Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS. If you enjoy it, throw us a rating here — it helps spread the word!

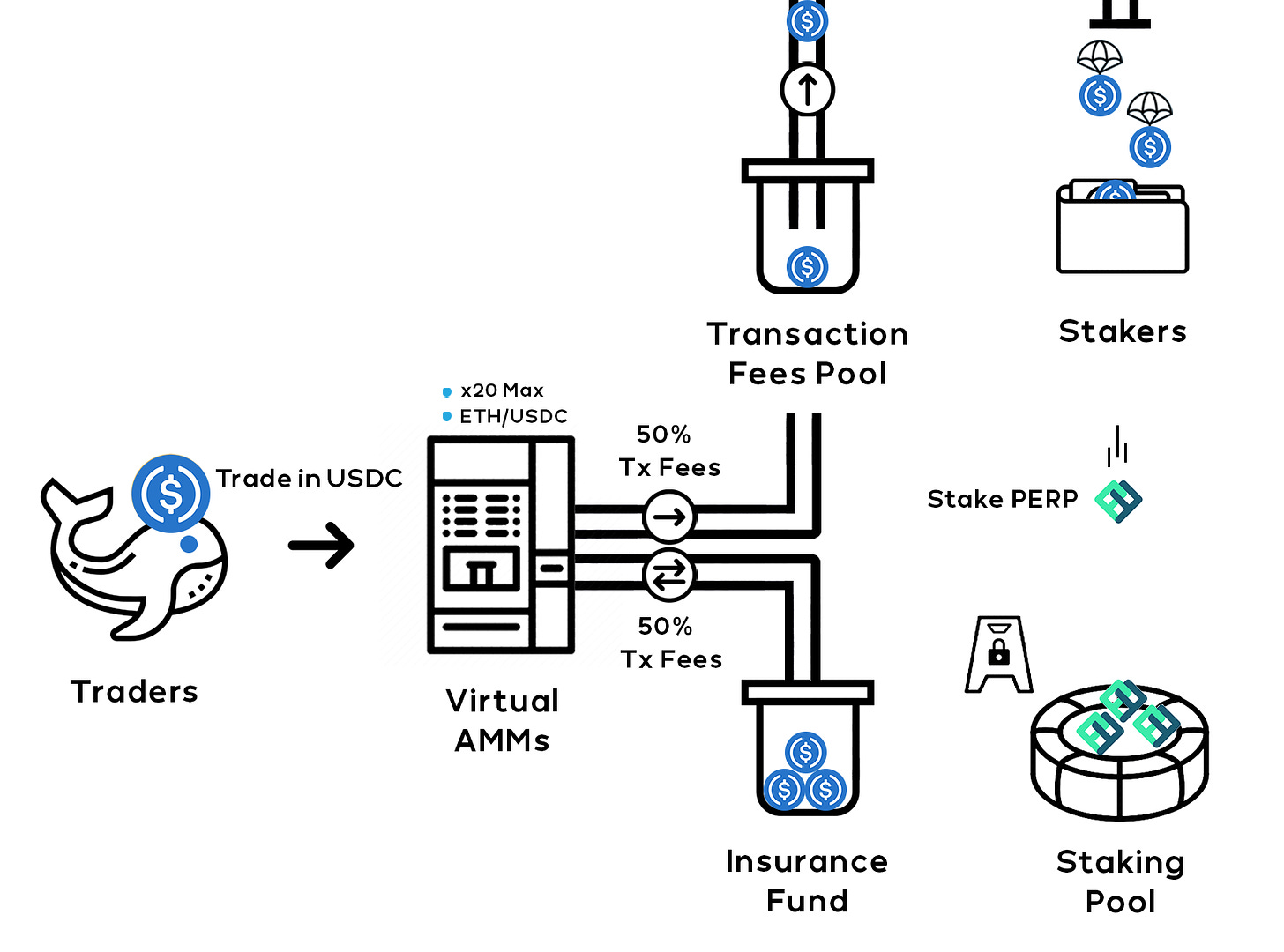

In this conversation, we chat with Yenwen Feng, co-founder of Perpetual Protocol, a decentralized perpetual contract protocol for every asset, made possible by a Virtual Automated Market Maker, with an aim to create an accessible and secure decentralized derivatives trading platform. Yenwen has over 17 years of various expertise and experience in the financial and tech industry, co-founding businesses like Cubie Inc. and Cinch Network. Yenwen also holds an MS degree in computer science from National Chiao Tung University.

More specifically, we touch on the idea of "perpetual trading" on top of AMMs. He explains how the idea is similar to traditional spot trading of the self custody assets on AMMs and how it's really capital efficient. He also talks about how he and his co-founder fell in the crypto rabbit hole in 2017 and how they joined Binance, and so so much more!

Go deeper in Fintech and DeFi by upgrading below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Sneak Peek:

Yenwen Feng:

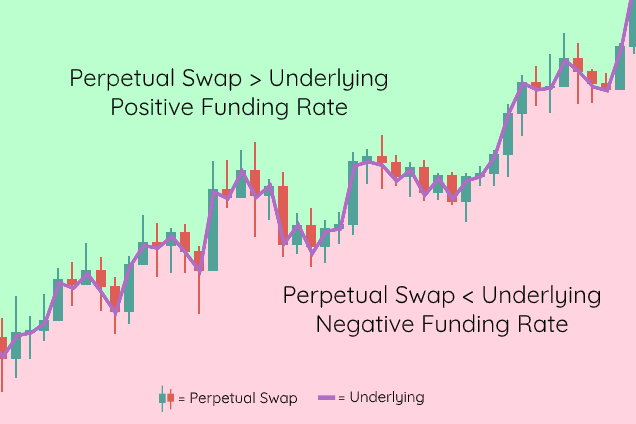

Cool. So a Perpetual swap, it's actually, first, popularized by BitMex in 2016. So Perpetual swap is actually a future, but it works a little bit different. So, in general, futures, in traditional market, it expires a certain point of time. So, expire in a week, in a month, or in a quarter. So, they have quarterly futures, weekly futures. And BitMex, at that time, they actually figure out, they want to build this financial instrument that actually don't expire. So, it's not really expired weekly or monthly. But actually, underlying of this financial instrument is that it expires every day, but they create another mechanism and co-funding payment that every given period of time, maybe eight hours or an hour, they will check, people who host long and short position, and then try to make sure people pay funding to each other to take the price pack of that financial instrument pack to a certain index. So, it's just like a future that never expires, but you have to take care of the funding payment that you might need to pay or receive.

So, I think this is quite interesting. It's a new token. It's like crypto native financial instrument. So, we really interested in…

More? So much more!

Subscribe to our podcast on Apple Podcasts or Spotify

What did we miss? Reach out here anytime.

Stop by our Discord!

Like it? Share it!

Podcast Conversation: Perpetual futures in DeFi and seeing frontier technology, with Perpetual Protocol Co-Founder Yenwen Feng