Fintech: Wealthfront's automated bond portfolios with 5.5% yield; Plaid launches financial identity verification

Don't miss the Revolut analysis and our conversation with Stripe

Hi Fintech Futurists —

You’re the best, today’s agenda below.

IDENTITY: Verify once, verify everywhere with Plaid Identity Verification (link here)

INVESTING: Wealthfront Launches Automated Bond Portfolio With A 5.48% Blended 30-Day Yield (link here)

LONG TAKE: Revolut's $100MM opportunity cost and faltering profitability without a UK banking license (link here)

PODCAST CONVERSATION: Exploring Stripe's growth in embedded finance, with Stripe Head of Startups for Banking-as-a-Service, Ashwin Kumar (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

Digital Investment & Banking Short Takes

IDENTITY: Verify once, verify everywhere with Plaid Identity Verification (link here)

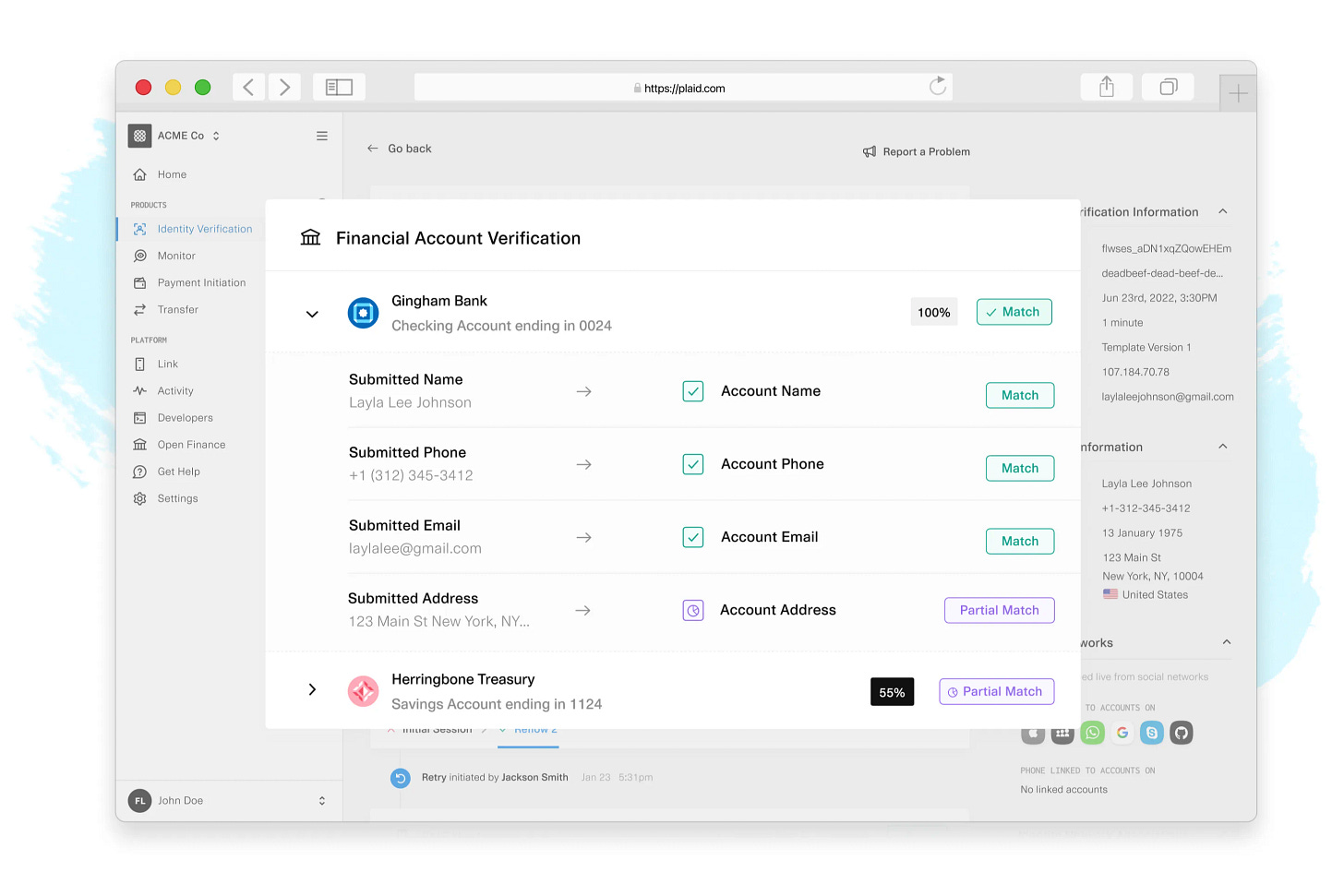

Plaid launched Identity Verification, enabling faster onboarding to any Plaid-connected apps or services. As a reminder, Plaid is a data network and payments platform that helps users connect third-party applications to their bank accounts. For example, a lending app can use Plaid technology to check the balances of borrower accounts before attempting to pull loan payments. This helps borrowers avoid nonsufficient funds penalties by automatically extending a grace period without the borrower having to do anything.

With Plaid’s new identity verification solution, apps integrating Plaid will be able to use fast-track verification, which includes know-your-customer (KYC) compliance criteria. As Plaid put it: “verify once, verify everywhere.”

Onboarding processes for financial services often require sensitive documentation and lengthy approval times — a common frustrating experience. According to Plaid, 6 out of 10 Americans give up on digital finance before completing identity verification processes. Plaid’s solution could improve sign up conversion rates for everything from setting up digital finance apps, to applying for loans, to buying a car or renting an apartment. Existing clients using the new integrated tools have reportedly seen an increase of success rates between 50-90%.

End-users have to opt in to save their verified data, which can then be ported to any Plaid-connected app, with the user verifying their phone number and mobile device to be automatically connected. This also helps third party financial application providers, who can get a better view of user risk — for fraudulent activity for example. Still, the Plaid verification system is not necessarily a guarantee of identity. The company uses industry-standard techniques to identify synthetic or stolen identities, and then provides a fraud risk score for each user. It can block identities across its platform if they are deemed to be malicious.

Plaid is further amplifying its position as the connection layer, a network perhaps, between fintech apps and the back-end of financial services trapped in banks and other financial incumbents. From a strategic point of view, financial authentication and login is similar to one-click checkout for eCommerce, in that it becomes embedded across all digital transactions. We know that Plaid may have had ambitions to become a payments network itself, certainly after its Visa acquisition moment, and building out a strong fraud tool is a requirement to operate at scale. Check out the related podcast below, as well as earlier strategic thinking.

👑Related Coverage👑

INVESTING: Wealthfront Launches Automated Bond Portfolio With A 5.48% Blended 30-Day Yield (link here)

Roboadvisor Wealthfront, known for its use of algorithms and machine learning techniques, has launched an automated bond portfolio, expanding from its historical focus on asset allocation and cash accounts. The roboadvisor had a hiccup in September 2022, when UBS terminated a $1.4B planned acquisition during the early flurries of what has become a fintech winter. Since then, Wealthfront has seen AUM grow from $27B in 2022 to $43B, a 59% increase, and now serves approximately 610,000 accounts.

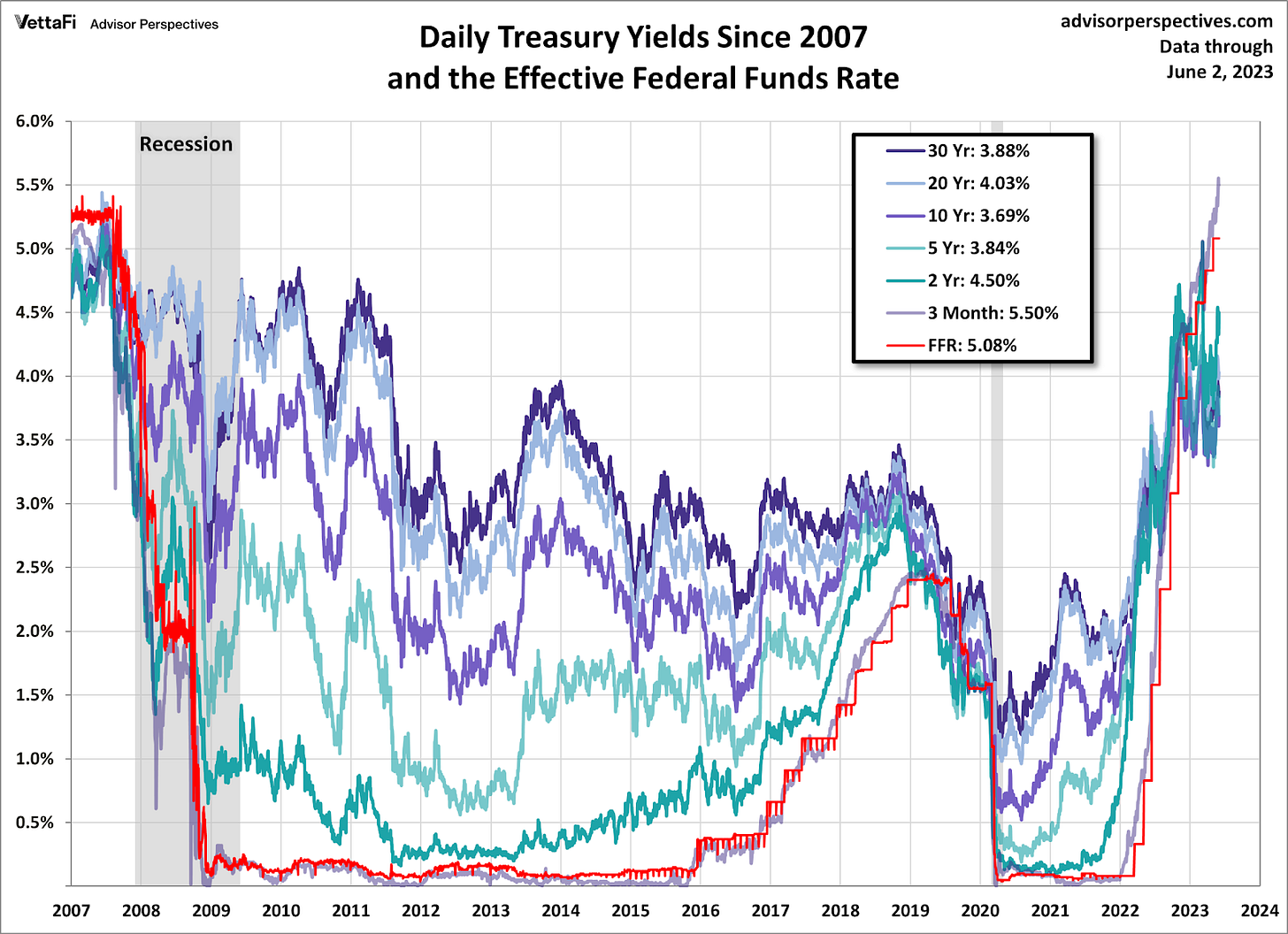

Yields are at levels not seen in 15 years since the global financial crisis — one can receive ~5.3% in U.S. 3-month or 6-month treasuries, which are backed by the “full faith and credit” of the US federal government. Perhaps less faith now than in the past, but the best we got aside from Bitcoin’s apocalypse insurance.

Wealthfront’s automated bond portfolio offers approximately 5.5% in a blended 30-day yield. The product is designed to maximize after-tax yield across an allocation of low-cost bond ETFs including corporate bonds, U.S. government bonds, and municipal bonds. Most of the earnings from bond ETFs are in the form of dividends, hence the focus on yield. The algorithm also determines an appropriate bond allocation based on each customer's marginal and state tax brackets.

But look, there’s still risk — this portfolio offers more return than cash because of its exposure to slightly more exotic fixed income instrument. And as a reminder, fixed income asset class performance suffered in 2022 as a result of the fastest rate of Fed rate hikes and inflation, since bond valuations fall when rates rise. Still, with an expected annualized volatility of ~3%, Wealthfront claims that the automated bond portfolio is half the expected volatility of its “lower risk” Classic and Socially Responsible Investing portfolio alternatives. More conservative customers can also default to Wealthfront’s cash account, currently at 4.55% APY.

This offering reminds us of a fixed income product offered by Public that pays 5.4%, where investors can purchase treasuries directly through the platform via its broker-dealer, Jiko Securities. We note 2 key differences: (1) Wealthfront has an investment minimum of $500 vs Public’s $100, and (2) Wealthfront charges an advisory fee of 0.25% vs Public’s 0.60%.

In the current market environment, we think that wealthtech firms have no choice but to expand their capabilities into fixed income — it is great to see roboadvisors rethink the manufacturing of traditional asset classes. Deeper automation of execution across the entire asset allocation can become a defensible strategy over time, and may become generalizable as a platform. Looks like it is paying off for now — according to the 1Q23 Robo report, Wealthfront outperformed all roboadvisors in the last 5-years across fixed income.

👑Related Coverage👑

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 170,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

Blueprint Deep Dives

Long Take: Revolut's $100MM opportunity cost and faltering profitability without a UK banking license (link here)

The banking system has been under our spotlight a fair amount recently, from the deposit runs on Silvergate and SVB to the collapse of Credit Suisse.

This week we leave the incumbents to focus on challenger bank Revolut, which — despite growing compliance concerns and a looming rejection for a UK banking license — crossed the 30 million user mark last week. In particular, we discuss Revolut’s position among European competitors, the value of banking licenses in the neobank strategy, and the cost of being rejected from its primary UK banking market.

Podcast Conversation: Exploring Stripe's growth in embedded finance, with Stripe Head of Startups for Banking-as-a-Service, Ashwin Kumar (link here)

In this conversation, we chat with Ashwin Kumar, Stripe’s Head of Startups for Banking-as-a-Service. Ashwin is the former CEO and co-founder of Y Combinator-backed Sway Finance, and now helps Stripe’s customers to use their BaaS APIs to embed financial products.

Ashwin’s startup roots help him guide fintech founders as they work with Stripe to solve complex financial problems. He’s designed products from scratch, taught himself to code, won several hackathons to support his entrepreneurial endeavors, and was part of Y Combinator’s S16 cohort. Prior to joining Stripe in 2021, Ashwin was a data scientist for YC Startup School, a product manager/machine learning engineer at Mythic and a software engineer at Autopilot.

Curated Updates

Here are the rest of the updates hitting our radar.

Neobanks

⭐ Digital bank One Zero to debut generative AI chatbot - Finextra

Payments

⭐ Amazon Pay taps Affirm to be its first buy now, pay later player in the US - TechCrunch

JP Morgan launches Payment Partner Network - Finextra

Eric Schmidt backs Keeta, a startup working to make cross-border payments ‘as easy as Venmo’ - TechCrunch

Swift steps up blockchain experimentation - Finextra

Adyen Launches Payout Services to Provide Faster Global Payments - PYMNTS

Digital Investing

⭐ Masttro Unveils Doc AI: Revolutionizing Alternative Investment Data Processing - Businesswire

Allfunds and Endowus partner on fund brokerage platform - Fund Selector Asia

Andes Wealth Technologies Announces Integration with Advyzon - EIN News

Financial Function

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Contributors: Lex, Laurence, Matt, Farhad, Daniel, Daniella, Michiel

Want to discuss? Stop by our Discord and reach out here with questions.

Later this week, we will share our Short Takes on the latest Web3 and Digital Investing news, reviewing several companies. If you’d like us to look at any specific item, feel free to share your thoughts in the comments below.