Fintech: Apple Cash push into ID and recurring payments; Blackrock Aladdin teams up with Avaloq, no FutureAdvisor mention

Don't miss our Apple Vision Pro take and the upcoming token engineering write-up

Hi Fintech Futurists —

You’re the best, today’s agenda below.

PAYTECH: Businesses will be able to accept IDs in Apple Wallet with iOS 17, among other changes (link here)

INVESTING: BlackRock And Avaloq Unveil Strategic Partnership To Provide Integrated Technology Solutions, Meeting Evolving Needs Of Wealth Managers (link here)

LONG TAKE: Strategic analysis of Apple's mixed reality launch and impact on Fintech & Web3 (link here)

PODCAST CONVERSATION: The role of USDC and tokenized cash in Decentralized Commerce, with Teana Baker-Taylor, Circle VP of Policy and Regulatory Strategy EMEA (link here)

CURATED UPDATES

Before we delve into today’s analysis, we would like to spotlight the upcoming next edition of our Building Company Playbook series. This issue focuses on token economics, and how to think about building value for fintech and DeFi projects through considered financial system design.

Catch up on previous editions of the Building Company Playbook here: (1) business models, (2) B2C marketing, (3) B2B go-to-market, (4) software development, (5) mastering financial models and raising money.

Playbook #6 will drop this Wednesday, June 21, and it is for premium subscribers only. If you are already subscribed, just wait until Wednesday. Otherwise, make sure to subscribe below for full access. 👇

FINTECH NEXUS WEBINAR

Challenges and Opportunities of Digital Credit: Transformation is a must for Community Banks and Credit Unions to Compete

On June 20th, the panel of founders and top level executives at leading fintech firms will explore the challenges associated with digital credit, especially as we approach a recessionary environment. How can community banks and credit unions compete and win against big banks and fintech lenders?

Digital Investment & Banking Short Takes

PAYTECH: Businesses will be able to accept IDs in Apple Wallet with iOS 17, among other changes (link here)

Apple has been relevant in fintech quite a lot recently.

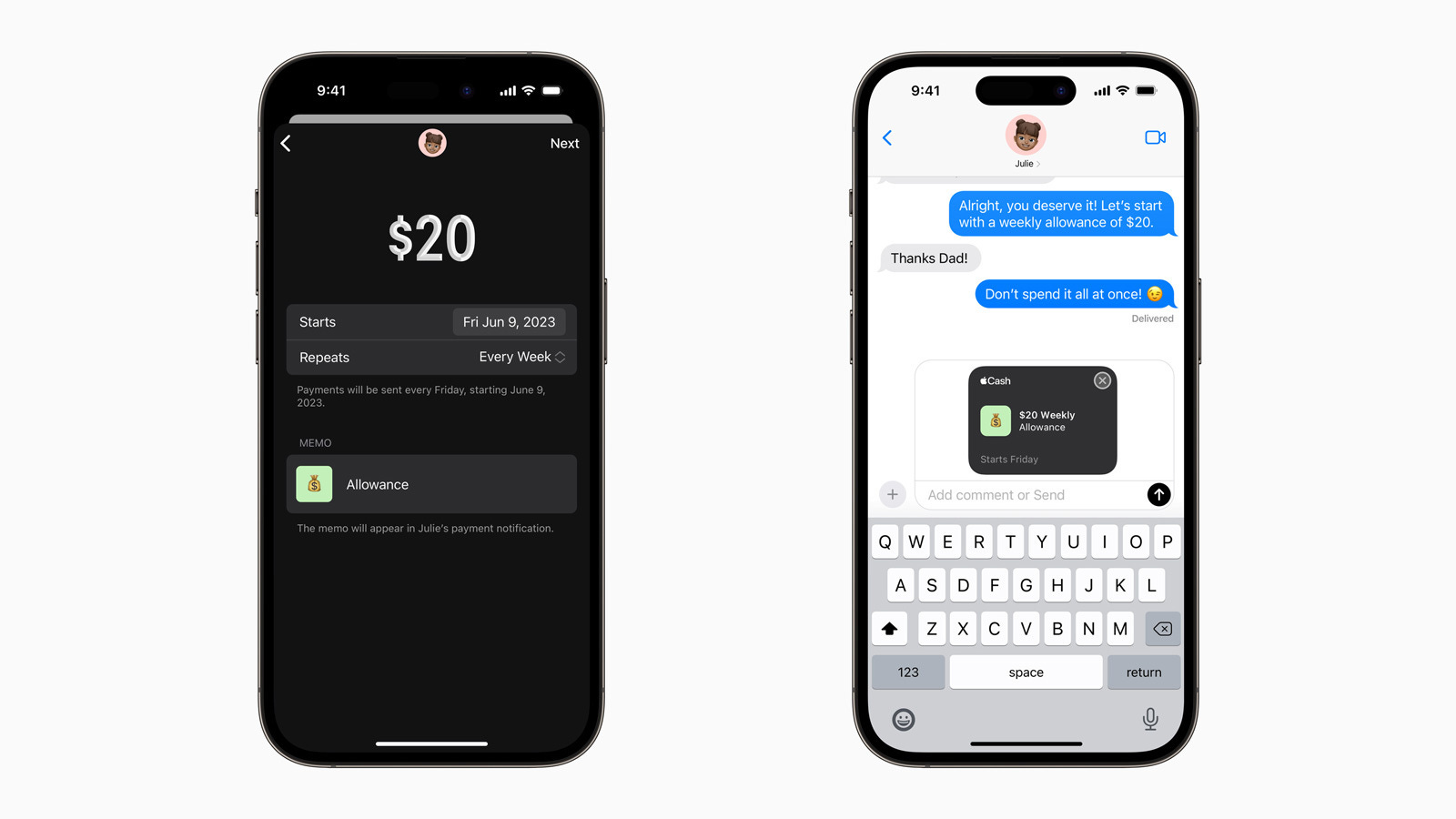

Two months ago, Apple announced the launch of the Apple Card savings account, in partnership with Goldman Sachs, offering 4.15% APY. The card also offers 1% cash back rewards, jumping to 2% for any purchases made using Apple Pay, and 3% with select merchants. Now, the company is introducing two new interesting features with iOS 17 in autumn — (1) recurring payments with Apple Cash, and (2) enhanced digital IDs.

Digital IDs have been available on Apple for a while, but have not been widely pushed to adoption. For example, the Transportation Security Administration (TSA) lists 25 airports that are currently testing digital IDs, including Santa Francisco (SFO), Los Angeles (LAX), Denver (DEN), Atlanta (ATL), Miami (MIA), among others, using specialized equipment called CAT-2 scanners. With the new upgrade, Apple enables businesses to accept IDs stored in Apple Wallet without additional hardware requirements.

A fast-access, trusted digital ID removes the need to check IDs for car rentals or alcohol purchases, and speeds up queues at age-restricted venues. It also transfers only the necessary information — like whether the person is old enough to enter a bar — without excessive loss of privacy, e.g., the individual’s address and organ donor status. The process works by holding your iPhone or Apple Watch next to the business iPhone, and then confirming the share using Face or Touch ID. Businesses will not store the data, unless they are approved by Apple to do so, and even then users will be notified beforehand.

On the recurring payments front, users can set up payments to recipients at predetermined intervals, as well as automatically top up their Apple Cash balance when required — a simple but useful feature that has been a long time in coming.

User experience has always been the core of Apple’s hardware strategy. There are over a billion iPhone users globally, making up over 50% of the US smartphone population. The focus on integrating essentials like ID and recurring payments straight from an iPhone makes Apple products one step closer to indispensable, and a convenient replacement for your actual, phyiscal wallet — which includes cards and notes from traditional bank services.

The breadth of the solution reminds us of Alipay, which has dominated fintech in the East with its integrated all-in-one offering. As of the end of 2022, Alipay reportedly had 680MM monthly active users. It’s impressive just how much Apple has been able to get into financial services, without owning any of the underlying regulated infrastructure.

The iPhone’s prevalence, coupled with its ability to deliver internet, media, ID and a core banking financial product all in one device makes it hard to imagine anyone going elsewhere. Further, any neobank or payments technology company is now competing not just with JPM and Visa, but also Apple’s default financial options and the distribution of its devices.

👑Related Coverage👑

INVESTING: BlackRock And Avaloq Unveil Strategic Partnership To Provide Integrated Technology Solutions, Meeting Evolving Needs Of Wealth Managers (link here)

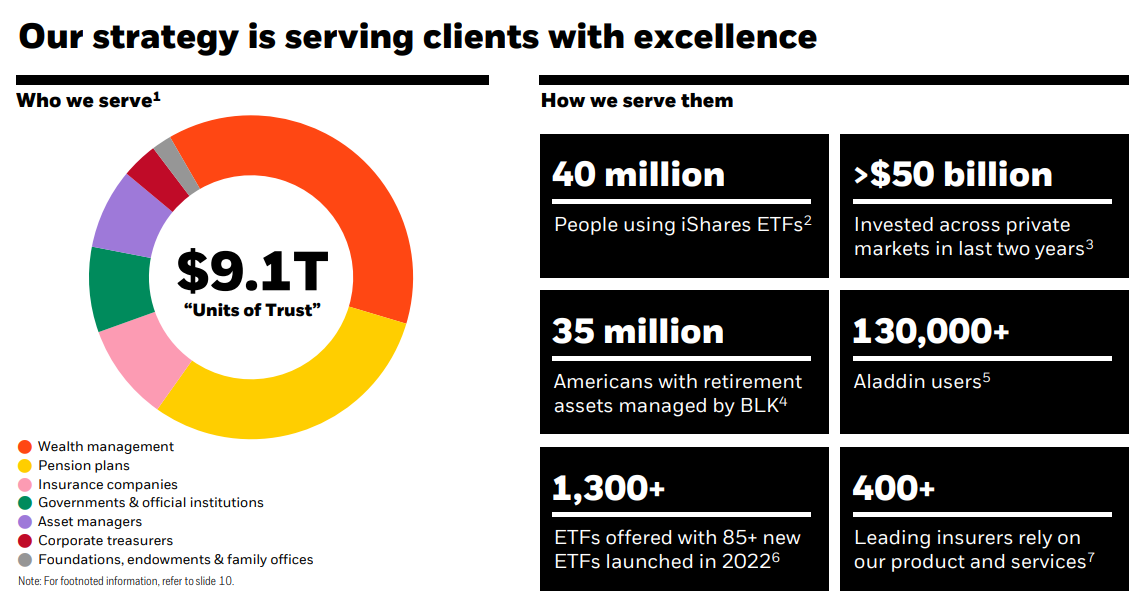

Blackrock the asset manager has a digital investing platform called Aladdin, which is their fee-based in-house portfolio and risk management software. It connects to roughly $20T of AUM, giving it access to a trove of valuable data from 130,000 customers. As context for scale, Alphabet and Apple rely on Aladdin software for their corporate treasury investment portfolios. Aladdin Wealth provides wealth managers with end-to-end reporting tools such as business management, portfolio construction and rebalancing, and risk analysis. And now, it will also leverage Avaloq’s investment technology solutions for wealth managers.

Avaloq provides banks and wealth managers large software deployments to run their core operations via 4 products, (1) Avaloq Engage, which helps relationship managers connect with clients using social messaging apps like WhatsApp or WeChat, including chat bots that answer client requests; (2) Avaloq Wealth, which provides investment strategies, risk analysis, and CRM, and supports streamlined client onboarding; (3) Avaloq Core, a core banking solution, and (4) Avaloq Insight, which offers analytics and reporting.

BlackRock is the world’s largest asset manager with ~9T in AUM as of Q1 2023. Its technology business, via Aladdin, drove $1.4B in revenue in 2022, or 8% of Blackrock’s top line, and grew at ~6% YoY, while BlackRock’s YoY revenue declined 7%. This divergence highlights the demand for technology and data-driven tools in the asset management industry, and explains the minority stake in Avaloq. The majority of BlackRocks’s workforce also sits in technology and data.

In 2022, the global wealthtech market stood at $5B revenue pool, growing to $15B by 2029. As a stand-alone business, Aladdin could currently command a lofty valuation with its approximate 25% market share. For context, Avaloq competitor FNZ generated $954MM in 2021, and in 2022 raised $1.4B at a $20B valuation. Using that same 21x revenue multiple, Aladdin would be worth $29B as an independent entity. Avaloq was acquired for $2.2B in 2022 with revenues of $664M by NEC — looks like a pretty good deal in retrospect.

The growth of the Aladdin platform and the partnership with Avaloq suggests that BlackRock is increasingly focusing on its technology and data analytics capabilities as key drivers of future growth. Horizontal strategic alliances appear to be a more attractive proposition in this environment for building scale, given the decline of deal activity to start the year.

Another angle that is somewhat confusing to us is — where is the FutureAdvisor technology? The early roboadvisor was bought by the firm in 2015 for about $150MM, and sold the B2C business off at a loss earlier this year. If Aladdin has to hunt for wealthtech partnerships, that suggests to us that not much of FutureAdvisor tech was integrated after the acquisition.

👑Related Coverage👑

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 170,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

Blueprint Deep Dives

Long Take: Strategic analysis of Apple's mixed reality launch and impact on Fintech & Web3 (link here)

Apple's recent venture into the mixed reality space with its Vision Pro headset presents an intriguing challenge to its competitors in the tech world.

Unlike previous attempts at such technology, like Google Glass, Apple is relying on its well-established brand and a distinct focus on design and technology to break new ground. The device's sophisticated features, such as high-resolution display, capability to record videos, and innovative face scanning technology, represent a significant evolution in VR technology. We look at the strategic implications in big tech, and then dive into the financial and economic elements — like payments and marketplaces — that have consequences for the Fintech and Web3 industries.

Podcast Conversation: The role of USDC and tokenized cash in Decentralized Commerce, with Teana Baker-Taylor, Circle VP of Policy and Regulatory Strategy EMEA (link here)

In this conversation, we chat with Teana Baker-Taylor, VP of Policy and Regulatory Strategy, EMEA for Circle, a financial technology company and sole issuer of the digital currencies USD Coin (USDC) and Euro Coin (EUROC). Teana works directly with policymakers on the development of regulatory policy for digital currencies.

Prior to Circle, Teana was the Chief Policy Officer for the Chamber of Digital Commerce, where she worked with Capitol Hill policymakers and regulators on policy developments for digital assets and blockchain. Previously, she held leadership roles at Crypto.com and Binance, where she was responsible for go-to-market strategies, operations, and government affairs.

Curated Updates

Here are the rest of the updates hitting our radar.

Neobanks

⭐ Majority, a digital bank for US migrants, grabs $9.75M amid expansion in Texas - TechCrunch

HSBC says rebranded Silicon Valley Bank UK will maintain startup focus while targeting global growth - CNBC

Digital Investing

⭐ JPMorgan rolls out sustainable investment data product suite -Finextra

Backbase Acquires UK-Based Digital Wealth Platform Nucoro - Private Banker International

Wealthtech OneVest Raises CAD$17MM - Finextra

iCapital® Launches iCapital Marketplace To Connect Wealth Managers To World’s Largest Selection Of Alternative Investment Opportunities - Business Wire

Digital Lending

⭐ Indifi raises $35M to expand digital lending to more small businesses - Techloy

Chase has launched the new Freedom Rise card for building credit — and you could be approved without a credit history - Business Insider

Financial Function

⭐ Paro raises $25M to match freelance financial experts with firms - TechCrunch

Finfra lets Indonesian businesses add embedded finance to their platforms - TechCrunch

Nasdaq to acquire financial services software company Adenza from Thoma Bravo for $10.5B - TechCrunch

FIS acquires Bond - Fintech Alliance

AI

Monarch AI Assistant - Product Hunt

Digital bank One Zero to debut generative AI chatbot - Finextra

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Contributors: Lex, Laurence, Matt, Farhad, Daniel, Daniella, Michiel

Want to discuss? Stop by our Discord and reach out here with questions.

If you’d like us to look at any specific companies, feel free to share your thoughts in the comments below.