Hi Fintech Architects,

In this episode, Lex interviews Jayendra Jog - co-founder of Sei Labs, about his professional journey and the innovative Sei protocol—a high-performance parallel blockchain. Jay shares insights from his time at Robinhood, emphasizing the importance of distribution over technology and the challenges of scaling a fintech company. He discusses the limitations of Ethereum's transaction processing and how Sei Labs aims to address these through parallelization. The conversation also covers the future of blockchain in finance, the need for regulatory clarity, and the potential of high-performance blockchains to support emerging industries like AI and decentralized science.

Notable discussion points:

Impact Over Paychecks – Jog’s career leap from SAP to Facebook, Pinterest, Robinhood, and Sei Labs was driven by impact, not salary. He thrived in small, high-talent teams where he could truly move the needle.

Robinhood’s Growing Pains – Early Robinhood was fast and scrappy, but as it scaled, bureaucracy slowed innovation. The shift from “missionary” to “mercenary” employees hurt culture and velocity.

Tech Doesn’t Win—Distribution Does – The best crypto projects don’t just have great tech; they win by getting users. Sei Labs focuses on real-world adoption, not just engineering breakthroughs.

Sei’s Parallelized EVM: A Game Changer – Ethereum is slow. Sei Labs fixes this by parallelizing transactions, enabling high-speed trading and complex on-chain applications. It’s Ethereum’s power with Solana’s speed.

For those that want to subscribe to the podcast in your app of choice, you can now find us at Apple, Spotify, or on RSS.

Background

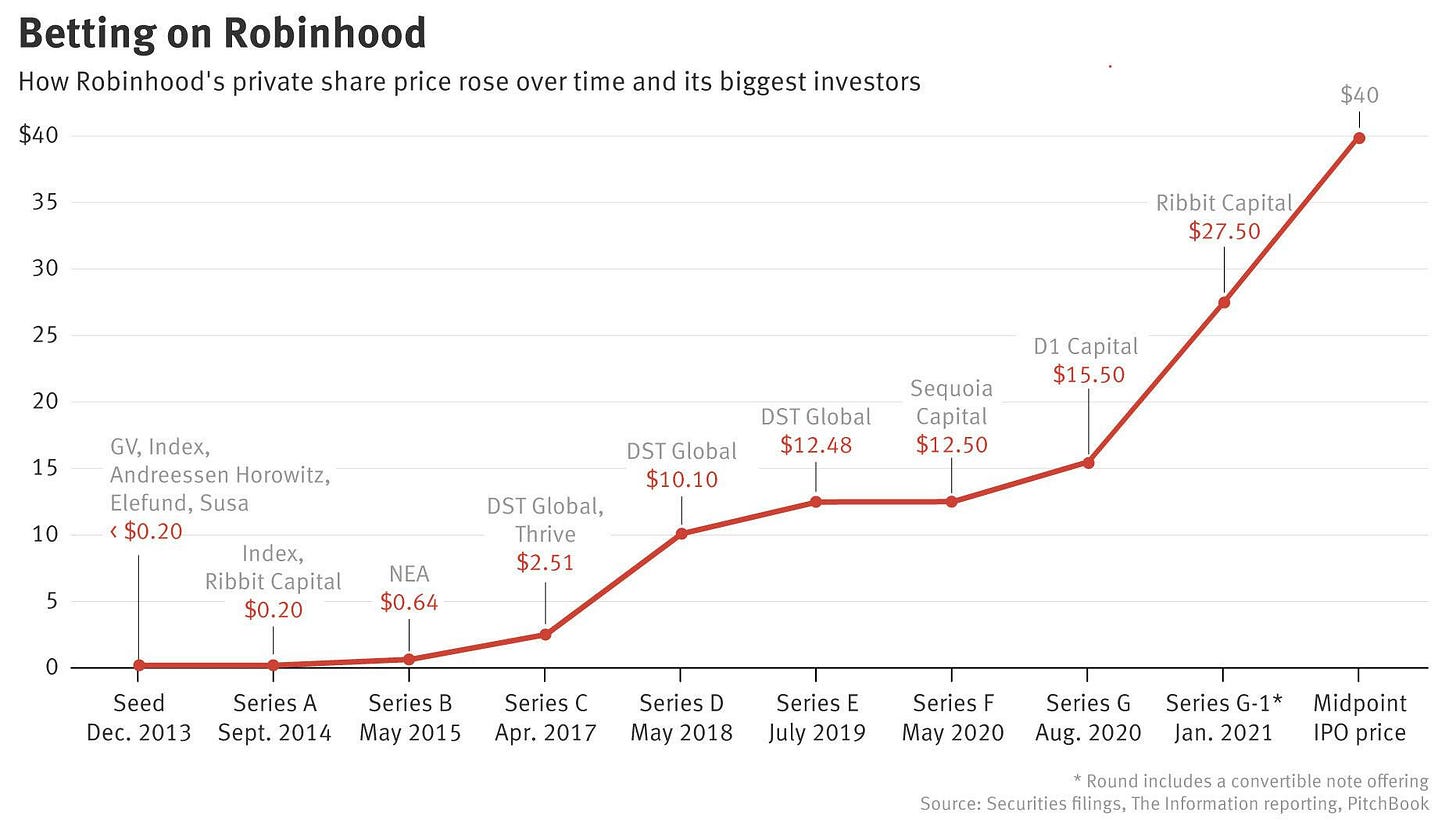

Jayendra "Jay" Jog is the co-founder of Sei Labs, the team behind the Sei Network, a layer-one blockchain designed to enhance decentralized exchanges. Before founding Sei, he worked as a software engineer at Robinhood, where his experiences influenced his decision to build a decentralized trading platform.

He earned his B.S. in computer science from the University of California, Los Angeles, in 2018. During his time at UCLA, he was selected for the 2017 KPCB Engineering Fellows program, distinguishing himself among nearly 2,000 applicants nationwide.

His professional journey includes internships at Pinterest, Facebook, and SAP, providing him with a diverse range of experiences in the tech industry.

In 2021, he co-founded Sei Labs, aiming to create a decentralized infrastructure for exchanges, reflecting his commitment to decentralization and the future of financial systems.

👑Related coverage👑

Topics: fintech, blockchain, Sei Labs, Sei protocol, Ethereum Virtual Machine, EVM, Robinhood, decentralized applications, DeFi protocols, DePIN

Timestamps

1’29: From Silicon Valley Roots to Startup Hustle: Jayendra Jog’s Journey Through Tech’s Elite Ranks

7’53: Scaling Robinhood: From Scrappy Startup to Corporate Bureaucracy

12’56: Why Robinhood Won: Distribution Over Technology in Fintech and Crypto

17’38: Sei and the Parallelized EVM: Scaling Blockchain for High-Performance Trading

25’18: Parallelization in Blockchain: Unlocking Scalability Without Breaking the System

28’03: Building Sei: Solving the Blockchain Adoption Puzzle for Finance and Developers

33’50: The Blockchain Race: Competing for Killer Apps and Market Dominance

38’02: The Next Wave: Sei’s Vision for AI, DePIN, and High-Performance Blockchain Applications

41’34: The channels used to connect with Jay & learn more about Sei

Illustrated Transcript

Lex Sokolin:

Hi, everybody, and welcome to today's conversation. I'm absolutely thrilled to have with us today, Jay Jog, who is the co-founder of Sei labs. Sei labs is behind the Sei protocol, which is one of the fastest parallel blockchains in the market, if not the fastest one, and is being deployed with a large ecosystem and a set of really interesting financial institutions. So, I'm excited to learn more about Sei, as well as to learn from Jay about his professional experience with that. Jay, welcome to the conversation.

