Blueprint: Emerging credit underwriting -- TomoCredit gets $22MM, X1 income-based card; FTX looking to buy Bithumb crypto exchange; Zesty.ai $33MM raise

Hi Fintech Futurists —

You are the best, today’s agenda below.

Digital Lending: TomoCredit raises $22M at a $222M valuation toward its goal of making credit scores ‘obsolete’ (link here)

Digital Lending: X1’s income-based credit card is about to launch publicly (link here)

Crypto: Sam Bankman-Fried’s FTX May Buy South Korean Crypto Exchange Bithumb: Report (link here) and Bankman-Fried says his firms may deploy 'hundreds of millions' to backstop struggling crypto industry (link here)

Long Take: The opportunities in the Web3/DAO CFO tech stack, compared to its Fintech counterparts (link here)

Podcast Conversation: Navigating the macro environment and crypto financial crisis, with the ConsenSys Cryptoeconomics team (link here)

Greatest Hits Report on DAOs

Friendly reminder that tomorrow we launch our second Greatest Hits report on Decentralized Autonomous Organizations (DAO) — a well rounded perspective on a particular issue by combining our best short takes, long takes, and podcasts on a specific topic.

In this Greatest Hits report on DAOs we will cover:

An introduction into DAOs and its history

The DAO ecosystem and how it has leveraged communities to perform a myriad of defined services

Our deep analysis into the top trends and stories within the DAO space

Talks with DAO pioneers and thought leaders

The report will be exclusive to Premium Subscribers.

If you want to get full access to the report along with all benefits of the Premium subscription …

By upgrading to a premium plan you will get full access to the report along with:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Flagship Long Takes on Fintech and Web3 topics, providing you with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Upgraded Podcasts, where we combine access to industry insider podcasts with value-added data-driven, annotated transcripts

Full Blueprint Archive starting in 2019, covering the rise of Fintech, DeFi, neobanks, roboadvisors, paytech, crypto & blockchain, financial artificial intelligence, and Metaverse themes across the ecosystem

Offer expires in a few days, so grab it while available!

Short Takes

DIGITAL LENDING: TomoCredit raises $22M at a $222M valuation toward its goal of making credit scores ‘obsolete’ (link here)

TomoCredit raised $22MM at a $222M valuation for its credit product targeted at young adults with no credit score. Originally created to help international students get access to credit, it has since targeted the broader market of young adults with little credit history. Instead of using FICO scores to underwrite, TomoCredit uses a proprietary underwriting algorithm, known as Tomo score, to give loans to those who have high borrowing potential. It collects data by connecting to user bank accounts, and analysing balances and income through data aggregation.

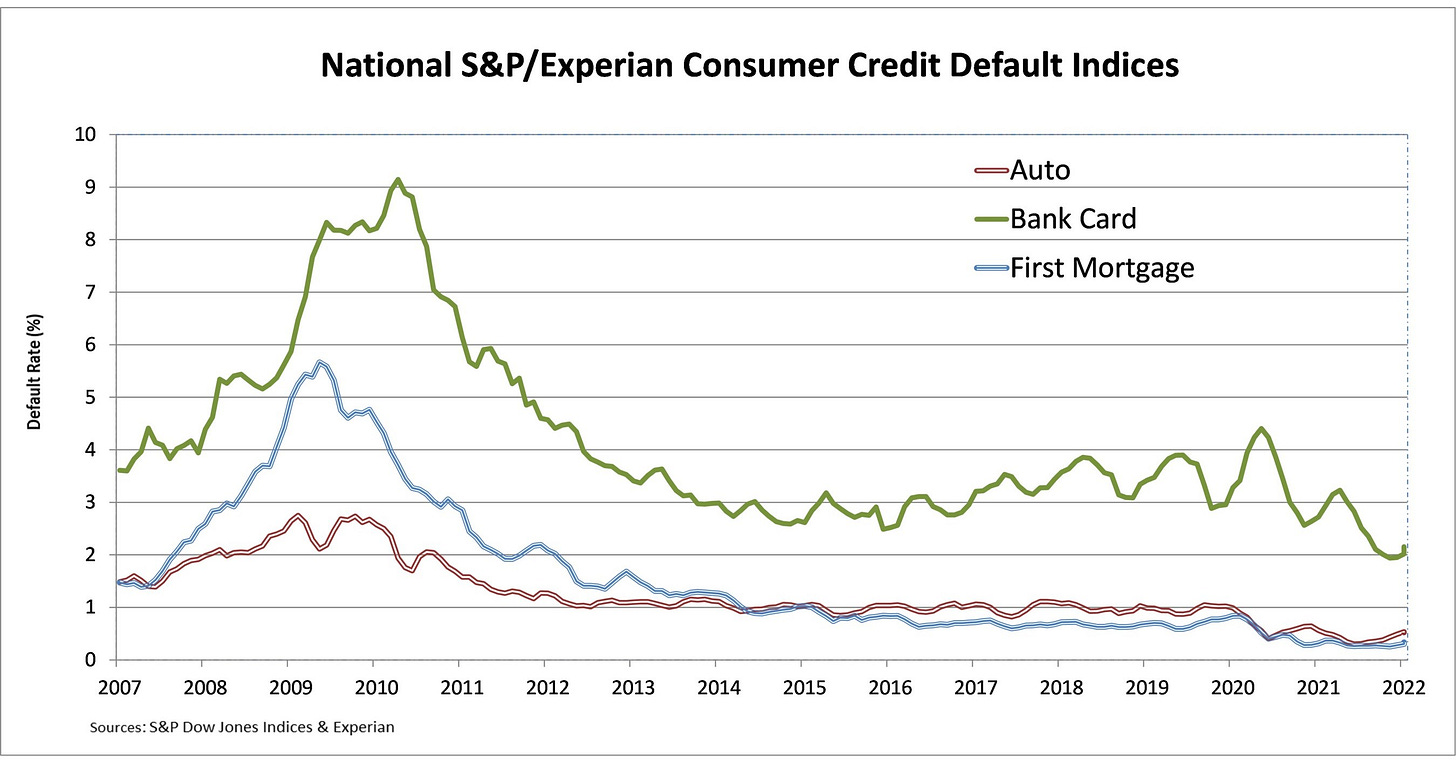

Credit limits go up to $30K, depending on cash flows, and all revenue comes from interchange fees paid by merchants, rather than consumers. The model seems to be working at the current scale, despite the risky target customer, with default rates of 0.11% (e.g., American Express has a default rate of 2.5%). The number of cardholders hasn’t been disclosed, but there have been over 2.5MM applicants.

We like the use of contextual underwriting, and do think that these types of data sets and scoring algorithms will become widely available and increasingly accurate. It’s unlikely that extraordinary low default rates continue at scale once the initial customer targeting limits market size, but perhaps the company can keep disciplined. Also notable is the use of payments revenue to underwrite credit. It is the 10th wonder of the world, that interchange.

DIGITAL LENDING: X1’s income-based credit card is about to launch publicly (link here)

But wait, there’s more! Another credit story that caught our interest. X1 is launching a credit product that will underwrite customers based on their income instead of credit scores, a method which they claim allows the company to provide up to 5x the credit limit of traditional providers.

X1 has had $50MM in monthly transaction volume over the past 6 months, providing the card to a limited group of customers. With $25MM in new funding, doubling their previous $12MM round in January 2021, the credit product is going public to their 500,000 waitlist. The card will offer 2x points on all purchases, growing to 3x when spending over $15,000 a year, and offers family based schemes to help earn points together with no fees on the users end.

To be honest, we are a bit surprised by how crowded this particular play is becoming. But end of the day, these card products are incremental distribution of capital-at-risk looking to travel the Visa money rails, rather than a big new platform.

