The Builder's Playbook

We are humans and our superpower is to make things anew. It is to build. And if you are here with us, it is probably because you want to build something meaningful in financial services or in technology — of whatever flavor.

This collective drive is precisely what inspired us to create the Building Company Playbook.

In this series, we lay out some of the basic lessons for building Fintech companies and DeFi projects, re-teaching ourselves the foundations of what makes things work.

To express our gratitude for your support, we are offering an exclusive opportunity to access Building Company Playbook #1: Designing Your Fintech Business Model, absolutely free. 🎁

Should you find it valuable, we invite you to become a Premium Member to access the remaining six playbook editions. Together, we are forging the path for the next wave of fintech innovation.

Building Company Playbook Series

Building Company Playbook #1: Designing Your Fintech Business Model (Free access below)

Building Company Playbook #2: Creating a B2C fintech marketing strategy 🔒

Building Company Playbook #3: Creating a B2B fintech go-to-market strategy 🔒

Building Company Playbook #4: Building Fintech & DeFi software products 🔒

Building Company Playbook #5: Creating your Fintech financial model and raising venture capital 🔒

Building Company Playbook #6: Using token design for financial and product success 🔒

Building Company Playbook #7: Planning and executing your exit strategy 🔒

Building Company Playbook #1: Designing Your Fintech Business Model

The Shape of Demand

In this series overall, we want to think about the various functions of a fintech company. How do you build a good Marketing team, for example?

But before we get there, we need to figure out when Marketing actually matters. Are you trying to build a brand? Create leads? Convert into product? Or do you not need marketing for more than decorating the activities of an enterprise Sales team? Each strategy is congruent to the shape of some company or project. That leads us to the question about that particular shape.

In some of our past work, we had talked about this as a “negative space” — see here Who are the customers of Embedded Finance, and what do they reveal about Stripe, Affirm, DriveWealth, and Green Dot? The shape a company — let’s just use this word for all sorts of entrepreneurial permutations — is determined by multiple factors. The wrong factor is to be merely a mirror of leadership personalities and their prior experience. Stubborn, opinionated management comes with pre-built assumptions about markets and value chains. This can be both an asset and a liability to a young company.

If, for example, you had run the UBS wealth management business, you might assume an entire industry structure of custodians, tech providers, and broker-dealers, as well as their prices, sales strategy, and other integrations. Alternately, if you had run a digital payday lending business, you might have very strong assumptions about what your previous customers need and their spending habits, as well as the value chains of underwriting and payment processing. Taking these different experiences as fact about some new problem, and applying that as dictate from the management team leads to a mismatch between the hypotheses of experienced people (i.e., your stubborn and expensive management teams), and what really matters.

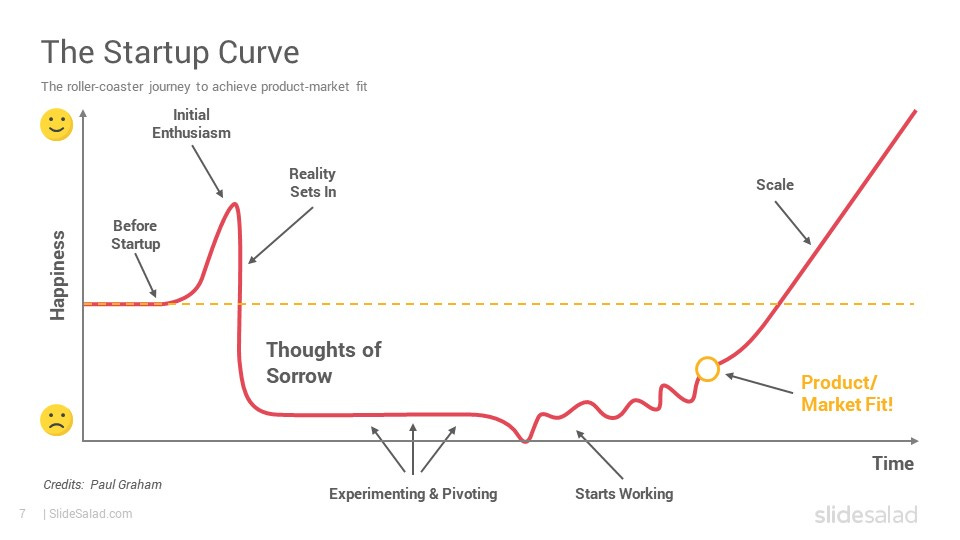

And what really matters is the shape of demand, and the ability of a company to wrap itself around that demand in all sorts of ways — from product strategy, to brand positioning, to customer support, to the execution of marketing programs. Some people call this product-market fit, and talk about pivoting a start-up until such a state is achieved. Venture investors will have specific metrics that qualify as product-market fit for their investment thesis, of needing to get viral unicorn hits in an otherwise doomed private portfolio.

So let’s say you are looking for that negative space, which is the set of problems that other people experience, and trying to run experiments to validate whether there is enough economic value for a company to be built sustainably.

There are lots of other places you can learn about how to run a product discovery and development process, so we won’t belabor it here. Whether it is the lean startup method, or some version of Agile, or just lots of conversations with prospective customers, the most important thing is that you get out there and actually learn what those prospects could want. Look for things that people would be happy to spend on, without hesitation.

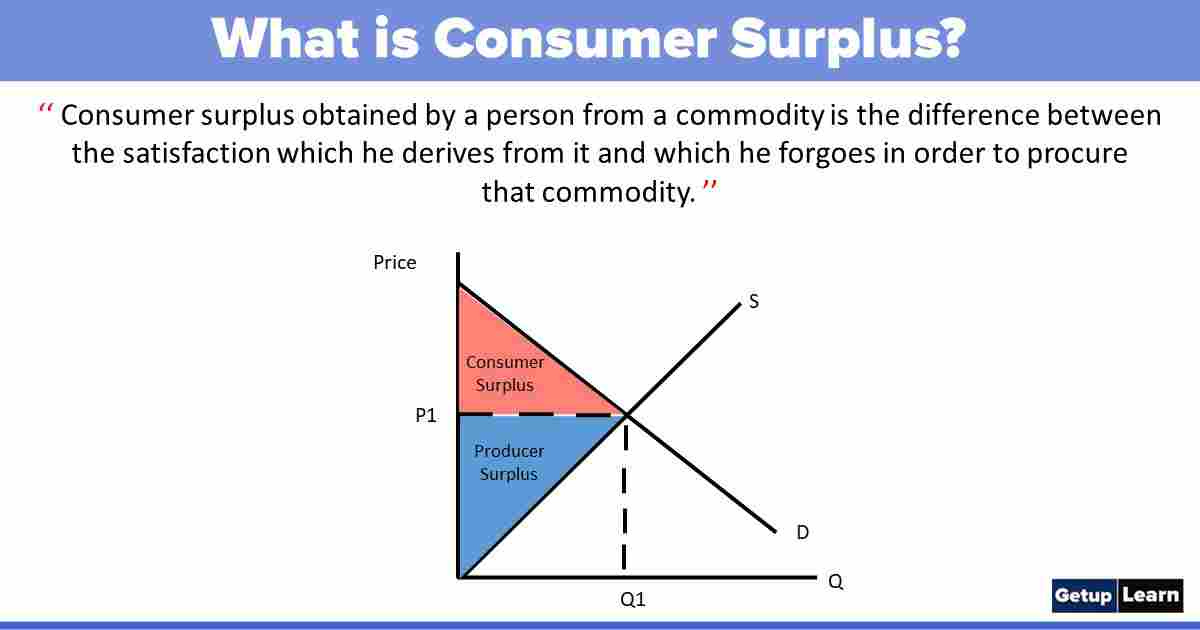

Economic value is oxygen. You want to find and target places with meaningful consumer surplus, where the price you charge to your customer is still lower than their willingness to pay. You want to leave value on the table for your customer, who will then recommend your business to others, and engage with it more fruitfully.

If you want examples of this, look at the value that roboadvisors offered in automating wealth management and reducing cost from 1.5% of assets under management to 0.25% of assets under management. Or look at Transferwise, cutting the cost of moving money from 3% in foreign transaction fees to below 1%.

If we look at the digital fintech tools — neobanks, roboadvisors, digital investing, payments wallets — as an investment analyst does, just cells in a spreadsheet with a lower cost base, we will miss the substance of what is actually going on. Financial analysis misses the important qualitative shifts that drive industry transformation. Isolated financial analysis is incredibly dangerous, begging for black swans to destroy its assumptions.

Back to B2C fintech. These mobile-first solutions were able to use a platform shift technology, i.e., cloud services and mobile devices, to attach to demand for financial services products. Now that demand manifests not in the need for some feature, like “an asset allocation” or a “digital loan”. No, demand manifests as a problem, like “I want to retire in 10 years” or “I can’t afford this home improvement, but I need it to live”.

If you want to look at B2B fintech, use the same framing. It is not “We need a CRM that integrates portfolio management and performance reporting data” but “Our teams need to convert more of our prospects into paying users”. The product feature are the “solution” to the business problem equation. Don’t fall in love with the solution. Rather, find a business problem you can love and pivot around — however that business problem must be appropriately sized.

The Models of Business

In the examples above, we talk about large and existing demand that is somewhat obvious. The nice thing about financial services is that we generally know what people need, because they have been needing it for millennia without much change. People pay, save, borrow, lend, trade, invest, and insure against risk.

Those are repeatable financial services patterns. You can segment each need by the customer asset size, psychographics, and so on.

Here’s an old meme industry map showing this in Fintech.

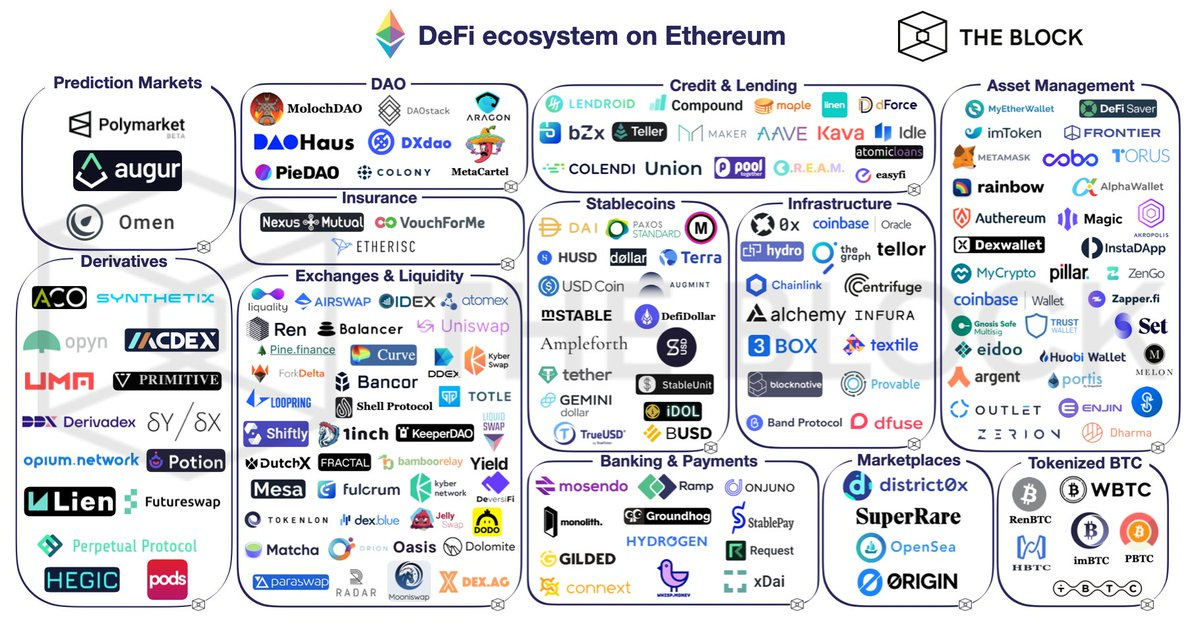

And here’s an old pre-FTX industry map showing this in DeFi.

We bet there was a version of this same thing for early Internet companies. We can’t find it, so here’s a Midjourney hallucination of the prompt. And here’s one from a steampunk version of the 1800s for good measure.

The shape of financial demand is fairly constant, relative to the rest of society. We aren’t saying that societies don’t get more or less financialized, but rather that you don’t have to guess at whether people need to do the basics with their finances.

Therefore one way that you can build things is to ride the technological platform shifts, and apply the advantages of those platform shifts to business models already serving large revenue pools. This requires knowledge of revenue pools and the particular industry value chains and structures. Would you like to learn how wholesale banking and payments work — then lean into blockchain, and propose new ways of moving money. Or perhaps you prefer the human psychology of peer-to-peer payments and commerce — then lean into mobile apps, how they get user attention, and why people spend in the first place.

Regardless, the key is to understand the macro technological shifts and then project out a few steps an applied version of that future technology. Today, we would recommend you think about Generative AI and the implications that its ability to instantiate our imaginations and shallow labor half-thoughts into beautiful, persuasive outcomes will have on how people will engage in value exchange.

What will happen to customer acquisition and content farming for example, and how will that in turn lead to labor we consider valuable? How will we pay to access a hivemind of digital objects — by our mere attention, or through some other financial contraption? Who will process this at the right transaction speed and machine scale?

Anyway, that’s one way.

Another way to think about demand is through novelty alone. It is easier to hunt for new business where there are few competitors. A toy example would be as follows. Imagine you are the first manufacturer of custom-print iPhone case protectors. It is uncertain whether the iPhone will be adopted, but if it is, your adjacent business will blossom. Similarly, companies that are right now trying to fix up the CFO technology stack for DAOs are playing with very uncertain demand. Will the macro environment and over-zealous regulation wipe out the DAO opportunity? Will enough people want to work for monetized Web3 forums with a treasury? How will we be taxed on tokens, and does it make sense to have thousands of equity-like-linked-currencies?

The shape of demand here is highly speculative, and likely you will be burning venture capital cash trying to figure it out. But novelty search has the surprising capacity to create asymmetric returns and open up incredible, large opportunities to those flexible enough to wait it out, and smart enough to float with the water.

For a case in point, you can see how Betterment is less interesting than Coinbase. With Betterment, the demand for passive ETF investing was known and large, and the company innovated in distribution through the web and automation of workflows. Meanwhile, Coinbase bet not just on digital distribution but the rise of crypto assets. That is a much larger upside bet, but also far more volatile. Generally speaking, the risk asymmetry has benefitted fintechs that got not just the established demand space right — “people want to invest on their phones” — but also the platform shift bet right as well — “Millennials distrust traditional finance, love tech, and want a new digital asset class”.

But such differentiation is not permanent. Fintech catches up to crypto. Banks catch up to Fintech. Everything integrates and re-integrates.

If you want another example, MetaMask is more interesting than Coinbase. Whereas Coinbase figured out the platform shift within the “investing” category, MetaMask figured out a platform-shift answer in the macro category above that — “the purpose of the Internet, or Web3”. Using a financial Internet for a digital lifestyle is a much broader problem set than holding some particular digital assets in the context of other investments.

Attaching an Economic Model to the Opportunity

Let’s assume you have figured out something worth doing, that you are testing things around it, and some of the experiments begin to yield economics.

It is worth highlighting two things. The first is the scalability and packaging dimension of your business model. The second is figuring out how to charge along with the grain of the value flows in that business model.

On the former, what we mean is that most experiments don’t start out as product. Instead they start out as services, or one-off custom engagements. Let’s say you are pre-DCG Barry Silbert and building out Second Market. The first version of your product is not going to be a fully built out tech platform integrated into a stock exchange with appropriate compliance. It is going to be a spreadsheet.

The first version of your digital investing app should just be an RIA. The first version of your incredible enterprise blockchain project is likely a PowerPoint to 15 different corporate innovation teams at $25,000 per “strategy workshop”. This is fine. We all do it. There’s lots of material out there like this —

It isn’t that important to create this into a process, unless you are running an innovation factory or a product lab. As an entrepreneur, you just need water to drink. So take those consulting gigs and figure out whose wallet is the most open.

The more you do so, the more you will see the number of your prospects increase. As those prospects increase, you will start to see patterns in the data of their demand and understand what it is that they actually want. This in turn allows you to package and productize your services into things that can be manufactured and sold more automatically.

Or perhaps you can choose a more sophisticated business model. If you have the insight that digital banking will prevail over branch banking, you could (1) start the digital bank yourself, or (2) start an infrastructure company that supports digital banks, or (3) create a platform that helps digital banks select and integrate various infrastructure companies, or (4) have a high-end consulting or legal business doing the integration of digital banks to their infrastructure providers using various platforms, and so on. It is a Rubik’s cube of choice. Pick the one matching your risk profile and natural talents.

Finally, your business model needs to be congruent with the economic flows of the underlying industry. When looking at financial businesses, understand whether the financial asset is money-at-risk (lending / insurance / BNPL), money-in-motion (payments / brokerage), or money-at-rest (investment management / savings).

In the first category of risk, you will be paid a lot of premium and underwriting fees upfront, but will also carry a liability that can blow up in several years. One of the worst errors of fintech VC has been to treat underwriting revenues as if they were SaaS fees. They are not, and should be valued much lower. The embedded risk also exposes companies to the business cycle in ways that are far more complex than just customer attrition.

In the second category of money movement, companies charge based on volume or number of transactions. Think of brokerages like Robinhood, whose sole purpose is to figure out how they can get you to trade. Or of PayPal, which needs you to buy and participate in commerce. Their lifeblood is your financial spending and turnover.

Last, money-at-rest wants to stay at rest. A savings account would prefer you not pull out your assets, because that may lead to duration mismatch. An investment account would prefer you keep your AuM in those ETFs, so that the funds and advisors can charge AuM fees.

When building your own company, figure out which of these economic models you want to use, and which are used by your customers. Do you like telling stories about change and helping people take advantage of day-trading opportunities? Or do you want to create sticky, long term relationships and protect people against surprises (e.g., Lemonade). The answers to these questions will build out your economics for you.

Of course, you can behave as a tech company and structure your fees as flat subscriptions, or perhaps on a per-user basis. We think such approaches work when they overlap with the type of usage that your customers have of your product — Adobe Photoshop or a CRM should have a usage subscription. But that approach will fail if your product is fundamentally about something different economically. Incentives will take over, and at some point someone will introduce transaction fees, overdraft fees, and spreads. Go with the flow.

Last, we point you to Web3, and the innovations the space has been building out around cryptoeconomic models. Whereas Fintech companies charge in the currency of their jurisdiction and keep equity exposure for investors, Web3 projects can run experiments not just around products but around community ecosystems. Prospects become economic stakeholders in the success of the protocols they use, such that they use the currency of their protocol and benefit (or lose) from equity-like exposure from their usage.

We will keep further discourse around tokenomic design for future analysis. But understand that powerful incentive design can expand out into the community and correlate their usage of a product with financial appreciation of the product’s token in both a positive and negative loop. In turn, that can push the responsibility to generate product-market fit, as well as the performance of bespoke consulting work, marketing experiments, and other early stage exploration to the community of the protocol.

This concludes our views on business model exploration. If you enjoyed this chapter, we encourage you to upgrade to a Premium Membership and unlock the remaining six chapters.

Building Company Playbook #2: Creating a B2C fintech marketing strategy 🔒

Building Company Playbook #3: Creating a B2B fintech go-to-market strategy 🔒

Building Company Playbook #4: Building Fintech & DeFi software products 🔒

Building Company Playbook #5: Creating your Fintech financial model and raising venture capital 🔒

Building Company Playbook #6: Using token design for financial and product success 🔒

Building Company Playbook #7: Planning and executing your exit strategy 🔒

A premium subscription includes all the benefits of a free subscription, plus:

🔎 Wednesday’s Long Takes on Fintech and Web3 topics with a deep, comprehensive analysis by The Fintech Blueprint research team.

⭐️ Lex’s Market Updates, a live Q&A session where Lex Sokolin explores trends in capital markets, generative AI, web3, global macro, and more.

🤖 ‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures. Topics include How to design your fintech business model, Using token design for financial and product success, and Planning and Executing your Exit Strategy.

🎤 Enhanced Podcasts with industry leaders, accompanied with annotated transcripts.

📚 Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands.

As always, thank you for your support.