Hi Fintech Architects,

In this episode, Lex speaks with Ali Niknam, CEO and founder of Bunq, a leading European neobank. Ali shares Bunq’s journey from its founding during the financial crisis to becoming Europe’s second-largest neobank. The conversation explores Bunq’s user-centric philosophy, innovative products, and unique organizational design. Ali discusses overcoming regulatory challenges, prioritizing cultural values, and fostering accountability within teams.

The episode also examines the complexities of the European fintech landscape and Bunq’s mission to revolutionize banking by focusing on user needs and continuous improvement.

For those that want to subscribe to the podcast in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In Partnership

Persona is a digital identity platform that has stopped over 75 million AI face spoofs in 2024 alone. Fight fraud and convert users, whether you’re processing loans, issuing credit cards, automating account openings, or any other use case. Make sure to check out Persona below.

Key discussion points:

Pioneering a Full Banking License in Europe: Bunq was the first greenfield company in 35+ years to receive a full Dutch banking license. Unlike many fintechs that built on existing infrastructure, Bunq built its own core banking system from scratch, enabling full regulatory control and long-term product innovation from day one.

A Radical, User-Centric Org Design: Bunq is structured around the user journey, not traditional departments. Every employee, including the CEO, handles support tickets to stay close to customers. Teams form dynamically around specific user needs, and ownership of outcomes defines seniority—not job titles. This fosters fast, user-led innovation.

Europe’s Potential vs. Its Fragmentation: While Europe offers excellent quality of life and talent, it suffers from a lack of unified leadership and strategic focus. Regulatory fragmentation (like GDPR) and inconsistent policy make scaling harder, causing many top founders to relocate to the U.S. despite Europe’s appeal.

Background

Before founding Bunq, Ali Niknam was a successful tech entrepreneur best known for founding TransIP (now part of team.blue), which became one of the largest domain and web hosting companies in Europe. Born in Canada and raised in the Netherlands, he studied computer science at Delft University before leaving to focus on building businesses.

Niknam founded TransIP in 2003 and grew it by focusing on automation, user experience, and building core infrastructure in-house. His success with TransIP gave him the technical expertise and financial independence to launch Bunq in 2012, with the goal of creating a fully licensed, user-centric digital bank from scratch.

👑Related coverage👑

Topics:

Bunq, ING, Revolut, Betterment, Synapse, TransIP, Fintech, banking, crypto, neobank, challenger bank, culture, Europe, VC

Timestamps

1’09: Bunq’s Bold Mission: Ali Niknam on Reinventing Banking for the Modern User

6’27: Building from the Core: Why Bunq Chose the Hard Road to Reinvent Banking

10’08: Bootstrapped Banking: Building Bunq Without External Capital or Compromise

13’56: Launching the Future: Bringing Innovation to Market with Bunq’s First 45-Person Team

17’35: From Payments to Personalization: How Users Drove a Decade of Product Innovation

19’52: Designing for Eva: How Bunq Rebuilt Its Organization Around the User, Not the Org Chart

22’02: Beyond Titles: How Bunq’s Ownership-Driven Culture Redefines Teams, KPIs, and Hierarchy

28’14: Culture Over Compensation: How Bunq Attracts Mission-Aligned Talent Without Relying on Equity

35’06: Europe’s Tech Paradox: Why Innovation Thrives Despite Fragmentation—and What Must Change

39’11: The channels used to connect with Ali & learn more about Bunq

Illustrated Transcript

Lex Sokolin

Hi everybody, and welcome to today's conversation. It's going to be a fantastic one. We have with us today, Ali Niknam, who is the CEO and founder of Bunq, which is one of the largest neobanks in Europe. And it's a fascinating story of incredible perseverance and scale. So, with that, I'm excited to have Ali on the podcast.

Ali Niknam

Lex, thank you for having me. Glad to be here.

Lex Sokolin

My pleasure. Let's just start with how large is Bunq today and what does it do?

Ali Niknam

Before I tell you that, let's take a step back, because Bunq is now almost an oldie in the new fintech scene or era.

We started back in 2012 at the height of the financial crisis, with a bunch of people who felt like things should be better, and banking should revolve more about users and about users wants and needs. And so as a bunch of techies, we came together to try and improve this highly regulated and a bit antiquated sector. And the first thing we did was pursue a full banking license, which was at the time deemed to be impossible. And so, we do like a challenge. We came together; we did our homework. We actually read the law books and the rule books and all the other books, and in doing so, we successfully We obtained a full banking license back in 2015 and became the first greenfield company in the Netherlands to get a European banking license in over 35 years. And our vision has always been very simple, which is we put our users front and centre in everything we do. We have a laser focus on our users and we try to make life easy for them.

I appreciate with the existing notion of what a bank is. We may think banks are simple, but if you compare that to what we believe, a bank could be your financial body. In our view, then we believe that the tools and the app and the services we provide, you know, significantly make life easy for our users. And I mentioned this because it is based on this very simple conviction that we have grown to where we are today.

Lex Sokolin

I would love to get to the early days of how it was all coming together and what the landscape looked like, and sort of what made you move forward with this. But let's just kind of anchor the scale of the bank. Today, I know that. I think a few years ago it was 9 million users, and I think it's gotten bigger since then. Assets I believe are over 5 billion. Right. What's the footprint?

Ali Niknam

I believe the latest numbers we disclosed are a totality of 17 million users on our platform, with over 8 billion in deposits. And that makes us basically the second largest neobank in Europe.

Lex Sokolin

How many countries are you in.

Ali Niknam

All the European countries. You can sign up for our services, and we are in the process of getting licenses in both the UK as well as the US.

Lex Sokolin

And this is kind of a weird question. I'm interested in it, since you said of it as being your financial body from a brand perspective, what is the personality of Bunq as compared to the others in the top five in the Europe Neobanks market.

Ali Niknam

Well, actually, that's a really good question, but I believe behind that question is another question, which is who is our competition for the insiders, for the fintech insiders, for the people who work in the fintech industry and have taken an interest in this sector? They may believe that our competition is revolute or Monzo or, you know, N26 or whomever you'd like to compare us to. But actually, what we see is that there is real competition is with the incumbent banks, whether it's ING in the Netherlands, BNP Paribas in France, Spartacus or in Germany, et cetera, et cetera, etc. I believe that because we have spent so much time in building a product people love to use and building a company that people entrust their money to bank. Is actually used as a bank, as a primary bank, and not just as a money service. You know, because we are used and seen as a full bank. People compare us to the other full banks of course.

Lex Sokolin

As compared to the traditional banks, you have a personality. Rather than having no personality.

Ali Niknam

Yes, we have a face. We're friendly. We're transparent. We have all the values that one could consider as being modern. You know you can reach us. We're normal human beings. Instead of being this faceless, anonymous machinery that's, you know, treats you like a cog in the wheel.

Lex Sokolin

Let's then go to the beginning and forgive me for using the word neobank, but in the time when you were starting the company, it wasn't yet obvious to everybody. I think it was clear to a number of people that digital and mobile storefronts were the way to interact with financial services, but it wasn't obvious to everyone.

And we had a couple of examples that led the way, you know, so banks simple in the late 2000 and kind of the beginnings of digital investing in the US and so on, but really just kind of the introduction of the idea. What was the landscape for digital banking when you had your founding moment, and what were the seeds that led you to building the company?

Ali Niknam

Yeah, that's a great question because you see many of the companies you just mentioned that I also know they focus on building an app on top of existing infrastructure. So, they were really good at creating an app. But on the one hand, they were held back because they had to still interface with outdated, you know, backends. And on the other hand, they didn't have full mobility of movement because they were dependent on the licence of the bank to be able to offer whatever service they were envisioning. I think Bunq was the first who said, you know what? We're not going to do first, a version on top of another bank, or get a e-money license, or get a PSV license and then build it out.

No, our vision is that we want to fundamentally change the financial sector. We want to make the financial sector into something that is more user centric because it's easy to forget. But that wasn't the case back in 2010 and the year before. And so rather than first building a layer on top of something else, we're going to immediately apply for a banking license. This was incredibly hard because first of all, because there had been no greenfield permits for 35 years, nobody really knew how to assess a greenfield application, and by working together with the Dutch regulator, we came up with many of the concepts that are now common, such as sandbox environment, for example. Then secondly, because, you know, we now have terms like fintech and neobank, but these didn't exist when we applied. So, it was notoriously hard to explain what it was we were trying to do and why the regulator, who is inherently risk averse and conservative, would approve us. So many of the conversations were like, okay, so what's going to be the difference between you and ING? And we will try to explain.

Well, you know, our culture is different. Our focus point is different. The service is going to be different. And then I would say, yeah, but you just have an app, and they have an app too. So, you can imagine how difficult it has been to achieve that first milestone. But once we achieved it, I feel like the doors opened because very quickly we were able to launch, and we launched with something that did turn out to be competitive with the big bags. And so we're all changed.

Lex Sokolin

Yeah, I'm sure the regulator was not there with open arms in the beginning of the 20 tens at all. I like your point about not just trying to build, you know, something that rides on embedded finance, which at the time wasn't even really there, but that takes a certain amount of appetite for pain, you know, because like everything you've described, if you put myself in the seat at that time, it's like all you've told me about is fixed cost and how long it's going to take you to launch.

Right? So, like if you're not going to sit on top of another bank and God forbid, you're trying to build your own core banking system, that's $25 million of cost. And if you are going to try to get a bank licence, that's probably two and a half years of legal regulatory fighting. You know that's going to keep you out of the market. So can you tell me about what gave you the perseverance and the conviction to kind of push through that? You know, and maybe that's also a tie in to you took this risk on your own using your own capital. Did that allow you to do things that other founders weren't able to do?

Ali Niknam

So that's a really, really great question. And also, thank you for acknowledging something that many, many people overlook, which is the incredible, painful dread of getting this over the line. Because you are right. It was very difficult, and you know, some people see the excellent series Silicon Valley and they think, you know, you show up, you drink some beers, somebody punches a hole in the wall, everybody's laughing.