CRYPTO: Sam Bankman-Fried’s FTX May Buy South Korean Crypto Exchange Bithumb: Report (link here) and Bankman-Fried says his firms may deploy 'hundreds of millions' to backstop struggling crypto industry (link here)

FTX’s Sam Bankman-Fried continues his shopping spree, with reports about late-stage talks with Bithumb, a South Korean centralised exchange. Bithumb has 8 million registered users and has had over $1 trillion in trading volume since inception.

Despite the impressive numbers, the exchange has been mired in controversy with accusations of fraud relating to its BXA token pre-sale. The pre-sale raised approximately $25MM for its native BXA token in 2018, but Bithumb never listed the tokens due to a fall-through acquisition by BK Global. It also came under fire with its management suspected of falsifying 99% of its trading volumes, which you know, maybe not great.

Overall, we see this as part of SBF’s strategy to increase market dominance and geographic spread through a series of acquisitions following the crypto market crash. Already trading platform Bitvo and clearing house Embed have been snapped up. FTX is also working on buying BlockFi in a up-to $680MM credit and acquisition deal, as well as deploying a large loan to support Voyager Digital and its customers. Having committed already about $1B, these moves have been backstopping the crypto markets for both retail and institutional investors.

The spending is not over —SBF told CNBC that he will be willing to spend hundreds of millions more to backstop firms affected by the crash. It’s a risky bet in a choppy market, but also the right time to take calculated risk. If the capital lasts, these moves witll have grown the FTXs customer base and capabilities significantly by the end of the year.

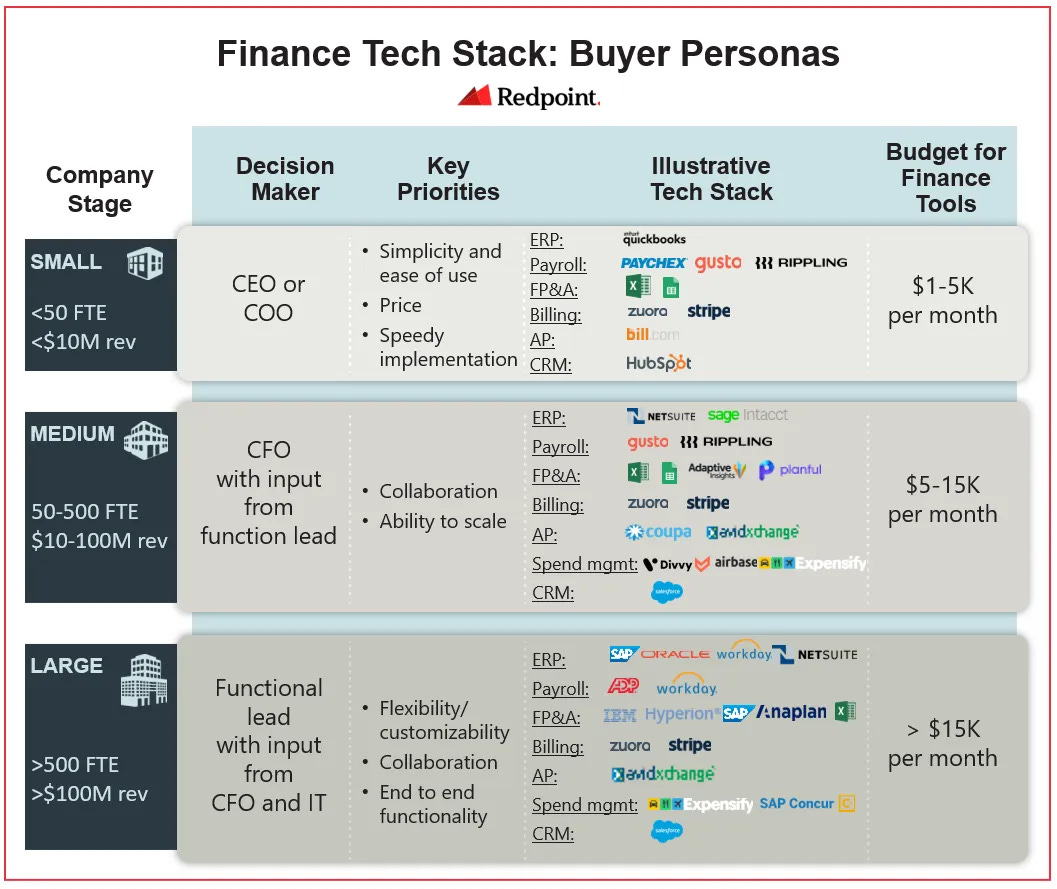

Long Take: The opportunities in the Web3/DAO CFO tech stack, compared to its Fintech counterparts (link here)

