Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Paolo Ardoino - Chief Technology Officer at Bitfinex and Tether. With his experience spanning close to 10 years in Web3 alone, Paolo Ardoino is a veteran in creating technology solutions for the decentralized world. Ardoino joined Bitfinex as a senior software developer in 2014, but was soon made the chief technology officer in 2015, and has continued in the role ever since. He has also served as the chief technology officer of Tether, which issues the USDT stablecoin, since 2017.

Since the early years of his career, Ardoino has worked on multiple research projects involving cybersecurity and cryptography for military applications. He started his professional career as a developer after completing a bachelor’s degree in computer science from the University of Genoa.

Topics: crypto, web3, stablecoins, crypto exchanges, custody, banking, T-Bills

Tags: BitFinex, Tether, USDT, Poloniex, Bittrex, Binance, Bitcoin, Omni Layer, Copper

👑See related coverage👑

DeFi: Binance launces L2 opBNB to rival Coinbase's Base; BitGo is a unicorn 🦄

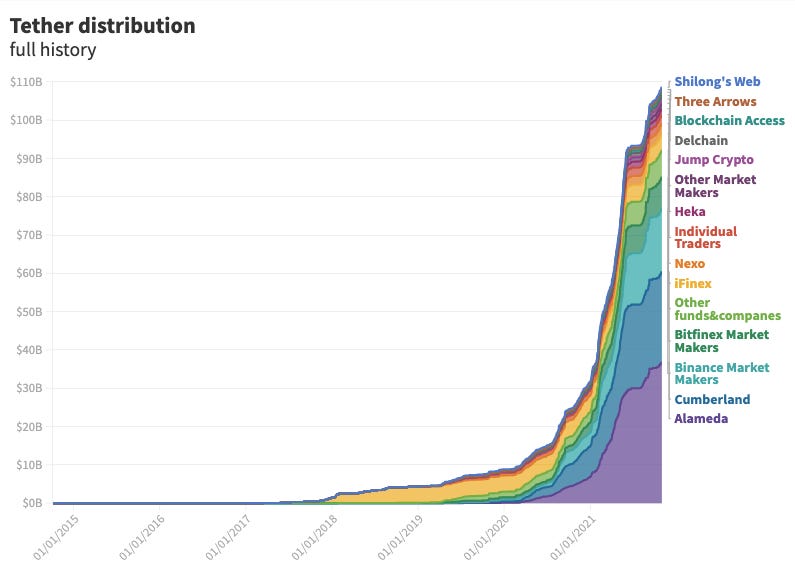

[PREMIUM]: Long Take: The role of Alameda and Cumberland as USDT market makers

[PREMIUM]: Long Take: The Chaos underneath Prime Trust's failure and $3B of TrueUSD

Timestamp

1’37”: Laying the foundation: Early experiences and technological DNA in the crypto sphere

11’35”: The motivating forces: Tech's role in building, exploration, and human progress

14’49”: Embracing Bitcoin's multifaceted potential: From asset class to economic infrastructure

18’35”: The complexity of crypto exchanges: Grasping the scale of trading activity on Bitfinex and vertically integrated challenges

26’02”: Learning from exchanges' mistakes: Industry evolution and future strategies

30’01”: Tether's inception and early architecture: Addressing volatility in crypto transactions

35’02”: Tether's on-ramp process: Early days and acquiring Tether, banking counterparty risk, and risk mitigation strategies

42’36”: Stablecoin usage dynamics: Institutional demand, market makers, and retail onboarding

46’26”: The channels used to connect with Paolo & learn more about Bitfinex and Tether

Sneak Peek:

Paolo Ardoino:

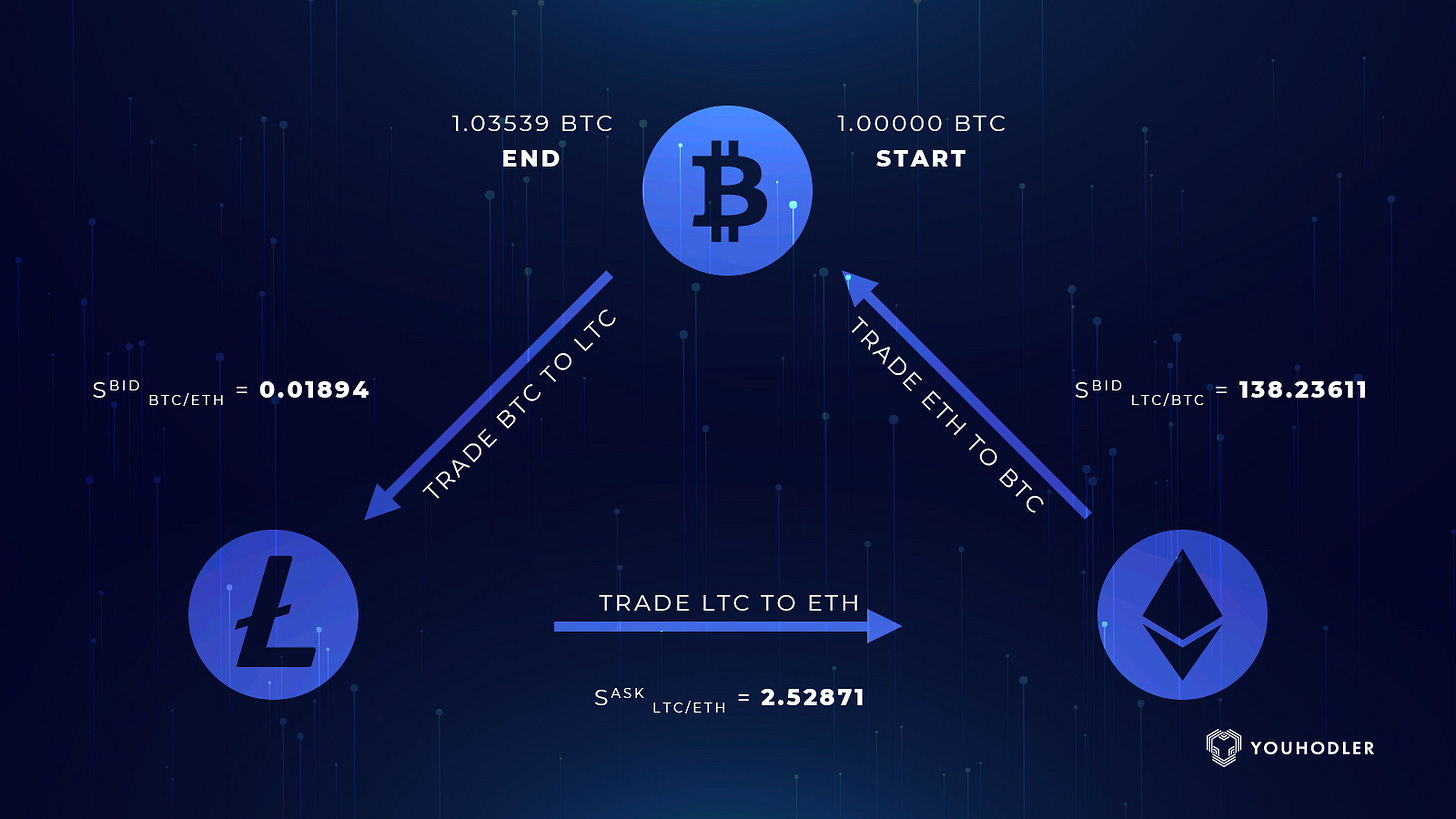

…back to 2014, the industry was collecting some new traders that were professional traders. One of the reasons was volatility. The other one was the issue of spreads across different exchanges. So, we had at some point, when Bitcoin broke $1,000, we were in a situation where on some exchanges the price of Bitcoin was $1,000. On the others where was $1,200. The concept that everyone from traditional finance would think about is arbitrage. Cross-exchange arbitrage. So, the arbitrages are traders that buy Bitcoin on the exchange where the price is lower, maybe it was $1,000 and move these Bitcoins on the exchange where the price is higher, like 1.2 and sell it there for cash. Then take the cash, move the cash on exchange where the price is lower and do it in loop.And this pressure, this is basically pressure on the market would bring the two exchanges aligned because if you put buying pressure on the exchange where the price is higher, sorry, lower, and you put sell pressure on the exchange where the price is higher, then you are going to bring the two exchanges aligned. But the thing is that you couldn't do this arbitrage because in order to do that, you would need to send wires around. And wires were taking three days, one day, seven days, who knows. So, the arbitrage opportunity was long gone when the money was hitting the account.

And so really the Bitfinex group that was running exchange, Giancarlo specific thought about a solution that if you think about it, is a really, really simple solution, why we don't use the brilliant technology that was created with Bitcoin, so the blockchain, but instead of running Bitcoin, you put a dollar on top of it? The dollar is the main currency of the world, is the thing that everyone wants. So, I mean the idea is really simple, but Ethereum was not there. And we look at around, the only solution to issue a token with a fixed value was product called Omni Layer. That was Colored Coin on top of Bitcoin, was still using the Bitcoin blockchain but appending some and keeping some metadata to express a different token, a different product compared to Bitcoin.

And that was really cool. In fact, with Tether, you could, instead of waiting days to get your wire hitting the other exchange, you had just wait 10 minutes, so the Bitcoin block time, to get your dollars on the other side. Of course, that needed all the exchanges to adopt better. And at the beginning it was not the trivial. We try to explain and you would think that other exchange owners would understand Tether and the importance of the solution. But actually, took two years from 2014 to 2016 to see the first…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions