Digital Wealth: $130B Alts manager Blue Owl selling through iCapital and Allfunds

Owl Rock, Blue Owl's direct lending platform with $65B+ in AUM, provides investors with risk-adjusted returns by originating, executing, and managing investments

Hi Fintech Futurists —

Welcome back to Digital Wealth. Today we highlight the following news —

NORTH AMERICA: Blue Owl Capital Inc. Expands Private Wealth Distribution Channel Through iCapital and Allfunds

EMEA: yeekatee Receives $1.9MM In Pre-seed Financing

ASIA PACIFIC: Endowus Partners With iCapital On Private Markets

Thanks as always for your time and attention. To dive deeper into our covered topics, check out the premium options below.

North America News

⭐🇺🇸 Blue Owl Capital Inc. Expands Private Wealth Distribution Channel Through iCapital and Allfunds - PR Newswire, January 18, New York

Blue Owl Capital, an alternative asset manager with $130B+ in AUM worth around $17B on the public markets, has expanded its private wealth distribution to iCapital and Allfunds, B2B wealthtechs for the fund industry. With this partnership, Allfunds' clients will access Blue Owl’s direct lending strategy, Owl Rock.

Owl Rock, Blue Owl's direct lending platform with $65B+ in AUM, provides investors with risk-adjusted returns by originating, executing, and managing investments, including senior secured, subordinated, or mezzanine loans and equity-related instruments. The platform is powered by iCapital, which has $150B in assets across 1,000+ funds.

Owl Rock's investment strategies use business development companies (e.g., OWL ROCK TECHNOLOGY FINANCE CORP - ORTF) that focus on originating loans to and making debt investments in high-growth tech and software companies. BDCs are a very particular, subsidized structure. Erik Bissonnette, managing director at Owl Rock, describes the investment philosophy as a downside-protected approach, focusing on significant and stable software assets, rather than early to mid-stage opportunities.

Today, banks are slowing corporate underwriting given the pressures on investment banking divisions — Hyman Minsky's theory about periods of economic (in)stability comes to mind, as capital returns to being a more a scarce resource. Public SaaS company valuations are down by 53% from Q3FY2021 to Q1FY2022, and these companies are re-evaluaing their growth expectations.

As a result private equity companies have been working to take these cashflow-generating businesses private. To do so, PE firms need debt — debt that the bank won't give them now. And that's exactly where Owl Rock comes in.

🇺🇸 Broadridge Extends Digital Wealth Platform Partnership with IGM Financial - PR Newswire, January 18, New York

🇺🇸 Schwab Sends Settlement Checks to Robo-Advisor Clients - Think Advisor, January 17, Texas

🇺🇸 Reverence Capital Partners Selects CAIS for Efficient Access To The Independent Wealth Channel - PR Newswire, January 18, New York

🇺🇸 Merrill Grows Advisor Headcount 2% Despite Market Drop - Wealth Management, January 13, New Jersey

🇨🇦 Mako Fintech and PortfolioAid Announce Strategic Partnership To Harmonize KYC & KYP - Businesswire, January 17, Montreal

EMEA News

⭐🇨🇭 yeekatee Receives $1.9MM In Pre-seed Financing - Fintech Global, January 18, Zurich

Zurich-based social investing platform yeekatee raised $1.9MM led by Avaloq co-founder Ronald Strässler. Last year, we covered Shares, a similar platform in the UK, which raised $90MM and, as of last July, had 150,000 users. The social investment app space saw a surge during the pandemic as many individuals took advantage of new zero-commission mobile apps to trade and invest. Charles Schwab and E-trade had to revise existing investment models to better compete with platforms such as Robinhood, which led the way with zero-commission and fractional shares.

yeekatee enters a crowded Europe where platforms like Freetrade, IG, Trading212, and eToro own a large share of the investing app market. While competition will pose a significant revenue challenge, it will benefit from not being UK-based, where payment-for-order-flow (PFOF) has been banned since 2012 and cannot be used to generate income. Robinhood’s reliance on PFOF is well known.

Platforms outside of the UK that attempt to become the Euro-version of Robinhood should review Robinhood’s challenging November 2022 report — (1) Monthly active users (MAU) are down 33% year over year; (2) assets under custody (AUC) are down 35%; (3) total equity trading volume is down 54%. Since its IPO, Robinhood’s market cap has fallen by 70% — so there’s also the benefit of staying private longer.

Studies conducted by the SEC and FINRA found that individual investors who use social media platforms to make investment decisions are more likely to be less financially literate, have lower levels of income, and are more likely to invest in high-risk products (queue AMC and GME), and more likely to be targeted and fall victim to investment fraud. Momentum trend investing is a fashionable but not a reliable long-term strategy.

Social investment platforms offer a convenient and simplified view of the markets, but investors should be aware of the potential risks (see $BUZZ and $SOCL). Play money should be separate from the broader long-term asset allocation.

👑 Related Coverage 👑

🇩🇪 FNZ Acquires Germany's Fondsdepot Bank - Finextra, January 16, Munich

🇪🇪 Sustainable Investment Startup Grünfin Scores €2MM - Fintech Global, January 18, Tallinn

🇴🇲 Ahlibank Llaunches Brand New Digital Wealth System For Its Wealth Management Customer - Zawya, January 17, Muscat

Asia Pacific News

⭐🇸🇬 Endowus Partners With iCapital On Private Markets - Fund Selector Asia, January 18, Singapore

Digital wealth platform Endowus has partnered with iCapital, an alts-focused B2B fintech with $150B+ in AUM. Endowus' accredited investors in Singapore and Hong Kong will have access to a range of private market funds powered by iCapital's private markets solutions. In October, Endowus acquired a 60% stake in Carret Private Investments Asia, a Hong Kong-based wealth manager, which was a move towards entering the Hong Kong market.

Besides Endowus's cash investing, savings, pension and retirement plan offerings, the firm provides wealth management solutions to investors with S$1MM+ to invest. The private wealth management service includes a personal wealth advisor and a team of investors who help create a customized portfolio alongside access to 200+ institutional share-class funds and alternatives. As aforementioned, iCapital is the alts incumbent that uses its Portfolio Intelligence model, a cloud-based, ML-powered analytics solution, to provide personalized investment recommendations, starting at $25,000. iCapital also allows clients to conduct due diligence on potential investments, such as reviewing fund documents and tracking the performance of existing portfolio companies.

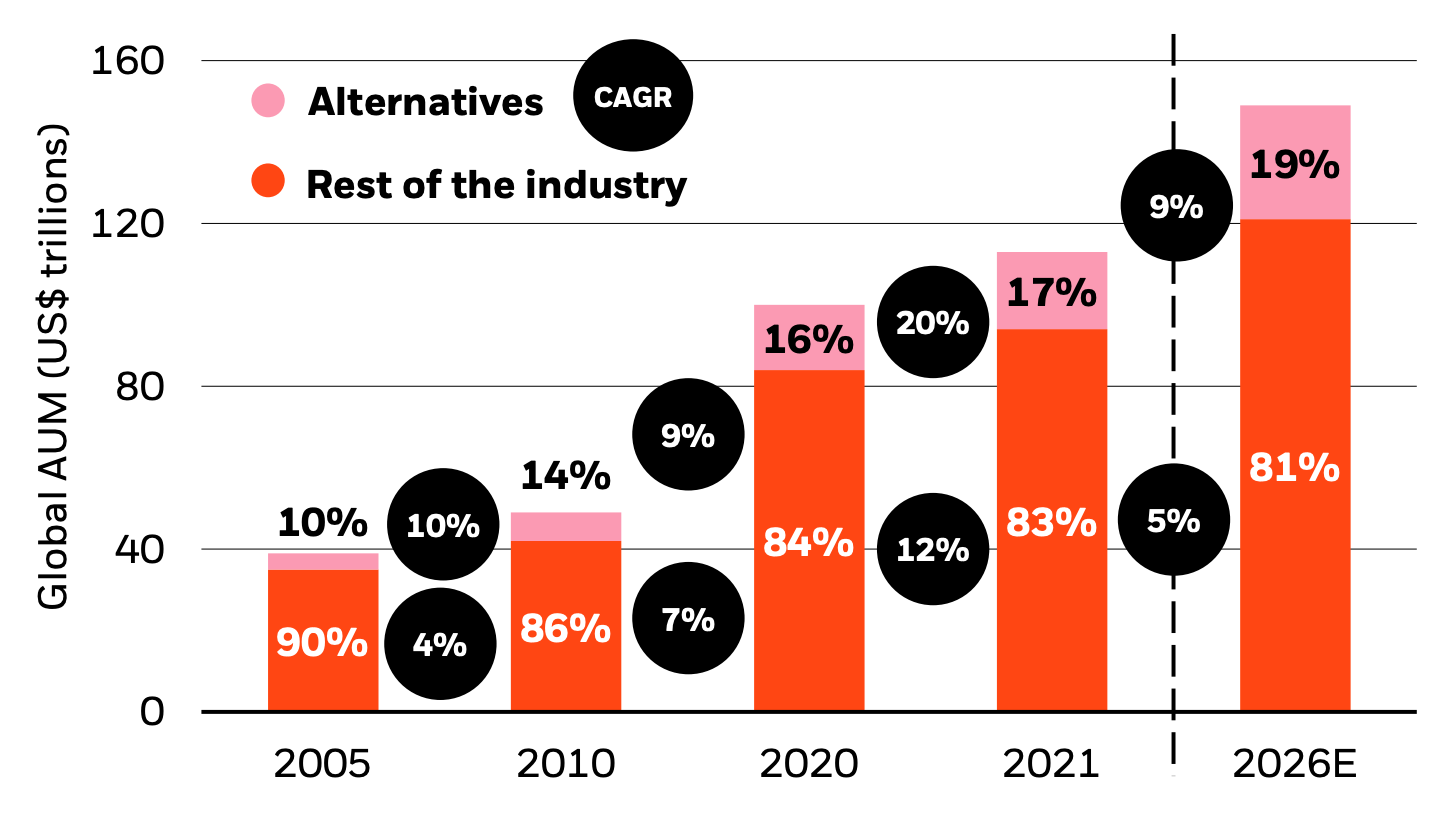

According to BlackRock, the decades-long "Great Moderation" of low inflation, low rates, and globalization has given way to a new era of high inflation, rising rates and supply-driven economies. In 2022, amongst the failures of portfolio heuristics, the 60/40 portfolio was one such casualty. As a result, the upcoming years will garner a lot more investment and focus on the private market sector.

As revenue multiples drop and expected earnings diminish, PE firms will take advantage of lower purchase-price multiples to drive economies of scale. As a result, the alternatives secondary market may grow as LPs seek liquidity options. On that note, companies like Forge, which offer private markets to the public, will also benefit from the shift.

🇨🇳 Soochow Securities Enables Use Of E-CNY In Financial Trading - Finance Feeds, January 18, Suzhou

🇮🇳 Groww Makes Investment In Fintech Startup Digio - VC Circle, January 12, Bengaluru

🇮🇳 Fintech Startup SayF Raises Pre-Seed Round Funding - VC Circle, January 17, Karnataka

Blogs, Webinars, Podcasts

🇺🇸 Rising Need For Wealth Management Services Is Expected To Fuel The Wealth Management Market - Globe Newswire, January 16, Massachusetts

🇬🇧 AdviceBridge Survey Reveals 23% Of Advice Firms Don’t Undertake Research On Tech Solutions - IFA Magazine, January 17, Bristol

🇮🇳 How Wealthtech Is Transforming The Investing Landscape For Individuals - The Financial Express, January 15, Uttar Pradesh

Events & Reports

🇺🇸 Wealth Management Edge - Informa Connect, May 21 - 24, Florida

🇬🇧 Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

🇬🇧Digital Integration In Wealth Management 2023 - Arena International, February 21-22, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.