’t can’t say that these are the right themes, but I think this did help inform, like the way we grew the company.

I think the first is, you know, at the core, we’ve always been a product and software company. So, you know, some SaaS companies are driven by marketing and sales and, you know, other functions. But I think at the core, we’ve always felt like, you know, the product we build is the company. And so a huge proportion of our company has always been people building stuff, you know, whether that’s design or product managers or QA or Engineering, of course. And so that focus for us actually led us down kind of an unexpected path, which was to actually open up a lot of satellite offices. This obviously is like pre-pandemic. I mean, we opened up our first satellite office in like 2007, like, you know, a year after we started the company and it actually was in Singapore, believe it or not. But, you know, there was a huge war for talent. There still is. You know, we just basically followed our nose in finding talent wherever we could find it.

And we were willing to have people be remote and open up remote offices. And I think in retrospect, that’s turned out to be quite fortunate for us because it’s allowed us to tap into really, really great talent, but also help kind of manage, you know, our cost structure. And it’s nice to have kind of both sides of that equation work really well. So if you want, you know, we can talk about, you know, the journey to kind of create remote offices and, you know, kind of have teams spread across the world. But the other thing that I think helped inform how we grew was really just finding the right leaders. You know, I think that’s advice that, you know, most investors probably give their founders is, you know, you can’t you can’t build a company by yourself. You get to surround yourself with really great world class people. You know, I think we took that seriously. And, you know, we we’ve always been kind of aggressive in kind of finding the right folks to add to the table.

I think part of what’s tricky about that in our space is we kind of perfectly need to straddle, like the software world with the finance world. If you only bring in people from software who don’t really understand financial services and, and the other side of the world, they’re going to have a real hard time. And if you only bring in people from finance and you don’t have like real true software DNA with world class software engineering. You also don’t get very far. And so for us, you know, the trick was kind of finding either people who had seen both sides of the world and those folks are not that common, or to find people who are really great specialists in kind of one half, but who are open minded and embrace learning the other half, and then, you know, bring those people together to do great work that that I think has been a recipe for success for us as well.

Lex Sokolin:

So tell me about where the company is today, because kind of SigFig, which is the prior brand in my mind, significant figures in my mind was a large scale private label, sort of industrial robo advisor platform for the big investment banks and then sort of the deposit banks as well.

A bit of the robo advisor strategy hit a limit in terms of size in the market. And as an entrepreneur in the space, like I feel like it went the wrong way. You know, we went from asset allocation to sort of hyper financialization, hyper gambling. You know, like the Robinhood’s and the Coinbase’s of the world. And now even sort of like more esoteric stuff like hyper liquid and so on have gotten the majority of mindshare from the younger generations because of this, like, weird macroeconomic situation they’re in. You know, so I feel like there’s sort of been we haven’t gotten with digital wealth to the size that like the ETF markets got into. But we might get there with, you know, tokenized assets and robo advice might be sort of like a new permutation of it as AI comes into the space. So tell me where the company is today, how you’re thinking about the future and the main things you’re excited about.

Mike Sha:

Yeah, I think what going back to what I said earlier, you know, investing is a chore, investing as a hobby.

