Fintech: Joe Duran's Rise Growth Partners secures $250MM for minority RIA investments

Despite presenting itself as an operating company, to us Rise falls squarely into the Private Equity and/or RIA minority investor categories

Hi Fintech Futurists —

Reminder: Today is the final day for The Fintech Blueprint community to use this link and receive $500 off your ticket to Fintech Meetup, taking place March 3-6 in Las Vegas. We look forward to seeing you there.

Today’s agenda below.

WEALTH MANAGEMENT: Joe Duran's Rise Growth Partners Secures $250MM For Minority RIA Investments

LONG TAKE: How The Machine Economy Combining AI, Blockchain, And Fintech Is Growing (link here)

PODCAST CONVERSATION: Investing in frontier capital markets, from Eastern Europe to ICOs, and tokenized securities, with TenSquared Capital Managing Partner Stan Miroshnik (link here)

CURATED UPDATES: Payments, Lending, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below.

In Partnership

Fintech Meetup (March 3-6) is the best place to find new business, partnerships and opportunities. Attendees & sponsors say Fintech Meetup is “the highest ROI event” with reasonably priced sponsorships, tickets, and rooms. Meet everyone for any reason across every use case over 45,000+ double opt-in meetings, and network with 4,000+ attendees.

Digital Investment & Banking Short Takes

WEALTH MANAGEMENT: Joe Duran's Rise Growth Partners Secures $250MM For Minority RIA Investments

The asset advisory market has grown dramatically, with Registered Investment Advisors now managing 27% of total independent investment capital in the US, up from 20% in 2011. In light of this shift, Joe Duran, former CEO of United Capital, has launched Rise Growth Partners, a new entity that invests in upstart RIAs, that has secured $250MM in funding from Charlesbank Capital Partners. Duran's journey includes founding United Capital in 2005, orchestrating its sale to Goldman Sachs in 2019, and departing four years later.

Although Rise Growth Partners invests into RIAs, it exists as an operating company, with a focus on equity growth. The venture aims to acquire a roughly 30% stake in RIAs with assets under management (AUM) ranging from $1B - $5B. In return, Rise will provide resources to help these RIAs grow. As veteran wealth managers know, growing from $0 to $1B is an enormous feat, but it can be done with limited enterprise systems and processes. Growing into a $10B+ platform from there often takes an entirely different set of tools. This is where Rise is focusing its efforts.

The firm is currently in active discussions with 33 RIA firms representing $100B in combined assets, with another 55 firms, representing $120B, in early-stage discussions. As for the resources, Rise will offer management, technology, and marketing support to their portfolio companies, without pushing a proprietary platform or building/enforcing an obligatory RIA tech stack. Instead, they have curated a list of software platforms they believe RIAs should consider using, without any obligation to do so.

Despite presenting itself as an operating company, to us Rise falls squarely into the Private Equity and/or RIA minority investor categories. The competition is fierce, with major new players in the RIA minority investing space. Former Emigrant Partners CEO Karl Heckenberg has launched Constellation Wealth Capital, aiming to raise $1B for the fund, targeting minority, non-controlling investments in large and mid-size RIAs. Additionally, RIA minority investor Merchant Investment Management is pursuing a $250MM raise.

Investing in RIAs is currently at an all-time high — the fee-based model used by RIAs, providing a stable recurring revenue stream and a loyal client base (with about 81% of revenue from asset-based fees), is a significant driver of this investment interest, especially for more established RIAs. But as we mentioned, the investment opportunities are increasingly competitive, and the reputation of investors is likely a major draw for RIA firms. For example, Joe Duran has established himself throughout the RIA lifecycle and has been making connections for decades.

And while we think Rise will focus on the larger $1B-$5B AUM range for the foreseeable future, we note that 84.3% of RIAs had less than $500MM in AUM as of year-end 2021, so the long-term vision may involve consolidating the bottom of the market, and aggregating the assets and firms to create larger platforms.

👑 Related Coverage 👑

Blueprint Deep Dive

Long Take: How The Machine Economy Combining AI, Blockchain, And Fintech Is Growing (link here)

Over the last 6 months, I (Lex) have been running Generative Ventures with my partner Will.

Aside from the usual pleasure of building something from nothing, it has also been an opportunity to sharpen our attention on the next thing — novelty search across finance, AI, and Web3. Below I share more deeply from our investment thesis, and invite you to write back with ideas and ways to collaborate. An abridged version of this write-up appeared as an OpEd on Coindesk.

Long live the machine economy!

🎙️ Podcast Conversation: Investing in frontier capital markets, from Eastern Europe to ICOs, and tokenized securities, with TenSquared Capital Managing Partner Stan Miroshnik (link here)

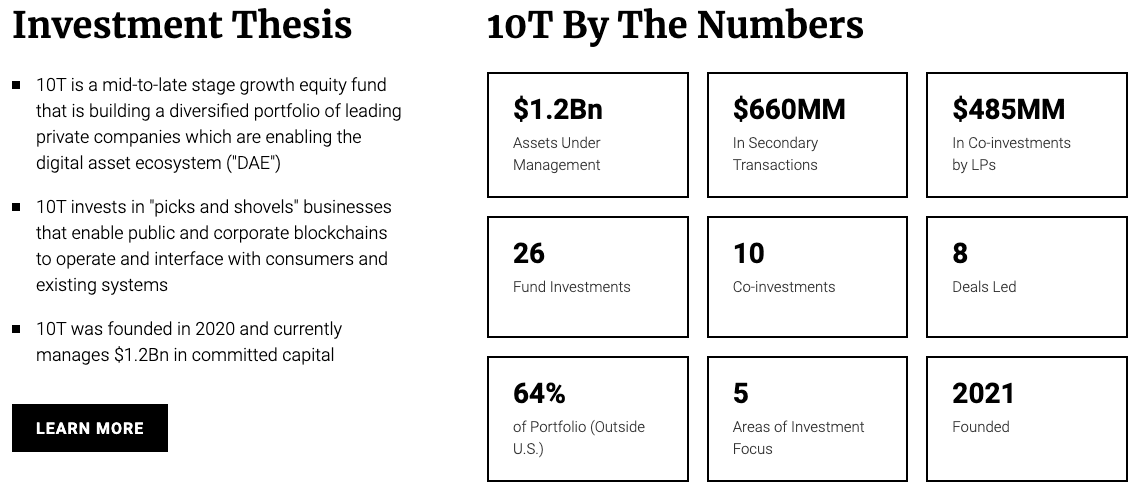

In this conversation, we chat with Stan Miroshnik - Founder and Managing Partner of TenSquared Capital LLC (10SQ). Stan has nearly 25 years of experience in growth and venture investing, investment banking, and corporate finance that bring a depth of global industry relationships with founders, companies, regulators, and peer investors.

Prior to launching 10SQ, Stan co-founded 10T Holdings LLC in 2019 - one of the largest private equity investment managers focused on the digital asset ecosystem with $1.2Bn in AUM. Stan started his career focused on financial institutions at Morgan Stanley, with investment banking roles across New York, London, and Emerging Markets. He received his B.A. in Molecular Cell Biology and B.S. in Business Administration from the University of California, Berkeley, and an MBA from the Sloan School at Massachusetts Institute of Technology (M.I.T). He lives in Los Angeles with his wife and three children.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

⭐ Paytm Shares Plummet On RBI Curbs - Finextra

Kriya Announces New £50MM Funding Facility From Viola Group - Fintech Futures

Nuvei Teams Up With Cash App Pay to Expands Payment Options For Businesses - Finance Magnates

Neobanks

⭐ Challenger Bank bunq Reports First Full-year Profit, Plans UK Relaunch - Tech EU

Banorte Launches Bineo, The First Completely Digital Bank In Mexico - Finextra

Despite Glimmers Of Profit, Most African Neobanks Remain In The Red - TechCrunch

Lending

⭐ Amplifi Capital Lands £22.5MM Funding To Fuel Reevo Money Expansion - Fintech Futures

Raymond James Bank To Use ICE Mortgage Technology’s End-to-End Digital Lending Platform - Yahoo Finance

Digital Investing

⭐ ESG FinTech Watershed Raises $100MM, Hitting $1.8B Valuation - Fintech Global

Schroders Personal Wealth Announces Launch Of New Investment Platform - Fintech Futures

Orion Expands Advisor Access By Adding AllianceBernstein Municipal Fixed Income SMAs To The Orion Portfolio Solutions Platform - Businesswire

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts for deeper learning.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.