AI 101: How financial companies can build AI Agents

60% of Finance already is subscribed to AI services according to Ramp

Hi Fintech Futurists —

Today’s agenda is below.

AI: Agents emerged as the next step towards efficient machine systems in finance. By autonomously pulling data, invoking APIs, and iterating strategies, they will soon make decisions on our behalf. Practical uses span the whole spectrum of finance. Founders and teams should go through the process of building an agentic system for themselves. Today, we discuss how to approach this process.

LONG TAKE: Programmable money comes to Fiserv and Shopify

PODCAST: Tokenizing $3.6T of real world assets on Canton Network, with CEO Yuval Rooz

CURATED UPDATES: Machine Models, AI Applications in Finance & Investment Outlook

To support this writing and access our full archive of IPO primers, financial analyses, and guides to building in the Fintech & DeFi industries, see subscription options here. Our current price point is only $2/week.

In Partnership

Persona is a digital identity platform that has stopped over 75 million AI face spoofs in 2024 alone. Fight fraud and convert users, whether you’re processing loans, issuing credit cards, automating account openings, or any other use case. Make sure to check out Persona below.

AI has Product Market Fit

AI agents have become a necessity for businesses competing in today’s economy. We are deep into 2025 — well past using AI models for simple text responses to text prompts.

So, how do we begin to take advantage of this tech ourselves?

Getting started doesn’t require a computer science PhD. What you need is patience to build a thoughtful strategy. Here are our recommended steps —

Identify a specific workflow or task to automate. Focus on a financial task that is repetitive, data-intensive, or time-consuming. Good areas to focus on will be generating budget forecasts, categorizing expenses, processing invoices, or monitoring compliance checkpoints. Without a clearly defined workflow, you will fail.

Gather the data and tools that your AI agent will need. Assemble sample data for the task (transactions, financial statements, customer data, etc.) and ensure you have access to any systems the agent needs to interact with (APIs for financial tools, databases, spreadsheets etc.). This is where the importance of Model Context Protocol (MCP) comes in — see here.

Ensure that regulatory and security compliance is covered in the system. Proprietary data within financial firms is protected by regulation. When building an agent, companies have to ensure private data is not shared with any external systems that can be accessed by others outside of the company. Solutions like Super Protocol have emerged to maintain privacy and confidentiality.

Leverage existing AI models. The brain of the agent will be a core model provided by OpenAI, Anthropic, Meta, DeepSeek, or Google. Each has different strengths and weaknesses. For example, OpenAI’s GPT-4 is known for broad knowledge and strong reasoning, while Anthropic’s Claude can handle complex instructions well, and open-source models like Meta’s LLaMA could be used if you need more adaptability in your system.

Use an agent framework to tie everything together. Frameworks like LangChain help in building chains of reasoning and integrating tools with your chosen models. Other libraries like AutoGen or DSPy provide templates for creating autonomous agents with memory and the ability to handle multi-step workflows.

Most importantly, finish with testing. Set up basic guardrails through a testing phase (e.g. limit an agent from executing financial trades above a certain amount without approval, or have it flag questions for human review). Early testing with real data will reveal where the agent makes mistakes.

Where Can AI Agents Help in Finance?

Not every problem needs an AI agent, but finance workflows offer some key early use cases.

Wealth Management & Investing: AI agents can function as digital investment advisors to analyze portfolio data and assess risk, helping to suggest trades and rebalance portfolios. This is the return of the 2010s roboadvisor theme, but with deeper personalization.

Fraud Detection & Risk Monitoring: AI agents excel at pattern recognition, making them ideal for fraud and risk management. An agent can continuously scan transaction streams, user behaviors, and account activities to catch irregular patterns that might signify fraud. Consider Persona or the recent Plaid products.

Regulatory Compliance (KYC/AML): Compliance workflows can automatically verify identities, cross-reference customers against sanction lists, and assess risk scores for new accounts.

Accounting and Bookkeeping: A finance AI agent can serve to parse invoices and receipts, categorize transactions, reconcile accounts, and generate financial reports. This theme is about the office of the CFO and leveraging automation. See our conversation with Ocrolus.

Cash Flow Forecasting & Financial Planning: Financial planning agents can project cash flows, run sensitivity analyses, and recommend actions to optimise future financial flows. Analyst work is subject to AI disruption in general.

We do think that in the long run, financial features will be embedded inside large AI footprints. ChatGPT will be the distribution of *everything*. However, in the medium term, there is meaningful enterprise value to create from optimizing existing business models and deploying these techniques.

Adoption Analysis

The finance sector has seen material adoption of AI tooling, whether by building internally or outsourcing to third parties.

The chart from Ramp below, highlighting industry spending, is shocking. It suggests 57% of financial businesses use AI in some form. The chart after highlights just how performant machines have become at doing human work.

