AI: Venture Capital financing Roll-Up M&A, hoping for AI synergies

If you can buy revenues for 2x and sell them for 20x, that’s a good business.

Hi Fintech Futurists —

Today’s agenda is below.

AI: Roll-Ups Are Back

We discuss how Elad Gil and top venture capitalists are reviving the Roll-Up strategy — this time as Vertical AI Roll-Ups — to acquire and integrate traditional service businesses using industry-specific AI tools. Unlike traditional private equity roll-ups, which relied on high leverage, these are being funded by venture capital, as PE struggles with poor exits and declining fundraising. The thesis is that AI startups can gain a competitive advantage and distribution by acquiring their customers and driving operational efficiency, particularly in fragmented legacy sectors. However, risks remain: VC firms lack deep acquisition expertise, and inflated expectations around tech-style valuations could clash with the realities of lower-margin service. Still, if executed well, this strategy could offer a hybrid growth path for maturing AI businesses and their investors.LONG TAKE: SharpLink's $425MM to build the Ethereum MicroStrategy with Joe Lubin

PODCAST: SharpLink's $425MM to build the Ethereum MicroStrategy with Joe Lubin

CURATED UPDATES: Machine Models, AI Applications in Finance & Investment Outlook

To support this writing and access our full archive of IPO primers, financial analyses, and guides to building in the Fintech & DeFi industries, see subscription options here. Our current price point is only $2/week.

Roll-Ups Are Back

Elad Gil became one of Silicon Valley’s most prolific solo investors in the 2010s, when he invested in over 40 unicorns, including Stripe and Coinbase. More recently, he was a first mover into AI, leading early investment rounds into companies such as Harvey, Mistral, and Perplexity. A pretty killer track record.

When Gil announces his strategy for future investments, we should take note. And his most recent plan is to leverage AI efficiency gains to pursue Roll-Ups.

Roll-ups are usually a series of horizontal acquisitions that build a larger commercial footprint. In doing so, the acquirer is able to cut costs and generate returns to scale. One of the most famous businessmen of the 19th and 20th centuries, John D. Rockefeller, employed this strategy to aggressively consolidate the oil refining industry through his Standard Oil Company, ultimately dominating a key component of the US economy through monopoly.

We can attribute the start of the “traditional” private equity roll-up strategy to Wayne Huizenga. In the 1970’s, his company Waste Management Inc. started purchasing and combining several small companies in the fragmented waste management business. While popular for financial engineering and fundraising, unfortunately, the returns don’t always materialize. A famous 2008 Harvard Business Review article quoted that two-thirds of roll-up businesses failed to create any form of value for investors, or end up as disastrous investments lost to history.

So why are tech investors going back to the roll-up strategy?

This time, the allure of AI and blockchain is here to dust off businesses that were traditionally ripe targets for private equity. Surely some value can be created by adding the bacon bits of innovation to existing cash-flow companies and then arbitrating the multiple as a result. Remember when all the publicly traded banks said they were technology companies?

This tech-upgrade roll-up strategy hasn’t quite landed on a name, so let’s call them Vertical AI Roll-Ups. To be clear, Vertical AI Roll-Ups are distinct from AI-native Vertical SaaS (VSaaS) platforms that have been flourishing recently. We’ve previously discussed the speed at which new AI businesses are building recurring revenue by nailing productivity pain points and monetising in specific industries.

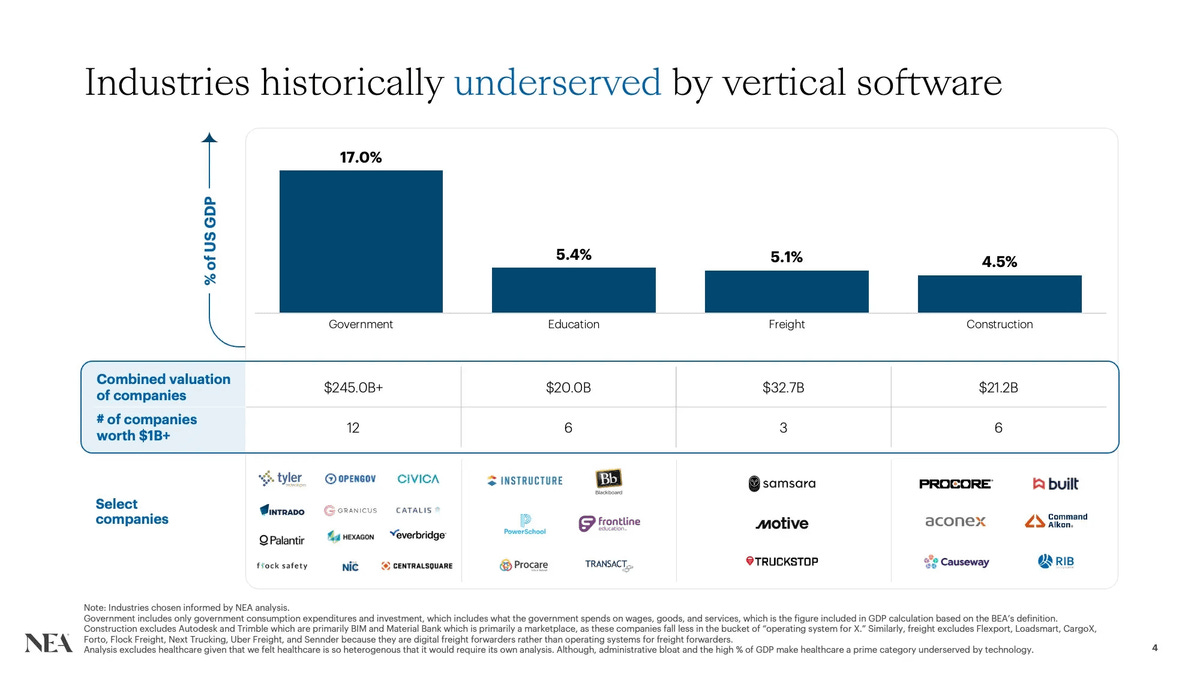

Here is a market map of how AI is transforming the SaaS market in difficult B2B industries. So can one take existing customer footprints and supercharge them?

Vertical AI Rollups seek to enter markets through acquisitions of their “customers” within a specific industry. This is where the investment teams diverge from that of the traditional software investors. Primarily, they require not just financial acquisition capability, but deep domain knowledge and operational and integration expertise.

Are Vertical AI Roll-Ups More Than An Idea?

There are several Vertical AI Roll-Up businesses that have formed in recent years.

Based on the investors in this list, the majority of are coming from Venture Capital and not Private Equity. Usually, venture investors don’t invest in change management, but current market arbitrage is too attractive.

So why is this happening?

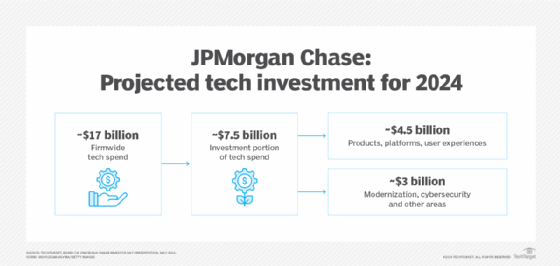

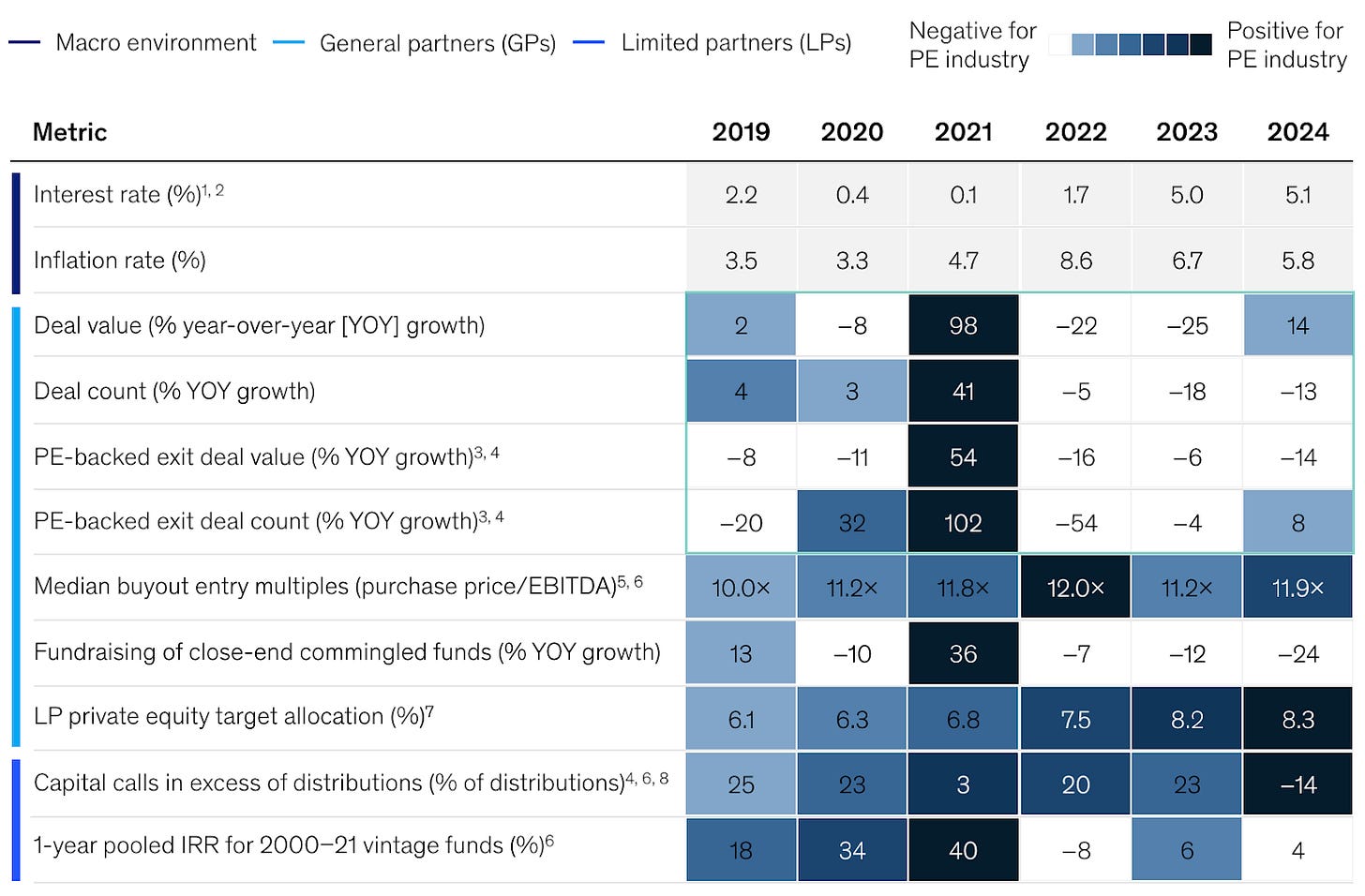

Private Equity has been struggling since the deal spree of 2021. Current deal count is down, despite a bounce back in deal value in 2024. More crucially, exit deal value is still challenged in 2024, which implies 3 years of negative exit deal value in a row. Interest rates have remained high, and private equity financing usually comes in the form of debt. When rates remain at 5%, the cost of capital is prohibitive to do buyouts. When money is cheap, at <1% interest rates, acquisitions fund themselves.

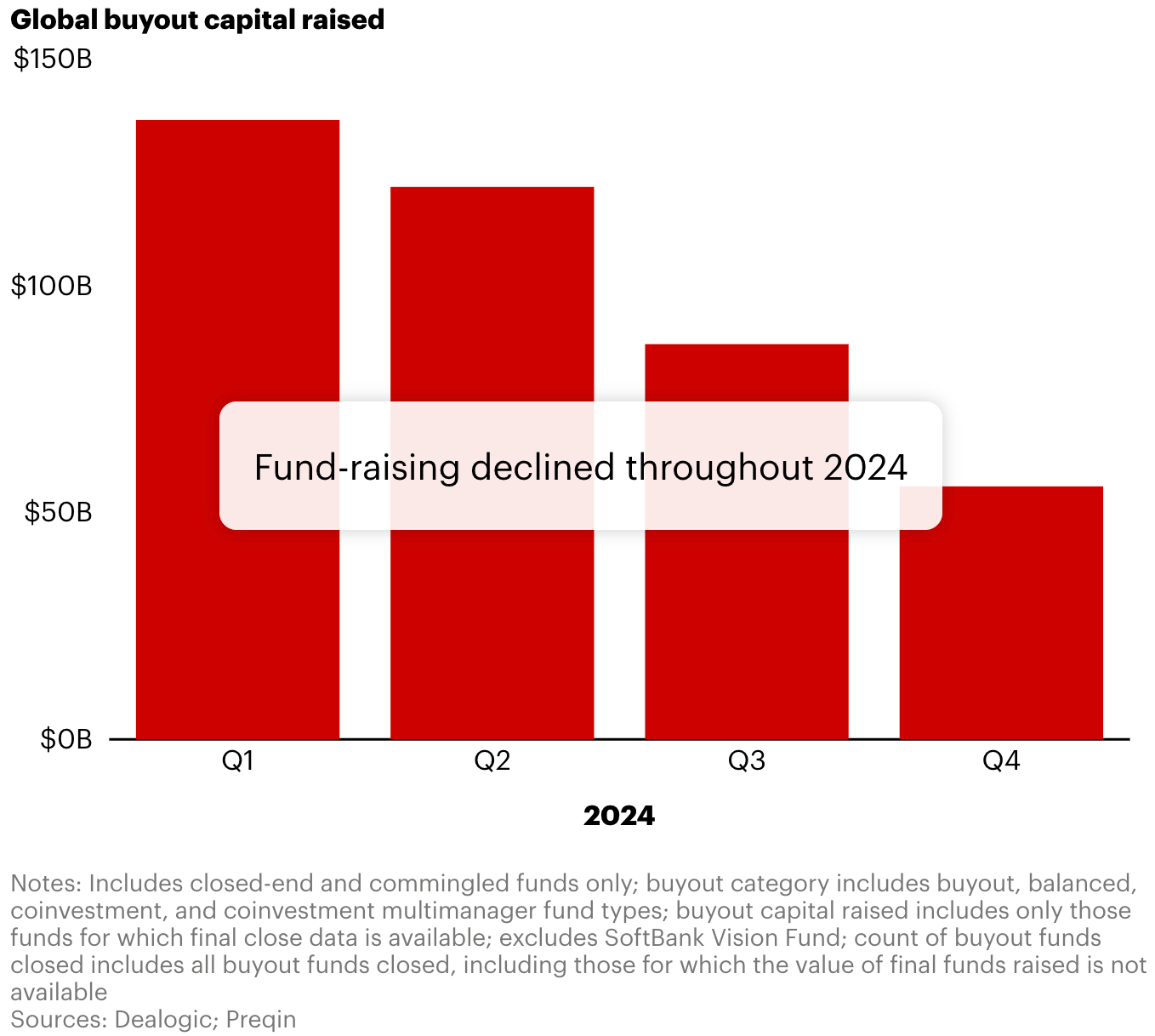

As Private Equity sits on more investments for longer periods, paying Limited Partners (LPs) less in distributions, these LPs are less likely to invest in a new vehicle. We can see in the numbers above that fundraising is challenged and has been declining through 2024.

Venture Capital follows a similar trend to Private Equity in peak fundraising and investments in 2021, but instead of declines, it has a better recent trajectory. In the US, mega funds like A16z have been able to continue raising multi-billion dollar investments as a beta bet on the entire early-stage ecosystem. Since more companies remain private for longer, investors seeking equities returns are forced to play in earlier investment markets.

We recommend our conversations with Carta and Angellist in regards to these trends.

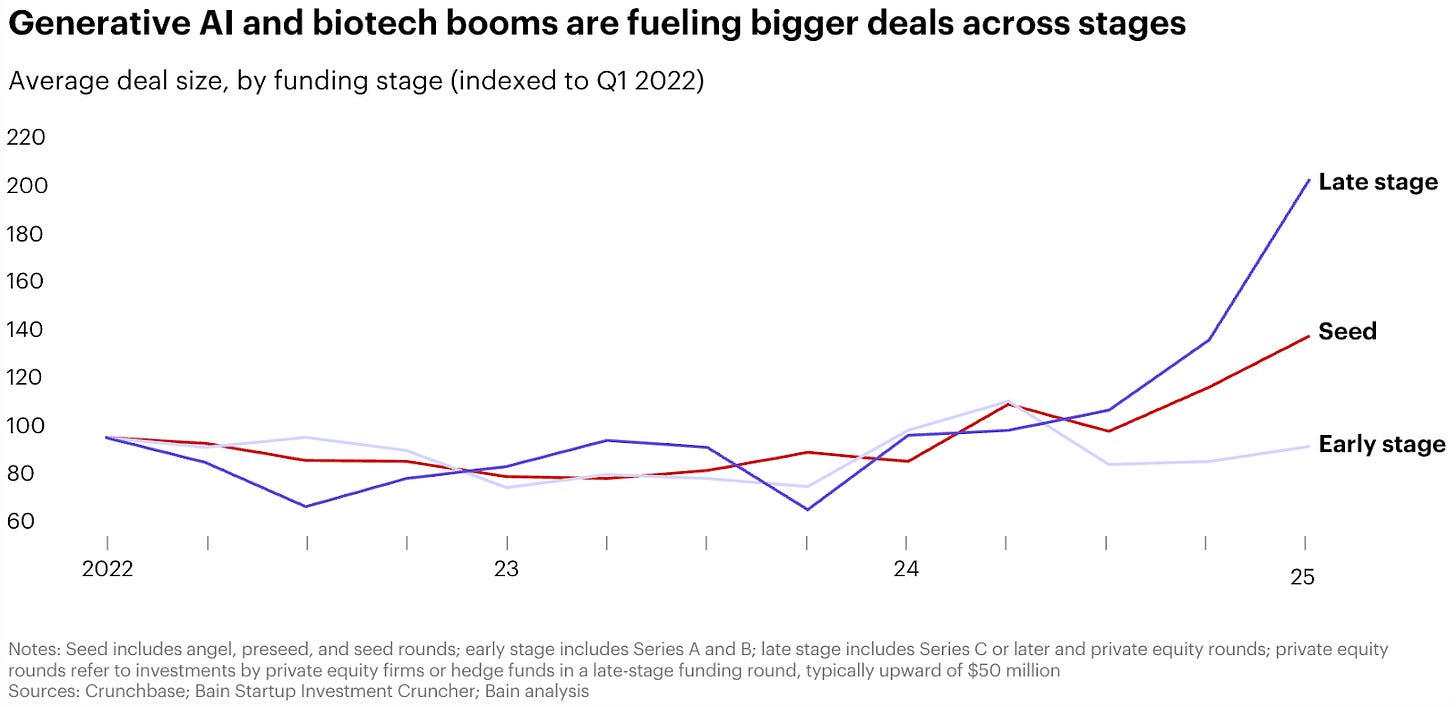

The fundraising levels are still only about 25% of Private Equity fundraising for 2024 globally, but there is a clear divergence of sentiment between the two capital destinations. Additionally, VC investment deal sizes have also skyrocketed for later-stage investing, suggesting that it is filling part of the hole left by Private Equity. It used to be very rare to see a $200MM check into a private company, and now it is the average amount. The AI and Fintech mega-deals are one clear driver of these numbers.

Venture Capital has the capital momentum, and through a few key funds, has managed to position itself as a real competitor to Private Equity in terms of investment mandate and exposure. Consider this the timeless battle between Growth and Value companies. It is just that the Growth companies are now much bigger — consider the role of the Magnificent 7 in the stock market.

Are Vertical AI Roll-Ups the Answer?

Private Equity succeeded in roll-ups through volume — purchasing hundreds or even thousands of small, fragmented businesses and unifying them into national footprints. Risk came carrying interest payments on high leverage, while trying to increase cash flows through operating activity.

Venture Capital does not have the same expertise or relationships to raise large amounts of debt to finance their roll-up strategies. Khosla Ventures, another venture firm looking to experiment with Vertical AI Roll-Ups, has already mentioned a need for acquisition expertise. They are looking to partner with a PE-style firm rather than hiring a team.

Investors are also betting that future business valuations get tech-sized multiples through a combination of AI technology with traditional services, such as in-person car dealerships. Whether this happens remains to be seen, but usually, markets find a conservative equilibrium after a period of time. Another area where we see opportunity is acquiring customers and plugging them into an existing AI business.

There is legitimate room for productivity improvement from AI. As an example, consider both Klarna and Dave as success stories. Marketing automation and code generation have been breakout successes for AI companies. In finance, earnings calls summarization, document automation, compliance, data extraction are all growing and adding value.

Is There An Opportunity?

We are still in the early stages of this new investment strategy.

One company going all in on an acquisition strategy Inversion Capital. Instead of AI as the key economic driver transforming these businesses, Inversion plans to use blockchain rails for transforming core financial and operating functions. Crypto multiples are similar to AI — far higher than that of private equity roll-ups. If you can buy revenues for 2x and sell them for 20x, that’s a good business. And chains are likely to give you grants to bring users to them to grow.

Blockchain investor Santiago R Santos announced the launch of Inversion Capital in November 2024, describing Inversion as “Berkshire Hathaway on-chain”. In February of this year, the business launched Inversion Chain, an L1 blockchain technology built on Avalanche. Acquired companies will be launched on the chain, which will aim to transform these businesses with the use of DePIN, stablecoins, and DeFi to address what Santiago identifies as “higher operating costs, capital expenditures, or degrading unit economics”.

But there is also a risk that we are over-complicating the investment thesis.

There are still many industries underserved by SaaS software — plenty of pie left for those willing to innovate by working with the laggards.

👑Related Coverage👑

Blueprint Deep Dive

Analysis: SharpLink's $425MM to build the Ethereum MicroStrategy with Joe Lubin (link here)

We discuss how, SharpLink (SBET), backed by $425MM in PIPE financing from Consensys and major crypto funds, aims to become the “MicroStrategy of Ethereum” by maximizing ETH yield per share through staking, restaking, and other on-chain financial primitives. In the era of user-generated content, Ethereum enables anyone to create digital financial assets — its infrastructure has led to over $250B in stablecoins, $200B+ in DeFi assets, and adoption by leading fintechs and asset managers.

We explore whether ETH can access Bitcoin's demand engine — driven by ETF inflows, MicroStrategy’s leveraged treasury strategy, and its store-of-value appeal. Notably, Ethereum’s programmability offers additional levers, such as participating in ecosystem tokens and infrastructure assets.

🎙️ Podcast: Forty Billion Reasons to Trust the Future of DeFi, with Aave Founder Stani Kulechov (link here)

In this episode, Lex interviews Stani Kulechov - founder and CEO of Aave, a leading decentralized finance (DeFi) protocol. They explore the evolution of DeFi, Aave’s growth, and its architectural shift from a peer-to-peer model to pooled liquidity. Stani reflects on the early days of DeFi, the impact of the FTX collapse, and the increasing adoption of DeFi over centralized exchanges. They discuss Aave’s strategies for attracting assets, the importance of capital efficiency, and future innovations, including the tokenization of real-world assets and the role of stablecoins.

Curated Updates

Here are the rest of the updates hitting our radar.

Machine Models

Ethical and Bias Considerations in Artificial Intelligence/Machine Learning - Matthew G. Hanna & Liron Pantanowitz & Brian Jackson & Octavia Palmer & Shyam Visweswaran & Joshua Pantanowitz & Mustafa Deebajah & Hooman H. Rashidi

A Critical Field Guide for Working with Machine Learning Datasets - Sarah Ciston & Mike Ananny & Kate Crawford

AI Applications in Finance

⭐ AI-Driven Payment Systems: From Innovation To Market Success - Merve Ozkurt Bas

The Rise Of Generative Ai Agents In Finance: Operational Disruption And Strategic Evolution - Inesh Hettiarachchi

Financial Modeling in Corporate Strategy: A Review of AI Applications For Investment Optimization - Olufunmilayo Ogunwole & Ekene Cynthia Onukwulu & Micah Oghale Joel & Ejuma Martha Adaga & Augustine Ifeanyi Ibeh

Investment Outlook

⭐ Private Equity Outlook 2025: Is a Recovery Starting to Take Shape? - Bain & Company

⭐ Global Venture Capital Outlook: The Latest Trends - Bain & Company

⭐ Global Private Markets Report 2025: Braced for shifting weather - McKinsey & Company

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our new AI products newsletter, Future Blueprint. (Don’t tell anyone)

Read our Disclaimer here — this newsletter does not provide investment advice

Contributors: Lex, Laurence, Matt, Farhad, Daniel, Michiel, Luke

For access to all our premium content and archives, consider supporting us with a subscription. In addition to receiving our free newsletters, you will get access to all Long Takes with a deep, comprehensive analysis of Fintech, Web3, and AI topics, and our archive of in-depth write-ups covering the hottest fintech and DeFi companies.