AI: The secret AI supercomputers powering XTX Markets and DeepSeek’s trading empires

XTX Markets has built one of the largest privately held GPU clusters in algorithmic trading, comprising over 25,000 GPUs—including 10,000 Nvidia A100s and 10,000 V100s

Hi Fintech Futurists —

Today we highlight the following:

AI: Why XTX Markets and DeepSeek are building massive in-house GPU clusters

LONG TAKE: THORChain’s ride from $90B in Swaps to $200MM in bad debt

PODCAST: How Sei is Breaking Ethereum's Limits with Co-Founder Jayendra Jog

CURATED UPDATES: Machine Models, AI Applications in Finance, Infrastructure & Middleware

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options here.

AI: Why XTX Markets and DeepSeek are building massive in-house GPU clusters

XTX Markets has built one of the largest privately held GPU clusters in algorithmic trading, comprising over 25,000 GPUs—including 10,000 Nvidia A100s and 10,000 V100s—paired with 650 petabytes of high-speed storage. This infrastructure supports daily processing of $250B in trading volume across equities, FX, fixed income, and commodities, and underpins the firm’s market leadership in FX liquidity and pan-European lit cash equities.

XTX Markets’ machine and deep learning models process over a trillion data points daily, including order book, tick, and sentiment signals data. Costas Bekas of Citadel Securities has detailed that a robust quant research platform should aim to (1) maximize productivity by reducing the time it takes for a quantitative researcher to run a test or experiment, and (2) optimize price-performance ratio by increasing the number of simulations run per dollar spent on compute and storage. Such requirements require a system architecture capable of running high-frequency simulations in parallel.

XTX Markets isn’t just pushing the limits of machine learning in trading—it’s proving that scale and efficiency translate directly into profits. In 2023, the firm posted £2.0 billion in revenue and £835 million in net profit, staggering figures for a 200-person operation running one of the most advanced AI-driven trading systems in the world. This is what happens when infrastructure isn’t just a support function but a strategic advantage.

Many trading firms, including Citadel and Two Sigma, use a hybrid approach: they maintain on-premise clusters for latency-critical trade execution and offload compute-intensive model training to cloud providers. However, cloud environments introduce variability in GPU availability; these limitations can extend training cycles or force simplifications in model architectures.

"We've all been challenged by this industry-wide capacity shortage. And this is true across many models, but it's especially acute with the latest ones like Nvidia's A100s and H100s," said Alex Hays, a Two Sigma engineer, while speaking at Google Cloud's big annual conference in Las Vegas this April. A chart showing Two Sigma's success rate of obtaining A100 chips was at most 20%. Source here.

Moreover, in 2014, the compute power needed for its workflows was 10 times greater than what its data centers could provide. After migrating to the public cloud, it boosted the firm's obtainability rate of A100 chips to about 80%. XTX Markets avoids these uncertainties by operating a fully in-house GPU cluster that supports continuous, deterministic scheduling of both model training and real-time data processing.

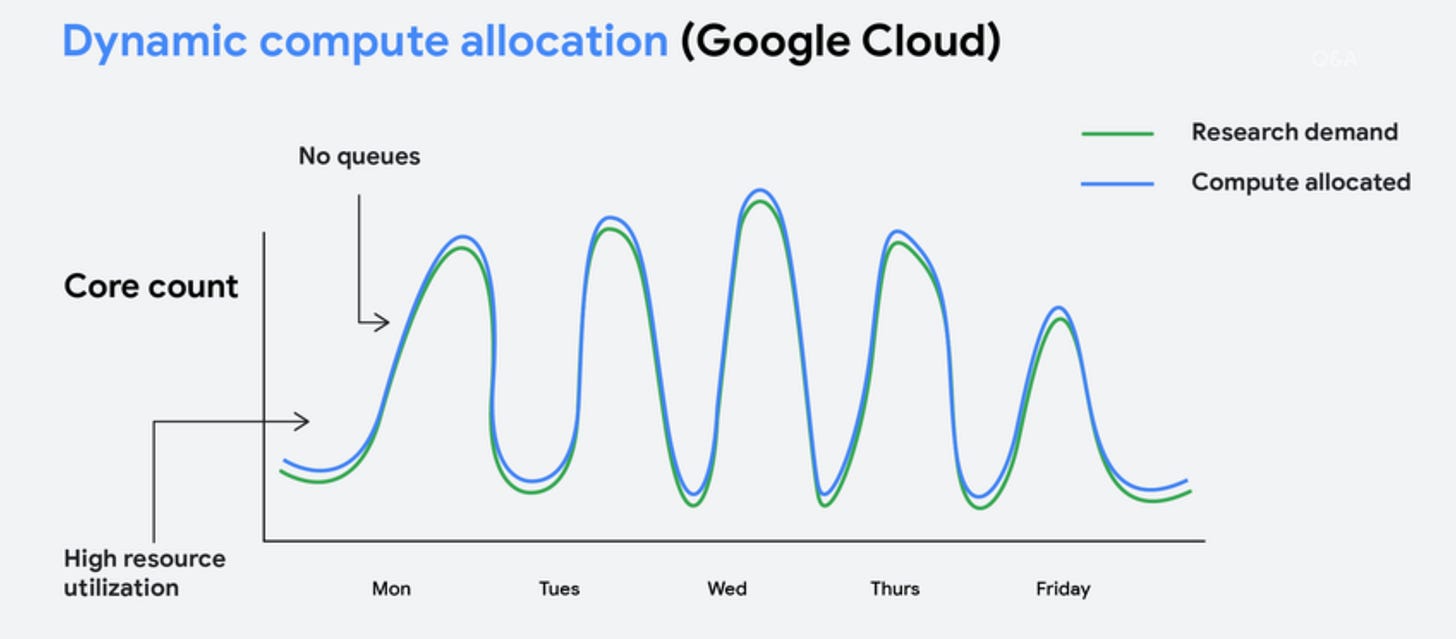

This approach delivers two primary technical advantages. First, it eliminates the queuing delays associated with cloud-based GPU provisioning, ensuring that compute resources are always available when needed for real-time processing. Second, it provides the computational predictability required for rigorous model back-testing and hyperparameter optimization. The ability to run continuous, high-volume simulations directly translates into faster iteration cycles and more precise risk management.

This level of computational control gives XTX Markets a decisive edge in the broader financial industry, where speed, precision, and reliability define success. In an environment where microseconds dictate profitability, the firm's ability to execute complex quantitative models without cloud-related bottlenecks allows for superior liquidity provision and tighter bid-ask spreads.

A similar infrastructure strategy is pursued by DeepSeek, which is the operational arm of High-Flyer Quant—a quant firm in China. The firm maintains an extensive GPU inventory, including 10,000 Nvidia A100 GPUs, to support end-to-end model training, hyperparameter optimization, and real-time risk management. Over the past three years, High-Flyer Quant has invested over 100MM yuan in high-performance computing (HPC) hardware to build one of China’s most advanced private clusters. See below for a great interview transcript on High-Flyer Quant.

Citadel’s strategy, on the other hand, isn’t about owning the most hardware—it’s about maximizing output per research dollar spent. Instead of committing to massive in-house GPU clusters, the firm optimizes "costs-per-research-hour" through a hybrid cloud approach, dynamically shifting workloads between on-demand and preemptible cloud instances for large-scale simulations while keeping co-located hardware for latency-sensitive tasks.

This ensures scalability without sunk costs, allowing Citadel to instantly ramp up compute power when needed and avoid the constraints of fixed infrastructure. Every workload is matched to its ideal environment, minimizing idle resources and accelerating research cycles. The result? Lower costs, faster model iteration, and greater adaptability—directly translating into higher trading profits and sustained market dominance.

The decision by XTX Markets and DeepSeek to build in-house GPU clusters is driven by the need to eliminate uncertainty in continuous model development. By avoiding external bottlenecks, they can run complex simulations on multi-terabyte datasets without delay, though at a significantly higher research cost per hour. As trading models grow more parameter-rich and data volumes escalate, this investment in proprietary compute capacity may directly enhance alpha generation, accelerate market adaptation, and sustain a long-term competitive edge in algorithmic trading. Meanwhile, Citadel’s hybrid approach remains effective, as evidenced by its 15.1% gain in 2024, balancing flexibility with efficiency. This divergence in infrastructure strategy reflects a broader transformation in financial markets, where computational power is as critical as capital.

Firms with dedicated high-performance computing may gain a lasting advantage, while those relying on cloud solutions must navigate resource variability and rising costs. Ultimately, the future of financial markets will be shaped by how well firms integrate AI with scalable, cost-efficient infrastructure to maintain their edge.

👑Related Coverage👑

Blueprint Deep Dive

Analysis: THORChain’s ride from $90B in Swaps to $200MM in bad debt (link here)

THORChain, a decentralized cross-chain liquidity protocol, saw its market cap crash from $3.5B to $500M due to risky financial engineering in its lending and savings programs.

The introduction of THORFi's lending mechanism, which burned RUNE upon loan issuance and minted new RUNE upon repayment, created a price-dependent debt spiral that became unsustainable as liabilities grew to $200M. How did the project recover from this poor financial engineering? We discuss the collapse as a cautionary tale about using volatile native tokens as collateral, reinforcing the importance of sustainable financial design in DeFi.

🎙️ Podcast Conversation: How Sei is Breaking Ethereum's Limits with Co-Founder Jayendra Jog (link here)

In this episode, Lex interviews Jayendra Jog - co-founder of Sei Labs, about his professional journey and the innovative Sei protocol—a high-performance parallel blockchain.

Jay shares insights from his time at Robinhood, emphasizing the importance of distribution over technology and the challenges of scaling a fintech company. He discusses the limitations of Ethereum's transaction processing and how Sei Labs aims to address these through parallelization. The conversation also covers the future of blockchain in finance, the need for regulatory clarity, and the potential of high-performance blockchains to support emerging industries like AI and decentralized science.

Curated Updates

Here are the rest of the updates hitting our radar.

Machine Models

⭐ No Equations Needed: Learning System Dynamics Without Relying on Closed-Form ODEs - University of Cambridge

⭐ ♠ SPADE ♠ Split Peak Attention DEcomposition - Amazon

⭐ Adaptive sequential Monte Carlo for automated cross validation in structural Bayesian hierarchical models - Columbia University

FlashRNN: Optimizing Traditional RNNs on Modern Hardware - Korbinian Pöppel & Maximilian Beck & Sepp Hochreiter

Tensor Product Attention Is All You Need - IIIS, Tsinghua University, Shanghai Qi Zhi Institute, UCLA, TapTap

AI Applications in Finance

⭐ Artificial Intelligence Asset Pricing Models - Bryan T. Kelly, Boris Kuznetsov, Semyon Malamud & Teng Andrea Xu

Convolution-T Distributions - Peter Reinhard Hansen, Chen Tong

Large Language Models: An Applied Econometric Framework - Jens Ludwig, Sendhil Mullainathan, Ashesh Rambachan

Machine Learning for Pairs Trading: a Clustering-based Approach - Bocconi University

Exploratory Mean-Variance Portfolio Optimization with Regime-Switching Market Dynamics - Yuling Max Chen, Bin Li, David Saunders

Hybrid Quantum Neural Networks with Amplitude Encoding: Advancing Recovery Rate Predictions - Ying Chen, Paul Griffin, Paolo Recchia, Lei Zhou, Hongrui Zhang

Infrastructure & Middleware

Brookfield to invest €20B in France’s AI infrastructure - Digital Infra Network

Amazon to spend $100B on AWS AI infrastructure - TechTarget

Iliad Group commits €3B in European AI infrastructure push - Capacity

Alphabet plans to invest $75B in AI - Verdict

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our new AI products newsletter, Future Blueprint. (Don’t tell anyone)

Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription. In addition to receiving our free newsletters, you will get access to all Long Takes with a deep, comprehensive analysis of Fintech, Web3, and AI topics, and our archive of in-depth write-ups covering the hottest fintech and DeFi companies.