There are many different ways to use “AI”, from implementing machine learning systems for underwriting or fraud prevention, to organizing internal data, to interacting with customers and documents.

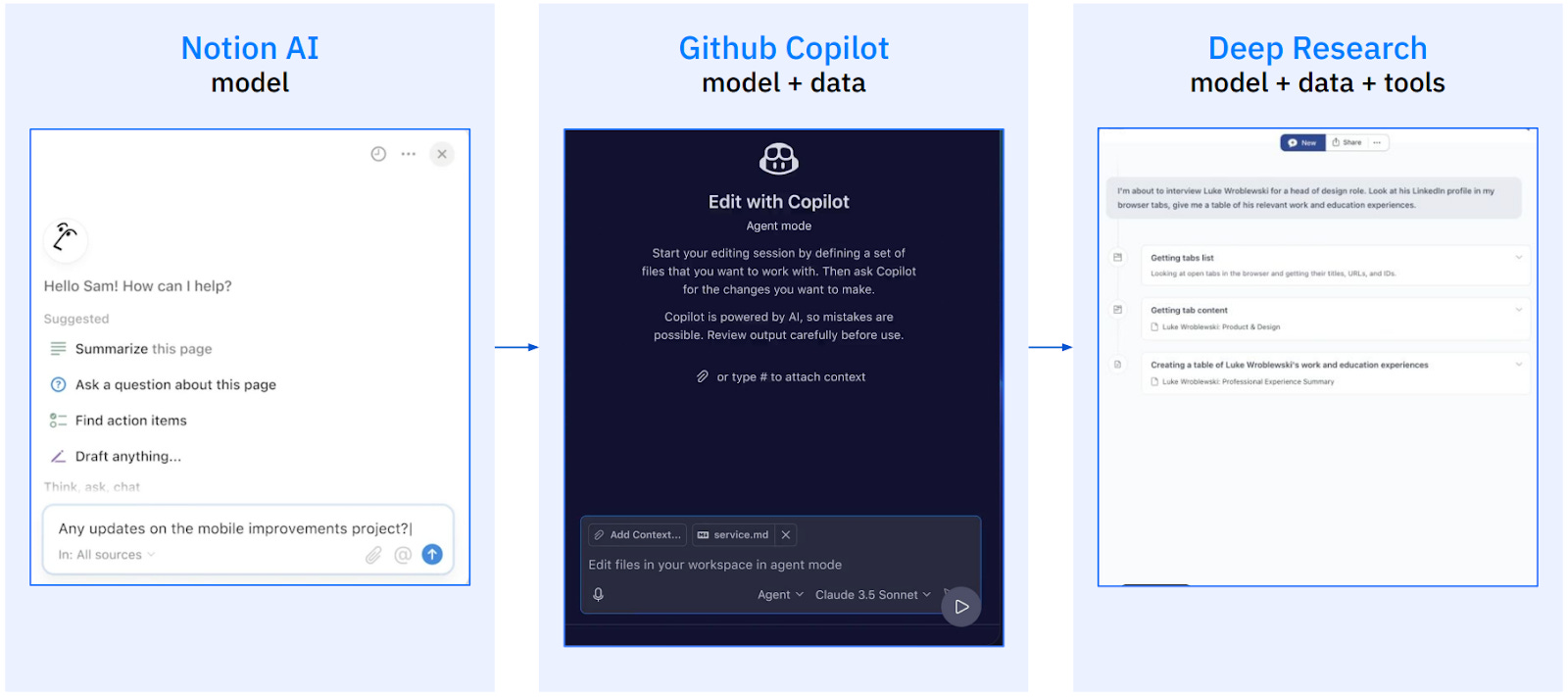

More recently, we have seen a move from (1) standalone model interfaces to (2) the integration of custom Retrieval Augmented Generation (RAG) to (3) Agents. RAG adds a layer of context and reasoning to information, but does not have goals to accomplish. Going forward, companies can get enterprise-level benefits by empowering AI systems to pursue tasks. The term “agent” is a highly debated one, but we think of it as any software actor that can take action on your behalf, and to whom you delegate some goal which it custodies.

Agents can pull in data, interact with other software (via APIs or MCP servers), and continuously adapt their strategy based on feedback, much like a human would. A finance agent could source data from an accounting system, call an API from Plaid or Stripe, write to a database or blockchain, and then trigger an alert for a human action. These integrations enable agents to act on their own decisions. 2024 was the tipping point for many AI models to outperform human ability in specific areas, and it is starting to show commercially.

Global AI usage in FinTech is a $10-15B revenue market, expected to grow 15x by 2033 to around $300B. Citibank reported an expected increase in total global banking profits of 9% or $170 billion from the use of AI by 2028. Our own estimates point much higher, with revenues managed by machines reaching trillions.

Financial products themselves are likely to become higher quality. A joint study from Stanford Graduate School of Business and Boston College Carroll School of Management found that when the portfolios of human managers from 1990 to 2020 were readjusted by an AI analyst using public data, AI outperformed humans in 93% of cases.

As another example, Steven Bartlett recently announced the results of an AI Agent competition he started internally at his media investment company, with meaningful results.

Every entrepreneur right now should be exploring a similar strategy — build more efficient systems and upskill the team to work with AI.

Build vs. buy — most choose to buy

There is a natural question about continuing to build in-house vs. outsourcing to specialised AI vendors. Building your own AI agent offers control of the system — one can tailor the agent exactly to existing processes, ensure data stays within company systems, and develop unique ownable IP. There are also reasons to leverage third-party AI solutions — speed to market, improved fragility at scale, and continuous specialist expertise are resolved by working with external vendors.

More and more businesses are turning to buying from third parties over building themselves. This is why vertically focused AI distribution apps are likely to hold value over the next 12-24 months and be acquired by large AI companies, like the $3B acquisition of Windsurf.

You can see this come through the revenue data of Anthropic and OpenAI, as the more developer-focused Claude keeps pace using a B2B business model. OpenAI is annualizing at $8B, most of which comes from consumers. Anthropic is also growing quickly, from $1B to $4B in ARR this year, showing demand from enterprise.

The ecosystem of AI-focused start-ups is also growing to support the needs of Fintechs, with plenty of teams offering AI-as-a-service for specific finance functions. We have said this before and will say it again. There is no time like now to learn how to implement AI.

👑Related Coverage👑

Blueprint Deep Dive

Analysis: Programmable money comes to Fiserv and Shopify (link here)

Programmable money is evolving. We examine Shopify’s integration of USDC payments via Coinbase’s Base Layer-2, leveraging programmable payment flows like escrow-based captures and refunds that mirror legacy e-commerce logic. Meanwhile, Fiserv’s upcoming launch of FIUSD on Solana, backed by Paxos and Circle, shows how core banking infrastructure is bridging to blockchain, with 24/7 settlement and embedded compliance tools.

The broader trend is clear: the future of money lies in programmable logic and real-time interoperability, with stablecoins acting as the foundational layer for both fintechs and legacy players.

🎙️ Podcast: Tokenizing $3.6T of real world assets on Canton Network, with CEO Yuval Rooz (link here)

In this episode, Lex Sokolin speaks with Yuval Rooz, CEO and co-founder of Digital Asset, about the company’s transformation from its early institutional blockchain experiments to launching the Canton Network - a purpose-built, privacy-enabled smart contract platform designed for financial markets.

Curated Updates

Here are the rest of the updates hitting our radar.

Machine Models

⭐ Data Mining: Practical Machine Learning Tools and Techniques - By Ian H. Witten, Eibe Frank, Mark A. Hall, Christopher J. Pal, James Foulds

⭐ New method efficiently safeguards sensitive AI training data - Adam Zewe

A Comprehensive Review of Advanced Machine Learning Techniques for Enhancing Cybersecurity in Blockchain Networks - Mukesh V, Electronics and Communication Engineering

Machine Learning in Sports: Open Approach for Next Play Analytics - Keisuke Fujii

AI Applications in Finance

⭐ A comprehensive review on financial explainable AI - Wei Jie Yeo & Wihan Van Der Heever & Rui Mao & Erik Cambria & Ranjan Satapathy & Gianmarco Mengaldo

⭐ AI is transforming finance, CFOs say. Here's how - Marie Penelope Nezurugo (World Economic Forum)

⭐ AI’s Next Leap: 5 Trends Shaping Innovation & ROI - Morgan Stanley

How AI Is Changing Corporate Finance in 2025 - Bruno J. Navarro

Does Artificial Intelligence (AI) enhance green economy efficiency? The role of green finance, trade openness, and R&D investment - Qiang Wang & Tingting Sun & Rongrong Li

Investment Outlook

⭐ Private Equity Outlook 2025: Is a Recovery Starting to Take Shape? - Bain & Company

⭐ Global Venture Capital Outlook: The Latest Trends - Bain & Company

⭐ Global Private Markets Report 2025: Braced for shifting weather - McKinsey & Company

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our new AI products newsletter, Future Blueprint. (Don’t tell anyone)

Read our Disclaimer here — this newsletter does not provide investment advice

Contributors: Lex, Laurence, Matt, Farhad, Daniel, Michiel, Luke

For access to all our premium content and archives, consider supporting us with a subscription. In addition to receiving our free newsletters, you will get access to all Long Takes with a deep, comprehensive analysis of Fintech, Web3, and AI topics, and our archive of in-depth write-ups covering the hottest fintech and DeFi companies.