AI: How Stripe, Block, and PayPal are using Model Context Protocol

Model Context Protocol is an Anthropic open framework enabling seamless interactions between AI models and other products.

Hi Fintech Futurists —

You might have heard about Model Context Protocol and its implications for the AI industry. Today, we discuss how it can also connect to finance.

AI: The Next Evolution in Agentic Finance with Model Context Protocol?

MCP is an open framework enabling seamless and secure interactions between AI models and external data or services. It standardises how context is maintained across interactions, allowing models to access external knowledge and services dynamically without losing coherence or context. It also solves what has been coined the M×N problem (M models times N tools) where each “Client” (AI Model) currently requires a unique integration for every system partnership it has with external companies.LONG TAKE: The $10T cost of ChatGPT's economic advice, and AI governance

PODCAST: Reinventing Traditional Services through Modern Platforms, with David Snider CEO of Harness Wealth

CURATED UPDATES: Machine Models & AI Applications in Finance

To support this writing and access our full archive of IPO primers, financial analyses, and guides to building in the Fintech & DeFi industries, see subscription options here.

Our current price point is only $2/week.

AI: The Next Evolution in Agentic Finance with Model Context Protocol?

Big AI models have been trapped in their ecosystems so far, but soon they will be connected to every application with an API.

We see so many articles talking about Model Context Protocol (MCP) and how it will power the future of AI agents. The open-source, Anthropic-pioneered protocol has even caught the attention of two of its biggest competitors — OpenAI and Google — who have both announced integration of the protocol with their AI models.

MCP is an open framework enabling seamless and secure interactions between AI models and external data or services. It standardises how context is maintained across interactions, allowing models to access external knowledge and services dynamically without losing coherence.

It also solves what has been coined the M×N problem (M models times N tools) where each “Client” (AI Model) currently requires a unique integration for every system partnership it has with external companies. Instead, all the tools have a standard packaging that the AI models can call. This helps developers plug into thousands of software programs through an open approach, rather than lots of direction integrations, and is beloved by the developer community.

WITHOUT MCP: FRAGMENTED AI DEVELOPMENT

WITH MCP: STANDARDISED AI DEVELOPMENT

Still, this can be hard to understand. We will repeat the main point — any software product with an API interface, from embedded finance to literally all of crypto, can become a set of functions that an AI model queries as if it were directly integrated into them.

In the same way that you, the human being, can use a user interface to direct interactions in a software program, an AI connected into MCP can pull the same levers of the software program through calling functions.

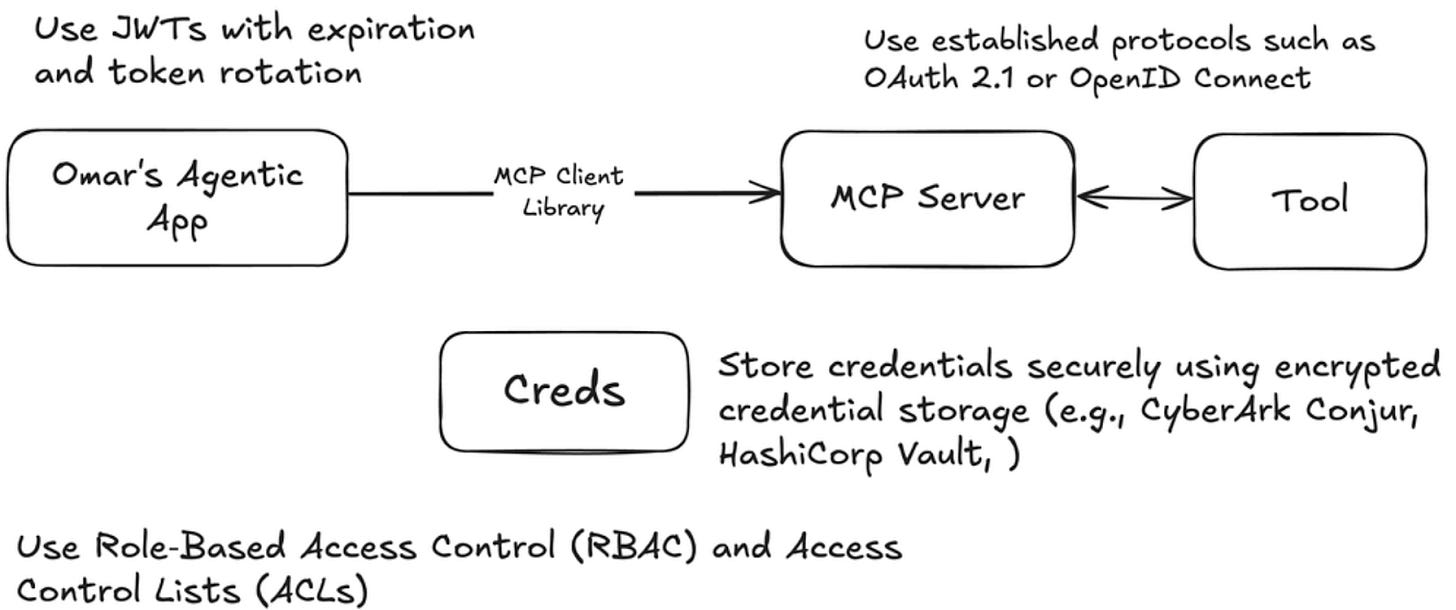

Beyond ease of use, Anthropic designed MCP to enhance transparency and safety in AI interactions. MCP achieves this by standardising data exchange, privacy, and consent management, helping models adhere to high standards of data integrity and user privacy. This is important when agents access *user data* and take action on other platforms using this data. Building the right security and permission around MCP is the next technical challenge.

The MCP protocol provides all of its integrations through MCP “servers”, which can be set up by anyone around an API offering mapped to functions. Large financial enterprises, like Stripe and Block, have created servers allowing access to their public data and services. Since the launch of MCP the developer community has created thousands of MCP servers — many lists of these have been popping up (e.g., GitHub “Awesome MCP Servers”).

For an example of what this looks like, a16z mapped out the current MCP universe below. OpenAI and Google would now also sit within the “Top MCP Clients” bucket.

The Role of Fintech

Stripe is a particularly interesting case study.

Its server acts as a plug-in for transaction processing, compliance information, and customer interactions. This is a goldmine for AI companies as it will allow agents to integrate into payment processes. It will also help any developer who wants to build an agentic workflow and wants to integrate payments.

The protocol helps Stripe improve its own use of AI, too. For example, MCP assists with risk management through integrations with market data and fraud detection from other MCP compliance/security systems. It can use external data sources and platforms to inform better decision-making within Stripe.

Stripe is also allowing customers to convert fiat currency to crypto more easily through its platform, and the recent acquisition of Bridge by Stripe also shows the importance of USDC to the payments company. We think these functionalities could be attractive to AI agents or users that integrate through MCP in the future as well.

Block, previously Square, also has an early live MCP server.

We are particularly interested in the “Commerce” capabilities of Square as it relates to agentic integration. One of our core beliefs is the importance of a machine economy, where AI agents can meaningfully contribute value to human society, and participate financially in that success. Having all of Square’s infrastructure to package and distribute digital goods could be a compelling unlock.

On a similar note, Paypal has also recently launched its official MCP server to allow merchants to more effectively utilise AI in their processes. The first service PayPal offered was Invoicing — merchants were be able to automatically generate PayPal invoices for AI products connected to the server. It has now launched a full agentic toolkit allowing developers to integrate Paypal’s full suite of APIs through MCP. This includes managing orders, invoices, disputes, shipment tracking, transaction search and subscriptions.

Many MCP servers have been created by the community around Crypto and Web3 platforms. To the extent that all of the public blockchains can be accessed permissionlessly, MCP turns blockchains into enormous financial engines for AI integration. Perhaps this finally removes the friction of the user experience and generates sufficient abstraction for users to build around crypto, without knowing they are really using it.

While the technology may not yet be stable, and prone to occasional error, the sheer amount of innovation and development is profound. Check out the full directory to get a sense of what has been made available.

MCP in Finance

This AI-enablement protocol is unlikely to stop at integrating just payments. It will power AI-driven automation across financial services, and can easily reach into capital markets, lending, and insurance. Most importantly, it reminds us that finance will be a feature within financial services — more likely than AI being a feature within finance.

If LLMs really can get access to accounts and financial actions — whether onchain or within banks — we will see far greater autonomy in the provision of services. The prophecies of self-driving money may even come true, as AIs begin to manage assets towards goals over time using real-world levers they can control. We will merely have to ask them nicely — no programming experience or button-pushing required.

