AI: Investment Banking AI Analysts come to Wall Street, Rogo raises $50MM

Rogo announces their latest Series B fundraising round

Hi Fintech Futurists —

Today’s agenda is below.

AI: Rogo’s AI Analysts Disrupting Junior Bankers and Empowering Wall Street

Rogo has just announced their latest Series B fundraising round of $50MM, taking total money invested to over $75MM. Founded by former investment banking analysts, the New York-based fintech is building an AI-powered financial analyst to replace the heavy lifting of their former roles with AI.LONG TAKE: The end of Apple's 30% monopoly tax and $30B of revenue

PODCAST: 400 Startups Building the Post-Web Economy, with Outlier Ventures Founder Jamie Burke

CURATED UPDATES: Machine Models & AI Applications in Finance

To support this writing and access our full archive of IPO primers, financial analyses, and guides to building in the Fintech & DeFi industries, see subscription options here.

Our current price point is only $2/week.

The AI Analyst for Financial Services

Rogo, the New York-based fintech, is building an AI-powered financial analyst. It has just announced a Series B fundraising round of $50MM, taking the total money invested to over $75MM.

Founded by former investment banking analysts, the business is planning to replace their former roles with AI.

This is a recurring dream of investment banking analysts.

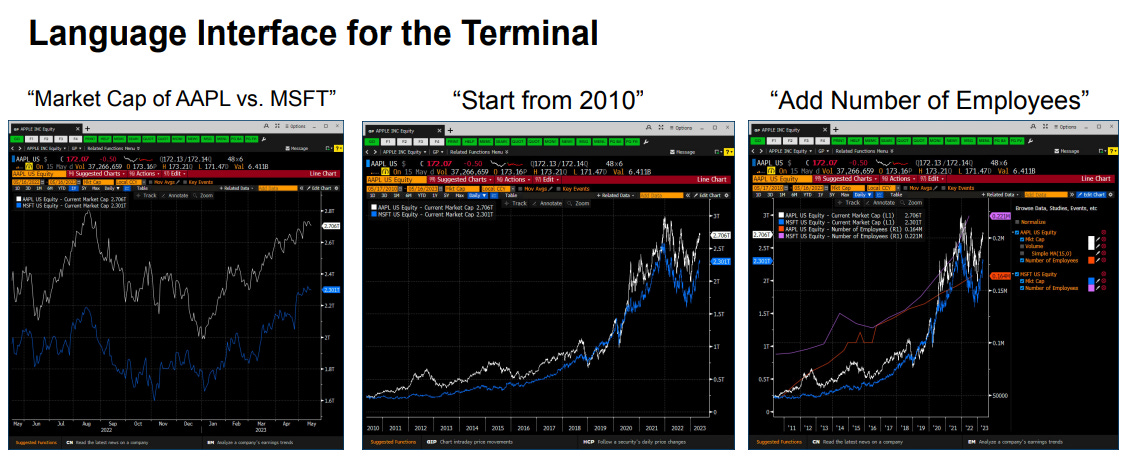

Rogo’s AI is trained on financial data and workflows, allowing it to automate tasks such as researching companies, drafting pitchbooks, building financial models, and preparing meeting materials for pitches to clients looking for capital support. The platform integrates internal and external data sources, combining data such as S&P Capital IQ with their client’s proprietary datasets.

Underneath, Rogo uses multiple OpenAI models for its agent. GPT‑4o powers Rogo’s chat-based Q&A and handles in-depth financial analysis, o1‑mini is used to contextualise and structure financial data for effective search, and o1 is reserved for evaluations, synthetic data generation, and advanced reasoning workflows.

This workflow can save time on a lot of work, and has attracted several pilots from leading financial institutions, including Nomura, Lazard, Moelis & Co, and more. Tiger Capital, Thrive Capital, and J.P. Morgan are both customers and investors.

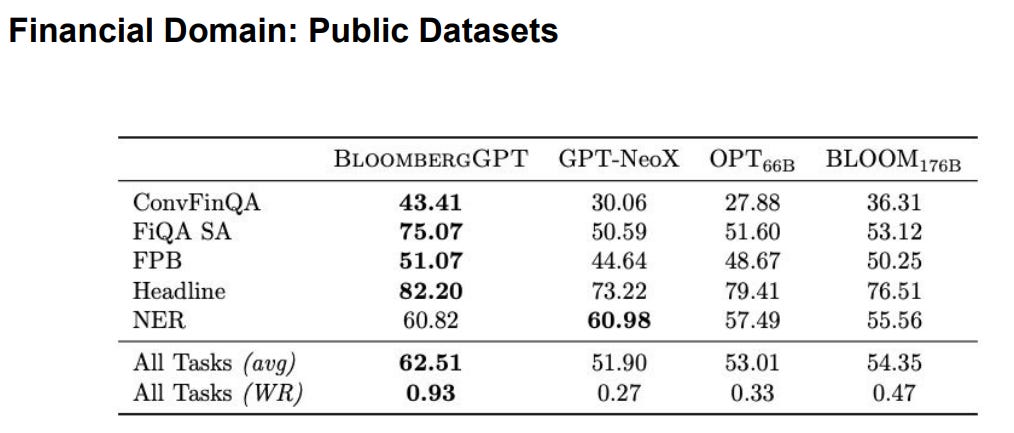

Rogo isn’t alone in building an AI analyst product, but has strong commercial momentum. Bloomberg had also trained a specialised LLM called BloombergGPT in 2023, though this model was overshadowed by the far more powerful general offerings from Google and Anthropic.

Several startups have emerged too, such as Finpilot in Seattle, which raised $4M last year to assist financial research. However, Rogo’s top-tier clients give it an edge at the moment.

Rogo’s Financial History

There is a race to fund AI applications in the financial sector.

Rogo’s first seed round in late 2023 attracted $7MM, led by early-stage investor AlleyCorp, with participation from Company Ventures, BoxGroup, and ScOp Ventures. Just nine months later, Rogo announced an $18.5MM Series A at an $80MM valuation led by Khosla Ventures. Keith Rabois of Khosla joined Rogo’s board, highlighting that the company started to gain insider status. Still, Rogo was in a competitive landscape of startups using AI for finance workflows, highlighted below.

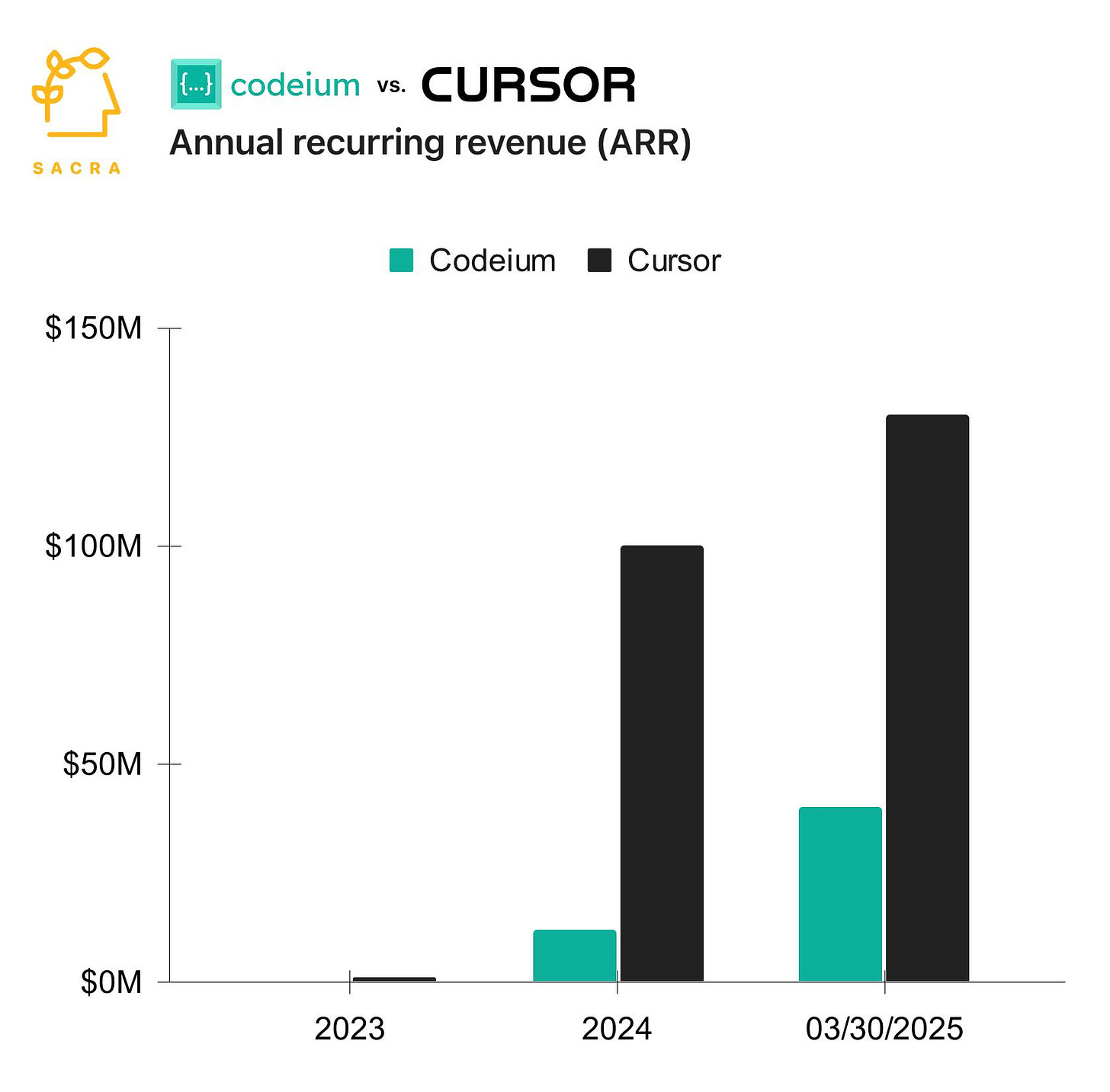

With the Series B of $50MM announced in April, Rogo appears to be pulling further ahead. We expect the valuation to be in the neighborhood of $200MM, which suggests a healthy revenue run-rate in the $5-30MM range. As another example, Loveable had catapulted quickly to a $30MM ARR for AI-based code generation in only 4 months. A similar story can be said about Windsurf, the company recently bought by OpenAI for $3B, or its competitor, Cursor.

The speed at which this is happening is remarkable and mirrors the path to high ARR across many AI-first companies.

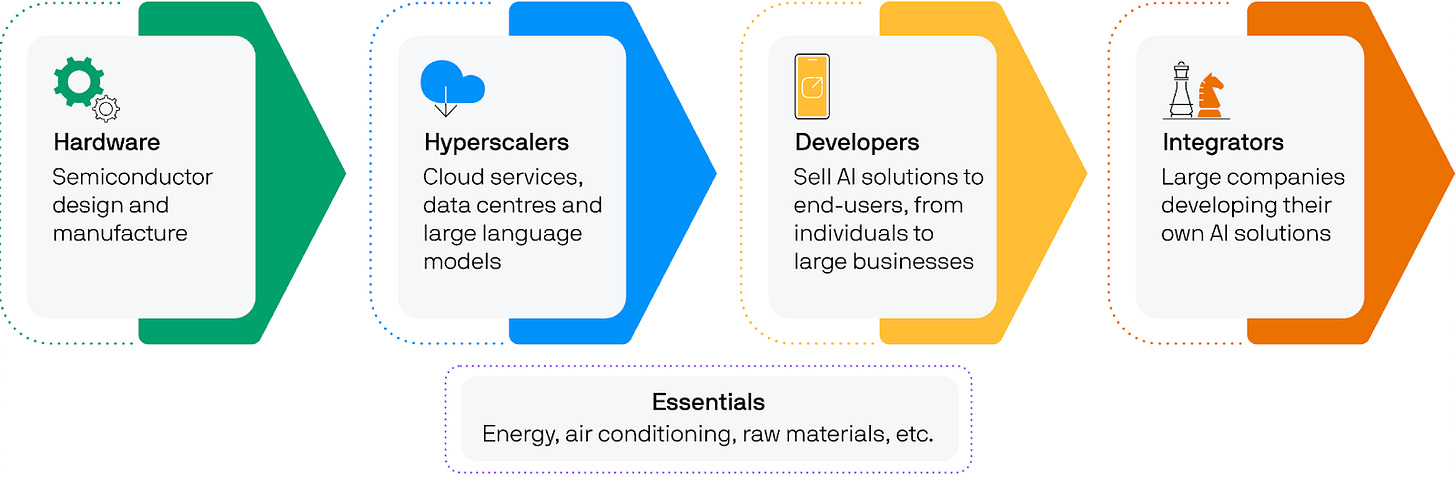

AI Investments are moving down the AI value chain towards applications from an initial focus on infrastructure. We have seen billions go into hardware (NVIDIA) and hyperscalers (Microsoft). Money is now focused on Developers and Integrators, who are quickly deploying this in various industry verticals and finding quick product-market fit. ChatGPT wrappers happen to be quite commercial, even as the infrastructure moves quickly underneath. Worst case, model providers can always be swapped around once you’ve captured an enterprise customer.

We expect this trend to continue for the next 18 months.

Replacing Junior Analysts

Assuming the product actually works, what is the financial implication for a Bulge Bracket Bank? First, some assumptions about junior analyst cost —

US : $85–120K, with bonuses often doubling their pay (~$170K total with bonus)

UK: $65–95K base (~$130K total with bonus)

Rest of World: $60–85K base (~$100K total with bonus)

These juniors work 80-100 hour weeks, meaning a single banker will provide roughly 4,200 hours of labour per year.

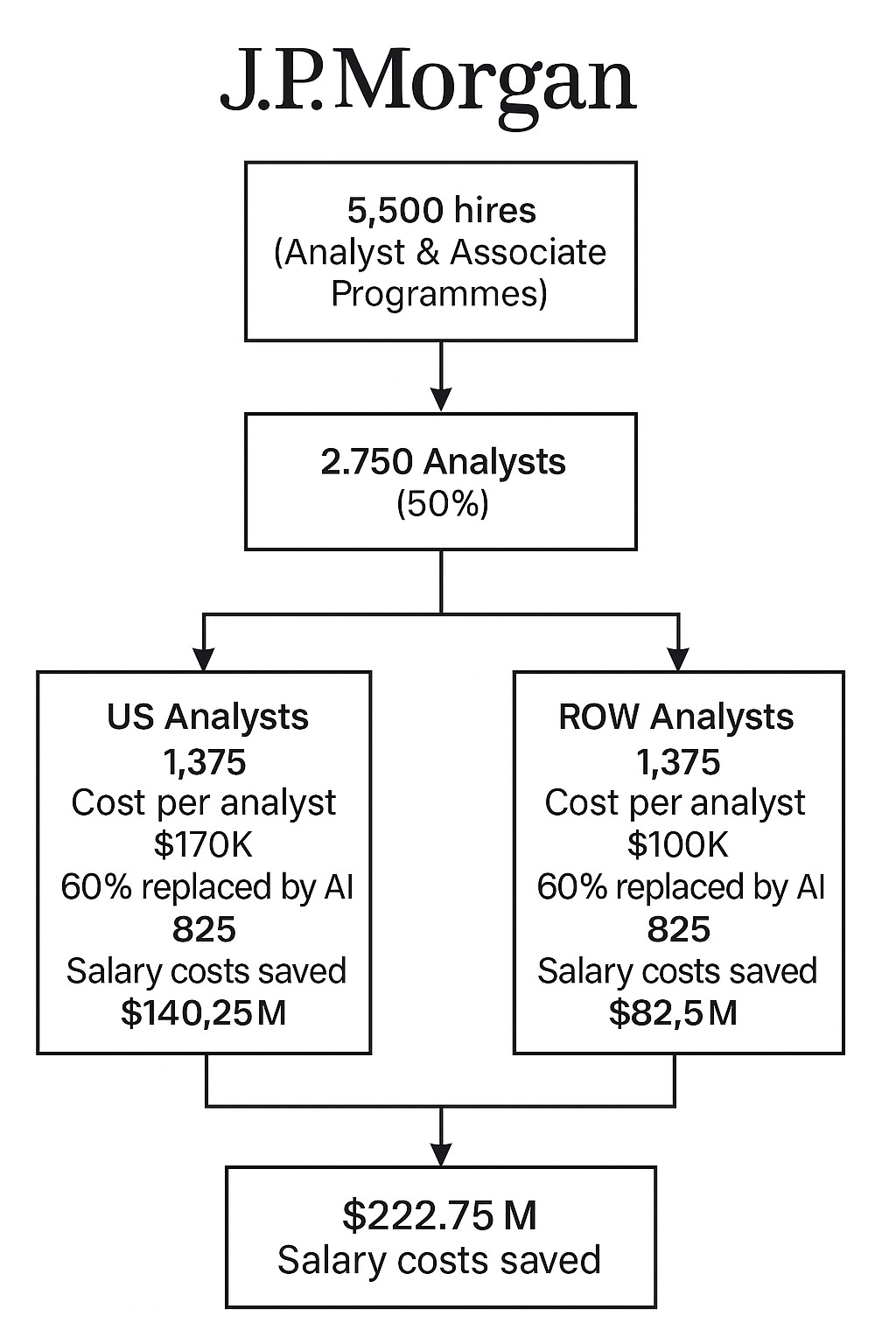

Consider a global bulge bracket bank such as J.P. Morgan, which invested in Rogo. Globally in 2023, 5,500 people joined the Analyst and Associate programmes. Assuming 50% were Analysts (50% in US and 50% hired into ROW), the annual junior analyst payroll could be as much as $370MM. If Rogo’s AI platform can replace 60% of these costs, retaining a smaller cohort of AI-skilled prompt engineers, we see around $200MM+ in savings per year.

We do not know Rogo licensing costs. But it is highly unlikely that they will charge anywhere close to $200MM a year for a single client. It is also unlikely that a bank will cut so much of its staff. But it is possible they will hire fewer people in the future. Consider the impact already on the hiring of developers as coding automation comes to market.

While cost savings are important, the strategic upside of Rogo’s AI for analysts and investment professionals might be the real impact. By offloading the basic, repetitive work to AI, team members can reallocate their time toward activities that are more client and strategy-focused.

Rogo could help people do more “interesting” work, where humans can spend time with clients rather than spreadsheets, and robots do the math. Rogo exemplifies a broader transformation underway in financial services.

Just as spreadsheets and Bloomberg terminals were revolutionary tools of past decades, AI analysts are poised to become standard in the industry. In an industry long constrained by “people hours”, that is a profound shift. The future hopefully isn’t one of machines completely replacing humans, but rather recalibrating what we as humans focus on.

On the other hand, here is a fascinating video of Satya Nadella of Microsoft discussing what’s next after optimizing Excel functions. The short answer is AI agents, doing the work on our behalf.

👑Related Coverage👑

Blueprint Deep Dive

Analysis: The end of Apple's 30% monopoly tax and $30B of revenue (link here)

It’s hard to be king.

The most commercial thing in the world is high technology. Apple has been holding on to a $3 trillion market capitalization crown, battling Microsoft, Google, Amazon, and NVIDIA for cultural relevance.

But is it possible that we are starting to see the faultlines caused by the absence of Steve Jobs? Where is Apple in Artificial Intelligence? Where is Apple in self-driving cars? Where is Apple going in China? The last several years of massive high-tech break throughs have left Apple’s P&L largely flat.

🎙️ Podcast: 400 Startups Building the Post-Web Economy, with Outlier Ventures Founder Jamie Burke (link here)

In this episode, Lex interviews Jamie Burke - founder of Outlier Ventures, about the current state and future of Web3, decentralized finance, and the metaverse. Jamie highlights Outlier Ventures' impressive growth, with a portfolio of around 400 startups, and discusses successful projects like IOTA and Fetch.ai.

The conversation delves into the open metaverse, emphasizing the importance of infrastructure and middleware in blending physical and digital realities. Jamie also explores the transformative role of AI in the metaverse and offers practical advice for entrepreneurs navigating this rapidly evolving landscape.

Curated Updates

Here are the rest of the updates hitting our radar.

Machine Models

⭐ Machine Learning for Cybersecurity Issues : A Systematic Review - Aseel Alshuaibi & Mohammed Almaayah & Aitizaz Ali

Comparative Analysis of Data Lakes and Data Warehouses for Machine Learning - Bhanu Prakash Reddy Rella

AI Applications in Finance

⭐ AI integration in financial services: a systematic review of trends and regulatory challenges - Darko B. Vuković & Senanu Dekpo-Adza & Stefana Matović

⭐ Generative Artificial Intelligence in Financial Services Strategic Business Report 2025: Global Market to Grow by $16.2 Billion During 2024-2030, Expansion of AI Chatbots Creates New Opportunities - Research and Markets

Revolutionizing finance with conversational AI: a focus on ChatGPT implementation and challenges - Zhisheng Chen

How AI Is Changing Corporate Finance in 2025 - Noah Kravitz

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our new AI products newsletter, Future Blueprint. (Don’t tell anyone)

Read our Disclaimer here — this newsletter does not provide investment advice

Contributors: Lex, Laurence, Matt, Farhad, Daniel, Michiel, Luke

For access to all our premium content and archives, consider supporting us with a subscription. In addition to receiving our free newsletters, you will get access to all Long Takes with a deep, comprehensive analysis of Fintech, Web3, and AI topics, and our archive of in-depth write-ups covering the hottest fintech and DeFi companies.

It’s incredible how many different players there are in the financial system and names just never heard of but killing with big numbers.