Jayendra Jog:

Good morning. Good morning. Thanks for having me on, Lex.

Lex Sokolin:

Absolutely. So, your career kind of went pretty much straight into tech and entrepreneurship.

Lex Sokolin:

Can you tell us about, you know, just the first baby steps that you took towards tech and what were those experiences like?

Jayendra Jog:

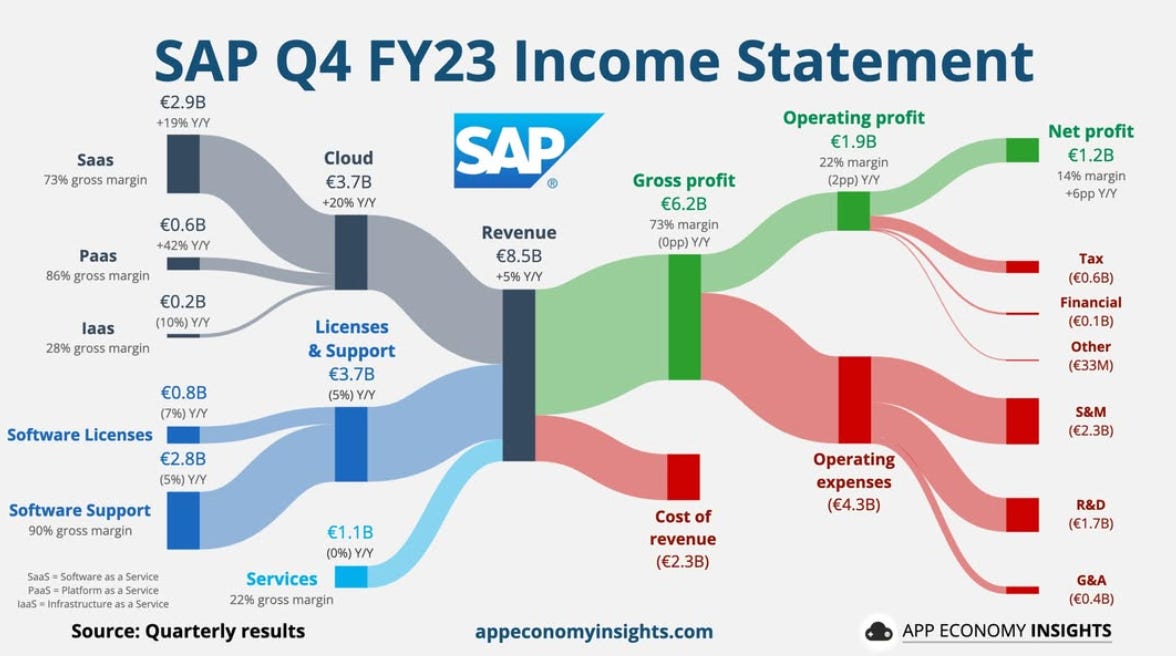

I mean, I grew up in the San Francisco Bay area, and as you can imagine, like you're surrounded by tech companies all the time. Like, all of your friends are working at tech companies, or your friend's parents are working at tech companies. Everything around you is kind of tied to tech. So, I wanted to be kind of doing something in tech from I mean, by the time I was in elementary school, honestly, I started learning how to code in high school. So, I took like the San Jose State University online kind of intro to CSS class. And I realized that, wait, it's actually it's actually a ton of fun. So, then I ended up going to college to study computer science. And I mean, while I was at college, I explored working at a lot of different types of companies. I worked at a bigger company. I worked at SAP, which is like a massive company.

And I realized, wait a minute, this is it doesn't feel that satisfying to just be working on something that chemically wasn't even that important for the company's success. Then afterwards, I moved like a magnitude smaller. I worked at Facebook and I'm like, okay, this is better, but it's not. It's still not that level where I'm kind of making the impact that I want to make.

Lex Sokolin:

Yeah. Facebook is known to be a tiny company.

Jayendra Jog:

Haha. Yeah. I mean, when I was there, there were some people that had been there back when it was tiny, but by the time I joined in 2016, I mean, this was post IPO. This is already like when it was quite, quite large. So, I'm like, okay, let's go a step smaller. And that's when I actually was a Kleiner Perkins fellow. I don't know how well known that fellowship is anymore, but back then it was I mean honestly like extremely difficult to get into. and it allowed you to work for one of the portfolio companies, which in my case was Pinterest and Pinterest.

This was like a pre-IPO company, not too big at the time, and the work that I was doing was just very, very impactful, impactful in the sense that it actually moved the business metrics. If I wasn't there, then it would be there'd be someone else that was working on it, whereas it the other places I'd been at if I wasn't there, like it was just an intern project. No one really gave a shit whether it got worked on or not. So, I'm like, okay, this type of environment is a much better fit for me. And I realized that in terms of looking for career opportunities, there were a couple of things that really mattered to me personally. The first is surrounding myself with people that I consider better than me, and I think that's really the only good way to grow. Like, I've talked to more new grads recently and they're just trying to optimize for like getting the highest possible salary. And I think that that's a recipe for disaster. Like, yes, you will in the short term make more money from that.

But I think in the long term you really stifle your learning. And as a result of that, you stifle both your career growth and then also your financial trajectory. So even if you're getting paid less money, I think it makes sense to join the company that's going to help you be surrounded by more talented people. And then the second thing that I realized about myself is I just want to go as small as possible in terms of company size, because the smaller it is, the more growth opportunities you have. And I mean, from a financial standpoint as well, like that's the more risk you're taking on. Therefore, the more upside in theory that you should have. So, 2017, there was this event called the Greylock Tech Fair happening in San Francisco. I don't know if they still have that, but it was basically this invite only career fair. So they only pick like 2 or 300 students to show up. And they had like all their portfolio companies there. There's only one company with the line at that time.

They had like maybe 100 companies there. They'd like rent it out. Back then I think it was called. Yeah, AT&T Stadium. And there was just one company with a line. And that company back then was Robinhood. So, I didn't really know much about it, but it was kind of like this cinematic effect where all these talented people were interested in working at this company and I'm like, okay, I have to learn more about this. So back then, Robinhood was basically just two houses across the street from one another back in 2017. And then one of the houses, they basically took the bedrooms, and they put up standing desks over there. That's where like the engineering teams were working from, like it was a really scrappy operation. Back in back in 2017. So, I'm like, okay. I mean, this seems like an environment where I can learn a lot. And I mean, at that time, my competing opportunities were like working at Pinterest again or staying in school for 50 years to get a master's.

And I'm I was like, I'm just going to go ahead kind of full send it, see what happens. And I think in hindsight, that was absolutely the best decision out of those three for me. I don't think I really would have grown much at Pinterest. I don't think I really needed to get a master's in CSS after already getting a bachelors in CSS, and I think the kind of people that I was surrounded with at Robinhood were I mean, they were just insanely good. And it's looking back at it now, I think out of my new grad class, around a third of the people in that class. So, it's something like nine out of like 25 or something. They've started venture back companies like from Silicon Valley, VC firms. And I think that kind of talent density is really, really difficult to find at most places. So, in hindsight, I think that was absolutely the right decision.

Lex Sokolin:

How many people were at Robinhood when you're joined?

Jayendra Jog:

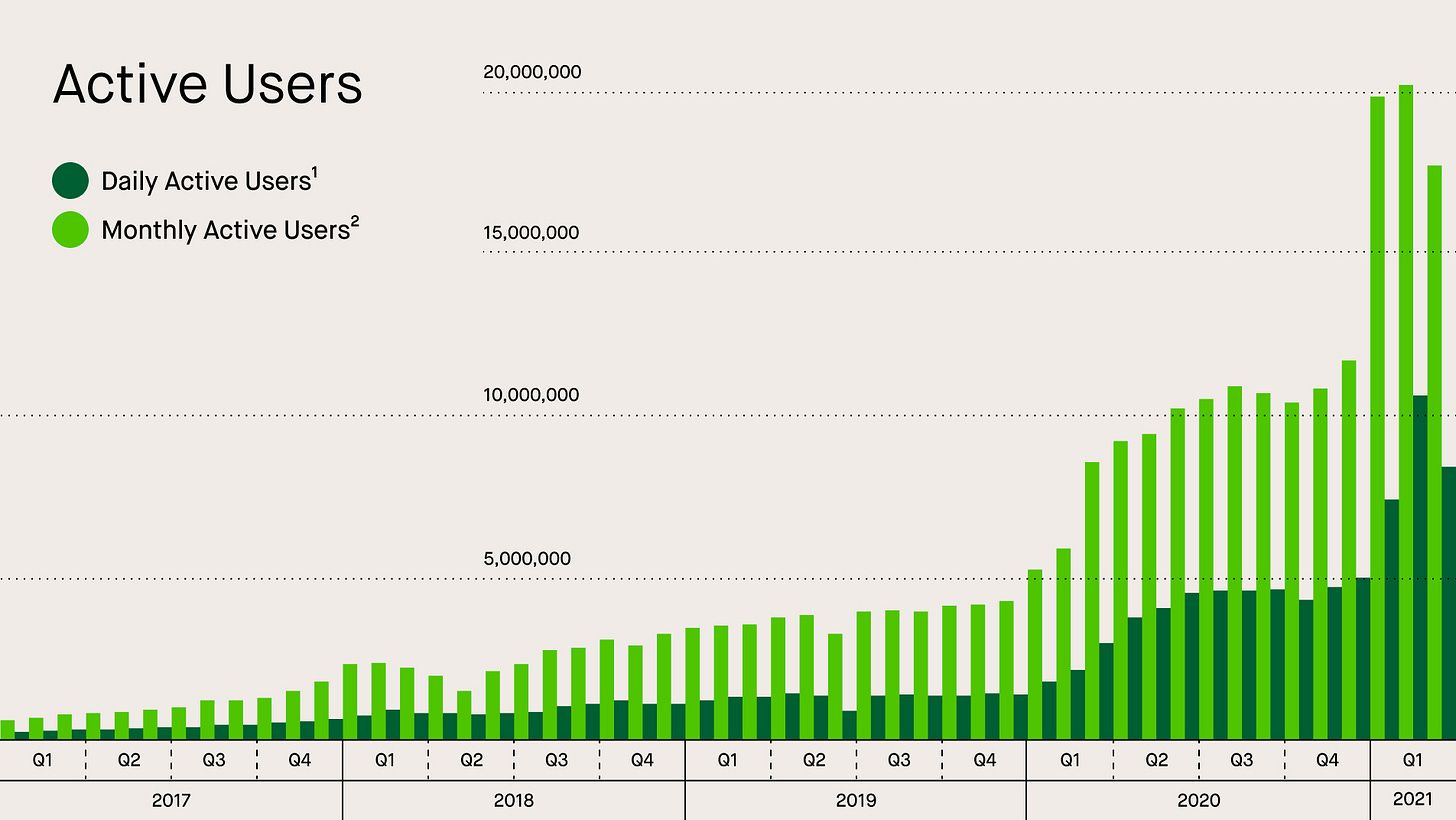

So when I interviewed, it was around 80 to 90 people. By the time I joined, it was around 200 to 250. So, it was not like a tiny, tiny startup, but it was still small enough where, like every single project I worked on, like moved the business metrics a shitload. And it was also small enough where I got to see 10X, whereby the time I left, like I stayed there for three and a half years. I was able I mean, I was not only like one of the most tenured people at the org, but also there had just been so much growth happening around me that I was able to play a very meaningful role in terms of onboarding people in terms of like helping scale the team and getting more involved in the management side as well.

Lex Sokolin:

Can you tell me about that scaling at Robinhood as a fintech company Robinhood is obviously a huge success. It played extremely well into the change in social culture towards much more sort of self-directed trading and risk taking. It's really transformed sort of the role of market makers in the equities markets.

It was one of the first brokers to add crypto trading, and it was a successful IPO and a great example of a fintech company that stuck to its roots. And the things that believed in whether or not you agree with sort of the importance of trading is separate, but like it did what it was meant to do. Can you walk us through, like what that scale up felt like, and in particular like I'm really interested in. Were there organizational design issues that kind of fell apart or that had to be rebuilt? Was there like a different approach to running teams as it became bigger? Were there like things you had to change to keep the culture fast and high performance? Like, can you talk about that experience?

Jayendra Jog:

Yeah. So, I'll caveat this by saying that I was a new grad engineer who then transformed into an engineering lead. So, I have much more of that perspective as an engineer, not the perspective that Vlad would have in terms of looking at everything from the top. But from my perspective, when I joined, everything had been built largely for the sake of getting to a working MVP.

So, I mean, when they got started building Robinhood, I don't think they were expecting it to be as successful as it had become even by that time. And I think that's absolutely the right mindset to have where you start off building things in a very scrappy way. You build MVP's, you don't really care as much about things like code quality or things like making it super like robust, extensible for the future. And I mean, honestly, if you care about that stuff super early on as a startup, you're burning time. It obviously takes more time to build things. And like the cleanest possible way. You're burning time that you could be using to get distribution and to get user feedback. So, I don't fault them at all for that, but it was kind of just some in many ways, the mess internally and my time over there was spent. I mean, first of all, on building new products with kind of that similar mindset where it's like, we're scrappy, very pre-IPO. We need to like just get this stuff out there.

