DeFi: The rise of DeFi banks, and Ether.fi's strategy beyond $5B of assets

What's the difference between a neobank and a DeFi bank?

GM Fintech Futurists,

Today we highlight the following:

DIGITAL ASSETS: Deep dive into ether.fi’s product suite and financials

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet). For $3 per week, you get institutional-level research delivered to your Inbox.

Call for Companies

If you are building at the intersection of AI, Fintech, and Web3 and looking for investment, share your materials with us at 👉👉👉 Generative Ventures here.

DIGITAL ASSETS: Deep dive into ether.fi’s product suite and financials

Despite all the recent stablecoin activity, it has been a dreary start to the year for many DeFi protocols. DEX volumes are down from $500B to $200B between January and April. This is in part a result of the Solana-led speculation in memecoins hitting a brick wall.

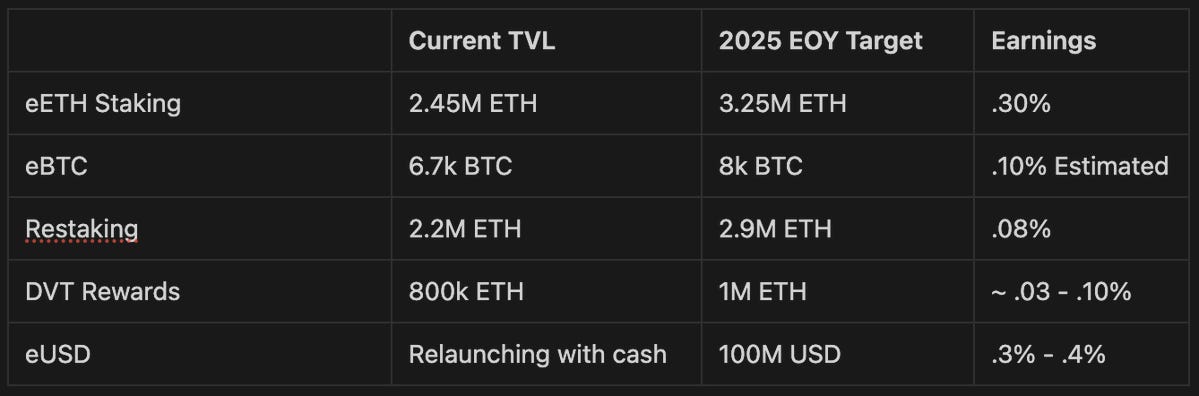

Also down is Total Value Locked (TVL/AUM), dropping from $120B to $100B over the same period. One company feeling the pain is Ether.fi, the ETH liquid re-staking protocol, with TVL dropping from $8B to $5B this year. However, it’s worth noting that this drop is lower than the 50% drop in the price of ETH in 2025, and ETH-denominated supply is at an all-time high.

Most recently, the company shared a bold new vision of building out a DeFi bank, and we are excited to go deeper into the story about what that means, and its fundamentals.

Ether.fi began its journey offering non-custodial liquid staking, enabling users to delegate ETH to node operators while retaining full control of their keys by leveraging distributed validator technology (DVT). This foundation allowed Ether.fi to capture users and scale TVL into the many billions. Its liquid staking derivative / liquid restaking token (LSD or LRT) is integrated into over 400 DeFi protocols, deployed across 17 chains, and used by over 200,000 wallets. Our initial research on the category is here:

The company receives the bulk of its earnings from this offering. Staking revenues are attained by taking a share of yields, with the exact amount varying depending on the asset type, total TVL, and the underlying yield market.

The project is expected to generate $26MM in revenue in 2025. The token trades at a $500MM fully diluted value, suggesting a 20x multiple on staking revenue alone. But we see a number of other meaningful revenue sources coming online.

Using staking as a springboard, Ether.fi then launched its second product, Ether.fi Liquid. This offering provides automated DeFi strategy vaults designed to optimize yields on deposited assets, including ETH, BTC, and stablecoins. Users deposit their assets into Liquid vaults, which then allocate funds across multiple DeFi protocols to maximize returns. Earnings are automatically compounded within the vaults, enhancing yield over time, while still retaining the flexibility to withdraw at any time.

Ether.fi’s Liquid draws revenue from management fees, partner vault agreements, and structured yield-sharing agreements. Revenue differs by asset class and vault design, with Liquid products generating roughly 2.5–3x more per dollar than pure staking. The current lineup includes ETH, BTC, and USD vaults across several chains, with fees between 1.25% and 2%. The estimated revenue from Liquid activity is $28M in 2025.

This is the evolution from an ETH staking protocol to a broader, aggregated yield capturing service that operates across DeFi, rather than within its specific silo.

Their latest product, launched in late April, is Ether.fi Cash. This is (potentially) the final phase of Ether.fi’s plan for creating a vertically integrated crypto-native alternative to traditional banks.

Ether.fi Cash is a crypto-native credit card and smart wallet that allows users to spend against their staked ETH without selling it. By using their eETH or other on-chain collateral as backing, users can access a revolving credit line in stablecoins or fiat, which is usable via a Visa credit card.

The product maintains the user's staking position and yield while enabling real-world spending, bridging DeFi assets with traditional payment rails. When a purchase is made, the system automatically initiates a loan using the user's crypto assets as collateral, providing immediate settlement in fiat currency. Repayment is flexible; users can repay the borrowed amount at any time without monthly minimums, and they have the option to use staking rewards to cover repayments, allowing them to maintain their crypto positions while accessing liquidity for everyday spending.

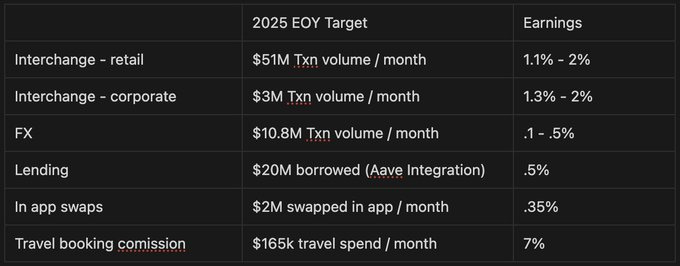

Revenue is earned from interchange fees, foreign exchange margins, and on-chain activity such as swaps and lending. It ties directly to card usage across both individual and business users, with additional income from in-app swaps, lending spreads via an Aave integration, and travel-related commissions. With increased user engagement and marketing in the second half of 2025, projected revenue is $4 million over the remainder of the year. Continued growth in 2026 is expected to push annual revenue beyond $60 million in the product’s second year.

DeFi Bank or Neobank

Now that we’ve seen how this wraps up into a comprehensive solution geared towards crypto natives, the question is how does this shape up against traditional financial institutions and neobanks? First, on AUM alone, eEther.fi would already be considered a top 150 US financial institution. Note that it was only founded 2 years ago.

Second, Ether.fi is not a traditional bank, nor does it aspire to get a license — the service is non-custodial and decentralised. Ether.fi won’t refund you if you lose your keys. It is a technology platform and not regulated as a financial institution. Its main deposit base is reliant on the demand for staking of a large crypto-asset like ETH, rather than cash deposits from employment or operations.

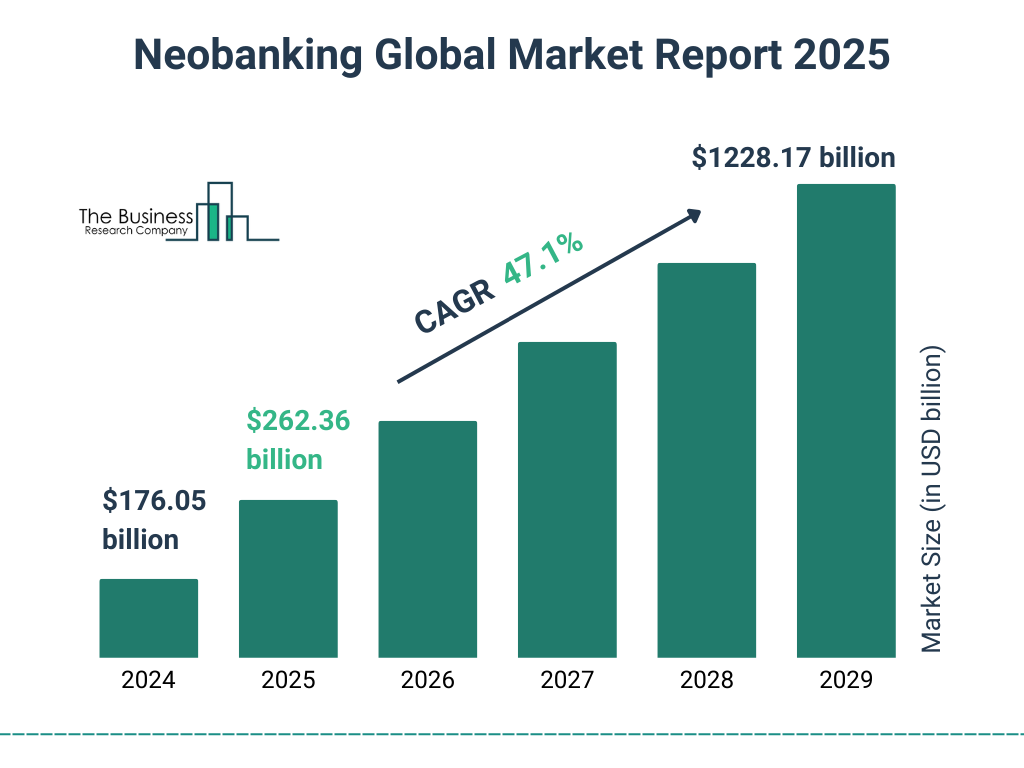

Now, let's take a look at neobanks. Neobanks surged in popularity due to lower fees and more customer-centric Web2 product designs. This is a result of structurally lower distribution and servicing costs, and leaner teams that are unburdened by a physical footprint.

Last week, we covered how Revolut and other neobanks have gotten to scale and profitability by addressing the needs of Millennials. In less than 10 years, Revolut captured 53MM customers and $4B in revenue. Others like Chime, Cash App, and SoFi are rumoured to total up to 70MM users. We highlight the key metrics below.

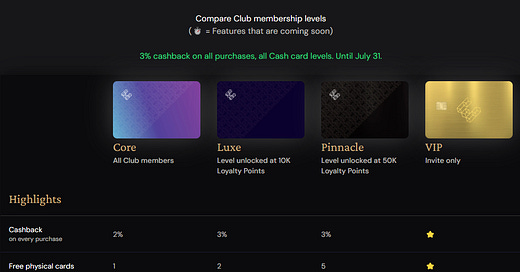

The demand for low costs and good cashback is high. Revolut caters to this with free international transactions up to £1000, after which they costs £5. Its cashback on purchases is 0.4-1.2%, depending on whether you pay for one of the premium services. In comparison, Ether.fi may not support transfers directly, but blockchains do, nowadays, for less than a cent.

Its cashback is also much higher, at 3%.

How is this possible?

DeFi “banks” are even leaner than neobanks, as they are non-custodial and can leverage live, transparent blockchain data. Public blockchains lower the manufacturing costs for financial products. In contrast, Revolut spent £794M in 2024, up from £498M in 2023, on its 10,133 employees. Ether.fi is a 25-person team. These lower costs, once again, are passed onto users.

There are two other distinct advantages: (1) DeFi banks can aggregate entire crypto portfolios, where it is cheaper to move money in and out of investment strategies, and (2) they are self-custodial (think narrow banking) and customer deposits are not rehypothecated, removing counterparty risks that would otherwise be passed onto the user.

However, self-custody brings its own sizable cybersecurity risks.

Economics

Let's look at the financials.

Currently, Ether.fi expects its customer lifetime value (CLV) to fall between $500-$1000 for retail and $1200-$1800 for business customers. With Revolut valued at $45B with 50MM customers, the estimated CLV is $900. So the two are competitive.

In 2024, Ether.fi ended the year with $26MM in revenue and $1.9MM in operating profit. Revolut had only managed to get £2.4M in revenue in its second year, a tenth of Ether.fi. In 2025, it is targeting $65-96MM in revenue with 30% profit margins and a 25% revenue buyback for ETHFI. With 8 million users, it could reach $1B in revenue. By comparison, Revolut had attracted 300,000 users in its first year, but now has 50MM+ users 9 years later.

Comparatively, Ether.fi is able to offer higher returns for users and has higher profit margins, but is focused on a more niche market. It plans to change this in the next year by beginning to focus first on capturing the remainder of the DeFi market (estimated at up to 10 million users and 3-5K companies), before expanding to CeFi users (c. 30-50MM users) and finally focusing on the much broader neobank market, which is valued at $176B.

Overall, despite the recent market downturn, Ether.fi’s margins and revenue look attractive, particularly when compared to neobanks. By comparison, Bunq took a decade to achieve its first profitable quarter. Fewer than 5% of neobanks ever reach profitability.

The inherent leanness of blockchain teams and a clear revenue model are an advantage. The non-custodial focus is a clear differentiator, making the products largely complementary rather than directly competitive.

The risk for Ether.fi and similar companies is neobanks moving into non-custodial solutions, before crypto-native projects can reach scale. Such a cultural shift, however, is difficult. Another risk is the inherent volatility of the “deposit” base, especially if it is not denominated in USD but in another currency.

Competition from DeFi protocols is still rampant, but we like Ether.fi’s innovative use of staking yields and loans to enable purchases. There is a risk that such an approach will be copied by competitors, which then becomes a game of who can optimise aggregation best.

One way Ether.fi is countering this pressure is to focus on its token, ETHFI. The token has been under severe sales pressure as the initial token rewards have been farmed and sold off, and the price of ETH itself has suffered.

Going forward, 25% of all revenue is going towards buybacks, creating a group of ardent token supporters that will promote the product for the sake of their investments. Whether it can bring the token back to its last year's highs is to be seen and, naturally, dependent on how many tokens are distributed as rewards and marketing.

👑 Related Coverage 👑

Advertise with the Fintech Blueprint

To reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

Analysis: Mastercard, Visa & Stripe huge push into stablecoin and AI commerce

We examine how stablecoins and AI-driven commerce are converging into the future of digital payments, with players like Visa, Stripe, and Mastercard leading the charge.

Stripe is gradually integrating stablecoins like USDC and USDP into its platform, while both Visa and Mastercard are enabling stablecoin usage across their network through partnerships with wallets, exchanges, and fintechs, and launching “agentic tokens” for AI-powered payments. These initiatives reflect a growing belief that both onchain infrastructure and intelligent agents will transform retail and B2B payments, potentially channeling trillions in future commerce. Though this transformation is still early, the payment layer is likely to be one of the biggest winners, with $10B in revenue per trillion dollars of processed volume at stake.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Apple Eases NFT, Crypto Rules for iOS Apps Following Antitrust Ruling - Decrypt

Nasdaq-listed freight firm building $20m Trump memecoin war chest - DLNews

Court Bars OFAC From Reinstating Tornado Cash Sanctions - Decrypt

US Bitcoin ETFs bought 6x more than BTC miners produced last week - CoinTelegraph

DeFi and Digital Assets

⭐ Stacks' STX Is Week's Best Performer as Bitgo Link Seen Boosting Institutional Use - CoinDesk

Dinari Raises $12.7M Series A to Bring U.S. Equities Onchain for the World - Dinari

Blockchain Protocols

⭐ Sam Altman’s Eyeball-Scanning Crypto Project Hits the US 'At Last' - Decrypt\

Nous Research secures $50M from Paradigm to build decentralized AI on Solana - Cointelegraph

NFTs, DAOs and the Metaverse

⭐ Exclusive: Camp Network raises $25 million to help firms collect AI copyright royalties using blockchain - Fortune

Ethereum NFT Horse Racing Game 'Zed Run' Reborn on Base as 'Zed Champions' - Decrypt

Sui Gaming Stablecoin Launching for SuiPlay0X1 Handheld, Playtron Ecosystem - Decrypt

'MapleStory N' Avalanche Crypto Game Launching This Month - Decrypt

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.

Nice one... Please continue with these protocol deep dives.