Hi Fintech Architects,

In this episode, Lex interviews Jamie Burke - founder of Outlier Ventures, about the current state and future of Web3, decentralized finance, and the metaverse. Jamie highlights Outlier Ventures' impressive growth, with a portfolio of around 400 startups, and discusses successful projects like IOTA and Fetch.ai.

The conversation delves into the open metaverse, emphasizing the importance of infrastructure and middleware in blending physical and digital realities. Jamie also explores the transformative role of AI in the metaverse and offers practical advice for entrepreneurs navigating this rapidly evolving landscape.

Notable discussion points:

The “Post-Web” Is an Intent-Led Internet

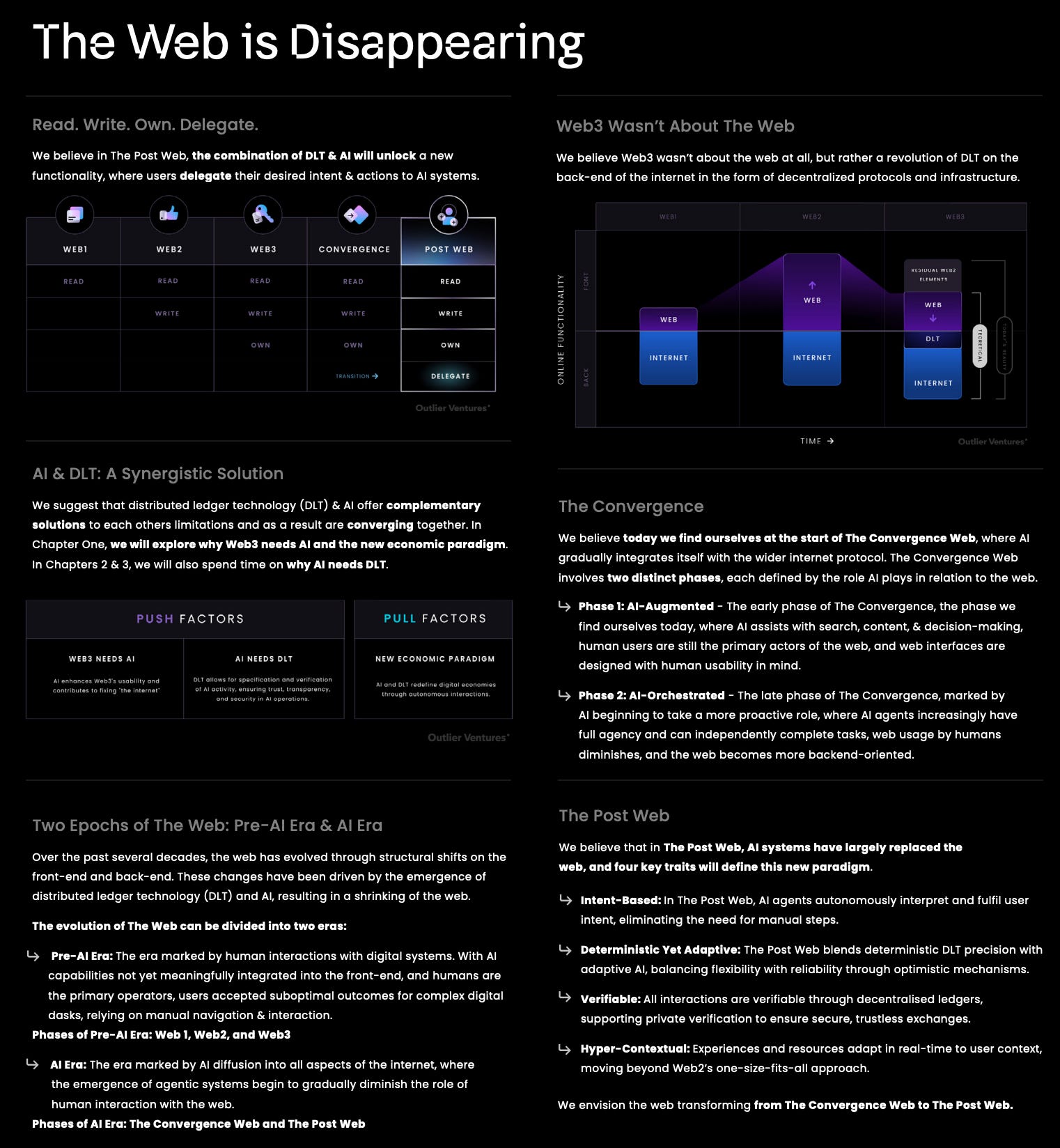

Jamie Burke outlines a shift from today’s attention-based web to an intent-driven internet, powered by AI agents, Web3 infrastructure, and DePIN. In this model, agents act on user intent, radically streamlining interactions and replacing much of today’s web interface.

Web3 Will Be Run by Machines, Not People

Burke predicts that autonomous agents—not humans—will become the primary users of blockchains, making crypto “machine money.” As a result, products, brands, and processes matter less, while incentive systems and on-chain automation take center stage.

Founders Must Embrace Systems Thinking

In the Post-Web era, survival depends on designing self-optimizing systems, not just building products. Burke stresses that token engineering, incentive design, and value flow mapping will define the next generation of durable startups.

For those that want to subscribe to the podcast in your app of choice, you can now find us at Apple, Spotify, or on RSS.

Background

Before founding Outlier Ventures in 2014, Jamie Burke built a diverse career spanning digital media, innovation consulting, and entrepreneurship. His early professional journey included roles at companies like Emap and IPC Media, where he gained experience in digital publishing and media strategy. He later transitioned into innovation consulting, working with firms such as The Innovation Group, focusing on emerging technologies and market trends.

In the years leading up to Outlier Ventures, Jamie co-founded and led several startups, including 90:10 Group, a social business consultancy, and Future Digital, a digital innovation agency. These ventures allowed him to explore the intersections of technology, business, and culture, setting the stage for his future endeavors in the blockchain and Web3 space.

Jamie's educational background includes studies at the University of Manchester, where he focused on politics and philosophy, providing a foundation for his analytical approach to technology and its societal impacts.

