Hi Fintech Architects,

In this episode, Lex interviews David Snider - founder and CEO of Harness Wealth. David shares his extensive fintech journey, including his pivotal role at Compass, a real estate technology firm. He discusses the challenges of aligning agents with new technology and the evolution of Compass's business model to empower agents with better tools and incentives. Transitioning to Harness Wealth, David explains his vision to enhance tax advisory services through a modern platform, addressing complex financial needs. The episode underscores the importance of innovation and human expertise in fintech and real estate.

Notable discussion points:

Empowering Advisors in Complex Industries

David Snider has built platforms that enhance human advisors rather than replace them—first in real estate with Compass - a technology-powered real estate brokerage, now in tax with Harness Wealth. In industries with high complexity and large transaction sizes, like wealth management and real estate, human expertise remains essential. His approach emphasizes that technology should enable, not displace, trusted advisors.

Compass Pivoted to Power Top Agents

Compass began with a plan to disrupt real estate agents but pivoted to support top performers with better tech and economics. This shift—paired with smart execution—enabled rapid growth and market leadership by focusing on high-value agents and transactions, rather than cutting them out of the process.

Harness Wealth Modernizes Complex Tax Advisory

Harness Wealth applies a Compass-like model to tax, serving clients with equity comp, crypto, and private investments by connecting them to top advisors through a modern, tech-enabled experience. The platform improves both advisor workflows and client usability, targeting a large, underserved market that DIY tools can’t effectively serve.

For those that want to subscribe to the podcast in your app of choice, you can now find us at Apple, Spotify, or on RSS.

Background

Before founding Harness Wealth, David Snider built a career at the intersection of finance, technology, and real estate. After graduating magna cum laude from Duke University and earning his MBA from Harvard Business School, he began his professional journey at Bain & Company and Bain Capital, working on high-profile transactions in financial services and real estate.

David went on to become COO and CFO at Compass - a technology-powered real estate brokerage that combines top-tier agents with a proprietary digital platform to streamline the process of buying, selling, and renting homes. At Compass, David helped scale the company from an early-stage startup to a national real estate powerhouse generating over $350 million in revenue. Following his time at Compass, Snider joined Bain Capital Ventures as an Executive-in-Residence, exploring the future of fintech and real estate innovation.

He’s also the author of Money Makers: Inside the New World of Finance and Business, offering insider insights into modern finance. With Harness Wealth, Snider is now channeling that experience into modernizing the tax and advisory space—empowering consumers and advisors alike through smart, seamless technology.

👑Related coverage👑

Topics: Fintech, Harness Wealth, Compass, AI, RealEstate, Platform-As-A-Service, Advisory, Data, Tax, WealthTech, TaxTech, CryptoTax, PersonalFinance, FinancialAdvisors

Timestamps

1’06: From Bain to Compass: David Snider on Navigating Finance, Real Estate, and the Rise of Advisor-Enabled Tech

5’42: Evolving Real Estate Through Tech: Market Levers, Rollups, and Building Compass's Super Agent Model

13’20: Digital vs. Human: Why Tech Wins in Some Industries—and Advisors Thrive in Others

17’16: Scaling Compass: How Tech, Economics, and a New Go-to-Market Strategy Fuelled Rapid Agent Growth

22’20: Overcoming Resistance: The Grind Behind Compass’s Data Integration and Agent Tech Adoption

26’13: From Compass to Harness: Building a Tech-Driven Platform to Simplify Complex Tax and Financial Advice

31’05: Serving the Underserved: How Harness Wealth Empowers Advisors and Clients Navigating Complex Tax Needs

34’16: Building Smarter Tax Tech: Harness’s Curated Approach to Streamlined Data, Insights, and Advisor Collaboration

36’02: Scaling with Purpose: Harnessing Data, Advisor Value, and a Massive Market Opportunity in Tax

37’46: The channels used to connect with David & learn more about Harness Wealth

Illustrated Transcript

Lex Sokolin:

Hi everybody, and welcome to today's conversation. I'm absolutely thrilled to have with us today, David Snyder, who is the founder and CEO of Harness Wealth. Harness is a fintech platform for tax advisors. And David has a really interesting experience in the industry, so I'm excited to explore that with him today. David, welcome to the conversation.

David Snider:

Thanks for having me.

Lex Sokolin:

So let's dig into it. How did you start working in startups and in fintech? What got you interested in this space?

David Snider:

I had always been interested in consumer finance. I remember, you know, early on getting an FAO Schwarz at Electronic Bank and being fascinated by it.

But part of it's also just sort of the way your career evolves. I started working at Bain and Company after college and just happened to get staffed on several cases with large investment banks just before the Great Recession, and then at Bain Capital did a number of transactions or delinquencies around real estate and in financial service companies. And when I was in business school, got really interested in particular of just the opportunities I saw of trying to tie wherever I had some credibility, which I thought, you know, it was largely in the financial services real estate, a little bit in retail, but to a lesser extent to my interest in being part of building something that would create real value for the clients that it served. And I was poking around thinking about starting something on my own, talking to some of the early fintech businesses C250 factoring business in the Midwest. You know, Betterment in the very early days. And a guy that I had known through a nonprofit, Rob Rifkin, asked me to join the team he was putting together to start Urban Compass, what became Compass as the first business hire.

And I'd sort of created this little matrix in business school of six things that would be ideal to find in my first role. After that industry was one. There were five others and thought if I was lucky, I'd get four, maybe five of the six, and the compass role was six of six. So that set me off. On what ended up being half a decade building in the residential real estate space at the intersection of technology and that theme that I took away ended up being building technology to support human advisor relationships. Despite. And I think there are maybe analogues to what you did in the financial advisory space. But a lot of the companies that preceded compass were very focused on getting rid of the traditional agent. We started there, but luckily pivoted quickly to a model of how do we perhaps get rid of the traditional brokerage and empower the traditional advisor agent? And that really has been the thrust of the company's growth since then.

Lex Sokolin:

Before jumping into Compass, you mentioned working on a few deals or projects at Bain related to real estate during and after the financial crisis. Can you give us a flavor for what kinds of projects you saw, and what kind of business models you came across? I mean, it must have been a kind of a cool time to see this stuff getting unwound.

David Snider:

Yeah, I mean, I was definitely fortunate relative to the classes, probably one and in 2 years ahead of me, and that I joined in oh nine, you know, sort of towards the bottom and got to work on the giveaway of one investment or the prepackaged bankruptcy of a company that did enhancements to SUVs and large autos that had seen a pretty rough couple of years, and IPO of a super successful industrial technology business called Sensata that had been on a Texas Instruments. But the big real estate transaction was a company that I think is now owned by Blackstone, called International Market Centres, which is at least when we did the deal, was a roll up of six of the best assets in the trade show space for the furniture industry. So, half the assets were in North Carolina, half the assets in Las Vegas that we pulled together in a in a business.

So, a pretty unique real estate model and all these huge showrooms basically only get used a couple of weeks out of the year when they actually host these major events for the buyers and for the manufacturers. But an interesting business overall.

Lex Sokolin:

Interesting how early on you got exposure to the rollup model, which I think is quite relevant for all these independent small businesses that operate on their own but share a lot of infrastructure. Well, one thing I know about Bain, the company has got great frameworks and gets you to pay attention to the levers of industries very quickly in looking at real estate. And I know this isn't really a fair question, but in looking at real estate, like what levers did you come away thinking were the most important in that beginning? You know, what were the sort of the major movers of what made companies successful or not?

David Snider:

I wrote an article when I first got to Bain Capital Ventures as an ER (Executive-In-Residence), after the Compass experience with Matt Harris, who leads the fintech investing there. And my observation was that there were a few different phases of technology, business models and success in real estate, which I think sort of frames the answer to that question, that businesses that might be successful today, you know, would have died on the vine if they had launched in, you know, the late 90s or in the mid 2000, etc., just because of the receptiveness to change and where the players were most open, you know, to evolving.

So I think, you know, the earliest stuff was like the Yardi and Costar's and how do you put a bunch of data that ought to be in one marketplace, sort of in one location, kind of the 1.0 businesses, 2.0 businesses were around, you know, differentiated real estate experiences at sort of the fringe of tech and real estate or more real estate with venture backing, things like that, as well as a lot of successful businesses around kind of SaaS offerings and tools for some of the folks in that ecosystem and even, you know, technology enhancements in the experience of interfacing with real estate, you know, businesses like envoy or sensors and systems to run buildings more effectively. And then kind of this third wave that I think still hasn't had huge successes. It's definitely, you know, got slowed down by the pandemic in many respects. But of beginning to incorporate AI, virtual staging and some of the more kind of forward-thinking ways that real estate can catch up with other industries that that tend to lead it. On the use of broad tech innovation and applications that actually can be profitable in this space.

Lex Sokolin:

Let's lead into Compass and the model for that business. What was the core value proposition? And you know, what did you start from to get there?

David Snider:

The genesis of the business really was around the founder, Robert, I think being ready to do something entrepreneurial. You know, talking to a lot of his peers in New York City about what were the pain points they felt. And, hey, why don't I start with something that feels like an issue people I know are dealing with and try to fix that. And so, the high cost of transacting in New York City residential rentals was sort of that initial pain point and a view of, hey, this is a big market, and maybe there's a way to, you know, cut down that 15% friction of renting an apartment, etc. And so, the early model was, if we break up the role of the New York City rental agent into having schedulers, neighborhood specialist chauffeurs Shows that are based in different neighborhoods.

Closures, etc. you know, we can bring down the cost of the transaction and hopefully drive up and have a higher NPS experience for a number of reasons that I'm happy to go into. That was not working for us particularly well or particularly scalable, but we got very lucky in that we launched in May. The rental season kind of ramps up from May to August. We were showing great growth. We raised a series A in September, and that gave us a lot of capital to quickly pivot the business from being focused on displacing the agents, which we can talk about why that was going to be challenging and probably ultimately unsuccessful, to recognizing that the top quartile agents in the market were really liked by their clients and had unique expertise and a key role to play, but that the tools and the value prop they were getting from the brokerages, where they were generally, on average, sharing, you know, a third of the economics that they would generate as independent contractors really wasn't keeping pace with what value that that relationship could drive for the agent, advisor, etc..

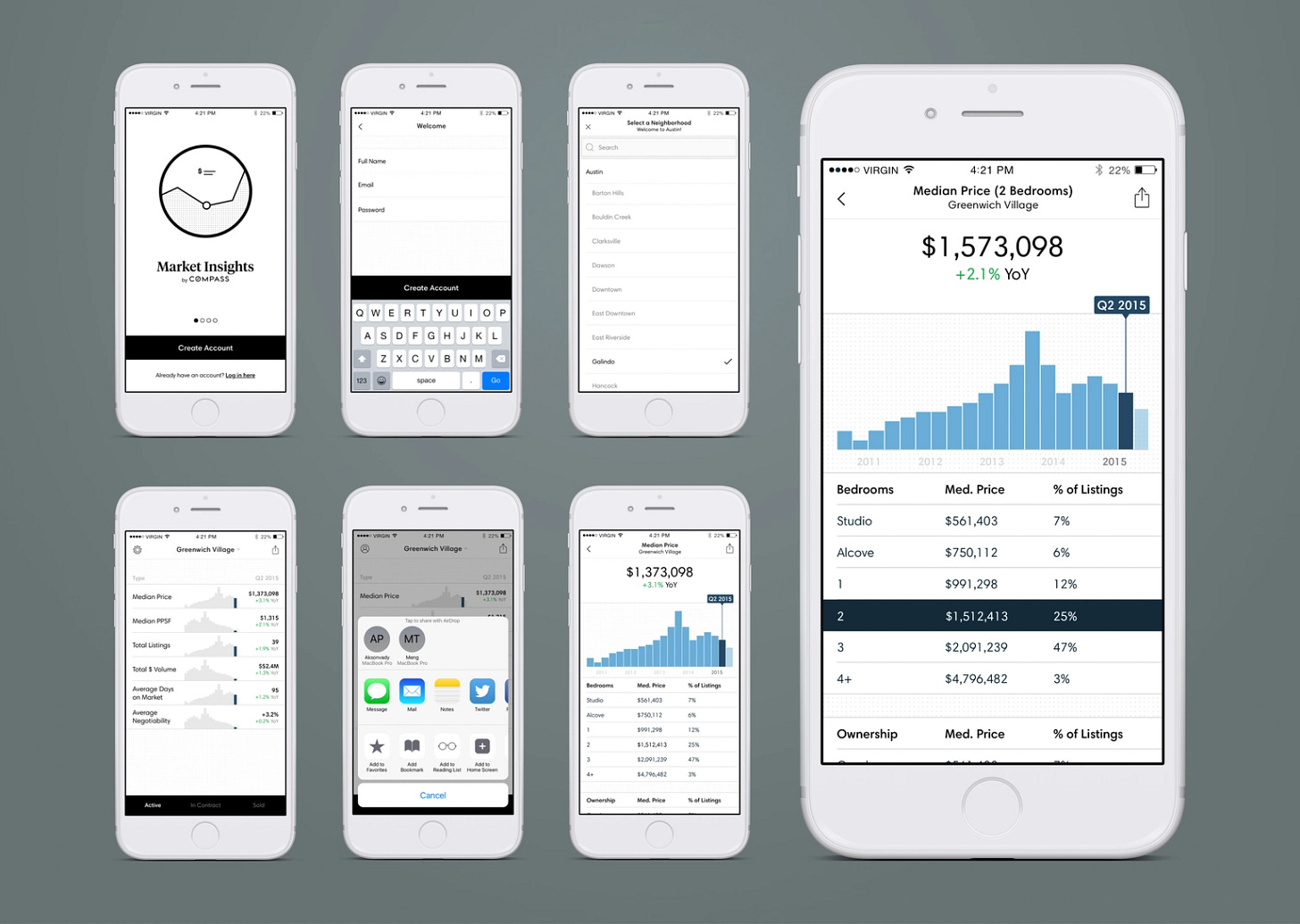

So, we started in sort of beginning of 2014, end of 2013, really focused on how do we create, you know, super agents. You know, we would sort of say at the beginning, I don't think that really stuck as a white describing what we're doing, but, you know, empowering them with mobile technology and even some, you know, desktop resources for their teams to create a much more contemporary platform that would make them more efficient, able to grow more successfully and successfully compete against the traditional brokerage model.

Lex Sokolin:

This is a really fascinating thing to unpack because at least for me, I'm pretty confused about what drives different outcomes in different industries for this kind of setup. The setup of being there is a human doing a task that it's a high value-added service. And then, like Web2 distribution technology comes in and shakes things up. And in some cases, you see a pretty profound collapse in the human model and replacement with digital distribution. And in other cases, it's really stubborn and very difficult. So, kind of the classic case is buying airplane tickets, buying flight tickets or, you know, travel agencies and booking a hotel where those services initially were brokered and very intermediated.

And with the advent of the internet, the whole thing became aggregated and extremely commoditized. Right? So, things like Travelocity and Booking.com and TripAdvisor are, for most people, a much better service than going to a human being and trying to get advice. And then, you know, the digital model sort of just wins. And then when I think to that early fintech moment and the emergence of robo advisors, I think lots of people thought everything's going to be intermediated and delivered by software, and it's going to be calculated for you, and that's the best path. And so, when you fast forward on that, the results are much more mixed. And of course we'll open this up more in relation to harness. But you know, Betterment and Wealthfront, which are as self-directed as they get, still sort of have to attach to B2B strategies and kind of play all sorts of tricks to be useful. Like to be an online bank to make any money. And then folks like Personal Capital or other much more sort of superpower advisor type platforms.

Even if you look at something like investment, right. Which I think it was actually Bain that took a private recently, you know, but they struggled to get recognized in the market beyond a $5 billion value as having the number one position in the industry, like good companies but not runaway wins. And so, I've now for over a decade, been kind of confused as to why, in the case of travel and holidays and all of that stuff, it was so clearly the digital model that won. And then when you came to larger tickets, as in the case of, you know, real estate, a very large ticket, or in the case of insurance sales, we're still kind of grinding. There's not a digital win that's super clear. What's your reflection on this? Like what's the framework to pull this apart. And how did compass navigate that to, you know, to build a very commercial business?

David Snider:

I think across the industry as you talked about, there's a segmentation component. I was fascinated, actually.

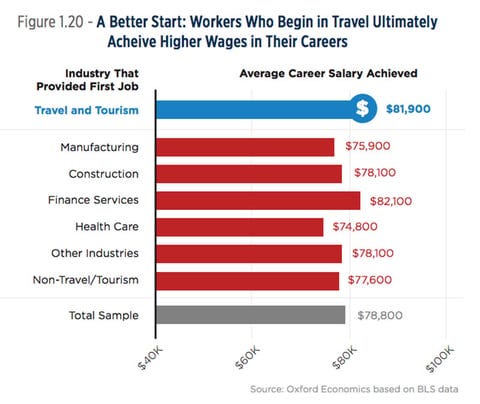

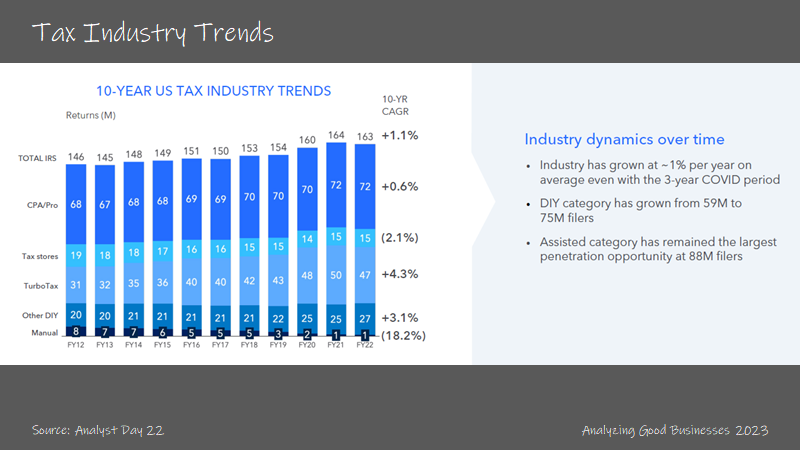

I looked recently at a job report around some of the roles with the fastest growth. And actually, travel consultant is a high growth job in 2025. And I think that is not people that are booking a flight for someone to fly from New York to Chicago. You know or book a room in LA for two nights. It's people that want to do a, you know, two-week vacation in Europe and have someone help with a higher complexity task. And I think that's analogous. You know, my current industry is is around tax, where TurboTax and some of the other guys do a great job, but they haven't been particularly effective at sort of breaking into much higher complexity situations. And I think that's the case as well. You know, with real estate, where, yes, for transactions where you're renting an apartment in a largely new build market, fairly commoditized inventory, etc., you've got success for apartments or other typical marketplace type of things. Compass was successful in embracing the higher end of the market, and we started in cities that are just more expensive and focusing on many of the best agents in those markets.

And those are places where, for a variety of reasons, right or wrong, there remains a dependence on advisors in the same way that there's a persistent role of investment banks, when you might say, hey, that's a gigantic transaction fee. Like, isn't there enough public information about a $5 billion company you wouldn't need, you know, to pay points on that transaction to a team to do it? I think across advisory industries, there's a persistence of perceived and or real value from best of breed human advisors, hopefully with increasingly sophisticated tools and resources to navigate a transaction, a process, etc., but increasingly value at the lower end of any of these spaces in people being able to do it themselves. They're not a ton of great traditional human advisors playing in the sub 100k, 200k client AUM market. But there's some extraordinary ones, you know, in higher, higher end segments. So, I think it really depends on where you're going to play. And I think Compass had success by very significantly shifting from, you know, $2000 - $3,000 a month rentals to $2 million - 20 million, you know, type of properties.

And embracing the advisors that were in 2014 and still in 2025, playing a pretty critical role in all those transactions.

Lex Sokolin:

So you would attribute it to the complexity of the advice and sort of the value add from the expertise.

David Snider:

Yeah, I think that's I think that's been my observation across industries in terms of where software only solutions have been effective. I mean, you know, Intuit and Tax is a $100 billion market cap business. Obviously, a few components to it. But you know, QuickBooks and TurboTax are the biggest engines, but that not being a solution for the entire market.

Lex Sokolin:

Does the transaction size play a big role in that?

David Snider:

It seems to. I mean, I can't think of great examples where you've got massive transactions in the view of the participants that are purely digital without reasonably high-cost advisers. As part of that, though, you may know of one that I'm not thinking of.

Lex Sokolin:

Cool. Thanks for going down that side corridor with me. Okay, so once Compass had done the pivot, how did things go? Like how did the company scale and were there any takeaways that you have from that experience that you want to share?

David Snider:

It grew like a rocket ship in terms of being at kind of a handful of real estate agents at the beginning of 2014 and growing at, you know, 5X, 6X, 8X year over year in attracting agents.

I think it had the dual value proposition of being able to offer more to the agents, as well as having the flexibility because of the way that the industry had historically priced and not evolved a ton, to also create economic incentives that for a good agent, you know, who might be giving 30% of the revenue they generated to their traditional brokerage companies and say, hey, we're going to give you a lot more a much more contemporary set of resources, both human capital and technology, and you're going to pay, you know, 5% less for at least the first two years. And so, I think having both an economic value prop and a services technology, you know, lift value prop, enable the company to grow very quickly. It also innovated in the go to market model, where traditionally real estate firms, even these really big multibillion dollar national scale ones, had often been the aggregation of acquisition, or really composed of a ton of mom and pop scale SME's, which were the individual office of, you know, Coldwell Banker in suburban Philadelphia or Corcoran just for Soho, etc., where you had, you know, one person leading that office and responsible for recruiting new agents and, you know, managing the existing ones and running the office.

And that didn't necessarily align with, you know, really aggressive organic growth, if you want to call it that, of adding new agents in a way that having a dedicated and highly focused sales team doing that exclusively ended up being incredibly beneficial to companies’ ability to succeed.

Lex Sokolin:

I've got two questions I wanted to follow up on. And the first is in terms of the tech build, what was the technology build like? And in particular, how difficult was it to get the underlying market data and unify it together. Like, what's the structure of market data in the real estate industry?

David Snider:

For residential, it is a very large number of individual MLS, multiple listing services that exist in some instances actually with overlapping geographies, but that are meant to be tools for the agents in a market to see listings. And they all have their own rules of what can be shown to the consumer client. And you know how fast an agent that's part of that network has to post a new listing versus kind of keeping it in their back pocket, etc.? So, it was definitely a big data aggregation challenge, both because a lot of these were even ten years ago, pretty dated technologies where you'd have very messy historical data.

A lot of the tools we want to build at compass involve getting Historical information important for commerce and valuation and things like that. In addition to having the fastest, cleanest, easiest to search views of things and often again, multiple data sources where like San Francisco, I think if I recall correctly, had seven different MLS. You know, New York has a primary one, and then there's some secondary ones in Brooklyn and things like that. So definitely a data aggregation normalization challenge. That wasn't the core thing. So, it wasn't like, hey, you're Zillow. Let's just figure out how we can, you know, buy, acquire or build, etc. because our core business is around it. It was really around how do we get data to then transform it in ways that are going to uplift consumer or advisor experiences to monetize? So that was a big piece of it. And then the other component was, how do you create the right set of tools for agents and their clients to feel like they're getting, you know, real uplift and the efficiency of what they're doing or the insight, etc., so that, you know, veered into stuff around valuation, a ton of tools around how you market properties and how you market yourself as an agent and things like that.

And, you know, consumer research tools and data, insight tools and a whole bunch of stuff, not all of which worked or created value, but collectively, I think, always was pretty impressive as the toolkit that agents that joined could utilize in addition to whatever they were doing already.

Lex Sokolin:

Fascinating, because my assumption was that it was a problem that was just too hard to solve, and there wasn't a Plaid or a Yoli in the space to do all that data, because the incentives were all messed up for, as you said, people sharing deals and keeping things in the back pocket and so on. Were there any magic tricks to getting over that hurdle?

David Snider:

No, it was a grind. I mean, I'd actually be curious if there are examples of companies that were sued as often by competitors as we were, at least while I was there. You know, for poaching agents or, you know, taking sales managers or, you know, improperly using some data or something else, I think, you know, very much generally without merit.

But no, it was very challenging. And there was not, you know, a period of time, despite all of the growth and really positive signals, that it felt easy or like the rock was just rolling downhill, you know, and we could all sort of wash it, watch it from the sidelines. It was very much market by market, you know, data set by data set. You know, retaining agent after agent if things you know were frustrating to them or you're trying to raise rates a little bit, etc., to build a business that is now the largest in that space today.

Lex Sokolin:

Another thing that comes to mind. And afterwards I want to talk about Harness because I think there is a connective tissue there. But another thing that comes to mind is that agents in general, in any industries, see themselves as small businesses and often, you know, have pretty idiosyncratic preferences about, well, I want this CRM, but not this CRM. I want this data source, but not this data source.

And then, you know, I want this reporting tool and so on and so forth, you know, so in the markets where I'm familiar with, like, you either acquire things outright and force people to use the stack that you have, or you create financial incentives and sort of acquire things halfway or give people retainers and so on. But then they can bring their own technology. How did you get everybody aligned on the same platform? And maybe this is just different in rental brokerage, but I'm curious if that was an issue.

David Snider:

I think the good news for us at the time was there was very little love for existing technology that people were using. So, it wasn't like 20% of the agents in the market were like, hey, I've invested in this custom Salesforce instance. You know, you got to bring over all this stuff and give me a Salesforce consultant. It was like they wouldn't. They were absolutely averse to change. And there was a very significant investment that had to get made to convince agents to adopt technology that we had built, even if it was materially going to help them or be better than what they were doing before.

But I think the advantage was, hey, you know, you can still do this with pencil and paper, you know, or, or poke around on a Zillow or something else that you want to use, but it's going to be much better. And I think for people feeling like, hey, I can do some of this stuff the old-fashioned way and then incorporate this new stuff where it's advantageous. That was compelling. It had or compass has the advantage where in some instances, it was bringing an independent small brokerage onto the platform, and the majority of cases outside of some bigger acquisitions that we can talk about. It was convincing someone that was already using some stuff from an existing brokerage and paying a lot for it in their split, and not really getting very excited about it. So, it's easier when you're sort of giving someone an overall improvement to their P&L to think about that stuff versus just saying, hey, you should be spending X amount on this new stuff. That's really going to be advantageous that you've got to learn day one to create any value for yourself.

Lex Sokolin:

Let's shift over to Harness. And I guess the natural question is how did your compass experience conclude, and then why were you motivated to, you know, take the entrepreneurship pill again and go a second time?

David Snider:

I felt very fortunate to have been able to be part of the executive team and scale the business. And in raising, you know, all the capital from series A to series E, kind of being very close to all the key decision making. I think ultimately at that stage of the business, you know, roles were narrowing. I'd been the CFO, CFO, managing, you know, lots of teams throughout the organization. I think I was excited to see not being, you know, one of the two core founders of that business. If I was able to take those lessons and build something impactful positively in an adjacent vertical and that was sort of why Bain, I think, invited me to come hang out there and think about what that might look like. The genesis of Harness really was, was twofold, I think, one where we started the conversation, that insight around the value of tech enabling advisors or giving them a dramatically more contemporary platform to collaborate with clients and create value and justify the role that they play and be more efficient, etc. was, I thought, a theme that was in a fairly nascent stage across service industries.

And second was, you know, despite having been an MBA, a CFO, an investor, like all these things that should have made me phenomenal at managing my own personal finances. It felt like every six months, you know, I was missing the boat on something and building a platform that would be helpful for sort of the upper middle market, but not the ultra-high end and not the mass market I thought hadn't really been done well at scale, and there was just increasing secular complexity driven by equity compensation be more prevalent, more self-directed retirement versus, you know, fixed pension or other things, more access to alternatives. We're just going to lead to more complexity and the need for new solutions that could embrace that and help people. And so, we started day one with a platform that would encompass service discovery. Like what should I be doing? Who should I be doing with and help? Hopefully helping to make that coordination more efficient across financial planning, holistic wealth, business tax, personal tax, trust and estate.

You know, as we got going and building, we found tax was the area where there was the most demand from the end consumer that we wanted to be serving and the shallowest pool of supply that we thought was great. And so, we decided to a few years ago, really go deep and ultimately build a much more compass like set of resources to power tax firms as part of our platform.

Lex Sokolin:

So what does the company look like today and which parts of it are you most proud of?

David Snider:

I think having really high net promoter scores sort of across the board for the consumers that we serve as sort of the most valuable, like we are entrusted with a fairly ethereal thing of helping people either find an advisor generally, you know, or navigate through the tax process, which is painful, arcane, feeling, opaque, and overwhelmingly people, you know, really enjoyed the experience when they work with us and feel like it's value additive, where we have devoted our R&D effort is really trying to create the most seamless and insightful tax experience that exists on the market.

And I think what's really nice is the way that we have chosen to build the things that benefit the consumer in allowing them to drop 20 files and having those auto categorized by type and file name and all this stuff is beneficial to the client and saves them time, but it's also beneficial to the advisor. It's luckily not a business where we run into conflict, even occasionally did on the compass sort of consumer side with the advisor side of sort of what you want to show and who's your priority, things like that. We found, I think, ways with the tax process that things that make the client feel better informed, easier to interface with. More likely to be prompted to indicate things that could create a savings optimization on the tax side, all accrue to the benefit of the advisor as well. And so that's been an exciting to see as we head into this 2025 tax season.

Lex Sokolin:

So it's interesting to see the the thread in your career around giving, you know, high expertise people tooling to become more productive in their practices and how it kind of spans different industries.

Can you talk about the ideal profile of a tax advisor that would be using the platform, and then, similarly, the personas of clients that would land on the site and find it valuable.

David Snider:

On the tax advisor side? It sort of starts with the breakaway advisor. You know, who's been typically at a top 100 firm for a while but is excited to have more autonomy. There's been a ton of private equity investment in the last 24 months, and that changes the dynamics for people that aren't necessarily the biggest beneficiary of that transaction, kind of at these big firms. And the calculus of sort of staying forever to earn a pension versus doing something more entrepreneurial. And then that that runs the gamut through, you know, boutique practices that might have one, five, ten, 20 people that are looking for a better way to operate, create value, grow, work with their clients, etc. and that's 99% of the tax firms in the US. You know, the 42,000 CPA firms, 99% are under 5 million of revenue.

So, it's really the core of the market that is delivering generally really good advice, working very hard but not necessarily structured in a way to make big investments and innovate on what that experience can or should look like.

Lex Sokolin:

Got it. And then from the user side, from the client side, who are you targeting. And you know, how would they end up on the harness website as opposed to, you know, being self-directed or just getting a recommendation of somebody they know?

David Snider:

So there are two populations, you know, the first population are clients of advisors that choose to join our platform, and they run the gamut, you know, from small business owners, professional service folks, you know, you name it. Of the people that I think are attracted to harness wealth. It tends to be people with some form of equity, compensation, complexity, crypto, private investment, whether that's because they work at a venture firm, private equity firm, or of invested in that space, etc. though there are lots of other use cases as well.

And more and more we've started partnering with financial service companies, either wealth advisors or companies that are as part of the ecosystem fund administrators, alternative asset folks that recognize that by introducing those services, those investments to a broader audience, it also creates downstream tax complexity for them. And that's tax complexity that, at least as of today, the DIY market is not particularly well suited to meet. And so, we become a really interesting strategic partner for a lot of businesses in financial services that want to create comprehensive solutions for their clients.

Lex Sokolin:

Same question as for compass in terms of technology, what does the tech build here look like? Does it go as deep in terms of having to integrate into lots of data sources and figure that out. Or is it more of kind of a platform that connects this two-sided market? How are you thinking about the tech product.

David Snider:

Conveniently on both the marketplace side and sort of the tax SaaS side? There is not the same complexity where, hey, to add value, you really need to have 90 something percent of the, you know, market transactions ever data to be useful to your advisors on the marketplace.

We do not seek to have a comprehensive directory of every provider. We seek to have a curated set of really good ones. And on the tax side, it's a lot more about how do you prompt the right questions, the right historical documents, etc. you need from clients. How do we use technology to make that comprehensive easier for the advisor, the client to know when all the things you You’re need are there to work through the process and then to continue building ways that we can draw more and more insights out of the underlying data that is provided and the completed text document. So, it's a different challenge. It's a lot more structured data versus massive amounts of messiness. But it's no easier to figure out the right way to bring together the use cases that advisors have with consumers in a way that creates value for everyone. And I think pushes towards the experience that I think most people and certainly most of our clients, you know, believe is possible and would like to have in terms of tax, which is the largest expense line item for the vast majority of individuals, and, you know, meaningful for many businesses as well in how they think about things. And it's a very opaque and generally antiquated feeling process for the vast majority of clients and participants.

Lex Sokolin:

What do the unit economics look like for you, and how do you think about sort of the scale of the business that you want to establish based on that?

David Snider:

So there are a few ways to look at it. I mean, as I mentioned, the volume of advisors that are not at a big four firm, for instance, is the vast majority of the ecosystem. You know, depending on how you slice and dice the IRS data to give you proxies for complexity around schedule E income or complex alternative investments or other things like that. You know, it's probably a quarter of the filing ecosystem that have complexity, that probably should drive people to an advisor to create the most value. So, you've got to, depending on how you think about it, a 10 to 20 million client population that we could be serving. And then tax is obviously the core piece. But there are lots of ways that if you have the data and can point them in the opportunity set that that they may have based upon that rich data, there are lots of other businesses that you can help facilitate services around.

So, it's a very, very large opportunity that that we have and want to just make sure that for the advisors were, you know, creating more value than we cost to be part of our platform ecosystem. Part of the harness network. And for consumers, I think it's very easy to quickly tell whether you're creating a value that someone's going to trust you to convert, transact in any respect for a service that is one of the more important financial decisions that they have to make.

Lex Sokolin:

Got it. Well, if our audience wants to learn more about either you or about harness, where should they go?

David Snider:

For me, I'm probably the most active on LinkedIn. So, if you send me a message there, I'm likely to respond to it. And for harness, I think for those, especially this time of year, they're thinking about their own, you know, tax needs, and do they have the right advisor to navigate that HarnessWealth.com is the best place to sort of start that journey.

And for the rare listener of yours who may be a tax advisor or financial advisor that wants to be part of the ecosystem, there's a four-advisor section on that website that tell us a bit more about how we partner with great advisors as well.

Lex Sokolin:

Fantastic. David, thank you so much for joining me today and sharing more on these topics. I've learned a ton, and I hope that everyone listening did as well.

David Snider:

Thanks for having me. I really enjoyed the conversation.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Share this post