Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

Greatest Hits

Reminder: The Stablecoin Greatest Hits report is now available for you to check out. We aim to provide a well rounded perspective along with insights on the current stablecoin market.

The report is exclusive to Premium Subscribers, so get your FREE 7-day trial now!

In this conversation, we chat with Will Beeson, Co-Founder & Chief Product Officer at digital bank BELLA. Previously, Will was a Principal at Rebank, a fintech advisory firm, as well as he co-founded Allica, a digital bank for businesses in the UK. After starting his career at Citigroup in New York, Will spent nearly a decade in Europe working with and managing financial services companies prior to launching Allica. Will holds a BA from Amherst College (USA) and is a Chartered Financial Analyst (CFA) Charterholder.

More specifically, we touch on frameworks for navigating down markets, valuations, multiples, why some fintechs have to disclose themselves as tech companies than banks, covid-19 implications, buy now pay later developments, and so so much more!

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Sneak Peek:

Will Beeson:

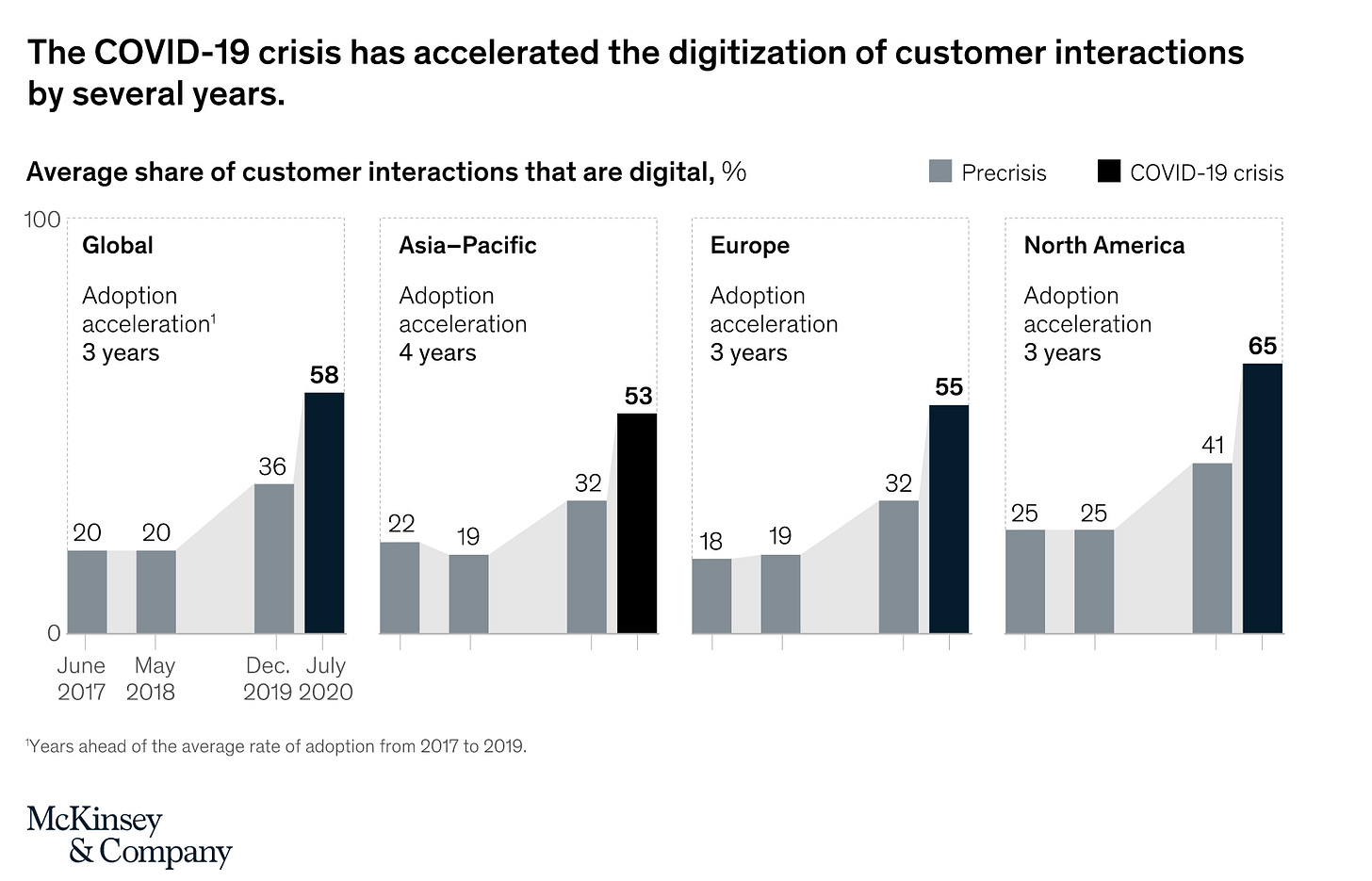

…during COVID I can assure you that I was not making these sort of lucid forecasts as to exactly how specific companies or consumer trends were going to involve. I think like most, I was kind of afraid for my life the first few months, but in retrospect, it turns out that stimulus checks are a powerful tool, in terms of consumer psychology and even the kind of economic details of how we avoided recession and how instead we ended up in this period of what appears to have been pretty meaningful overheating. I think it'll take years and deep analysis to understand all the various component parts. But to your point, we certainly did stay at a recession and to the contrary, it was a massive growth phase.I think in terms of, did it shift digital adoption meaningfully, did it speed up the future? I'm still convinced that yes, it did find myself and those around me using a lot more technology on a much more regular basis than previously. I work remote now. I didn't work remote before the pandemic. I don't think I expect ever to be…

To read the full transcript, subscribe below:

Postscript.

Subscribe to our podcast on Apple Podcasts or Spotify

What did we miss? Reach out here anytime.

Stop by our Discord!

Like it? Share it!