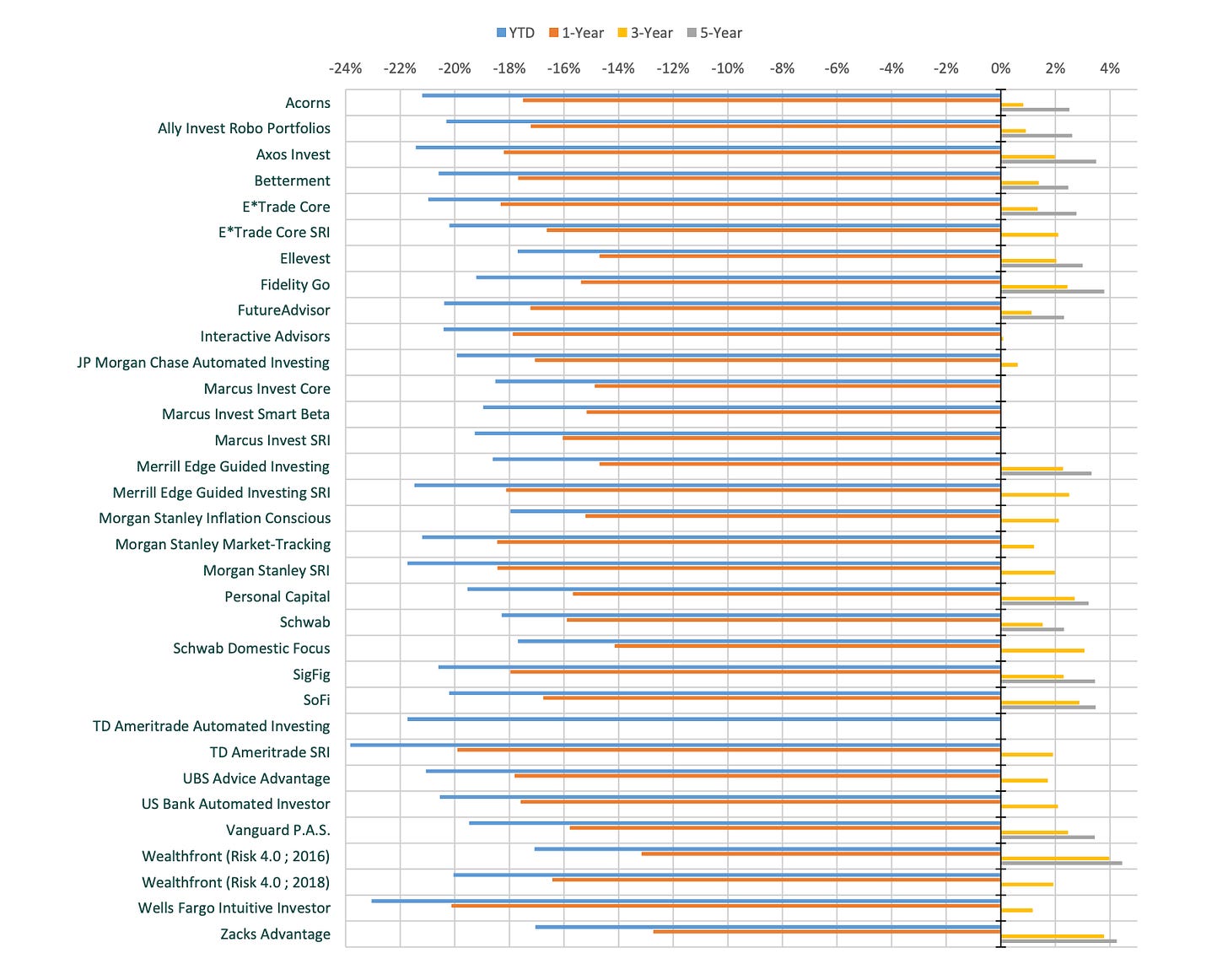

Digital Wealth: Roboadvisors lost 20% this year on average

Condor Capital's Robo report surveyed performance across 30+ roboadvisors.

Hi Fintech Futurists —

Happy 🦃 day, Americans. Today we are all turkeys, and here is your turkey discount.

Let’s highlight the following digital wealth news —

NORTH AMERICA: Canoe Intelligence to Power Alternative Investment Data Management for SEI using machine learning

EMEA: UAE Investment Fintech Baraka Lands $20MM Series A

ASIA PACIFIC: Singapore's Kristal.AI Secures $10MM For Its Pre-Series B Funding Round

REPORTS: The Robo Report | Third Quarter 2022 - Condor Capital WM

Thanks as always for your time and attention.

North America News

⭐🇺🇸 SEI Selects Canoe Intelligence to Power Alternative Investment Data Management - PR Newswire, November 21, Pennsylvania

SEI, the $8B market cap investment management technology firm, has partnered with Canoe Intelligence, an automated data and document management service provider for alternative investment managers. Recently SEI also partnered with wealthtech provider, LifeYield, to add tax-efficient retirement income planning into their offering. We are encouraged by the integration of third party best in class solutions.

SEI’s Archway Platform, offered through its family office division to automate workflows in middle and back-office operation functions, includes includes (1) charts of accounts and sub-ledgers for partnership accounting and tax; (2) portfolio management analytics via a client portal; and (3) outsourced services for bill payment and client reporting. Reminder that family offices still spend a meaningful amount of time on manual functions.

Canoe’s technology sources investment documents (e.g., K-1s, capital calls, account statements, HF fact sheets, quarterly reports) from an array of fund administrator portals, scans these documents, and categorizes them into a database for extraction and validation, delivered via APIs to downstream accounting and reporting systems. Getting good alts data into structured systems is hard, and a messy problem. Putting machine learning on top of the platform seems like the right answer, and SEI is distribution for that solution.

👑 See related coverage 👑

🇺🇸 upSWOT, Cion Digital To Offer Embedded Finance Tools - The Paypers, November 23, North Carolina

🇺🇸 Marstone Announces Marstone@WorkTM Solution Providing Digital Wealth Management Services to Corporations’ Employees - Silicon, November 17, New York

🇨🇦 Mobilum Technologies Announces OTCQB Uplisting - PR Newswire, November 22, Vancouver

🇨🇦 TradingView Adds Velocity Trade To List Of Supported Brokers - Finance Feeds, November 23, Toronto

🇺🇸 Quant And UST Partner To Accelerate The Adoption Of Institutional Digital Assets Across Financial Services - PR Newswire, November 22, California

EMEA News

⭐🇦🇪 UAE Investment Fintech Baraka Lands $20MM Series A - Fintech Futures, November 17, Dubai

UAE-based wealthtech Baraka has closed a $20MM Series A round led by Peter Thiel’s Valar Ventures with participation from Knollwood, bringing total funds raised to $25MM. Baraka is part of Abu Dhabi’s tech ecosystem Hub 71 and is backed by Y Combinator.

The commission-free investing platform offers investors more than 6,000 US stocks and ETFs and its investor toolkit, which contains stock analysis and reports from Refinitiv. Reminder that the London Stock Exchange acquired Refinitiv for $27B to rival Bloomberg. In terms of analytics, those include 12-month price targets, sector analysis, and scoring across earnings, fundamental analysis, relative value, price momentum, risk, insider trading, as well as comparative analysis. Baraka’s toolkit also includes (1) automated investing; (2) a Sharia compliance screener; (3) dividend reinvestment plans, and (4) a calendar with relevant information and updates about stocks in your portfolio.

Baraka will use the funding to expand throughout the Gulf Cooperation Council states (Saudi Arabia, Qatar, Oman, Kuwait and Bahrain) and Egypt, and add an extended hours trading option. On that note, Hub71 selected its latest cohort of 16 tech startups — Hub71’s startups have accumulated $436MM from investors while generating close to $700MM in revenues. The ecosystem is now developing cross-border programs helping startups scale in other markets while deepening market access to the UAE.

While this particular company is a pretty straightforward mix of roboadvice and automated microinvesting, we do think it is important to highlight local champions, as digital wealth tends to have trouble consolidating internationally given different regulatory regimes and market psychographics.

⭐ 🇨🇭 Credit Suisse Forecasts $1.6B Loss As Wealthy Clients Withdraw Funds - Financial Times, November 23, Zurich

🇬🇧 Quantifeed Acquires UK Fintech Firm Alpima - The Asset, November 22, London

🇪🇸 Allfunds Blockchain Expands FAST Solution To Streamline Stock Transfers In Spain - Fintech Finance News, November 21, Madrid

Asia Pacific News

⭐🇸🇬 Singapore's Kristal.AI Secures $10MM For Its Pre-Series B Funding Round - Technode Global, November 21, Singapore

Algorithmic wealth management platform Kristal.AI raised $10MM, bringing total financing to $27MM. Kristal.AI also recently crossed $1B in AUM, tripling AUM over the last twelve months.

Kristal offers a range of investment products, such as its Pre-IPO fund, mutual funds, and structured products such as equity-linked notes (ELNs). Kristal also builds algorithmic portfolios, such as Kristal high growth, which consists of a multi-asset ETF strategy driven by an automated asset allocation. Most roboadvisors use Modern Portfolio Theory for their asset allocations — e.g., Singapore-based roboadvisor StashAway offers proprietary asset allocation using its Economic Regime-based Asset Allocation (ERAA), which is MPT augmented with the state of macroeconomic conditions. Private market solutions, such as ESOP liquidity, are also supported.

In January 2020, when Kristal raised $6MM for its Series A, it was handling $100MM in AUM, and has since surpassed $1B in client assets and grown its investment product suite. Adoption is trending across wealthtechs in Asia, such as Singapore, India, and Indonesia. Invite-only Dezerv recently hit $120MM in AUM within a year of launch, and Endowus recently surpassed $2B in AUM. Kristal.AI has also announced an application for a license to expand into the United Arab Emirates, and if approved, we can expect more competition. Technology is borderless, even if regulation is local.

🇮🇳 Vijya Fintech Raises $1MM In Its Angel Round Led By Multiple Strategic Investors - Entrepreneur, November 16, Gujarat

🇸🇬 Moomoo SG Emerges As Wealth Management Platform With Five-Fold Increase In AUM; As Parent Company's Net Income Surges 24.8% YoY To HK$806.1MM In Q3 - PR Newswire, November 23, Singapore

🇸🇬 Haru Invest Adds Support for USDC Across Platform at Competitive Earn Rates - PR Newswire, November 17, Singapore

Blogs, Webinars, Podcasts

🇺🇸 Family Offices Go Digital With Pershing-Arta Deal - ThinkAdvisor, November 22, New York

🇺🇸 Personalization Of Wealth Management In The Post-Covid World - EPAM, November 23, Pennsylvania

🇺🇸 Wealth Management Apps Essential To Attracting and Retaining Younger Investors, J.D. Power Finds - Businesswire, November 22, Michigan

🇺🇸 Wealthtech 2023: 5 Tech Insiders On The Tools And Tips That Actually Help Financial Advisors - Financial Planning, November 23, New York

Events & Reports

⭐🇺🇸 The Robo Report | Third Quarter 2022 - Condor Capital Wealth Management, November 17, New Jersey

In the previous coverage of the Q2 Robo Report, we expressed, “Things are looking pretty dire YTD” given the poor equity performance and uncertainty in global economic conditions. The recent destruction in the market has spared no one, and has especially hurt those invested in growth and international markets. The average YTD performance across the 30+ roboadvisors covered in Q3 stands at -20%. Such is the life for the passive investor in a risk-off environment.

🇺🇸 2022 Forbes Wealth Summit - Forbes, December 6, Virtual

🇸🇬 Opportunities In Institutionalizing The Digital Frontier - Hedge Fund Asia Digital Assets Summit, December 7, Singapore

🇬🇧Digital Integration In Wealth Management 2023 - Arena International, February 21-22, London

Premium Membership discount

Our ultimate goal is to keep you on the forefront of Fintech innovation so you don’t get left behind. That’s why we created the Fintech Blueprint Newsletter years ago.

We’re pleased to see that over 54,000 Fintech leaders have joined us since then.

You’re now on a free membership plan of the Fintech Blueprint, which limits your exposure to the top notch content we produce 5 times a week.

We are running a Black Friday campaign to give you the opportunity to take full advantage of the Fintech Blueprint Experience at a 33% discount!

Get your Premium subscription now for a third off the price and stay ahead of the shift that’s coming.

See you inside ✌️

Postscript

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.