DeFi: Open Standards for Autonomous Finance on Ethereum

Ethereum’s new standard lays the groundwork for agents that can identify, verify, and transact without human intermediaries.

GM Fintech Futurists,

Today we highlight the following:

DIGITAL ASSETS: ERC-8004 and the Rise of the Machine Economy

VIDEO INTERVIEW: From Roboadvisors to Stablecoins

ANALYSIS: Binance’s Flash Crash Exposes $40B Market Fragility

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet). For $3 per week, you get institutional-level research delivered to your Inbox.

Our Ecosystem: AI Venture Fund | AI Research | Lex Linkedin & Twitter | Sponsors

In Partnership with Oscilar

SoFi has modernized its risk stack with Oscilar’s AI Risk Decisioning™ Platform to support its growing lending business. The collaboration introduced a unified, no-code system across credit, collections, and fraud: delivering 50% faster policy rollouts, 30%+ quicker processing, and real-time agility.

👉👉👉 Read the full story to learn how SoFi is reimagining risk ops.

DIGITAL ASSETS: ERC-8004 and the Rise of the Machine Economy

Last week, the Ethereum Foundation’s dAI team and Consensys released ERC-8004, a protocol that allows AI agents to discover, verify, and transact with one another. The signatories include MetaMask, the Ethereum Foundation, Google, Coinbase, EigenLayer, ENS, and The Graph.

Until now, autonomous software, including bots, models, or smart contracts, have lived in silos. Frameworks like A2A (Agent-to-Agent) and MCP (Model Context Protocol) have emerged to let agents communicate. A2A provides a shared language for software agents to send structured messages, while MCP, introduced by Anthropic, allows AI models to exchange context and coordinate tasks. Both are useful for interoperability, but they stop short of trust. They don’t tell you who an agent really is, whether it has a credible record, or if its outputs can be verified.

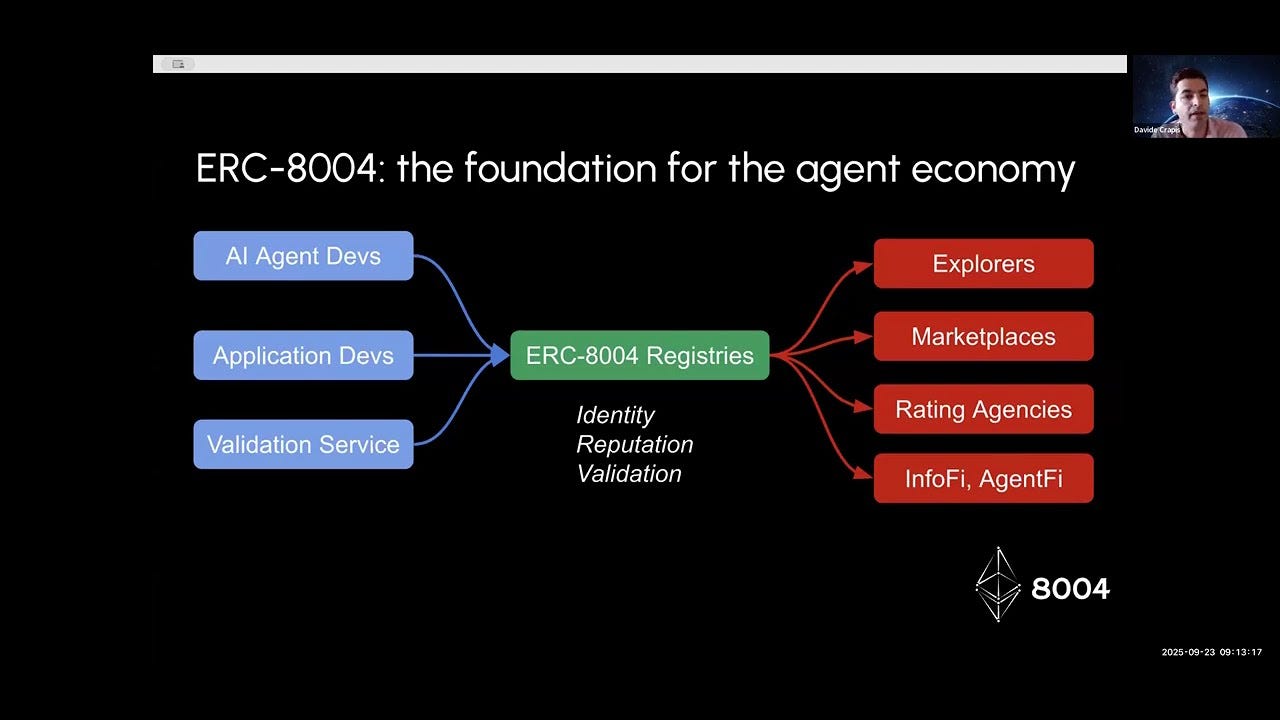

ERC-8004 introduces a neutral set of on-chain registries to solve that based on Identity, Reputation, and Validation.

Each agent receives a portable on-chain identity as an ERC-721 token, an NFT representing a machine. This token points to a registration file describing the agent’s name, skills, wallet, and endpoints. Because it’s standardized and on neutral infrastructure, any marketplace or explorer can index it.

On top of that, ERC-8004 brings structured reputation and validation. Agents can leave feedback for one another, tag it by task, and link it to economic proofs of payment (x402 – short for EIP-402, a cryptographic receipt that ties the on-chain payment to an off-chain interaction). For higher-assurance use cases, validators can confirm outputs through hardware enclaves, staking mechanisms, or zkML verification. In short, an open ratings and audit layer for autonomous agents.

This standard creates the plumbing for a machine-to-machine economy. It builds a world where agents can trust others when negotiating, transacting, and improving, without the need for human gatekeepers. It’s the logical continuation of what blockchains are doing for money and contracts — removing the platform middlemen between AI agents.

So far, over a hundred teams are reportedly building on the spec.

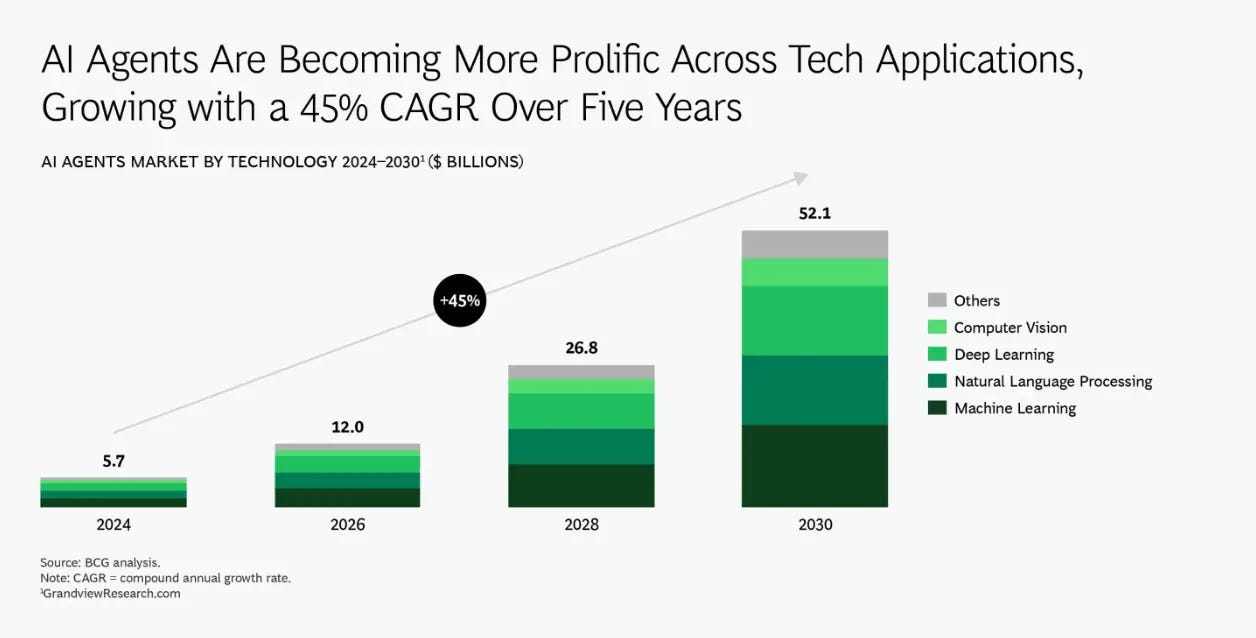

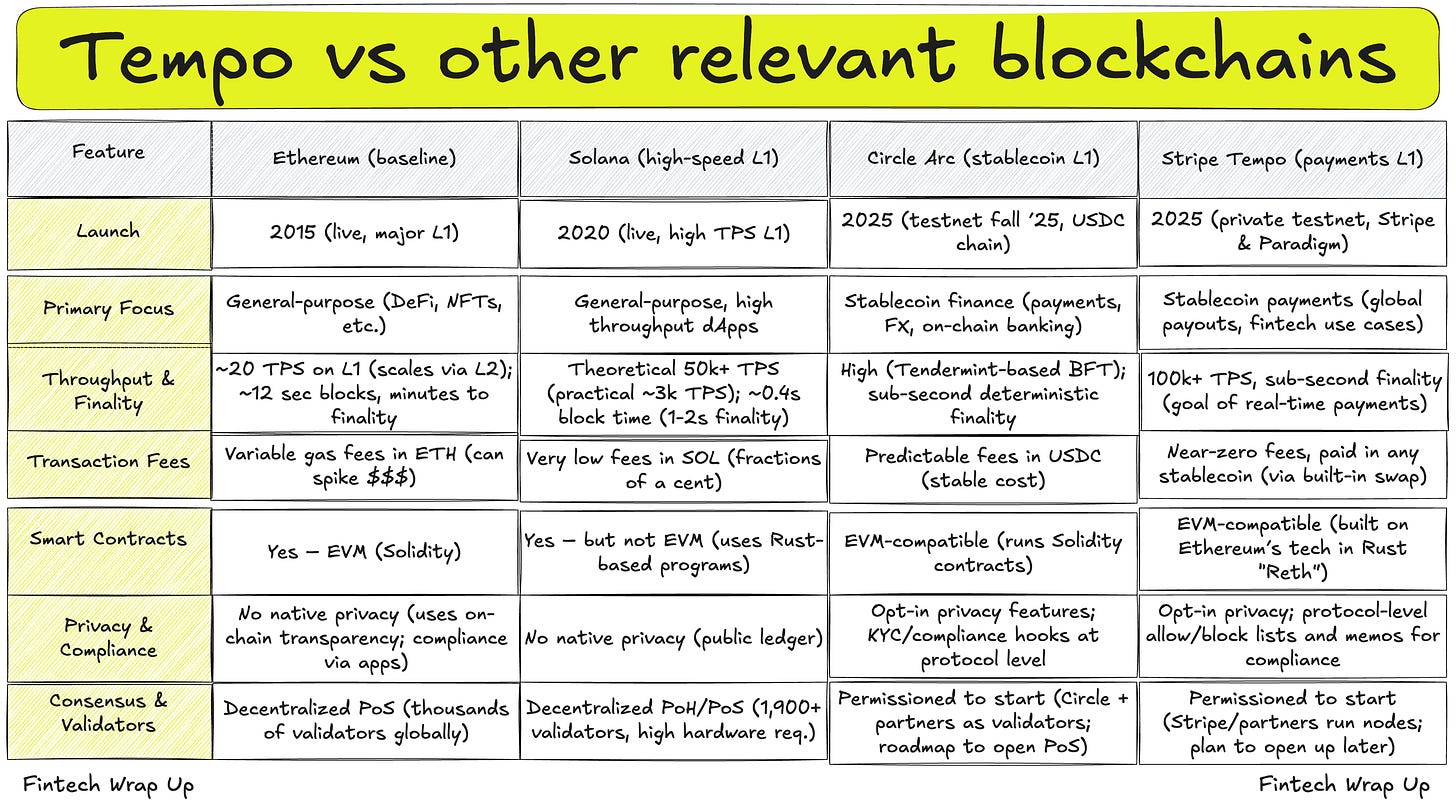

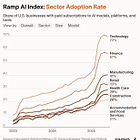

The release lands amid gigantic investments into the infrastructure underpinning the AI economy. Tempo, a payments-oriented layer-1 blockchain, just raised $500 million at a $5 billion valuation. Thinking Machines, an AI startup founded by former OpenAI leadership, raised $2 billion at $12 billion. We are seeing the largest rounds ever going into both AI and Crypto “startups”.

Tempo is constructing a closed payments network optimised for stablecoins and real-world finance — effectively a corporate version of what Ethereum once promised: high-throughput, low-fee settlement rails for global transactions. In Tempo’s world, agents could handle payments at machine speed, but within a private ecosystem controlled by its validators and fee model.

ERC-8004 could give that ecosystem an open discovery and reputation layer. Rather than Tempo defining which agents or merchants are approved to transact, Tempo could integrate ERC-8004 registries so that any verified agent with a public on-chain identity could plug into its payment network. It would turn Tempo from a closed settlement layer into a programmable one, interoperable with the broader Ethereum agent economy.

Thinking Machines operates a layer above. Its goals are still opaque, but there are products around training models to be more resilient and flexible. That can help populate the Internet with autonomous agents that can reason, collaborate, and transact. Today, those agents exist in closed, vertically-integrated environments.

By adopting ERC-8004, Thinking Machines could build training tooling for the open economy: each model or agent would be discoverable and verifiable on-chain, carrying an ERC-721 identity token and building real economic reputation through x402-verified interactions. In practice, that means a Thinking Machines agent could contract a data-provider agent on Ethereum, pay via Tempo or another chain, and post the result back on-chain without human mediation.

In short, ERC-8004 could unlock programmable markets. It gives autonomous agents the capacity to contract, settle, and build reputation on-chain, precisely the ingredients that made DeFi work for humans.

For fintech, the near-term impact is small; few businesses will replace APIs with agents overnight. But once agents can prove identity, reputation, and payment, they can handle tasks from credit scoring to trade execution without a platform middleman.

👑 Related Coverage 👑

Video Interview: From Roboadvisors to Stablecoins

Check out the latest interview with Lex below:

Analysis: Binance’s Flash Crash Exposes $40B Market Fragility

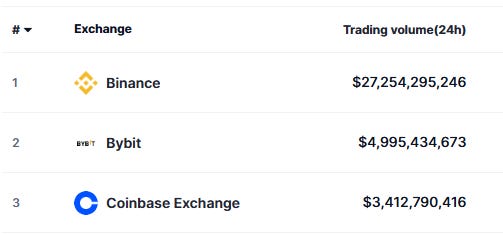

We examine the pendulum between centralization and decentralization in financial markets, using Binance’s growing dominance as a case study in the cost of monopoly.

Binance’s scale and liquidity have made it the indispensable venue for global crypto trading, yet this concentration of power introduces fragility and systemic risk. The October 2025 flash crash, which wiped out up to $40B in crypto value due to Binance’s oracle and liquidity failures, demonstrates how even high-performing monopolies can destabilize entire markets.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Tempo, Stripe’s new blockchain, hits $5B valuation in $500M funding round - Cointelegraph

Crypto Exchange Gemini Launches Solana-Themed Credit Card With Auto-Staking Rewards - CoinDesk

DeFi and Digital Assets

Polychain Capital leads $110 million investment to kickstart a Berachain crypto treasury - The Block

Solana co-founder Anatoly Yakovenko is designing a perps DEX: GitHub - The Block

Ripple-Backed Firm Plans SPAC, Raising $1B to ‘Create the Largest Public XRP Treasury’ - CoinDesk

Andreessen Horowitz’s crypto arm invests $50 million in Solana staking protocol Jito - Fortune

Blockchain Protocols

⭐ Kalshi secures over $300 million as interest in prediction market platforms grows - Reuters - Reuters

Solana founder brews up new perp DEX ‘Percolator’ - Cointelegraph

NFTs, DAOs and the Metaverse

⭐ OpenSea pivots to multi-chain crypto trading hub - The Block

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.

Couldn't agree more. This exploration of ERC-8004 and the potential for AI agents to truly interact is just mind-blowing. It really makes me wonder about the new kinds of complexities and ethcal questions that will emerge from a machine economy.