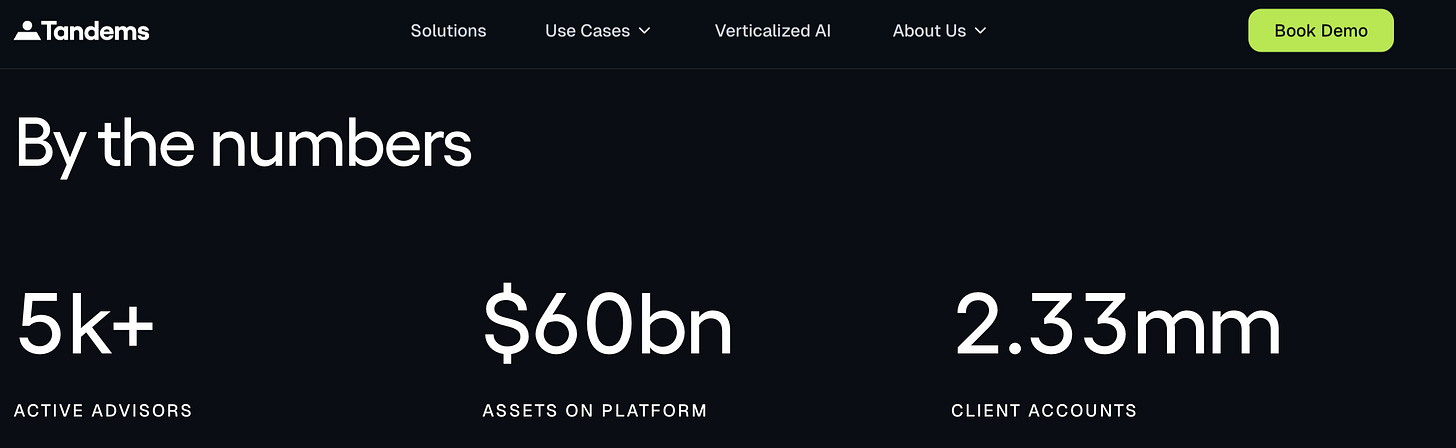

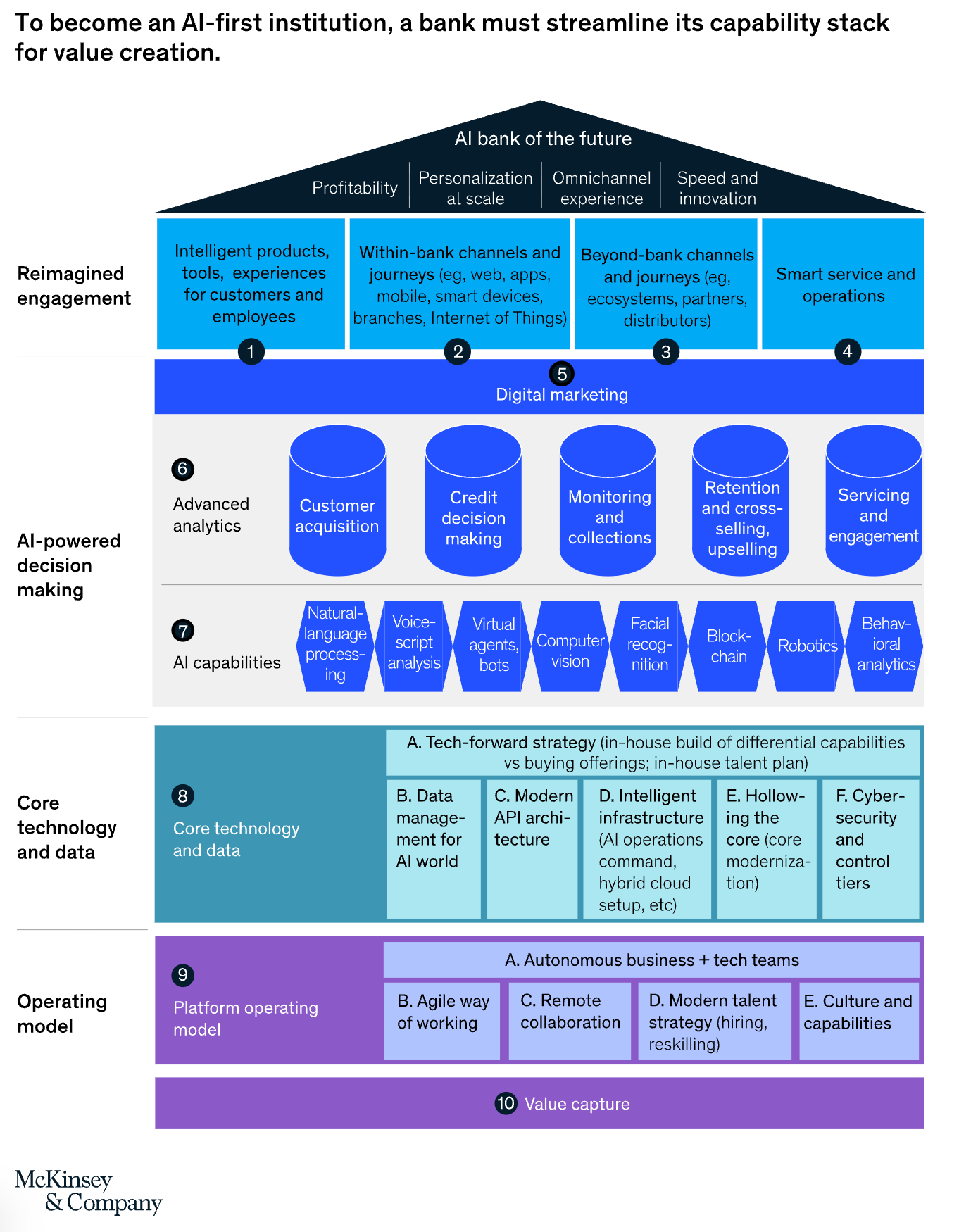

I think we squarely doubled down on serving the market for whom investing is a chore. And the reason for that is because, you know, it’s a much, much, much bigger market. And to some extent it can be an underserved market depending on which pockets of the market you’re talking about. And what happened with us is as we launched SigFig, you know, we built a B2B robo advisor. We’re working with, you know, these big banks like Wells Fargo and UBS and citizens and so on and so forth. One of the things that we realized is the technology that we had built to help modernize the software stack in the wealth space, actually would be even more valuable in the hands of advisors. And so what happened was we started kind of deploying our solution with traditional financial advisors, helping them offer better investment advice to their clients. And that really started to scale. So, you know, we started getting thousands of advisors, tens of billions of dollars of assets on the platform. And, you know, once you really get inside the bank and you talk to advisors, you realize that there is some really, really crappy old technology that they’re using.

We basically felt like a little bit like a kid in the candy store. You know, if you put a bunch of people who want to build awesome software and you let them see the software that is being used by the industry today, you’re suddenly like, oh my God, there is opportunity everywhere to build better things for this industry. And so we started out, you know, with that kind of digital investment product, and we started to really expand the suite of offerings that, you know, we were building for financial institutions and, you know, the financial professionals that work for those institutions. And so over the years, you know, we ended up building out multiple different kind of products. You know, just this year we renamed and relaunched the company as Tandems. And the reason we did that actually goes back to what you said. You know, you think of SigFig as a robo advisor. And we had significantly expanded beyond robo advice at that point. But a lot of people still kind of understood us to be a robo advisor.

Some of them even thought we were still B2C in our focus. You know, we just thought kind of a new name and brand. And obviously we built a whole new product suite. You know, all of that probably made sense to be launched to the world under kind of a new identity. The other obviously huge driver in, you know, kind of our product strategy and also the decision to kind of launch as Tandems is we have just been so bullish on the potential for AI to help modernize, you know, the whole industry. And, you know, of course, I’m sure there’s tons of companies out there who believe that as well. But I think where we really felt we had a differentiated approach is we had spent the last decade actually working with advisors. We saw the actual work that they do. We saw what’s broken about it. We saw what’s broken about all the systems. And so instead of thinking about the impact of AI as some newfangled technology that was going to go off and solve a bunch of totally new problems, we’re like, well, there’s actually a ton of existing unsexy problems that exist in how advisors do their job and the way that they give advice to consumers.

And let’s start with, you know, tackling some of those challenges, but using AI as part of the solution. And, you know, that’s gone really, really well for us.

Lex Sokolin:

Can you talk about what it means to use AI? You know, it’s such a broad term and it can be anything from like I’ve put chat into my website to I’m using machine learning at industrial scale to help like underwrite my lending and optimize my trading. So can you talk about where you saw the open spaces in investment management for AI and then sort of the things that you’ve worked on.

Mike Sha:

Yeah. I think you’ve got to think about this. In time horizons, you know. So I think we’re in the early phase. And our hypothesis on what happens in the early phase is that the first place that AI will make a big difference is taking a huge amount of the manual labor out of how advisors spend their time, and really using AI to help them automate a lot of that work. So if you actually observe advisors and what they do all day and how they spend their time.

By our account, something north of 90% of their day is spent doing kind of repetitive administrative tasks scheduling meetings, preparing for meetings, conducting meetings, emailing clients, responding to clients, doing paperwork, doing compliance reviews, doing annual client meetings like these are all very, very repetitive tasks. You know, the typical advisor is like just barely, if at all, leveraging technology to help them with that work. And so imagine, you know, just like AI is doing a lot of other walks of life. Imagine you had software that could help you do a lot of that work that you really don’t actually enjoy doing. You know, like if you talk to advisors, they love spending time with clients. They love helping clients. They do not love doing paperwork. They do not love filling out, you know, compliance notes. You know, these are not the reasons that people love their jobs. And that actually leads to a high degree of receptivity for AI to help do that work that they don’t actually want to do.

So how do you actually make that happen? Goes back to that legacy technology stack. So, you know, think about all the systems and workflows involved in doing everything I just said setting up meetings, running meetings, doing paperwork, opening accounts, rebalancing portfolios. I mean, there’s oftentimes 20 different systems involved to do that work. And so our belief is that the promise of AI that’s useful and effective at doing that work, it’s got to be AI that’s well connected to all those systems and workflows. So we have a whole kind of software layer that we’ve built. We call it the wealth OS, where at the middle of that layer, we’re connecting data systems and workflows across all those existing legacy systems. And then we’re building an AI application layer on top of that that helps automate the completion of that work. So that’s kind of phase one. And we have broken up our product in this kind of early phase of AI rollout into kind of three big themes. We’ve got one solution, family that’s focused on helping advisors run better meetings.

And so think about all the work related to meetings. You know, I mentioned some of that before, but scheduling meetings, prepping for meetings, pulling the materials together, preparing presentations, actually conducting meetings, taking notes, doing follow ups from those meetings, like all of that workflow can all be kind of automated and supported through AI. The second big theme that we have is around helping advisors gather assets. So, you know, a lot of people inside the industry realize this, but, you know, a huge function of hiring a huge team of advisors is as a Salesforce, you know, they’re out meeting with clients, convincing clients to let them manage their money. Again, like if you look at how advisors do that work today, it’s almost all manual. Imagine, you know, you could take modern software and AI and help deploy that to the way that advisors add the most value for the firms that they work with, which is as a Salesforce. So we’ve got a whole product suite that’s basically focused on helping them gather assets.

We call that Tandems grow the first product lines called Tandems meet. And then the third product line is Tandems Invest, which is an extension of all the things that we’ve been doing over the last decade, which is using software to help manage and automate a lot of the work related to managing portfolios. So obviously, a huge part of the value proposition of an advisor is that they actually manage your money. So, you know, we’ve built a ton of software that does that really well and at scale. And, you know, with all the compliance and risk and regulatory requirements that, you know, banks live by. So we’re not we’re not, you know, kind of running away from our past. We’re kind of continuing all the things that we have done for the industry and expanding upon them. Now, if we ever get to like phase two and phase three, which I’m sure we will over the coming years, you know, once you get through automating a lot of the work that people don’t want to do, then you can get into the opportunity set of all the things that advisors could and should do that maybe they’re not doing yet.

And we’re also really, really bullish on, you know, how AI can do that. But I think it’s interesting when you when you really get into the psychology of advisors, I think they want to build conviction that AI is going to help them first, before they believe that AI is going to make them better. And so, you know, I do think if you talk to the average advisor and you said, oh, you know, is there a software that, you know, could help you be a better advisor? They are probably pretty self confident that they’re great advisors already. And so I think our goal is to earn their trust that this software is here to help you. And, you know, the first step of that is kind of helping to eliminate the work that they don’t actually want to do.

Lex Sokolin:

Which AI providers have you found to be the most conducive for this? Like are you using Claude or what’s underneath?

Mike Sha:

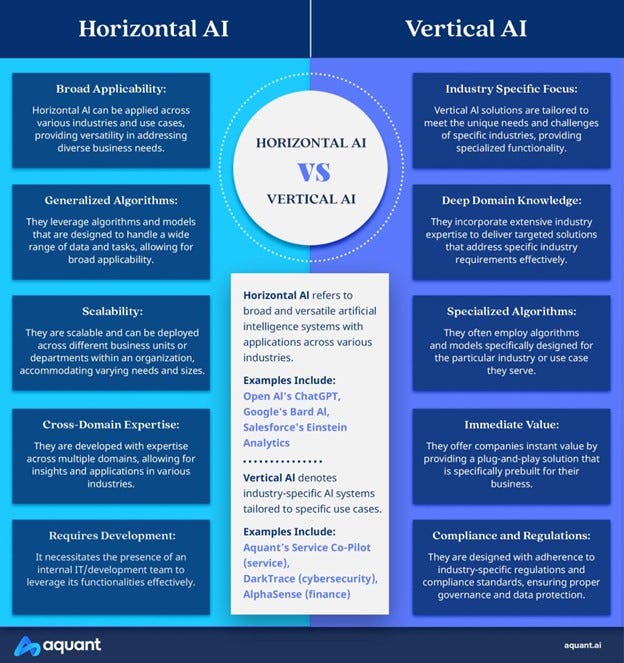

Yeah, we were very, very explicit in being open architecture in our underlying kind of models and what we call the kind of horizontal AI players.

There are a lot of different reasons for that. We probably won’t have time to get into all of that today, but I’ll give you the kind of quick versions of like why we chose to do that. One is we obsess around trust and accuracy, and it turns out that, you know, when you apply a horizontal AI model to a specific vertical eyes task, they all perform at different levels of quality, and the best performing model is not true for every kind of skill. So being open architecture allows us to use the right model or sets of models to solve the right problems. You know, if I’m trying to extract data from a photograph of a statement versus I’m trying to summarize a meeting versus I’m trying to, you know, manage a portfolio, it’s not surprising that the best model is not the same for each of those tasks. So being open allows us to drive accuracy and trustworthiness and reliability. Being open also allows us to adapt to the fact that these models are changing, like every week.

You know, like the best providers and the best model versions are constantly evolving. So if we even if I told you like last month, X, y, z vendors were the best. Next month it might not be true, you know? So being open allows us to adapt our solution to, you know, whoever is performing the best at the right cost, you know, structure and all those other considerations. And then the third reason we’re open is that, you know, we anticipate that certain firms may impose restrictions or have their preferred model providers that have been approved. And so we want to be able to be adaptable, you know, given the fact that we serve a lot of different institutions and, you know, not everyone’s going to make the same choice. And that allows our solution to be more widely adopted. You know, a huge part of what I’d say we learned over the last decade, working with a lot of banks, is to kind of make your product highly configurable. You know, as much as we’d hope that, you know, every bank has the same technology stack and has the same go to market approach.

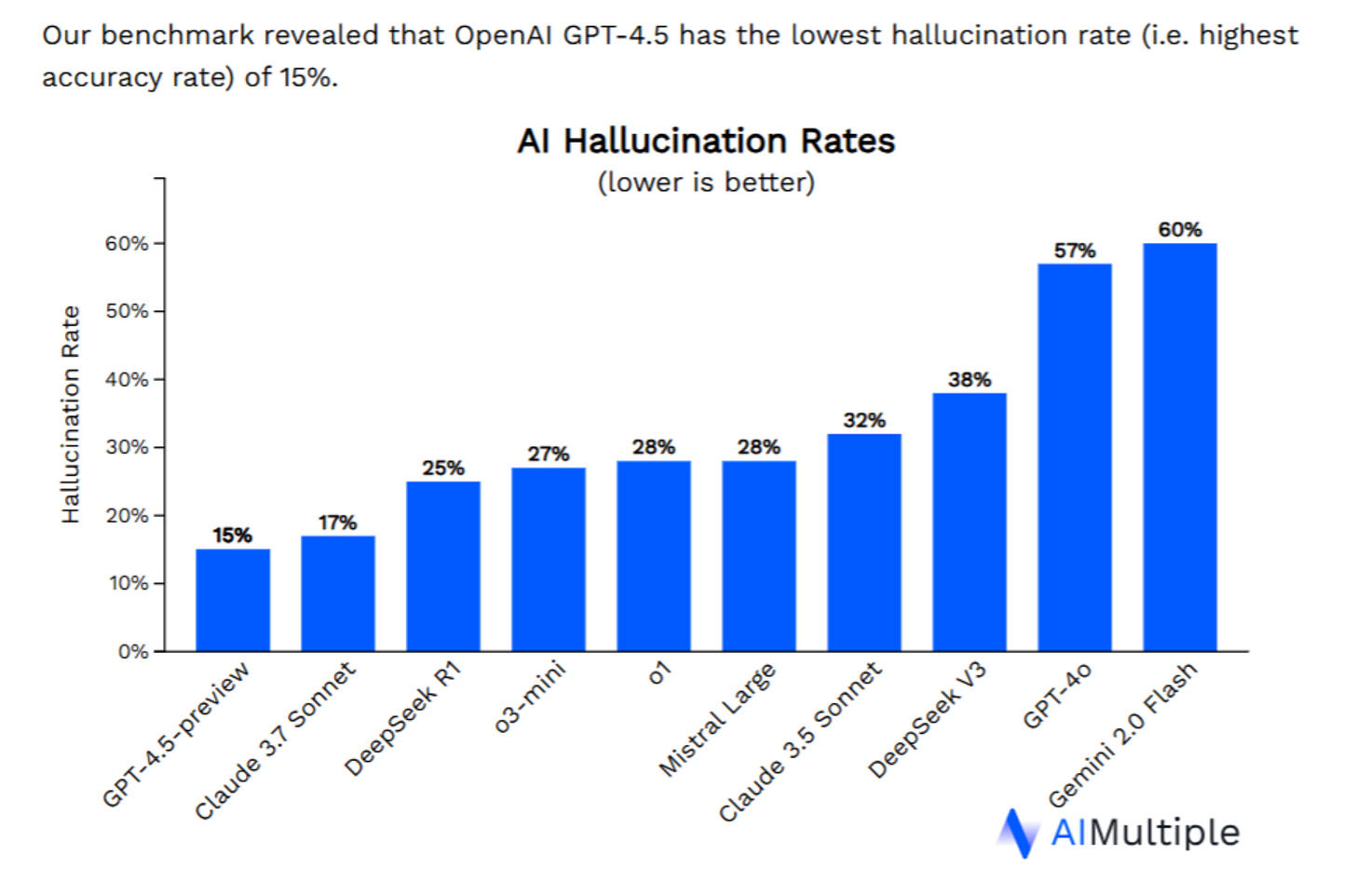

You know, the truth is each firm is a little different. And configurability allows you to still have, you know, one core software product but adapted to be a little bit different, you know, depending on who the client is and what their needs are. And, you know, we anticipate that the same thing will be true, you know, on the AI stack as well. Now, we don’t just take those horizontal models and just use them out of the box. Most of our IP that we built in the space has been in verticals using the kind of open large language models for the very specific use cases of, you know, our industry and our users. And that is actually what allows us to drive high levels of accuracy is, you know, we can kind of focus on a more narrow set of problems and users and jobs to be done and make sure that, you know, our adaptations of, you know, the the AI models can drive to really high degrees of reliability. Sometimes I like to say, you know, in the AI space, you know, I think we’ve all heard about hallucinations and accuracy and all the things that people talk about.

Even if you took like a generalized model out of the box and used it, maybe it’s 80% right, 70% right, 90% right, depending on what what the what the skill is. It turns out, you know, in most use cases in financial services, being 90% right is kind of like 0% useful in production. You know, getting to that last mile of, you know, four nines or five nines of reliability is kind of where, where the world needs to get to for banks to want to deploy, you know, AI in certain use cases, you know, in production. So a huge amount of our effort has been in building upon open models to make them more reliable.

Lex Sokolin:

I love this conversation, and it’s been fascinating to hear kind of the evolution of the business and how you’re going deeper and deeper against the market opportunity. I think that’s absolutely fantastic. If our audience wants to learn more about you and about the company, where should they go?

Mike Sha:

Check out our site Tandems.ai

Lex Sokolin:

Awesome. Mike, thank you so much for joining me today.

Mike Sha:

Yeah, great talking to you, Lex. You clearly have been around for a long time. And remember a lot of the last 20 years of fintech. And it was fun to kind of think about the longer arc of where the industry has been and really where it’s headed.

Lex Sokolin:

My pleasure.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.