Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Kevin Levitt who currently leads global business development for the financial services industry at NVIDIA. He focuses on global trends in accelerated compute and AI for consumer finance – including fintech, retail banking, credit card and insurance. Prior to joining NVIDIA, Kevin served as Vice President of Business Development at Credit Karma, and Vice President of Sales for Roostify.

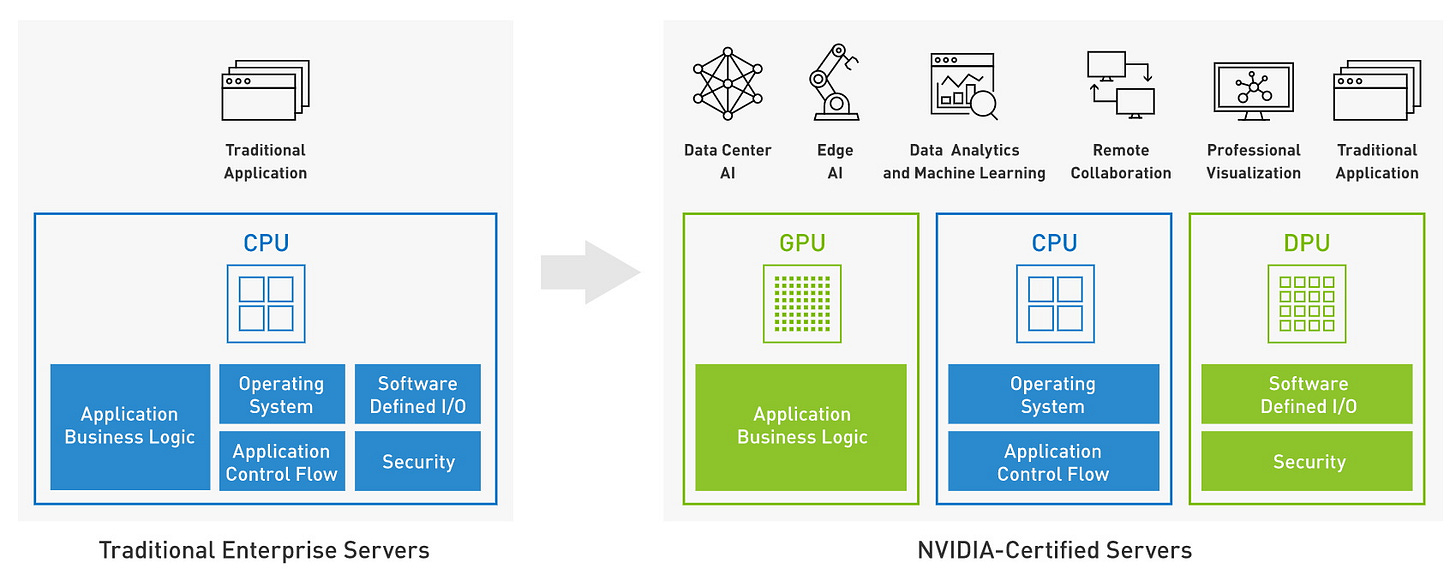

More specifically, we touch on the role data plays in the financial industry, how the needs of financial institutions have changed, the age of big data, the definitions between artificial intelligence and machine learning, how to train an AI algorithm, the reasoning behind the incredible amount of parameters machine learning solutions consume, the fundamental purpose of AI/ML in financial services, what NVIDIA’s platforms comprise of, and lastly the future of AI/ML.

For premium subscribers, a full transcript is provided along with the recording.

Hope you enjoy, and do not hesitate to reach out here!

Excerpt

Kevin Levitt:

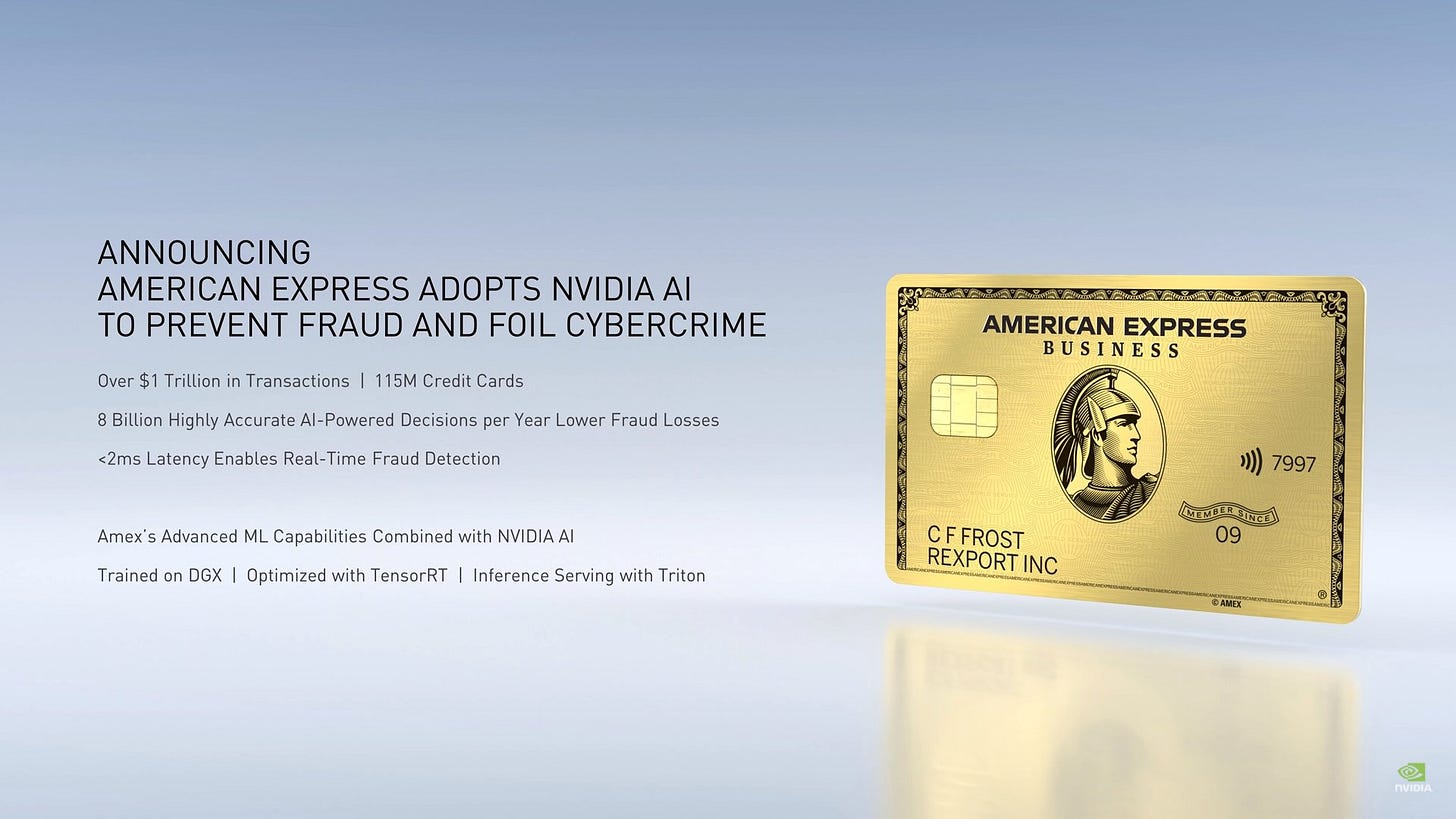

…we've got a great case study with American Express who's using deep learning to identify fraud, and they need these deep learning expansive models at the point of sale to happen in less than two milliseconds. And you need the same thing from your virtual assistant and chat bot. The last thing any of us want is to be waiting seconds for an answer because that's not how natural language works. It's immediate. And so, you need the computing power of an accelerated computing platform like NVIDIA's, whether that's on premise or in the Cloud to not only train the models but also to handle the inference so that at the point of sale, at the point of communication, it's a natural interaction, one that is seamless and one that delivers the value that we're expecting as users of the technology.

Help us grow and improve with your feedback

Tell us what you thought about today’s newsletter by clicking above or here.