Fintech: CFPB to supervise Apple, Google, and Amazon like banks

What CFPB’s new rule means for digital wallets

Hi Fintech Futurists —

Today’s agenda below.

FINTECH: CFPB to supervise Apple, Google, and Amazon like banks

LONG TAKE: The $90,000 Bitcoin world, and where Fintech and Crypto are going next (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Regulation & Policy, Digital Investing

Have you been waiting to get a personal or gift subscription to the Fintech Blueprint? Our Black Friday deal starts now!

Support the Blueprint with an annual plan at a 25% discount below:

Digital Investment & Banking Short Takes

CFPB to supervise Apple, Google, and Amazon like banks

Big tech has had a free ride to integrate financial features into its operating systems. Apple and Google in particular have been building out wallet and payment apps at enormous scale.

In its last actions under the current administration, the Consumer Financial Protection Bureau has been targeting Big Tech. A recent order forced Apple to pay nearly $90MM in fines.

Now, it wants to treat Apple and its peers as equivalent to banks for supervision purposes.

Earlier this year, we highlighted a new interpretive rule that aligned Buy Now, Pay Later (BNPL) providers with credit card companies, and a proposed rule to classify most Earned Wage Access (EWA) products as consumer loans. Announced within weeks of each other, these actions underscored the CFPB's push to bring fintech under stricter regulatory scrutiny — a trend we anticipated would intensify during this election year.

Building on this momentum, the CFPB recently finalized a rule expanding its oversight to nonbank companies offering "general-use digital consumer payment applications," such as digital wallets, payment apps, and peer-to-peer (P2P) payment platforms. This rule marks a significant shift in how these increasingly popular apps are regulated, bringing them closer to traditional financial institutions like banks and credit unions.

To understand the context of this rule, it's helpful to revisit the CFPB's origins and authority. Created under the Dodd-Frank Act following the 2008 financial crisis, the CFPB was established to protect consumers and promote fair, transparent, and competitive financial markets.

While its primary focus has been on traditional financial entities like banks, credit unions, and mortgage lenders, the CFPB also has authority over certain nonbank players considered "larger participants" in consumer finance. Over the years, this framework has been applied to industries such as debt collection, student loan servicing, payday lending, and consumer reporting. Now, the CFPB is extending this principle to digital wallets and payment apps, signaling its intent to hold these platforms to the same standards of accountability as banks.

So, what exactly does the rule do, and who does it impact? Essentially, the rule targets apps that facilitate "general-use" payments, acting as digital stand-ins for wallets — allowing users to send money to friends, split bills, or pay for goods and services. Platforms processing over 50 million annual transactions will be subject to CFPB oversight. However, apps tied to single-use scenarios, like wallets on Uber or Starbucks apps, are excluded from this rule.

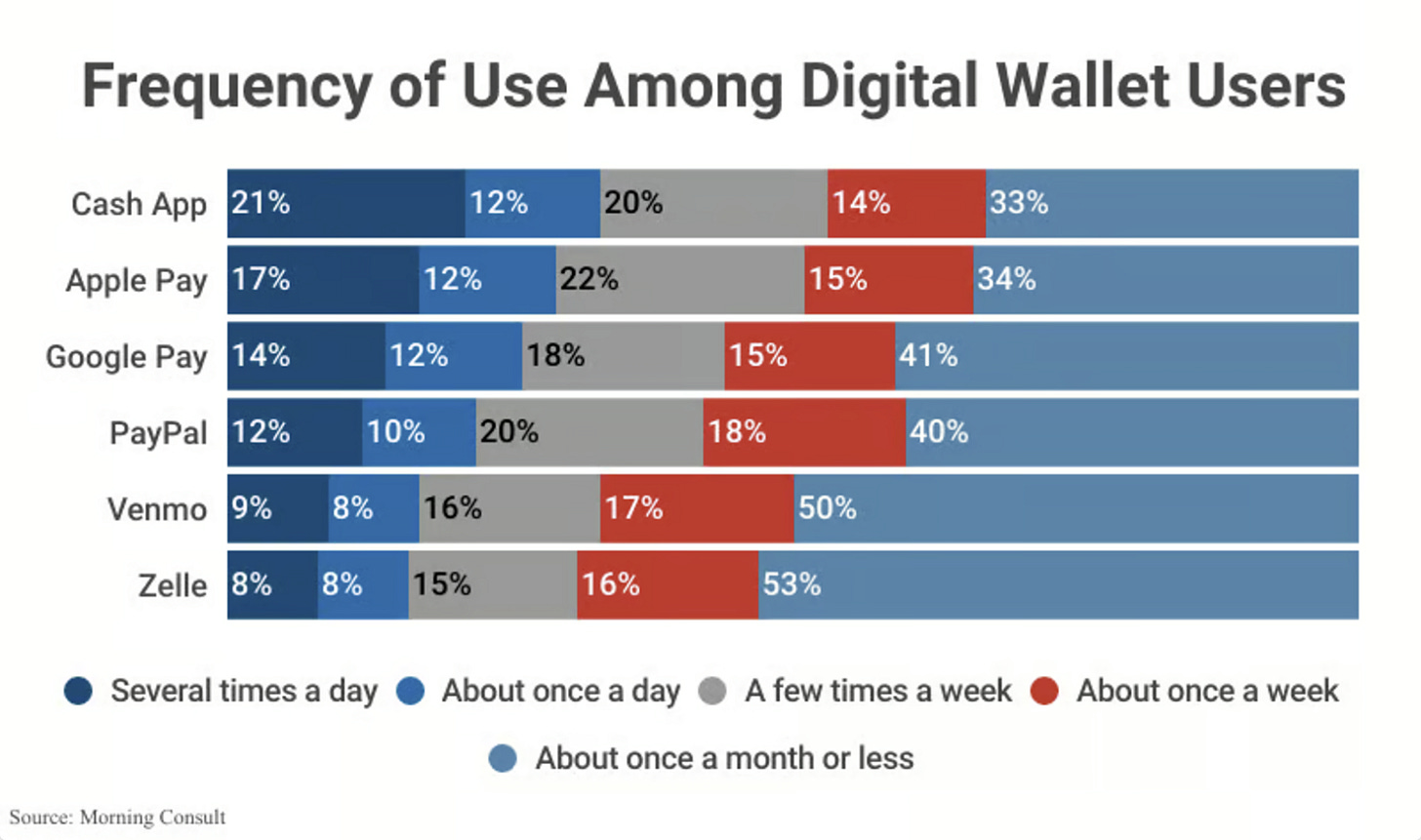

While the CFPB didn't name specific companies, they indicated that seven nonbanks currently meet the criteria, collectively accounting for 98% of the market and processing 13 billion consumer transactions annually. Given their market dominance and scale, these are likely Apple, Google, Amazon, PayPal, Block, Venmo, and Zelle.

So, what is the overall impact?

For consumers, this added oversight aims to provide stronger protections against fraud and misuse, along with improved data privacy standards. For tech companies, however, the changes bring significant operational challenges. Compliance will likely require major investments in infrastructure, potentially increasing costs and complicating innovation in an already competitive space.

The new rule also emphasizes the CFPB's role in regulating the influence of Big Tech in financial services. Regulatory scrutiny has intensified as digital payments become increasingly intertwined with tech giants like Apple and Google.

The CFPB's efforts mirror other regulatory moves aimed at perceived unfairness, such as the Department of Justice's antitrust lawsuits accusing Google of monopolistic practices and calling for the divestiture of services like Chrome and possibly Android. Apple's control over NFC technology for its payment systems has also been a focal point for regulators concerned with monopolistic practices.

Despite its ambitions, the new rule — like many others introduced in recent years — faces a cloud of uncertainty. The CFPB itself may be at a pivotal juncture. Even after the Supreme Court ruled the CFPB's funding structure constitutional, many still question it. Moreover, a shift to a Trump administration could lead to a rollback of regulatory measures. During his last presidency, Trump openly criticized the CFPB's expansive reach, and it seems Trump and a Republican-led congress are already weighing significant changes to the Bureau.

One glaring omission in the final rule was its treatment of cryptocurrency and digital wallets. This leaves major blockchain-based wallets and exchanges operating in a legal gray area. With crypto becoming increasingly integrated into traditional finance— and a potentially crypto-friendly administration on the horizon — it remains to be seen how this rule, if upheld, might eventually impact the regulation of crypto wallets and platforms.

👑 Related Coverage 👑

Long Take

We cover the recent resurgence in crypto and fintech markets, marked by Bitcoin's record high of over $90,000, the rising influence of meme coins, and improved performance of fintech stocks. Significant industry moves include Revolut launching a crypto exchange, Coinbase expanding stablecoin services via its Bridge integration, and Bitwise enhancing its ETF offerings with Ethereum staking through its acquisition of Attestant.

The "machine economy," where autonomous devices transact using blockchain, is gaining traction, exemplified by projects like Peaq and NEAR Protocol's AI collaboration. With AI and blockchain merging, fintechs and crypto wallets are set to battle for user experience dominance, while the evolving regulatory landscape under new administration may further catalyze these trends.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

Klarna files for US IPO - Finextra

PayPal will let you pool money for group gifts and shared expense - The Verge

NovoPayment obtains USD 20 million investment from Morgan Stanley - The Paypers

PayPal's Xoom launches cross-border stablecoin settlement - Coin Telegraph

SocGen Crypto Arm to Bring Its Euro Stablecoin to XRP Ledger, Lays Out Plan for Going Multichain - CoinDesk

Neobanks

N26 Group Reports First Quarterly Profit As Growth in Customer Numbers Accelerates Strongly - Fintech Finance News

Revolut to launch mortgages, smart ATMs, and business credit products - TechCrunch

Lending

Mbanq Debuts AI-Powered Loan Origination Platform Comet - PYMNTS

Goldman plans to spin out tokenization platform to be industry owned - Ledger Insights

FinTech Lending Market Poised for 27.4% CAGR Growth As Revealed In New Report - WhaTech

Regulation & Policy

⭐UK to Unveil Long-Awaited Crypto, Stablecoin Rules Early in 2025 - Yahoo

Howard Lutnick’s Other Top Client: Crypto Giant Tether - The Wall Street Journal

DC attorney general sues EarnIn over ‘deceptive’ marketing - BankingDive

Digital Investing

Robinhood's Acquisition of TradePMR to Transform Wealth Management - Yahoo Finance

Fintech Giant Revolut To Offer U.K. And EU Stock Trading After Getting License - Forbes

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.