Greatest Hits Report: FTX, iCapital, MakerDAO, Goldman, and Apple are our top Fintech industry movers of 2022

Hi Fintech Architects —

Welcome to the Greatest Hits report on the top 5 Fintech and DeFi industry movers of 2022. This content curates and aggregates the most relevant Blueprint articles, across form factors, focusing on a key concept.

Today we are going to cover key developments and concepts about the following trend setters:

FTX, and its prescient and aggressive moves in B2C fintech and crypto

iCapital, and its dominant position in alternatives investment tech

MakerDAO, and novel governance developments around financial instruments

Goldman Sachs, and its lead in digitizing traditional banking distribution

Apple, and the advantage it has over other big tech in finance

You’ll notice there are names we are not covering, from Brex and the CFO suite, to Robinhood and the retail investor, to Chime and the emergent neobank. These other trends are still deeply important, though operating on the backfoot in 2022.

👉 Let us know if you agree or disagree!

Housekeeping

If you are reading this by email, we recommend you open the write-up fully in the browser given the length of the materials.

Full access to the Greatest Hits reports is available only to premium subscribers. The full Premium Fintech Blueprint newsletter experience now includes:

3 industry newsletters per week, including short takes covering the latest Fintech, Web3, and Digital Wealth news via expert curation and in-depth analysis, with full archive access

Weekly flagship Long Takes on Fintech and DeFi topics, providing deep, comprehensive, and insightful answers without shilling or marketing narratives

Our upgraded weekly industry insider Podcasts with value-added data-driven, annotated transcripts

Full archive of all Long Takes, Greatest Hits report, and other premium content

And now, let’s jump into the companies that are setting the pace for the rest of us!

FTX

An undisputed winner of the market volatility and pressure cooker economic environment, FTX has been repeatedly in our spotlight as a key firm to watch.

Their consolidation strategy will likely be seen as very well timed in the long run. And their ability to both be smart about trading strategies and retail distribution has pushed FTX ahead of Robinhood, Coinbase, and other retail B2C players in our view. The firm (or its affiliates) gained initial capital and market power through large crypto trading arbitrage, establishing a DNA of risk-taking, capital deployment, and multi-geographical footprints. From that stronghold, as an arbitrageur and market maker, it expanded into distribution and user acquisition, leaning into brokerage for the active investor.

The long term bet for an FTX is that all asset classes, from crypto to equities to commodities and derivatives, will collapse into a single, blockchain powered infrastructure, like a Solana or one of the Move-based projects, and will also have single points of distribution. Being the aggregator of active investors that want novel products is the organizing principle, and what we are seeing now is the execution. Any fintech or traditional footprint where this audience resides is fair game.

Long Take: Should Robinhood, Voyager, and BlockFi sell to FTX -- a view on the industrial logic

In this analysis, we look at how FTX and Alameda are spending their balance sheet, supporting crypto broker Voyager with a $500MM revolver and crypto lender BlockFi with a $250MM loan. We examine potential strategic rationales for this loans in the context of FTX strategy, as well as the underlying cause of distress for those companies, such as the Terra and 3AC fallout. We also think about Robinhood, and what it would add to the FTX equation.

Web3: FTX swallows Voyager for almost free

Given that FTX has already put capital on the line for the company, and would have to be repaid in a messy way anyway, especially if someone else bought the business, this outcome was in a way pre-determined. It’s an example of masterful industry consolidation execution by SBF, and also a reasonable end outcome in regards to brokerage businesses with levered up balance sheets entering a prolonged down market. The longer the burn, the more scale and size of the war chest matter.

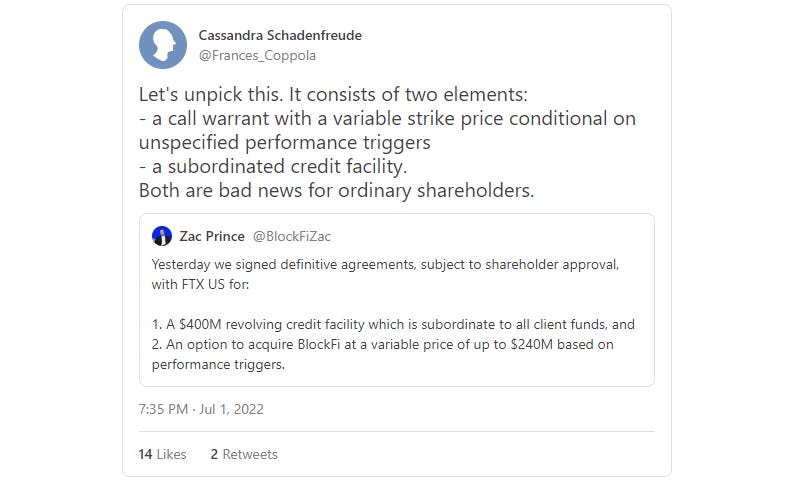

Blueprint: BlockFi and FTX structure a $240MM acquisition

FTX and BlockFi got to a deal — the exchange will acquire the distressed lender for up to $240MM, including a $400MM revolving line of credit. Whether BlockFi goes for the full $240MM will depend on whether it hits performance triggers. The sale could potentially go for considerably cheaper, with the lower end pegged at $25MM, as reported by CNBC.

Blueprint: FTX looking to buy Bithumb crypto exchange

FTX’s Sam Bankman-Fried continues his shopping spree, with reports about late-stage talks with Bithumb, a South Korean centralised exchange. Bithumb has 8 million registered users and has had over $1 trillion in trading volume since inception. Despite the impressive numbers, the exchange has been mired in controversy with accusations of fraud relating to its BXA token pre-sale. The pre-sale raised approximately $25MM for its native BXA token in 2018, but Bithumb never listed the tokens due to a fall-through acquisition by BK Global. It also came under fire with its management suspected of falsifying 99% of its trading volumes, which you know, maybe not great.

Blueprint: Paradigm and FTX Team Up To Launch Crypto Futures Spread Trading

Crypto exchange FTX and institutional liquidity platform Paradigm (1,000 clients, $10B+ volume per month) are launching spread trading on FTX — simultaneous purchasing and selling of two related investments to create a net trade with a positive value.

iCapital

iCapital has continued to come up in our digital wealth coverage, alongside FNZ and others, this year. They have executed remarkably on a strong thesis.

The integration of alternative investments into portfolios is a long standing theme in investing, and only getting stronger with fintech. First, digital distribution makes it easier to access any kind of asset class. That suggests that the same financial advisor — person or robot — that gives you access to ETFs can give you access to alternatives. Second, the traditional portfolio has taken a nose dive on performance, where all risk-on assets are correlated and in deep negative territory. Alternatives at least offer a different narrative, whether or not they behave the same way as the rest of the world. And third, the fees for both making and selling private equity, hedge funds, and other alternatives are still much richer than public instruments, which makes the sector an attractive place to build both products and their infrastructure.

iCapital seems to be on a war path after raising $50MM at a $6B valuation earlier this year. It also has to contend with heavily funded competition like Opto. The nature of the competition is to go fast after distributors — i.e., financial advisor footprints — and embed their platform into digital workflows.