Fintech: UK's Zopa raises $93MM; A dive into The Robo Report for 2Q

Amid a challenging fundraising environment for fintech, Zopa has raised an impressive $186MM in 2023

The Fintech Blueprint is a newsletter authored by me, Lex Sokolin, and a small group of brilliant researchers who focus on frontier technologies impacting the future of financial services. I am glad you are here. Was this email forwarded to you? You deserve your own:

👉 subscribe here.

Hi Fintech Futurists —

Here is today’s agenda:

PAYTECH: Zopa, the UK neobank, hits 1 million customers and raises another $93MM (link here)

INVESTING: The Robo Report | 2Q 2023 (link here)

LONG TAKE: Visa, Worldpay, and Nuvei settling transactions using stablecoin USDC on Solana (link here)

PODCAST CONVERSATION: Modernizing the entire banking system, with Caitlin Long, CEO of Custodia Bank (link here)

CURATED UPDATES

Fintech Meetup Ticket Prices Go Up Friday! Fintech Meetup (March 3-6) delivers tangible ROI. Attendees say it’s the “highest ROI event out there!” Join 45,000+ meetings, See 175+ incredible speakers, Network with 5,000+ attendees and Enjoy 100+ co-located events.

Digital Investment & Banking Short Takes

PAYTECH: Zopa, the UK neobank, hits 1 million customers and raises another $93MM (link here)

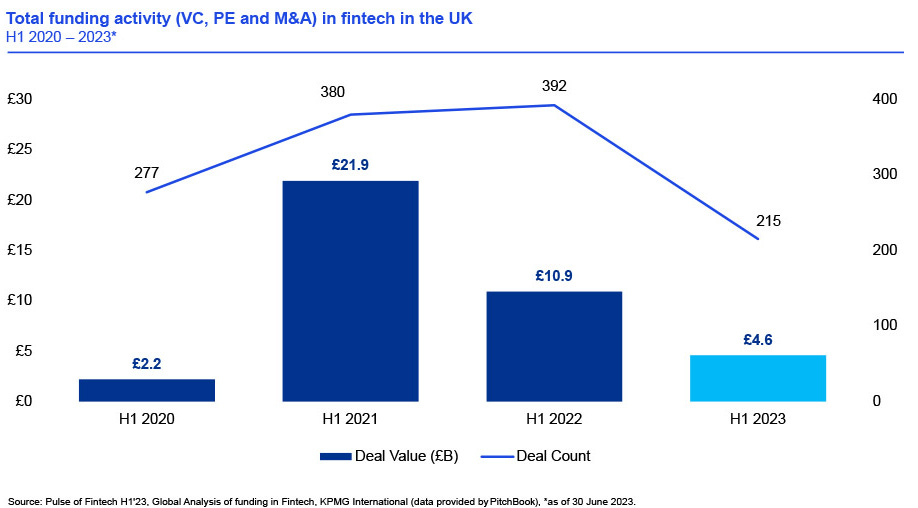

UK neobank Zopa has raised $93MM in debt led by IAG Silverstripe and other investors, bringing total funding to $660MM. In any environment, raising debt is a way to avoid dilution of equity. Earlier this year, Zopa also raised a $93MM equity round at an undisclosed valuation. Add the $300MM round in 2021 led by SoftBank, which helped it attain unicorn status, the scale of Zopa’s fundraising in a span of 2 years impressively stands out among other fintechs. According to a KPMG report, total UK fintech investment dropped to $5.9B in the first half of 2023, down 57% from $13.8 billion in the same period in 2022, and just a fraction of the activity seen in the first half of 2021.

Raising $186MM in a year that the fintech sector has seen a material contraction and recalibration of valuations shows that investors are making a big bet on Zopa's growth.

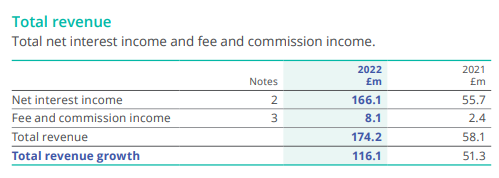

Zopa’s roots date back to 2005 as a digital peer-to-peer (P2P) lender. In 2020, it began to operate as a fully licensed UK bank and has since attracted 1 million customers, $3.7B in deposits, $2.5B in loans, and has issued 400,000 credit cards. However, when compared to similar European neobanks, Zopa still has a lot of ground to cover. We believe much of its funding will be used to fuel growth via M&A if only to diversify its revenue sources, as currently 95% is driven by interest income from its loan book.

Profitability is a challenge for many neobanks. Zopa lost $26MM in FY22, though management has highlighted they are on track to profitability in 2023. This is a far cry from domestic rival Starling Bank, which reported $178MM in profit in FY22, but is far superior to others like Monzo, which reported a loss of $119MM in FY22. We noted a large jump in expected allowance for credit losses, +164% YoY, which we believe is attributable to the composition of Zopa’s loan book, largely made up of unsecured personal loans. These loans represent a higher risk of default, particularly in a rising rate environment.

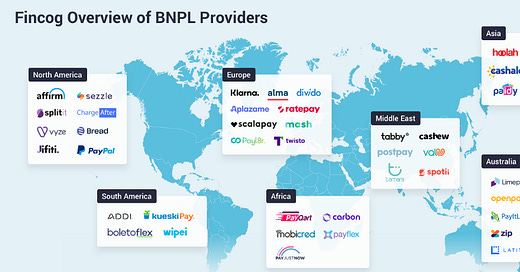

Earlier this year, Zopa acquired DivideBuy as it sets its sights on the UK’s crowded BNPL market. It’s estimated that 36% of UK consumers have used BNPL more than once, so the addition of this new product makes sense. DivideBuy is expected to bring 20% more revenue to Zopa this year alone. As the company grows, revenue diversification will be important as will growing its user base, which can be a costly affair. There have been talks of an IPO this year, but we think that will be reserved for when market conditions are more favorable and the company has succeeded in its M&A, revenue diversification, and user growth initiatives.

👑 Related Coverage 👑

INVESTING: The Robo Report | 2Q 2023 (link here)

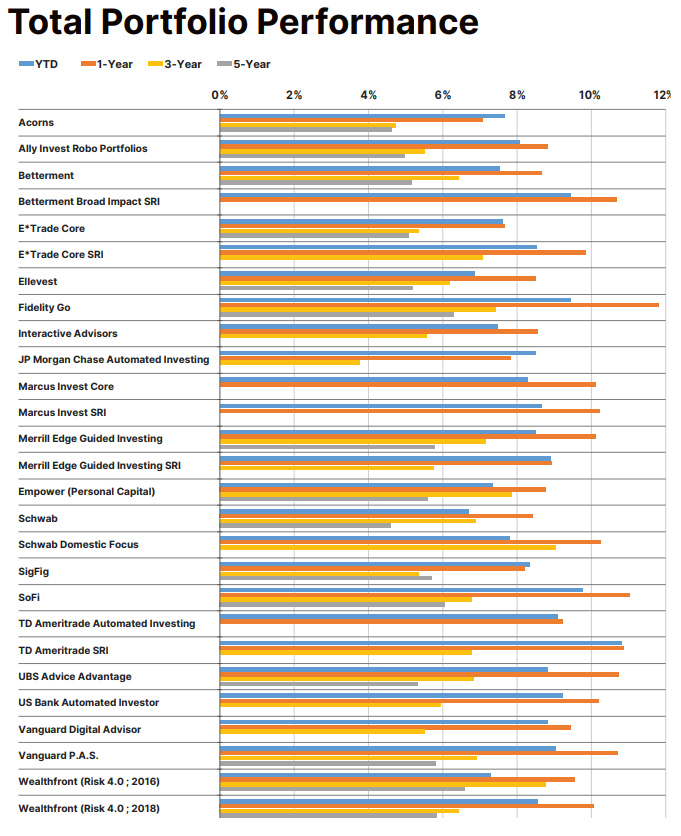

In the latest Robo Report, Charles Schwab’s Intelligent Portfolios emerged as the “Best Overall Robo Advisor”, with honorable mention given to Merrill Edge’s Guided Investing portfolio. 2023 has been a watershed moment for financial markets, with the S&P 500 up 17% YTD and the tech-focused Nasdaq index up 40% YTD. TD Ameritrade’s Social Responsible Investing (SRI) portfolio has been this year's top-performing robo with YTD performance at 11% — for context, Schwab acquired TD Ameritrade back in 2020 in a $26B deal. This outperformance stands in stark contrast to last year; in our prior Robo Report coverage, the average YTD performance across 30+ robo advisors was a dismal -20%.

Recall that Schwab was fined $187MM last year by the SEC over allegations of hidden fees and suboptimal fund allocations in their robo-advisory service between March 2015 and November 2018. In light of this, achieving the “Best Overall Robo Advisor” distinction is quite an accomplishment, showing Schwab has managed to recalibrate its robo advisory platform.

Schwab’s portfolio strategy features tax-loss harvesting and a "retirement paycheck" option, all without a management fee, which sets it apart from similar platforms. Schwab’s cash allocation, over 10% of the account value during the measurement period, proved to be a prudent risk mitigator amid market volatility. While factors such as low-cost access and digital financial planning enhance customer and advisor experiences, performance remains the paramount metric. Schwab's resurgence serves as a case study in effective crisis management and ethical realignment.

The broader market has demonstrated resilience, particularly among the largest mega-cap tech companies. We believe this is attributable to bullish sentiment surrounding the AI disruption narrative, which has been a focal point in quarterly earnings reports this year. The S&P 7, shown below, have surged an impressive 54% this year. Meanwhile, the remaining 493 stocks in the S&P 500 have seen a modest increase of 4%.

The robo-advisory industry was estimated to hold $900B in AUM at the end of 2022, down 10% from the end of 2021. While established market leaders experienced AUM contractions in 2022, smaller, independent robo-advisors like SoFi, Stash, and Betterment experienced AUM growth. SoFi recorded a surge in member growth during 2Q, adding 584K new accounts. This brings its total membership to 6.2 million, a 44% increase YoY. Yet, it is far from a level playing field. Nearly two-thirds of the sector’s AUM is concentrated in the hands of Vanguard, Financial Engines and Schwab. Thus, despite the plethora of options, investors still continue to favor established names.

👑 Related Coverage 👑

Blueprint Deep Dives

LONG TAKE: Visa, Worldpay, and Nuvei settling transactions using stablecoin USDC on Solana (link here)

We discuss the evolving landscape of networks in the financial and commercial sectors, focusing on the integration of traditional and emerging payment systems. We highlight the recent strategic move by Visa to facilitate transactions via Circle's USDC stablecoin on the Solana blockchain, involving acquirers Worldpay and Nuvei.

We mention the significance of this integration in enhancing cross-border efficiency and transaction speeds, given Solana's high throughput capabilities, despite some concerns about its growth strategies and occasional system outages. Financial networks must adapt and integrate with emerging technologies to meet growing commercial demands and foster a resilient innovation ecosystem.

PODCAST CONVERSATION: Modernizing the entire banking system, with Caitlin Long, CEO of Custodia Bank (link here)

In this conversation, we chat with Caitlin Long - founder and CEO of Custodia Bank (formerly Avanti Financial Group).

Caitlin is considered one of the most popular personalities in Bitcoin and blockchain thanks to her longstanding interest in the industry, her work for reforms and the adoption of digital assets, especially in her native state of Wyoming. She’s an American entrepreneur, Wall Street veteran, a Bitcoin evangelist since 2012 and a public speaker participating in numerous cryptocurrency events and conferences.

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 185,000+ Substack and LinkedIn audience of builders and investors, contact us here.

Curated Updates

Here are the rest of the updates hitting our radar.

Payments

⭐ Perfios Raises $229MM For Its Real-time Credit Underwriting Solutions - TechCrunch

Momnt Announces New $15MM Investment, Continues To Drive Fintech Innovation - Businesswire

Neobanks

⭐ Kroo Targets £70MM In Funding As Distrust In Banks Grows - Fintech Global

Firstcard Raises Seed Funding To Help College Students Build Better Credit - TechCrunch

Wealthtech

⭐ Compound and Alternativ Wealth Merge To Form $1B+ Digital Family Office - Investment News

Alix, The Pioneer In Wealth Transfer, Secures $5.5MM Investment - Fintech Global

CapIntel Announces Launch Of Cutting-edge Holistic Wealth Solution, OMNI - Yahoo Finance

FP Alpha Releases AI Tool To Help Financial Advisors 'Read' Insurance Documents Quicker - Financial Planning

Investing

⭐ Zurich-based Fintech yeekatee Secures €575k To Build A Fully-Fledged Social Investment Platform - EU Startups

Shape your Future

Curious about what is shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Wednesday’s Long Takes on Fintech and Web3 topics with a deep, comprehensive analysis

Office Hours, monthly digital roundtable discussions with industry insiders

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands