Hi Fintech Architects,

Lex interviews Alessandro Chesser - CEO of Dynasty, a San Jose-based online platform for trust creation and management. In this episode, the key topics discussed include:

The importance of aligning business and product teams, and the challenges Chesser faced when this alignment broke down during Carta's unsuccessful foray into the private markets business.

Chesser's decision to leave Carta and co-found Dynasty, a startup that aims to simplify the process of creating trusts to avoid probate and protect assets.

Dynasty's go-to-market strategy, which focuses on driving organic growth through short-form video content on platforms like TikTok.

The technical and legal complexities of automating the trust creation process, and how Dynasty is navigating those challenges.

For those that want to subscribe to the podcast in your app of choice, you can now find us at Apple, Spotify, or on RSS.

Background

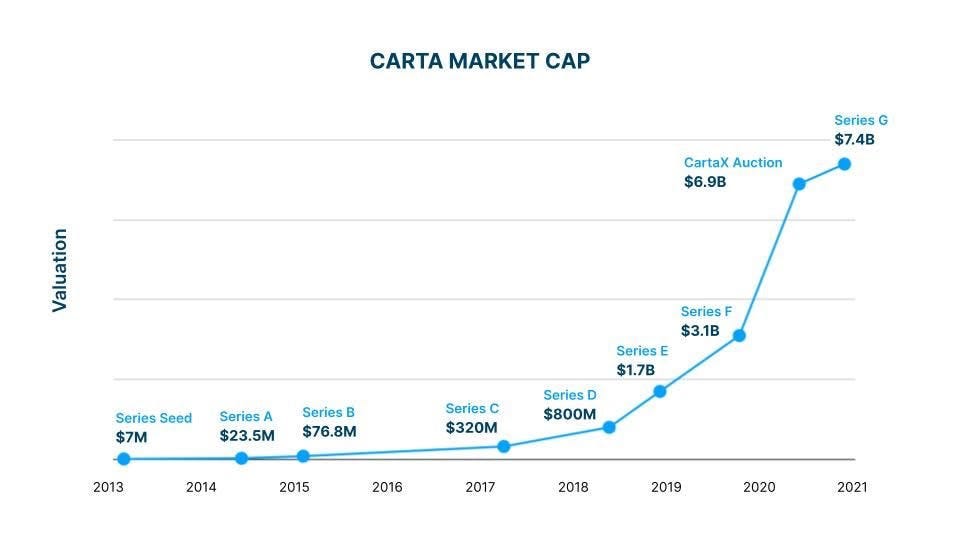

Before joining Dynasty, Alessandro held a series of senior positions at Carta, where they made significant contributions to the company's growth and success. Notably, they served as VP of Sales for Carta Total Comp, CartaX, and Public Markets between 2018 and 2022, leading sales strategies and driving business development across multiple sectors. Alessandro also played a pivotal role in Carta’s early expansion, overseeing the Private Markets division from 2014 to 2018 and heading the Valuations and Tender Offers business units.

Prior to his impactful tenure at Carta, Alessandro worked as an Account Executive at Quantcast and as a CapMx Account Manager at Solium, building a strong foundation in client relations and financial solutions. Alessandro holds a Bachelor of Science in Finance from San Jose State University.

In Partnership

We are supporting Shopify Finance - a brand new hub that brings together the existing financial products enabled by Shopify, allowing merchants to manage their finances where they manage their business--all within the Shopify admin.

Some additional benefits of Shopify Finance:

Shopify Finance simplifies application processes and provides entrepreneurs with the ability to access earnings and funds faster than traditional financial institutions.

Shopify Finance helps entrepreneurs maintain cost-effective cash with products designed to promote sustainable growth and reduce financial growth.

Products that make up Shopify Finance: Shopify Balance, Shopify Credit, Shopify Capital, Shopify Bill Pay and Shopify Tax

To Learn more about Shopify Finance: 👉 https://www.shopify.com/news/finance

👑Related coverage👑

Topics: Dynasty, GetDynasty, Carta, eShares, fintech, trusts, legaltech, private markets, legal, SaaS, social media, TikTok, Instagram, LegalZoom

Timestamps

1’24: From Sales Pioneer to Scaling Success: Alessandro Chesser on Building Carta’s Sales Organization and Transforming the Cap Table Market

5’38: Building Carta's Success: Strategic Partnerships, Demand Generation, and Sales-Product Synergy

9’57: Navigating Growth and Product Alignment: Carta's Scaling Challenges and the CartaX Experience

14’19: The Journey from Carta to Founding Dynasty: The Lessons Learned and Taking the Leap

16’55: Democratizing Estate Planning: Dynasty’s Mission to Make Trusts Accessible for Everyone

23’11: Unlocking Wealth Protection: Directed Trusts, Asset Security, and Tax Strategies for Founders and Investors

26’00: Trusts for the Middle Class: Simple Solutions for Inheritance and Probate Avoidance

28’19: Privacy and Protection: Using Trusts to Safeguard Real Estate and Build Awareness Through Organic Growth

32’02: Cracking the Viral Code: Leveraging Short-Form Video to Drive Customer Acquisition in Estate Planning

35’09: Building a Viral Marketing Team: Crafting Convincing Content for Organic Growth in FinTech

39’35: Engineering Simplicity in Legal Tech: Automating Trusts and Navigating Legal Complexities

42’52: The channels used to connect with Alessandro & learn more about Dynasty

Illustrated Transcript

Lex Sokolin:

Hi everybody, and welcome to today's conversation. I'm really excited to have on with us Alessandro Chesser, who is the founder and CEO of Dynasty. Dynasty is a really interesting FinTech company about the easiest way to put your home in a trust, and he's also got fantastic experience in the industry, especially around the go-to-market function. So, we're going to learn everything we can about how to grow a big business. With that, Alessandro, welcome to the conversation.

Alessandro Chesser:

Thanks for having me on the show, Lex.

Lex Sokolin:

Fantastic. One of your foundational experiences early on in your career was at Carta, the private shares company. Can you tell us how you joined Carta, what you did there, and just high level, what were you focused on?

Alessandro Chesser:

Yeah. So, I was fortunate to land at Carta or formerly known as eShares as the first sales hire in 2014. The way that I ended up there was actually a salesperson for the incumbent cap table software product that was owned by Silicon Valley Bank actually. Silicon Valley Bank ended up selling it to a company called Solium. Solium ended up selling to Morgan Stanley. So, Morgan Stanley currently owns this product, the incumbent product that I was a salesperson for.

And so that's why Henry, the CEO of Carta targeted me to be the first sales hire hoping that I would go rip my old customers that I had signed on to the other product.

So, I landed there as the first sales hire, stayed for eight years, helped take the company from zero ARR to just over 400 million ARR when I left. Really helped scale a large part of the sales organization. At one point, I was managing 200 people. Sales org that I built brick by brick, hired by hire. And so, I got really good experience going zero to one a few times with a few different products and a good experience managing people, and I built relationships with Carta board members and was fortunate to end up there and experience that.

Lex Sokolin:

Amazing. So, let's take it down to the very basics, day one at a company like that. What is sales and how did you approach it? When you were the only person there and now, you're going out to convert all these clients, how do you approach the practice of selling and what are the core ingredients?

Alessandro Chesser:

So Henry did an incredible job building demand prior to me joining actually. So even though the company had zero ARR, he had a transactional model. I think he was getting $20,000 a month in new transactional revenue. So, the initial go-to market model, when I got there, it was just leveraging the investors that invested in Carta and getting them to introduce him to the portfolio companies. We really took that; we expanded upon it. When I got there, it gave him the leverage to be able to go reach out to companies directly, to turn it into a subscription. That was a whole process on its own converting Carta to a subscription revenue model versus the one-time fee model that they had when I joined.

And I really pushed for it just because it was easier for the customers to understand. I knew from my prior experience with the incumbent product, subscription revenue businesses are the best. They're predictable. Especially this business, it's a very sticky product, and so I really pushed Henry to let us turn that into a subscription. And in the beginning, it was actually a really interesting story where Henry wasn't sold on the subscription model, and so he said, "Okay, well we're going to continue doing the transactional model for self-signups, but now we're going to have a new ability for somebody to create a demo request and they'll speak with you, and you can try and sell them a subscription."

And so that's how it started. First subscription was $1,000 ARR, and kind of scaled up from there to I think a large contract value of $100,000 at the top end. But yeah, the go-to-market model was we started reaching out to companies directly. We spent a lot of time with law firm paralegals, getting them comfortable with the product, because they're kind of the gatekeepers. When a company raises its first round of financing and works with the law firm, the law firm sets at the cap table. And so, we wanted to get in there and build really tight relationships with the big law firm paralegals because if they started putting customers on our product to begin with, they were going to be with us for we knew as a sticky product.

Lex Sokolin:

Yeah. How did you figure out that they were the key to the lock? And then once you knew that what was the strategy to actually approach them? Was it you scrape a bunch of leads in email and see who responds, or these are the five top firms we have to partner with, or how did you actually open that up?

Alessandro Chesser:

I was very fortunate to have the incumbent experience, so I had a lot of relationships already with the law firm, paralegals and partners. And it wasn't just me that joined at that time. There were a couple other individuals that worked with me at the incumbent. So, I was the salesperson. Then we had the top customer support person, and we had the product person, so we kind of brought over the incumbent team and the relationships came with that.

So we didn't start cold. We definitely had relationships that had already been fostering. So, we just expanded into that and allowed that to expand into the network. These paralegals know each other.

And in addition to that, the more companies we got signing up, the paralegals were coming inbound to us, and they were like, "What is this? I don't even know. Is this legal?" That was the question we always got from law firms. "Is this legal? This isn't legal. You can't do this."

And so, it allowed us to build those relationships with them on two fronts, reaching out to them cold and building through the network of paralegals that we had already known and partners at law firms, in addition to them coming inbound because we just signed up one of their company. Because we were also going directly to the companies, so we had a threefold approach. We were working with the venture firms, we were working with the law firms, and then we were going directly to companies as well. It wasn't one thing that worked, it was all of them worked together. Slowly. It took time to build that, but we had a lot of help.

The big moment, after I got there and we turned on demo requests, we started getting a couple of requests a day. But that quickly jumped up by a viral blog post that one of our investors wrote, Fred Wilson. Fred Wilson wrote a blog post. Actually, Henry wrote the blog post. It was called Broken Cap Tables, and then Fred Wilson wrote about it and shared it, and then it went viral, and demo requests jumped from two a day to 20 a day.

Lex Sokolin:

That's a pretty big jump. You said you built the sales team brick by brick. Can you talk about what the other bricks in that wall are? You talked a little bit about the process of demand generation, but what were the other components?

Alessandro Chesser:

What I learned at Carta most importantly over anything else is the importance of business and product having high communication. A friend of mine told me this, a mentor of mine, but he said, "The quality of a product and the quality of a business manifests itself in the ability for business and product to communicate." Sales can go out and can sell whatever. I can kind of sell ahead. That's what Henry liked to call it actually. It was sell ahead, sell ahead of the curve. That was my job. My job was to go out there and see what I could get customers to pay money for and get big contracts for.

And Henry said, "You sell it and then we'll build it. The engineers will build it." It's not exactly that easy because first of all, some things are very difficult to build, and it takes time to build things. And you can't sign a customer up and get them to pay you money. Number one, you have to already have something to show them. So, we called it vaporware or demoware. And so, you had to be really good at working with product, and working with engineering, and having some type of vaporware for something that you are able to capture sick contracts for, get people to sign up for a vaporware that can turn into an actual product within weeks. It had to be quick. You couldn't sell too far ahead.

We did a lot of that. But most importantly, the ability for business and product to communicate, and we're going through that now with my current company. It's the most important thing. It's translating that message for what the customers will pay money for to what's actually possible to be delivered.

Lex Sokolin:

In selling ahead, you're essentially discovering what the customer needs, the demand that's out there in the market, and fishing for that demand, and then bringing it back to product to build around. Were there times when that broke down and there was a disconnect, and how did you navigate that?

Alessandro Chesser:

Yeah, so that's why we always say get contracts, get people to pay money for it, because you can go to the market all day and like, "Oh yeah, I would buy that." Customers are like, "Yeah, if you build that, I'll buy it," and then you build it and they don't buy it. Because I think the challenge is customers don't know exactly what they want and what they'll pay money for. They have these ideas of problems that they have, but how much is that problem actually worth?

So, I think the clearest indicator you can get for product market fit is, Henry said, get people to pay us money. If they will pay money for it, we will build it. Contracts, contracts. Money, contracts. So most important thing. If you can't get people to pay money for it, we shouldn't be building anything.

Lex Sokolin:

Zero to 200 million is quite the range. Were there inflection points in that? Were there kink points in the revenue curve where you get to 2 million and then getting to five is harder, or you get to 10 and getting to 50 is hard? How did it feel and what were the different parts of it?

Alessandro Chesser:

It got harder and harder. I mean, when I left Carta, it was over 400 million in ARR and it's the hardest now it's ever been because you still want to grow fast, and it gets harder the bigger you get.

So, one to 10 million was hard, really hard. But after we hit 10, 15 million, things started to really take off. I think one of our investor pitches when we were fundraising was just really selling into the network effect of Carta, where the network is so tightly connected between founders, and paralegals, and venture investors. The network is so tightly integrated that the network, the way it works is the bigger you get, the faster you converge it. You grow faster. And that definitely worked I think up until about 300 million ARR. The bigger we got, the faster we grew because we converged the network. It got to a choking point more recently because the markets not huge. So closer you get to saturating it, then growth starts to slow down.

Lex Sokolin:

And you have to go sideways with different products too. Right? I mean Carta was somewhat famously in the news around the private markets business and the decision to move away from that and instead focus on the cap table stuff. I think you were involved in the private markets business. How did Carta manage these product decisions? Was there any tension between trying to get bigger, but then also having to spin up more adjacencies?

Alessandro Chesser:

Yeah, so you're touching into a very touchy subject for me personally and interesting. I've been on a lot of podcasts and nobody's asked me this specifically. So, I was the go-to-market lead for CartaX, which is the product you're referring to. That was the reason why I joined the company was we're going to create a stock market for private companies. That vision that Henry sold me, I got super excited by.

And so, I was the go-to-market lead. Once we finally decided to go in on building that product. The way Carta is built is it has, there's three leaders of the team. It's business, product, and engineering. It's a trifecta. And so, I was the business lead. And your specific question there about business and product, that was the worst relationship I ever had with product for any product that I ever worked on at Carta. We had zero connectivity in what we were building.

Lex Sokolin:

That's really tough.

Alessandro Chesser:

And I'm friends with those guys now, but we don't work together anymore. But there was a lot of tension and it was just a huge failure on all of our parts. And I'll take 100% responsibility because if I failed to communicate with somebody, the only one I can blame is myself. And we didn't have the same vision for the product, and it didn't work, and now they're out of the business.

Lex Sokolin:

I think it's one of those ideas that just is so clearly good, and you want to follow it, and bring it to market, and then there's just traps littered all over. There are so many companies that have tried to do the secondary market for private equity and it's really challenging.

Alessandro Chesser:

Yeah. There's a lot of companies that try to do it, but Carta had the data and the users, the ability for you to be able to go in, and click a button, and buy shares of name your private company. The only one that can actually do that is Carta, because you have to be... Henry laid out the public markets and he's like, "You have the transfer agents, and the brokerages, and you have the central registrar, the DTCC, and you have all this infrastructure that makes it possible for you to go into your E*TRADE account and buy shares of Apple." Well, for that to exist in the private market, Carta. Carta is the only one that can do that. And so that was our, plus the network, all the users are already customers. Everybody has a Carta account already. We thought we had the natural advantage. We weren't successful.

Lex Sokolin:

Fair enough. And thank you for opening up about that. I appreciate it. Your Carta experience was seeing some really bright parts of scaling and then other difficulties in products and markets that were harder to navigate. How did you come to becoming a founder and taking that zero to one risk again? How did you encounter the idea for Dynasty and what did you do?

Alessandro Chesser:

Yeah. So, after the CartaX, after we bumped heads for two years and it took two years to build the product, it wasn't selling before it was built. I was like, "Henry, this is not the right product." And so, I finally just quit, and I said, "You know what? I can't keep bumping my heads against this."

And at that point I was fortunate to experience the upswing of Carta, and so I was able to take liquidity. I sold in a few tender offer transactions, so I could take the risk of just quitting and starting a company. And so that's what I wanted to do. I wanted to go. I said, "You know what? I'm tired of not having control. I want to go out and have control. I want to start my own company."

And I had the perfect situation because my co-founders, they were ready to start a company as well, and they were people that I worked with for many years at Carta. My co-founder, Kyle, he was the very first employee at Carta. He was the engineer, the architect that built it. My co-founder, Edison, he was our first product manager. So, to Henry's model, business, product, and engineering. So, we had three. We wanted to start a company. We had taken liquidity from Carta already, and let's do it, and the market was red-hot. "Let's do it. Everybody's starting companies now." So that's why we wanted to start a company, and that's why we left after, I was there for eight years.

Lex Sokolin:

So what does Dynasty do? How did you come on the idea?

Alessandro Chesser:

We knew we wanted to start a company. We didn't know what company we wanted to start. We tossed around some ideas. I had one idea for a sales tool that was getting close to getting interest from a large venture firm, a partner that I know, Sequoia, I consider myself friends with. And so, we were going to do the sales tool, but Sequoia ended up having a conflict and we couldn't do it. And so, we didn't do that one. We didn't know what we were going to do.

But what happened was a friend of mine, the same friend that gave the quote about product and business, and quality of product manifests itself in the communication. He came up with this idea for Dynasty. He pitched me on it, and he was like, "This needs to exist. Dynasty is an online trust creator."

And so, the idea was that, and this was actually very relevant for me because I spent close to a decade working for different banks, Bank of America, Wells Fargo, Washington Mutual. So, what was very apparent to me when I worked for these banks was that the richest people used trusts, living trusts, revocable and irrevocable trusts, and the rest of us didn't. Nobody in my family had a trust. I come from an immigrant family and could have definitely used a trust. Could have saved a lot of money and a lot of time when people have passed away. We didn't know anything about it and we didn't work with lawyers.

And so, I knew that this product needed to be democratized. And as I mentioned, I worked at Carta for eight years. I was able to take liquidity, and I started a family. I got married, I had kids, and I didn't have a trust. For me of all people. I worked at the banks. I'm licensed a series 7, series 63, series 20. I know all about this stuff and I still didn't have a trust. I'm like, "Why don't I have a trust?" Well, number one, it takes time to set it up and nobody wants to go through that process. Nobody wants to go see a lawyer. And then number two, it is expensive. Even having, if you know you're going to spend $3,000+ for something that is going to just be a lot of work on your point... In fact, the first thing I did when we thought about starting this company was, I went through the process of creating a trust with a lawyer. It's actually a cousin that I have who's an estate planning attorney, and I'm like, "Hey, why don't we just go through this?"

And I never finished it because he gave me too much homework, and it was all through email, and I just didn't... I'm like, "You know what? We're going to build this. We're going to make it much simpler."

Lex Sokolin:

What is a trust? Let's lay some of the ground rules.

Alessandro Chesser:

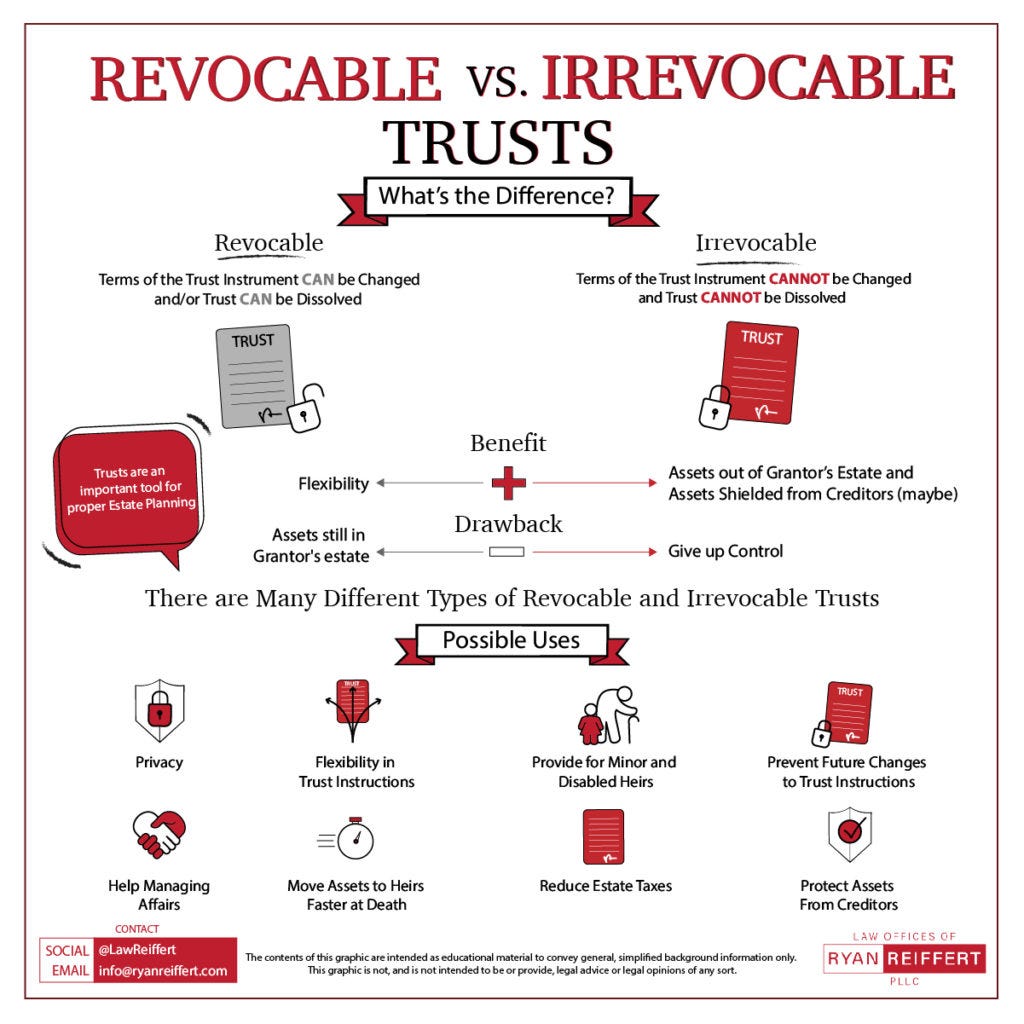

So a trust is a legal entity that you put your assets into. So, you put your home, your rental properties, your startup shares, your crypto, everything that you own, your bank accounts, you put it in your trust, and a trust is legal entity. So, you don't own those assets anymore. Your trust owns that.

That trust can do a lot of things. Primarily, the most common use case for a trust is just inheritance planning. So just in case I die, or I become incapacitated, I want to make sure that my assets get distributed to my family in the way that I want them to be distributed. So, it's almost like... It's better than a will. It's a will replacement. The problem with wills is that they have to go through probate court, which means the government processes them. And so, your family will have to go to probate court and will have to make a claim for the assets against that will, and that causes all kinds of friction, all kinds of challenges and family drama. The only way to avoid probate court is to create a trust.

And so, what happens when you die or you become incapacitated with the trust, your successor, whoever you elect takes over control of your trust and does whatever you want with it. They can continue to operate it and they can distribute income to your children, or they can distribute it lump sum, or they can create milestones and say, "You have to use this money to create businesses." You can continue to manage and control things when you don't have physical ability to control anymore. The trust speaks for you when you can no longer speak for yourself. So that's the most common use case for a trust.

That's what most Americans need. That's what my family needed. Because otherwise, the probate process takes on average 18 months. Sometimes it takes, I've seen it take sometimes seven plus years where nobody's getting any money from the estate. The families, the siblings are fighting in probate court. The money is going away to judges and lawyer fees.

And you look in some of the largest estates this has happened to. The founder of Zappos, Tony. His estate is, I think still in probate court. It was $800 million, and it's been there for five plus years now. And a lot of money's going to lawyers and legal fees.

And that's why it's kind of an inside joke in the industry. But lawyers, estate planning attorneys, they will refer to will as a lawyer's retirement plan, because you just create wills for your clients, and they pass away. Then you have to go argue for their children in probate court, and you make the money in probate court. And so, we believe every single American should have a trust. Not a will, a trust.

The other things you can do with the trust is you can protect assets from lawsuits, and creditors, and even divorce better than a prenup. Putting your assets in an asset protection trust is more secure than creating a prenup. It's a lot less friction too because you just put your assets in there and you don't have to negotiate them with anybody. You can do that before you get married, and your assets are protected. They're locked up.

Lex Sokolin:

When you lock things away in a trust, doesn't the trust have some sort of purpose for which it exists? Aren't you locking away the assets away from yourself in a sense too?

Alessandro Chesser:

It depends on the type of trust you set up. And so, referring to the asset protection trust or the trust that can save you money in taxes, yes, it comes at a cost. That cost is direct control. They have these new trusts. We actually create them. They're Nevada trusts, but you can do the same type of trust in South Dakota and Wyoming. There are a few states that offer them. They're called directed trusts.

And so, the way that they work is you don't directly control the trust, but you appoint the people that do. And so, you can say, "Okay, I want brother and my mom to direct the trust," and so they will serve in these trust director roles, and they will control it completely.

And so, you don't have direct control, but you put people in charge who have direct control. So that's a newer, very common instrument for the billionaires. This is what the billionaires do. They create directed trust, and they don't directly control it, but somebody that they know does.

And so that was one of the biggest things that we're democratizing is the directed trust. We're doing Nevada directed trust. And most Americans, they need the mass market product that helps with probate court. But when it comes to the directed trust, that's how you protect assets from, like I said, divorce, whatever. Lawsuits, creditors. And that's how you can reduce your taxes as well, because doing it in a state like Nevada, Nevada has zero state income dividend and cap gains taxes. So that's another reason why the billionaires do it, because they can significantly save taxes.

And there's additional ways to save taxes for startup shareholders specifically, mainly for founders and angel investors is anybody who's subject to QSPS, qualified small business stock, which is a $10 million capital gain exemption of the first $10 million of capital gains in a QSPS eligible stock is 100% tax-free federally. State, depends on what state you live in.

Lex Sokolin:

If it's in the trust wrapper?

Alessandro Chesser:

No, everybody gets up to $10 million even without the trust. The benefit, what you can do with the trust is you can expand that. So instead of 10 million in tax-free gains, you could get 100 million or more. Unlimited really, depending on how many trusts you create.

Lex Sokolin:

I'm really excited to learn about this. Let's anchor it in an example for, as you said, the average American who's maybe not facing the 10 million capital gains problem but is living a middle-class type of income and expense scenario. What can you get the trust to do for you? What are the number one and number two scenarios that you can imagine somebody applying this product in their life and after their life?

Alessandro Chesser:

So the two things specifically is our free product. We have a free product. Anybody can sign up for it on their phone in less than five minutes. There's no paperwork, no lawyers required. The free product will allow you to create a simple trust that helps you distribute your inheritance when you pass away or if you become incapacitated. Creates the instructions for speaking for you when you can no longer speak. So that's our free product. That's the most common use case.

And the reason why our site is branded easiest way to put your home in a trust is because we're distributing that free product as wide as we can go, and homeowners are a very, very wide group that have a problem. Their house is going to have to go through probate court, and so they want it to go to their children. So that's the mass market product. Put your home in a trust. In a trust for probate avoidance.

Lex Sokolin:

Let's say the house is in the trust and you've passed away. What happens then? Is the asset liquidated, or does it come out of the trust in some way? What are the mechanics of it?

Alessandro Chesser:

Yeah, so it depends on how you set up the trust. You can set up a trust in a way where the asset is passed, doesn't have to be liquidated. It can stay with the beneficiary who can continue to own the house in addition to receive a step-up in cost basis. Which is huge, especially for people that live in states like California, the Bay Area where property values have gone up in a short period of time. Look at somebody that's owned a home in the past 20, 30 years and they have a massive million plus dollar capital gain. If they inherit the house, they can get that step up in cost basis, which means that they can step all the way up to the current value and not have to pay any of that capital gains tax. So, it's huge for people that are in that situation.

So you can sell the house, they can inherit the house, and live there, and continue to live there. It's really, that's the beauty of a trust is you have the ability to create those type of instructions for what you want to happen.

Lex Sokolin:

Okay. And you had the second use case coming up.

Alessandro Chesser:

Second use case is privacy. This is for people who they own real estate, because real estate records are public, and so anybody can just Google search you and they can find where you live and what properties you own. And especially for people that own a few properties, now you're a target for lawsuits. It's really interesting the way lawyers work. But if somebody is trying to sue you for whatever reason and they go to a lawyer, the first thing the lawyer's going to do is look up your property records. And if they see that you own property, "Oh yeah, let's sue them. I know I can get the money. I know they have money to get."

If they don't have any property records and they're like, "You know what? I don't know if this person owns anything. I'm not going to take this case on," because by the time we find out, they may own nothing, and I wasted all my time. And so, owning real estate on the public records makes you a target.

So that's the second use case is if you own real estate, even just your home, and you don't want to be on the public records, you can set up the trust in a way where you are not on the public records at all. That's the second most common use case, because that doesn't just help you when you die, or you become incapacitated. That helps you today. It helps you become private today.

Lex Sokolin:

When you are going to market, we talked about building out the sales team and all of that before. Is this a direct-to-consumer product? Are you going through third parties again? How are you thinking of getting people to use this and to trust it?

Alessandro Chesser:

So we're getting about 2,500 people a month signing up right now. Where we're getting them from, a significant portion are coming from word of mouth. We always wanted that to be our number one acquisition channel. We want people to tell their friends and family about it. We kind of manufacture word of mouth many ways, but we are doing a lot on a short form video. So, we have our channels. I have my own personal channel on TikTok, and I never had been a social media person, but now I'm doing TikTok videos. I haven't even done that many. I've only done 10, and I had one of them that hit 400,000 organic impressions. And every time we do those videos, we get dumped on with customers. We had one video that we did on our company page that got 3 million impressions organically.

And so, at this point, we spend a lot of time and energy in figuring out short form video, because we knew that we're not going to be a company that spends money on advertising. We need to be figuring out the best organic ways to grow. And there's nothing more organic than a viral TikTok video. It is wonderful. You can put five minutes into it, and it can go viral, and a million people see it, and you have thousands of people liking it. It's a really incredible way to spread awareness.

Lex Sokolin:

So you are selling a financial product or a legal financial product, which if I were to rewind back 20 years would be really difficult to sell, right? You need a lot of people in suits, and contracts, and everyone in the process generally feels bad about their life trying to get this to happen. I'm sure that customer acquisition costs for setting up an estate or setting up a trust are really, really high.

But here, you figured out a formula in short form video that is getting millions of views. What can you share with us about that marketing hack? How did you make it so interesting and attractive to people that they want to engage in it?

Alessandro Chesser:

I think we're fortunate to have really interesting content if you frame it correctly. And it's like, "Here's what the rich do to reduce their taxes. Here's why Donald Trump was able to file bankruptcy six times and he's still rich." And so, I think especially if you lean into polarizing subjects like Donald Trump, and there's other examples that you can talk about, Elon Musk, polarizing. You got people that like it, people don't like it. What ends up happening is a lot of people end up commenting and those comments help it go viral.

And so, like with anything else, there's a formula and you just need to learn that formula, and it just takes practice. And the more that you learn it, the more successful you become. And so, we're still in the early days. But I think as far as customer acquisition goes, this is our number one method for customer acquisition for top of funnel free customers.

Lex Sokolin:

How long did it take you to squeeze out that magic and figure out what the formula is to frame this product?

Alessandro Chesser:

It wasn't until we partnered with a YouTuber who really showed us the power of short form video by talking about us on his page. And for us so far, it's been the closest thing that I could compare to Carta, our Fred Wilson moment. He talked about us, and we had a step function in growth. And then we had a podcaster talk about us, and we had a step function and we're like, "Okay, these channels are powerful. How can we control our own outcome by creating our own audiences?" So, then we started really leaning into the creator.

So, we have both sides. We have the partner, influencer, partner side, and then we have our direct production side. And it's still a work in progress, but we've done really well on both. We're building our own. Our Instagram page is, I don't know how many, 60, 70,000 followers now. And TikTok doesn't have as many followers, but we learned that TikTok followers don't matter as much, because TikTok, you can go viral without followers. I think the difference is when you use TikTok, most people are not seeing the people that they follow. You're on there to see random content, and so anything can go viral. Versus on Instagram, on Reels, most people just see their followers, and so it's harder to go viral beyond your followers.

And so yeah, just a lot of time, and a lot of effort, and a lot of trial and error. And we are not done yet. We still have a lot more to go, but it's been a very effective channel for us.

Lex Sokolin:

How did you build that team? I'm just thinking about all these potential FinTechs that are still trying to figure out Google Ads. How did you build that team? What's the DNA of the team that knows how to do organic Gen Z type short reel type of content?

Alessandro Chesser:

So very, you can waste a lot of money on a lot of poor-quality creators. I think this is the hardest part. Getting somebody who knows how to do it to help you do it. It's a very important part because you can get a lot of the wrong people.

I think that there's a lot of agencies out there. "We can do short form videos for you, we can do this, we can do that." But doing it right, the actors are very important.

And so, we studied a lot about, what's the language app? Duolingo. Duolingo, I'm not sure if you've seen any of there are case studies on their growth and how they did it using short form video TikTok. They did it with, they were wearing mascot outfits. And so, there's a lot on that. And so, we studied that a lot. And there's other examples.

Basically, the most important thing we did was just looked at other companies that are successful with this, and we dug into how they did it. And then from there, it was just trial and error and just trying to find people to help us. And there's a lot of experts out there that say they can help with this type of thing, but you need to keep going through them until you find somebody that actually can... I think the most important thing is you have to connect with the vision of the company. That's the most important thing.

Lex Sokolin:

You went outside and tried to find people who they're able to attract attention, and then you figured out a way to work with them?

Alessandro Chesser:

So actors. So, there's two parts to creating a short form video. There's a script and then there's the actor. And so, scripts, there's a formula for that. And we have a whole bunch of... I have a spreadsheet. It's on hooks and how to create hooks. And then there's TikTok SEO, like the words you use. And then there's polarizing, be polarizing in the hook, and then have interesting content, educate people. There are all these different ways to go viral, use celebrities. So, the scripts are one part. You got to write really good scripts, and that's hard. That's very hard. But the other part is finding an actor that can have conviction when speaking the script. That's very hard as well.

And so that's why I've kind of taken it on my side a bit where I'm like, "I need to figure out how to do this myself. I'm the founder." And because at first, we were just like, "I'll hire somebody to do it." We hired somebody and it worked a little bit. But the more that it worked, we knew that there's a lot more potential here. Let's dig into it. And that's why I was like, "Okay, I saw an example of another company that's founder led." The founder has a TikTok page, is the actor, and it's got millions of impressions every single video. And I was like, "This is what I need to try to do." And so that's why I started building my own page.

And my own page is not huge. Like I said, I have done 10 to 12 videos. But I figured out a formula where I can get, like I said, I got one that was 400,000 views. But on average, I can get over 20,000 views now.

And so, I think when we're ready to really lean into it, I'm going to spend a lot more time on that page personally. And I think the founder speaking helps me; I have more conviction naturally. But what we're working on right now is not necessarily trying to explode the top of funnel. Right now, we're working on delivery. We're delivering these directed trusts, we have enough demand now, and we're just perfecting the experience and the product for our customers.

Lex Sokolin:

Awesome. Thank you for opening up how that works. And I think it's fascinating, your intuition for getting to where the demand is. And whether that's a sales go-to-market motion, or a marketing, or a social media go-to-market motion. I think it's pretty impressive how you're able to open that up.

In terms of the products and the technology around the business, is there anything you can share with us in terms of the engineering that goes into being able to automate these trusts? I had the pleasure of going to law school, and one of the things that I was told is that nobody can practice law other than licensed lawyers, which means everything has to be on paper and signed in blood with feathers. So how do you engineer yourself into an answer here and what needs to happen?

Alessandro Chesser:

Yeah, it's very, very hard. We spent the first two years doing zero go-to-market, and we were kind of just figuring out how to build what we wanted to build and then how to get around the legal gray areas, how to really navigate them, and always be on the side of being conservative with what we're doing.

And we had a lot of experience doing that at Carta too. As I mentioned, the law firm said we were illegal in the beginning. We had to navigate that. And it's similar. To your point, everything in this space is on paper. And so how do we digitize it? That's one whole side of it. We had to spend a lot of time of figuring out the laws, and the precedents, and where we can take risk, and where we can't.

And then on the other side of it, you have the actual templates. And so, for the trust documents, you turn them into templated documents so that way customers can just fill in the blank and we can automate the trust creation. Those templates, the simple trust, that's easy. Anybody can go to LegalZoom or Rocket Lawyer or wherever, name your online provider, and you can create a simple trust. But when it comes to the complex trust, you want to protect assets or you want to reduce taxes, none of the online providers do those trusts.

And you're told in the very beginning, when we started thinking about this from lawyers, "You can't automate it. It's way too complex. These trusts are way too complex." But I'm like, "Wait a second, you use a template." I'm like, "How do you create your trust?" And they're like, "They have a software they use; they have a template." I'm like, "Why can't we use a template too then? Why does this have to be a lawyer?"

And I think the biggest thing in this space is that the way LegalZoom was able to pioneer this space with simple trusts and simple wills was that it's do it yourself. You go in, it's self-serve, and you fill out your own documents.

And so that's the approach that we take. It's do it yourself. There's no handholding. There's no legal advice. If you need legal advice, you need to see an attorney. We are not an attorney, and we're very explicit when you sign up. We are not an attorney. If you need legal advice, go see a lawyer.

And so, once you do that, then the challenge becomes, how do you explain this product in such a simple way? Do it yourself, that people can do it, and sign it, and feel comfortable with it without needing to talk to somebody. We're still working on that. How do we completely simplify things? And it's definitely a challenge.

But I would say that's where the challenge lies, is on more of the product side, and the experience, and the way we educate people, and navigating the legal complexities, and the template documents, and the laws and the regulations. But it's less of, and maybe my co-founder whose head of engineering may disagree, maybe. Maybe. But it feels like less of an engineering challenge, and more of a product and go-to-market challenge.

Lex Sokolin:

Thank you for sharing a couple of really fascinating anecdotes, and I know that our audience will learn a lot from you and your journey. If they want to check out the company or learn more about you, where should they go?

Alessandro Chesser:

Dynasty.com to learn about the company. And if you want to learn more about me, find me on LinkedIn Alessandro Chesser, or I mentioned I have that TikTok page, check it out. I think I call it sandrochess, but we also have our company pages as well. So yeah, check us out on short form video, Instagram or TikTok, or find me on LinkedIn.

Lex Sokolin:

Thanks so much for joining us today.

Alessandro Chesser:

Thanks for having me.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Share this post