Financial AI agents will be autonomous, but contextually informed by human preferences, as well as transparent, compliant, and efficient. AI-run businesses with commercial interests will ingest information from a broad range of data sources, both real-time and historic, to understand customers and instantiate products.

AIs will become the largest distribution footprint for financial products in the world, creating massive demand for their own use of capital, as well as creating far greater velocity of economic activity and payment than we have ever seen before. This will have an obvious positive impact for technology firms that have been able to spend the last decade preparing a modern chassis for integration into the Web. Open banking, embedded finance, the discussion about Plaid and its unification of financial data, all ring true and relevant in this future.

One loser in this equation is OpenAI’s GPT store, which was meant to be the place where companies bring their own capabilities. Anthropic has been able to build a broader, friendlier industry solution by figuring out what developers actually want. The trend towards openness, rather than closed gardens, is likely to continue.

We will end with a diagram from 2018, which is slowly but surely coming true.

👑Related Coverage👑

Blueprint Deep Dive

Analysis: The $10T cost of ChatGPT's economic advice, and AI governance (link here)

There is a difference between bullshit and reality. Financial nihilism is a failed philosophy — just because something about the world is wrong does not mean everything is wrong. Nuance and degrees of thinking matter. Building fundamentally functional things matters. There is a distinction between Astrology, the voodoo practice of making up stories about stars, and Astronomy, which has gotten us to land on the moon and on the way to Mars.

Economists have a broadly-consensus view on global tariffs. That view is that they are bad by distorting free market incentives. Large tariffs break trade, and trade is the source of consumer surplus and GDP creation. This is the same logic by which economists have a broadly-consensus view on minimum wages, which is that minimum wages are bad by distorting free market incentives, putting a limit on production. As a society, we may have policy goals that involve these trade-offs. But at least we know the variables that we are trading off.

🎙️ Podcast: Reinventing Traditional Services through Modern Platforms, with David Snider CEO of Harness Wealth (link here)

In this episode, Lex interviews David Snider - founder and CEO of Harness Wealth. David shares his extensive fintech journey, including his pivotal role at Compass, a real estate technology firm. He discusses the challenges of aligning agents with new technology and the evolution of Compass's business model to empower agents with better tools and incentives. Transitioning to Harness Wealth, David explains his vision to enhance tax advisory services through a modern platform, addressing complex financial needs. The episode underscores the importance of innovation and human expertise in fintech and real estate.

Curated Updates

Here are the rest of the updates hitting our radar.

Machine Models

⭐ Data Mining: Practical Machine Learning Tools and Techniques - By Ian H. Witten, Eibe Frank, Mark A. Hall, Christopher J. Pal, James Foulds

⭐ New method efficiently safeguards sensitive AI training data - Adam Zewe

A Comprehensive Review of Advanced Machine Learning Techniques for Enhancing Cybersecurity in Blockchain Networks - Mukesh V, Electronics and Communication Engineering

Machine Learning in Sports: Open Approach for Next Play Analytics - Keisuke Fujii

AI Applications in Finance

⭐ A comprehensive review on financial explainable AI - Wei Jie Yeo & Wihan Van Der Heever & Rui Mao & Erik Cambria & Ranjan Satapathy & Gianmarco Mengaldo

⭐ AI is transforming finance, CFOs say. Here's how - Marie Penelope Nezurugo (World Economic Forum)

⭐ AI’s Next Leap: 5 Trends Shaping Innovation & ROI - Morgan Stanley

How AI Is Changing Corporate Finance in 2025 - Bruno J. Navarro

Does Artificial Intelligence (AI) enhance green economy efficiency? The role of green finance, trade openness, and R&D investment - Qiang Wang & Tingting Sun & Rongrong Li

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our new AI products newsletter, Future Blueprint. (Don’t tell anyone)

Read our Disclaimer here — this newsletter does not provide investment advice

Contributors: Lex, Laurence, Matt, Farhad, Daniel, Michiel, Luke

For access to all our premium content and archives, consider supporting us with a subscription. In addition to receiving our free newsletters, you will get access to all Long Takes with a deep, comprehensive analysis of Fintech, Web3, and AI topics, and our archive of in-depth write-ups covering the hottest fintech and DeFi companies.