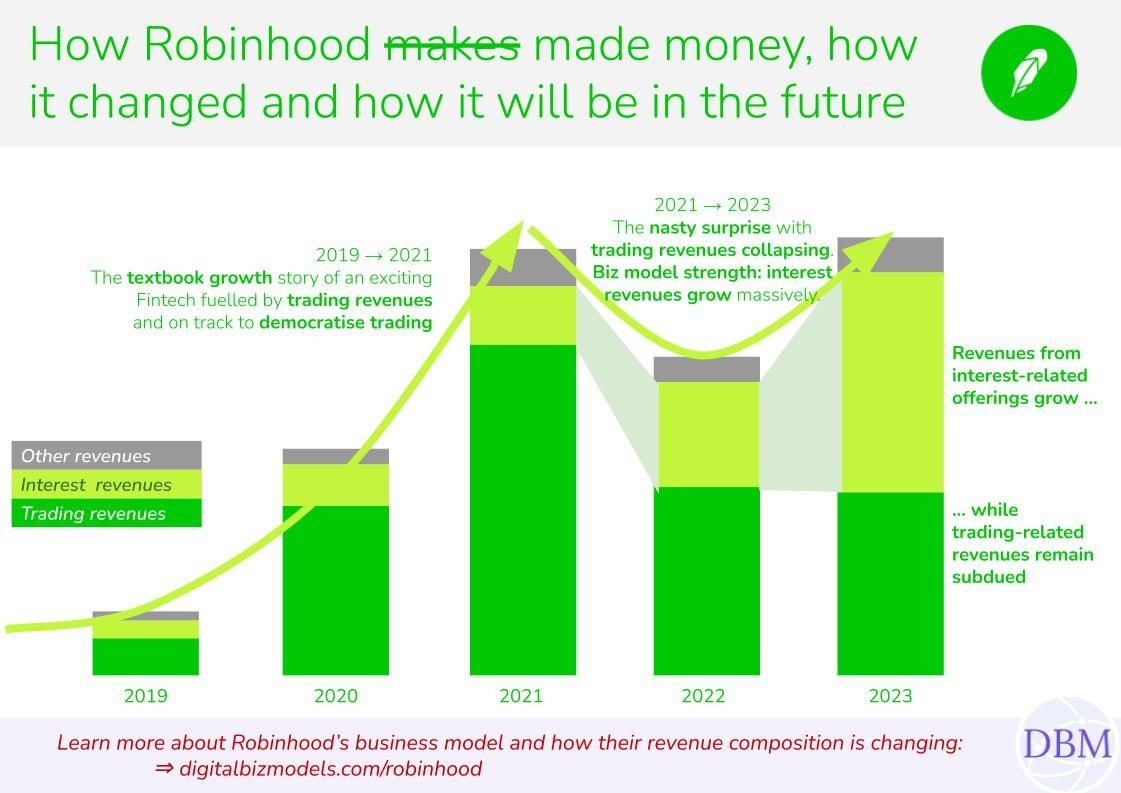

And then I started noticing a transition. This transition happened around 2019, timeframe 2019, 2020, when we just started having a bunch of incidents in production. Like it was just like pure technology incidents that were tied to things not being built in the best way. And these were like very meaningful issues for the business. I won't go into the types of sets that we saw, but I'll just say that there were some of them could have been very existential, and we in many ways got luckier on that. And I think that after going through that leadership was like, okay, we need to build things in a maintainable way moving forward. So, there became much more of a push to get things ready to be kind of the long-term type of things that are built in a clean way that will be able to ideally handle the kind of scale that we're seeing. And I think at this point, it seems like those initiatives have been largely successful. But I think back then when I was there, even when I was, even when I left, by the time in 2021, it still felt like there was a lot of work to be done over there.

The second part that I'll mention is around people. When I joined, it felt like everyone was largely a missionary. The offers that most people got to join Robinhood were less than the offers they had from other places that they'd be interviewing at. So even in my case, I turned down like a pretty large signing bonus from Pinterest to join Robinhood. And I was making a very conscious financial decision to accept less money for just being surrounded by a ton of talented people. I think when you get people like that to join an organization where they're basically not just accepting the highest salary that they're getting, they're picking a company for some broader reason. I think they tend to be much more bought into what's happening, and they tend to be just working harder and like kind of giving more efficient. As the company started to to scale, and especially as we got to the 2020/2021 timeframe, I noticed that there was a shift towards, I mean, basically getting like people that are, in my view, kind of like traditional thing type of employees.

And what I mean by that is they're not necessarily in it for like that missionary mindset of like ownership or like having some kind of big impact. It's more just like trying to earn money to like just working 9 to 5 to focus on whatever else there is in life. And I think that really resulted in few things changing. Like, first of all, I think our product velocity changed quite a bit from that because people were just more checked out. And I think the second thing that I noticed was that when you bring in these like, career thing type of employees, they tend to be a lot more political. So, it becomes much more of a focus on kingdom building for like management. Like instead of just focusing on getting product shipped, they focus on their own career success. So, they focused on hiring as many people as possible under them so that they're able to justify getting promoted from like VP to senior VP or something. And it becomes more of this like internal political game. Instead of just focusing on the product and the mission.

So I feel like we scaled way too aggressively at that time. And I think that there were a lot of things just kind of slowed down because of that. I think at this point, it seems like from the outside looking into Robinhood, they've been able to improve a lot of that. And I mean, the company seems to be at a much better spot now than it was back when I left in 2021.

Lex Sokolin:

The growing pains of a company often actually where things completely fall apart. And it's quite rare for for founders and teams to be able to navigate that transition, you need to have a good economic engine to actually do that. If you're going through that growing pain, but you don't have a business model that works. You know, it's like the square of the problem is just it's so much worse. The last question about Robinhood for you is if you look back on some of the technical problems that you worked on, whether they were markets related or scalability related, or things that you saw. What were your takeaways about what made Robinhood special, or maybe more broadly, like what does a modern capital markets infrastructure look like?

Jayendra Jog:

Yeah. So the former question in terms of what made Robinhood kind of special? The key learning I had from that is that it's never the best technology that wins. It's always the best distribution that ends up winning. And I mean, for someone that's a VC like yourself, like that's a pretty obvious insight. Nothing to really write home about. But for someone that was an engineer, and you got engineer, that was kind of like, it was like that shattered my entire concept of how the world works, because I had this impression that like, oh yeah, technology, like programmers are like especially working in places like Facebook. It's like programmers are the people that are really running things and like technology, like whoever built the best technology is the one who's going to end up winning. And the kind of customer obsession that I saw at Robinhood was, I mean, everything was kind of guided by product decisions.

And I think that's absolutely the right way to be growing any kind of consumer business. And it's really interesting because in crypto, that's not how a lot of that's not how most companies work. Like most companies are completely tech driven. They're really honestly, if you talk to a lot of companies, they don't even have like a user feedback funnel, which to me is quite bizarre. And a lot of stuff that happens in crypto, it's like these smart guys fresh out of college, they're able to raise a pretty large seed round or eventually a pretty large series, and they just work on these technical problems for the sake of kind of being able to work on a product and launch a token. And this kind of user feedback cycle isn't really there. So, I think that was one of the most important things that I realized. And I think that's honestly why Robinhood won. Like they were really good at generating hype, like from the very beginning when they had that wait list on Hacker News all the way to, I mean, even now, I think that the kind of approaches that they're taking are kind of building delightful products for their users.

So, I think that's like one really important thing. The second thing around modern capital markets is that they're extremely, extremely antiquated. That was like one of my key takeaways from how everything works from the Robinhood side. And growing up, I feel like I had this view that, oh yeah, all these things are done in a really good way. Like, for example, I used to think like doctors to everything is kind of done in a perfect way. I used to think fintech, like, oh, everything happened with the stock market. It must be done in a really perfect way. But as you get older, you start like understanding a lot more of how this works. In the case of doctors, I'm seeing like my friends that went to med school become doctors and I'm like, wait a minute, these guys don't really know shit. A lot of the time. And I'm like, okay, well, I guess that the way that things work in the medical world is like very, very like people have very specific skill sets and they're kind of just not really able to get involved in a lot of other issues that might come up.

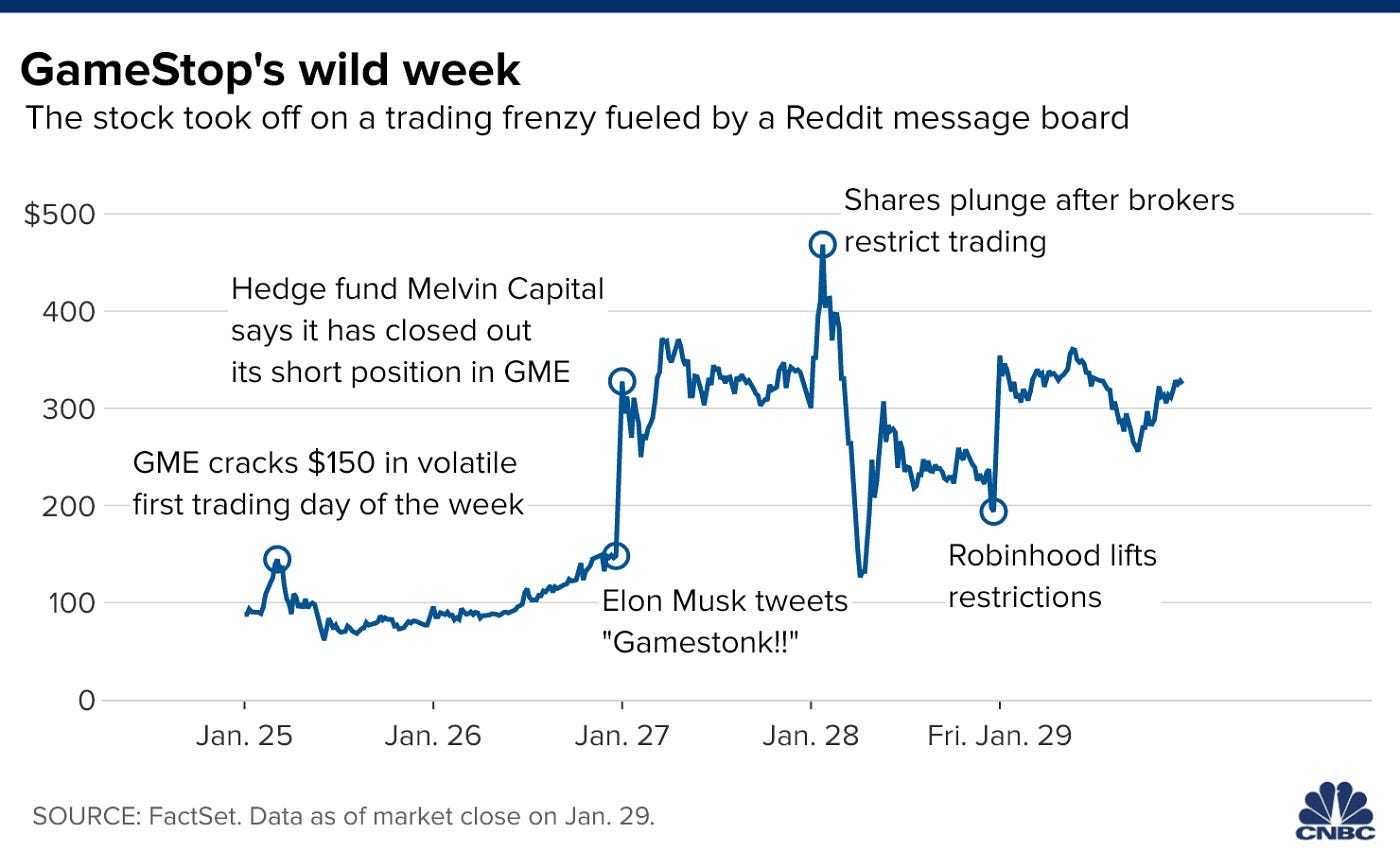

In the case of fintech, it's like, okay, it turns out that everything that happens behind the scenes is just a complete mess, where there's a lot of manual intervention that needs to happen. There's a lot of very fragile systems that are like the way these systems are built internally into being very fragile because there's they're not built with like, modern technical standards in mind. They're built with standards from like the 1980s, 1990s, which by the time like 2017, 2018 comes around. It's like these systems can be built in much better ways, and there's a lot of things that really don't need to be there. Like for example, T plus two settlement where you have to wait two days for rates to settle that really degrade how the user experience works. So, I think that I don't know if the American financial system will be able to transition into using a much more modern technical stack, but I do think that the way that it's built right now is definitely hurting just customers that are trying to trade. But we saw this happening with, like, the entire GameStop saga at Robinhood.

The GameStop saga was my impetus for starting a crypto company in the first place. And back then, I used to think that, like Robinhood was doing a very poor job of handling it. But in hindsight, after spending a lot more time waiting for the dust to settle, I think that a lot of it, like Robinhood, did a very poor job communicating with how the GameStop saga was happening. But in terms of the actual mechanics behind it where they owed collateral to the DTCC. And these collateral requirements were raised to $3 billion kind of overnight. So those are really poorly designed systems. And I think it ends up having like. It definitely makes it harder for brokerages that are operating. But I think it also ends up impacting users who are like no longer allowed to trade, for example. And if these systems were built on crypto rails, that would be just substantially better.

Lex Sokolin:

…too kind to call them systems. It's more of like a large clump of feelings that people might share at some particular point of time. We're in a world where it's not fair to me to say, but I think is in certain parts of the tech world, it is trivial to build this correctly at this point. So that brings us to say, tell us about what it is, how you got the idea and kind of what were the first steps you took to make it happen?

Jayendra Jog:

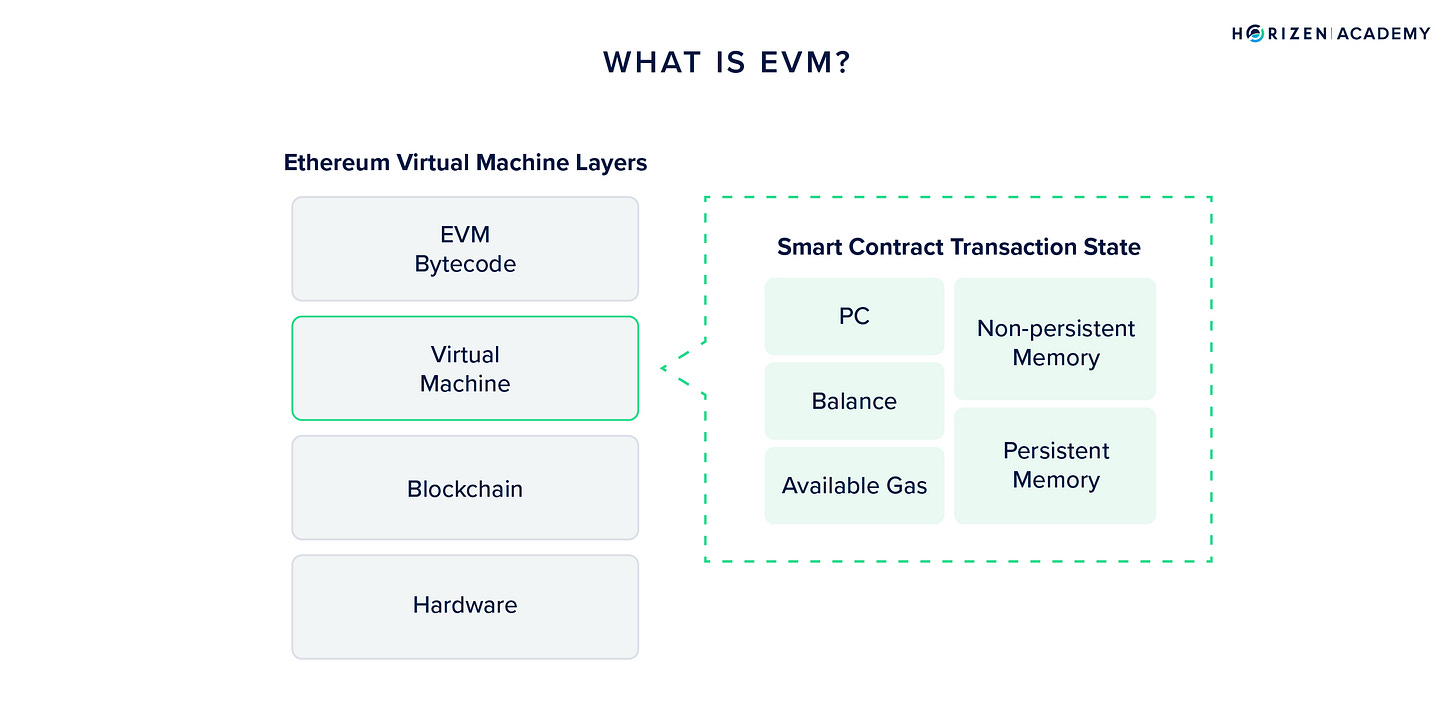

Yeah. So, say is the first paralyzed EVM.

Lex Sokolin:

Let's unpack what is an EVM and then what is parallelized.

Jayendra Jog:

So, an EVM stands for the Ethereum Virtual Machine. and the EVM is what the Ethereum Layer one initially introduced to the market. So, before Ethereum came to market the most. I mean, back then it was basically Bitcoin. Bitcoin was like the thing. There were a lot of other projects, but they were basically doing the same thing as Bitcoin where you'd be able to like send and receive money, but you weren't able to do anything else. So, with the Ethereum Virtual Machine introduced, it's this idea of a general-purpose Turing complete virtual machine to be able to write arbitrary programming logic on the blockchain.

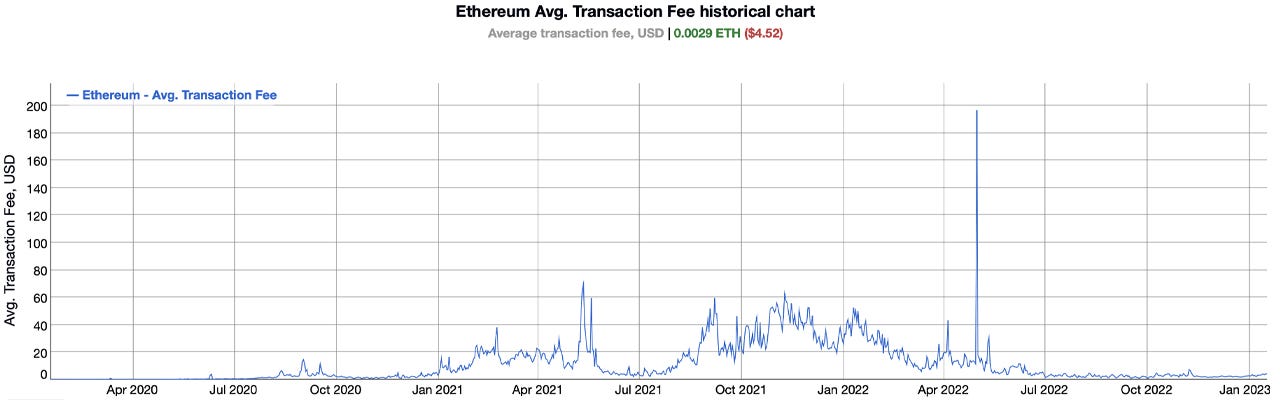

And I mean, honestly, when I first learned about this in 2017, I was like, this makes no sense to me. I don't really understand it. And I was a CSS major, so it took me some time to kind of understand what that means. But basically, you can just write whatever you want to on the blockchain. And that was the key unlock that Ethereum offered. The only thing is that Ethereum was not built with scalability in mind. Like when Vitalik and all these guys were building Ethereum, they like raised money and then afterwards they were like, oh shit, we're running out of money. We need to launch something. And they had a lot of these, like, grandiose ideas for how they'd be scaling Ethereum and making it more performant, but they never got around to doing that before the launch. And as a result of that, the launch happened and Ethereum was only really able to process like 50 transactions per second. 50 transactions per second is really, really low. And that's like the upper bound.

What you see in practice ends up being closer to 20 transactions per second. It works fine. If no one is using the chain, then you're able to write these complex smart contracts that are doing stuff when there's not much demand spikes. But as soon as there's any kind of demand spike, it's like a thousand people are trying to buy this NFT on Ethereum. How do they actually purchase something? Well, the way that their transaction is included is they need to raise gas fees a lot because that's how you're able to get your transaction prioritized. And that basically means spending more money. And the result of that is you end up seeing things like $100 transaction fees on Ethereum L1. And that's like actually pretty recent like that was happening. I mean, less than a year ago, like $100 to even be able to send her to, like, send his home. So that is kind of, I mean, crazy in my perspective. And that's why we explored making the EVM higher performance. And there's different ways that you can do that.

The clearest way to us was by parallelizing the EVM. So, the idea of parallelization means just doing multiple things at the same time in the context of the EVM. This basically means processing multiple transactions at the same time instead of processing them one after the other. Because initially the EVM was built in a sequential model where if you had 100 transactions coming in, they'd all be processed one after the other. The end result of that is that it takes a lot longer to process these transactions. You're not making use of modern hardware because like for example, this laptop, the laptop that I'm recording this podcast on, it has multiple courses in it and it's able to process multiple work streams at the same time. Like I'm able to have Spotify running at the same time that my Google Chrome is running. And what this means is, like you have multiple courses, you're able to process multiple work streams, and it's kind of just low hanging fruit to take the EVM and start parallelizing it by making use of the multiple cores that are already there on the hardware that these that this VM would be running on.

So because of that, like we started parallelizing the EVM. And yeah, I mean, I think that the other benefit you get from improving the throughput for the EVM is in a much bigger developer design space. So, if you look at the market right now, most developers in crypto, they're making use of the Ethereum virtual machine for writing their smart contracts. The only other contenders really would be Solana's two-level runtime. I mean, that's honestly the only real contender. There's a few kinds of long tail types of VMs right now. For example, there's move VM, which like sweet Aptos Movement Labs are using, but there's very little like even though these projects have raised a lot of money and they've been able to get like their token is doing very well. There's not really much adoption on move right now. I think it's like less than 5% of the overall market share. And then outside of that, it's like fuel and a lot of these other ones that in my perspective, it seems like no one is really using.

So basically, everyone is using the EVM right now, over like 75% of crypto developers. And similar to how JavaScript got started in the mid 1990s. And then it was able to build up this kind of mindshare, and then it was incredibly difficult to replace. Like, I mean, there's been a ton of things that people have tried to build to replace JavaScript, like for example, VBScript from back in the day, and even more recently there's like WebAssembly, but it's not really getting replaced. And the reason for JavaScript is because all the developers are tied to it. All the tooling is tied to it all the mindshare is tied to it. It's kind of the default choice that any new grad developer, like any new person entering the industry, would use. Similarly, the EVM is kind of that thing. That is the default thing with all the tooling developer’s mindshare. And that's why one of the core theses that we've built up is that the EVM is here to stay. No one is going to be replacing the EVM.

And as a result of that, you really want to be optimizing the EVM to enable better developer experiences. So, with the current EVM right now, if you're not able to get more than like 60 transactions per second, the end result of that is developers need to build applications for users that only support 60 transactions per second. Like they can't build more complex applications. And if you look at something like trading, if you're trying to trade on Nasdaq, you need around 20,000 transactions per second that can be supported on Ethereum. Right now, there's 60. So, what that means is you can't really build something like Nasdaq on chain. That's why what we've noticed in crypto is you start seeing people making use of anti-patterns, like building things that are purposely simple, that don't follow whatever kind of traditional best practices are just to get something that works on chain. One example here would be the concept of an automated market maker. Automated market makers like Uniswap. They do not exist in traditional finance because they are not capital efficient, but they exist in crypto because they're able to fit the limitation to what the IBM offers.

So that's why we got started parallelizing the EVM. And this basically lets you get the best of both Ethereum and Solana. You're able to get the developers tooling mindshare that you have with the EVM, and you're also able to get the high-performance nature that you get with a chain like Solano. And I would say that the market and the community received this extremely well. We put out the announcement for the first parallelized IBM in November of 2023. After that, I mean, everyone was extremely excited about it. We went live in July of 2024 with the public kind of made it on that. And since then, there's just been a ton of new stuff that's deploying on, say.

Lex Sokolin:

The image in my mind is always like, you've got the original Nintendo with 16 colors and a bunch of pixels, and you're trying to render PlayStation five video games on it, right? You just can't. You don't have as much memory. You don't have enough throughput. You can't make it happen. And so, there are a number of approaches to making protocols more capable of doing what they're meant to do, which is support financial infrastructure payments and so on.

And one of these approaches is parallelization. Can you talk a little bit, not in full technical detail, but in an abstract way, perhaps about what are the tradeoffs when you introduce parallelization? Like, you know, a lot of the Ethereum people say that the trade-offs are too expensive, and you can't do what you're describing. So, by what magic trick are you able to create this new architecture?

Jayendra Jog:

I think one big aspect of it is it's technically difficult, and most other projects are not really willing to take the risk of like changing that architecture. In Ethereum's case, they already have this project that has been around for several years now, and it's really risky to kind of re-architect the entire system. Like, I mean, there's like I want to say like hundreds of billions of dollars on assets on Ethereum right now. So, it's just introducing a ton of risk to try to change a system that in some ways, in the case, is already good enough. Now, from more of a technical side, there's two issues that come up and I'll keep this kind of higher level.

The first issue is state bloat. And the core idea there is if you're processing more transactions, there's more data that you need to store. And that's in and of itself an extremely hard technical problem to deal with. And I can elaborate on that if you're curious, but we figured out a way to address that that other chains really haven't been able to. And then the second issue is just tied to hardware requirements. If you want to have this high-performance chain, then you ideally want to be running higher performance hardware to be able to get just more transactions per second that you're able to squeeze out of the chain. And that's kind of a philosophical decision that differentiates us from a chain like Ethereum. In the case of Ethereum, they want people to be able to run a Raspberry Pi to validate the blockchain. We don't think that's the direction the industry is moving in. We don't think that's the best for user experiences. So, we have different kind of node requirements. And our node requirements are much more similar to what you see in the rest of the industry, for example. Like what Solana Aptos like similar node requirements to other modern blockchains.

Lex Sokolin:

There is a trade-off end of the day that you have to abide by, and in this case, you know, the hardware has to be quite specialized. What does it take to run a node and what kind of entities are able to do so?

Jayendra Jog:

You can run a node on a beefy laptop. So, it's not like actually that specialized. I think that people have this idea that like, oh, you need like GPUs and all this, like custom stuff built out. No, I mean, you could just start running it on your laptop or if you have like a beefier machine, or you could just get like an EC2 instance on AWS or something similar on some cloud provider. So honestly, it's very accessible for people to run validators and full nodes if they want to.

Lex Sokolin:

I remember when SE was just coming out, quite a bit of the reputation of the chain, and the project was around being purpose built for capital markets. And obviously, you know, we've talked about your Robinhood background and your comments on whether the capital markets are fit for purpose.

How did you approach go to market and approach your positioning? And then, you know, what's the relationship that you have to the financial services industry?

Jayendra Jog:

Yeah. So, the first part of, I guess what you're asking before around who's running a validator, who's running full nodes. Validators are being run by just, I guess, specialized validator providers. So basically, the people that are the most legit validator service providers in the industry, they're all running validators on today right now. So, it's people that know exactly what they're doing in terms of our initial go to market and in terms of how, say, is going to be kind of growing and also the also the relationship with the financial services industry. The first part is that it's extremely scrappy in terms of getting a layer one blockchain built. A layer one is like a multi-dimensional market problem in a way, because you have you have to build a core technology, but then you also need to get developers to start making use of that technology. But then on the other hand, you also need like normal community members to come onto the blockchain.

And it very much is like a chicken and egg problem where developers don't want to come until there's community members already. Community members don't want to come until there's cool ops to be building, which developers need to build. So, getting that right is extremely difficult. And that's why building a layer on blockchain is the hardest problem in crypto. Like, it's extremely technically complex, but it's also extremely complex from a market standpoint. And I mean, in a way, that's also why the upside is so high. If you're able to do it right, projects like Bitcoin, Ethereum, like the reason their market caps are so high is because they've been able to get that kind of chicken and egg problem solved. In our case, the way that we got started was just being very focused on understanding what the core set of developers would be that would benefit from this and really supporting them in getting applications built at the start. And now that we're bigger, I think the foundation. So, there's like a, say labs, which I'm leading, which is responsible for R&D and building the core technology.

Then there's the Sei Foundation, which is responsible much more for helping grow the ecosystem. And the approach that the foundation is taking right now very much is a approach that doesn't scale, which is building one on one relationships with a lot of these founders understanding their needs, their pain points, and then supporting them through the entire process of getting something started on, say, so. This would be from the ideation process to the product building process to the fundraising process, and then eventually on the launch process. So, it very much is building these relationships and then helping them succeed. And I think right now we're we have a relatively large ecosystem. I think there's still a pretty large delta between an ecosystem like ours and an ecosystem like Solana, for example, where there are several killer applications that have been deployed. And the way to kind of become that Solana level chain is by focusing very deeply on building these killer applications. So, supporting developers and building something like a pump fund or a poly market or now something like virtual.

So, on base understanding, like what trends are happening in the industry and supporting these developers and really being able to launch these products, like as early in that kind of the life cycle for that vertical as you can. And the last part of your question around financial services, that there's a lot of market makers and financial services players that are investors in Sei labs. I think long term, the way that this will play out is that they will start coming on chain once it's both safe from a regulatory standpoint for them to do so, and it's profitable from a financial standpoint to do so. I think that's why a lot of financial services players haven't really come on chain quite yet. They might just be trading assets like Bitcoin and Ethereum Because it's safe for them to do that on their balance sheets. But coming on chain, I mean, it's a big technical lift. And if there's not as much upside to be gained from doing that, they won't be coming on chain. So, I think the way it'll play out in the next few years is once there's clear regulation defined by the government, that will result in a lot more developers, investors coming, kind of coming back into crypto.

And I think it will also result in these sophisticated financial players that will start experimenting with like having on chain smart contracts or building their own custom blockchains. I don't necessarily think it'll be like the American government or like us traditional finance tool kind of rails. Like for example, how like trade settle. That'll immediately come on chain. I think it'll start off by being stuff like stablecoin payments that end up getting the most utilization, at least in the United States. And then gradually we'll start seeing more and more stuff start coming onto the blockchain.

Lex Sokolin:

Got it. So just to anchor our listeners in terms of the scale, right at the time of this recording, Sei has a market cap of around $1.5 billion and a fully diluted value of around $3.5 billion. So, it's a large project, about 200 million or so worth of capital that's locked into the various DeFi protocols or what, you know, in the old world, we'd call AUM. It's hard to get to the point where you are, and especially doing that ecosystem development and kind of it's really hand to hand combat, to get applications to build on your protocol, because it's kind of like, you know, between the iOS App Store and the Android App Store, you know, the app stores are competing for the best applications to build their first because they have the most users.

And you've already described the sort of chicken egg problem. If you look across the competitive landscape today, which is, you know, other chains, high performance chains, modular chains, rollups, you know, arbitrary monad, Mega ETH and sort of things that people expect will exist, things that already exist. I think there's just a lot of confusion about the splintering of the Ethereum world into all of these chains. How do you see from the perspective of, say, labs, like, how do you compete against all of these other players? And then more broadly, how does the Web3 world come back together where this is less zero sum and more collaborative between all the different chains?

Jayendra Jog:

Yeah. So, first of all, in terms of competition, it's entirely about getting killer applications to deploy onto. If we're able to get multiple killer applications, then it doesn't really matter what kind of technical innovation other chains are doing. The only thing that matters is how you're able to get distribution, and that fundamentally is distribution.

So whichever chains end up winning are going to be the ones that have these killer apps getting built. Now, I think the biggest two differentiators over there will be the execution environment. So EVM versus like move, VM, SVM or whatever else. And the second thing will be performance. How much scale you're able to support. I think those two things matter a lot for developers. A lot of other stuff. At least based off conversations we've had, tends to be a lot kind of fluffier in a way, and doesn't really mean much for developers. So, I think whichever chain is going to win, it needs to support the EVM. And it also needs to be extremely high performance. And that's why a lot of these like alt VM type chains, I think it's going to be much harder for them to succeed than it would have been if they'd gotten started with the EVM. That's my first thought over there.

The second thought in terms of kind of Ethereum fragmentation. It's really been interesting, especially over the past week, to see how like so for listeners like when at the time of this recording, the Trump meme coin launched around, I guess six days ago, and after that, there's just been this entire reaction from the Ethereum kind of community where like, oh, why did this launch on Solana? Why didn't this launch on Ethereum? And it definitely is bringing to light right now that the Ethereum ecosystem has problems both in terms of setting direction, in terms of go to market and in terms of just having some kind of like leadership structure that people are satisfied with.

What I anticipate happening there is there will need to be some kind of like leadership clarity. And I think Vitalik is pushing for this to like really improve a lot of the processes from the Ethereum Foundation side. I don't think Ethereum is going anywhere. I mean, it's the second biggest project in existence, and I think they will be able to fix a lot of the problems that they have right now. And in terms of like how things in the longer term will be playing out. First of all, I think the crypto is winner take most. So, in terms of these blockchains, there might be 100 blockchains that people create out of them. There will be five that are really able to get any kind of significant market share. The other 95 will just be kind of existing, but not really used by too many people. So, you basically need to figure out who these five winners are. These five winners are going to be completely redefining the way several industries work. I think finance will be the most lucrative part of this, but there will be other industries that they redefine as well.

So, I think there's a ton of impact you can have by figuring out which like from the chain standpoint, like they'll be having a ton of impact from investor standpoint. If you figure out who these five chains are, I think the returns are going to be extremely high just because of the amount of infrastructure that will be replaced by these chains in sectors like finance. And I also think that in terms of how this will play out from like when it's up to coming zero, some one way to think about it right now is the pie is so small that focusing too much on how you are positioned against these other chains isn't really the best use of time. Like, the best use of time is to just get killer applications to come and build on your chain. Then you're going to like, that's the thing that matters, to just focus on that. And then as more regulation comes out for crypto, as people become more comfortable with the idea of crypto, as there's more use cases, more people will come on chain anyway.

And I think that's when you'll start seeing it become less of a zero-sum game in more of a positive sum game.

Lex Sokolin:

It's definitely easier to be in a positive sum game when everybody's growing. Instead of doing the roller coaster of Clown Town, which is what sometimes things feel like. Okay. Last question. You know, if you look at your social accounts now, you guys are hiring for a head of deep n, head of AI, head of decentralized science, which signals to me that you're thinking about finding those next waves of attention that require a high-performance chain. Can you talk about what you think are the biggest levers for the types of applications you want? Like, who do you want to come to say in the next year, in the next two years? And where do you think those pockets of growth are going to be?

Jayendra Jog:

Yeah. So, in terms of who you want coming to say from more of the developer standpoint, there's like a persona for a founder that we've found to be really strong.

And then there's the type of application they're going to be building in terms of the persona. We found what we called internally as failed founders to actually be the best fit. So, if you think about it like the people that are going to be best at building a startup are the people that have already built a startup already. There's a successful founder who've already, I mean, successful founders are probably still working on their company. So, it's really difficult to get them to leave and start building onto it. But then there's other people that are really talented founders, but they just weren't able to get lucky in the right ways. And they end up having a lot of the grit, determination, kind of mental acuity you're looking for. And they've already been through the cycle as well. So, first of all, they know that they want to be founders. And secondly, they've already learned a lot from that process. So, I think those folks end up being the most effective people from the get-go. It's not like college kids from hackathons.

It's not like people leaving their job at Google. They're trying to start a company for the first time. It's like these founders that haven't really found much traction before, that I think, are the sweet spot in terms of the types of applications. I think what really moves the needle in the short term is an application that does have some kind of, some kind of candidly like speculative aspect to it. That is the thing in crypto that has, in my opinion, the highest kind of chance of having very fast growth. And if you look at it in Web2, I think it ends up being tied to like some kind of cardinal sin. Like, for example, like, I mean, greed is definitely one part of it, which is why Robinhood succeeded. And then there's like stuff tied to social standing, which is why applications like Facebook and LinkedIn succeeded. And I think that certain things are much better on chain when I think stuff tied to finance definitely kind of fits that description, where you have like parties that don't trust each other, that are able to do things in a trust and trust this kind of way.

So, I think some types of speculation will definitely take off. What I want to start seeing happening after, though, and I think that's why the foundation is hiring for things like head of AI, head of DePIN is more broader types of industries that start building onto. And right now, it does seem like deep in AI. Decentralized science industries like this are still pretty early outside of like what we've seen with DeFi and trading. And these industries have our industries that are that have the potential to be extremely massive, and they all benefit from having higher throughput. Like in the case of AI agents, for example, if you're constraints like a 20 transactions per second environment, then you cannot really have agent agent interaction happening, at least not in a seamless way. Whereas if you're suddenly like a five-gig asset, like 250,000 transaction per second environment, it's much easier to support all these random interactions like agents would want to do. In the case of DePIN, it's much easier to support hundreds of thousands or millions of people that are running physical hardware and then having transactions getting submitted on chain.

So, I think we are seeing certain types of industries that are going to do really well from higher performance, and that's why the foundation is focusing on those industries for kind of long-term bets, basically, to see whether those experiments, those industries will be able to grow on, say.

Lex Sokolin:

This certainly going to be a very fast paced year and we'll see a lot of change. But I'm excited to hear the longer-term plan, because I do think people can always say that we're early, but we are. The adoption from an industry perspective is still quite low. And technology in many ways is still quite janky. But that is also the exciting part. And I think why we're all here. Jay, if people want to learn more about you or about, say, where should they go?

Jayendra Jog:

Yeah. So, Twitter is the best spot to get in touch. My Twitter handle is Jayhendra_jog. So just shoot me a DM and I'll be happy to chat.

Lex Sokolin:

Fantastic. Thanks so much for coming on.

Jayendra Jog:

Thank you so much for having me on.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Share this post