We look at the analogy between the CFO technology stack and the potential tooling needed to run DAOs. If the Web3 economy is going to see DAOs create a lot of the core value, then DAOs need to be performant in their payment processing and financial functions.

This is a very early stage sector currently, but has potential as more and more people contribute their labor in novel ways. We look at a number of comparisons by functions, and suggest gaps and opportunities for the current solutions.

Navigating the macro environment and crypto financial crisis, with the ConsenSys Cryptoeconomics team (link here)

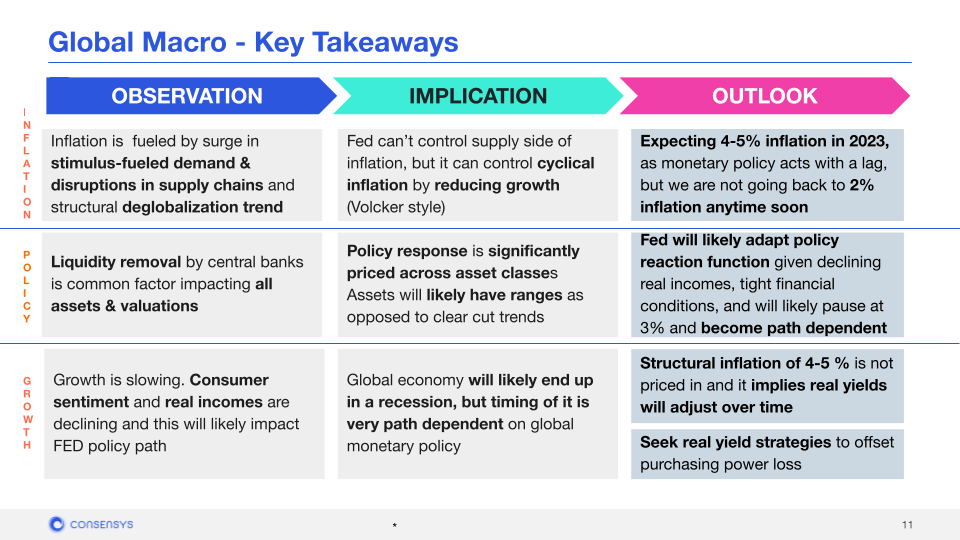

In this conversation, we have some great members of the Consensys Cryptoeconomics team — Ivan Bakrac, Ajay Mittal, James Chung, and David Shuttleworth — with whom we discuss the current macro environment, the fundamental trends in Web3, as well as the connection between crypto and all of these other indicators.

Additionally, we tease out some particular projects and catalysts that we think are important for the markets. Most of which, can be found in a great report here.

Rest of the Best

Here are the rest of the updates hitting radar.

BNPL: Fairbanc provides BNPL for micro-merchants in Indonesia

INVESTING: JPX Launches ESG Bond Information Platform

INVESTING: Edelman Financial Engines Launches New Workplace Platform

NEOBANK: Rabobank selects US fintech InvestCloud for financial planning tools

NEOBANK: Sudanese fintech Bloom nabs $6.5M, backed by Y Combinator, GFC and Visa

INSURTECH: Virgin Money and Superscript partner up to provide insurance to SMEs

INSURTECH: Insurance Supermarket raises $100 million

AI: Zesty.ai raises $33 million — cool stuff, worth a look

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes

Web3 Short Takes

Long Takes on Fintech and Web3

Digital Wealth

Access to the Podcasts with annotated transcripts

Full Access to the Fintech Blueprint Archive

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinons of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions