Fintech: Splitit raising to go private; Securitize acquires Onramp Invest

Plus, a glimpse into Tether and crypto exchange Bitfinex, with CTO Paolo Ardoino

The Fintech Blueprint is a newsletter authored by me, Lex Sokolin, and a small group of brilliant researchers who focus on frontier technologies impacting the future of financial services. I am glad you are here. Was this email forwarded to you? You deserve your own:

👉subscribe here.

Hi Fintech Futurists —

Before we jump into today’s insights, we want to remind you about our upcoming Deep Dive into Bunq, the European neobank unicorn. It will be delivered to premium subscribers this Wednesday, 23rd of August.

Bunq is standing strong with a $1.9 billion valuation amidst the driest quarter of fintech funding since 2017. But with its recent $111M fundraise and plans for US and UK expansion, there are vital questions to explore:

How does Bunq's M&A-focused growth strategy compare to key EU competitors?

Is Bunq’s reliance on high interest rates sustainable for maintaining profitability?

With 90% of its fee income earned in the Netherlands, how will Bunq persuade US customers to embrace its paid plans?

We'll dissect these questions and more in our deep dive report this Wednesday.

Full access to the Bunq Deep Dive is exclusive to premium subscribers.

Now is the perfect time to upgrade your subscription.

Now, on to today’s fintech topics. Here is the agenda:

BNPL: Splitit moves to go private in exchange for fresh funds (link here)

INVESTING: Securitize Acquires Onramp Invest, Extending Tokenized Alts to RIAs Managing $40B in AUM for First Time (link here)

LONG TAKE: Launching Generative Ventures, an engaged venture capital fund focused on the machine economy of Fintech, Web3, and AI (link here)

PODCAST CONVERSATION: A glimpse into stablecoin Tether and crypto exchange Bitfinex, with CTO Paolo Ardoino (link here)

CURATED UPDATES

Digital Investment & Banking Short Takes

BNPL: Splitit moves to go private in exchange for fresh funds (link here)

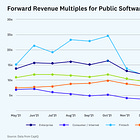

Cracks have started to show in the BNPL space in the past two years. Klarna, one of the most valuable fintechs in Europe, witnessed an 85% drop in its valuation, US-based Affirm’s share price dropped by 77% and Australian-based Zip’s also dropped 89%. Splitit was founded in 2012 as a standard consumer BNPL provider but pivoted in 2022 to focus solely on a white-label installment payments platform for merchants.

Now, Splitit is looking to raise $60MM under two conditions: (1) that the firm delists from the Australian Securities Exchange (ASX) and (2) that it reincorporates as a private entity based in the Cayman Islands. If successful, the deal will bring total funds raised to $350MM. Motive plans to provide $50MM, at a price of $0.20 per preferred share, split into two equal tranches. The first tranche is conditional on Splitit delisting from the ASX, whilst the second is dependent on the fintech achieving undisclosed 2023 full-year financial performance milestones, which they are already on target for. The remaining $10MM will be supplied by Parea Capital and Thorney Investment Group as a convertible note - debt that can be exchanged for equity in the future.

Whilst Splitit has been listed on the ASX since 2019, the firm is actually headquartered in Atlanta and has offices in Israel and London, whilst being registered in Australia as a foreign corporation to enable it to be listed on the ASX. Delisting will require the approval of shareholders and the new, private entity would be based in the Cayman Islands, primarily for its tax benefits. The Caymans do not have corporate income tax, payroll taxes, capital gains or other direct taxes for startups located there. If the shareholders agree to the delisting they will either be provided with private ownership in Splitit or they will have the opportunity to trade their shares on ASX before it occurs.

The BNPL model fundamentally changed the e-commerce shopping experience globally, pioneered by Klarna. It did so by using both “soft” credit checks and data on consumer purchasing behaviors, enabling providers to accept c. 70% of applications. BNPL managed to capture 8% of online payments in Europe and 4% in the US in 2021, and by 2025 these numbers are forecast to triple. But, taking Klarna as a case study, these firms have traditionally struggled with profitability, in part because of operational expenditure on aggressive expansion strategies, but also due to an estimated 8% of customers not repaying loans issued. For context, traditional banks have loss rates of <1%. We see BNPL as a fundamental fintech tool in the future but more innovative underwriting and more sustainable spending will need to develop as the space matures for these platforms to stay alive and thrive.

👑 Related Coverage 👑

🤓 Insights Report

Before we move onto our next topic, we would like to highlight an Insights Report from Fintech Nexus and Brighterion, a Mastercard company. In their survey of 100 financial institutions, they explore how financial institutions are using artificial intelligence for transaction fraud monitoring in the dynamic digital landscape.

INVESTING: Securitize Acquires Onramp Invest, Extending Tokenized Alts to RIAs Managing $40B in AUM for First Time (link here)

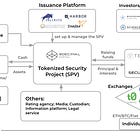

Securitize, a digital asset platform that uses blockchain tech for companies to tokenize assets and raise capital, announced its acquisition of wealthtech Onramp Invest for an undisclosed amount. To date, Onramp’s platform includes RIA firms with a combined $40B in AUM, an impressive feat for a firm launched in 2020. Securitize reportedly has 1.2M investor accounts across 3,000 clients, with ~100MM raised since 2017, backed by investors like Blockchain Capital and Morgan Stanley Tactical Value. Earlier this year, both firms flirted with a partnership that unveiled four tokenized private equity feeder funds from the likes of KKR and Hamilton Lane. Last month, Securitize also launched the first issuance of tokenized securities in Europe. The acquisition is indicative of competitive pressures emerging in the space and the broader desire for institutional adoption of digital assets.

Securitize's platform provides tokenization management services to issuers, simplifying the process of capital raising, asset management, and trading. Onramp supplies the architecture that enables RIAs to access crypto assets and also integrates with known CRM and reporting tools like Orion and Wealthbox. RIAs on Onramp will now be able to extend clients tokenized access to alternative asset classes such as private equity, private credit, secondaries, and real estate - a natural product extension given that its client-base already had crypto exposure.

It is prudent to highlight why wealth managers should expect client interest in digital asset products. Boston Consulting Group and ADDX suggest that the market for asset tokenization could be worth as much as $16T by the end of the decade. A CAIS study showed that nearly 90% of advisors plan to increase allocations to alternatives over the next two years. And, although some institutional investors are taking a more cautionary stance with their digital asset investments, investors are optimistic about the outlook on blockchain and digital assets and view them both as a means of diversification and as a growth potential.

But despite all bullishness, most surveys still show that investors don’t feel educated enough about alts as an asset class. The decision to venture into digital assets hinges not just on current trends but also on long-term beliefs about the future of finance. We’re excited about this next evolutionary phase, as it’s not a matter of "if" but "when” Continued innovation, cooperation among industry players, and regulatory alignment will be pivotal in steering this promising technology to its full realization.

👑 Related Coverage 👑

Blueprint Deep Dives

LONG TAKE: Launching Generative Ventures, an engaged venture capital fund focused on the machine economy of Fintech, Web3, and AI (link here)

After 4 years at Consensys, where I worked on tokenized digital assets, crypto wallets and DeFi, macro investing, and token economics, and over a decade in fintech, I remain deeply committed to innovation and the promise of technology in financial services and in our economy.

With that, I am excited to announce that I am building a venture capital fund called Generative Ventures as a founder with several fantastic partners. The thesis is focused on the rise of the machine economy, which is the synthesis of new economic activity accelerated by AI, powered by fintech, and settled on Web3 blockchain networks. Our investment thesis is articulated in more detail in this long take, and I’d love your engagement on the topic.

Podcast Conversation: A glimpse into stablecoin Tether and crypto exchange Bitfinex, with CTO Paolo Ardoino (link here)

In this conversation, we chat with Paolo Ardoino - Chief Technology Officer at Bitfinex and Tether.

With his experience spanning close to 10 years in Web3 alone, Paolo Ardoino is a veteran in creating technology solutions for the decentralized world. Ardoino joined Bitfinex as a senior software developer in 2014, but was soon made the chief technology officer in 2015, and has continued in the role ever since. He has also served as the chief technology officer of Tether, which issues the USDT stablecoin, since 2017.

Curated Updates

Here are the rest of the updates hitting our radar.

Payments

⭐ ClassWallet Raises $95 Million to Grow Purchasing and Reimbursement Platform - PYMNTS

⭐ Dutch poster child Adyen’s stock dips 31% as PayPal and Stripe layoffs send ripples through fintech sector - TFN

Matera Acquires Cinnecta to Combine AI and Instant Payments - PYMNTS

Mastercard to purchase a minority stake in MTN’s $5.2B fintech business - TechCrunch

Digital Investing

⭐ UK launches £1 billion fintech fund to compete with Silicon Valley - CNBC

Educbank raises $14.2M to drive financial innovation in Brazilian education - LatamList

Lending

⭐ GoLogiq signs letter of intent to acquire Fram Venture 7 and SME lender DragonLend - Fintech Futures

⭐ As Goldman Sachs looks to sell its GreenSky lending unit, Apollo and a group led by Sixth Street emerge as leading bidders - Fortune

Reliance spin-off Jio Financial Services makes muted market debut - TechCrunch

Financial Infrastructure

⭐ Shape your Future

Curious about what is shaping the future of Fintech andDeFi?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Wednesday’s Long Takes on Fintech and Web3 topics with a deep, comprehensive analysis

Office Hours, monthly digital roundtable discussions with industry insiders

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands