Apple and Google help with government contact tracing, setting stage for war over Data

Hi Fintech Futurists,

This week, we dive into the social, economic, and financial implications of data in a post-COVID world. As Apple and Google work to build out the government's contact tracing apps to combat pandemic, what Pandora's box are we opening without consideration? As Plaid reaches into payroll data to accelerate small business bailouts, what power do we hand to aggregators? Will dignity-preserving solutions come to market in time? The opportunity for decentralized identity and data storage is clearer than ever. Or will fear drive us to make permanent compromises?

These opinions are personal and do not reflect any views of ConsenSys or other parties. Still, you should check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments here.

Thanks for reading and let me know your thoughts here!

Weekly Fintech & Crypto Developments

If you’ve found value over the years from my newsletter, now is the time to give back by purchasing a premium subscription, which includes an additional 12 key weekly updates with graphs and analysis on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality (example 1, example 2, and example 3). Click below to subscribe.

Long Take

The most interesting Fintech development of last week for me was the $1.2 billion SoFi / Galileo deal. I covered it in a bit of detail in the premium newsletter, and a hosted a ReBank podcast with Will Beeson about it. If you want business-as-usual meat and potatoes, check out the conversation.

I am still having trouble talking about business-as-usual. Like many of you, I am trying to find my way in the COVID epidemic. There are so many more people on social media now (!), which makes it easier to figure out the mood. We seem to be in the "What life after COVID looks like" phase of the narrative.

What coronavirus means for the global economy (Ray Dalio)

After the first wave: How CIOs can weather the coronavirus crisis (McKinsey)

This is a giant wealth transfer from average savers to wealthy investors (Ari Paul)

World’s Back Office Rushes to Stay Online in India Lockdown (Bloomberg)

Creativity and courage are the vaccine -- from molecular technology, to digital workspaces, to solving for global health data (my pior entry on the topic)

The core answer seems to be that the damage to our economic institutions and the hit to our trust systems (finance, healthcare, government) will be so severe that the world will go in a new, orthogonal direction after the shock wears off. Instead of getting back to business as usual, we will have new priorities and beliefs. Entropy has been building in the system for decades, manifesting as Brexit, Trump, and the global misinformation wars. Incumbent institutions have worked to smooth the experience of living in this pressure cooker, but now the lid is off.

If you've been laid off, defaulted on your rent, bankrupted your business, lost all your investments, got sick because you didn't wear a mask, didn't get access to a ventilator, were disenfranchised from voting remotely -- maybe it's time to revisit your frame of mind.

If the biggest danger to health is the lack of information (or truth), then who will benefit? I don't think it will be the authoritarian demagogues for much longer. On the one hand, the power of propaganda in the age of TikTok is very strong. I also worry about the human need for "strong leadership" and our kind's inability (or lack of attention span) to see all the shades of grey, instead of just searching for black and white. But transparency and reality should be stronger in the long run.

You should not be able to spin away facts about how the West (but for Germany) bungled its response to a natural phenomenon. You cannot spin away historic unemployment, market collapse, and default. If our leaders are the reason for failing to prevent catastrophe, those leaders should not be allowed another chance at obfuscation.

That is if we at all listen to history and don't replay the 1930s.

The other theme that seems to be emerging as a permanent fixture is *data*. The anchor news item is Google and Apple partnering to support government efforts in contact tracing. This type of technology has been successfully applied in the East to slow transmission rates. It it more difficult in the West given expectations about privacy. Therefore, this will be structured as an opt-in initiative from both tech firms.

When time is of the essence, when there is urgency, we suspend habeas corpus. We put to the side our Constitutional agreements and rely on raw power. We hope not to trample our freedoms -- but we do it to save lives. Interestingly, I am not sure Americans will allow politicians to do so in the case of pandemic. But they will cheer on private oligopolies to open up their massive data troves. If a private actor (even a corporation) contributes to the greater good, broadly defined, is that not admirable? When we all opt-in to report on each other, are we not saving each other?

Another example is in the Fintech realm. Small businesses are due $350 billion in loans from the government. However, disbursement is controlled by banks, who run traditional approval / underwriting programs. Data aggregation company Plaid has offered to build a product that would collate payroll data from the accounts of those small businesses, and then intermediate it into a format useful to the lender. Plaid will reach into what it knows about small businesses in order to offer them a lifeline -- an option most of them should take.

I think we misconstrue data. We misunderstand what is dangerous and what is a gift of modern technology.

Let's take a detour for a moment, and flip a fair coin in the air. One would say that probability of it landing heads is 50%, and the probability of it landing tails is 50%. But is that really true? No, it is not. The coin will only land in one way, and not in another. The probability we assigned to either outcome is based on *us*, the observer, and not the actual coin. It is *we* who do not know how the coin lands; the probability relates to our lack of knowledge and personally perceived uncertainty only.

If there was a really granular physics engine modeling precisely how the coin was flipped, including its angle, velocity, air resistance, and other forces, would we not have a better knowledge of the resulting outcome? Could we not, for example, say that based on the position of the thumb, the chance of the coin landing heads will be 75%? Could we not be more accurate with more data about the world, and better tools for simulation? Yes -- see Yudkowsky's writings on rationality for the source of this example. This is the point of having more information.

If you have more data on a thing, in a financial services sense, you eliminate uncertainty. You can sell your better knowledge of the truth as a derivative, and charge a premium. For example, insurance companies have better knowledge of risk than you, and can smooth that risk across a population. If they know that someone is a worse risk (e.g., drunk driver), they charge that person a higher premium to be smoothed into a pot. If everyone had perfect information about their risk profile, you would not need a financial product. And the insurance company would not sell you one as it does not want to just assume some certain cost -- this is why insuring pre-existing medical conditions in such a problem. Banks and investment firms do the same thing in the capital markets, all acting on imperfect data and imperfect models.

Uncertainty allows for the monetization of financial capital. Entropy is income. Stasis is the death of speculation.

In a post-COVID world, we have more data than ever before. It is delivered by the largest tech firms in the world for the greater good. Healthcare data is embedded into proximity payments. Payroll data follows employers and employees across their bank accounts and shopping habits. Information is the antidote to the blindness of Nature.

The war over data will be brutal. Authoritarian governments will take the opportunity to permanently flow information through their filtering and censorship machines. In more open countries, private corporations may bend and tilt who has data access to maintain their market positions. Banks and startups with small footprints evaporate; their information is so bad that the risks they take will be punished by bankruptcy. Consumers may try to defend themselves through forms of decentralized identity, using blockchain-based wallets with strong permissions and cryptographical systems to assert self-sovereignty. Anything without scale will fail (see uPort and IPFS as potential solutions).

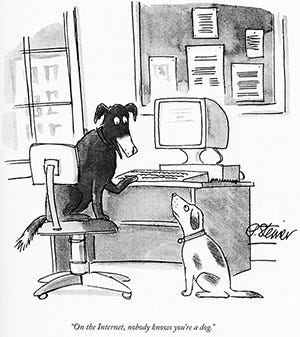

As a parting thought I give you this. In 2001, I and millions of other teenagers used Napster to download Metallica songs and rip CDs as some sort of political statement. "We broke their system", thought millions of peer-to-peer network file sharers, "We are liberating knowledge." Another common meme in the 1990s was a picture of a dog browsing the Web, happily saying, "On the Internet, nobody knows you're a dog". Of course, the latter ended up entirely false. Everyone wants everyone else to know who they are! The popularity of influencers means that real identity is the anchor of social content.

Well, Napster and the Web didn't just crack open the private vaults of music labels. It also cracked our own private data vaults. Governments and the tech giants are routinely pirating our data through legislated surveillance. In many cases, this is a social good and will help save lives. In many cases, this is a bargain we make explicitly. It will also be one of the most dangerous frontiers of the post-COVID world.

Looking for more?

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.