Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we talk with Brian Barnes of M1 Finance, about finance “super apps”, the cost-efficiencies of robo-advisors, fractionalized share trading, and tackling the titans of the Wealth Management industry. We also discuss the nuts and bolts of the financial infrastructure making this possible.

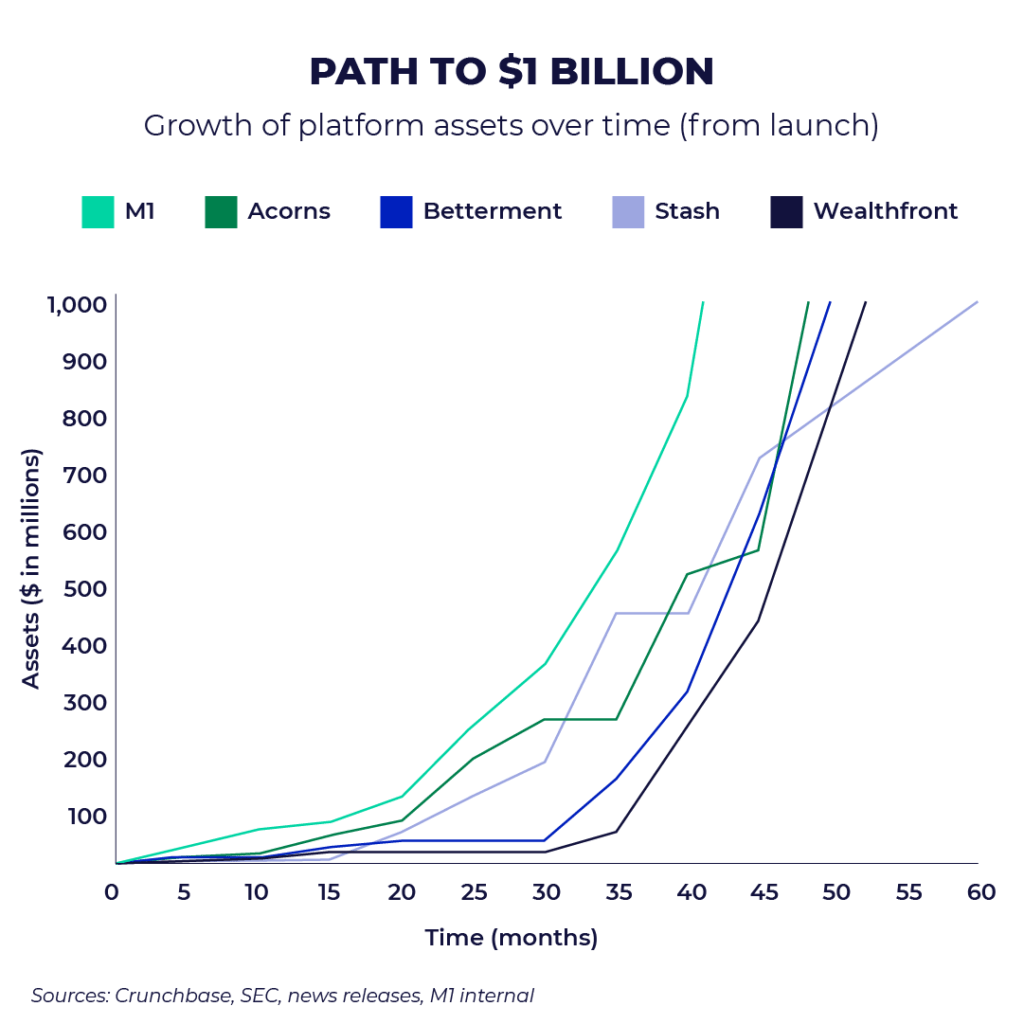

M1 Finance bundles together roboadvisory, neobanking and lending into a single “super app”, allowing for combined pricing power (i.e., charging nothing on asset allocation). The firm currently has $3 billion in AUM, a growth of 50% in the past four months and tripling their total in just over a year. Notably, the company has its own broker/dealer and offers fractional shares, and partners with Lincoln Savings bank on the deposit accounts. That makes for a compelling business model from securities lending, interchange, and order flow.

For premium subscribers, a full transcript is provided along with the recording.

Hope you enjoy, and do not hesitate to reach out here!

Excerpt

Brian Barnes:

So, on the interchange front, there's two big distinctions between interchange for debit card, which is typically less than interchange for credit cards, which is typically more. A lot of that has to do with the risk parameters that on the credit side. They're actually providing credit. That being said, the higher interchange on credit cards is also what facilitates the cash back and rewards that people do love.

On the debit card side, there's also two tiers of interchange. And it's much higher for banks that have less than $10 billion in assets. And then, it drops off a cliff if you go above $10 billion in assets.

And so, some of the things that fintechs are doing is partnering with banks that have less than $10 billion in assets and will for a long time, so they can monetize off of the higher interchange rate. It'll be an interesting question of whether that dynamic changes or there's any regulatory pressure on that over long periods of time.

For us, choosing the bank was a combination of reasons. One, we did want to go with a bank sub $10 billion to monetize at the higher rate. Not many banks are super pro-fintech. And so, having some that are open to relationships with fintechs limits it pretty dramatically. And so, that cut down the available universe to just a handful of small banks, but that handful is growing over time.

But then the bank that we ultimately selected…

For the annotated transcript and additional premium analysis, subscribe here: