Digital Wealth: Euronext bids €5.5B for B2B Allfunds investment platform

European-domiciled long-term funds saw net outflows of €130B in 2022, their worst year since 2008

Hi Fintech Futurists —

Happy Thursday! Today we highlight the following —

NORTH AMERICA: Wells Fargo Introduces LifeSync®, A Digital Platform To Help Clients More Easily Plan And Track Their Money

EMEA: Euronext Launches €5.5B Bid For Allfunds

ASIA PACIFIC: SCB Focuses On Digital Bank Strategy

GEOGRAPHIC NEWS CURATION

REPORTS & EVENTS: The Robo Report | Fourth Quarter 2022

Based on your feedback, we know that many of you are interested in reviews of companies or projects highlighted by our community. Leave a comment below with a company of your interest and we’ll do a deeper take on it later!

Digital Wealth Short Takes

⭐🇺🇸 Wells Fargo Introduces LifeSync®, A Digital Platform To Help Clients More Easily Plan And Track Their Money - Businesswire, February 22, California

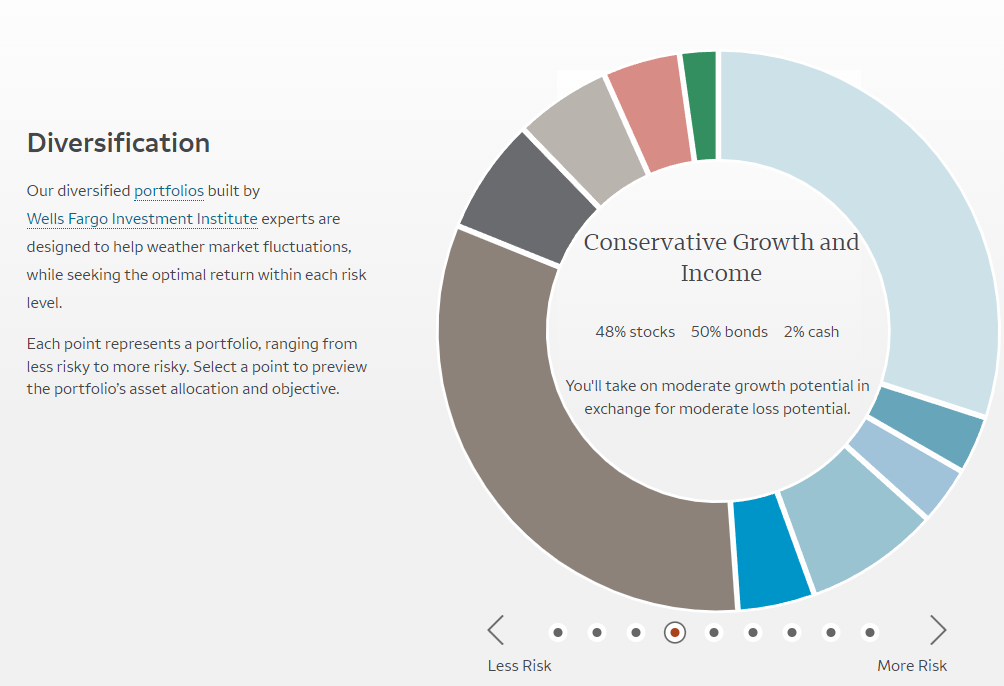

Wells Fargo is launching a new in-app digital platform, LifeSync, for its existing wealth management clients. The latest offering aims to improve the collaboration between advisors and clients, tracking personalized financial goals in real-time.

For context, Wells is the fourth largest bank in the US with total assets of $1.7T and an advisor headcount of 12,000+. In its latest 4Q earnings report, the Wealth and Investment Management division reported $3.7B in revenue and $715M in net income, representing YoY increases of 1% and 27%, respectively.

However since 2017, the Fed has had Wells Fargo operating under an asset cap, prohibiting the bank from growing beyond $1.9T due to various internal scandals, which resulted in significant fines and a loss of customer trust. Spending time on remedying compliance failure, rather than on growth, slows the ability to innovate or launch new products. Meanwhile, competitors like Morgan Stanley and Bank of America have grown client assets to $4.2T and $3.4T, respectively. Conversely, Wells has had to downsize or sell off entire business functions — e.g., it sold its asset management division for $2.1B in 2021.

Wells Fargo faces a digital wealth space that has matured significantly since 2017 and a customer that demands more from their digital relationship manager. Recent investments into Fargo, a virtual digital assistant using Google AI, and the relaunch of roboadvisor Intuitive Investor serve as promising initial developments. It is difficult to tell how much traction these efforts will yield, but they are the right next step for a business trying to modernize and keep up with the fintech state of the art.

👑Related Coverage👑

⭐🇳🇱 Euronext Launches €5.5B Bid For Allfunds - Financial Times, February 22, Amsterdam

Stock market infrastructure company Euronext has made a cash and stock offer of €5.5B to acquire B2B wealthtech platform Allfunds, which services 3,000 fund groups and has €1.3T+ of assets under administration. Euronext is in discussions with Hellman & Friedman and BNP Paribas, who jointly own 46.4% of Allfunds, to gain their support for the acquisition.

Allfunds experienced a turbulent 2022, with assets under administration decreasing 8.6% year on year in Q3, to €1.3 trillion, primarily due to equity outflows totalling €13.7B. Taking out money from risk assets to generate cash was a common theme for investors in 2022. Nevertheless, Allfunds continued its horizontal integration strategy by acquiring digital solutions provider Web Financial Group, data analytics firm instiHub Analytics, and ESG platform Mainstreet Partners.

The acquisition of Allfunds by Euronext is in line with the trend of stock exchanges seeking to diversify their revenue streams — Euronext is reducing its reliance on traditional trading and settlement services, which have become increasingly electronic. The deal also reflects the increasing importance of tech in the fund industry, where we have seen the London Stock Exchange Group acquiring data provider Refinitiv for $27B, Intercontinental Exchange buying mortgage software provider Black Knight for $13.1B and Interactive Data Corporation for $5.2B.

For Euronext, Citi analysts have highlighted their concern about Euronext offering €3.6B in cash without breaching its net debt/EBITDA thresholds. The analysts have also underlined the challenge for the Allfunds board considering an offer much lower than where the value of company was 18 months ago. We must note, however, that European-domiciled long-term funds saw net outflows of €130B in 2022, their worst year since 2008. With the end of the period of great moderation, in which fund investing was prevalent, Allfunds may benefit from the safety brought by the acquisition.

👑Related Coverage👑

⭐🇹🇭 SCB Focuses On Digital Bank Strategy

Siam Commercial Bank (SCB) has unveiled its "Digital Bank with Human Touch" vision. DBS Bank has had similar initiatives, launching its "digibank" app, offering personalized financial advice to millennials.

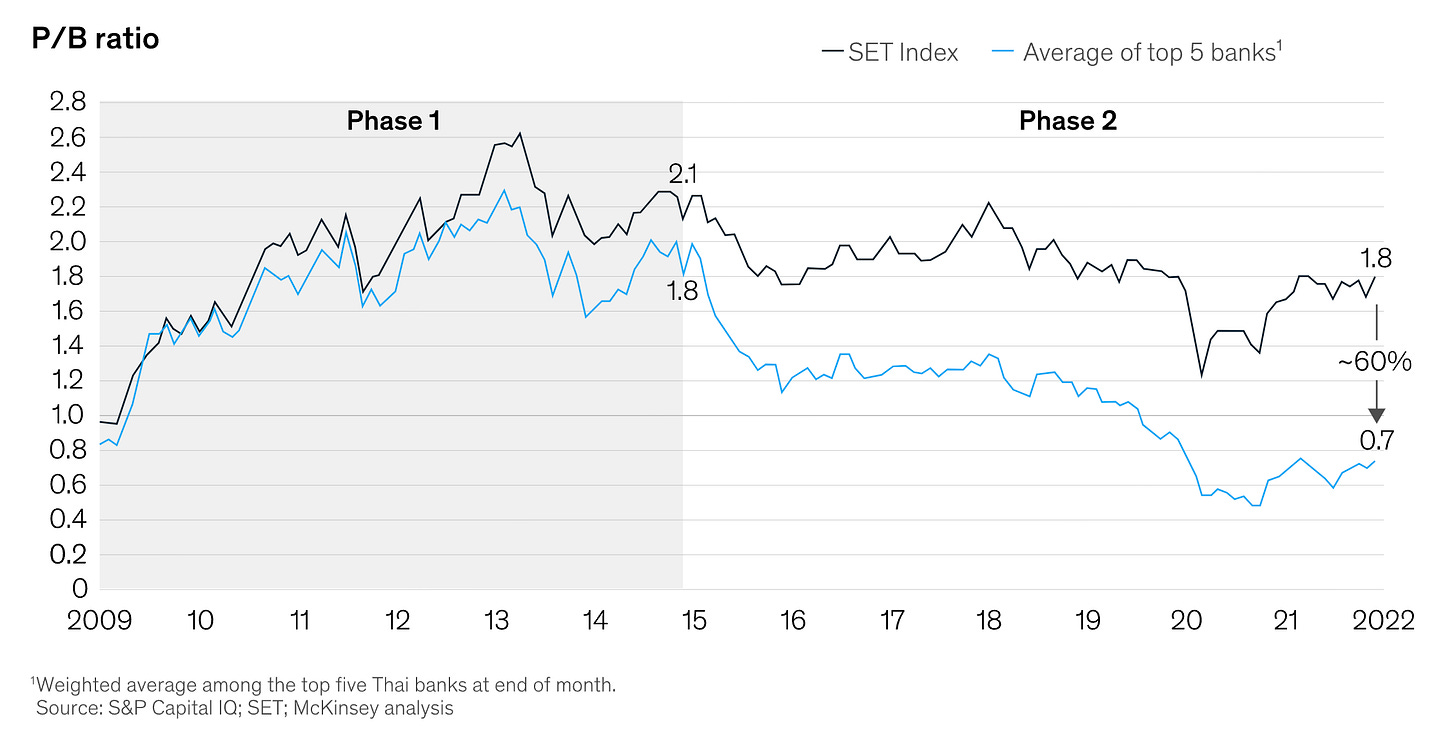

Over the next three years, SCB plans to complete its digital transformation, achieving an ROE of over 10% and lowering its cost-to-income ratio to below 40% by 2025. Thai banking has been challenged since 2015, with ROEs dropping from 14% between 2009-2014 to 7% and getting stuck there. Additionally, the bank aims to increase its share of the wealth wallet market to 40% and allocate an additional 100 billion baht ($2.9B) towards green finance.

The bank is pursuing three stragic initiatives: (1) transforming into a digital bank via the high adoption of financial apps in Thailand; (2) becoming a leader in wealth management by focusing on the "Emerging Wealth" group using digital solutions; and (3) improving the omnichannel service experience by modernizing infrastructure and increasing connectivity between client touchpoints. In other words, more digital distribution and onboarding.

Thailand's banking industry is at a critical juncture, with the country's economy facing a slowdown. As such, Thai banks are adopting new technology, such as AI, cloud, blockchain, and digital assets, to meet changing consumer preferences. Per the McKinsey report linked above, these banks need to shift from a product-centric to an advisory-centric approach, with wealth management, advisory services, and retirement and estate planning, increasing customer engagement, and growing fee-based income.

That said, it can be tough for traditional players to invest a lot in technology and see the returns promised from innovation. Those initiatives takes multi-year commitments, patient investors, and high customer centricity.

Curated News

North America News

🇺🇸 Orion Launches Advisor Academy, A Free On-Demand Learning Platform For Fiduciary Advisors - Businesswire, February 22, Nebraska

🇺🇸 Dynasty Financial Partners And BridgeFT Announce A Strategic Partnership To Make BridgeFT’s WealthTech API The Primary Data Aggregation Partner For Dynasty’s Integrated Technology Platform - Businesswire, February 22, Illinois

🇺🇸 Wealthtech Addepar Introduces New Tools, Data And Access To Insights As Financial Market Shifts Continue - Crowdfund Insider, February 19, New York

🇺🇸 GoLogiq’s Nest Egg Completes Integration Of GPT-3 AI Technology Into Consumer Investing Platform - Globe Newswire, February 21, New York

🇺🇸 QUODD Acquires Xignite To Capture Larger Portion Of Cloud-Native Market Data Industry - Businesswire, February 16, New Jersey

🇺🇸 Groundfloor Surpasses $1B In Investments, Celebrates 10-year-anniversary - PR Newswire, February 21, Georgia

EMEA News

🇳🇴 Bricknode And Quantfolio Team Up To Deliver Digital Wealth Management Tools To The Advisory Sector - Market Screener, February 16, Norway

🇬🇧 Ad Infinitum Capital Seeks To Change The Game For Retail Investors With A Smart Portfolio Program - EIN Presswire, February 15, London

Asia Pacific News

🇸🇬 Digital Assets Platform FalconX Expands Global Presence To Singapore - PR Newswire, February 22, Singapore

Blogs, Webinars, Podcasts

🇺🇸 Apex Fintech Solutions’ Data Highlights Millennials As The Most Active Traders In 4Q; Three-Year Lookback Shows Rise of Self-Directed And Wealth-Tech Traders - Businesswire, February 22, Texas

🇸🇬 McKinsey: Asia’s Booming Affluent Segments Introduce New Opportunities in Digital Wealth - Fintech Singapore, February 17, Singapore

🇬🇧 Trust And Wealth Tech Providers Merge - International Adviser, February 21, London

🇺🇸 Prepare To Meet The New Generation Of Clients - Advisor Perspectives, February 21, Massachusetts

🇲🇾 Singapore Records Highest Fintech Funding In Three Years Amidst A Global Slowdown - Techwire Asia, February 20, Kuala Lumpur

Events & Reports

⭐🇺🇸 The Robo Report | Fourth Quarter 2022 - Condor Capital Wealth Management, February 21, New Jersey

Here is the full-year picture of roboadvisor returns across 2022. Our prior coverage of the Robo Report demonstrated a poor 3Q, with average returns at -20% YTD. For full year 2022, average returns across 30+ roboadvisors stood at a slightly improved -15%. Still not great, but understandable given the state of the markets and diversified their investment product.

According to the report, the top 3 best overall roboadvisor rankings based on a balance of product depth, simplicity, functionality, and customization were given to: Wealthfront, SoFi, and Fidelity Go, respectively. Wealthfront had a rollercoaster year, see our coverage of the acquisition that never was by UBS.

🇺🇸 Wealth Management Edge - Informa Connect, May 21 - 24, Florida

🇬🇧 Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime. Leave a comment below on what you think and what we should cover next.

Hi

Y para acá ni un millón o que