👑Related coverage👑

Topics: Web3, decentralized finance, metaverse, Open metaverse, Post web, Outlier Ventures, IOTA, Fetch.ai, accelerator program, AI, artificial intelligence, Agentic AI, agents, Web3, post-web, digital economy, blockchain technology

Timestamps

1’18: Outlier Ventures in 2025: From IOTA to Fetch.ai, Backing the Infrastructure Behind Intelligent Web3

10’24: The Open Metaverse Revisited: Outlier’s Long-Game Bet on Augmented Reality, Middleware, and AI-Driven Agents

26’01: FThe Post-Web Era: How AI Agents, Web3 Infrastructure, and Delegation Will Redefine the Internet

35’57: From Attention to Intention: How AI Agents and Web3 Are Flipping the Internet on Its Head

49’39: Surviving the Post-Web Paradigm: Why Founders Must Shift from Startup Thinking to Systems Design

57’49: The channels used to connect with Jamie & learn more about Outlier Ventures

Illustrated Transcript

Lex Sokolin:

Hi everybody, and welcome to today's conversation. I'm thrilled to have with us today, Jamie Berk, who is the founder of Outlier Ventures. Outlier is one of the marquee names in Web3, it’s an investor and accelerator, and has been involved with hundreds, if not thousands of different projects across the space. I'm really excited to talk to Jamie about his new thesis for where all of this stuff is going, as well as understand and revisit the fundamentals of the space. Jamie, welcome to the conversation.

Jamie Burke:

Great to reconnect.

Lex Sokolin:

Yeah. My pleasure. Thanks for coming on again. Let's just catch everybody up on where outlier is today.

Lex Sokolin:

It's the beginning of 2025. There's lots of weird macro stuff going on. Tell us kind of how you think of outlier today. What's the scale and what you're focused on.

Jamie Burke:

I think we're coming close to a portfolio of about 400 startups, and we are celebrating. Well, last year was a decade of our existence. So, we're in our 11th year now. And you know, we're kind of really continuing to just double down and scale the core business, which is our accelerator, where we work with teams at precede seed stage. But then we are becoming a little bit more vertically integrated. We've kind of got some later stage advisory offerings all the way up to token launch, which of course, you know, now TGS are back on. We have a large portion of our portfolio that are now beginning to launch their networks. In fact, as we speak, February, I think we've got two a week, which has its own challenges. Right. So that's kind of helping them do that final mile.

And then as part of that later stage offering, we're also working with what we call kind of third-party networks that haven't gone through the accelerator, but that are kind of significantly progressed. They're well capitalized, and then they're looking to go live again with their network. And so, we're working with several teams a quarter there and exploring lots of other things like market makers and stuff like that.

Lex Sokolin:

Can you maybe tell us some of the greatest hits in terms of the companies that have gone through the accelerator program? For all venture investors and, you know, for places like Y-Combinator. There's usually a couple of projects that really move everything forward. You know, just by the power law. What were some of the most meaningful projects where you guys were involved?

Jamie Burke:

I mean, there's a couple of ways of looking at this, right? Of course, when people ask this question, they typically mean, you know, tell me the projects you've worked with that I've heard of, right. And the kind of the big names.

And we have a handful of those over the last decade that have, you know, they're the more high-profile ones. They're the ones with kind of, you know, the largest, largest networks in terms of valuations and everything else. And then there's this subset remembering that we are, you know, sometimes the first check into a project less so now, to be honest with you, we kind of working with teams just a little bit later, stage and seed. But historically we have been in some cases that the first check in. And so, and it's our own money that we deploy as well. So, it's not LP money. So, we get 100% of any return. And so, our economics are very strong. We're very good at realizing value from investments, even if they don't necessarily kind of enter the top 100. Now with so many thousands of tokens going live. Right. But to kind of come back to the first one, which is what are the most heard of. So going back to kind of the 2017 era, I think our first home run, the first network to go to multi-billion dollar network was Iota, which as far as aware was the first deep in investment And I think real testament to how we've been looking at what we've framed as the convergence of DLT with things like IoT and AI, which of course is now deep in and the AI.

And so, Iota went into. Oh, God. It might have even gone into the top ten at one point, but it was certainly top 20. A little bit early for what it was trying to do and has had its various criticisms, but I think nevertheless pointed in this direction of trying to approach. Well, firstly, it wasn't a blockchain. So, you know, it was a DAG (directed acyclic graph). So, taking different approaches to scaling for the machine economy. Of course, very topical now. We did that back in 2017. In the same time period we invested, we were the first investment into something called fetch, fetch.ai, which has gone on to merge with several other investments that we made, one being Ocean Protocol, another one being kudos. Ocean protocol is data marketplace. Fetch.ai was the first blockchain to solve for agents again very popular now and kudos was doing decentralized compute. So those three things merged into Artificial Superintelligence Alliance along with singularity net three of the four teams that have kind of merged there, we were, if not the first, one of the first angel investor tickets into those.

And so, I guess that that's probably by far the biggest success, both in terms of monetarily, in terms of if you look at the kind of charts today. But I think also pointing to our thesis, because the fact that three of our investments pre-seed seed stage, what is, you know, several years ago now are, you know, industry first, first deep in first day, one of the first decentralized compute, first decentralized data marketplaces. All of these things now, at least as approaches, are highly relevant for the world that we find ourselves in. Coming into 2025. And then there are kind of several others that, again, are kind of related and adjacent to that by economy, which is also moving into the authentic space, have been focused on abstraction, cross-chain abstraction for some time, and one of the first to then move into deploying agents to solve for that. And, you know, several others that we can point to, and I recommend people to kind of go to the portfolio page.

Lex Sokolin:

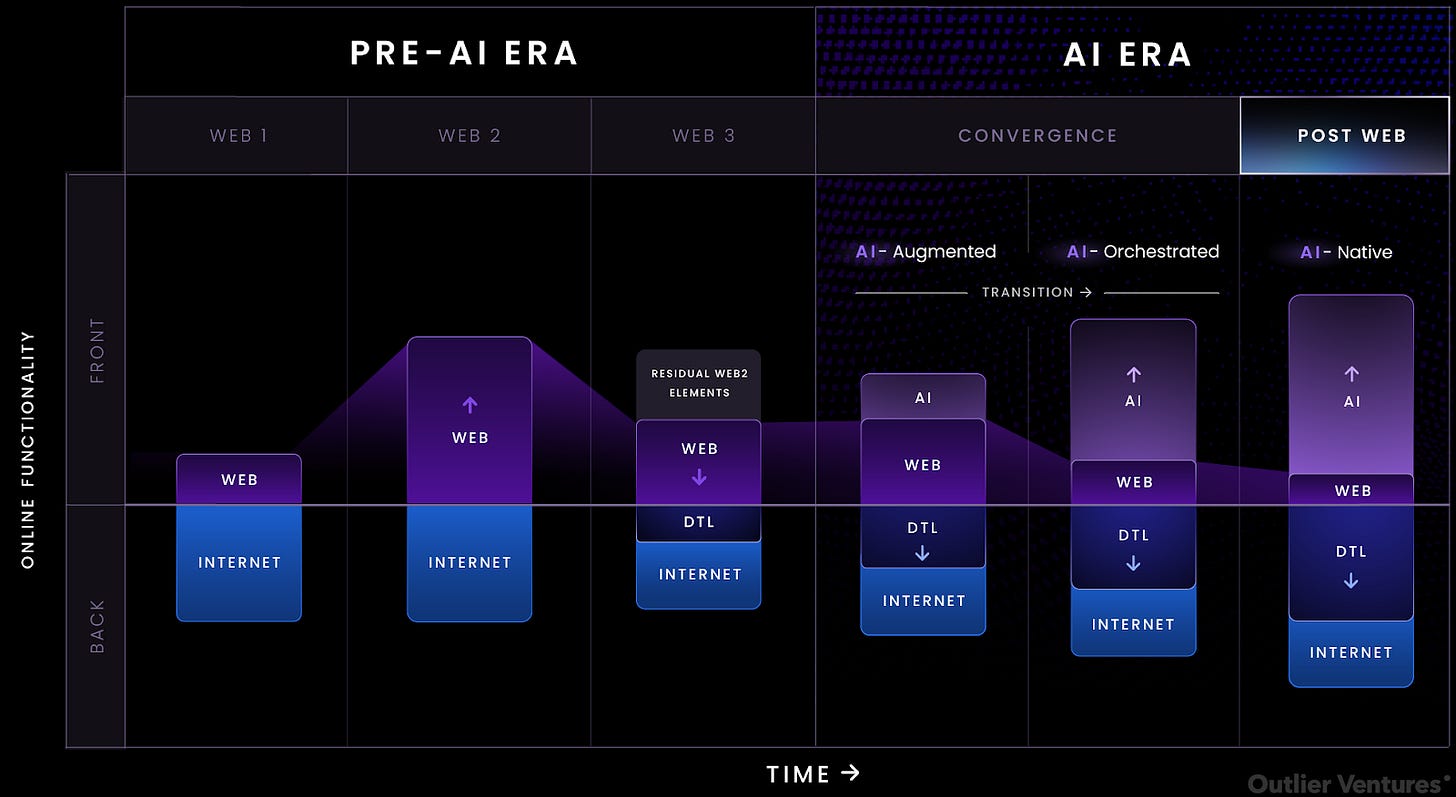

One of the things I've always respected out there for is independent thinking about where the industry is going. And, you know, it's in the name Outlier. And I think there was when you think back to 2017 through 2022, really that five-year period, a lot of the mainstream things that people cared about and for sure you were involved with, but sort of the mainstream narrative was computational protocols scaling those out and then financial applications on the computational protocols. And that's in many ways the easy bet. Like, it's glaringly obvious that that's one of the large use cases for blockchain and Web3.

And you, an Outlier, have thought much more rigorously about what else you know, about what are the other adjacent markets and opportunities that can be built on top of this infrastructure that are, you know, frankly, a lot more? I don't know if interesting is the right word, but that raised kind of more questions than they answer, which drives entrepreneurs to go and build in that fog of uncertainty. And I remember a few years back that thesis was around the metaverse, and it was before, you know, Facebook and Zuckerberg decided to be Meta. And it was before apes and punks and all of that stuff became a speculation vehicle. And you had a really rigorous view on if our third space that we spend time in becomes digital, which Covid accelerated. You know, what is the Web3 infrastructure? What are all the different components from storage to computation to the rendering of objects and avatars and so on, that can be enabled by Web3 that come together to create the metaverse in this third space. I'm sure that for the average listener, they have skepticism.

Now about that thesis. And in many ways, you know, the virtual reality spatial computing stuff, even now with Apple's interest in it hasn't come to pass at the rate that we in the industry maybe all wanted. Can you take a moment, maybe to refresh us on that original thesis that outlier had put together and reflect on where we had gotten to, you know, by 2025?

Jamie Burke:

Yeah, absolutely. And I'm really glad, actually, that you give me the opportunity to kind of address the open metaverse, because I think often people are kind of moved on wrongly in, in my view. And maybe just before I do, I think it's important to kind of speak to our function in the ecosystem. So, we're an accelerator today. Prior to that, we were an incubator. And that was because there weren't enough teams to accelerate and even invest in, to be honest with you. And so, you know, actually pre Ethereum, we were incubating projects and as a consequence we did lots of infrastructure and very hands on work with the technology, which allowed us to realize all the all the things that had to be built for any of this stuff to be, to happen at scale.

You know, fast forward at 11 years and you could argue it's only just starting to happen now. So, we've been kind of forced really to take long term views to develop a thesis that will hold for a decade plus. And because we're not a classic fund structure, we don't have LPs. We also have that luxury. So now that said, nowadays we're an accelerator. We're accelerating more teams than ever. Hundreds a year. And so, we have to be a little bit closer to the emerging narrative. But we still try to do that within a bigger vision. And we're going to probably talk about the update to our thesis a little bit later, which is the post web. But the open metaverse is a nice segue. So, as I was saying earlier, we've been obsessed by the idea of convergence for several years and working with teams like I try to solve for the machine, machine-to-machine economy, working with teams like fat, trying to build out infrastructure that can support agents at scale.

Working with teams like Ocean in terms of trying to develop a new data economy and a quantification of data and various other ones. DIA data for trustful oracles and kudos for decentralized compute, etc. all of that's given us this kind of grounding in Both the infrastructure but where it will be kind of applied. So that forms kind of the meta thesis. And we kind of refresh that based upon the conversations that we're having, both with the teams applying to accelerator and thousands apply each year, which gives us great insight into, you know what, what's emerging at Pre-seed stage. And now we've got this maturing portfolio, one of the biggest in the world, which gives us the advantage of seeing kind of later stage. And so now we're beginning to get a more complete picture of both what's emerging and then what's working and what's not working on where these technologies are being applied. So that's kind of the context. We have this very unique position. And so really, it's then just pattern recognition because we don't have LPs. Then taking a bigger view.

We now run programs with partners. They could be VCs that we're close to. They could be protocols like peak, for example. We actually began working with them prior to them launching their network, but we've worked with practically every major protocol on the planet on developing their ecosystem over the years. And so, we kind of nowadays, we have to be a little bit closer to the market than when we were an incubator. So typically, the sweet spot is our accelerator programs run for three months. so ideally, we want to kind of be just slightly ahead of the trend in order that when the teams graduate, there's actually capital to be deployed into them from our investor network in, you know, 3 to 6 months from our engagement. And that's really the sweet spot. So that that means that if you kind of look at the complexion of a lot of the teams that we're working with now, they're perhaps a little bit more obvious, but as I said, they kind of sit within these grander theses and that may be something we externally communicate or not the open metaverse.

So long winded way to get around to it. But the open metaverse for us is still very much alive. We just don't talk about it as much because it's not seen as topical. But if you both look at our portfolio, our maturing portfolio, from the investments that we made into that thesis or however many years ago that was now, you know, 3 or 4 years ago, but then also applications of convergence thinking and convergence technologies. Increasingly, they are within what we would classify as the open metaverse. But you might kind of look at it in a slightly different way. So, I'll give you give you some examples. The first thing is the definition of the open metaverse. And so, we were always very clear about this in our definition of the open metaverse. It's somewhat nuanced but we think important a lot of people used to think of the metaverse and still think of the metaverse as virtual worlds and requiring, you know, XR at scale, in particular virtual reality. And they kind of think Ready Player One, that's for sure, will be an aspect of it.

But for us, the open metaverse was the blurring of this, this kind of distinction between our physical and our digital lives, and more an augmentation, augmentation of reality, not necessarily AR, although absolutely a very interesting area, more interesting than virtual reality as far as I'm concerned. But this kind of augmentation of reality. And so that's really important distinction because I think if you if you take that definition, then this is still very much happening, and I think is going to be accelerated even further by AI. I. So actually we have several investments that I would say are still relatively under the radar at the moment because people kind of got a little bit bored with the metaverse thing. You know, root and the root network are a good example. And they've been building out infrastructure for interoperable worlds and various standards around NFTs. Crucible and Open Meta actually just launched some of their kind of virtual world spaces this week as we speak. And so, the thing about the open metaverse is it requires a lot of infrastructure, a lot of infrastructure, a lot of middleware.

And there's kind of this tortoise and the hare scenario, which is, by the way, quite typical with Web3 and whatever it's kind of competing with is, is the status quo is that it takes time for all the gains of having this composable, highly composable, poseable interoperable technology stack to catalyze. And so, whilst everybody's attention has been on of the things we've been looking and watching within our portfolio and seeing huge technical progress now that hasn't materialized at the application layer yet in terms of games, massively multiplayer games, or in kind of what we refer to as decentralized commerce, like changing how people shop online. But we're starting to see that happen now. So that's kind of the first thing. But actually, what's really interesting is if you look within our portfolio in an AI context or an authentic context, we have some projects like Auki Labs, for example, Auki Labs has built a protocol to allow for allow for spatial compute to happen at scale. One of the big limiting factors in AR, for example, is positioning.

It sounds like a really simple problem. You'd think that it had been solved by somebody like Niantic, or even just by using GPS. But actually, that's not true. It's until now, it's been very difficult to place an object, a virtual object in a social environment. And for multiple parties to be able to see the same thing in the same position, you know, within a few millimetres. And that's because GPS is 2D. It's not 3D, it's not volumetric. And so, it doesn't handle space. And anybody that has had kids or is a big kid themselves and has played Pokémon Go, actually a lot of that's kind of faked. There is there isn't really a true, truly effective positioning system in there. So, the reason why that's important in our vision for the open metaverse is so this is seen as a AI project. And of course that's true. Spatial compute is a form of AI in terms of how these things are kind of rendered and everything else. But actually, our key for us is very much an example of the open metaverse.

How can you have layers of reality on top of our physical reality, our physical world, without something like Auki? You can't. Now, that's just one example of a primitive that is going to enable the open metaverse to begin to happen at scale. And until you solve that, it can't. It isn't a virtual world, it is an augmentation of, existing world. And we've got other things like 3D, so 3D, again, wouldn't necessarily identify as a metaverse project, but it allows for brands and they work with some major brands in the fashion industry and, and other forms of kind of online retail where you want an immersive shopping experience, you want to see a 3D object, you can kind of spin it around. So, they have technology that both renders that really effectively but then allows for that to be distributed and viewed in browser to like a very, very high standard. And so a lot of this stuff is going to be driven through the browser versus, say, a pair of VR goggles.

Increasingly it's going to be locked by innovations with glasses and AR solutions. And so, for us it isn't this isn't about games necessarily, or virtual worlds or virtual spaces or even necessarily the buying and selling of NFTs. It's really the infrastructure that allows for greater levels of immersion and greater levels of kind of new realities to be kind of layered onto our physical lives. So, for us, in that context, when we looked at the open metaverse, we actually defined the open metaverse and our investments as an operating system. And so that operating system is now beginning to catalyze. And when it does, people will be able to start doing things that has not been possible before. In order to create these kinds of seamless, immersive experiences, what you might refer to as the metaverse. So maybe kind of just to wrap up the point, we actually I mean, I've been saying a little bit on, on Twitter recently. The open metaverse is definitely not dead. And in fact, the whole agent narrative is going to lead us into this kind of revival of the open metaverse.

And the problem with the open metaverse, historically, versus the closed metaverse of worlds like Fortnite, is that they're empty worlds and they're empty worlds because it's been historically very difficult to build anything in them, to deploy games for them to be usable. That was an infrastructure and a middleware problem. That's all increasingly being resolved. And these worlds are going to be increasingly populated by agents. And again, there's lots of interesting innovations happening in our portfolio. Think is a new protocol. It's actually based on a merger that's again launched from the root network, which is looking at cross world memory for objects. So, an object can be transferred between worlds and retain memory. Really important when you're looking at I and I processing. So, I and agents are going to reawaken all of this infrastructure that's being built out that is Web3 infused. And I think open metaverse is going to be the hot narrative again once all this technology begins to integrate with AI.

Lex Sokolin:

On my side. You know, I've tracked blockchain, AI and then AI, AR, VR. As these big platform shifts. You know, since 2015, 2016. And like you say, they are converging, and they do so at really difficult to predict times. You know, so we had this boom in the initial crypto markets with ICOs and then DeFi. And then during that time, if you remember, I was completely dead. Like, yes, there were a bunch of machine learning companies that were building out compliance software for banks, but we didn't have nearly anywhere the attention that we have today on generative AI and the energy and capital that went into trying to make virtual reality happen at that time, I think far exceeded the interest in kind of pushing the AI research forward. And now we have the complete flip, like AI's leading everything that is changing what cryptos for turning it into robot money instead of only human money. And I think all of the stuff around spatial computing is going to open up because very naturally AI is it’s the user experience that you need for any sort of device that presents you with a rendered digital world on top of the actual world.

Like we need to be able to speak to the device, it needs to be able to pick up our voice and figure out our intent and then, you know, manipulate objects with first language, later with thought, you know, so there's a whole bunch of things that need to be unblocked. And really, nobody knows the full limit of the things that need to be unblocked. But I think once you zoom out, it's very clear that things are going to be more digital, that these research areas that people have been working on for decades and decades are only going to unlock more and more potential as we evolve from the original kind of bet that people in Web3 were making about the metaverse, which included digital objects, NFTs, gaming worlds, kind of the stuff that was at the height of Covid, the most addictive and the most interesting. And as we move into a world where you know, every iPhone is going to have a DeepSeek level model on it, if not even more powerful, where we're getting research capabilities, PhD level research capabilities for free out of open AI and so on, where you know your toaster is going to be smarter than your professor and university.

As we move into this world, what happens to the internet? What is the next version of your thesis about where things are going?

Jamie Burke:

And this has been the big question that's occupied me since the summer of last year, 24. So I actually stepped back to or up or however you want to look at it, to chairman the year prior and took a little bit of time out to kind of just to be honest with you. decompress. You know, decade in in cryptos is an intense thing to put your, your body through as ever. You know, it's one of those addictive things you, you, your mind always comes back to. And actually, having a little bit of space and distance, both from outlier and from the market for several months over the summer of last year, gave me this kind of healthy, healthy distance to reflect on a decade of Web3, to reflect on the convergence thesis, to reflect on the open metaverse. And then I came back, just started speaking with founders, and as I said, we've got close to 400 startups now, and many of them have multiple co-founders.

So I don't know, call it 600 founders we've got in our network, aside from, you know, all the all the brilliant partners who we've always been able to kind of lean into and, and speak to, whether that's Ilya of Near, whether that's Joe Lubin of Ethereum, whoever it is, able to kind of just reach out and just start talking. And that really began this process of thinking about the direction of the web. And, you know, usually web cycles last a decade. And it was not only our ten-year anniversary, but it was also actually ten years since the web three term was used in the context of blockchains. Obviously different. Tim Berners-lee's. And so, it would have been fair to say, well, that's over now. Right. You know, web three is over. What's next? Which is obviously a strange question to ask, because I think many people, including those working in it, would feel that whilst a lot of cool things have been built from an infrastructure perspective, we're a million miles away from prime time, you know, making any real positive, meaningful impact on the world, you know, beyond perhaps having this way of escaping, you know, the traditional finance system.

But again, even that is perhaps under question. The conversation I was having when I was speaking with founders, you know, very quickly it became clear that innovations in AI were going to actually be a big win for Web3, because the problem with Web3 that everyone had been busy trying to solve for until really, you know, summer of last year, 24, was abstraction. Okay, how do we just abstract all this Web3, all the complexity of Web3 away for the average consumer so they can begin to benefit from all of its innovations around digital property rights and transferability, etc., etc. even all those efforts of abstraction really kind of just failed to cut through. Whilst those these kind of emerging innovations in AI, be it LLMs, just a more conversational interface or agents again, something that was not new to us. Having made the investment into Fetch in 17, but as a as a trend that we were starting to see catalyze at scale. These two innovations in and I'm speaking obviously in very general terms, promise to solve for and truly abstract the complexity of using web3 away.

Now, this is probably well established by the time that this podcast is going out. I don't think this is a brand new concept, but it was there when we were writing this paper and we began to say, okay, look, there's a new thing happening here that fundamentally allows for us to catalyze Web3 and take it mainstream, but in the process of doing so would actually change what we even think of as the web and our relationship with the consumer internet. So LLMs abstract the front-end usability of Web3 to be more conversational. And agents can handle all the on-chain execution of quite complex tasks. And of course, you know the idea of an autonomous economic agent and even DAOs, you know, DAOs for people suck, but DAOs for agents with the right incentives could really work. And so, we've kind of got a decade of infrastructure that was much more about upgrading the internet than it was actually anything at the web interface layer. And the problem was that it actually didn't have a native Web3 interface layer that allowed for all that functionality to be unlocked.

And now is that. And then beyond that, if that is the case, if agents are the things that are carrying out all the on-chain actions on blockchains, then and tasks are increasingly delegated to agents via LLMs, then who are the users for blockchains? Well, it's not people. People directly anyway. And so, you know, for us, if you kind of follow the read right on the convergence of these two technologies offered a fourth innovation in the context of the web. And that was delegate to read, write, own and delegate. And we felt that was a really significant upgrade to what you can do on the web. Now, when you think about that and kind of meditate on it, and that's what I did. I spoke to I did about 100 hours of interviews with founders. Much of this now is being shared in an audio documentary called The Post Web, and various papers is as you begin to delegate more and more to agents to carry out work on your behalf, they need they actually need economic agency, they need personhood.

And so, on the one hand, I solve lots of problems for Web3. On the other hand, Web3 promised to give new forms of agency to AI, both in terms of economic agency and, I think increasingly legal personhood. As we begin to want to complete contracts. You know, sign agreements. Of course, there needs to be some catch up in the kind of legal world, in a regulatory world to that. But ultimately, if you want an agent to be able to not just advise, but to complete a task, then it needs those forms agencies. And so, our view is that all roads lead to this Web3 infrastructure. And so, you have this really beautiful relationship. You know, Web3 needs all these innovations in AI, AI to realize its full potential in the context of delegation needs, Web3 infrastructure. And so, these two things promised to catalyze one another in a flywheel. And actually, there's a third part to that, which, of course, is deep in, which allows for the infrastructure to also happen in a kind of more privacy preserving, decentralized and actually efficient way, because there's lots of efficiency gains in compute, storage, memory, stuff like that.

So that was the first piece. Is that okay, this read-write own delegate and this flywheel. Really it is kind of the moment when, when all of this stuff that we've been building comes to life because it can be abstracted away and but also because its functionality can be unlocked, its complexity can be unlocked by agents that can have the cognitive capacity to do that.

Lex Sokolin:

Yeah. I mean, I hear kind of two things in there. The first is an argument that we've been making for a long time, and that argument is that people don't need to know how an engine works to drive the car. Crypto people are really interested in how the engine works, and the rest of the world just wants to drive the car. There are very few people who make engines, and there are a lot of people who want the service of transportation, and I think that analogy has been used a lot in terms of wallet experiences, user experiences and so on. It also goes to financial engineering, like financial engineering is something that blockchains unlocked for people.

But financial engineering is a hobby of a very, very small percent of people. It's not the same thing as democratizing finance in the sense that you're letting people pay or borrow. It's you're democratizing the manufacturing of financial services, which, again, is an interest of only people who enjoy manufacturing financial services. The second kind of thing that I think is more unusual or new is, I mean, something that I believe in these days more and more is cryptos for robots. It's machine money. And so as we have more and more economic growth from, I sourced economic participants, you know, whether it's people using AI tooling around them and levering themselves up for greater productivity or whether it's, you know, fully automated owned software robots or hardware robots that do things that are productive. These are the appropriate users of the large, you know, settlement, payment, money movement, capital market engines that are native and Web3 and that are in most ways far more appropriate for modern technology. For me, those two things kind of stand out as like, okay, well, we're ready for abstraction, for the unification of all of this technology into one place. Did I get the gist of it, or is there anything else you want to kind of spin on top?

