Hi Fintech Architects,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Anthony Moro - The Chief Executive Officer of Provenance Blockchain Labs, Anthony Moro joined the Foundation in July of 2022 to lead the expansion of the Provenance Blockchain ecosystem, and to enable financial institutions globally to realize the benefits of blockchain.

Previously, Anthony held various senior executive roles over his two decade career at BNY Mellon, including managing one of BNY Mellon’s most profitable businesses, the DR group, which made up over 800 issuer relationships from 73 countries. More recently, Anthony was President of ROX Financial, an asset management fintech company focused on democratizing access to commercial real estate through innovative NYSE listed REIT securities.

In addition to his role at Provenance Blockchain Labs, Anthony is also a Board Member of Provenance Blockchain Foundation, and an Advisor to Banyan and Zecurity.

Topics: Blockchain, tokenisation, capital markets, DeFi, TradFi, NFT, Financial Services, Governance, crypto

Tags: Provenance, Sofi, Provenance Blockchain Labs, ProvLabs, Ethereum, Cosmos, Merrill Lynch, Figure Technologies, Figure Markets

👑See related coverage👑

DeFi: Unpacking EIGEN's $10 Billion+ launch and restricted design

[PREMIUM]: Long Take: How the Machine Economy combining AI, blockchain, and Fintech is growing

[PREMIUM]: Long Take: Why $ billions are flowing out of Banks into Money Market Funds, and how startups can benefit

Timestamp

1’28: From Traditional Finance to DeFi: Insights on Provenance and Financial Services

4’48: The Complexities of ADRs: Insights on Traditional and Decentralized Financial Systems

8’54: Provenance and Blockchain Innovation: From SoFi Founders to Cosmos Network Integration

13’17: Transforming Capital Markets: The Evolution of Figure's HELOC Business and Blockchain Integration

17’28: Revolutionizing Mortgages with Blockchain: The Impact of NFT Mortgages and Disinflationary Technology

21’20: Exploring Alternative Investments: The Value of Pork Bellies and the Unexpected Tale of Uranium

26’39: Bridging Provenance and Ethereum: Open Source Development and Financial Services Security

30’01: Revolutionizing Governance in Financial Services: Provenance's Approach and Future Directions

32’56: Navigating Centralized Exchanges: Bringing an Institutional Network to Retail Markets

39’20: Regulatory Shifts in Crypto and FinTech: Navigating the Evolving Landscape Ahead of US Elections

42’49: Embracing the Future of Tokenization: Provenance's Vision for Retail Inclusion and Financial Services

46’31: The channels used to connect with Anthony & learn more about Provenance

Illustrated Transcript

Lex Sokolin:

Hi everybody, and welcome to today's conversation. I'm really thrilled to have with us today, Anthony Morrow, who is the CEO at Provenance Foundation, which is one of the leading real-world asset blockchains out there and has a really interesting history interweaving FinTech and crypto technology. So, with that, Anthony, welcome to the podcast.

Anthony Moro:

Yeah, Lex. Thanks for having me. Longtime listener, first time speaker, so I can't wait to dig in.

Lex Sokolin:

Fantastic. Maybe let's take a quick detour to your background because I think that'll help set the stage for the questions about Provenance and what it is. What's the core career experience that you've had? What are you bringing to technology and to thinking about financial services?

Anthony Moro:

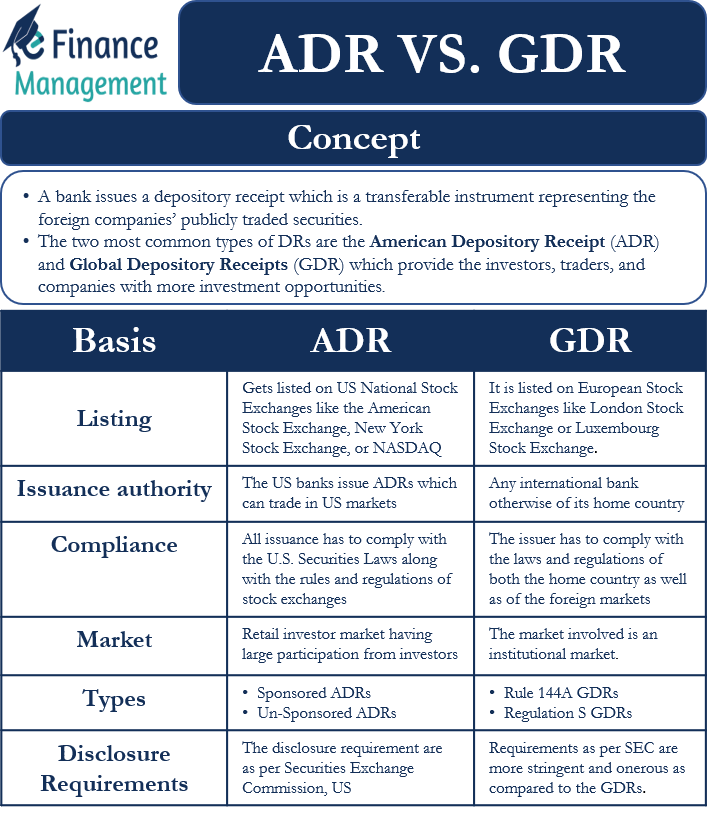

So, I spent the vast majority of my career at BNY Mellon in their security servicing businesses, particularly the ADR and GDR businesses. And in those businesses, you have non-US equities trading here in the US on the New York Stock Exchange or NASDAQ. And they're very heavily intermediated businesses and they're very profitable businesses for custody banks like Bank of New York Mellon. You have all the inefficiencies of securities transactions across the ocean in the farm market. You have a whole host of cross-border intermediaries, and then you have of course the inefficiencies of the US public markets, and you roll all that in together into one security, and it becomes one of the most intermediated and most expensive securities transactions around in the public markets for sure.

So, I was on the dark side for many, many years running those businesses, and I always thought there was a more efficient way to do it. The technology didn't exist there yet, obviously, but now that I've moved over into DeFi, I really keep a worldview of financial services into what we're doing here at Provenance. And in the TradFi world, you think of a custody bank as a good control location, meaning it's a safe place to store securities or hold securities. And I think of a Layer 1 blockchain in a very similar light. I think Provenance is positioning itself as a good control location for ownership of securities, meaning the network is always alive, it's always active. You always have access to your securities, particularly in times of high volatility when you're going to want access to your securities more than ever. This is what we're building for, this is why we're purpose built for financial services, and we can talk a bit more about that in a minute.

Lex Sokolin:

Yeah. One of the interesting things that people say about decentralized finance or the crypto networks is that you're noncustodial. You're on a network, you're noncustodial, no one's holding stuff on your behalf, but of course it's the network that's custodial for you. That's where your stuff actually is.

Anthony Moro:

If the network goes down, you do not have access... In Bitcoin, of course you do, your wallet, your keys of course. But if it's a security, there is some layer of... and it's not centralization, but there is a network at the heart of it, even though it's a decentralized network. If you can't place a bid or an ask or settle a trade of any asset when you want to do that, it's usually the times of high volatility when you can't. Right? I would just say without throwing shade at all, because there's a lot of good Layer 1s out there, but if a network goes down in the middle of the trading day and the token price goes up, no one is thinking about that network as a good control location. I can tell you that.

Lex Sokolin:

Yeah, that's interesting. The internet is similar in a way in that it's custodying information and we expect it to be up all of the time. We don't expect outages for all of our key services and all of our infrastructure, but there is a chance that the network actually ceases, especially when attacked. And I think that's an interesting angle for the finance discussion as well. I want to spend just a little bit more time on BNY Mellon and security servicing and the traditional or the orthodox infrastructure for that. Can you give us an intuitive picture of what heavily intermediated international security servicing is like? I'm imagining coal being shoveled into a train and steam rising, but can you give us some stories of how that machine works?

Anthony Moro:

Yeah, so the one I like to tell is... and it's absolutely fine to talk about it now because the business is no longer active. The Russian oil and gas giant, Gazprom, was one of the biggest ADR clients in the history of financial services of any bank anywhere. And I'll give you the example of the fees that were charged on that because it's all public. So, there were 4 billion ADRs, or shares, outstanding in the US of a very large company. And every time, once a year, they would pay a dividend in rubles and the custody/depository bank that Bank of New York Mellon was for that program would take the rubles and turn them into dollars and ship them back to the US markets and distribute them to US shareholders. And when the process of doing that, you would obviously make an FX fee of the ruble to dollar conversion, but on top of that, you could also charge a 2-cent dividend fee.

Now for those of you who can do the math, 2 cents times 4 billion shares equals an $80 million fee. You would share some of that back as a rebate with the customer, in that case Gazprom, and you would keep $60 million of it to the bottom line of the Bank of New York. Talk about an intermediated process with a fee that really didn't need to exist. But it did exist and it was awfully profitable. It was a very profitable trade for BNY Mellon every year. Of course, that whole business has gone away with the Russian sanctions and the war in Ukraine, but that's another story for another time.

Lex Sokolin:

One question I have here is about ledgers. In that example that you gave of an ADR, and I think in some ways it's similar or related to what we'll talk about anchoring off-chain securities on-chain, where you're running two parallel different systems. How does the ledgering work for ADRs? Because you have the foreign markets, in this case, you'd have the Russian market and then you'd have the American market, they might have different price movements, there might be different owners. What is that tracking and reconciliation like?

Anthony Moro:

So the depository bank, there were JP Morgan, Bank of New York, Deutsche and Citi were the four oligopolistic depository banks, and they would control literally the entire market of a trillion dollars in market cap of ADRs. You would essentially hire a subcustodian in the local market. Subcustodian would own the, let's call it 30%, position, that was represented by ADRs, and they would treat that subcustodian as essentially one holder. That one holder would be omnibus account held by Bank of New York Mellon in custody. And then Bank of New York essentially runs a separate ledger here in the US that has the ADR holders. The omnibus is paid 30% of the dividend, it would take that dividend, convert it into dollars and bring it over to the US and charge a fee for doing that.

Lex Sokolin:

Does this ever break?

Anthony Moro:

The bridge isn't super timely. You have two pools and the two pools that you have the US pool and you have the non-US pool. The US pool trades independently of the non-US pool. Obviously, it trades at different market hours, trades in a different currency, so there's a lot of arbitrage opportunities between the two. As long as the local market is open and doesn't break, and separately the US market is open and doesn't break, the arbitrage should take out the differences between the two when the markets are open in their respective time zones. The New York Stock Exchange had a hiccup just the other day, these things break from time to time for sure. Hopefully nothing, the whole GameStop fiasco, these things break from time to time. Not often. They're still the most trusted capital markets there are because they're almost always up. I'll just tell you, some of these Layer 1 networks go down, the token price goes up. If Bank of New York systems ever went down for five hours in the middle of the trading day, you can guess what kind of a hit the stock price would take.

Lex Sokolin:

I wonder if you're talking about something that starts with an "S" and ends with "olana", but we'll leave it for later. Okay, so that's our starting point. Let's switch to Provenance and where did Provenance come from? What is it and where did it come from?

Anthony Moro:

So, taking a bit of a step back, I have to tell the story of Mike Cagney and June Ou, co-founders of SoFi. They left SoFi in 2018 and they founded Figure Technologies at the time with the thesis that the whole world was moving to blockchain and blockchains were going to remake capital markets in an efficient manner. Mike's big mantra is replacing trust with truth, and operating in a manner where you can settle bilaterally without any intermediaries. It's a purest blockchain view of the world that he had or has. Went around to lots of big banks and said, "Hey, let's remake your capital markets." And they all said, "Great, Mike, we love you. We'll invest in your company, but we don't want to be your first client. We'll be your 10th." So, Mike and June went out and they built Figure Lending, which has become by far the largest issuer of blockchain native assets anywhere times a multiple. And we can talk about that in a minute.

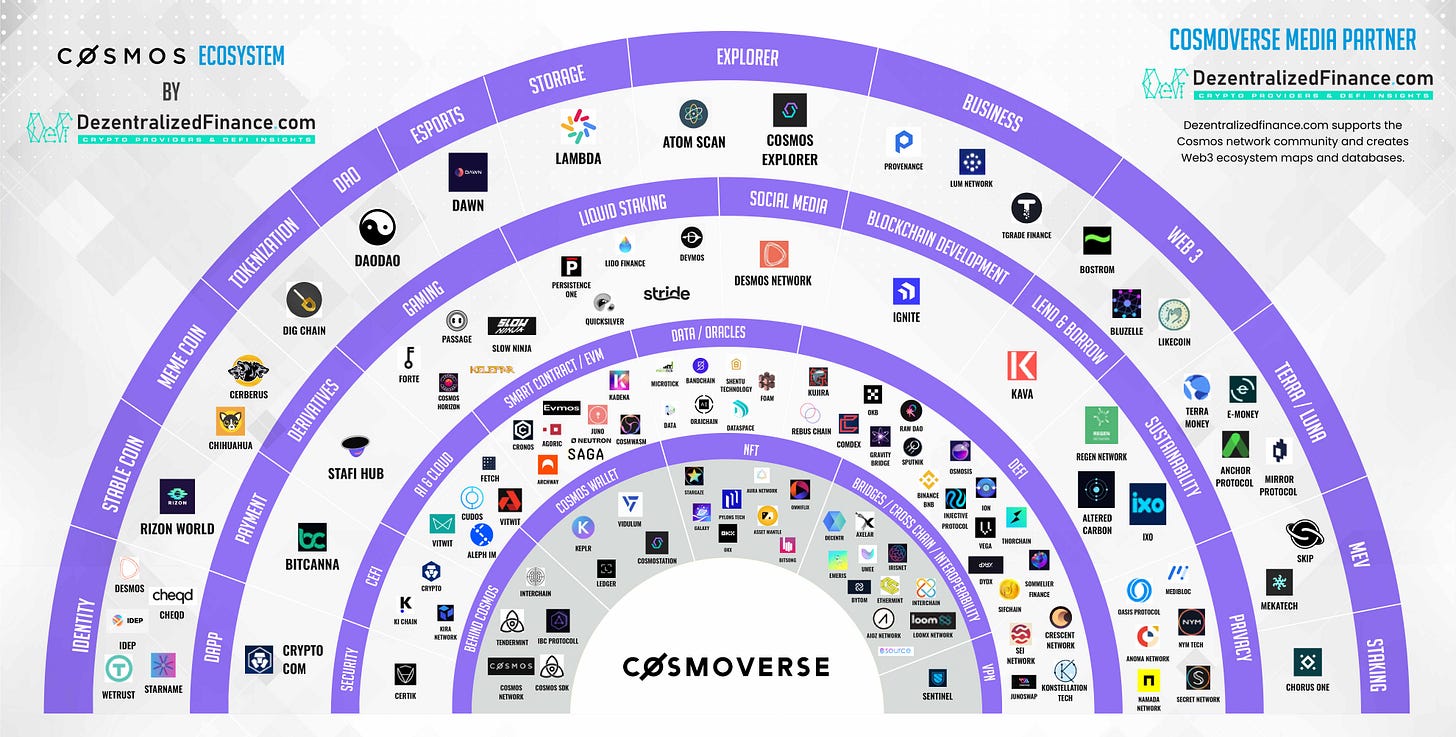

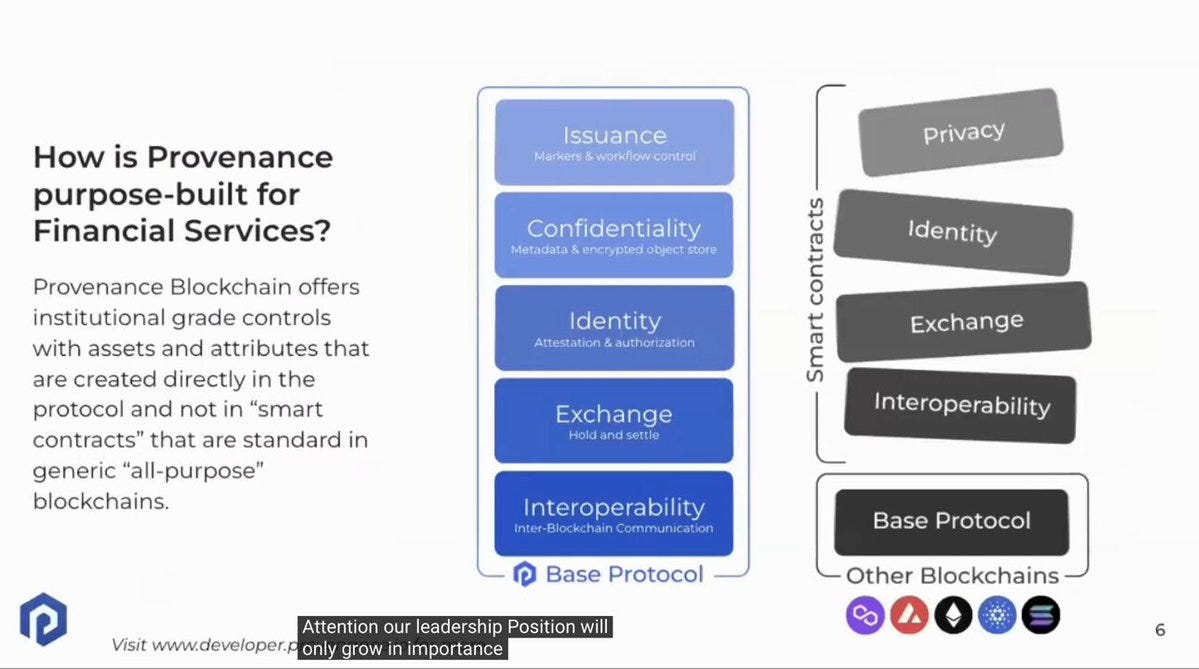

They recently spun out. And that business, which has discussed doing an IPO in the press, they have that. They have Figure markets, which is a decentralized exchange trying to remake the trading of all things digital with a asset perfection and lending against them, and a collateralized, decentralized exchange backed by great technology, which we can unpack in a minute. But all that is built on Provenance. And Provenance when they came over, they started off in Hyperledger Fabric, private permissions, because that was the technology of the day. In 2021, Ira Miller and the team who is our CTO now, switched over to the Cosmos network. So, we're a Cosmos sovereign chain. We're a Layer 1 in the Cosmos network. And why the team chose Cosmos is because you were able to spin up a sovereign chain, but you were able to put in the appropriate attributes that makes Provenance purpose built for financial services.

And the reason that was important is because, like in ADRs where there's an oligopoly of providers, which I talked about, or custody where there's an oligopoly of providers or credit cards where there's an oligopoly of providers, I think financial services blockchain will be run by an oligopoly of Layer 1 networks. And those Layer 1 networks will not be generic. By a generic blockchain, it's the popular ones that you know that need what I call a Jenga tower of smart contracts on top of the base protocol in order to spin up a meme coin or to run a metaverse project or to have a regulated financial services project.

And having sat in bank risk committee meetings for many, many years, I can tell you that those committees will analyze each and every step of each and every transaction. And for instance, when you put a bid or an ask in a smart contract, you don't own your security or your assets during the time that it's in somebody else's smart contract. If you get a dividend or you get an interest payment, who gets that? If they go bankrupt while bidding your asset in the smart contract what happens. There are too many unknowns for proper regulated financial services to run in the Jenga tower of smart contracts of a generic network.

We built Provenance with what we call attributes that sit into a marker. So, you don't just tokenize something, you create a marker that tokenizes something, and within that marker you can toggle on essentially all the ERC-3643 standards or ERC 20 standards or 721 standards. You can do, create, redeem and hold and whitelist or blacklist and callbacks and all the other financial services functions that you need. These are done in a marker format and the marker sits in the protocol, not in a smart contract that's owned by somebody else in the protocol. So, it's just a better governance. We like to say cheaper, faster, and very, very importantly, safer. And this is the safer part.

Lex Sokolin:

So there's a lot to unpack in there, which is great. I'm going to try to start naming some of the bits. So, you've mentioned that there are banks that are interested in this community and in Figure. Figure was started as a HELOC-focused FinTech, so this lending asset class, and it needed two sides of the market as I understand, the lenders and the borrowers. And so, can you talk about that early community of capital markets players? Who are the providers of capital, who are the borrowers of capital, and maybe how has that evolved over time just from a pure market venue perspective?

Anthony Moro:

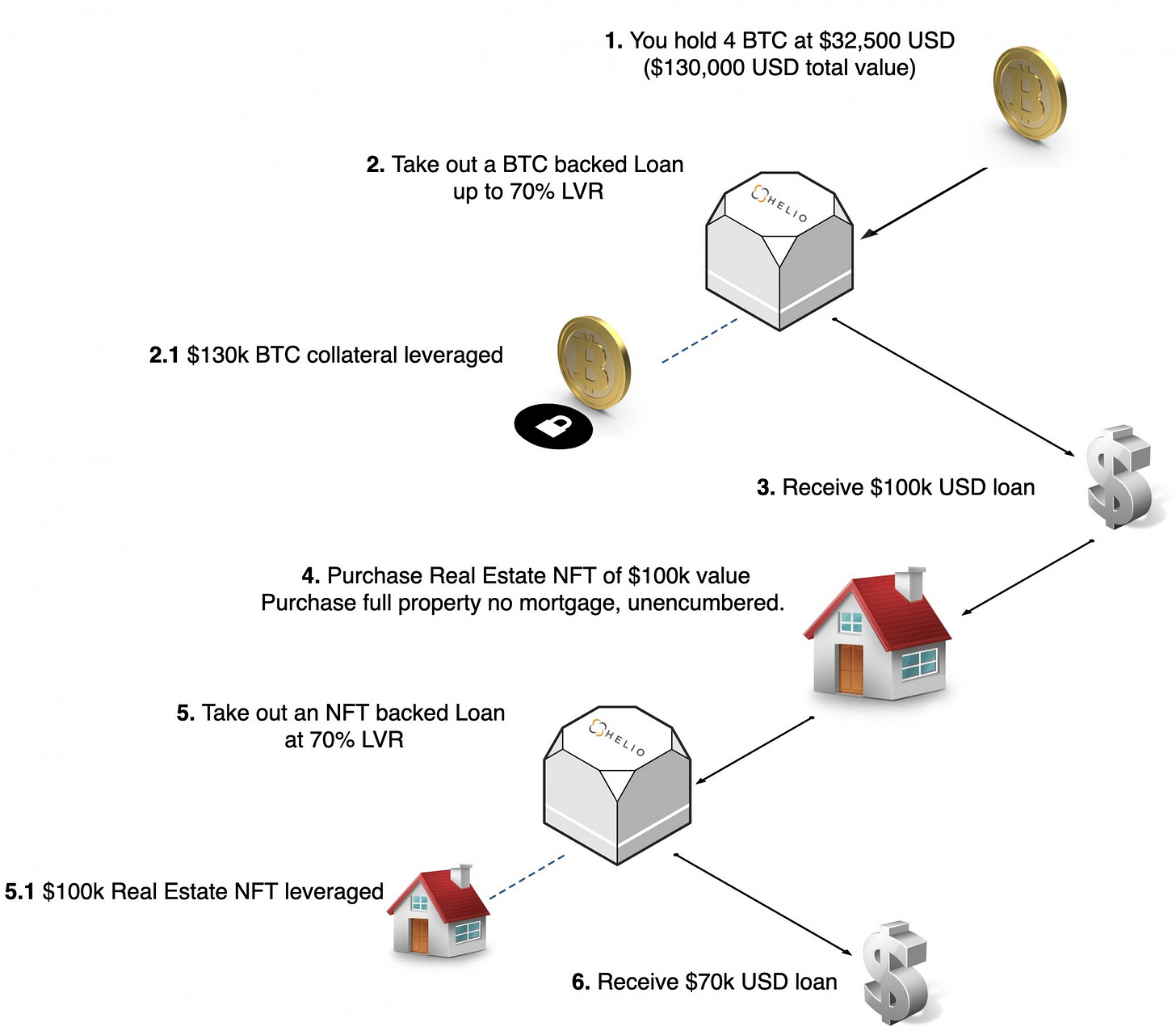

So I guess in 2018, the world of interest rates was very different than it is today. Mortgage rates were two and a half, three and a half percent, and the prevailing way to get equity out of your home was a cash-out refinance. Most of those loans are covered by Fannie and Freddie, the GSEs, and there really isn't much efficiencies to be gained by putting that on blockchain because you can't compete with free takeout, which is what Fannie and Freddie are; government-backed takeout. When interest rates started to rise... and there was a nascent home equity line of credit, which is a second mortgage for people listening. There was a nascent market there, but again, because interest rates were so low, you could just cash out refinance your first and move forward.

As interest rates rose that's really when Figure's HELOC business started to take off. Obviously if you're locked in at 3% for your thirty-year mortgage, you're not going to touch it ever. It's the cheapest form of capital in a seven, eight, nine percent world. So, if you need to put your kid through college or finance a kitchen renovation, you take out a home equity line of credit and you get funded, let's say $50,000, and you pay your interest rate and off you go. So as interest rates rose, the bank lending box is also massively contracted. Banks just don't want to operate in this business anymore. HELOCs are also an operationally inefficient business for banks and non-bank lenders because the amount of work that goes into a $50,000 HELOC, is the same amount of work that goes into $500,000 mortgage.

So what Mike and June and the team did is they brought the blockchain technology into that, what they've done in the process of creating a loan, issuing loan to a borrower. From there, it goes into a warehouse and from there it goes into an ABS securitization. In that process, they've taken out more than 150 basis points of fees in each of the three steps, and they've made the loans profitable for originators in a way that they weren't previously. So, they were always marginally profitable but nothing exciting, but now they're exciting for originators. And also, they can lower rates to borrowers because of the cost savings. Technology is apparently disinflationary. This is a great example of it.

So, the business started off, it was B2C, so Figure had a website and you go there and you get a HELOC. But then over the last couple of years, they've been pivoting to offering the technology to other bank and non-bank lenders. So, something like 30 or 40 of the top 50 lenders of HELOCs and mortgages in the US today are using the Figure underlying technology and putting loans every day on Figure Provenance blockchain, to the tune of about $700 million a month right now, $600 or $700 million.

Lex Sokolin:

What were they using before? Curious.

Anthony Moro:

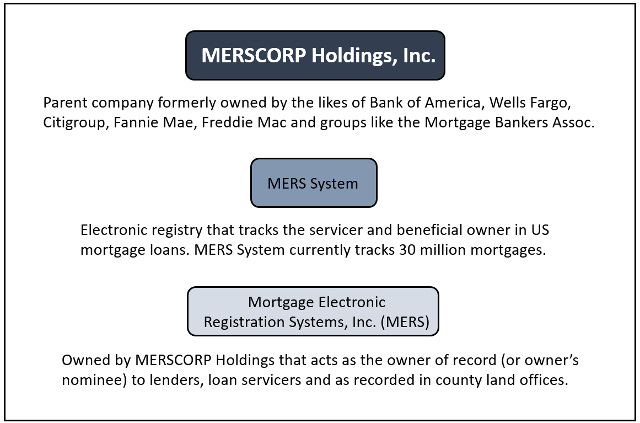

Yeah, paper-based systems. There's something called MERS, which is owned by the ICE, the New York Stock Exchange parent company. It's very paper-based. At each step of the process from origination to the first sale, which is the warehouse sale, to the second sale, which is the ABS sale, everything needed to be re-audited. So, this is just one example. So of course, the second audit doesn't trust the first audit, the third audit doesn't trust the second audit, so everyone has to re-audit themselves. But the beauty of blockchain is you have a cryptographically true process. And all the way through the ABS, they've gotten the rating agencies to agree that each step of the mortgage or the HELOC that has been proven cryptographically true does not need to be re-audited, and everyone's gotten comfortable with that process. So, they've taken the audit cost down something for like $600 a loan to $50 a loan. And that's just one little small part.

But the way that it works is, for instance, you have a video notary set... I don't know if you've gotten a HELOC recently or a mortgage. There has to be a notary, and in this case it's a video notary session, but obviously you're not going to put that massive file on the blockchain. But we've developed technology called an encrypted object store where you can keep it stored off-chain, and that encrypted object store writes a hash to the blockchain and that hash is tied to the NFT mortgage in this case. So, if you're properly permissioned, you can theoretically click on the hash and go see the video notary session if you wanted to do that part of the audit.

Lex Sokolin:

I love hearing the words NFT mortgage. It's such a pleasure to be at a time when this is the cutting edge.

Anthony Moro:

Yeah, this is why I get excited about blockchain. Obviously, it's not for cartoon pictures of cats, it's to remake the mortgage market and take out massive amounts of fees. And again, to do societal good, disinflationary technology that lowers rates for borrowers. If you take 150 basis points out of a process that's 300 or 400 basis points in total, yeah, you can put money back in people's pockets, real-life people who are doing real-life things, sending kids to college or doing a new kitchen. I like that aspect. I'm not saying we're doing God's work here at Provenance Blockchain or in this industry that we're doing, but again, having technology being disinflationary, we can do some good for some people here.

So yeah, that's the process. It's really interesting. I like to say if you're in the HELOC or mortgage business and you're not using this technology, you've already been disintermediated, you just don't know it yet.

Lex Sokolin:

Essentially you have a new custodian for these assets, although maybe some of the data is hashed and referential, but at least in part this is the new place where these assets are living. I also know that you've got a bunch of private equity firms and financial firms that are in the ecosystem. Can you talk about what their involvement is? And some of them might be running nodes. What is their interest and how are they playing this?

Anthony Moro:

So yeah, Franklin Templeton runs a node. Apollo has got a fund on chain. JP Morgan used us for Project Guardian, which theoretically was a proof of concept that showed how you could remake an entire wealth management industry by running processes on blockchain. So, there are a lot of banks in the ecosystem, asset managers in the ecosystem, and as you saw with BlackRock's investment in Securitize recently and then the success of BUIDL. Jenny Johnson said all of the world's funds, mutual funds, ETFs, I think equities will be tokenized at some point. Again, it comes back to the process is cheaper, faster and safer, and there's no way around that. And that will always win the day, because at the end of the day, you can't compete unless you are cheaper, faster, and safer than the other guy.

My career is old, I've been around. So, we first ledgered things on Lotus 1-2-3 spreadsheets. I think before that they were actually on paper, and then from there they went to on-premises data centers. From there they went to the cloud. And then this next iteration of ledgers is really just on the blockchain. It's really, if you think about, and this is the way that I think about blockchain, I think about that progression, it really isn't groundbreaking from a ledger perspective. Where it is revolutionary is the things that you can do with that ledger now with blockchain and the decentralization that you can never do before with particularly a centralized database or a spreadsheet on a computer somewhere. That you can build now a system around it, you can bring in all the other parties who need access to the information at the same time, and you can bring down costs massively. You can shorten timeframes massively. And again, doing societal good, instead of you or I being able to invest a 60/40 stock bond portfolio, we can now theoretically invest, like the Yale University Endowment where we have all sorts alternative investments. Timber, any things that's in the Yale University Endowment portfolio, which outperforms the market year, year after year, because it's modern portfolio theory, it's the appropriate balance of risk and reward.

Lex Sokolin:

I have two favorite alternative investments. One is pork belly is an important part of all asset allocation. And then the other is... I still remember this from around the time of the Lehman crisis, where it was a story of a trader who ended up doing a big uranium trade that unwound during the bankruptcy, and he had to take physical delivery of a ship of uranium. So, we definitely need some exposure there.

Anthony Moro:

I don't know about physical uranium, but can definitely get behind pork bellies.

Lex Sokolin:

The pork belly exposure is important. Yeah. Okay. So, I think it's fantastic again that we're in a place in this story where large institutions are being very authentic in saying all of our stuff is going to end up ledgered on chain. The next point I want to pull apart, and you've already made this point, I'd love to flesh it out a bit more, is about the technology stack itself. So, you mentioned that Provenance started out on Hyperledger Fabric, which is open source, but very enterprisey, custom-built consortium. And during that time, 2017 through 2020, there are a lot of consortia and many of them had this intranet problem where they didn't have access to liquidity of the public blockchains or what you've called generic chains. And the cost of maintenance was very high. So, whether it was a supply chain consortium or whether digital asset consortia, even though the cost was mutualized among the participants, it was still high to maintain the network.

And so at least from where I've sat, it seems like a lot of that has fallen apart. As I understand, you've switched over to Cosmos. Cosmos is a public chain infrastructure with some very opinionated designs about how to make chains. Can you talk about what the Cosmos technology is like and what are the trade-offs, and in part, how do you think about relating to the public chains where a lot of the buzz and the activity is today?

Anthony Moro:

First, we are a public chain, we're an open-source chain, so I'll just make that perfectly clear. We're built in Cosmos, which is different. It would be easier at this stage if our development, if we were an EVM chain just because that's what everybody knows and that's what everybody's connected to. But in EVM, we wouldn't be able to build the attributes into the protocol the way that we have. We would need that Jenga tower of smart contracts. And I just don't see, given everything I've ever learned about security servicing, how large financial services firms get comfortable with an EVM chain and the Jenga tower of smart contracts, because they do not own the process and they have too reliance on parties who frankly they wouldn't take a credit risk from. So, I was at BNY Mellon in '08 and Deutsche Bank and Morgan Stanley were begging us to take cash and we wouldn't because we didn't trust that they would be open the day after. Honestly, in '08 you think you're going to an ATM machine and you're crossing your fingers that you're going to get cash out the next day. It was the end of the world as we knew it, almost.

So, counter-party risk is at the center of everything banks think about all the time, and there's just too much counter-party risk with a generic blockchain and the Jenga tower of smart contracts. So, the only place that we know of that can have the protocol control the attributes in a manner that we hoped to build financial services, is Cosmos. Cosmos also has a concept of IBC, Inter-Blockchain communication, which frankly is safer again than a lot of the bridging solutions that are out there. And it just felt like the right place to build the blockchain. We have very reasonable block times, four second block times. The cost of running the chain is relatively inexpensive. We do about $500,000 a quarter in fees on chain right now, so maybe almost $2 million annualized. The 70 validators, if they're efficient are profitable, which is rare in this world.

I look at this as an operational network, not as a, "Let's make fees as low as we can. Throw up a bunch of meme coins and see what happens." If these things are going to scale broadly, they need to have a semblance of a business model. You need to have unit economics that makes sense at some point, right? And that doesn't have to be today, I get that. You can have the Amazon model and build these things for 10 years and eventually you turn on the profit switch and make money. But if you're a generic blockchain and you turn on the profit switch, someone's going to come in and undercut you. So, what's your value prop? What's your moat? So, our value prop and our moat is the way that we've built the infrastructure for financial services into the protocol. Hope that makes sense?

Lex Sokolin:

It does. I'm interested in this question of, it'd be convenient to have the ability to build on EVM, and especially now there's so much progress around scaling up Ethereum and connecting things to Ethereum. So yes, of course Solana is an exception with its all-encompassing design, but you do have things like roll-ups and they do have privacy, they do have scalability. Do you see in the future any bridging or crossover to ecosystems like Ethereum and maybe the broader question is even... You mentioned that Provenance is a public chain and its open source, so can anyone write software for Provenance, pick up and bring over their own assets?

Anthony Moro:

So two questions there, I'll do the second one first. So, Provenance is open source, completely public. There is one element of permissioning, which is the one you just mentioned. The only way that you can write code to the chain is with a governance vote. We have that. The reason we have that is to prevent attacks, to ensure that the ecosystem remains built for regulated financial services. I think if you tried to put a smart contract that allowed a meme coin, I don't know if it would get past governance. But what that does is it keeps us more solid as a good control location.

I'll also add though, because of the way we're built, just users don't need to put a wide variety of smart contracts on top of Provenance in order to get things done. So let me give you one example. I'm going to go down a rabbit hole a little bit here. So, in the protocol there's something called a hole-in in the exchange module. And what that does is, if you have digital cash and I have an asset, we can transact bilaterally without any intermediaries whatsoever without a smart contract, without third parties. In the EVM chain, what you need to do is you need to put your bid in a smart contract that you don't own. I put my ask in a smart contract that I don't own, then we execute it and yet another smart contract and then you unwind it the way. So, it's not dissimilar to the way that Merrill Lynch or Charles Schwab, and I sell you a hundred shares of Amazon, it goes introducing broker dealer, to custodian, to exchange and then back down to get paid, now one day later instead of two days later.

An EVM chain is a little bit like that. Provenance is not because in your wallet, we have an in-place escrow. So, your bid or your ask is escrowed in place. When the conditions are met, we execute. And that's great because if you get a dividend or a distribution, then the funds are in your wallet, you get that dividend or the distribution, not the smart contract that you're putting the bid in the escrow. So, it's things like this that really not a lot of people think about in financial services blockchain, or really care about. But they should. And I can tell you that the risk committees in the bank care about that.

Lex Sokolin:

Let's zero in on the governance because governance is such an interesting direction and it really, recently at least, was made interesting or revolutionary or sexy or disruptive again through DAOs. Right? So, the history of this in Web3 is that you can think of this trend as forums on the internet over time going from IRC chat rooms to early two thousands, just forums to now discord channels organized by tokens, now connected to pools of money. And people are finding ways to collaborate and invest that money or create budgets or manage a treasury, some of them coming into billions of assets and really being overwhelmed.

And so, governance has come out as a way to align interests of really the disparate people, sometimes people from all over the world with different values and so on. And it's almost become its own field after whatever it is, decades and decades of governance, being something, you outsourced to the shareholder groups that vote on your behalf for ETFs. Right? Where BlackRock doesn't want to do governance on their own, so it's just a paid service to a company that has it as a niche business. Now governance is really important. Anyway, all that prelude to say, tell me about what kind of governance structure Provenance has and what are the principles according to which it's organized.

Anthony Moro:

Great question. So yeah, in TradFi we have risk metrics and Glass Lewis who are the proxy advisors and they have outside influence. And I can tell you I've crawled around in them quite a bit during my TradFi days. And there there's teams of analysts and they have guidelines and it's a pretty institutionally-oriented process. And as you mentioned, BlackRock, and every other asset manager, does not want the risk of opining on a situation, whether it's executive pay or a merger and acquisition, because it's risk mitigation for them. If a shareholder doesn't like what their decision is, they get sued. It's much easier to outsource that decision to a Glass Lewis or Risk Metrics.

And I think we'll see the same thing develop over time in financial services blockchain. We're far, far from there right now. But what we do at Provenance is we've got about 12% of the tokens are bonded and those are the ones who can vote on measures. That being said, again, there's not a lot of voting that needs to be done because it's really only when you're... There's governance around the foundation of course, and then there's governance around smart contracts that go onto the chain. So, there've only been a dozen or so smart contracts that are on chain. So again, because everything's built in the protocol, you don't really need the smart contracts.

So, I think everything that's gone through, that's been proposed, has been approved. And then just very standard stuff around the foundation management of the foundation's treasury, the percentage that the foundation takes of each transaction to continue to manage the foundation, things like that get voted on and Figure obviously has the largest position of HASH, but they do not vote. So, it really is more of the community minded voters.

That being said, it's still a pretty concentrated group because we're not traded on a centralized exchange right now. So, it's Apollo and Morgan Creek, I believe are the second and third-largest HASH holders, and after that there's a whole host of proper institutional layer VCs. But we have been talking a little bit more publicly about the fact that we probably by the end of the year, will for the first time ever be listing HASH on centralized exchanges, so that gets really exciting really quickly. And we'll distribute further and I think we'll see the stake materially higher than it is, so voting will be more widespread than it is now, I hope.

Lex Sokolin:

What do you look for in a centralized exchange as a counterparty when you're bringing a network that is so institutional? If Apollo and Franklin are running nodes and have this exposure, it's hard for me to imagine Binance and Bybit doing an offering. What are you navigating even in getting there? I don't want to just ask a regulation question, but what are the main hurdles that you're thinking when you're trying to get to a new venue?

Anthony Moro:

Yeah, so great question and stuff we've been discussing internally for the last couple of years. So, we've never done an ICO, so we don't have a giant liquid treasury that we can go out and do the things that many of the other foundations are doing. So, we've run leaner, we've run more institutional over the last couple of years and that's fine, that's the way we wanted it. But Figure Markets has just very recently spun up its business and Figure Markets will be a retail-oriented, decentralized exchange. They're doing some incredibly innovative things. They won one of the Solana auctions from the FTX estate, they actually trade FTX claims. They've got a market for Bitcoin, ETH and HASH spinning up and turning... It's on now, but they haven't really publicly announced it, but there is some trading now. Jump and others will make active markets. They use MPC wallets very creatively in a way to disintermediate the custodians, again on the thesis that you and I can trade bilaterally without intermediaries. And for the tokens, the crypto tokens, that's great, but once you get into securities, as long as we're both clients of the Figure broker-dealer or the Figure ATS, we can still trade bilaterally.

There's a yielding stablecoin coming into the mix. Don't know if you've seen it, but it's been filed with the SEC publicly for a couple of months now called YLDS or Yields. Again, if it gets through the SEC, it'll be the first ever yielding stablecoin. So, imagine a USDC with a SEC blessing and a 5% yield, really boggles the mind what you could do with that. We'll park that for another day. But my point here is we are getting more retail every day, and on Figure Markets you'll use HASH to pay fees.

So we need to get more retail. We have the first retail use cases spun up and live and we need now to be more the other side of the coin. We actually built a real business and now we're going to go to the centralized exchanges. I think many of the other coins, for sure, hyped themselves and listed on a market and then tried to build a real business. So, I think it's much easier doing it the way that we're doing it than doing it the other way. So, we're pretty excited about the next few months. And yeah, it'll be the big exchanges, Coinbases and the Binances and the OKXs of the world that I think we'll see. Gemini will see us listed on. As well as some of the DEXs, they'll put up some pools, USDC to HASH.

Lex Sokolin:

Super interesting. I'm very excited to see that.

Anthony Moro:

It's been a long time coming. I've only been here for about two years, but Mike and the team have been building this for a very long time, so they're pretty excited too.

Lex Sokolin:

Can you describe the Yield stablecoin and how that's designed?

Anthony Moro:

There's a public S-1, which I would encourage everyone to read. The name of the company is called Figure Certificate Corp. And the thing that makes it work is for all the 1940 Act nerds in the audience, there's four different security types in the '40 Act, open-end fund, closed-end fund, something else, and then a face amount certificate is the fourth one, which is never used. I forget what the third one is. The face amount certificate from what I understand is the only type of security that the SEC will publicly register that allows trading peer-to-peer without the use of a broker-dealer. So that's very important because any other instance of this, you would need to create and redeem through a broker-dealer. Here I can trade a dollar to you, you can trade a dollar to me. From the second that it's held in your wallet, you accrue interest, which is I think accrued daily. Again, game-changing, right?

So now extrapolate that out a little bit. If now Starbucks is a client of the Figure broker-dealer, you can go to Starbucks and buy a coffee. If your PayPal Web2 experience is now, instead of backed by whatever PayPal backs their dollars with, it's now backed by YLDS. Now you have PayPal-type Web2 experience, but you have a five percent-yielding dollar in your wallet. You start to extrapolate out, why do I need a checking account? Why do I need a savings account? Why do I need a treasury account? Why do I need credit cards? It gets pretty crazy pretty quickly. If I live in Uganda, why do I need a local bank account? I can have a five percent-yielding dollar account.

We're on the verge of something extraordinarily cool in blockchain and only blockchain can do this because the owner of the account sits in a ledger on Provenance Blockchain. We know who that person is because, again, it's an SEC-registered security, and we have to know who that is because we have to send them a 1099-Div, we have to tax their interest. And these are things that USDT and C don't have to worry about obviously because they don't pay interest. But wow. Right? Think about the implications of all this. It's extraordinarily cool.

Lex Sokolin:

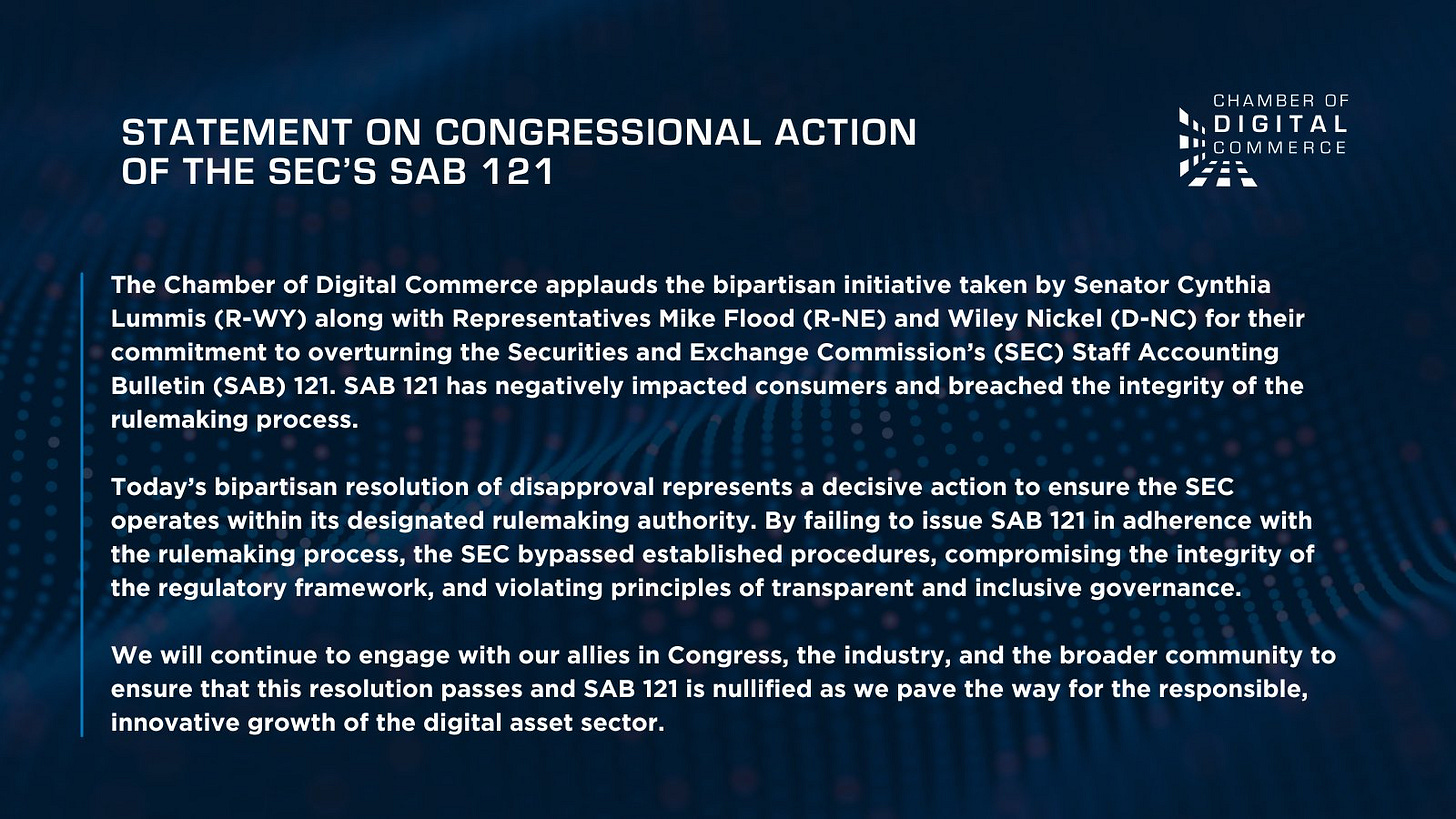

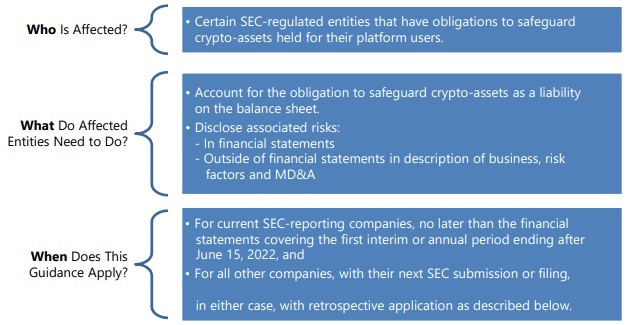

Let me ask you a question about the regulatory temperature. And the context for this is that the US elections are coming up and there's been a really surprising amount of crypto-related and more generally even Fintech-related regulatory activity, right? We've got on the FinTech side, the collapse of Synapse and banking as a service and a whole bunch of actions I believe from the FDIC. On the stablecoin side, we've got statements from the SEC where the Congress, both in the House of Representatives and the Senate had voted to overturn or to prevent the SEC from a particular treatment of crypto as an asset on bank balance sheets. And then this was vetoed by the President. You've got the SEC losing ground in the courts and indications that we're likely to have an Ethereum ETF.

So, you've had this, I feel like enormous amount of activity, in part because the politicians are polishing up their positions for the election and people are realizing... I saw recently a stat that said, "More people in the US own crypto than have dogs." They're realizing that that's a constituency. You're in a highly regulated business and you have lots of entities that I'm sure have strong controls. What can you share about your experience with the regulators, and especially which direction are things changing towards, which way is the wind blowing?

Anthony Moro:

Yeah, so there has been a sea change recently, despite SAB 121, which is the custody rule you mentioned, is silly from the beginning, never made any sense. The fact that President Biden would veto it makes no sense whatsoever. But it's great that Congress got together and in a bipartisan manner agreed that it should be overturned. If Bank of New York and State Street could lean in and custody crypto, it would more legitimatize the business than even it has grown over the last couple of months, years. So, I don't understand that one.

Fit 21 was a great start. It's not going to pass because there isn't a corresponding bill in the Senate. But again, bipartisan, directionally great, moving in the right direction. I think particularly the Democrats have realized that there's no money on the other side of this. Cryptos got some money, they can lobby, but no one's lobbying really for anti-crypto, whatever anti crypto is. It's progress, its technology, and it absolutely has been tainted by the malfeasance that's gone on in the industry. The industry never loses an opportunity to shoot itself in the foot. The celebrity meme coins and all the other garbage that's going on regularly is a detriment to what we're all trying to build. It's part of the exuberance, I'm sure it was there at the beginning of the internet and any really new technology that exists. So, you got to just deal with that, get past that, keep building.

But the environment has certainly changed. The ETH ETF was shocking to me. I didn't think that that would get approved. And again, the S-1s haven't gotten approved yet, but so we'll see. But it looks super good to happen. Bitcoin's a very different construct than Ethereum. Ethereum is a business, it's a positive unit, economics and all that that we talked about. Whereas Bitcoin is just a store of value. Bitcoin truly is, I believe a commodity, and Ethereum, it's debatable. You can take either side of that argument. But it's great that the SEC is moving in that direction. We're more excited about the regulatory environment, particularly over the last two months, than ever.

Lex Sokolin:

It's one of these profound disappointments for me I think, how the US has been shooting itself in the foot, because crypto is largely dollar denominated. And in terms of geopolitics, the position of the dollar given the Russian conflict, given the conflict with China and as well as all the energy issues in the Middle East, you would want to do anything that can help grow a technology paradigm that is dollar denominated. And there's just been this, in my view, completely irrational pushback, especially with Elizabeth Warren who in the early days was affiliated with consumer protection and then you had the Occupy Wall Street movement, and there's nothing more Occupy Wall Street in my mind than Bitcoin. And somehow things have gotten completely topsy-turvy, but it does feel like there's a reset now.

If we think about the future, and you list your token and you've got retail investors and retail users who are interacting with Provenance in a way that they haven't been able to so far. You've got I think something like over 10 billion in real-world assets and tokenized assets that are anchored on chain. And we've talked about HELOCS, I'm sure there's other things going on as well. Can you describe the vision of the ecosystem with that full openness and inclusion of the retail investor and paint for us a picture of the long-term future for Provenance?

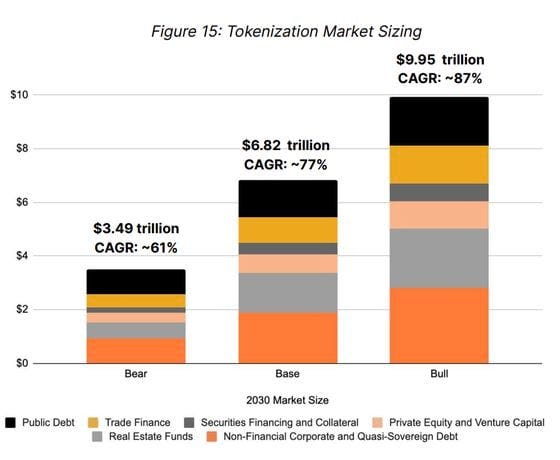

Anthony Moro:

Yeah, good question. So, I think we can certainly agree on two things; that the global financial markets are going to tokenize several trillions of dollars of assets over the next decade, and asset issuers and servicing firms are going to need a lot of help managing that transition. So, the questions then are where and how? The only open question. So, for where, I think you look to the TradFi networks as we discussed and from custody banks to credit cards, we see a global oligopoly of risk providers evolve due to security and interoperability and regulatory pressures, and I think we'll see the same dynamics in DeFi.

And I think a very small number of public blockchains will be used to register and ledger and exchange the world's financial assets. And within this construct, we think Provenance blockchain is perfectly positioned and we think it's going to be one of a very small number of global Layer 1s that are built for financial services that ledger the world's assets. I just don't see other existing networks, there could be networks that pop up in the future, that are appropriate for financial services. I'm not to say that there aren't great networks at doing things that we don't do, but they can specialize in other things, right? And there's going to be a lot of use cases on blockchain, from supply chains to trading markets, to meme coins, to metaverse, to gaming. I think each blockchain will be purpose-built for efficiency for its use case and ours is financial services.

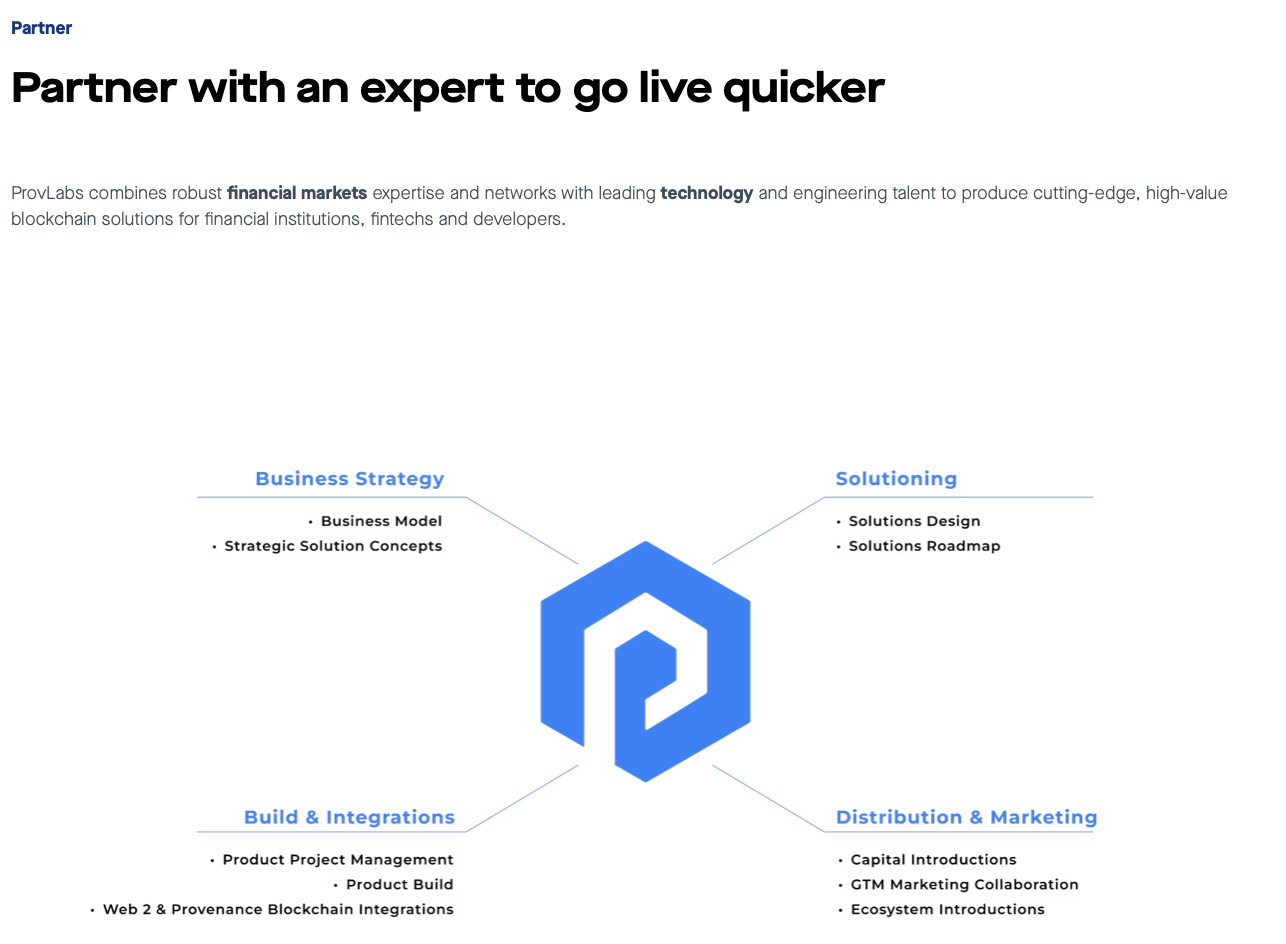

And then the second is how do you get these institutions over the chain? And everyone's dabbling in it, as we talked about with Apollo and Franklin Templeton and some of the others. We've recently just spun up an affiliated firm called Provenance Blockchain Labs. We're very late to the game, I know almost every other foundation has a labs entity. Usually, the labs was a team of engineers that went out, built a protocol, and then did a big ICO and then said, "Oh my goodness, we need to not be a security. Let's spin up a foundation in Switzerland and give them some of the assets and we can pretend that we never did this."

That's not what we did. We didn't do it that way. We did it the way we talked about and now we're spinning up our Prov Labs entity, which is building a suite of foundational infrastructure, SaaS products, that enable asset issuers and services to efficiently transact on Provenance. Meaning you have the core layer protocol, you have the infrastructural SaaS layer on top of it, and then you can go and build your business on top of that, depending on the asset class. And the revolution, I think comes asset class by asset class. It certainly does not come all at once, and each asset class has its own conditions and issues and things that they need to integrate.

So that's our vision. We think we win the space or we're a winner in the space. There are literally trillions of dollars of financial services revenue, like the $80 million in Bank of New York revenue that I talked about with Gazprom, to be disintermediated. Again, doing societal good because lowering costs being disinflationary. But in the process of destroying market cap, destroying fees, I think there are some winners. I think Provenance blockchain will certainly be one of those because it'll continue to accrue fees to the network in a much smaller ratio than they currently are being taken by TradFi. But still, nevertheless, fees do need to be involved because the technology needs to continue to run and be developed, and validators need to get paid because they're doing work of course. But new businesses are going to be rebuilt and there's going to be very clear winners and very clear losers unfortunately in the process. So those of them who get on board now, as we're seeing over and over again, will have a clear path to being the winners.

Lex Sokolin:

It's a compelling and also precarious time. We'll see how it goes over the next couple of years. I'm super excited. Thank you for coming on and sharing the story. If our listeners want to learn more about you or about Provenance, where should they go?

Anthony Moro:

The website's a great place, provenance.io. The Prov Labs is Provlabs.io. Discord, there's Twitter, there's Telegram, there's all the usual suspects. Just reach out and we'll be there.

Lex Sokolin:

Perfect. Thanks so much for joining me today.

Anthony Moro:

Thanks for your time, Lex. It's been great.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.