Digital Wealth: JPMorgan invests in risk analytics wealthtech Edgelab & Evooq

The bank also bought ESG-focused wealthtech OpenInvest and share plan management software platform Global Shares and invested in data groups Kraft Analytics Group and MioTech

Hi Fintech Futurists —

Welcome back to Digital Wealth. Today we highlight the following news —

NORTH AMERICA: TIFIN Announces The Asset Management Industry's First SaaS-Based AI Platform For Modern Distribution

EMEA: J.P. Morgan Private Bank Invests In Two Swiss Fintechs

ASIA PACIFIC: Yubi Launches India’s First Fixed Income Platform, Yubi Invest, To Democratize The Fixed Income Sector

Thanks as always for your time and attention. To dive deeper into our covered topics, check out the premium options below.

North America News

⭐🇺🇸 TIFIN Announces The Asset Management Industry's First SaaS-Based AI Platform For Modern Distribution - PR Newswire, December 6, Colorado

TIFIN, a wealthtech connecting retail investors, intermediaries, and investment managers, has launched a new AI-powered SaaS platform, TIFIN AMP, which combines marketing, data science and sales enablement capabilities.

TIFIN AMP uses marketing data to identify leads, rank them using various signals, and then start automated nurturing programs through custom content creation (thought leadership papers, videos, infographics), campaigns, and engagement. There’s an algorithmic element that pulls in what kinds of activities both investors and advisors do on the digital investment platforms, and this feeds rich data back into the marketing funnel.

TIFIN keeps being in the news — they’ve gotten 40+ asset management firms, raised $109MM in its Series D at an $842MM valuation, acquired Sharing Alpha, and partnered with ETFMG and Chalice Network. This offering expands capabilities towards more intelligent demand generation and lead management. Competition in this space is still brutal — FNZ raised $1.4B this year, and Avaloq is also a contender. What we like is differentiation around the top of funnel, rather than more focus on back office efficiency.

👑 See related coverage 👑

🇺🇸 Orion Expands ETF Lineup By Adding Dimensional Wealth Models To The Orion Portfolio Solutions Platform - Businesswire, December 1, Nebraska

🇺🇸 J.P. Morgan Launches Digital Money Coach To Help Clients Make Smart Money Decisions - J.P. Morgan, December 1, New York

🇺🇸 Huntington National Bank Launches InvestCloud’s ‘Find My Advisor’ Technology - IBS Intelligence, December 6, Ohio

🇺🇸 reAlpha Asset Management Inc. Secures $100MM Capital Commitment For Post IPO Funding From GEM Global Yield LLC SCS - Businesswire, December 1, Ohio

🇺🇸 Seeds Investor Completes Initial Capital Raise To Promote Personalized Investing - Businesswire, December 6, New York

🇺🇸 Leading Private Investment Platform Linqto Partners With Wealth Management Innovator Farther - PR Newswire, December 7, California

🇨🇦 Tetra Trust Announces Partnership With Meetami Innovations To Deliver Turnkey Solution For Digital Asset Investing To Wealth Managers - Globe Newswire, December 7, Calgary

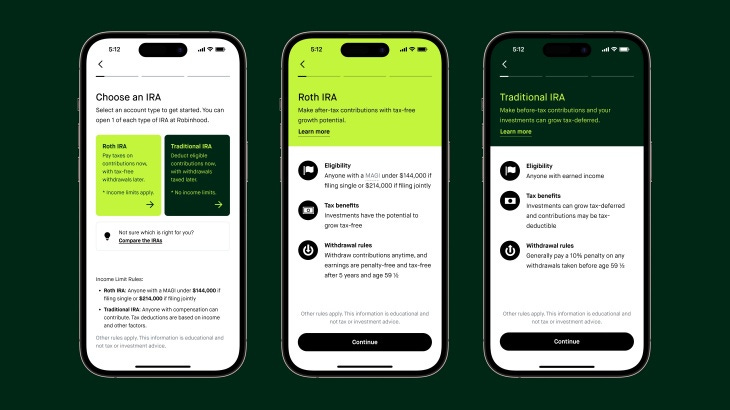

🇺🇸 Robinhood Banks On Retirement To Slow User Attrition - TechCrunch, December 6, California

EMEA News

⭐🇨🇭 J.P. Morgan Private Bank Invests In Two Swiss Fintechs - Reuters, December 1, Zurich

J.P. Morgan Private Bank has invested in two Switzerland-based wealth management software companies — Edge Laboratories and Evooq. Edgelab and Evooq are sister firms, employing 285, with Cédric Ullmo as CEO and Founder of both.

Edgelab and Evooq offer: (1) multi-asset class portfolio construction (including OTC and structured products); (2) pre and post-trade compliance checks; (3) portfolio simulation for stress tests and construction of an optimal risk/return ratio; (4) reporting, with aggregated views on risk, including sensitivities of moves on market variables and (5) portfolio optimisation, in which clients get investment recommendations. Edgelab is more focused on risk and analytics, and Evooq on process automation.

JP Morgan has a long-term view on fintech, and a $12B+ tech budget overall. Recently, it has done a lot in wealthtech, including acquiring roboadvisor Nutmeg for a reported $1B, ESG-focused wealthtech OpenInvest, share plan management software platform Global Shares, and investing in Kraft Analytics Group and MioTech. Consolidation in wealth software is on the rise more generally — e.g., FNZ buying New Access, a digital core banking system for private banks, and Orion acquiring Redtail CRM and TownSquare Capital. So for entrepreneurs, the plan is build a feature, sell it to a platform.

👑 See related coverage 👑

• Long Take: What will Goldman Sachs do with Marcus, and Why?

• Long Take: What's wrong with $12B Credit Suisse, but right with $8B Wise

🇬🇧 M&G-Backed Moneyfarm Buys UK Digital Pension Adviser Profile Pensions - Reuters, December 6, London

🇫🇷 Indosuez Wealth Management Launches Digital Platform - Wealth Briefing Asia, December 6, France

Asia Pacific News

⭐🇮🇳 Yubi Launches India’s First Fixed Income Platform, Yubi Invest, To Democratize The Fixed Income Sector - CXO Today, December 5, Chennai

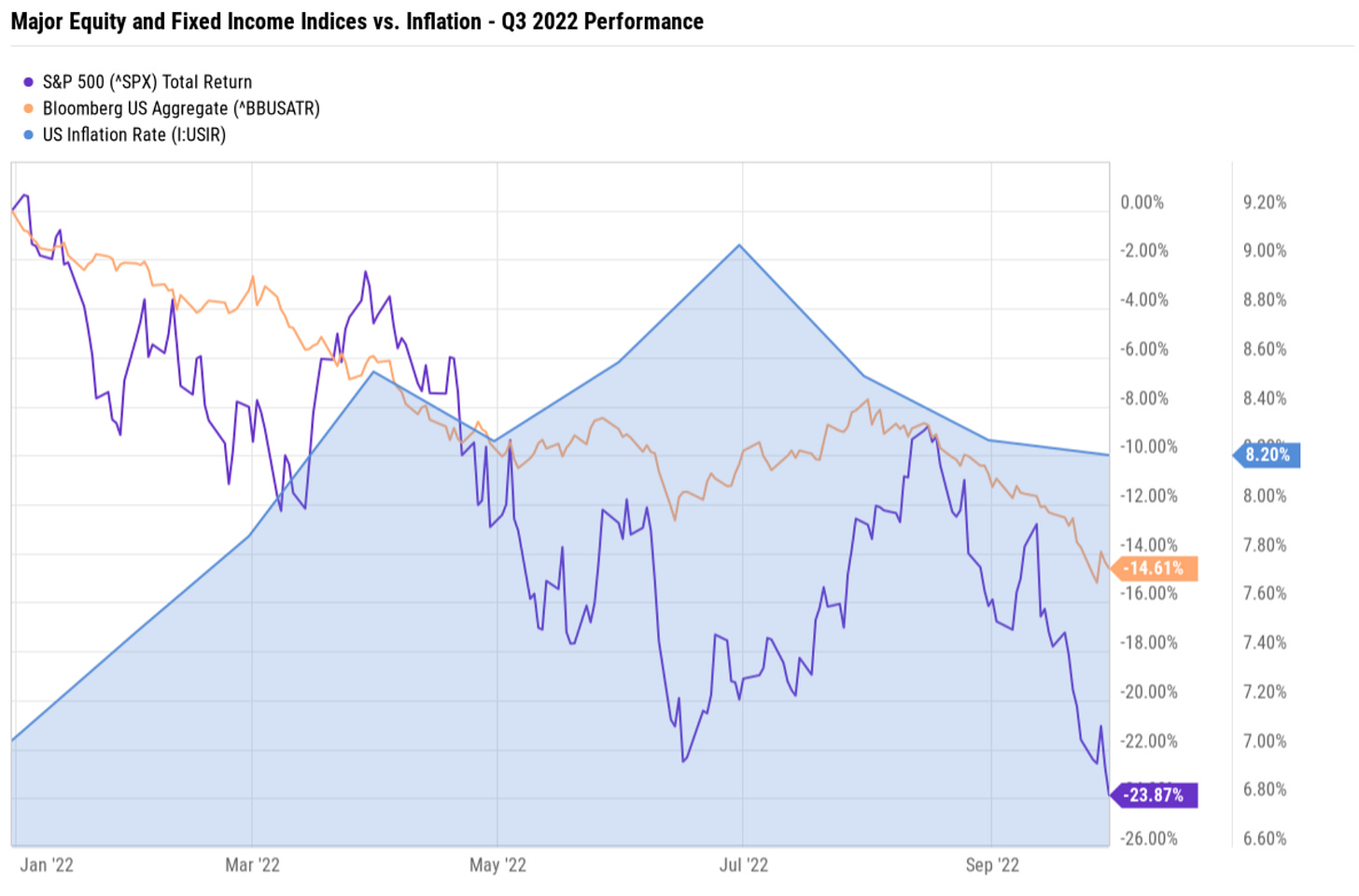

Indian fintech Yubi, previously known as CredAvenue, is a digital debt marketplace connecting businesses to lenders and investors. Yubi Invest enables wealth managers, advisors, and retail participants to invest and trade bonds, a unique pivot to capture the fixed income asset class. Reuters recently reported that India's 10-year benchmark rate appears attractive at 7.5% compared to other Asian economies. In an inflationary, risk-off environment, pitching interest rates is easier than capital gains.

Yubi's product suite includes (1) loans for SMBs; (2) a supply chain financing platform arm; (3) a co-lending marketplace for banks and non-bank financial institutionss; (4) real estate and infrastructure financing ; (5) and end-to-end asset-backed securitizations. The addition of Yubi Invest offers yields of 5-12% across products such as market-linked debentures, non-convertible debentures, commercial paper, and tax-free perpetual bonds and a unified platform to view bonds and their credit ratings across industries.

Earlier in March, the firm closed a Series B round of $137MM at a $1.3B valuation — a strong number given the fall in valuations. We like the multi-sided network play here. The company first had to build out the borrower side, attracting small businesses with capital. Now it is growing out the investor side, and creating marketplace experiences. This reminds us of OnDeck, in terms of credit risk, and Lending Club, in terms of capital sourcing. The challenge is matching duration and finding enough liquidity for both sides of supply and demand.

👑 See related coverage 👑

🇭🇰 HashKey Group And SEBA Bank Form Strategic Partnership To Accelerate Institutional Adoption Of Digital Assets In Hong Kong And Switzerland - Yahoo Finance, December 5, Hong Kong

🇮🇳 India's AlgoBulls Raises $2MM Pre-Series A Funding Led By Venture Catalysts - Technode Global, December 7, Mumbai

🇲🇾 Versa’s Customers Can Start Investing In Real Estate And Gold From RM100 - Fintech News Malaysia, December 5, Kuala Lumpur

Blogs, Webinars, Podcasts

🇬🇧 Wealth Management Firms Double Down On Digital Infrastructure - Consultancy, December 6, London

🇬🇧 Asset Managers Pour Money Into Tech Platforms To Take On BlackRock - Financial Times, December 4, London

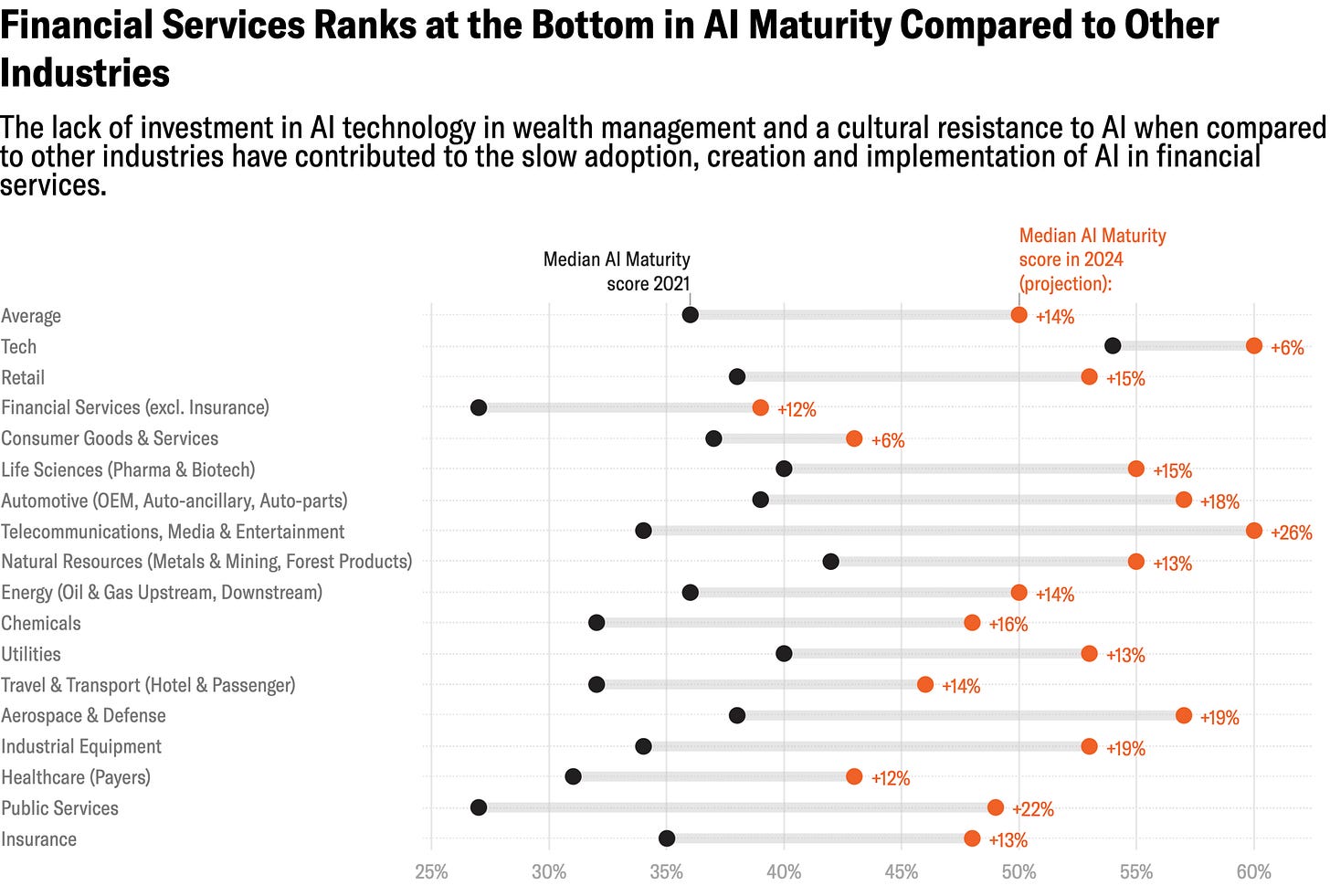

🇬🇧 Good Data and Great Algorithms: Using AI To Enhance Portfolio Management - Global Banking & Finance Review, December 2, London

🇸🇬 Private Wealth Digital Assets Study Finds Investor Interest In Digital Assets Remains High - PR Newswire, December 6, Singapore

🇺🇸 Modernizing Fund Distribution Through Connected Intelligence - Financial Advisor, December 7, New Jersey

Events & Reports

🇺🇸 Wealth Solutions Report Announces Inaugural Wealth Exemplar Award Winners - PR Newswire, December 6, New York

🇺🇸 2022 Forbes Wealth Summit - Forbes, December 6, Virtual

🇺🇸 Wealth Management EDGE - Informa Connect, May 21 - 24, Florida

🇬🇧 Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

🇬🇧Digital Integration In Wealth Management 2023 - Arena International, February 21-22, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.