Hi Fintech Architects,

In this episode, Lex interviews Stani Kulechov - founder and CEO of Aave, a leading decentralized finance (DeFi) protocol. They explore the evolution of DeFi, Aave’s growth, and its architectural shift from a peer-to-peer model to pooled liquidity. Stani reflects on the early days of DeFi, the impact of the FTX collapse, and the increasing adoption of DeFi over centralized exchanges. They discuss Aave’s strategies for attracting assets, the importance of capital efficiency, and future innovations, including the tokenization of real-world assets and the role of stablecoins.

Notable discussion points:

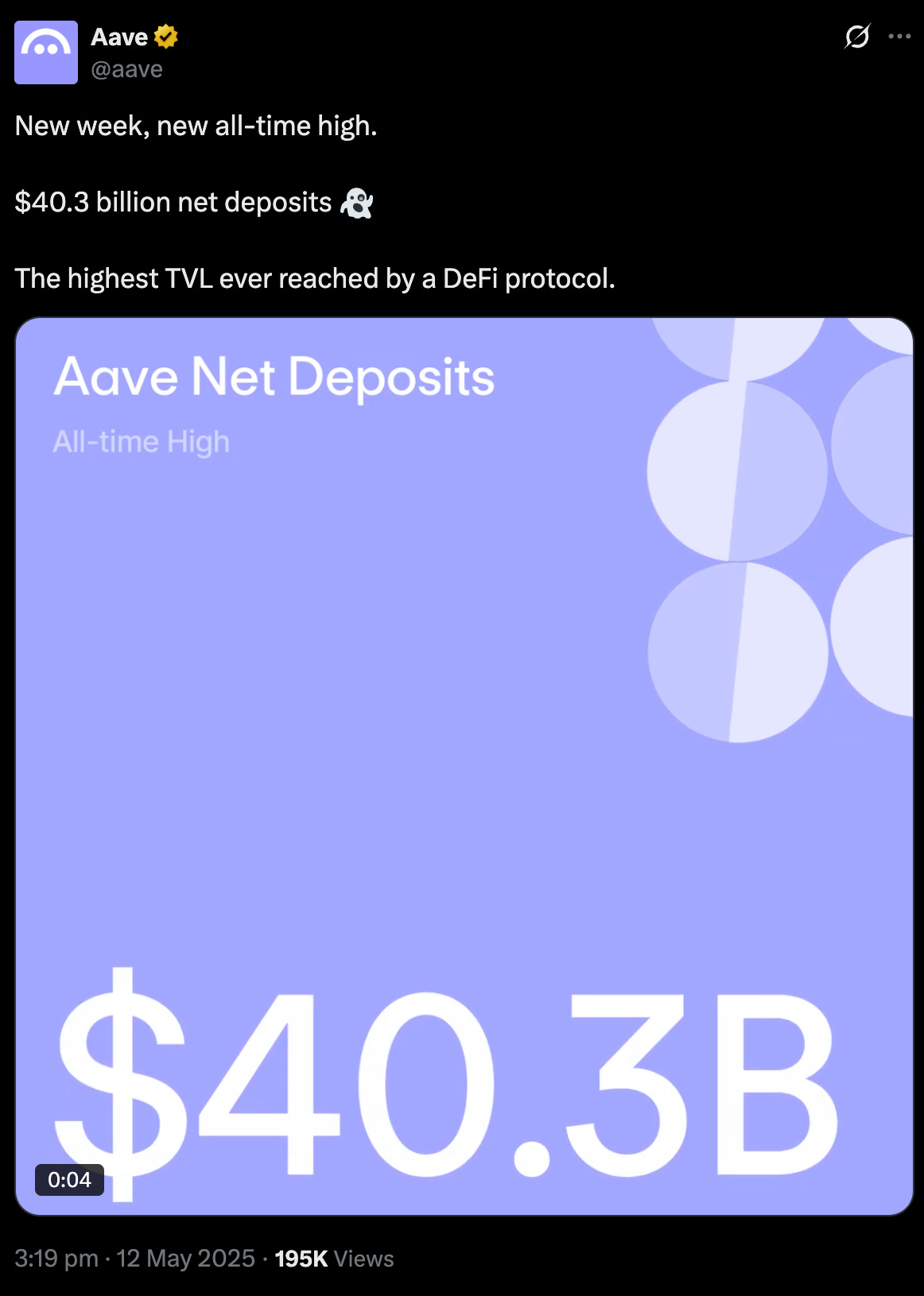

Aave Reaches $40 Billion in Net Deposits

Stani Kulechov shared that Aave has achieved a record-breaking $40 billion in net deposits and $25 billion in active liquidity, making it the largest DeFi lending protocol ever by total value locked (TVL).DeFi’s Evolution from Peer-to-Peer to Liquidity Hubs

The conversation detailed Aave’s architectural shift from early peer-to-peer lending models to pooled liquidity and now to a hub-and-spoke model with Aave V4 — designed to balance capital efficiency and risk segregation for both native crypto and real-world assets (RWAs).The Rise of Real-World Assets and Stablecoins in DeFi

Kulechov emphasized that tokenized real-world assets (like treasuries) and decentralized stablecoins (such as Aave's GHO) are reshaping the DeFi landscape, predicting RWAs will outgrow both stablecoins and native crypto assets in total value locked within five years.

For those that want to subscribe to the podcast in your app of choice, you can now find us at Apple, Spotify, or on RSS.

Background

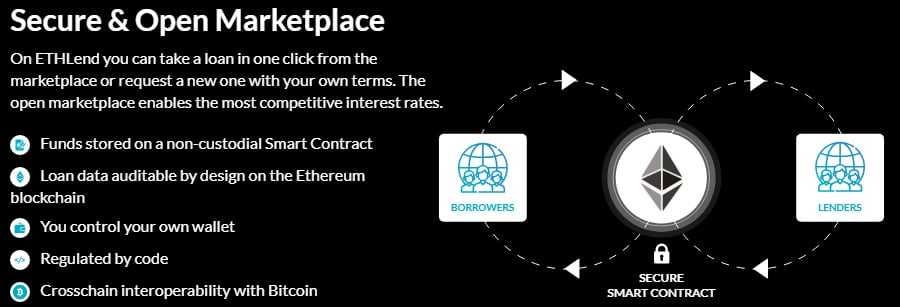

Before founding Aave, Stani was a law student at the University of Helsinki with a strong background in programming, having started coding as a child. While studying law and interning at firms like Castrén & Snellman and Bird & Bird, he developed a deep interest in how blockchain technology could automate legal and financial agreements. This led him to create ETHLend in 2017, one of the first decentralized peer-to-peer lending platforms on Ethereum. ETHLend’s success and the growing DeFi movement inspired him to rebrand and evolve the project into Aave in 2018, shifting from P2P lending to a liquidity pool model and pioneering new DeFi innovations like flash loans.

👑Related coverage👑

Topics: Aave, Lens Protocol, GHO, Horizon, FTX, Project Guardian, AaveDAO, MakerDAO, Web3, DeFi, Lending, stablecoins, tokens, RWA, decentralized finance, capital markets, DAO, Digital assets

Timestamps

1’11: DeFi at $40B: How a Lending Protocol Redefined Blockchain Finance

9’06: From Peer-to-Peer to Liquidity Hubs: Evolving the Architecture of DeFi Lending

15’01: DeFi's Growth Curve: From Airdrops to Institutional Adoption After FTX

20’49: Scaling Safely: How a Lending Protocol Outpaced Rivals Through Capital Efficiency and Brand Trust

24’34: Beyond Infrastructure: Why Token Issuers Need Capital Markets, Not Just DeFi Hype

28’33: Building Beyond Lending: How a Stablecoin and Institutional Arm Power DeFi Profitability

31’33: From JPMorgan to BlackRock: How Horizon Bridges Institutions to On-Chain Finance

35’18: Tokenized Treasuries and the Future of DeFi: Why RWAs Will Eclipse Stablecoins by 2030

39’36: From Fragmentation to Focus: Why DeFi’s Future Depends on Application Layers, Not More Chains

41’47: The channels used to connect with Stani & learn more about Aave and Avara

Illustrated Transcript

Lex Sokolin:

Hi everybody, and welcome to today's podcast. I'm absolutely thrilled to have with us Stani Kulechov who is the founder and CEO of Avara. And of course, you'll know him from being the founder of Aave, the non-custodial lending protocol Lens Protocol, a social Web3 initiative, as well as a number of other really meaningful things in the space. I've been committed to Web3 from the beginning and is one of the original entrepreneurs that has brought this space to where it is today. With that, Stani, welcome to the conversation.

Stani Kulechov:

Thanks for having me here. It's good to be here. And I was just mentioning that earlier before this discussion that we've known each other for quite a few years. So, we've we've seen the space pretty much non-existing, especially when we think about decentralized finance and tokenization. And now we actually see some significant progress. So, it's been nice to kind of like follow how things are evolving.

Lex Sokolin:

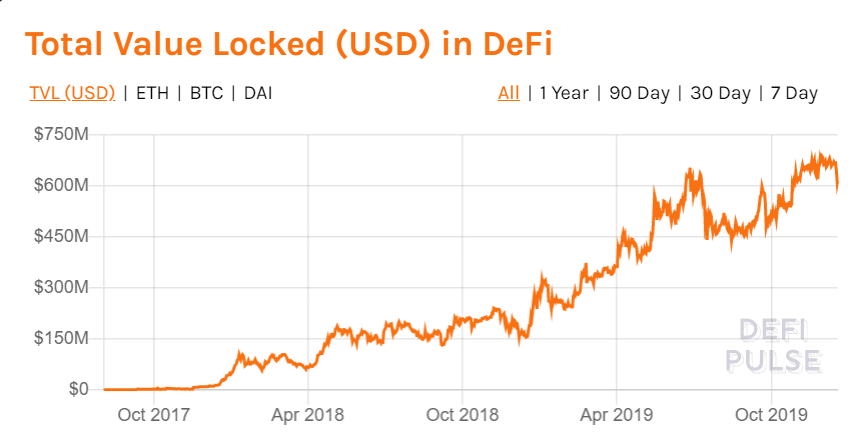

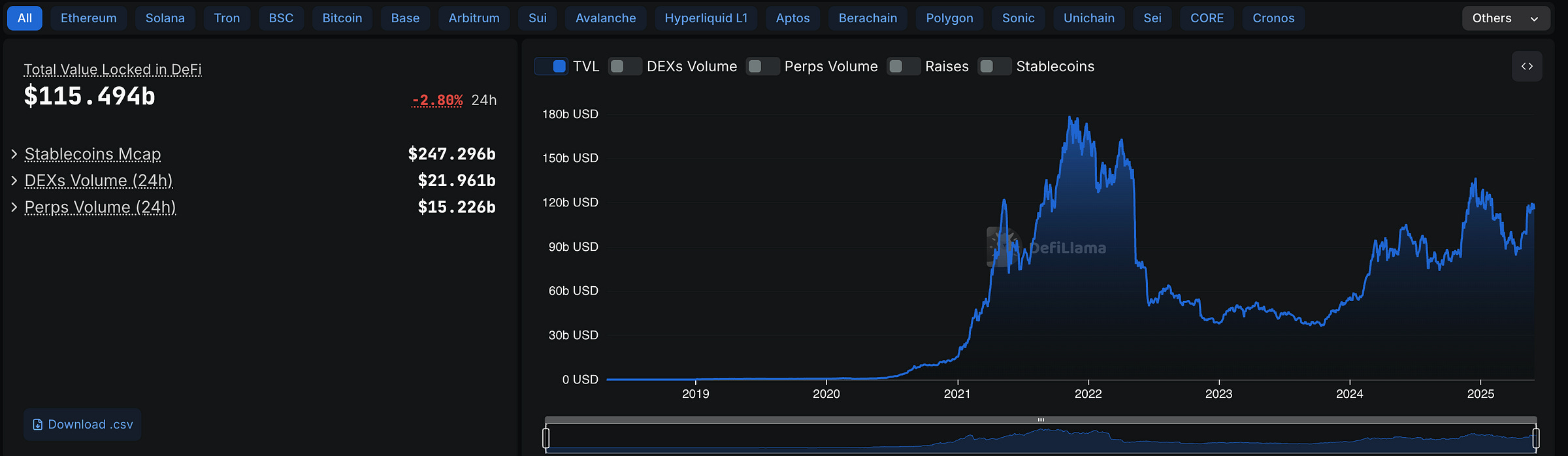

And I think we're really just starting to open the book on where it's going to land. I remember joining the space seriously in 2019, like committed to it, going to consensus Specifically because for me, decentralized finance was the right answer to what should happen to the financial services industry. Like, we had all this transformation in people using the internet and mobile apps to use financial products, but all the financial products that they were getting from Neobanks or these payment wallets, they were all the same old stuff on portfolio management systems or banking systems. And at the time, DeFi must have been $200 million in total assets, you know? And now in 2025, tell us the size and scale of Aave. Where did it get to?

Stani Kulechov:

Yeah, I think this week we actually reached $40 billion net deposits. So that's basically the amount of supplied and deposited liquidity within the of a protocol. And with the borrowing as users borrow that liquidity out there's roughly $25 billion of value just sitting on those smart contracts. So that's the highest number of TVL a protocol has had ever. It's a really remarkable milestone and we're quite excited about that. But we also know that it's just like a very small drop in the ocean when we think about all the financial value that exists as of today. Are you surprised?

Yes and no. So, one of the things that we kind of like a little bit chatted earlier, and I'm trying to always assess whether DeFi is actually moving fast or whether the whole kind of like Web3 space is moving fast enough. And when you think about other types of innovation, like the internet, when a lot of these web internet primitives were invented, it took quite a lot of time, even over a decade, to actually get to at some point from inventing that technology, making it available, and then also to that point where we saw an application layer being built around, and we see we saw big social media companies being built, e-commerce companies being built, and also banking moving to digitalized.

So, in one way I would say that it's been taking time. So, I started in 2017, 2016. I was trying to get somehow into the space to understand what to build. In 2017, we built a first version of called it EthLend, short for Ethereum Lending. Was it more of a peer-to-peer model? And now as of today, being the biggest DeFi protocol, we feel that there's been a lot of progress. But also, since we're changing the whole concept of money and how we interact with finance, I think it's going to still take a couple of decades to really take this technology to, to mainstream and for everyone.

Lex Sokolin:

What's amazing is that even in 2025 with $25 billion in the protocol. A lot of people that are listening are probably not going to know how the thing works. And so, let's set some definitions in a narrow way, like about the very beginning when you were conceptualizing the product in 2017 and thinking about lending, what was the core loop that you designed, like in the early days, and who was it for?

Stani Kulechov:

Yeah, I think one key principle that I wanted to achieve is the ability to earn interest on the blockchain. And at the same time, the way I wanted that to happen is by borrowing. And I noticed that there's a lot of different kinds of assets that are in cryptographic form. So, they exist on the on the blockchain, but they have different kind of a purpose. So Ethereum itself, which is a economical transaction token for the Ethereum blockchain has a function, but also it is an asset that that that has value and that can be used as a collateral that can be borrowed against. And this whole concept of collateralization isn't really a new thing. You know, a lot of lending is actually collateralized in traditional finance. And even so, in the context of consumer finance as well. So, mortgages are collateralized by the actual real property. Sometimes we can even conceptualize that credit scores are some sort of form of collateralization where you put your name and back alone with your credit worthiness.

Lex Sokolin:

So that's very profound.

Stani Kulechov:

But what I try to solve is that how you could use these so-called smart contracts, which are simply a piece of code, just as any piece of software, but it's running on the blockchain.

And because it is on the blockchain, it adds and inherits a couple of interesting properties. So one is that once you deploy a system or a piece of code, it means that you can decide also that that code can't be ever changed, or there's a formal governance process of how that software could actually change. Now, what it allows to do is that you can create certainty by ensuring the participants of that software, or as we call it, a protocol, that certain things will happen and are guaranteed in terms of execution. So, if you take a piece of a collateral like Ethereum, which is a crypto asset, and put it into the smart contracts to borrow a stablecoin, it means that then no one can actually come and just take that collateral without permission, even those who created these smart contracts. So, from a technical, economical perspective, that's what we try to create. And in more simplicity, we wanted to kind of like create a marketplace where you have these borrowers that come and consume the liquidity and it's instantly available.

And then on the lenders side, you have anyone that can actually come earn interest by supplying the liquidity and start earning right away. So, there's a marketplace which is matching the supply and demand on lending.

Lex Sokolin:

In those early days, I was thinking about it as kind of like a vending machine that is managed through code, and you can put things into the slot and get things out of the slot automatically. And it's a very kind of straightforward, deterministic robot, because only so much processing power is available on first generation computational blockchains. With any amount of abstraction, you can start saying, okay, well, you can put Eth in here, but you can also put any other token, or you can put a house or, you know, some tangible assets outside of that or equities or really anything that is a native digital asset. As you think about that product in the early days. How did the architecture of it evolve? You know, and I know there's been like experiments about liquidity across different pools.

There's been experiments across different chains. What's been the architecture of the product from the beginning to now?

Stani Kulechov:

It's interesting because the architecture of our product from the early days, as of what is it today and what we are building for the future has changed to quite some extent. So, we started first on a more of a peer-to-peer model. So, I come from a background where I've built fintech applications before, and I saw the rise of peer-to-peer lending and crowdfunding and this whole kind of like a financial marketplace economy. And for me, kind of like from that perspective, it was very interesting to build a peer-to-peer model by using these smart contracts that just remove the kind of like middleman function where the smart contract can actually guarantee the behaviour that is, that the users are subscribing to. And back in those days, the novelty of Ethereum and all these assets with most of these assets, they really didn't have a significant market capitalization. There wasn't a concept of a stablecoin.

So, for example, in Ethereum, which is the biggest blockchain and securities, most of the value, there wasn't even a way to transact a stable value. So that created some complexity. So that was time before stablecoins. So, we tried to build the system in a way where we try to put reliance a lot on the users. So, for example, users do their own risk assessments. You don't have pooled liquidity. Instead, if you use a collateral, you put into a segregated smart contract vault, and then someone who likes that type of collateral accepts, they can go and find that vault that gives the access to the funds to the borrower. So it was really a typical peer-to-peer model. And actually, what happened over time is that stablecoins came into existence in a decentralized world in Ethereum. And at the same time, the market capitalization of these many assets started to increase. So, the liquidity risk decreased over time to use these assets as a collateral.

And this pooled concept of pooling liquidity for everyone's benefit became more of a standard. So, we saw with decentralized exchanges that actually allowed users to just move liquidity there and park it. And that's always available for trading. And this pooling model became a very obvious capital efficiency mechanism. So, we moved to that model. And now when we look at the existing protocol, we have some interesting features where you can also go into very high correlation, almost getting like 99% out of your collateral value if you borrow against, correlated assets. So typically, you might have a borrower that is using staked it so token as version of staked Ethereum as a collateral borrowing Ethereum. And then kind of like increasing that exposure or depositing one type of a stablecoin and borrowing another one and doing this kind of like a more deep, deeply liquid but complex financial transactions. And now a new version of it, which is the latest one that we're building of a V4, inherits a lot of these properties, but also changes the architecture from the existing, kind of like a pool, isolated pools into or isolated markets into this kind of like hub, liquidity hub and spoke architecture where users come to a particular spoke, which is just a configuration of credit risk and credit worthiness.

And then they when they supply liquidity, they go from that spoke to the liquidity hub where the actual liquidity is stored. So, what this allows is that new types of markets and innovation can be created on all of it. So, if there is a are some sort of RWA that users want to use as a collateral that didn't exist before in Aave, they can create a new liquidity spoke and get a credit line from the liquidity hub and then consume it. So, we kind of solve one of the key problems of DeFi is, is like segregate risk sufficiently without breaking the network effects of concentrated liquidity.

Lex Sokolin:

Super interesting. I mean, a lot of these changes are in response to market demand and pretty complicated. I think the simple version that I think about is margin lending in a brokerage account. If you hold a bunch of Apple stock and you want to borrow against that Apple stock, you can get a loan, often a very expensive loan. And that margin lending revenue always goes to the broker. Whereas on DeFi lending platforms, that functionality is in a protocol, which means it's a market venue, it's two sided.

People can come and go, and then you get into these kind of re hypothecated and leveraged loops, which are very attractive to investors who know what they're doing, or to investors who, don't have fear of risk and like to write things up and down. So just switching tracks, the demand for the product, I think, is also shifted quite a bit. And I want to explore your go to market and like what was responsible for growth. And in my mind, there's two periods. There's the pre-FTX period and then there is the post-fight period, right where in the first one there's like the discovery of protocols like Aave and adoption and token launches and airdrops and things like that. And then the second period, it's been kind of a slog to build it back up. But you're bigger than ever. Can you talk about in the beginning how you attracted assets and what you think brought assets in? And then we'll contrast that with today afterwards?

Stani Kulechov:

I would say DeFi overall has been growing because there's a certain type of interest in crypto, including Bitcoin and Ethereum.

And just looking back in 20 2019 and 2020. And DeFi was really like a small piece of overall crypto. Like a lot of things happen on a centralized exchange. And typically, when people think about crypto, they think about speculation, they think about prices. And that's mainly thanks to the fact that, you know, we have these big exchanges and that's kind of like the main that's how typically crypto is marketed to coming to an exchange instead of coming to some sort of other type of activity, whether it's financial or non-financial. But what happened is that DeFi started to grow quite significantly. And I think one aspect was in back in 2020. In January, we launched the first version of the of a protocol. We spent roughly a little bit over a year to actually build that version. And what was interesting is that Covid happened at that time. I think we were able to go to a couple of events, one here in London and one in Paris to present what we build. And pretty much after that there was a major lockdown everywhere.

And during those months, what happened is that a lot of people were online, you know, they basically weren't doing. You couldn't do much. You can go out and socialize. And at the same time, the central bank interest rates were pulled down to stimulate the economy. So DeFi kind of like showed a very good delta in terms of the financial opportunity that compared to that existed in the traditional finance and also there was the whole aspect of quantitative easing. So, we saw some of the values of crypto assets also going and appreciating a bit, and then doing that 2020 summer, we had to DeFi somewhere where DeFi protocols started to figure out how they can actually give ownership of these protocols in a decentralized way to their users. And they started to pay that kind of like governance token of their protocol as an additional interest rate. When you're supplying, depositing into these protocols, that made it really attractive. And obviously everyone was experimenting with this model, and we saw a really big uptake in DeFi during that time.

And I think that really lasted for a good year. And I think the FTX was an interesting kind of focal point, because at that time, centralized exchanges were growing and FTX was growing significantly. And when the issue started to happen there, a lot of people started to think again, well, why don't we use decentralized finance, where you can actually interact with other peers and pools without actually giving your assets to someone else's custody? You keep the control, you have the full transparency, and the execution is guaranteed by the smart contract. So, I think after FTX, what is significant really, was that people trusted less on centralized exchanges. I don't think that kind of like distrust has completely expanded. People still use them. And the second thing that was happening during that time is that Ethereum shows a scaling strategy by having a second layer of networks that that basically can transact faster and with a lower price point. And that stimulated a lot of activity and credit access for DeFi as well. So, in Aave’s case, we saw a lot of smaller deposits on these L2s compared to the main Ethereum network, because the gas fees were significantly lower.

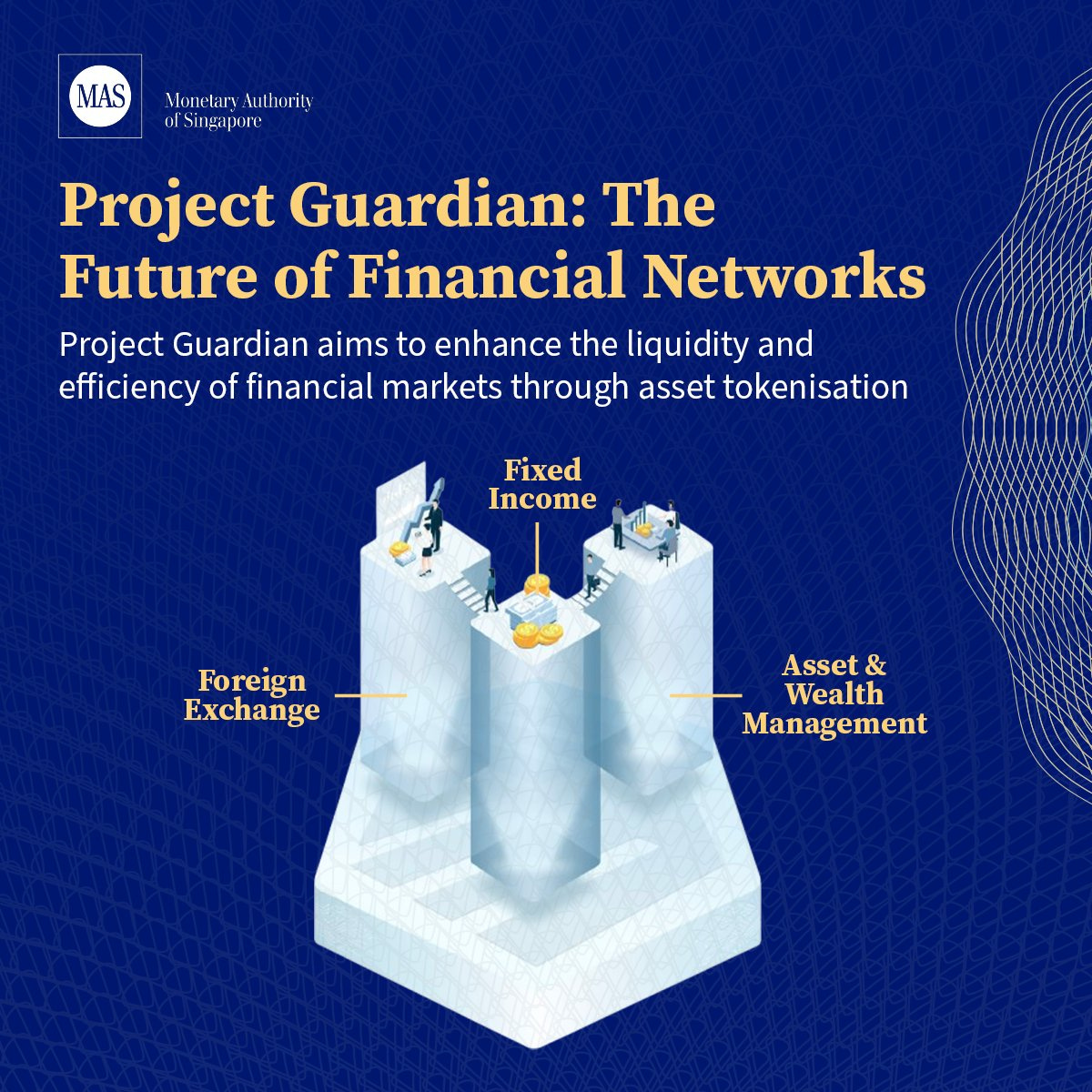

So that was like a really interesting observation from like the kind of like a slightly post FTX experience. And one interesting incident I want to also mention is the institutional side of DeFi, because just before FTX happened, we were working in a project with JPM, the Project Guardian, and the idea there was to actually deploy a permissioned version of Aave on a permissionless network. And that was the first kind of like a big initiative of a major bank experimenting with permissionless blockchain networks. Because remember back in those days where everything was tested out on, on, on a permissioned kind of like a private blockchain network? So that was like a very big momentum.

Lex Sokolin:

When you look at today and the more recent run up, I want to talk about the other initiatives under Avara in a bit as well. But if you look specifically at the lending protocol today, which is multi-chain, it's got lots of high-quality markets. It's really pulled away from the competition in the last two years. You know, in the last two years have been really challenging for people who are interested in Web3, not as a meme coin death spiral, but as the infrastructure for financial manufacturing for the next hundred years.

But you've been able to execute and deliver and capture a lot of assets prior competition like compound and even newer competition like Morpho, mean much lower scale great products, but don't have the mindshare that Aave has been able to deliver. What do you think happened? I mean, what's changed in the market structure and what's allowed you to bounce back so quickly?

Stani Kulechov:

I think a lot of it boils down to the technology, the way the Java protocol is structured. It focuses quite a lot on capital efficiency and network effects. So that has been really a big thing. And I think that a new iterations of lending protocols are segregating a lot of liquidity. And that's why it's harder to bootstrap and grow. And typically, we see a lot of incentives being shown at these protocols and trying to grow them. But to be honest, what really matters is to find a right balance between capital efficiency and risk segregation. And I think all three has been able to achieve that at best at the moment when we look at the market.

But Aave is basically taking few steps forward and trying to figure out like how we can actually expand the spectrum of risk in terms of different types of collaterals and fulfilling everyone's appetite, growing, fuelling innovation, but at the same time have a risk mechanism where that type of different risk profiles can be capped to a certain point and can be liquidity can be seeded as well for these what I call liquidity spokes from the liquidity hub. And this allows faster scaling, faster innovation, but still with a really good cap and doesn't need doesn't require the Aave DAO which governs the over protocol to spend liquidity incentives. That’s basically just typically a very inefficient way to attract liquidity. So, a lot goes to the to the actual fact that when you create a really strong protocol offering, you're able to tie a lot of user base and a lot of capital, and that's user base becomes relatively sticky in, in my opinion. I do think there's a lot to still innovate on.

The lending and borrowing side over probably will be a kind of like a flagship for a while. But I but I do think there's different ways to, to improve the existing space and innovate. And what I like about our space a lot is that you get ideas from everywhere. So, anyone can actually contribute to DeFi and build some of these protocols and experiment are kind of like an angle that we're building towards mainstream, towards consumers, towards institutions. So, we want to build this as safely as possible. And being able to do that for over five, even seven years with if you include EthLend, is a big statement. So, I think that's kind of like a brand that all like being a good product, focusing on safety, managing the risk properly, that then reflects and comes out at a very strong brand value that the users like.

Lex Sokolin:

So if I think about it in a, in a very like naive and applied way, let's say I'm yet another layer two, I'm a layer two, that's for, you know, ZK data agent verification and people love me. I'm now worth $10 billion. And I'd love to set up some collateralized lending markets for my token. And so, I go and I look around the ecosystem today. How does your description of capital efficiency, broader capital pools that are spread across the different markets, like in a very applied way, how do I interact with that? How does that benefit me as that token issuer?

Stani Kulechov:

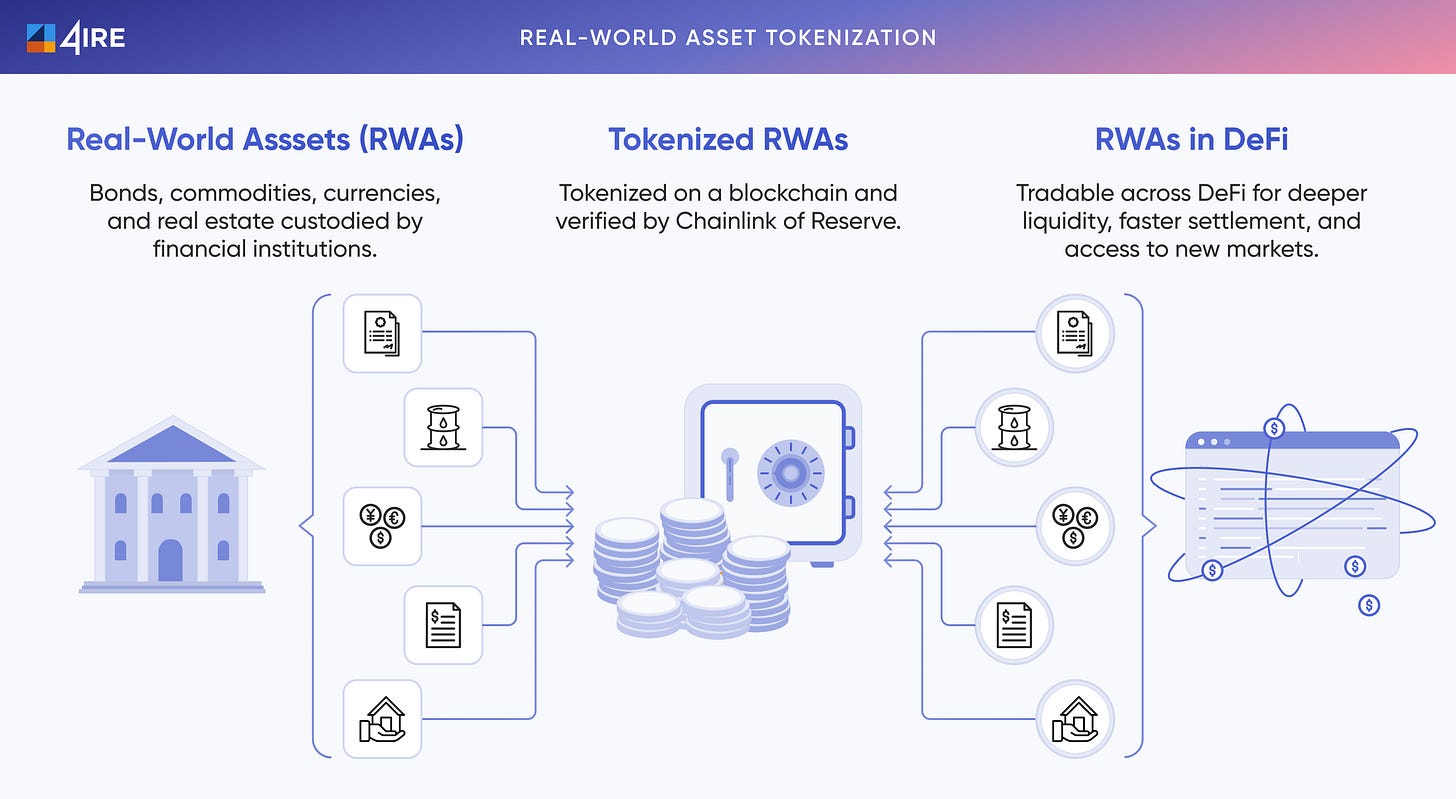

I mean, as a token issuer, what it helps, obviously, is the fact that it creates a really strong utility for an asset. I personally believe that you can go quite far with the concept of tokenization, and I think that's native tokens will be at some point outgrown by stablecoins. And I think that RWAs effectively security tokens will outgrow stablecoins altogether with native crypto assets. But what it allows to do is it creates really a baseline for interest rates. So, once you have interest rate markets on assets, that is the kind of like really fundamental for economic activity. So at that point, then you can use an asset that you want to keep as a collateral, borrow against that, and then do another economical leg in another protocol and kind of like stimulate the whole economic activity in DeFi.

I personally don't think that every single L2 and network needs DeFi. If there is like a strong user base and it focuses on financial transaction, that means that definitely makes sense. But for example, in one of the other of our project lens, which is basically a decent like a stack of decentralized social primitives from identity to decentralized usernames, feeds and groups and so forth, operates on top of a lens chain, which is a simple layer two on Ethereum. And that doesn't focus at all on D5. I mean, it uses the native GHO stablecoin as the gas token to establish a stable, economical unit because I personally believe that when Web3 goes to mainstream, users want to use a stable value because it's harder to understand if the gas token or transaction token or whatever token that establishes the economic unit is volatile. So, there it makes sense. But DeFi doesn't need to exist everywhere. So, I do think that's what actually means more is having a really strong application layer. I think there's a lot of infrastructure already in our space.

We have scalability. We have enough ways to transact on Ethereum. On Layer Twos, we have DeFi, we have yield and ability to borrow, and raise are tokenized now. And we're launching also Horizon, which is an initiative that includes a RWA market where you can use RWAs as a collateral to borrow against them. So, all this infrastructure really exists. What's really missing is that strong consumer. I would say like a strong application layer, but that is really well tailored for consumers. So even of Aave as a leading DeFi protocol having let's say 40 billion net deposits. The scaling is going to be really slow if we don't find a way where every single person could use Aave in a very simple way, and that just doesn't exist today, but it should exist at some point.

Lex Sokolin:

Absolutely. So, let's double click more actually into GHO, the stablecoin of which there is about 265 million in supply and horizon the institutional and DeFi play. I think it's actually really interesting how a lot of the DeFi protocols that have survived have built these analogous functions, you know, but coming from very different places, like you started with the P2P lending concept and, you know, something like MakerDAO's started with a concept of a central bank, but then you've got kind of convergence to these shapes, these financial instrument shapes that everybody needs on chain. Tell us a bit more how you decided to enter these business lines and then like what the traction has been for them.

Stani Kulechov:

Yeah, I also see that they are kind of like a business line for Aave. And I started from lending and borrowing and scaling that across multiple networks. And it does create a really good revenue stream for Aave and, and brings also profitability. So, one thing that is interesting about Aave as not just a protocol, but as a DAO, it's basically it's creating revenue. And that revenue is between 50 to 80 million. Sorry, the profit is from 50 to 80 million a year annualized, depending how we calculate it. And it is really interesting because it's so hard to actually build a business that is generating revenue in, let's say, in fintech in overall, but it's so much harder to do it as a DAO. So, I think there's not many examples and Aave DAO is one of them. And Maker is a really good example as well of that. And what we actually did is that, you know, we some of the users were basically expressing that they want to have more predictability on the borrowing costs.

