Why Fintech Venture Capital firms are not returning your calls and emails

Hi Fintech futurists --

Happy Monday. This week, we look at why venture capital investors are slowing down, and the dynamics of how their portfolios work under duress. We talk about the incentives of limited partners to derisk exposure, the implication that has on cash reserves, new deals, and fundraising. We also touch on how the various Fintech themes are responding to an increase in digital interaction while seeing fundamental economic challenges. Shrewd competitors will be able to consolidate their positions and gain share during the crisis, but that will have to come from the balance sheet, not intermittent growth equity checks.

These opinions are personal and do not reflect any views of ConsenSys or other parties. Still, you should check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments here.

Thanks for reading and let me know your thoughts here!

Weekly Fintech & Crypto Developments

If you’ve found value over the years from my newsletter, now is the time to give back by purchasing a premium subscription.

A free "Futurist" tier includes the weekly Long Take, which you are seeing here.

A premium “Architect” tier include an additional 12 key weekly updates with graphs and analysis on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality. You can see example 1, example 2, and example 3.

Click below to subscribe.

Long Take

Imagine we are venture capitalists and succeed in raising $10 million. Let's say in this world there are two types of VCs: (1) ones whose network, skillset, and timing luck provide enough advantage to generate real returns, and (2) ones whose attributes are insufficient for beating even the most conservative benchmark. In the simulacrum, 10% of VCs will be in category (1), and 90% will be in category (2). The reality is that most VCs burn money relative to a benchmark.

We don't know apriori which kind of investor we are -- there is a haze blocking the view for 7 years. Only after those 7 years, do we start to realize and mark to market our investment bets. Given human bias and nature, of course we are convinced that we are in the good category, and self-confidence is high.

Since there are no market prices, proxies are used. Whenever one of our companies raises a follow on-round (e.g., Series A), the paper valuation from that round trickles down into our valuation models, which then trickles down into performance reporting, and is then presented to limited partners (LPs). Since the entire value chain has an information problem, not knowing what anything is really worth, everything *could* be worth a lot. But on paper, our returns look correct -- generating 25% IRR every year in valuation gains.

The stated investment strategy is to have lots of bets that have some probability of returning a massive order of magnitude return, with nearly all others failing out. So a single Facebook among thirty Myspaces is just fine. Also, we will want to leave about half of the cash in the portfolio for follow-on investments, so that if some of our companies start to derisk and show signs of success, we can add more money into them. Since the mark-to-market moment comes after we've invested our fund, and we believe that our fund has good underlying performance we just can't see yet, we will raise as many new investment vehicles as the market permits to stack management fees and our personal reward as we wait for the realization of value. And the valuation numbers will just keep going, as per the below chart from Pitchbook shows:

Now lets apply a shock like coronovirus. All of a sudden our whole portfolio is in distress. If you run a public equities fund and value fell by 30%, your capital base looks like this:

I am going to repost a similar chart from a different source for additional effect.

That's as much of a "Thanks but no Thanks" message as you can get. People are turning off risk and going into cash, full stop. But in the case of Venture Capital, your investors (i.e., your limited partners) have a harder time both seeing the price collapse, as well as pulling money out. So the first issue right now is that VCs are trying desperately to sanity check their portfolio. Of those 30 projects, which are most likely to have the cash position to weather the crisis? And which are most likely worth supporting through it?

If you are an entrepreneur trying to raise money, understand that pretty much every single one of the venture investments the portfolio manager *already* made is raising again. This means that new deals may be interesting, but they are far less interesting that preserving the valuations of the most promising companies already held. Because if you are actually forced to mark-to-market on those venture portfolios, many will lose 20-50% immediately. This is not in the self-interest of the VC, who would like to have a follow-on fund and keep getting paid management fees. Thus capital reserves will be used for internal bridges and bail-outs.

To that end, see the watershed moment of SoftBank pulling out of their $3 billion commitment to purchase WeWork shares. Or the general sense that VCs are starting to act "badly" and pull term-sheets from companies. Or the comments that VCs will not be able to raise very much over the next year to continue funding new companies. Well, yeah! All our stuff is on fire and reputations are in tatters!

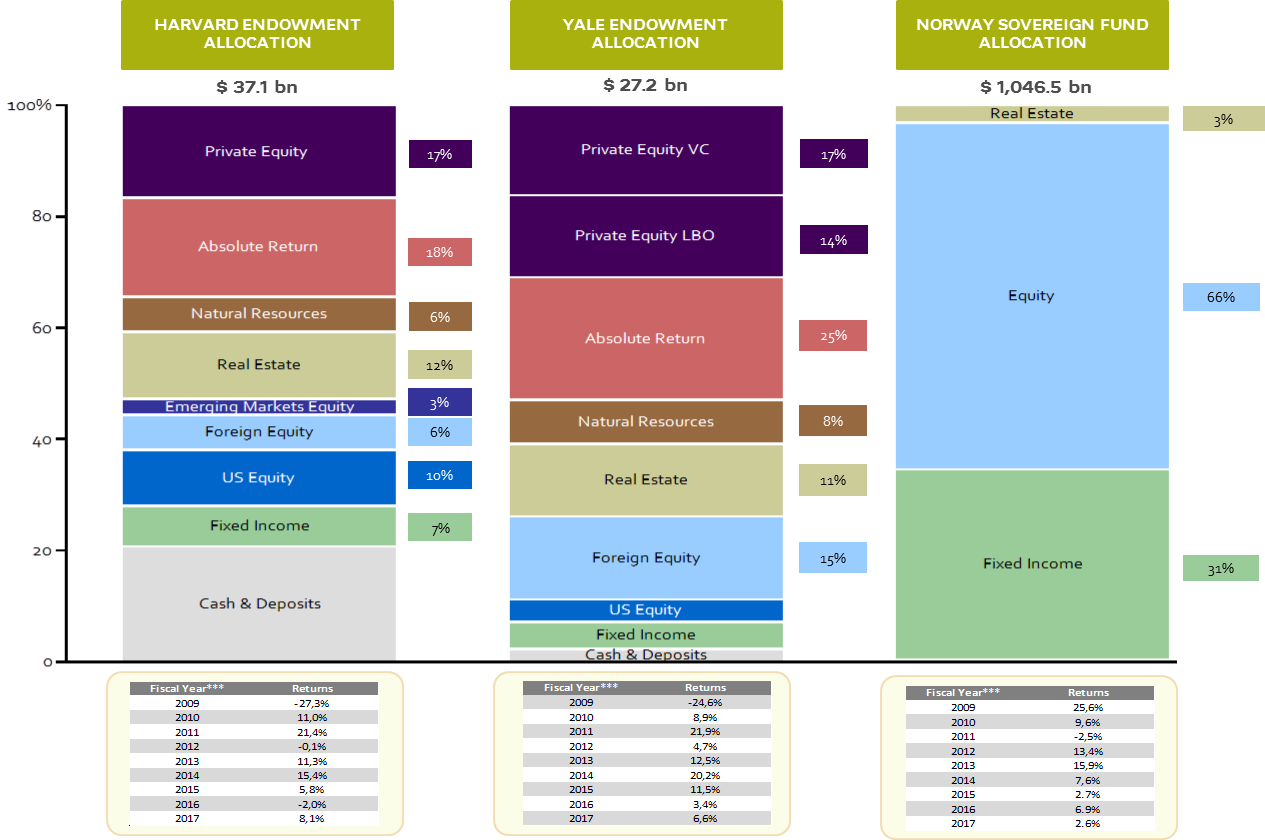

The other important thing to keep in mind is that VCs don't necessarily hold all the assets they raised in a bank account. Instead they have what are called "capital commitments" from other institutional investors, like endowments and pensions (e.g., Harvard). That endowment runs an asset allocation with lots of things in it, and most of those things are down, or being sold into cash. So the endowment just may cancel, or somehow reverse, its capital commitment. You thought that the $5 million will hit your account when you trigger a contract clause, but your LP may prefer to breach and litigate rather than give you the money, which will cost them less in the end.

Let's address the concept of liquid venture capital as embodied by digital assets and crypto tokens. Would we be better off if VCs were actually marking-to-market their early stage positions, incorporating all available information into digital markets and trying to get to the best intra-second valuation of tiny companies? I don't think so. Just because something trades, doesn't mean it is reflecting actual price discovery, or that there is depth of liquidity to support markets and counter price manipulation. What happened to cryptocurrencies in 2017 is that there was a dearth of information on real operating progress. As a result, people traded tokens based on ideas, philosophies, and logics, rather than cashflows and economics. Meme trading does not stand up an economy (notably, I couldn't even find a good negative performance chart for ICOs anymore).

Anyway, all this to say, there is a shakeout coming in VC. The pandemic shock is causing an economy-wide mark-to-market event in private assets, caused by the need of large managers to rebalance and take risk off. The net outcome will be that the equivalent of leverage in the VC, Fintech, and crypto ecosystems will go down. Right now, VCs knows that each investment round is about 18-24 months of runway, and that someone else will fund the company at that junxure, at a higher paper valuation. The probability of that being true has evaporated, and the reserve capital saved for the best deals is now in bailout mode.

For entrepreneurs, the same deleveraging is happening. Hopping from growth funding to growth funding, with value underpinned by a metric that doesn't lead to cashflow is now a suicidal strategy as evidenced by the defunding of WeWork. You need a business to say that you have a business.

While investors sort out their own houses, the shrewd entrepreneur has a chance to make a killing against less disciplined competitors. You have probably seen the inspirational images already hitting the Internet about companies started during recessions.

In the crypto markets, I think that means aligning yourself with survivors like Binance and Coinbase and their businesses. Watching Binance try to snap up CoinMarketCap for as much as $400 million and launch a debit card suggests to me that (1) in this coming period, spoils will go to companies that generate their own cashflow and balance sheets without external funding, and (2) companies with the largest user footprint will survive, while the rest will be integrated as features or liquidated.

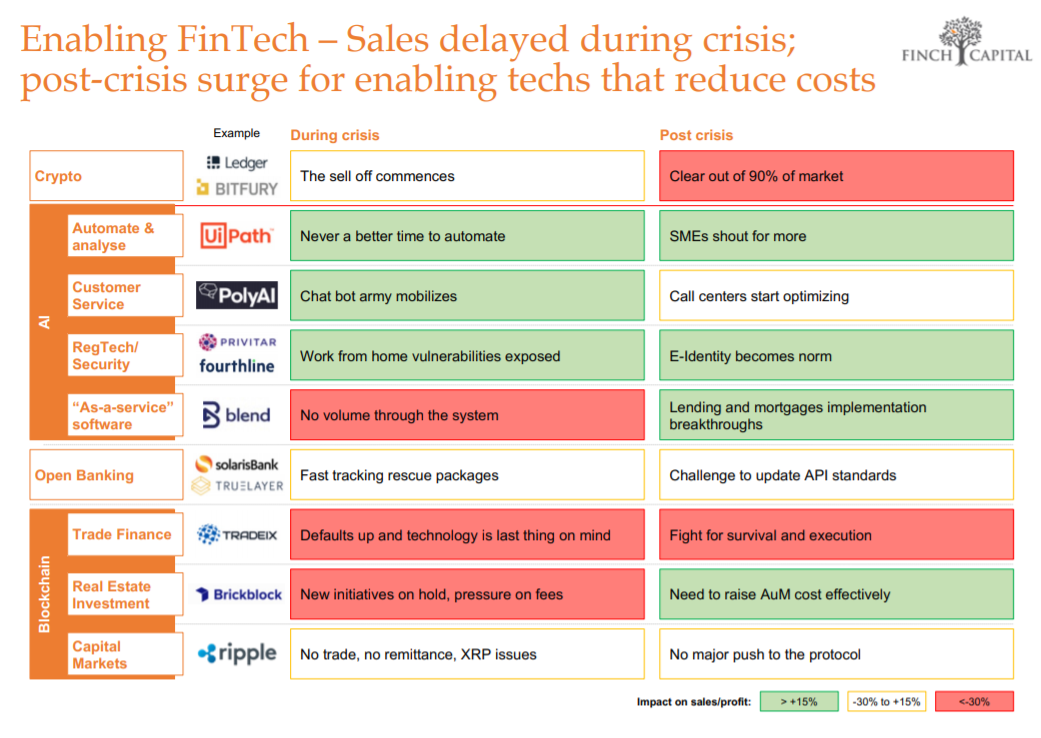

In Fintech, if you haven't yet, read this great Finch Capital report -- linked here, with the key pages pulled out below. In multiple sectors, from neobanks to payments to roboadvisors, we will see consolidation and downward valuation pressures.

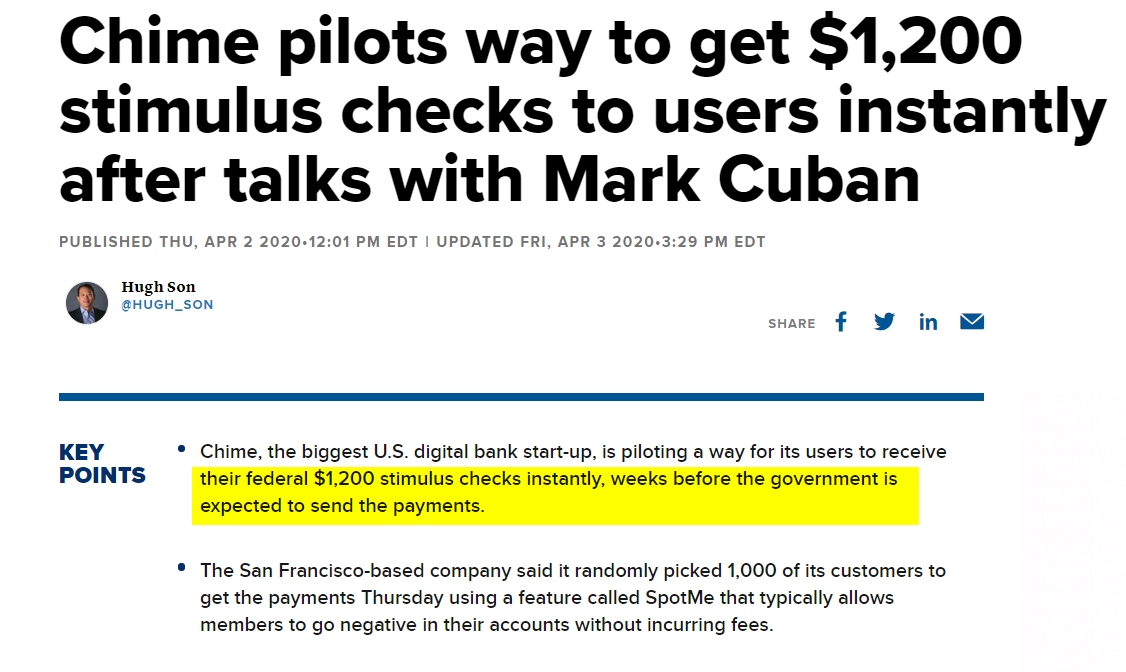

While I don't agree with every single takeaway, many seem right on. Automation software and digital experiences are likely to become more existential than ever -- not just a nice-to-have, but key to remote commerce. As an example, digital wealth managers have seen a surge in account sign-ups as people stay home. The same is likely to happen to companies like Chime, Square, and other digital first money movers as they try to become the chassis for universal basic income (I mean stimulus) in the US.

The SME and mortgages sectors will need smart digital providers, connected to digital personal and corporate identity. The more transformational projects will be hard to commercialize in the short term, but to me that doesn't mean they aren't worth doing in the long run, especialy when others are fearful.

It is just time for skunkworks and bootstrapping.

Looking for more?

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.