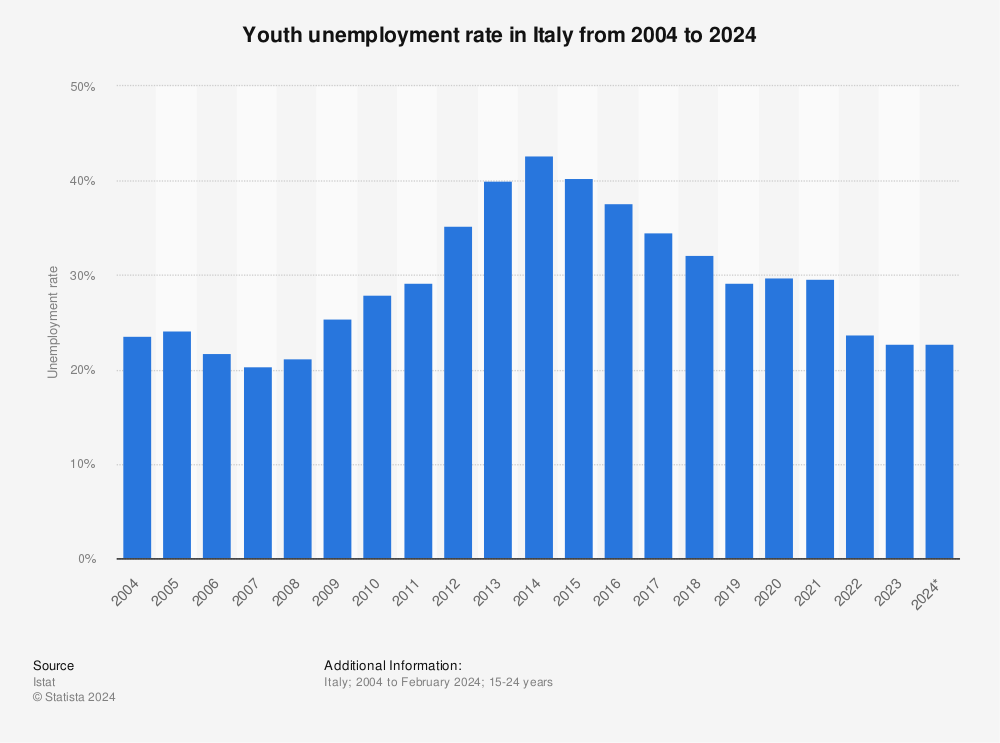

You go home happy. That's not really how it works, at least not for us. But I think, you know, the people that joined punk at start, they were all very idealistic, and I believe that idealism still exists today. We truly felt that we were doing this for the greater good, and we were touching many social aspects. For example, when we started, because of the financial crisis, youth unemployment was very high in Europe. For example, in Italy it was over 30%. So, one of the things we did at Bunq is we purposely hired younger people to get them off the streets, because there's nothing worse than not being able to have a job in your formative years. I mean, this happened in the 1980s and people talked about the lost generation, because if you don't learn how to show up on time and you know what discipline means and what responsibility means at a young enough age, it's difficult to learn this later on. Things like user centricity, actually caring about the people who use your services rather than just seeing them with as a wallet.

That was new. I mean, if you spoke to some bankers back then, not all of them, but some bankers back then, you know, these were just commercial sharks trying to get as much money as they could. The image of the Wall Street banker, I guess, you know, that's a known image. And then to change all of that, amidst of a crisis that led the regulators to be even more conservative was incredibly painful. And the one thing that drove us through it is this belief that no matter what, we were doing the right things for the right reasons, and that helped us to endure. And then as for your second question, the reason why we didn't attract any funding is because we were playing the long game. I don't know what your experiences with VCs and PEs are, but we were convinced that if we would go to PE or the VC route, we would have been forced to develop a product launch within a year.

Get some users, then go for, you know, a bigger license or a more elaborate license and iteratively, you know, do things. But that didn't match with the ambition we had and the ideology we had. And so, for us, there really was no other route than to self-fund it so that there was no shareholder pressure or less shareholder pressure to become profitable within X time. So, you can do an exit within Y time and, you know, etc., etc.

Lex Sokolin

The time horizon of investors is very often not the structure that gets you there. Yeah, especially when you're doing the most difficult things unless you do have really particular partners. What was it like once you got your first product formulation and market? Like what was the very first product that you were able to ship? And then how big was the team when that product shipped, and how did you get your first customers to use it?

Ali Niknam

Okay, so this is a while back, and I'm trying to be as accurate as I can, but take it with a grain of salt because, you know, it's almost ten years ago, or actually it is ten years ago, I believe when we launched, we were about 45 people and we launched with a simple service on the front end side that allowed you to do basic banking payments, online payments, peer to peer payments.

But already that first version had a lot of things that are now more common, but that were innovative for the time, such as payment requests, being able to get money back directly to your bank account from someone else's bank account, or having invites to your bank account so you could have like a shared pot with whatever number of people you want to have. So those things were very, very new. And of course, purely the fact that you could sign up online that was new at the time. We didn't have many of the tools that we have today. There was no face ID, so we had to come up with our own biometric identification, stuff like that. Those things were very, very innovative at the time. As to getting our first customers, because it was such a newsworthy moment that we indeed got our banking permits. At least in the Netherlands, it was all over the news. And because it hadn't happened. Right. So, people were just curious. And we got that first initial push.

Lex Sokolin

And how big did that get you?

Ali Niknam

I don't remember it was big enough to get started. Oh, we were worried about at the time was because all of this innovation you see in the front end was preceded by a lot of innovation in the back end. We built our own core banking platform that could do things and can-do things that no other core banking platform can. And so, you know, obviously we had tested it, and it worked. But you know, getting to launch and then getting all those I think we had 5000 users in the first day or something, which is a big number when you just start and you know, you're dealing with other people's money. So, you want to make sure that everything goes well. And it all went very fast from there.