And we figure out that one very straightforward way to do that is by minting a alternative stablecoin, because you can set the interest rate based on governance decisions periodically. And that was how that's how GHO was essentially borne by just simply user requests and as a business line. It's interesting because it has roughly 240 something million in circulation. It's not as much as many of these centralized stablecoins, which can grow much, much faster as an example than a decentralized stablecoin. But just to give an example, 100 million borrowed GHO earns the same amount to the other DAO as 1 billion borrowed USDC or other stablecoin. So that just showcases the magnitude of revenue that it creates to the to the other DAO. And that revenue then can be used to pay different service providers overlaps other service providers as well or used to pay also incentives and incentivize and refuel the growth of GHO as well. So that's the kind of like a significance of that business model.

Lex Sokolin:

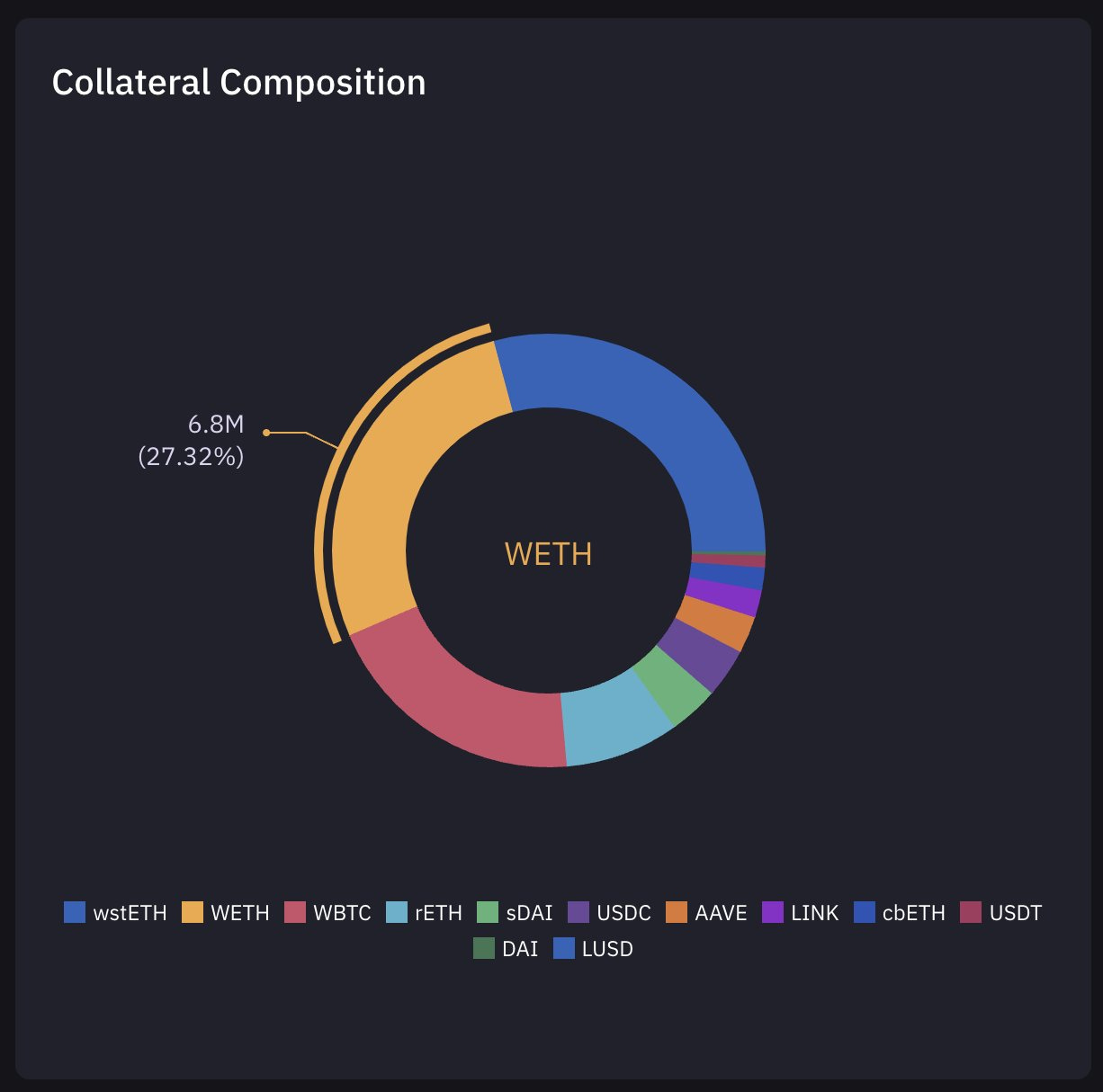

What is GHO collateralized by.

Stani Kulechov:

Its collateralised, mainly by its derivative. Basically, staked it and so. And also, with some rough versions of Bitcoin those are the most. Pretty much all of the collateralization.

Lex Sokolin:

Tell us about Horizon. And maybe what would be great context is how institutional interest has transformed. You know, from the early days of J.P. Morgan trying to experiment but scared to go on chain to what we're seeing now.

Stani Kulechov:

Yeah, I mean, a lot has changed over the years. I think I've really significant move has been the Blackrock entering into the space going really being very expressive about Ethereum and also being very expressive about RBA's and creating little tokenized fund is really fascinating progression and really opened a kind of like a new wave of tokenization and of securities. And we will remember that tokenization of securities isn't really a new thing. It's been here since, you know, the very early days. But this shows how like a kind of like a there's always needs to be some sort of a catalyst to, to ignite some of the initiatives.

And I think also having high central bank interest rates has been able to contribute to that, that consumption quite a lot because bringing them on chain brings a lot of additional revenue sources to those users that are using DeFi on an ongoing basis, and also decentralized organizations and foundations and those that get access to this type of product more in a streamlined way directly on chain. Horizon is an initiative from the overlaps, and the idea of horizon is, is to create different kinds of institutional initiatives. So, our first initiative is to deploy a RWA market on Aave. And this will mean that you could use different types of RWAs as a collateral that have sufficient amount of liquidity and are eligible for the users. And the way it works is that these are the Bas are permissioned on the asset level. So, the asset issuer is the one that approves a user to hold a particular RWA. And then on the other side, on the liquidity side, you have GHO minting directly into these pools and also permissionless USDC supply into that pool. So, it's a kind of like a hybrid market approach that we created with horizon.

Lex Sokolin:

What do you think the RWA sector starts looking like when you fast forward a bit and then, you know, what's the implication for the product that you're describing? And just for kind of definitions, RWAs here are not risk weighted assets, but real-world assets. And what we're really talking about are usually treasuries that have some sort of yield set by nations. And the yield gets packaged and passed often to stablecoins, which are the distribution mechanism for those. So, people will people being like asset managers like Blackrock or Franklin Templeton or Wellington, they will tokenize big chunks of treasuries or funds that represent treasuries, you know, money market funds, and then they'll still have permission gates to get into those funds. So, you might need a minimum of like a $5 million ticket in order to be able to buy it. But often these RWAs go underneath stablecoins as collateral. And then stablecoins are the sort of the fractional, very liquid mechanism by which people can hold and spend interest bearing cash.

There's a whole bunch of kind of structuring risk and counterparty stuff underneath. But the end result is pretty amazing. And you know, the natural question is like is BlackRock going to move 50 billion on. Is it going to be 100 billion. Is it 500 billion. And if that happens like how is that going to impact our space? And how does that impact the products that you're building?

Stani Kulechov:

Conceptually speaking, I think what is happening is basically the evolution of the technology that we use to record these financial transactions and how we interact with them. So, you know, tens of thousands of years, we started with clipboards to mark in some sort of a ledger form of a ledger. We moved to paper. And then decades ago, we started the move to digital, which is still going on. There's a lot of paper, but there's also a lot of digital. And now we're moving to a new medium, which is the blockchain. And every medium kind of like has its own additive properties.

That makes it very appealing. So obviously moving from paper to digital is that you have a very fast and easy way to query information. You can transact more efficiently. Moving to blockchain, you add a lot of certainty, transparency as well, and a really interesting form of programmability and reduce, you know, things like counterparty risk or custodian risk and, and these types of elements. So, I think that that's what is happening under the hood conceptually, where the world is moving towards instruments of the financial world, then actually like how long it takes to the more traditional market participants to follow the progress. I think that as long as there is high utility, the tokenization keeps happening and we see more assets coming on chain. And that's why the landing component is really important, because being able to once you tokenize the asset, you want to be able to do something efficiently. So, you know, an example is that with the horizon RWA market, you can supply a RWA into the market, borrow against it 24 seven.

So effectively you have a 24 seven repo market that you can access. It's far more flexible. You can repay at any point, draw more liquidity without actually disposing the, the underlying RWA. So, it is a really important that we don't just bring assets on chain and let them sit there on a new kind of like a transparent ledger, but we actually create the more utility. And that's why DeFi will be so, so important for these traditional assets and asset managers that are bringing more value on chain because that creates the, the wider utility. And that's why I think that's in two years from now, stablecoins will overgrow native crypto assets, and in five years, security tokens will overgrow stablecoins and native crypto assets altogether. In terms of TVL, the total value that is locked in these smart contracts.

Lex Sokolin:

I think in the same way that nobody expected, well, few people expected the 500 million of DeFi to grow into, you know, the 50 or 100 billion of it on chain today or 150 billion, depending on your time horizon.

You know, we're going to get to trillions, and it is just a matter of time. And in the same way that nobody expected Apple to be worth 3 trillion or Blackrock to manage 10 trillion of assets, I think these numbers sound crazy. But if you see where the trends are going and if players can maintain their position and sort of high-quality execution and ethics and commitment to some version of the public good. I think we're going to see much, much bigger numbers all across the board. The last question I wanted to get your temperature on the chains as market venues, and there has been a ton of kind of turnover and development and cultural shifts in the last couple of years as well, relative to the early days of DeFi summer. How do you think about main net Ethereum and the various layer twos and the app chains and Solana and then the high-performance chains? Of course, it's great for Aave to be in all of the destinations, and it's important to manage all of them. But what's your mental model for longer term, what the world looks like and what's going to be utilized, and how?

Stani Kulechov:

There's a compelling offering to use L2 for a specific use case, such as, for example, non-financial transactions where you don't really want to compete with other market participants that are creating financial transactions and outpacing the with the transaction costs, the non-financial transactions that doesn't need the same amount of security than storing high amounts of financial value.

So that's one example. And then kind of like is DeFi needed everywhere? I would not necessarily think so because end of the day, the more you have these different venues, the more liquidity will spread around and start fragmenting. And that's what we are seeing with even in lending protocols where the actual you see fragmentation between the different markets. The same thing is happening across the L2 layers. So that's why I think that the concentration of value is really important. And I think that Ethereum is the biggest and most liquid marketplace for that concentration of liquidity both on the trading site and also on, on the lending perspective. But overall, I think that the infrastructure isn't really the problem, I think. Ethereum is already has throughput and is focusing more and more on scaling mainnets. And then you can do on layer two. So, you can do a lot of non-financial transactions. That's really low cost. I think like one of the challenges of all these different networks is that they lack of a very strong application layer, and I think that's where most of the space should focus upon, I would say like we should flip around where 20% is focused on infra and 80% of the developers are focusing on the application layer. I think that's where the energy should go at the moment.

Lex Sokolin:

I could spend certainly a lot more time with you on the industry and hope to do so in the future, but for now, we've got to wrap it up. So, if you want our listeners to learn more about AIV and then any other projects from Alvaro or about you. Where should they go?

Stani Kulechov:

The best thing is to go to Avara.xyz. Or for all the other? For lens or non-financial social protocol lens.xyz. And also, if you want to try out a very user-friendly wallet that's family.co, and then you can follow me also on socials. And that's basically @Stanikulechov on Twitter.

Lex Sokolin:

Awesome. So great to catch up with you.

Stani Kulechov:

Likewise.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

![TEMP CHECK] Aave 2030 - Governance - Aave TEMP CHECK] Aave 2030 - Governance - Aave](https://substackcdn.com/image/fetch/$s_!van-!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2f1490c1-b5fd-4bd9-9e3a-98b008b98158_1540x1048.jpeg)

![Temp Check] Horizon's RWA Instance - Governance - Aave Temp Check] Horizon's RWA Instance - Governance - Aave](https://substackcdn.com/image/fetch/$s_!sJvw!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0b09ade9-4156-4736-854c-5417875fce24_1540x948.png)

Share this post