Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

In this conversation, we have some great members of the Consensys Cryptoeconomics team — Ivan Bakrac, Ajay Mittal, James Chung, and David Shuttleworth — with whom we discuss the current macro environment, the fundamental trends in Web3, as well as the connection between crypto and all of these other indicators. Additionally, we tease out some particular projects and catalysts that we think are important for the markets. Most of which, can be found in a great report here.

Ivan Bakrac - is a Senior DeFi Market Strategist at ConsenSys, as well as Adjunct Professor in Blockchain Technologies & Decentralized Finance at Stevens Institute of Technology, and Adjunct Professor - Global Fintech: AI, Blockchain, Business Data Science at Berkeley College.

Ajay Mittal - is a Senior Strategist, Cryptoeconomics at ConsenSys, as well as Co-Lead of Treasury at Friends With Benefits.

James Chung - is a Senior DeFi Market Strategist, Cryptoeconomics at ConsenSys, as well as Founder at BANKR.

David Shuttleworth - is a DeFi Economist at ConsenSys, with a history in HealthTech, data analytics, and token engineering.

Timestamp

1’30”: Introductions of each guest

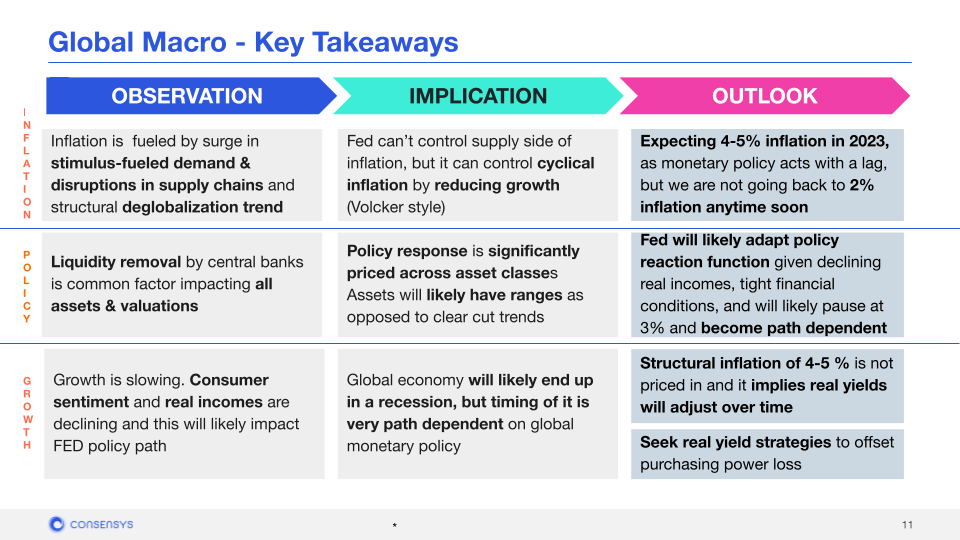

3’17”: Summary of current macro environment

4’11”: Components influencing the current state of The US’s stagflation

5’45”: The metrics/numbers relating to the current economic environment

9:35”: What is the inflation trajectory for a market in this state?

13’57”: The impact of interest rates, geopolitical risks and tighter financial conditions on technology/fintech and crypto markets

15’35”: The paradigm shift in terms of interest rate risk

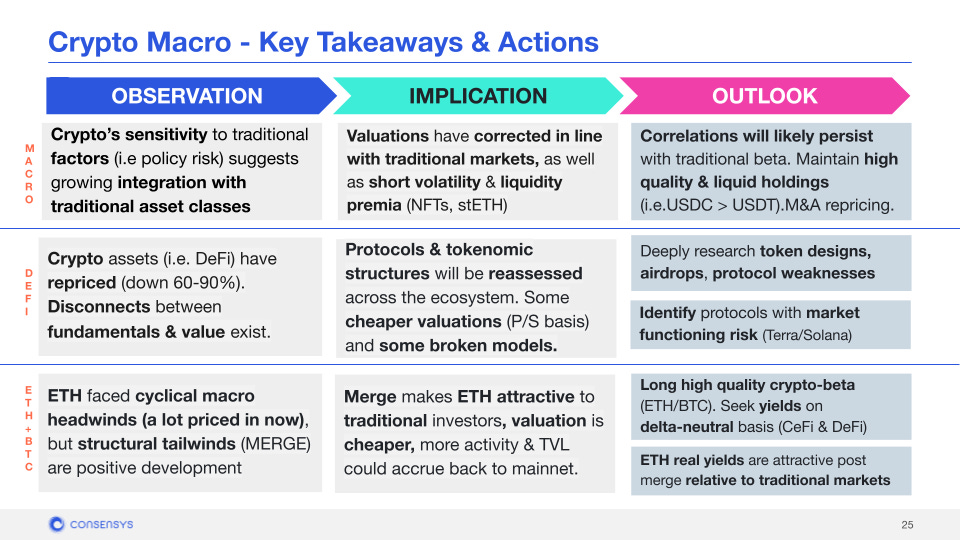

19’10”: The crypto liquadation cascade caused by the demise of Terra LUNA

21’49”: What is the market for leverage across CeFi and DeFi?

25’48”: How DeFi protocols performed during the liquidity crisis

30’23”: The growth and activity around tokens and governance, and the trends that tend to emerge in these times

34’11”: The Ethereum merge and the potential financial outcomes of this event

34’21”: Methods to connect with Simon

Sneak Peek:

Ivan Bakrac:

…And then, that liquidity is taken and levered in many different forms across the OTC markets. That was another problem. So, I kind of view these two issues as something that led to this escalation that we have seen lately.David Shuttleworth:

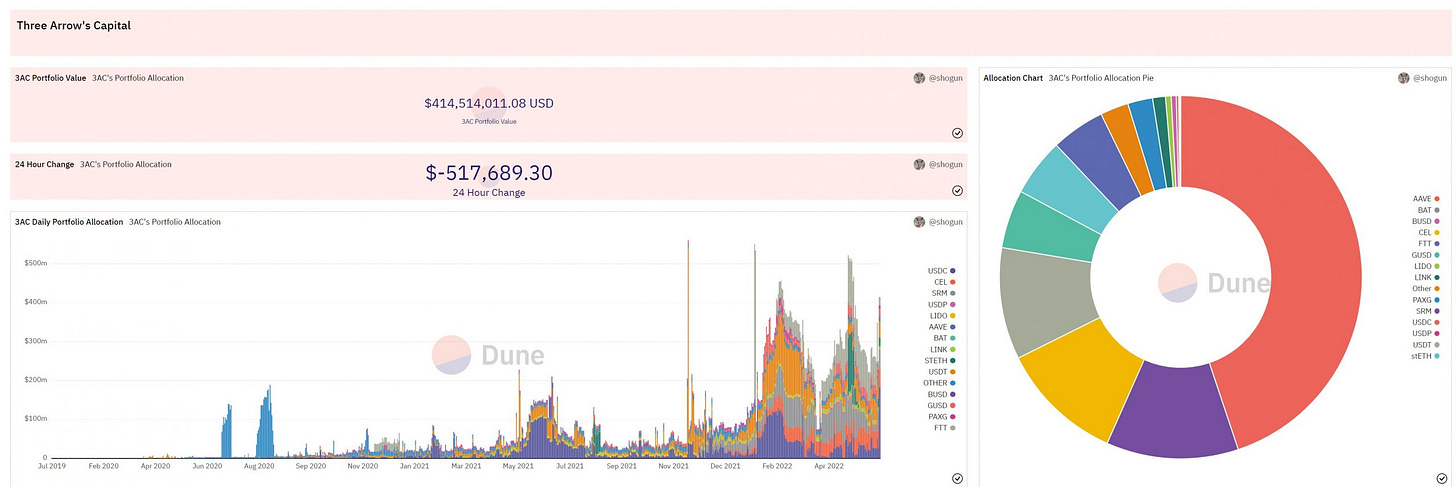

I think Ivan is exactly right there, particularly around undercollateralized or even no collateral. So, I think when markets are good and you look at a Three Arrows' capital and like, "Hey, you're worth a few billion dollars on your balance sheet." And Bitcoin is $50,000. Yeah. You're going to make the commitment to loan the money. But when that collateral, either, is cut by 80% or whatever the case may be, or maybe there was even collateral, that's kind of when you get yourself in trouble. And I think, again, risk management just wasn't there. Regulation just wasn't there. There was super reckless behavior. And I think the other one kind of built in, and Ivan touched on, is a lot of these different exchanges and CeFi platforms were offering very attractive rates, like, "Hey, stake your Bitcoin in Ethereum, and get an eight or 10% APY." Or whatever the case may be. But they're not super forthcoming about what's being done with that, with those assets.They're lending them out to other OTCs or other entities that are doing very risky behavior as well. Maybe borrowing them out or lending them out to people without collateral. And then, what happens is…

To read the full transcript, subscribe below:

Postscript.

Subscribe to our podcast on Apple Podcasts or Spotify

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinons of FINTECH BLUEPRINT LTD.

What did we miss? Reach out here anytime.

Stop by our Discord!

Like it? Share it!