Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Stan Miroshnik - Founder and Managing Partner of TenSquared Capital LLC (10SQ). Stan has nearly 25 years of experience in growth and venture investing, investment banking, and corporate finance that bring a depth of global industry relationships with founders, companies, regulators, and peer investors.

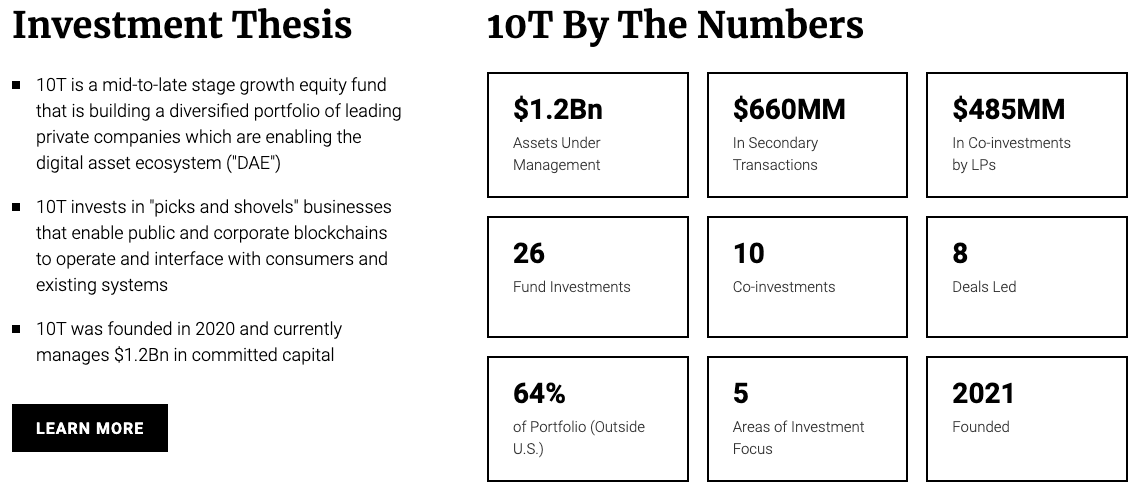

Prior to launching 10SQ, Stan co-founded 10T Holdings LLC in 2019 - one of the largest private equity investment managers focused on the digital asset ecosystem with $1.2Bn in AUM. Stan started his career focused on financial institutions at Morgan Stanley, with investment banking roles across New York, London, and Emerging Markets. He received his B.A. in Molecular Cell Biology and B.S. in Business Administration from the University of California, Berkeley, and an MBA from the Sloan School at Massachusetts Institute of Technology (M.I.T). He lives in Los Angeles with his wife and three children.

Topics: crypto, digital assets, venture capital, investment, blockchain, ICO, tokenization

Tags: TenSquared Capital, 10THoldings, 10T, 10SQ, Animoca, Coatue, Tiger, Civic

👑See related coverage👑

DeFi: Tokenization is cool again, from Franklin Templeton, to Fasanara's Untangled Finance, & SC Ventures Libeara

[PREMIUM]: Long Take: Can we be optimistic about 2Q2023 Equities, Crypto and Venture markets?

[PREMIUM]: Long Take: The "fundamental" economic design driving crypto valuation to $2 trillion

Timestamp

1’28: Navigating the Financial Landscape: From Soviet Childhood to Blockchain Innovation

4’03: Transitioning from Soviet Roots to Global Finance: A Journey Through Capital Markets and the Emergence of Digital Assets

11’07: Emergence of Russian Capital Markets: Navigating the Complexities of Financial Evolution and Integration

15’15: Bitcoin and the Birth of a New Capital Market: Pioneering Digital Asset Investment Banking

19’13: Compliance Complexity in 2024: Navigating the Evolving Landscape of Digital Asset Regulation

23’25: Reflecting on the ICO Market: Balancing Innovation, Speculation, and the Evolution of Digital Assets

27’53: From ICOs to Institutional Investment: Charting the Evolution of Digital Asset Markets with 10T Holdings and TenSquared Capital

32’18: Assessing Growth Stage Investments in the Digital Asset Space: Navigating the Challenges of Valuation and Opportunity in 2021-2022

35’24: Identifying Emerging Leaders in Digital Assets: A Look at Key Sectors and Companies Shaping the 2024 Market Landscape

36’25: Exploring the Future of Digital Assets: Exploring Infrastructure, Consumer Applications, and Financial Services in the Blockchain Ecosystem

43’04: The channels used to connect with Stan & learn more about TenSquared Capital

Sneak Peek:

Stan Miroshnik:

…we started seeing very exciting companies we've been tracking for a while start to come to market and talk about primary fundraisers. So, I'm very excited about Q1 and Q2 of 2024.The other piece of the market we didn't really talk about, but there's a big secondaries market that's developed for all those great companies from the last cycle, there's a large chunk of stock available in the secondary market at meaningful discounts. And so that also presents an opportunity to step into companies that have been on my shopping list for a very long time at what are becoming fairly attractive valuations.

Lex Sokolin:

Can you give a sense of some of the sectors or some of the types of companies that you're most excited about?Stan Miroshnik:

Our taxonomy of this space is these five verticals that we really care about. The first is infrastructure and developer tools. Then we look at what we called functional networks that kind of became popularly known now as DPINs, which is decentralized physical infrastructure and smart contracts. We spent a lot of time thinking about consumer applications, data analytics, and then lastly financial services and tokenization. And so, if we think about infrastructure, it's companies like Fireblocks, it's companies like Tatum, Figment, some of the well-known names that have established themselves and have a strong track record of operating performance throughout the last two cycles.On the DPIN and functional network side, obviously Helium has been a fantastic historian. We've been Helium investors for a long time, but there are other great companies in that space like Demo that are emerging on the smart contract side, big players like…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions