Hi Fintech Architects,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Danielle Sesko - Director of Product Management at TruStage. TruStage provides insurance coverage for loans in the digital lending space.

Danielle has been with TruStage for over 10 years and has held a variety of roles ranging from financial leadership to transformation and product development. Prior to joining TruStage Danielle spent her career in financial services and Mergers and Acquisitions. Danielle currently leads TruStage’s Digital Lending Insurance initiative which is focused on creating new digitally native products for new markets.

Topics: InsurTech, Insurance, Digital Lending, Lending, embedded finance, embedded insurance, API, fintech

Tags: TruStage, Payment Guard, Lending Club, FDIC

👑See related coverage👑

Fintech: Mexico leads as Fintech Hub, with Nubank expansion and Clip's $100MM

[PREMIUM]: Long Take: Why $ billions are flowing out of Banks into Money Market Funds, and how startups can benefit

[PREMIUM]: Long Take: Can we be optimistic about 2Q2023 Equities, Crypto and Venture markets?

Timestamp

1’27: From Financial Consulting to Insurance Innovation: Danielle Sesko’s Journey in Financial Services

4’58: The Role and Necessity of Insurance: Insights on Financial Resiliency and Industry Structure

9’52: Innovation in Insurance: Creating Relevant Products and Navigating Regulations

13’39: Navigating US Insurance Regulations: Engaging State Regulators and Structuring Underwriting for New Products

17’59: Adapting to FinTech: How Established Underwriters Leverage Experience for Digital Lending Innovation

20’48: Assessing the Rise of Digital Lending: Timing, Consumer Preferences, and Regulatory Challenges in FinTech and InsurTech

27’39: Bridging the Gap in Digital Lending: Ideal Customers for PaymentGuard and Their Unique Needs

31’21: Defining Digital Lending Coverage: Target Workflows and Payment Flows for Embedded Insurance Solutions

34’36: Understanding PaymentGuard's Economics: Coverage Duration, Cost Structure, and Value for Digital Lenders

37’42: Integrating InsurTech and Digital Lending: The Technology and Processes Behind Embedding Insurance Solutions

40’11: The channels used to connect with Danielle & learn more about TruStage

Illustrated Transcript

Lex Sokolin:

Hi, everybody. Welcome to today's conversation. I'm super excited to have with us Danielle Sesko, who is the director of product management and Innovation at TruStage. We're going to have a fascinating conversation about insurance and innovation in the sector. As well as tracing the impact of Fintech through the industry and understanding how insurance can be embedded across the different products. With that, Danielle, welcome to the show.

Danielle Sesko:

Thank you, Lex. I'm excited to be here.

Lex Sokolin:

My pleasure. Let's start with the broader landscape of your career and the sector that you operate in. Can you tell us about how did you get started in insurance and what were some of your foundational experiences?

Danielle Sesko:

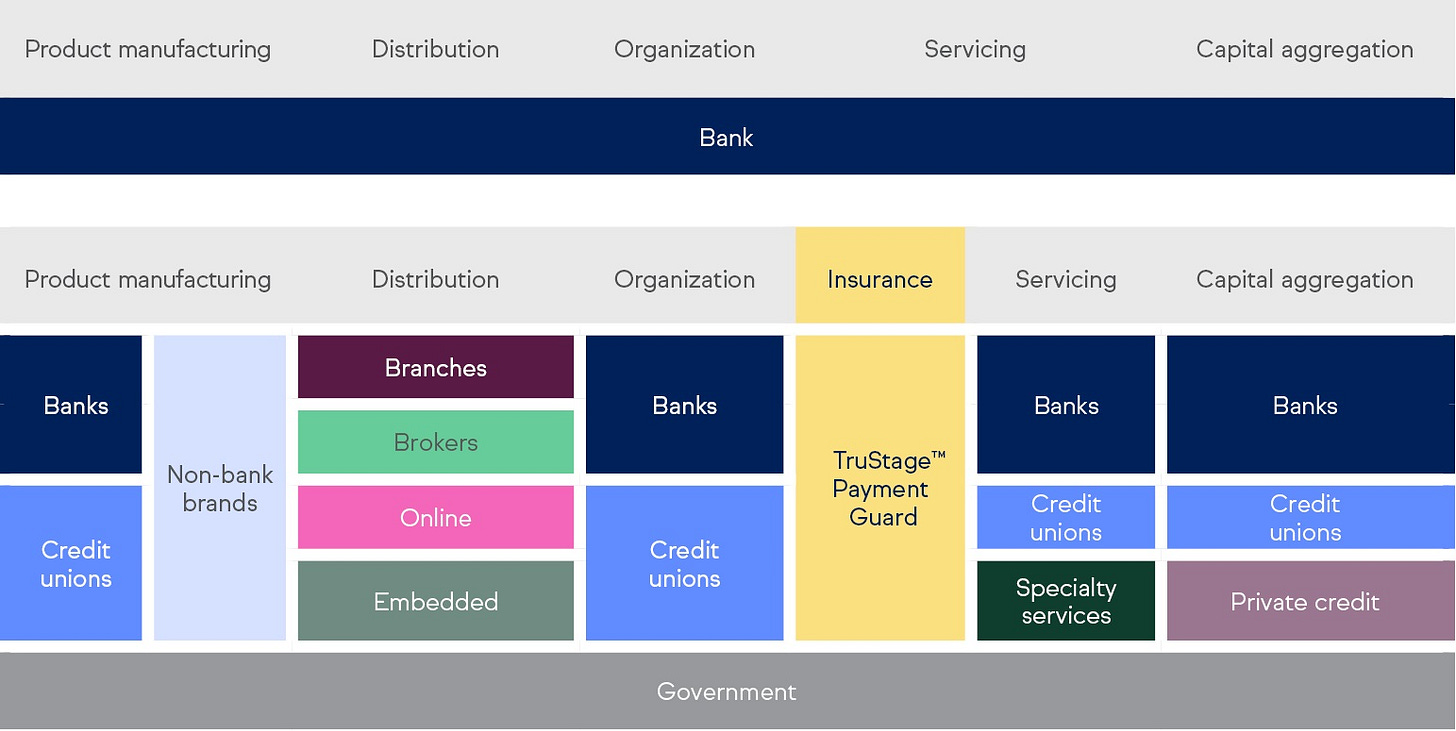

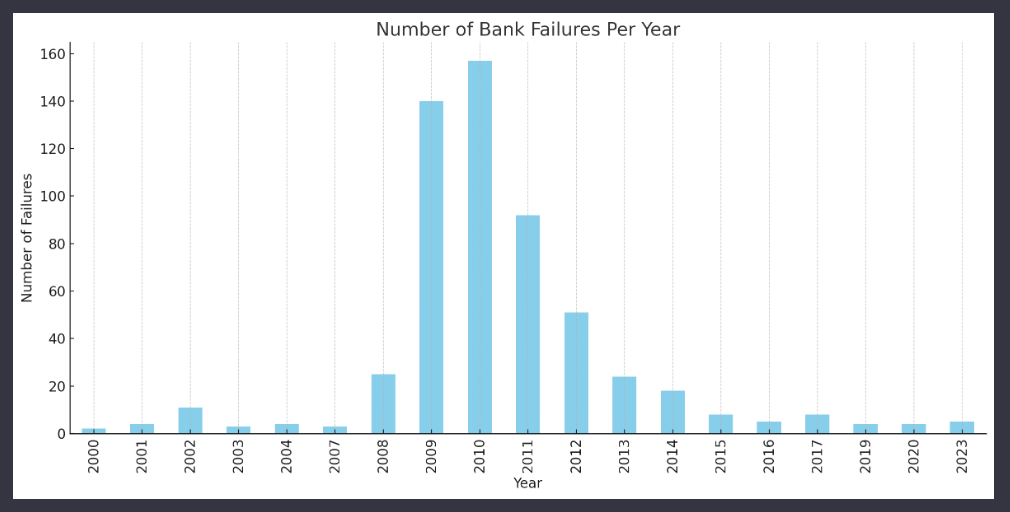

When I think about my career, I think in regard to insurance, I actually think back a little bit earlier before insurance and back to probably where I started my career in financial services in general and that is back in 2008, 2009. During one of the last largest financial crises of the US. One of the more salient pieces of that financial crisis back in 2008 and 2009 was bank failures and FDIC assisted acquisitions.

At that time, I was working in financial consulting, my job turned into actually navigating through those bank failures and FDIC assisted acquisitions. My clients were the banks that were purchasing and acquiring the failed institutions. At that time, really saw my role as ensuring that individuals who had deposits at those companies still had access their money after everything was done.

Where our whole goal was to ensure that alongside FDIC, that people had access to their funds and there was no disruption. Unfortunately, almost two decades later, some of the post-mortem analysis that's been done, it shows that the local communities are still impacted to some degree with higher degrees of unemployment, lower socioeconomic footprints in some regions.

The reason why that was so probably impactful, the footprint of or stamp of my career was I started understanding the value of having some type of financial backstop in our broader financial ecosystem. We think government provided, FDIC provide insurance at that point for deposits, but insurance as itself as an industry is a financial backstop for much of our economy and private insurances.

I started realizing the value that insurance itself has on the economy, on local communities. That took me into a career into insurance where I've now built about seven different financial service product categories over my career and four brand new insurance products. I focus much of my career on innovating on insurance itself to help ensure that it's relevant.

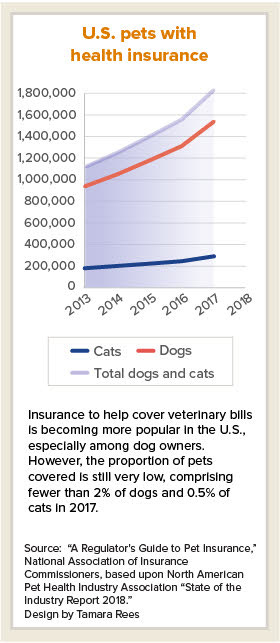

It's protecting risks that consumers are concerned about and that it's affordable and easy to access. That's taken me through a couple of different journeys and paths in my career with cash flow insurance for individuals, cash flow insurance for businesses, pet insurance. Now, most recently where I'm with TruStage focusing on the intersection between insurance, fintech, embedded finance.

Lex Sokolin:

We are in a pretty interesting moment in the fintech industry, one of the largest banking-as-a-service providers that gone to bankruptcy. We're seeing a whole bunch of consumer footprints now going through something similar to what you described in 2008 where people don't have access to their deposits and it's this shocking surprise.

You constantly have a rhyme of these events. At the highest level, if you really zoom out and think about insurance and its purpose, can you motivate for us why this industry exists? Shouldn't it just be buyer beware? If you put money into a bank that's going to likely be small and collapse. Isn't that your fault?

If you're not making payments on a cash flow product, isn't that really in your control? How do you motivate the existence of the industry? How do you think about it?

Danielle Sesko:

Yeah, the industry itself isn't new. I mean back in the US; it's been around since the 1700s and it's dated back many hundreds of years prior to that. What it is at its core where insurance is at its core is it builds financial resiliency. It builds resiliency for the local economy, for businesses, for consumers.

I think sometimes it gets mislabelled as a protection product as it should protect a against inside consumer who chooses to bank with a small bank or chooses to use a platform where there's some financial risk involved. It doesn't protect against those risks from happening, but what it does is it allows for the rational decision making to occur.

It allows for that consumer to possibly bank with a smaller institution or a newer institution if there's proper insurance and safeguards in place. If something were to happen, these unforeseen events happen, the institution that consumer have some type of financial safeguard in place. A lot of our purchases and our economic growth cannot exist, I would argue with all insurance.

Most of us could not take it down to a personal level. Most of us could not sustain a total loss of our houses so we need homeowners’ insurance. It's similar as we think about that to the, I think the corollary applies, we think about that to the financial services industry. Most of us could not live our financial lives and continue to choose to hold their deposits with institutions or make purchases or take on other business without the existence of insurance as a category.

Lex Sokolin:

You have these tail risks that are unpredictable, but then you also have the ability to price those risks and spread them out and support people and companies in doing things that otherwise they wouldn't be able to do or that could be too destructive.

In broad strokes, what kind of entity do you need on the other side to be able to take exposure to some of these catastrophic or highly unlikely events? Is there a repeating shape of an insurance company that you've seen across your different experiences or is it bespoke every time?

Danielle Sesko:

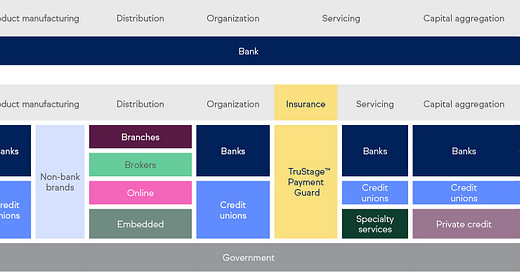

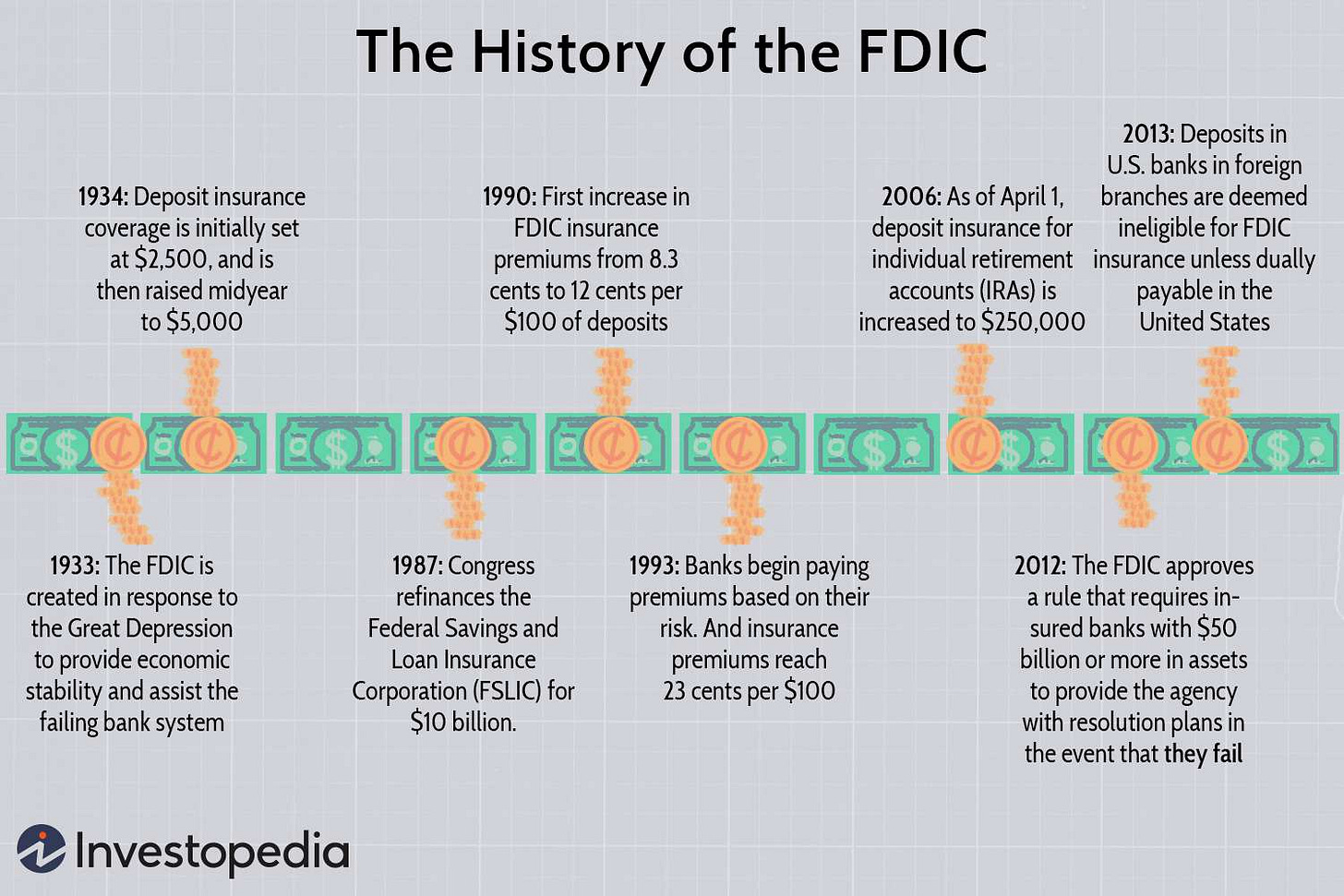

I think there's different flavors and certainly different structures to be successful in the insurance market, but what it does require though is probably a consistent set of ingredients or building blocks. At simplest point, you need an MGA or a producer to bring that policy to market to meet the business who's buying it or the consumer who maybe buying it.

There needs to be a large carrier, and that's the underwriter of the product. Order for losses to be, for insurance to be covered in broad sections or broad pools, which is the ideal scenario for insurance coverage where we protect large pools of diverse risk, it needs to be a large enough entity. Those entities, those carriers, underwriters are in the US are regulated on state-by-state level.

Then depending on sometimes the exposure of those risk or the size of the carrier of the entity, there may also be a reinsurer to take out from the tail ends of that risk as well. Sometimes we see that in, those are the ingredients for insurance companies to be successful. Sometimes looks could be three different entities.

Sometimes that can be a full stack insurer who's possibly working with a reinsurance entity, but the ingredients are still the same. Where ultimately, there needs to be a relatively large carrier that's assessing an underwriting risk and has that first position of loss.

Lex Sokolin:

How large is large?

Danielle Sesko:

It really depends on the type of coverage. Right now, I'm working with a company called TruStage. TruStage is not a consumer brand that we're B2B2C company, but we have over 32 billion in assets under management. While we're a company you've never heard of, we're 32 billion in assets under management.

We protect 37 million consumers throughout the US. I would probably put us not in the category of large, but in the category of a large regional insurer. Billions of dollars of surplus and capital is what's needed to be a carrier in the insurance world depending on the type of risk.

Lex Sokolin:

You've mentioned that you've built a number of insurance products across your career, and I'm interested in the idea of what innovation means for this industry. Across FinTech for example, a lot of innovation has been around using technology to distribute financial products or using software machines, artificial intelligence to manufacture financial products in a new way.

Can you talk about what innovation has meant for you in your career and maybe specifically in creating new products? What's involved?

Danielle Sesko:

I think there's a lot of different definitions innovation, while we see innovation play out in the insurance industry or InsurTech. I think all those definitions are right, but writing context where I've spent most of my career has not been on rebranding companies or finding new ways to market to consumers where that's innovative and somewhat for the insurance industry.

Historically, insurance has been sold and not bought through an agency bottle where there is a licensed agent who meets over the phone or in-person and an office and sells insurance product to someone. As the industry is starting to evolve more towards digital experiences, we are and I would say rightfully so, we're calling innovation sometimes digitizing those products.

It absolutely is, it's a form of incremental innovation. Where I focus or chose to focus, most of my career has been innovating on the product itself. The insurance solution itself, not the marketing of the solution or the intended digital experience, though to me that has to be table stakes for today's world.

When I talk about innovating on the insurance product itself, that means creating brand new products for needs that consumers have today. I think that's an important aspect of the industry and a gap to fill in the industry because consumers' lives have changed, but yet we're working a lot with the same products in the industry that have been around for nearly a hundred years.

The way consumers lived their lives, it doesn't look like how we lived our lives back in the 1900s. We now have access to the internet. We're making decisions more quickly through smartphones, through other digital experiences. That's causing what I would describe more as a precarious nature in consumers' cash flow where there can be expected disruptions due to loss of income, loss of expenses.

There's sometimes a mismatch between cash flow coming in or cash flow coming out. When I think about what's needed in today's insurance world or industry to be relevant for consumers a lot, it relates to critical period cash flow protection. Protecting or providing notification for loss of expenses or due to loss of income.

To create new insurance products, I think probably the secret ingredient of that recipe is to work with, the regulators don't work against regulation. The insurance world and the regulations they weren't ran with innovation in mind, but there's certainly ways to create something new within existing regulations or to create new markets.

Pet insurance I think is a great example of a relatively new product in the US. It's I think the first product was issued back in 1981 and is to a dog named Lassie a star back in the 1980s because of the show Lassie. It took still 30 years for the US to create a model law across all by the NCAA for that category of insurance.

The product existed well before that it was issued policies existed, but regulation eventually changed over time. It existed within a period within a framework that allowed for it to exist. That's where I think the challenge and uniqueness comes with insurance innovation is truly understanding the regulations and how we fit innovation within regulations in the course, always working with the state-by-state regulators.

Lex Sokolin:

Before we dive into the details of Lassie's coverage, which I'm sure was spectacular, can you talk about the regulatory structure and who the relevant players are? If we map that out, how does one engage with these regulators to do what you describe

Danielle Sesko:

In the US? Insurance is regulated on a state-by-state basis. The department of insurance is the regulatory agency in the US and each and every state and in every state has its own set of regulations that they've adopted depending on the insurance category that's being examined or referred to. I mean, the way to work with regulators is simply of state-by-state basis.

That's absolutely what's needed in the US given the current structure. It's a matter of contacting always in all cases, contacting the state, which turns into 50 state conversations or 50 state due diligence exams. That's simply the way to go about it is to work with literally every single regulator.

Which can be time-consuming for bringing a new product to market. If we're looking for having entire country coverage, it needs to be done on a 50-state basis.

Lex Sokolin:

That's quite a bar to clear and I can imagine has made InsurTech a pretty difficult category in which to start building products. I guess, you also have the other challenge of if you're building a new product, how do you assemble the math to do the underwriting?

Maybe if we switch for the moment to TruStage and the product that you're launching there, how was that initial architecture for the underwriting put together before you were out of market?

Danielle Sesko:

When we think about pricing adequacy or pricing for the risk of recovering or insuring, it's really two factors mainly that come into play in the insurance world. We'll get a little technical here for a second and that is frequency and severity. Frequency means the frequency of expected losses over the protected population.

Severity means the amount of payout for those losses that's essentially what insurance pricing comes down to at a very basic level. That's defined by the product itself. What we did at TruStage, we offer a variety of different insurance products, life insurance, home and auto through one of our partners.

What we have been providing probably for one of the longest periods of time of all of our products has been lending related insurance solutions. We have been providing debt protection, credit insurance for many decades now at this point where we are covering and protecting consumers' loss of income, disability or life.

We're making payments on their loan or paying off that loan in case of those events. We have a wealth of understanding and experience on how frequently those events occur for consumers and what's the severity of those occurrences as well. We use that decades of experiences since I think probably about the 1960s, 1970s was the first variation of one of those products.

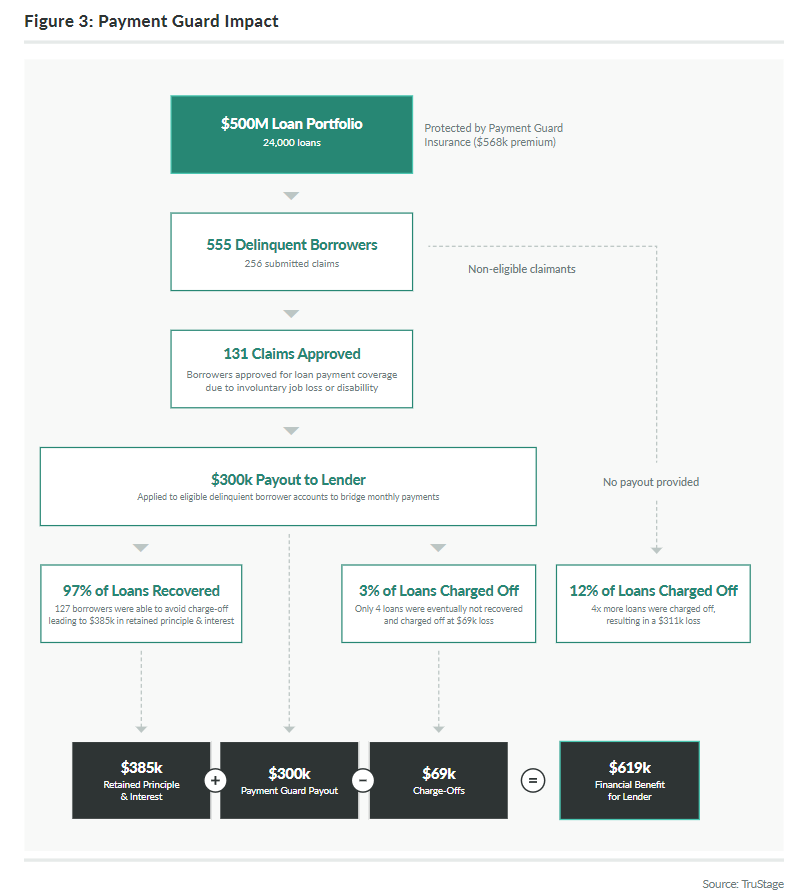

We have 30 or 40 years of experience just with that one product section, which is a relatively unique product section. We're actually the largest underwriter in the US for that product category. We took those decades and wealth of experience, and we leveraged it into our newest creation, which is PaymentGuard, which protects fintechs and digital lenders in the case of our experience, loss of income.

That's truly a win-win that we've structured with that product where we're helping the borrower if they were to unexpectedly lose their job or become disabled. We're helping the fintech lender, which is a relatively new category of lenders in our country ensure they're not financially exposed.

We're providing some resilience for that lender in case of the borrower possibly missing their loan payments. We're making those loan payments so that we're protecting those loans from going to default. As a result, we're helping to build more resilient financial portfolios for those companies. We're helping to protect consumers as well in their financial wealth.

Lex Sokolin:

If I understand correctly, because as an established underwriter you have the track record of providing insurance products to lenders on a B2B basis, you have something that can be used as the bootstrapping data set to go and replicate that model in digital lending on the FinTech side?

Danielle Sesko:

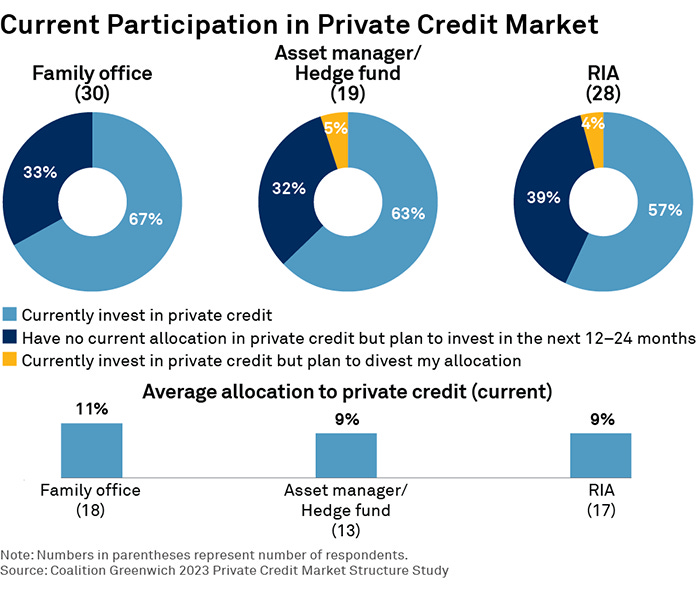

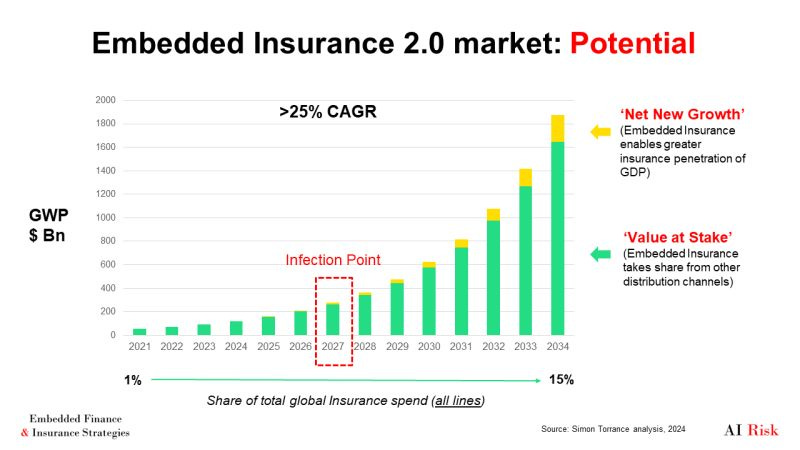

Yeah, absolutely. This goes back to my comment of we need to continue to evolve and keep insurance relevant to how consumers are experiencing or how financial institutions are navigating today's economic landscape. FinTech lenders, digital lenders are relatively newer entrants to the market.

I don't think the word FinTech was coined until 2018, but there's really three forces that are allowing those digital lenders to occur. The first being asset intermediation we're seeing probably is actually around 60% of private wealth owned now by non-financial institutions, and that's up from 48% in 2008. We're seeing more asset intermediation, whether it's through private credit lending, securitization.

Other trend we're seeing is the potentization of technology. We're not seeing outside of AI, we're not seeing a lot of, we haven't for some time innovation in terms of technology itself. Instead of what we're seeing is standardization where APIs are becoming a standard power of the digital tech stack and that consumer preferences, where consumers prefer to take out a loan digitally now versus going into the branch location for a small consumer loan or an auto loan.

It's just inconvenient to physically go to a branch. Over the years, we've seen consumers vote with their mobile devices and their keyboards that they want to experience and take out a loan online, they want to shop online. It's those three themes, asset intermediation, capitalization, technology and consumer preferences that is changing the lending landscape right now.

That's whereas insurance providers where we've been providing TrueSage has been providing insurance solution for face-to-face lending. We've needed to change and evolve to ensure that we're still meeting the needs of today's consumers and today's lenders.

Lex Sokolin:

You're essentially following the form factor of your customer, which is the lender to where they do business, which has at least for some shifted to the web. I'm curious as to your point about timing and how big did fintech need to get for this category to emerge? If you think back, Mint.com was 2007, right?

As the first consumer experience of money online using Web2 technologies, but it's taken quite a bit of time to grow and to become mainstream and to become the default where it's hard to imagine often having to go to a bank of branch for anything. How big did the digital lending category have to get to really motivate the business case?

When is it a big enough signal that industry has changed platforms that it was interesting for the business to follow?

Danielle Sesko:

I think there are two data points I can think of specifically, and that is you referenced the business changing, but I would point to the consumer changing as well. We're seeing roughly about two thirds of all loans start online. Consumers are searching first online to get the loan versus going to their branch. They're preferring to close that loan online as well though that's where it's in industry is lagging a little bit and ubiquitously providing and tend to dual lending.

That's starting to change as well. We're starting to see growth rates in intend lending. The other thing we're seeing in the industry is the growth of digital lending technology platform. As I mentioned, technology is componentizing in this industry and we're seeing roughly about a 25% compound average growth rate in the size of digital lending technology platform.

When you think about the aspect of technology on the trajectory of enabling digital lending to occur and that trend to continue, and then you combine that with consumer preferences. It's those two things that we point to for the business case to say, "Yes, we need to be in this space to provide insurance through an end-to-end digital experience. Not that we're not providing it through an omnichannel experience.

We'll still provide it through face-to-face transactions as well or phone transactions, but we need to also be digital." The reason we need to be digital is because like I said, the formalisation of tech is starting that trend, but foundationally consumers want to go online to take out a loan.

Especially if it is a relatively small dollar cash advance, a personal loan, or they want to take all loan a dealership through the dealer versus traditionally going to their physical branch location for a bank which has been possibly the more traditional route back in prior to the 1990s.

Lex Sokolin:

The same trends that you're describing for lending on the consumer side have also hit the consumer insurance category, right? About half a decade ago, if not a little bit more, we saw a number of InsurTechs get built on the story of disruption and innovation and so on. You've described two barriers that are quite difficult to overcome.

One being, working with 50 regulators in a separate process across every state on new products seems pretty tough. Then number two is having a sufficient data set that can make your product actually the engine of your product work well enough. Before we go deeper into digital lending, I'm curious to get your view on InsurTech and the vector of that change.

We haven't seen as many InsurTech players scale up as we have, for example in capital markets or in neo banks or in payments. What's going on?

Danielle Sesko:

I think InsurTech can take, like I said, a lot of flavors because the insurance company stack itself can take a couple different variations, what's that needed in terms of core ingredients are the producer that can be InsurTech, a licensed company, but they might not have the scale of data or the regulatory expertise to truly be a carrier.

They need to partner with the carrier and then possibly reinsure as well. I do believe it's difficult to be an early-stage insurance company holding all the risk of their insurance portfolio just given the amount of capital it takes, like I said from previously needs to be there depending on the number of the insured that InsurTech plans to cover or the type of insurance line or category that they're in.

It is not easy, and I don't think we've seen a lot of insurance companies scale quickly. I think there's definitely some exceptions to them. We probably all know their names off the top of our heads, but as you mentioned and as I would add on, and insurance needs to be evaluated in the US on a 50-state basis, especially for new product development.

What that requires and what I've done all throughout my career is work with a strong legal staff, regulatory insurance experts. That takes finding the right skill set early on in the stage of product development. Then the second thing is having the data set to ensure the risk is priced appropriately.

That comes down to ensuring simply that the insurance company has the capital to pay on the claims when those claims occur. Early-stage companies without the capital to pay insurance claims won't be essentially allowed to operate in that state. That's part of the safeguards that exists in the US economy and governance over insurance in general is ensuring that company.

The insurance companies have the capital to pay their claims. I think that's a large part of why we haven't seen a lot of truly full-stack InsurTech carriers scale quickly is because the barriers to entry are so large, but there are other aspects of where in the insurance value chain where InsurTech or technology can add a lot of value.

That would be, I think a lot of the industry right now is looking at improving claim adjudication and timeliness of payments. Assessing claims quicker and faster and that helps both businesses and consumers when they have experienced the covered loss to get their claim payments sooner as soon as possible so that they can get back on their feet.

While we haven't seen a lot of full-stack insurers grow quickly throughout the US, I think there's still opportunity for innovation within the entire value chain of insurance and for InsurTech companies that fill those gaps for the industry.

Lex Sokolin:

Super interesting. I think another challenge that we've seen is that so many venture investors in the private markets don't understand the insurance industry. They end up pricing things as if premiums were the same thing as software-as-a-service revenues. Then once you get to the public markets, you've got a huge disconnect between how the companies are valued.

I think that's created a bit of fear as it relates to early stage investing in this industry. It does seem like you need to have a couple of advantages in place to actually be able to launch a new product. One thing that stood out to me is you were saying the digital lending platforms, the emergence of digital lending platforms.

Can you describe some of the ideal customers for PaymentGuard and what shape they are, whether it's from what kind of products they offer or what kind of software stack they have to have or maturity stage? Who are your best customers and what do you want them to look like?

Danielle Sesko:

We created this product to fill a gap of coverage in the industry because many of the companies that we're working with wouldn't be able to be the type of coverage that we're offering elsewhere in the market. Our ideal customer is a digital intent lender, and that could be someone who, that could be an entity that is licensed as a financial institution or that is licensed as a consumer finance company, or it could be a technology platform as well.

If they identify themselves as a lender, they have that relationship with the consumer. The consumer sees them not maybe from a technical perspective as their lender, but the entity that they go to access and service their loan. That's the type of company we're working with and ideally looking to continue to work with.

One of the things that I think is unique, especially in the digital lending landscape is companies that are really just truly tech platforms. What they're doing is providing a service that some financial institutions aren't providing in-house or choosing not to provide in-house. That service is they're better online marketers. They are able to reach consumers more efficiently and more effectively at scale.

They're able to provide more different type of digital experience or a higher value digital experience for that consumer all the way through the end of servicing their loan. They're not actually exposed the financial loses directly of defaults on debt. They're simply a technology company that the consumer has a relationship with to get their loan.

That's a different type of lender than what we've seen emerge probably about 30 years ago. We're seeing more and more of those types of lenders enter the market and ecosystem now. That lender, because they are lender, the technology platform can't access the insurance market in the way that a financial institution could and wouldn't have access to the same type of products that a true financial institution would.

That's the type of lender that we started building our solutions for because that is still there. Consumer need is still there 60%, and you can quote any stat that's out there, probably all different stats saying the same thing of many consumers in the US are living paycheck to paycheck. They're relatively unprepared for an unexpected loss of income.

When a consumer has experienced unexpected loss of income or they're on this precarious point of being one paycheck away from defaulting on their loan, that impacts the consumer and then that impacts the technology company, the underlying lender. What we're trying to do is ensure that ultimately as value mentioned, value of insurance, we're still providing financial resiliency throughout the entire lending value chain.

Even though the entrants and the players of that chain might've changed a little bit, we're still looking to provide financial resiliency so that when unexpected things do happen to good people, someone loses their job unexpectedly, that loan isn't going into the fall, that consumer knows their loan payments are being made.

The financial institution's balance sheet is still protected. The technology partner is still providing a much-needed value-added service to the consumer who unexpectedly just experienced a loss in income.

Lex Sokolin:

If I just flesh it out a little bit with an example to make it specific, are we talking about somebody going to LendingClub and getting a loan? Are we talking about within the Shopify app you've got Klarna and they're getting a BNPL loan or is it Apple? The tech platform has BNPL in their wallet? Which of these workflows are you targeting?

Danielle Sesko:

Right now, we're in the former, we're looking to expand the latter, but what we're focused on is ensuring that lending insurance is a ubiquitous feature of all loans. Regardless of how the consumer may have accessed the loan that may have gone through an online aggregator to do some price shopping.

We're covering the loans through, for example, through Lending Club for Prosper. We can cover BNPL loans as well. We're covering those specific transactions regardless how the consumer may have come about them.

Lex Sokolin:

What's the money flow? Who's paying who? Is it Lending Club that would be paying you the premium for the underwriting on the loan asset that they have, the loan liability that they've got? Does the consumer know they're buying the insurance so that they're insured? How does that whole thing get integrated together?

Danielle Sesko:

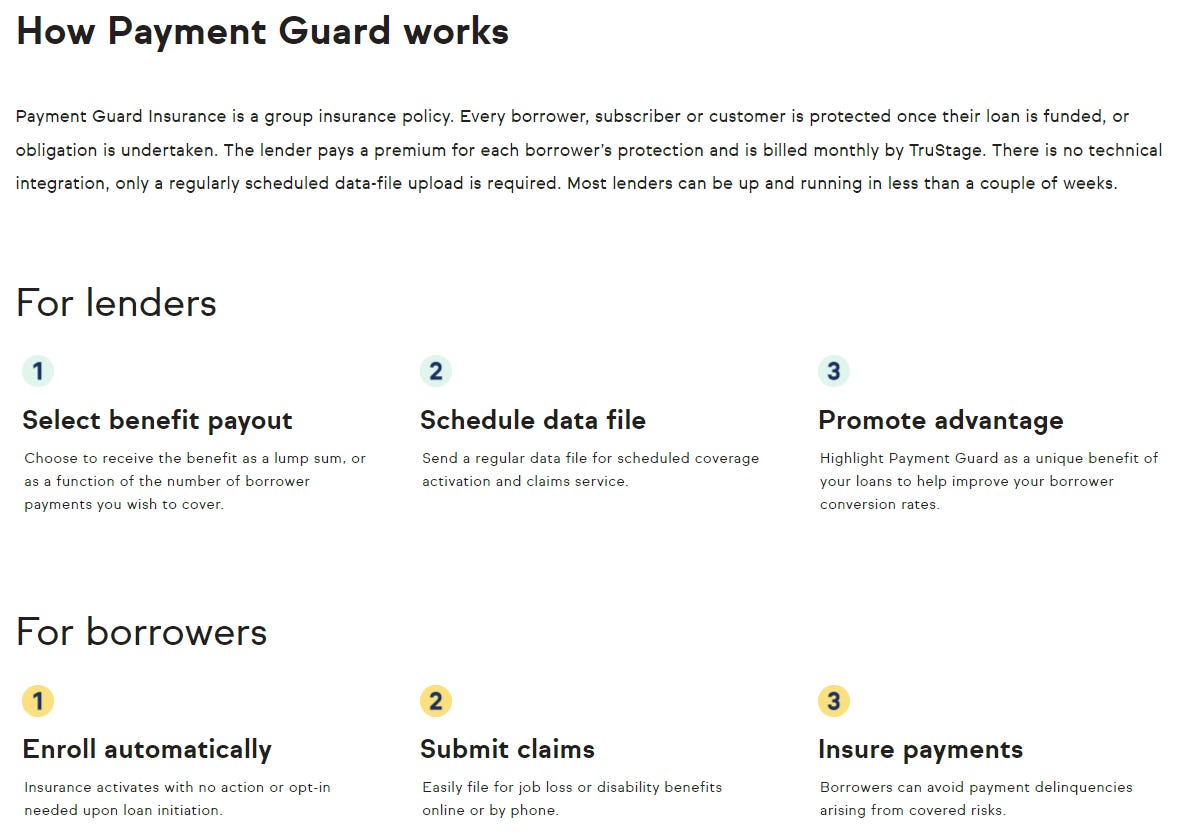

There's a couple different ways to approach the market. With our current product PaymentGuard, it is a B2B commercial solution. With that solution, what we designed was we wanted to be truly an embedded component of every loan in order to build that insurance solution to be embedded component of every loan, not actually at friction with the loan experience that's really important.

It's what we've heard from all the digital lenders with its table stakes. Their real estate, there for consumers needs to not have any disruption throughout it. We've built a product that covers the entire portfolio. All loans originated through that. We'll continue use LendingClub just as an example here.

All loans originated through that company would be covered, but the product would also then be paid for by the commercial entity. It'd be paid for by that digital lender at no cost to the consumer. The consumer would be aware of the protection, they would know that if they were experienced one of those unexpected events such as job loss or disability, they would file a claim.

We do all the claim review adjudication, and we make the claim payment to the digital lender. What that does is it's not a deferment of the consumer's loan, it's an actual pay down principle. We'd be paying down a set amount of principle or a set number of monthly payments so that consumer can get back on their feet.

That lender's portfolio can be protected from delinquency and default. What that does is it's referred to its precarious nature of cash flow previously. What we're trying to do is get ahead of that loan from even going to delinquent and going into a non-accrual status and then going to charge off.

It's the timing of the cash flow payment that's critically important of getting it in front of to the consumer and to the underlying loan before it goes into default.

Lex Sokolin:

Let me ask a bit more about the economics of this product. For what period is the insurance going to make hold the consumer? Is it three months, six months? Is it based on some sort of trigger?

Then in terms of the cost of the service, assuming something like a 10% interest rate, how many points of interest would go into the insurance into paying the insurance policy? And maybe that's not the right way to think about it, but if you were to size it.

Danielle Sesko:

The product can be structured in whatever way it makes most sense for that lender. One thing I will say is loans go online or especially shares start to become more prominent of the market. What we're saying is not all loans are structured the same. Some of our customers provide small cash advances and the size of $500 or a thousand dollars.

That's the amount of cash that's relevant for their consumers, whereas some of our customers provide much larger personal loans or auto loans ranging from 20 to 30,000. Our product structured in a way that makes the most sense for a lender's business and their end consumer. It can be anywhere from up to six months of paying loan payments or it could be paying off the entire loan or a portion of the loan.

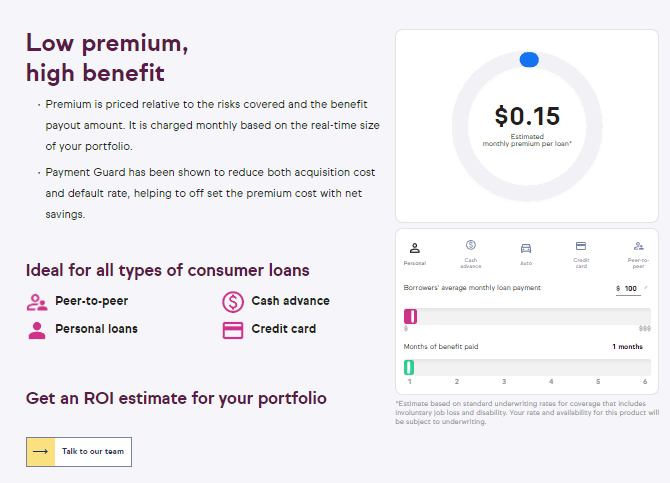

We're flexible in how we structure the product to ensure that's meeting the needs of our lending partner and their end consumer. Very flexible to that degree. In terms of price, how I think about insurance is the come in terms of the value we're doing, we're providing, like I said, needed critical period cash flow at the time, at the moment that's needed most.

It's not a one for one cost of the premium relative to the cost of cash that we pay out, but it's the timing that's critical, that's the value of it. The other value of it is the differentiation. We're seeing a lot of lenders market this product as a differentiator and that's helping to drive their conversion rates up relative to their competitors and drive down their acquisition costs.

The price varies depending on the particular book that we're insuring and how we're structuring the product. Like I said, it varies depending on the needs of the business customer, but just the general starting point for us is roughly about 15 cents per $100 of benefit. You can find that in our site as well.

If you are a lender listening to this interest in learning, more interest in pricing your portfolio, we have an online calculator, so you can run some what-if scenarios, and you can also talk to one of agents as well to get more definitive pricing, but roughly about 15 cents only for, one five for a hundred dollars of protection, so very nominal costs.

The way we're able to do that is we're protecting an entire book or pool of loans. We're spreading our risk out and that's how we're allowing our costs to be so low on a relatively low on a loan-by-loan basis.

Lex Sokolin:

From a software perspective or technology perspective, we've got a lot of terms flying around about embedding fintech and APIs and connecting everything together, but it sounds that the process in this case is handled by the consumer and submitting evidence of their case and so on.

Can you talk about the technology integrations between these different industries, the InsurTech industry and the digital lending industry in your product? How do you see that coming closer together over time? What are the systems that have to be woven together for this thing to work?

Danielle Sesko:

I think truly about the value of embedding insurance, it's really democratizing the supply of insurance by working with insurance companies, working so closely with non-insurance brands such as lenders for an example. That allows us to protect, that allows us as an industry and as a lending industry as well, protect more consumers and get insurance accessible to more individuals.

From a technology integration perspective, depends on how the product's designed, but with PaymentGuard, there's actually minimal integration from a technology perspective. That's because we're truly providing portfolio protection. We chose that path because we've heard that some integrations are painful for technologies to go through, to truly integrate some aspects, some insurance categories.

Despite those companies being tech firms, everyone, every product manager has a long roadmap and their tech teams planned out or scheduled out for the next several quarters. We designed a solution that is truly portfolio protection that doesn't require really significant integration. Most of our new customers get up and running in a few weeks depending on their timeline.

That's just a matter of ensuring that we're transferring data through the two companies so that we can basically adjudicate our claims. To do that, it's a simple SFTP transfer, we can certainly set up APIs as well though most of our lenders actually choose a file transfer protocol approach. Very easy to get up and running. It's actually just about three stops for us, and that is because of the way the product's designed itself.

Which is as portfolio protection and not a consumer opt-in solution, which adds a little bit more friction to the loan experience and also requires a higher degree of integration as well.

Lex Sokolin:

Super interesting. I love the use cases of crossover between the different financial services categories and those crossovers being catalyzed by the change in the underlying consumer behavior. The platforms and behaviors that we both use and have really driving the industry forward in these step changes.

Like one jigsaw piece comes down, and then the next one, the next one, and the next one. Thank you so much for joining us today and sharing the story. If our listeners want to learn more about the company or about you, where should they go?

Danielle Sesko:

They should go at TruStage.com. We have a wonderful site that explains and summarizes everything that I talked about. That's the best way to find us is at TruStage.com.

Lex Sokolin:

Fantastic, thank you for joining me today.

Danielle Sesko:

Thanks for having me, Lex.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Share this post