Fintech: Stripe's new charge card program; JP Morgan building investment AI service; Masttro deploys machine learning on alts data

Also a really great podcast about the Nigerian CBDC

Hi Fintech Futurists —

Before diving in, we want to share an exciting announcement with you.

Our in-depth analysis of Revolut is coming to premium subscribers this Wednesday, June 7th.

Over the last several years, Revolut has become synonymous with neobanking in the fintech world. But key to their longer term success are crucial questions:

What does it mean if Revolut gets rejected from the UK banking market? We estimate it could be as much as $100M in missed revenue.

With a changing economic environment, can Revolut sustain its growth and fend off competition from neobanks and traditional institutions?

What strategies propelled Revolut forward, and how does that differ from its competitors?

We will unravel these and more in our deep dive report this upcoming Wednesday.

Access to the Revolut Deep Dive, and others like Klarna, is exclusive to premium subscribers. If you are already subscribed, sit back and enjoy our beautiful math! If you have not subscribed and want to receive this in-depth report straight to your inbox, upgrade your subscription today.

With that out of the way, here is today’s agenda —

PAYMENTS: Stripe Issuing gets charge card programme (link here)

AI: JPMorgan is developing a ChatGPT-like A.I. service that gives investment advice (link here) and Masttro Unveils Doc AI for Alternative Investment Data Processing (link here)

LONG TAKE: Surviving the recession and understanding low unemployment, RPA, and AI's rising role (link here)

PODCAST CONVERSATION: Exploring Nigeria's payments landscape and CBDC eNaira's adoption, with Remita's Alisa Chinedu (link here)

CURATED UPDATES

Digital Investment & Banking Short Takes

PAYMENTS: Stripe Issuing gets charge card programme (link here)

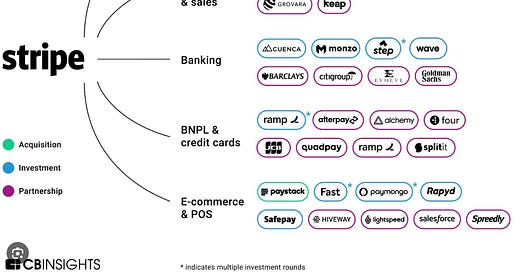

Stripe announced a new charge card program to expand access to credit for SMEs. Launched in 2018, Stripe Issuing enables companies to create, manage, and distribute physical and virtual payment cards. It is one of Stripe’s fastest growing products, having issued over 100MM cards across the UK, US and EU, thereby becoming a foundational layer for fintechs like Klarna and Ramp.

Previously, Stripe only provided pre-funded cards. Charge cards allow Stripe customers to offer credit to their own downstream customers. Stripe Issuing manages fund flows, API integration, network connections, compliance, bank partnerships and ledgering — essentially the entire charge card workflow. This new product complements Stripe Connect, its embedded finance solution that offers white label financial services, like working capital loans and financial accounts.

For Stripe, this provides a new revenue stream and expands its reach by offering new financing capabilities with low operational costs. Revenues will come from compliance and interchange fees, meaning that as downstream customer transaction volume increases, so will Stripe revenues. But the firm also has to rely on platform distribution, into which they are integrated, to provide credit to their clients.

For example, this solution is able to power Ramp’s entire corporate card offering, one of Ramp’s primary products. Reminder — Ramp raised $750MM in debt and equity at an $8B+ valuation last year. While prepaid cards have limited commercial potential, charge cards can provide Stripe with additional exposure to the SME debt asset class. And given the current market, consumers and businesses are leaning ever more on credit. Given Stripe took a 50% valuation hit in their recent raise, revenue and profitability are top of mind.

👑 Related Coverage 👑

AI: Masttro Unveils Doc AI for Alternative Investment Data Processing (link here) and JPMorgan is developing a ChatGPT-like A.I. service that gives investment advice (link here)

Financial services and the investment management industry are embracing the deployment of AI and LLMs into finance. Just last week we saw Public launching a ChatGPT-powered interface within their investment app. This week, wealthtech Masttro has launched Doc AI, which uses machine learning for document management and data extraction for alternative investments, shortly after a $43MM raise led by FTV Capital and Citi Ventures. On the incumbent side, JPM is building an investment advisory AI service as well.

Despite recent cuts in enterprise tech spend, JP Morgan has built an arsenal of 1,700+ data scientists and machine learning engineers, to embed AI-like guidance into their applications and services. A recent investor presentation suggest a $1.5B AI productivity boost target, with over 300 use cases in production. We think the bank could benefit from ChatGPT-like distribution of financial products in the front office, as well as use some of the underlying transformer models for portfolio generation.

Separately, Masttro's platform serves family offices and independent wealth managers by connecting with 500+ global custodians and providing a holistic view of wealth via portfolio management, risk analysis, and reporting tools. They sit on a large data lake with a deep focus on alternative investments. The diversity of data sources, which includes multi-asset class investments, complicated legal entity structures, different currencies, tax reporting, and more, poses significant challenges for wealth management firms in need of a cohesive platform yet stuck on legacy systems. This presents an opportunity for smart investment SaaS platforms to harness machine learning to create coherence out of this data, and an ability to query it naturally.

According to Capgemini’s 2023 World Wealth Report, relationship managers “spend two-thirds of their time on non-core activities and only a third of their time on pre-sales efforts and client interaction”. Lack of digital maturity can result in suboptimal process and investment decisions that are not substantially tailored. More than half of the wealth management firms surveyed were in early planning stages for deploying AI-based solutions, and another 22% said they did not plan to take on AI soon.

This is the usual technology story in finance — while the potential of AI is widely recognized, over three quarters of wealth managers are slow to react. One of the strategies for new tech is to go down-market to retail and mass affluent users, but the revenue pools there are still a challenge for the various firms that have tried it. Perhaps our robot overlords will do better!

👑Related Coverage👑

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 170,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

Blueprint Deep Dives

Long Take: Surviving the recession and understanding low unemployment, RPA, and AI's rising role (link here)

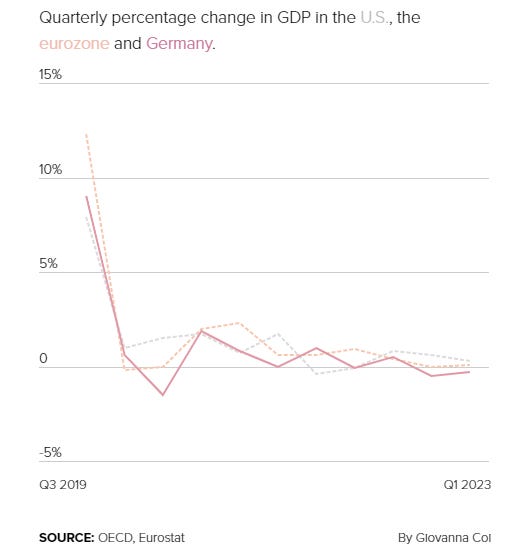

Today we think about jobs. Despite recession concerns, unemployment rates remain unexpectedly low, particularly in the tech sector where layoffs were a strategic response to market changes rather than economic downturn signals.

The wider economy appears stable with high interest rates, but this may conceal difficulties within specific sectors like fintech and crypto. The enterprise sector is being reshaped by the rise of Robotic Process Automation (RPA) and AI, which automate mundane back-office tasks. Innovators like FlowX.AI, UI Path, Workfusion, and Hyperscience are integrating these AI-driven solutions into traditional systems, creating new applications, and establishing 'digital workers' to work alongside human teams. The wide-scale adoption of such technologies could disproportionately impact the workforce, especially those within the fintech and crypto sectors.

Podcast Conversation: Exploring Nigeria's payments landscape and CBDC eNaira's adoption, with Remita's Alisa Chinedu (link here)

In this conversation, we chat with Alisa Chinedu, Retail Manager at Remita. Remita is a payment solution platform that helps individuals and businesses make and receive payments, pay bills, and manage their finances; making it key to supporting the Nigerian payments and fintech ecosystem.

Alisa Chinedu is a seasoned IT, business, and marketing strategist with extensive experience in financial technology and back-office automation. With a degree from the Federal University of Technology, Owerri, Alisa has developed key expertise in innovation advisory and business strategy. Alisa has extensive experience in the financial technology space and currently manages the retail business at Remita Payment Services Limited, a leading Nigerian fintech company that processes more than US$45 billion in annual payments volume.

Curated Updates

Here are the rest of the updates hitting our radar.

Neobanks

Wellthi Reels In Significant Investment To Reshape Social Finance And Mobile

OpenFin’s attack on the ‘toggle tax’ in financial apps secures it a $35M Series D round

Payments

Digital Investing

BCG & FNZ 2023 Report | Scalable Tech And Operations In Wealth And Asset Management

BofA, Morgan Stanley Share Vision of Sourcing Next-Gen Wealth Clients In-House

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Contributors: Lex, Laurence, Matt, Farhad, Daniel, Daniella, Michiel

Want to discuss? Stop by our Discord and reach out here with questions.

Later this week, we will share our Short Takes on the latest Web3 and Digital Investing news, reviewing several companies. If you’d like us to look at any specific item, feel free to share your thoughts in the comments below.

Hi guys

Great articles and analysis.

FWIW, based on a sample of 2, Revolut shouldn’t get a banking licence in the UK.

First, they booted me off the platform about 2.5 years ago because I made 3 legitimate US to UK transfers from a US Schwab trading account to the UK, in order to fund a house purchase. All came through but then they started asking for more and more documents to substantiate I wasn’t (presumably) money laundering. I refused to give them my tax returns (as those were none of their business and I had no confidence that they would stay secure within Revolut). I was thrown off.

Now, my wife transferred $2500 to the UK on April 25th 2023 via Revolut. She’s still waiting for the money. Initially they denied ever receiving it, then told her the sending bank had to reclaim it, after we showed the wire paper trail straight to Revolut, then refused to interact with the sending bank, then admitted they had made a mistake, yet still refuse to let us interact with a human except their maddening customer service agents on the bot who have no authority to blow their own noses, let alone take accountability to sort out a customer problem they have caused. Still waiting to get the money back.

I know you’ll be taking your usual macro view of things in your analysis (and I’ll only get to see the summary) but happy to give you more details if it helps, and hope you will make the point that their customer service sucks big time, and 30m account holders would be withdrawing large sums if they knew how bad the service would be when they have to get something fixed…

Cheers

David