Fintech: Klarna IPO Primer; will it reach $30B?

Benchmarking the category-defining Swedish BNPL against Affirm

Hi Fintech Futurists —

Is Fintech back?

The F-1 filing from Swedish BNPL company Klarna and neobroker eToro last month, sparked hopes that the fintech investment landscape might finally be recovering after a post-pandemic slump. For context, Fintech IPOs raised less than $4B over three years since the $22B they did in 2021, with virtually all of it raised in 2024. Klarna coming to market now, as one of the largest European fintechs, could be a tidal shift in sentiment — though markets have been choppy — and other large players like Revolut are sure to be watching closely from the sidelines.

Today’s agenda below.

FINTECH: Key Charts Ahead of the Klarna IPO

INVESTING 101: DeFi Fixed Income Yields (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Regulation & Policy, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet). Prices will be going up soon, so lock it in now.

Digital Investment & Banking Short Takes

Key Charts Ahead of the Klarna IPO

First, a bit of background. Unlike most fintechs, Klarna was founded before the financial crisis back in 2005. Sebastian Siemiatkowskvik, along with two other co-founders from the Stockholm School of Economics, created an e-commerce solution for merchants to get paid upfront while debiting consumers upon delivery — effectively a first version of its deferred payment product.

The results were good. In exchange for a fee, merchants could grow their customer conversion by 20%+ and average order values by 23%+ by making customers more comfortable with spending online.

These short-term loans were underwritten by Klarna by combining the “soft” credit check with data on customer purchasing behavior, which resulted in higher acceptance rates of up to 70% and potentially lower defaults versus traditional credit cards.

This sparked the beginning of a wave in Buy-Now Pay-Later products that sat elegantly between the traditional payments and lending experience, combined in a novel and digital way. With e-commerce growing rapidly in subsequent years, BNPL took the spot as a popular payment method in many markets around the world.

This was in part thanks to Klarna’s go-to-market strategy, which placed it front and centre in a familiar checkout experience. Instead of competing with other payment providers, it partnered directly with Worldpay, Stripe, and Adyen, pushing it to their underlying network of merchants as an alternative payment method.

Klarna’s product suite naturally grew beyond the initial deferred payment option. In the wake of the financial crisis, Klarna embraced a familiar fintech narrative –

“We realized many old bank practices were harming their customers. So we changed our course. We had our reckoning. I decided this bank was going to be different.” Siemiatkowski reminisced in a recent letter to investors.

The company acquired an EEA banking license for Europe, enabling it to start funding loans via customer deposits and build more flexible payment and banking products like longer-term financing, savings accounts, and credit cards. See below the typical operational flow for a $100 funded purchase.

More recently, it struck a partnership with OpenAI for customer support and added e-commerce solutions like in-app shopping and advertising services. Today, Klarna serves 93 million active consumers and more than 675,000 merchants in 26 countries. It facilitated $105B in annual payments volume last year with impressive penetration in its domestic Swedish market, where 86% of adults made a payment via Klarna.

The company’s financials are in good shape, with growing revenues and improving operational efficiency. In 2024, the company made $2.8B in revenues, up +24% YoY, and booked a profit of $30M, closing the $304M loss the year before.

Klarna attributes the turnaround to strong volume growth and customer engagement in the US and UK, where it charges higher take rates. The company’s main revenue driver comes from merchants who pay an average 2.7% of a customer’s purchase value to Klarna — this is made up of a service fee, interchange, and any fees for settling disputes. Merchant income grew +17% to $1.6B in 2024.

Another revenue driver is interest income. Nearly all of Klarna’s loans are interest-free (99% of total), but the 1% of longer-term loans that do charge interest represent nearly a quarter of the company’s annual revenue and growing.

Longer term loans are typically harder to underwrite, leading to higher credit losses, especially in new markets where Klarna lacks consumer data to feed its models. We warned of higher losses in the US when we last covered the company pre-profit.

Today, US credit losses are 1.2% of GMV, nearly half of what they were in 2022. In fairness, they are still twice as high as other high-growth markets, but the trend is encouraging, and more importantly, the savings flow to its P&L in the form of a smaller loss allowance.

Despite strong growth in the US, Klarna has also faced growing competition from existing domestic providers like Affirm. Top level numbers show Klarna is ahead of Affirm on customers, merchants, and volume, but has a smaller average order value (AOV) and generates much lower revenue per user — $30 for Klarna vs. $133 for Affirm. What does this tell us?

For one, Klarna is more embedded in the everyday shopping experience.

This is in part due to a focus on e-commerce, with a dedicated customer shopping app and in-app merchant advertising. The company generated $180M in advertising income last year and 66% of the top 100 merchants in its key markets have reportedly advertised on the platform. However growth has been slow, with the segment accounting for 6% of total revenue compared to 8% two years ago.

Meanwhile, Affirm is going after larger ticket sizes with an AOV of $283 vs. Klarna’s $100. As a result, a much larger 72% portion of Affirm’s loans require customer financing and are interest-bearing, which does well in a high-rate environment. 51% of Affirm’s revenue is tied to interest income, which contributes to the higher ARPU.

Affirm also doesn't rely on the same customer late fees and penalties that Klarna does, which Affirm recently categorized as “junk fees” (see here). Late payment fees and “snooze” fees made up 13% of Klarna’s total revenue and are growing faster than other parts of the business. These could come under pressure as competition intensifies. Affirm is already seeing stronger customer growth at +19% YoY and GMV +35% YoY than Klarna.

With the IPO expected to happen this month, we’ll be closely watching how the market values Klarna relative to Affirm, Paypal, and Afterpay (acq. by Block). The credit markets are sensitive to Trump’s economic tariff games, and therefore the public market comps have been under some severe pressure.

Klarna’s valuation in recent years has been akin to riding up and down an elevator, growing from $6B to a peak of $45.6B in 2021, back down to $7B and currently sitting at $15B following an existing investor’s mark-up in October. A multiple in line with Affirm, which has been shifting around 6-12x FY24 sales this year so far, would place Klarna between $15-30B. Looks like we’re not stepping off just yet.

👑 Related Coverage 👑

Long Take

We explore how crypto has matured to support capital preservation strategies akin to fixed income, focusing on conservative yield generation rather than high-risk speculation. Protocols like Spark, Aave, and Ethena now offer APRs ranging from 0% to 20%, depending on market demand for leverage and protocol mechanics. Spark (by MakerDAO) manages $4.3B and currently yields ~4.5%, Aave supports a $3B USDC lending market with historical APRs up to 15%, and Ethena uses complex derivatives to offer yields up to 100% while maintaining a dollar peg.

DeFi investing, and crypto more broadly, is associated with very high-risk assets. The boom and bust of the sector is constantly in the news.

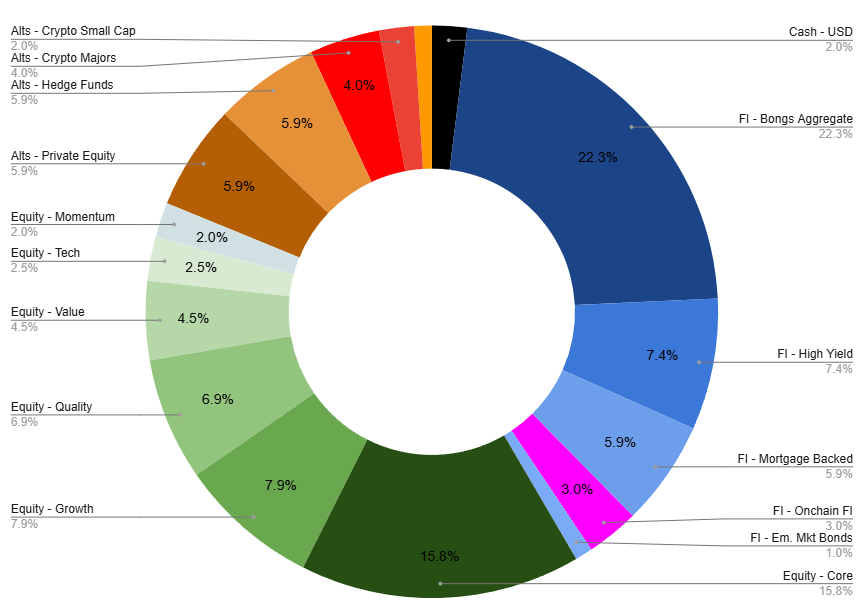

However, the asset class has matured significantly. It is possible to think about it not just as a subsector within the Alternatives slice of an asset allocation, but as a component of Fixed Income or even Cash Equivalents. As we think about investment strategy at Generative Ventures, one of the research areas has been to highlight the absolute safest onchain investment opportunities.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

Stripe reports FY24 numbers - Stripe

Stablecoin company Mesh raises $82M - Payments Dive

Fidelity Investments tests dollar-pegged stablecoin - Reuters

Neobanks

⭐Fintech Mercury lands $300M, doubles valuation to $3.5B - Techcrunch

Revolut and Visa file legal challenges over PSR's plan to cap fees - Finextra

Mexico’s neobank Albo raises $26.4m Series A total - Fintech Futures

Lending

Walmart-backed fintech One introduces buy now, pay later - CNBC

CFPB set to ditch BNPL rule - Finextra

Digital Investing

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice

Global After Party. Com GAP