Lex Sokolin

Around the same time in the US, you had robo advisors as a category emerging. Also, the words weren't there, but that was going on and Betterment, which now I think is 60 billion or something like that in assets launched at TechCrunch disrupt.

Like their killer feature, I will forever remember this. Their killer feature was the fact that you could move money into their account like that. Was it. You know, they did. It wasn't it wasn't like you could really invest into a thing because going from cash into an ETF would be difficult, at least as I remember it. But it was, you know, the TechCrunch disrupt demo was somebody in real time like opening and funding the account. And they also made the choice kind of like you where you know, half the companies. And this is what I had done built on top of other custodians and brokers, which is the equivalent of, you know, sitting on top of a depository institution. And they had built their own broker dealer and vertically integrated, and so they were able to get this performance boost, which creates a customer experience that's very difficult to replicate if you're sitting on third party infrastructure. And as we've seen with the collapse of synapse, which tried to be the middleware between banks and fintech, sort of customer footprints, like if you're doing spaghetti code, it's going to be spaghetti code. So it's a huge investment, but it definitely pays off.

Ali Niknam

I fully agree, we fully agree on that point, I think. But it's a pain to get there.

Lex Sokolin

So what was the sequence of additional products that you launched once you were able to hold money and move money?

Ali Niknam

I think the nice thing is that because we are so user centric, from then on, it was basically simple. We were led by feature requests from our users. We have so many things today. I can't replicate the sequence of events anymore from memory because basically we have been doing ten years of innovation. We do three bank updates per year, which are big events in this theater in the center of Amsterdam, where hundreds of people show up, hundreds of users show up, and we relaunch, you know, all these new things. Last month update, we launched crypto, which is innovative. If you see it in the perspective of banking, there are no or not many banks that allow you to invest in crypto directly from the bank app.

So that's the thing. But we also launch seemingly simple things. that people really love to use. So, for example, last month update, we launched customizable cards where kids can draw their own, you know, styles and figures on the card, and then we produce it for them. And kids love this. They absolutely love this. You know, we've had so many innovations. I you know, I can give you a list afterwards, but it's too much to mention. Yeah.

Lex Sokolin

Let me then structure the question this way. As you scale the company from 50 people to, you know, 500 people, and you're listening to customers who are going from those initial 5000 to 5 million and on and on. Right. The company has to change, and you need to design the organization in a way that maintains the current business, but then also organizes product teams in a way where they can innovate. Tell me about the organizational design of Bunq. Once you started to have that traction, like how did you design the company? What was the product development process and what were the customer feedback loops to make it work?

Ali Niknam

That's a really good question because I believe also within the company structure, we are quite different. And we decided to build something that I haven't heard much of. I guess you may know that, you know, traditional companies are organized around functional domains. So, you have a CFO. He has a head of finance, head of FB and a head of treasury, head of whatever. And you go down the tree in getting more and more specialists about people's knowledge areas. And then you have products, and you know, and so you go and bank. We are organized quite differently first of all. We expect each and every employee to be in direct contact with users. So that means that all employees, including myself, we all do support tickets. And this, you know, gives a wide understanding of what it is our users want or where we need to improve throughout the company. So that's one. The second thing is we are not organized on functional domains, but we're organized along users wants and needs. So basically, we have taken our user. We have defined a persona. We call our Eva. This is the prototypical user.

And everybody knows who she is and how she thinks and what she believes in and what she prefers or doesn't prefer. We have pictures of Eva all across the office, so that everybody is reminded all of the time that this is the person that we are building this product for. And then basically, we have organized Bunq in her getting to know us, her getting to use us, her getting to love us and her getting to stay and invite other people to use Bunq. And I appreciate this. Sounds very simple, but this very different structure then comes with all kinds of challenges because people are not used to working in this manner.

Lex Sokolin

What kind of titles do people have? You know, like VP of getting to know me. like, how do you how do you recruit people into this? And, you know, people like feeling a sense of prestige and control and ownership and so on. What do you do there?

Ali Niknam

That's one of the secrets of Bunq. Well, secrets. Not really. But, you know, titles don't mean anything. People almost are free to choose whatever title they want because we don't really care what your what your title is. And so, we often end up choosing a title that helps a person execute their job better. Because indeed, sometimes a more senior sounding title opens up doors. What matters that Bunq, is how many ownerships you have and which ownerships these are. And ownership is basically a problem to be solved for Eva in her journey from her not knowing about us until her becoming, you know, a Bunq fan. And this journey is split up in tiny steps, and each of these steps is a no is a problem to be solved, and it has processes to make sure that the problem is not just solved once but has been solved in a replicable manner. And then, depending on which of these steps you own, that basically makes you more or less senior or prestigious within the walls of Bunq.

Lex Sokolin

How data driven is this whole architecture? Like how do you keep people accountable? Is it objectives, key results or KPIs? Like how do you deal with alignment in the sort of spine or skeleton of tasks to do? And then often also you have to think about the shapes of teams.

Some are teams with ownership of a problem, whereas others are kind of horizontal, enabling teams, right. Like people in talent or the accounting for the entire business or legal right. So, or some sort of technical specialty, you know, the best person who knows database design and scalability, who can help everybody or something like that. So, what's the nuts and bolts of measurement and then topologies of the business.

Ali Niknam

Now obviously whatever structure you're going to have is going to have some friction, right. You always end up in some sort of matrix where two things intersect. I think what's really nice about Bunq is that at least this structure enforces and underlines the priority we give to being user centric. And so most KPIs of most people end up being user centric as well. So, we actually have basically two things. So, we have on the one hand, we have people who maintain or take responsibility for an ownership. And on the other hand, we have objectives we want to achieve. And so, I don't want to say we have self-organizing teams.

But, you know, in many projects we have self-organizing teams where, you know, somebody decides based on whatever input, like, hey guys, we really need to fix this or we need to build this, or we need to improve this. And then various people from throughout the company, because we are not structured in a strict, formal, hierarchical way, pitch in. And then basically they create a slack channel, and you know, everybody sits in there and then, okay, this is what we this is what we're trying to solve. This is where we need to solve it. You do this, you do that. I'll do this. Let's speak tomorrow to see how far we are. So, it's a very dynamic process, and it is not a structure I'd seen anywhere before, maybe as a little bit of context. So Bunq is my third unicorn. I've created other companies before and my first unicorn was then called TransIP, today called Team Blue. It is the world's third largest domain name and web hosting provider, and we launched it back in 2003, and I think it was 2004 or 5 where we started organizing this company in what we call units.

And basically, that is very similar to what has become publicly known as tribes. And, you know, basically the Spotify model that became very popular. And I'd like to think that if that was organizational design version 1.0, what we are doing at Bunq is version 2.0. It is more granular, it is more dynamic, and it is more results driven.

Lex Sokolin

It sounds very, very responsive. I'm avoiding the word of the use agile, but, you know, sort of like fit for purpose and kind of shaped around the demand that you see in a way that somebody in a big bank driving sort of like an oil tanker, is going to have a lot of trouble moving a very large, rigid structure. But like you said, everything comes with trade-offs. And so, it comes to mind. You know, the Zappos experience with Holacracy comes to mind at consensus. We also had sort of very decentralized thinking about how to build teams and ownership. And I think it's a really, it's a difficult thing to land, in part because the talent you have to bring into the organization has to be of a very particular kind.

You touched on hiring young people, but I'm sure there's more to it than that. How did you think about recruiting and the recruiting machine for people who will fit this culture? And, you know, to whatever extent you can share. I think it's also important to understand incentives, right. So, was there any special magic in designing equity incentives or other incentives? And I'm thinking I'm just thinking about that situation where, like, I'm on the team that's all about, you know, brand awareness and then somebody else is on the team about customers who are, let's say, leaving for whatever reason. And you're trying to reduce churn through a last-minute offer, you know, and like the people who are having a problem with the churn are trying to fix something with brand. So, they go to the brand team, and the brand team's like, well, my main KPI is like new onboarding, so I don't really want to spend time with the churn people, right? So, it goes to who are the people you're filtering for? And then what are the incentives from an equity or otherwise perspective to get it to work?

Ali Niknam

It starts with getting people that are aligned culturally. Culture is first very important. That's step one. And that is exponentially difficult as you grow bigger. But it's also exponentially more important to get it right as you grow bigger.

Lex Sokolin

What is culture like is culture. Like people I personally get along with and like and that understand me.

Ali Niknam

For us, culture is two things. One is the same work ethos and two. After a hard day of work, someone you want to drink a beer with or tea with, or whatever it is you want to drink. Which is why at least you have to see this in a Dutch perspective. Right? So many of these things may be more commonplace in Silicon Valley today, but in the Netherlands 15 years ago, many of these things were unheard of. So, food is a big thing at Bunq. Eating together, drinking together. That's a part of our culture. That's the informal bit. That's how people, especially because we have a lot of people coming from all over the globe. That's how people connect. In the early years, when we were a little bit smaller, we used to party together as well, you know.

Then Fridays we would have a beer round, where people come by with a cart full of beer and they introduced themselves. So, there was a really good process of getting to know the new people who had joined. And then, you know, we would have dinner together. And then, you know, as you may know, Amsterdam is a big party city. So, then we would end up going to some kind of venue together and have some fun to blow off some steam after a week of very hard work. So, for us, culture is that people you genuinely enjoy being with on the one hand and on the other hand, it's also a work ethos which we like to describe as just getting shit done. So, we don't like people who are, you know, I don't want to hear that the dog ate your homework or that you're late because the bridge was open, or we want people to just move the needle, you know? And so, we try to make sure that whoever comes through our door adheres to these both principles.

So that's one. The second thing is, as a function of our idealistic approach, we try to understand what people's motives are. I mean, are you looking for a job or are you looking to make a difference? Are you looking to prove yourself or are you looking for money? Are you looking for a visa? I mean, people have different motivations, right? And we try to find the motivations that align with our longer-term objectives. Thirdly, being in Europe. Things like equity haven't been a thing, in the Netherlands. Yeah. I mean, it's socialist Europe, right? So, you pay taxes. The government take care, takes care of you. You have a health care system that works, that you don't need to pay that much for. You have pensions. You have schools. I mean, I'm in New York right now. I love New York. I love the US. But if your kid needs to go to school, you often end up having to go to private school.

That costs, I don't know, 50 or 60 K a year. I mean, that's all of this is well taken care of in a European context. And I think in that context, equity is not the same. Like even today, after having spoken to the government for many years on this topic, only now, I believe that as of this month, they are going to introduce new fiscal measures that make it feasible for employees to have some sort of equity stake. That's also a thing that this European environment has a very different reward structure to the US. What we try to do is we try to be transparent because that's one of our values. When we first started, because I self-funded it and we were loss making, we told people, look, this is the type of money we have. Don't expect you're going to get the highest pays here. This is just. But what you will get is a unique experience and an opportunity to, you know, have an influence that you wouldn't get on a big oil tanker before a very big group of people.

This was very appealing. And, you know, we got somewhere. And then about three years ago or four years ago, I don't quite remember when we became profitable. We changed that strategy because now fairness is a big thing, right? So now we were no longer loss making, and we moved from the 50th percentile to the 95th percentile. And so, working at bank today you can expect very high salaries. But with that comes a huge problem for us as well. Because now suddenly we're getting an enormous inflow of people who don't necessarily align with our ideology and with our, you know, with our with our vision. And they're just there too, because the salaries are great. So that then creates new problems. So, making sure that we hire the right people, etc., etc.

Lex Sokolin

It's really the DNA of how all these companies are. And from the DNA, you get the end result and the expression, right? Like you did this for ten years. And at the end of ten years, what you're going to get is clearly the outcome of the machine and the inputs that you've seeded into it.

And I think a lot of fintechs that have grown up over the last decade and have had for some of them, the privilege to get customers and get over the initial hump and so on. Now they're behaving as the organisms that they are, and that comes from that original DNA. We've got only a little bit of time left and what I kind of want to hit on, and you've mentioned it a little bit, is Europe, because Europe is in a kind of a contentious place right now in the world. Right? You've got the US and China driving enormous narratives around high tech and value creation, coming from either artificial intelligence or the foundational models underneath it or, you know, blockchain based mega services, many of them dollar denominated. And there's sort of this negative buzz around is their venture for investing in Europe or is the market big enough. Is the regulator too slow. You know, GDPR was so destructive for tech companies. And look at all the enterprise value that's not here but over there. How do you respond or think about these narratives, having built a large and valuable company in Europe? And what do you say to the skeptics or, you know, even just the entrepreneurs who are here who are trying to decide where to build their company and how to do it?

Ali Niknam

Well, this is you know, this is a question where it's difficult to answer, right? Because whatever answer I give is going to be outdated in 1- or 2-years’ time, and then everybody's going to blame me for whatever answer I've given.

But look, if I look at Europe today, I think it is hard to beat Europe as a place to be, especially during summer. The streets are clean; the food is fantastic. You can get whatever you want in an hour and a half or two. Totally different cultures, totally different whatever. You know, architecture is different. Languages are different. That is great. That's what that's so appealing about Europe. It's a great place to live. When I look at the social infrastructure, so many things in Europe are genuinely fantastic. Things like schooling, health care, the average education level of an employee. This is all very perfect. But what Europe lacks is leadership. It's not quality. It's not, you know, it's leadership. And because of a lack of leadership, all that brainpower has been unfocused and dispersed. And so rather than having the left and the right hand working together as we have in the US and China, the left hand is pulling, is tugging left, and the right hand is tugging right.

So, on the one hand, of course, privacy is very important. And so, you have a group of people who are rightly concerned about that. And they come up with regulations like GDPR, but then being able to afford this great health care system that we have built over the years is also important. So, on the right hand, you have people that are trying to build a business that generates jobs and income and, and therefore tax income that ultimately pays for all this stuff, and they're going in a different direction. And I think what Europe lacks is this cohesion. I mean, not too long ago you're in London. Europe almost fell apart, right? You had Brexit and then in the Netherlands people were like, hey, maybe we should exit too. two. And this, this lack of cohesion. That's what's hurting Europe today.

Lex Sokolin

How do we get out of it?

Ali Niknam

Well, that question has a very simple answer. It's not how do we get out of it? Because the how is very simple. That is, unify our vision towards a common goal. So, I don't believe any anyone disagrees with that, right? The problem is how do we reach that common goal. And that's what has made Europe both great as well as weak. So, the greatness is that there is this divergence of thought, and there is this divergence of, you know, societies that leads to this vibrant place where everybody loves to be. But then at the same time, something's got to give, right? You can't have someone making it their life effort to make sure that each and every website on the planet has a cookie banner, whereas on the other hand, people are like, dude, you know what? Has this cookie banner ever brought anyone to speak? And then, unless one of the two sides is willing to step towards the other side, we're going to be in a place we are now. And then the consequence of that is that many, many, many of the more serious entrepreneurs I know simply move away, mostly towards the US.

Lex Sokolin

Yeah, it's a challenging situation, and it gives even more context to your accomplishment of being able to build across all of these barriers and create, you know, a company of the scale that Bunq occupies today. So, thank you for sharing your views and the journey.

Ali Niknam

Well, thank you so much for that. It means a lot. Thank you.

Lex Sokolin

If our listeners want to learn more about you or about Bunq, where should they go?

Ali Niknam

Well, preferably download the Bunq app. Let us know what you think. There's the first 30-day trial. Get on the lead plan. Start spending. Get that cash back. Experience what it's like to to have one. Invite your friends. Look at all the amazing features we've built. Don't use it as a traditional bank, because that's not what it's intended for. Try to have it as your financial body. That makes your life easy. So that's one and two. You can have a look at bunq.com or look at one of our bank updates through YouTube. But mostly enjoy our product because we've built it for you.

Lex Sokolin

Awesome. Ali thank you so much for joining me today.

Ali Niknam

Thank you. Thanks for having me. It's been a pleasure.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Share this post