Jamie Burke:

Yeah, no. That's it. And so, the thing is, when you say, okay, it's always difficult to time these things. I mean, as you said, you know, that flywheel, each of its constituent parts, whether it's Delta DePIN or agents, you know. They have their own push and pull dynamics. They have their own technical limiting factors. And sometimes it's one is driving a flywheel more than the other or stalls the flywheel. But I think it's safe to say at this stage that those three constituents have a relationship. And that relationship is, generally speaking, going to see each reinforce the other. And so, then the question is, well, as an investor or as a founder, if this is a new web paradigm defined by this delegation, then what are its characteristics. And so, we identified for one, you mentioned word intent earlier, but it's intent based. Its intent led.

So, everything starts with an intention. I'll come back to that in a little bit because that's a really, really important and I think so far quite under appreciated or underdeveloped concept. The second one is it's obviously verifiable. So, you can begin to verify what these AI and agents are doing. A USP for AI versus centralized AI, and especially in an authentic context, because we're not talking about a single monolithic AI interacting with people, or a single monolithic AI interacting with another single monolithic AI. We're talking about potentially billions of agents solving things in swarms in, in, you know, breakneck speed, like being able to at least audit that is retrospectively, if even if it doesn't have a high, kind of high, higher form of consensus is going to be critical. It's going to be hyper contextual because it's intent based and because the UX can be determined by AI. And then finally it's going to be deterministic but adaptive. And again, one of the limiting factors for a lot of AI today, LLMs etc. is they're probabilistic, which is great in some things, but a really big problem.

If you want surety of executing a financial transaction or a legal contract, you need to know if this, then that. At the same time, if that's to handle complex workflows, then it needs to be adaptive. And so, we think those these four things are the kind of characteristics that are borne out of the convergence of LMS agents and DLT. DLT kind of as a broad classification for tokenization, DAOs, you know, all the Web3 infrastructure that we see. And the really interesting thing is coming back to the intent point when you have an internet that now has these four characteristics. You actually see a shift from the web paradigm. The organizing principle of the consumer internet as a whole, which also extends into SaaS, by the way. But let's just stay on the consumer internet for simplicity's sake. You shift from the attention economy to the intention economy. And for us, really, that is the kind of crystallizing thought.

Lex Sokolin:

I like that it's very memorable.

Jamie Burke:

Yeah. And look, I mean, the intention economy was actually a term phrase by somebody called Doc Searls some time ago.

Most people who come from the advertising world would have been familiar with it. But I think in this context, it goes one step further when we're talking about technically talking about the impact of intents. And again. I mean, it's memorable. It almost sounds like you could throw that away. But if you again meditate on this thought, quite almost shocking realizations start to come to mind, and some of them may be a little bit more obvious than others. So, the entire consumer internet today is oriented around the capture and harvesting of attention, almost to the kind of failing of everything else. It's kind of a paperclip moment. I don't know if listeners are familiar with the idea of kind of an AI paperclip maximizer, but it was proposed. If you ask an intelligent system to optimize for something making paperclips, it will destroy the planet. In doing so, it will. It will turn the entire planet and all of its resources into a paperclip factory to the point where there's nothing left but paperclips. And that sounds bizarre.

But actually, if you think about what we're doing with algorithms that optimize for attention, it's kind of happened, right? We often, as consumers of the internet, find ourselves like doomscrolling in an app for like 20 minutes, and we kind of come out of it and we're like, what the fuck have I just been doing? Like, I've no idea why I was doing that. I was just kind of somehow, I've got in, got into this loop or you might start out with a particular task, or I've got to go, but this holiday or I've got to go research this thing before you know it, you're doing something else completely different, non-productive. Your kind of attention has been hijacked. And it's not just our attention as a consumer. And by the way, you can take that one step further and just think about, you know, the effect on our physiology and our mental state and impact to children and their attention spans. But even putting aside all the ethical arguments for that. The interesting thing about this economy that optimizes for attention is it doesn't even work for the brands that subsidize this economy.

So, the reason why we've got free, generally free products in the consumer internet, social media, and what have you is because it's subsidized by brands, it's subsidized by brands because they want to serve ads. The conversion rate, average conversion rate for an ad on the internet is 2%. So, 98% of all advertising spend is wasted. So, if you said, okay, well, look, we're farming attention. And it's, it's confusing people and we're not productive. But people are you know, it's like a 40% conversion rate. People are buying things that they're beings. Then you say, okay, well, maybe there's an argument to say, we could tolerate this, but like, literally it's not working for anybody, including the brands that are subsidizing it. So, the attention economy is the paperclip maximizer at scale. That's what happens when you get a set of algorithms to optimize for a particular thing. The interesting thing happens when you optimize for intent. So when all this computational power and all these algorithms start optimizing for intent, I believe you flip the entire consumer internet on its head.

Because actually, if everything starts with an intent, an intention, I express an intention through my LLM. Hopefully in the future it will be my sovereign agent I can trust, so I can be more happy to kind of share my thoughts, my moods, my desires. And then the agent will go and outsource that task to the internet. It will go and find other agents to solve for that problem, and it will do so with ruthless efficiency, you can't distract an agent. A really good agent, right? It won't get caught in attention traps. It doesn't care about brands. It won't use a search engine. It won't use comparison websites. It avoids interruptive advertising. It doesn't need a website with a complete menu of every product and every service. It doesn't need an app for everything. It doesn't need an Uber app, right? It just needs a set of APIs, and it needs a semantic layer to be able to identify and communicate. And then of course, an economic layer to transact and potentially contract with agents.

But it removes the lion's share of the web, the interface that we as people use to just try and navigate the attention economy in large part removes that. It becomes redundant pretty quickly because of this ruthless efficiency to solve for intent. And so, it flips the consumer internet on its head. It'll do the same thing in SaaS. And the promise is without being to your topic, that it actually allows for a more intentional relationship with the internet. It allows for a more purposeful relationship with the internet. In theory, it gives us back attention to invest in. Hopefully, you know, more meaningful things that may or may not be on, on or offline. And so again, that that was a really big realization for me on a number of fronts. One directionally where the consumer internet's heading. And this is what's led us to refer to the paradigm that comes next as a kind of byproduct of this convergence of AI and Web3 as the post web. It's not web four or web five. The web actually almost disappears.

What's left is a thin web. Again, coming back to my four qualities hyper contextual. So, you will only see a web interface when you have to make a decision, or it requires a greater level of immersion and that will follow Maslow's hierarchy of needs websites will be made on the fly. You'll just see the thing you need to see. You won't need to navigate it. If it can be minimally hyper, hyper minimally presented to you, like through just a question through your AirPod, it will be. But then circling all the way back to how we started this conversation. What's left when you don't need all of the consumer web that exists today? When everything that is boring or transactional can be outsourced to agents, what's left is the metaverse. It's more immersive experiences, more purposeful social experiences could be gaming, could be more immersive. Shopping could be learning about the world around us.

Lex Sokolin:

Wow. That's fantastic. I'm aligned with you on a lot of these points. I mean, if people want to just get a flavour of this, there is a very simple exercise you can do, and it doesn't even need modern technology.

It just needs a smart speaker from five years ago. You know, if you ask your smart speaker a question, it will give you one answer and that will be the answer. And that's a very different experience from putting in a query into a search engine and being presented with literally a billion answers, and all the decoration that goes around being able to deliver that to you. So, the difference between getting the answers to your question versus being shoved into an ocean of information and made to swim on it. We've come up on time, but I do want to ask you one final question. Maybe to wrap up, which is something I think about as an investor, and I'm sure lots of people who are building companies out there that are thinking about it as entrepreneurs, which is let's say you do have this profound vision of where the world is going, and let's say even 20% of it comes to pass in some form, right? You already have an advantage in seeing the future and kind of having a North Star that's meaningful.

You talked about market timing. And you know, in crypto this is extremely volatile and expressed with schizophrenia and psychosis in tech. It's a little bit slowed down. But it's also you can be off by, you know, 25 years or 50 years on some of these themes that are very futuristic. So, my question to you is pretty bounded, which is in practical terms, how does somebody building a company along these themes just survive the market. Timing, you know, not how do they get it right or how do they win, but just how in the current market setup, do you even stay at the table long enough and not get wiped out? You know, because an AI startup in 2002 is pretty much certainly dead, a stablecoin project in 2010 is most certainly dead. All of the metaverse stuff from 2017, most of it is almost certainly dead. You know, you can find all these examples of how you can be right on the trend, but wrong on the selection of the project and kind of getting to an answer. So what can people do to last enough to actually hit some of these themes?

Jamie Burke:

Yeah. And of course, this is the holy grail, the billion-dollar question. And I hate to say it, but it's only going to get worse. So, and we've already just seen it with Deep Seek. Right? There was this assumed truth in AI that it was kind of all just about the size of the model and the compute you could throw at it. And whilst there's some debate around exactly the implications, we should be taking from Deep Seek, it has nevertheless challenged that narrative overnight. And there's going to be more of this, right. And that's before any of this stuff is even connecting up to agents in our context in a post web context. Right. This is just kind of, Kai, the minute that this stuff begins to take on AI generally begins to take on the complexion of crypto and Web3. It's going to get even worse. It's going to get the kind of rate of innovation is mind blowing.

I mean, we've only just scratched the surface in what people think of as agents today. These kinds of memes, meme, meme agents. I mean, technically, you could say many of them aren't even agents, but nevertheless, they've got people excited, right? When all of this stuff begins to catalyze this flywheel, I was talking about the post where flywheel of agents deep in and DLT went and DAOs get unlocked, and tokenization and game theory and incentive design when they really get cranked up and used by AI, the rate of innovation is going to be eye watering. And so, for a founder in this space, it's going to get really tough, right? Because not only are you now in the crypto timeline and these kinds of boom-and-bust cycles, which I think are going to, become more volatile, more exaggerated, I think a Trump presidency only increases that, by the way. Is this stuff still kind of seems to just reflect macro. So actually, the environment that you're trying to build in is, is getting more volatile, more complex.

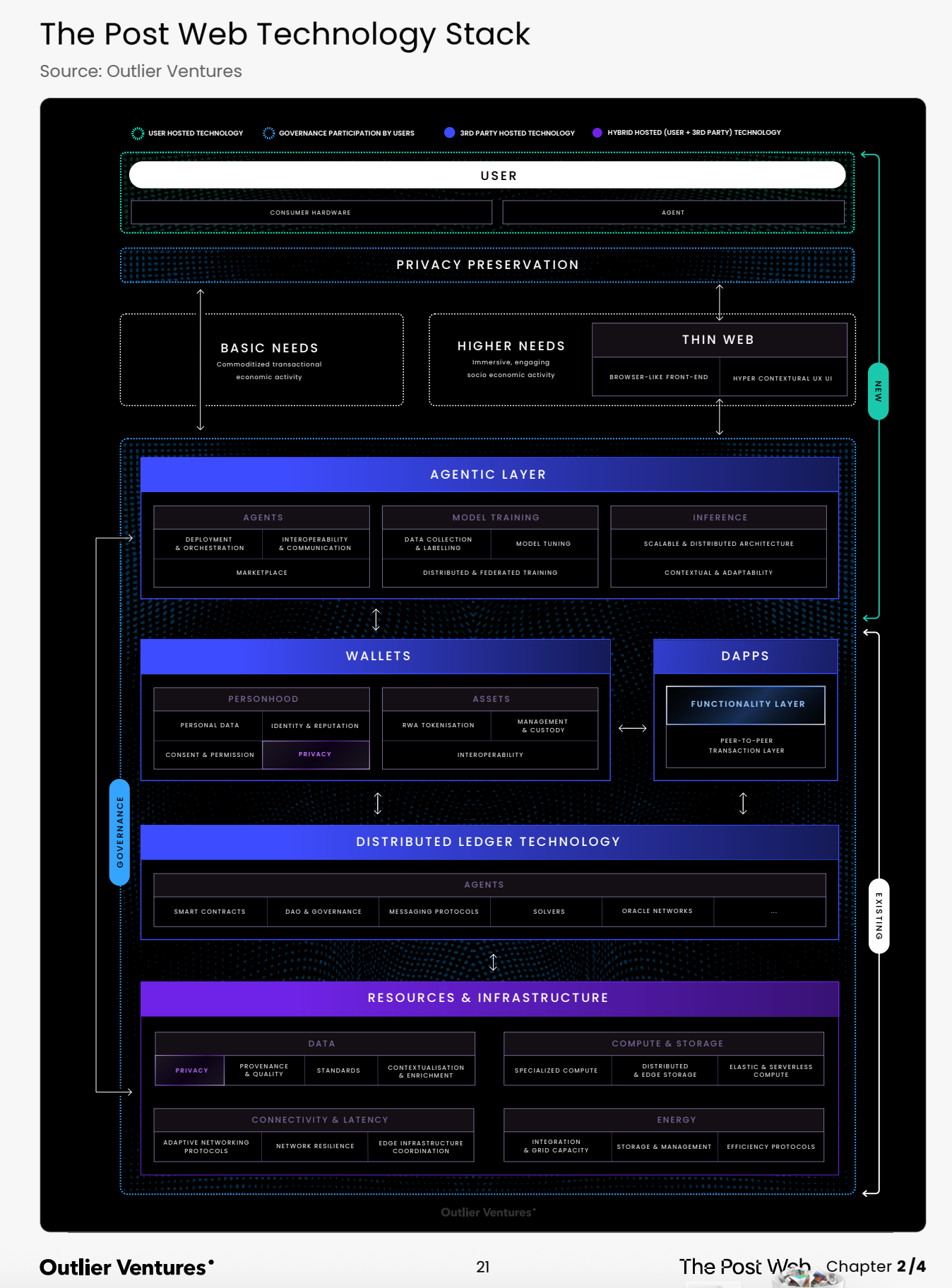

And it's actually not so clear where moats exist because again, remember we are truly talking about a new paradigm. Now the post web is very, very different from previous web cycles. And it's actually changing. It's probably the biggest single upgrade to the consumer internet that's ever happened in terms of kind of a functionality gain. Big problem, big challenge. The way there's a couple of ways that I think founders can navigate this stuff. What I will do is I'll caveat this and say this is live thinking. So, you know, we've been developing the post web thesis since July. So before all the agent hype kicked off, we released the first chapter, I don't know, September. We've kind of been releasing them sequential as we write them. We just released chapter two, which was the post web stack. It's 100 pages, very detailed, one our audio book alongside it for people to kind of help process that. One of the big realizations that I've had, and this comes from the benefit of working with really brilliant people in the world of token design and token engineering, a discipline that really hasn't seen.

It's time yet. We wrote one of the first papers on token design. I think it was the four days of token design and building token economies back in 2018/19, and we've actively sponsored the token engineering world for some time to kind of develop that, develop that discipline. A lot of our thinking has been published as open source. That whole world of looking at incentive design, of thinking of these things as systems, looking at value flow across systems, looking at ecosystem fit, looking at how you can incentivize this kind of distributed coordination of value flow. A lot of that's been very theoretical to date. And that's because, again, people can't handle the complexity of those designs. And people are illogical. They're actually not very good at following incentives in a way that agents are. And so I believe that increasingly, the way to think about building in the post web is you're not building a classic startup, classic, classic startup theory of really product kind of people and process actually become vulnerabilities. They bring fragility into what you're trying to do in a world where the web interface.

The software will probably be built by agents and delivered and executed on the fly in a hyper contextual way. Products do not emote anymore. Also. Agents don't care about brands; they just care about incentives. So, product is not so much of a, I won't say not a moat, but not so much of a moat as it used to be. Process. Most processes are going to be workflows by agents. So again, like you know, having really great people and really well-developed processes become less of a moat again. So, people product process less important. Increasingly so and so. Well, what's left if there's no people products and process or these things are kind of give you limited competitive advantage. I believe it's this shift from kind of start up thinking to systems thinking. You have to be thinking you're designing a system, and there'll be those that will coordinate, there'll be things that will coordinate systems and there'll be things that contribute to systems. And so, you need to kind of figure out which camp are you in, are you building things to coordinate systems and incentivize their coordination and to increase the velocity of value flow in these systems, or are you contributing something of value into that system that makes it function, something that can be commoditized? And you might be doing multiple things, by the way.

So, you might be seeding this system, this ecosystem with multiple elements that may or may not happen to bundle into what you might think of as a product or a platform. But that kind of heart of it is systems design. And that's really complicated. It's really hard. You need some clever mathematicians. You need people well-versed in intention, theory and incentive design and I believe token engineering. And that's where the juices. Because if you can contribute, if you can effectively coordinate and contribute to a system that will be self-optimizing, that will be itself ruthlessly removing any inefficiencies and middlemen, then maybe you can build something of value, but even then, you can't relax because an authentic internet is all about removing inefficiency on behalf of whoever's expressing that intent and solving that problem. Agents will bias together for various reasons. Again, intention theories been theorizing about this for a decade plus. Really, you need to be getting very familiar with the whole world of token engineering, incentive design and systems thinking, mapping that ecosystem, understanding value flow and then figuring out how are you going to to contribute elements to its effective governance and operations.

Lex Sokolin:

Thanks, Jamie, so much for joining me today. If our listeners want to learn more about you or about outlier, where should they go?

Jamie Burke:

Hopefully this has inspired a few people to kind of go down the post rabbit hole, so I'd recommend go to post-web thesis site. We're publishing all the information there. It's freely available. There's very, very technical papers, very comprehensive, or there's more accessible audio books which kind of summarize this stuff. And you can kind of listen to that on the go. And I just recommend letting this percolate a bit. I'm not saying I've got the answers by any means. In fact, the more I think I'm closer to understanding it, the more I realize it's fucking complicated. And there's several more things I need to think through, but we're at least asking the right questions there for founders or investors who are looking to develop a thesis that is going to hold. So, I'd start there in parallel to that. We are always accelerating and accepting teams into concurrent programs. You can find the programs that we're running.

Outlierventures.io, And what I would kind of just say, finally, if you allow me, Lex, is that perhaps slightly self-serving answer to your question about how to founders figure out where to put their time and attention is one of the benefits of applying to our accelerator is, as I said, we've got 400 startups working in the space. We've been doing it for a decade. We speak to thousands every year in the process of due diligence when teams apply to the accelerator. We will we use mental models and frameworks to ourselves, interrogate their business model, its viability, its sustainability. And so just the process of applying. Means you get to stress test your thinking with us. And we have 100, you know, close to 100 full time people. Every ESI will bring in a token design person. It will bring a technical analyst; it will bring in a governance analyst. And so, you get to have a chat with these people. They'll kick the tires on your business, they'll challenge your thinking.

And even if you don't get accepted, you can walk away with hopefully a new mental model to build in. And actually, I think for you and I as investors, we're quite lucky because we get to spread bet, you know, we're betting on I want to do a thousand investments in this space in the next couple of years in total, and so I can afford for some of those to fail, even the majority. But a founder is using the most valuable thing of all the commodity of time. You can't get that back. You can't get it back from family and friends. You know, it's a really precarious moment to be building in this space, and it's going to be very easy to waste time and money. And so I would just say it's highly valuable whether it's urs or somebody else, if you can just have your thinking interrogated, you might just save yourself a few years.

Lex Sokolin:

Thanks again Jamie.

Jamie Burke:

Thanks Lex.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Share this post