Fintech: Moody's downgrades New York Community Bancorp to junk status

NYCB absorbed billions in loans from Signature bank upon its failure, which increased regulatory capital requirements and led to a dividend cut.

Hi Fintech Futurists —

Today’s agenda below.

WEALTH MANAGEMENT: Moody’s slams New York Community Bancorp and its stock declines 57%

LONG TAKE: How can Farcaster avoid the death trap of decentralized social media? (link here)

PODCAST CONVERSATION: The evolution of derivates from structured products to decentralized perpetuals, with SynFutures CEO Rachel Lin (link here)

CURATED UPDATES: Payments, Lending, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below.

In Partnership

Fintech Meetup (March 3-6) is the best place to find new business, partnerships and opportunities. Attendees & sponsors say Fintech Meetup is “the highest ROI event” with reasonably priced sponsorships, tickets, and rooms. Meet everyone for any reason across every use case over 45,000+ double opt-in meetings, and network with 4,000+ attendees.

Digital Investment & Banking Short Takes

WEALTH MANAGEMENT: Moody’s slams New York Community Bancorp and its stock declines 57%

New York Community Bancorp (NYCB) is in a challenging position, attempting to reassure investors following a significant stock slide and a Moody's credit downgrade to junk status. The bank has faced a 57% stock decline since announcing a dividend cut and reporting a $252 million net quarterly loss in Q4 2023.

The struggles stem from the 2023 regional bank crisis that saw a bank run on deposits and the subsequent collapse of Silicon Valley Bank, Signature Bank, and First Republic. A bank run is where a large number of customers want to withdraw their money en masse because of worries around the safety of their deposits. This spurs other customers to do the same, putting all of the deposits at risk, thanks to fractional reserve banking whereby only a portion of bank deposits must be available for withdrawal.

NYCB absorbed billions in loans from Signature bank upon its failure. This decision pushed NYCB above its asset threshold of $100B, increasing the regulatory standards to which it is subject, and requiring more capital to be set aside to cover potential future losses. To meet these capital requirements NYCB opted to cut its dividend in Q4 and set aside more capital, totaling $552MM, for potential loan losses. These provisions were well above analyst estimates and were designed to protect the bank against any vulnerabilities in its commercial real estate portfolio. The decision also stemmed from pressure from the Office of the Comptroller of the Currency for the bank to set aside more money and cut dividends in case commercial real estate loans went bad, particularly due to its exposure to the rent-controlled apartments in New York City, which account for 22% of its loans.

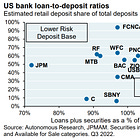

Moody’s main reasoning behind the credit downgrade is this exposure to rent-controlled apartments. Under current conditions, inflationary pressures have increased the interest rate expense for refinancing and maintenance costs, which are often passed on to tenants via rent increases (rent-controlled buildings aside). The credit rating agency also cited the bank’s high dependence on wholesale funding, short-term financing from other financial firms, and a comparatively smaller pool of liquid assets when compared to peers.

Amidst these struggles, NYCB has focused its investor relations and regulator communications efforts on affirming its liquidity and deposit stability, highlighting an increase in total deposits since the end of 2023 with deposits up from $81.4B to $83B. Uninsured deposits account for $22.9B (27% of total deposits), which appear to be well covered by liquidity levels of $37.3B.

The future success of NYCB hinges on its ability to effectively manage its commercial real estate exposure and reassure both investors and regulators of its financial stability. This is difficult to accomplish amid a “junk” rating downgrade. NYCB must also keep depositors happy, which the bank is trying to do with a 5.5% annual interest rate on some short-term certificates of deposit. NYCB reports that the downgrade from Moody’s does not have a material impact on its contractual arrangements, though this is unlikely to boost confidence in its customers. And while NYCB is reassuring us that they are hedged, Lehman brothers claimed the same. Overall, we are concerned not just about NYCB, but about the scores -- perhaps hundreds -- of banks behind them. History’s rhyme is difficult to ignore.

👑 Related Coverage 👑

Blueprint Deep Dive

Long Take: How can Farcaster avoid the death trap of decentralized social media? (link here)

In this article, we explore the rise of social media as a recent phenomenon reshaping business and financial landscapes.

The discussion transitions to the challenges and missteps in creating decentralized social media (DeSo) platforms that prioritize financial features over improving the core social media experience. We examine several attempts at integrating blockchain and financialization into social media, such as Steemit, EOS's Voice, BitClout, and Friend.tech, noting their initial promise but ultimate decline in user engagement and value. Farcaster is introduced as a new contender aiming to blend the social media experience with Web3 capabilities without compromising on the social aspect.

🎙️ Podcast Conversation: The evolution of derivates from structured products to decentralized perpetuals, with SynFutures CEO Rachel Lin (link here)

In this conversation, we chat with Rachel Lin - co-founder and CEO of SynFutures.

Lin started her career in TradFi at Deutsche Bank in the global markets department, specializing in structured derivatives. Later on, she joined Ant Financial , where she helped build the first version of its blockchain platform under Alipay. Prior to SynFutures, Lin was one of the founding partners and head of DeFi and lending for Matrixport, a spin-off of Bitmain and one of Asia’s largest crypto neobanks.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

⭐ TikTok Tests Feature That Could Make All Videos Shoppable - Bloomberg

Adyen half-year revenues up by 23% - Finextra

Nigeria’s Central Bank bars banks from international money transfer operations - Techcabal

Metronome’s usage-based billing software finds hit in AI as the startup raises $43M in fresh capital - TechCrunch

Neobanks

⭐ HSBC installs first of ten 'Cash Pods' in town with no bank branches - Finextra

CommerzVentures leads €25 million Series B in Tuum - Finextra

Natwest becomes first bank accepted into UK Open Banking DPS - Finextra

Revolut combats roaming charges with 'eSIM' - Finextra

Lending

Digital Investing

Nasdaq Private Market raises $62.6 million - Finextra

SUMA Wealth grabs $2.2M as its financial platforms reach 1M users - TechCrunch

Financial Operations

⭐ Introducing Carta Conclusions - Medium

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts for deeper learning.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.