Hi Fintech Architects,

In this episode, Lex Sokolin speaks with Edward Woodford - CEO of Zerohash. They discuss Zerohash’s growth, the rise of stablecoins, and the evolving fintech landscape. Edward explains how stablecoins now make up half of Zerohash’s volume, highlights regulatory shifts in the U.S. and abroad, and explores the distinction between crypto and stablecoins.

The conversation covers usability challenges, emerging payment use cases, and the future of embedded finance, emphasizing the need for regulatory clarity and collaboration between fintechs and traditional financial institutions.

Notable discussion points:

Stablecoins Overtake Crypto in Volume: Stablecoins now make up over 50% of Zerohash’s volume, driven by regulatory clarity and real-world use cases like payments and treasury. Institutions prefer them for their centralized control and ease of integration.

Brokerage and Payments Are Converging: Zerohash sees strong demand across brokerage and payment rails, with banks and fintechs embedding stablecoin infrastructure. Global payouts, account funding, and subscriptions are key growth areas despite UX friction.

Regulatory Climate Is Rapidly Improving: U.S. policy has shifted from regulatory overreach to bipartisan support for stablecoin legislation. This change is unlocking institutional adoption, with banks now moving aggressively into crypto and digital assets.

For those that want to subscribe to the podcast in your app of choice, you can now find us at Apple, Spotify, or on RSS.

Background

Before founding Zerohash in 2017, he co-founded Seed CX, an institutional digital asset exchange designed to bring regulatory-grade infrastructure to crypto markets. Under his leadership, Seed CX became one of the first crypto platforms to receive both a CFTC-regulated swap execution facility (SEF) license and a FINCEN-registered money services business (MSB) designation—laying the groundwork for institutional adoption of digital assets.

Before diving into crypto, Edward built his early career in traditional finance and commodities. He worked at Goldman Sachs in commodity derivatives and macro research, where he gained firsthand experience in the complexities of global trading systems, risk, and regulatory environments. This exposure shaped his conviction that blockchain infrastructure could radically simplify global financial networks.

Edward holds a degree in Politics, Philosophy, and Economics (PPE) from the University of Oxford and a Master’s degree from MIT, where he focused on the intersection of financial systems, distributed technologies, and public policy. During his time at MIT, he published papers on market structure and digital payments, and engaged deeply with the academic and regulatory debates surrounding the future of financial infrastructure.

👑Related coverage👑

Topics:

Zerohash, MoonPay, Transak, Ramp, Stripe, BlackRock, Franklin Templeton, Hamilton Lane, Morgan Stanley, Charles Schwab, SoFi, Uniswap, fintech, web3, digital assets, blockchain, tokenization, rwas, stablecoin, crypto, regulation

Timestamps

1’51: From Crisis to Convergence: Edward Woodford on Scaling Zerohash and the Future of Embedded Crypto Infrastructure

5’06: Scaling the Pie, Not Stealing Slices: Rethinking Volume, Margins, and Meaningful Growth in Digital Asset Infrastructure

10’02: The Great Rebrand: How Stablecoins Are Shedding the 'Crypto' Label and Reshaping Digital Finance

15’22: From Overreach to Opportunity: How Regulatory Pushback in the U.S. Sparked a Global Shift Toward Stablecoin Adoption

20’31: The Semantics of Trust: Why ‘Stablecoin’ Sells and ‘Crypto’ Scares - and Why the Framing Now Matters More Than Ever

22’36: Unlocking Real Utility: Why Stablecoin Payments Are Finally Poised to Scale Across Commerce and Subscriptions

30’50: Disrupting the Rails: How Stablecoins Are Reshaping the Power Dynamics of Global Payments

34’49: The New Brokerage Mandate: Why Every Platform Is Racing to Add Crypto - and What’s Unlocking the Shift

39’03: Rewiring Financial Infrastructure: How Stablecoins and Super Apps Are Forcing Banks to Rethink Risk and Relevance

43’07: The channels used to connect with Edward & learn more about Zerohash

Illustrated Transcript

Lex Sokolin:

Hi everybody, and welcome to today's conversation I've got with me today, Edward Woodford, who is the CEO and founder of Zerohash. Zerohash is one of the OG embedded crypto platforms out there. We're going to learn about the journey over the last several years. I'm really excited for this conversation.

Edward Woodford:

Yeah, good to be back. Nice to have a catch up.

Lex Sokolin:

So I looked at the last time we talked, and it was three years ago. So, we're recording this in 2025, which means it was 2022. I think Moonpay had just raised $500 million for their onramp at a $3 billion valuation. We were in the middle of this like NFT boom.

Embedded finance was a big thing. You know, we had DriveWealth and Synapse and lots of other companies that were doing open banking and plugging financial products into all of these fintech footprints. And we were about to go into this SPAC fintech boom with everybody making billions of dollars. And of course, that's when the crash happened. And lots of people got lost in the desert for the next three years. Zerohash has not tell us where the company is today and what things look like from your seat.

Edward Woodford:

It's been a been an interesting ride. You give a good synopsis of the past. I mean, look, I think one of the things I say is that the challenge of building in this space is narrowing your emotional bounds, right? You know, that was the absolute peak frostiness and not, you know, getting above your skis, so to speak. And likewise, you know, there was a pretty material downturn and then kind of narrowing the fearfulness and continuing to build. So, you know, we built and scaled year on year since then.

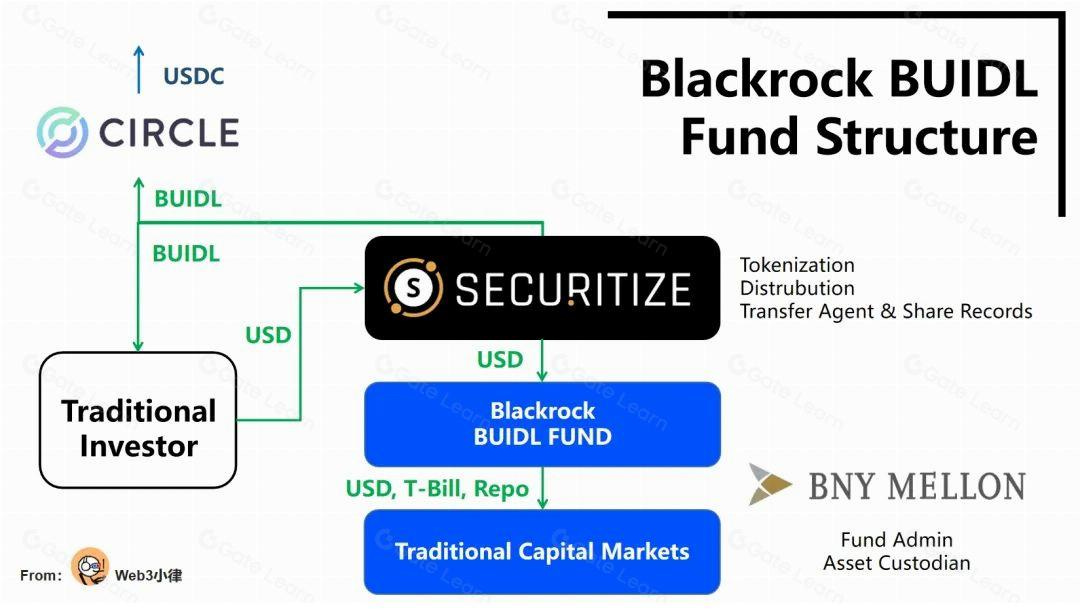

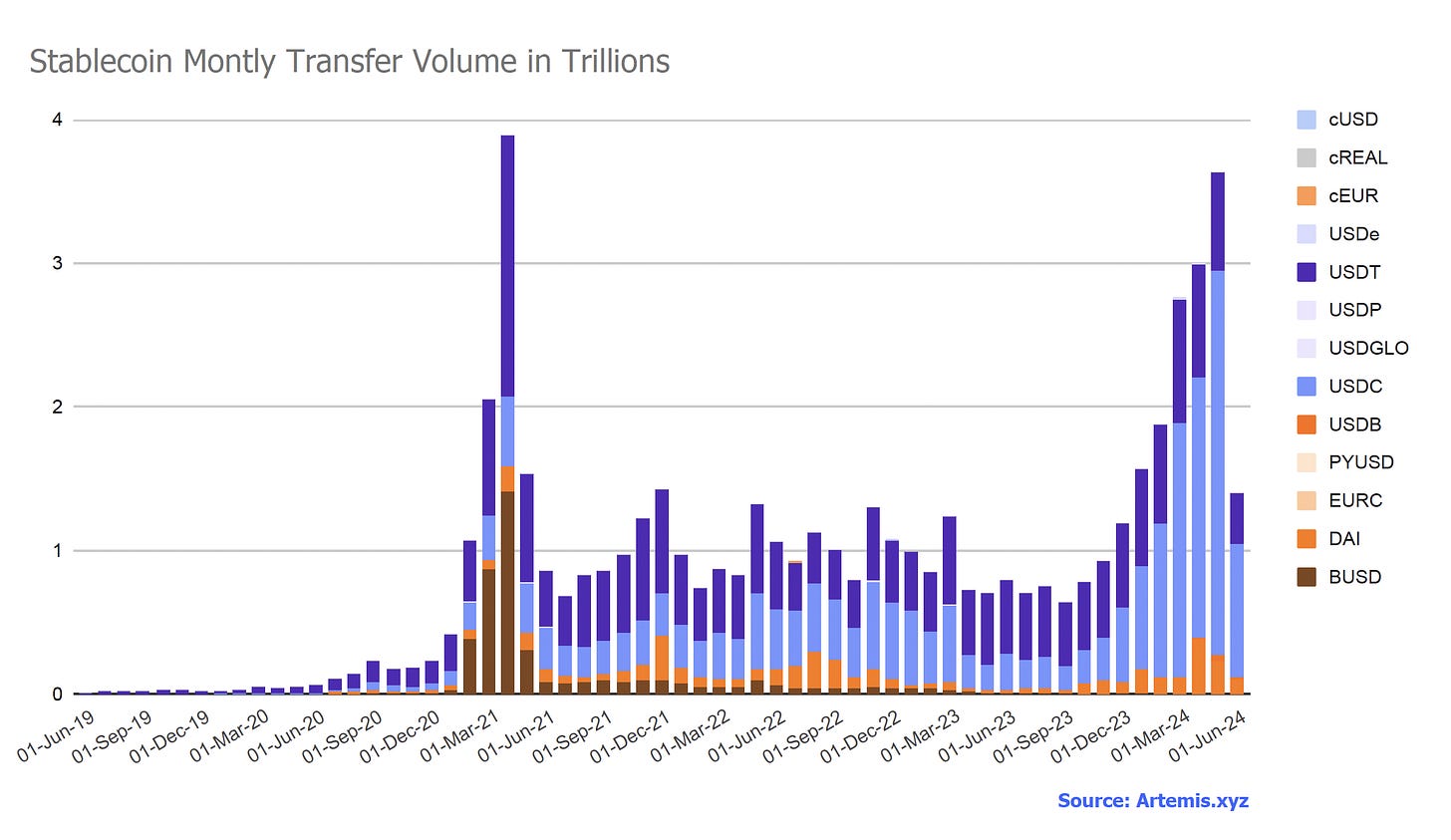

So we've grown revenue year on year, which is our key metric and also scaled up volume. You know, the way that we kind of describe the business now is that we are an infrastructure business for both stables and crypto. About three years ago, stablecoins were less than 5% of our volume. They are now 50% of our volume. You know, the breadth of use cases has expanded from, for example, clients that are crypto native, such as MoonPay and Transak and Ramp to increasingly web2 or fintech native companies, whether that be for example, groups like shift for or new they or for example, stripe and then new verticals that have continued to expand such as tokenization. We now power, for example, stablecoin on and off ramping into BlackRock's Buildl fund, Franklin Templeton’s Benji Fund, Hamilton Lane's funds as well. And then obviously the brokerage space. So, if you think about that, payments has grown. I would say it's broadened into more traditional companies. And we've been a big part of that.

Then there's been the new space of tokenization, which has now started to get some, I would say some, some decent traction. And then, you know, we did also do a lot in brokerage three years ago. And I would say that that business line more or less went on hiatus. It grew slowly, but that was largely because of some of the actions of the SEC with, you know, things like 1 to 1, these accounting bulletins, which effectively made it uneconomical for groups to expand into the crypto space. If you were a brokerage firm. And now when you look forward, we're sitting here and its public that, you know, major banks, Morgan Stanley, Charles Schwab, SoFi have all publicly announced that they're going to do crypto products. And so that brokerage part of our business is accelerating very, very quickly as well. So that's kind of how we break down the business payments, tokenization and brokerage.

Lex Sokolin:

It's nice to have revenue as your north star. I've seen some pretty crazy kind of volume sizes recently around different parts of this industry, you know, so Uniswap, the on-chain DEX, recently announced that they've powered a cumulative 3 trillion of volume, which you know, for scale stripe I think does a trillion and change give or take per year.

So Uniswap, which is like a team of 15 very smart kids, I mean adults professionals built this machine. That's huge scale. I think the bridge acquisition into stripe the numbers that kind of float around. There are volumes somewhere between 5 billion to 20 billion per year, you know. Can you give us an order of magnitude like where does Zerohash sit in terms of how much flow you power?

Edward Woodford:

Yeah. So I think obviously comparing a trading business like Uniswap where the margins are sub bits to obviously a payments business like stripe, you know I would say is maybe a little bit of a false analogy. The margins that stripe make are obviously significantly greater than Uniswap per se. But Zerohash process tens of billions of dollars a year. And we're really proud of kind of our on-chain volumes as well.

Lex Sokolin:

Did you expect that when you were starting the business, were you like, in four years, I'm going to process 30 billion of volume? Like, are you surprised by where you got to?

Edward Woodford:

I mean, I wouldn't necessarily surprise. I mean, I think I always want more. I'm a little insatiable. I think, you know, when people ask me, hey, are you worried about your competitors? You know, you mentioned, for example, Bridge. I think the honest answer is no. I mean, we have the largest names in the space, and I know my volumes and I know my revenues. I want to get to hundreds, if not billions of dollars of revenue. And that has to come not from taking business from my competitors. It has to come from scaling the pie. And so, you know, I still think we're relatively early. I think that the taps have come off. You know, the SEC has taken a step back in the US. Every bank will now enter the space, the stablecoin bill that will accelerate that as well. And then the Bridge acquisition by Stripe. It has really drawn a lot of attention to the space from Stripe's competitors, many of which are already customers of Zerohash.

And so I think putting Stripe into context is also important. Stripe, although a very large and established company, a fantastic business, they actually only account for less than 2% market share. And so the other 98% market share are playing catch up or starting to move very, very quickly. And so that will lead to more and more acceleration. But I think, you know, the question of volumes, I think it really comes down to the applications of stables and crypto. You know, if it's more of a merchant payments use case, the volumes are going to be smaller. You cited, for example, the straight number. If stables continue to disrupt, for example, cross-border remittances, those numbers will be much larger. But the margins will differ. Right. And this is often what I talk about when we talk about stables and crypto. The margins that you can charge really depend on the use case. And that depends on what you what value proposition you're actually providing. People will pay for application and use case and usability.

So, to make that more tangible, for example, you know, not sharing anything too confidential, our margins on our for example, our account funding product are significantly larger. So, our account funding product is effectively leveraging stablecoins to fund a brokerage account, a gaming account. So, we have, for example, groups like Kowsky, which is an event-based trading clearinghouse in the United States. We're going to be launching a number of players, including clearing brokers and brokerage platforms, including Tasty Trade. So effectively there, you're leveraging stablecoins to fund your account. And the margins there are higher because the alternative is you don't fund your account. If you want to fund your account on a Saturday, you're happy to pay a higher fee, because the alternative is that you just simply don't place your trade when you when you basically look at remittances. What you're effectively leveraging stablecoins as is a mechanism to not have to pay cost to capital and cost of capital as interest rates come down. You know, you're talking you know, 5 to 10 bps is effectively the overnight rate.

And so that's what you're competing against. So, I think when we talk about volumes, that's often an ego number. That's why I talk about in terms of revenue we talk about volume and revenue. But revenue really depends on the use cases that you're powering, and they differ based on the actual value proposition that you're providing through stables and crypto.

Lex Sokolin:

Yeah. I'm with you. Let's dig in for a moment into this distinction. The industry is starting to make between crypto and stablecoins. Which tickles my fancy. I'll put it that way, because the way I see stablecoins are as structured products and derivatives that happen to be trading on chain like any other token. You know, and a lot of the story of stablecoins is the same story that Bitcoin used to tell us. You know, we're going to have international payments in a store of value that is fit for purpose for digital cash. And this kind of payments use case that Bitcoin was supposed to have is now sitting with the US dollar.

Can you talk a little bit about why do you think the fintechs are okay with stablecoins, and why all these kinds of new entrants and people that are coming into the space are happy to work with stablecoins, and why are they trying to shed the sort of crypto label? And, you know, whether from a company or product perspective? Is there any difference or is just a repackaging?

Edward Woodford:

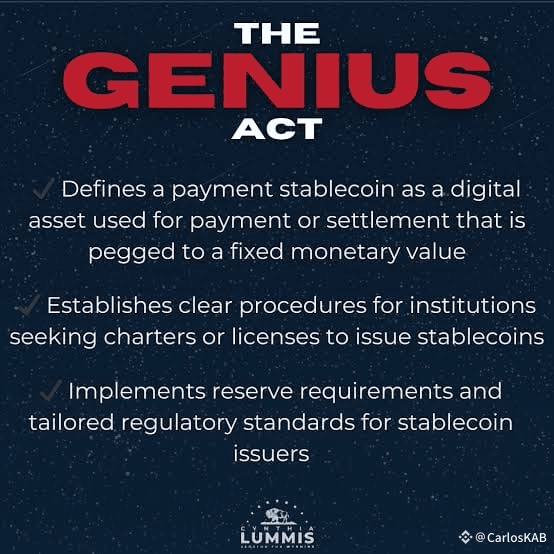

Yeah. I mean, look, a great question. I think in hindsight, we were potentially a little slow around this bifurcation. And I'm actually very aligned with you philosophically about what you're saying. Look, a stablecoin does not exist without crypto. And what that means is if you're sending a stablecoin on the Ethereum blockchain, you need to pay a fraction of Ethereum. If you're receiving USDC on Solana, you have to pay a fraction of Solana, for example. So, these two things are incredibly interwoven. And my mental model is more that there's blockchains, there's assets and there's infrastructure on top. And I think that's maybe, you know, similar to you if you spent a long time in this space, that's kind of how you that's your mental model. However, we've had to adjust based on the practical realities, and I'll let you know what you know. I'll explain why the realities have shifted. The first thing is obviously legislative. Here in the United States, there's been a fundamental bifurcation between crypto, which has largely been captured in the market structure bill versus, for example, the stablecoin bills, either the Stable Act or the Genius Act.

There is a big difference in terms of how these things are overseen, overlooked and how you speak about these things. I think, secondly, fintechs have become maybe more comfortable with stablecoins more quickly than crypto for a number of reasons. And I think it's fundamentally driven by the fact that stablecoins have some fundamental properties which crypto don't, primarily that stablecoins. And I'm talking about the majors, right? I'm not talking about, you know, the long tail of algorithmic stablecoins. I'm talking about centralized issue stablecoins, which I think is what most people talk about. If we talk about stablecoins, they are centrally issued. And what does central issuance mean? Central issuance means that you can effectively lock and block assets on the blockchains. And so that gives people comfort that effectively you are able to lock through a centralized entity, those assets, which is obviously very, very different to what people deem to be crypto. I think thirdly, people potentially see more applications of stablecoins. Beyond, for example, what people have bucketed crypto to be as a maybe a speculative asset, which I think is a very, very narrow view of what crypto can be.

But it's a simple heuristic that people that have been building in stablecoins have really latched on to. So those would be the three drivers that I think have created a distinction and a distinction that matters to buyers. And therefore, as the seller into these groups, you have to adjust. And that's why, for example, you'll , you know, in terms of what's shifted in the last three years, the, you know, the way that we framed the business, we are a crypto and stablecoin infrastructure business. We talk about our volumes, distinguish between stables and crypto. And so, I think those are kind of important points. I actually think the construct of stables is even broader. So maybe you've heard it here first, but within stables I think you're going to have this bifurcation between stablecoins, right? USDC, USDT, RLUSD and stable instruments, yield bearing instruments. And again, I actually think that it's somewhat of an artificial distinction, but one that is actually going to be distinguished largely for legislative reasons, that in the United States, stablecoins won't be able to pass interest where stable instruments will.

And the way that we've defined and the way that these things are licensed and regulated. Stablecoins can be much more fragmented or fractionalized. Rather, they're much more programmable. They're much more easily transferable. And when you compare it, for example, Buildl or Benji, where Buildl has a $5 million clip size, there's some limits in terms of permissions, in terms of transferability. But ultimately, I don't think that the distinction should exist between stablecoins and stable instruments. But they will partly because of legislative reasons and partly because of application reasons and technical distinctions that that currently exist.

Lex Sokolin:

Yeah, it's an interesting point. I mean, my current thesis is that stablecoins are the distribution mechanism for yield bearing RWAs, you know, so you have these large chunks of institutional collateral that have a bunch of permissioning on them, but then they collateralize currency, that currency can float around and live in applications and be applied. I mean, your business is very global, and the regulatory posture has changed so dramatically in the last six months.

I'm sure you were paying attention to MiCA in Europe and the stuff the UK is doing. And then, you know, in Singapore and Hong Kong there's things going on. The MAS is always pushing the Hong Kong dollar - who are the live players in regulatory policy now and what is really driving it. Like what's the reason for it? I know there's been a big political push on the Republican side in the US to like, unlock crypto, and part of that is the industry's lobbying efforts. What's really going on in terms of where the leverage is coming from?

Edward Woodford:

Yeah. So, we operate in 200 plus countries. And, you know, we have licenses and entities in, for example, Canada, Brazil, Bermuda where I was last week, you know, the Netherlands, which is a kind of our maker hub. Australia and New Zealand. So, we take a very global view in terms of, you know, what's driving each of these factors. I think, you know, for example, in the US, I've been to DC, I think close to eight times already this year.

And I think there's a couple of drivers primarily around overreach of government. And for example, sub 1 to 1 is this very niche accounting bulletin. But effectively the government own what is called the Government Accountability Office. This is often missed. The government's own Government Accountability Office during the Biden administration actually said this was a governmental overreach. And both houses actually agreed. Both chambers rather both agreed that this was an overreach by government. And it was actually, you know, overruled by Biden. I think what shifted was this pushback of governmental overreach that existed and has actually been a relatively bipartisan issue. I mean, both the House and the Senate agreed that some 1 to 1 was an overreach by government. And so I think that's the abiding force. I mean, I am, you know, friends with some of the largest donors to the campaign. And often they start the conversation with, I'm not a Trumper, but…And then the story that tends to be told is one of pretty scary government overreach.

I've had friends who have had the FBI turn up their house purely to ask questions. Right. The SEC. And people talk about regulation by enforcement. I think that's actually missing part of the story. I mean. Regulation by enforcement is actually much more in the open. There's actually that what was very nefarious was what I would call regulation by implication. So having the FBI turn up at the exact same time at you, and your co-founder's house is implying that you're doing something wrong, and we will continue to push on you. If you look at the FOIA requests that have come out, and Coinbase has done a fantastic job of this. If you look at what the guidance letters that were being provided by the banking regulators, they are effectively saying this is a highly risky space and if you do something in it, we will make your life hell. So, I think it was this visceral pushback against both what was very much out in the open, which was regulation by enforcement, but actually a much more subtle, maybe not even subtle, but much more not in the open regulation by implication.

And that is what I think drove people to move into one direction. And I think it's what frankly, now there's actually very little pushback from both sides. I think there's actually large, largely bipartisan support. And, you know, I hope I don't jinx it for the stablecoin bills, but largely bipartisan support. What's left? Now to get over the hump is relatively minor, and it's largely been politicized. But I think that's ultimately what drove the conversation in the United States. And clearly, you know, other places like Europe saw an opportunity to take advantage of some of the challenges in the United States. And actually, I think it's a pretty simple story. Robinhood invested very heavily in Europe. Obviously, they bought Bitstamp. And Robinhood is actually people think of them as a brokerage business. I actually think of them both as a dominant brokerage and payments business. And when Robinhood does something, other people pay attention. And I think, honestly, Robinhood has been the greatest marketing tool for Europe because it showed a massive US entity spending significant time, significant resources in Europe. And it drove the conversation to Europe.

Lex Sokolin:

There's still a bit of reluctance in the US and some pushback on the genius act. And there's still a portion of the anti-crypto army. But I think this reframing of stablecoins into something equivalent to a payment rail, even though technically that's not really what's going on and distributing it through every fintech possible kind of de-risking using a different word and de-risking it. And you know, like I'm gonna go on a rant here because it's just it's so offensive to me, honestly, that because the word crypto sounds dangerous, it's bad. And because the word stablecoin sounds stable, it's good. You know, like I feel that's the level of engagement that we get as an industry from the entire world. And it's just ridiculous. I mean, the word crypto is a fantastic word because it implies cryptography, and cryptography is safety and security and effectively is what was dispositive for the outcome of World War Two, like being able to crack the communication secrets of one side versus another. You know, it's like sophisticated math and all it's taken to drive institutional adoption is to replace a scary word with a word that sounds a lot nicer.

Edward Woodford:

Yeah, I mean, I've been in this space since 2017. I bought my first Bitcoin in 2015. I'm a very much a true believer in terms of what this technology can do. But ultimately, if I have to change the framing that that's okay with me. And maybe that's just the pragmatic optimist, but if we had not changed the framing, you get bucketed into one section. And this is what sometimes frustrates me around relative new entrants into stablecoins. People within the last two years when I entered, stablecoins weren't a thing. Actually, stablecoins, the market cap of stablecoins, were actually significantly larger four years ago. I think as a founder, like my principles haven't changed. The framing has had to change. And like I said, we were a little slow. But ultimately, if the regulatory and the business way that people are thinking about things is shifting and creating this artificial distinction, despite the fact that ultimately, they are built on the same fundamental technology. That's okay with me, but you do sound very similar to me behind the scenes in terms of my views on these things. But you have to adapt in terms of marketing and that you otherwise you get bucketed as an outsider.

Lex Sokolin:

Let's talk about the use cases. And you mentioned a couple of pillars of growth. I am interested in this delta between the embedded brokerage business, which a lot of the consumer footprints, you know, whether it's the Robinhood's or revenues or whatever, need an embedded crypto brokerage business versus the emerging payments use case and payments split out into treasury operations and remittances and commerce. All of this, we've all been waiting for commerce to catch up to trading as a revenue driver in Web3, and it's taken a very long time. Can you reflect on why that is? And then when you look at that question as applied to your business, like what are the primary sectors or business types that are getting traction and growing really well within commerce and payments?

Edward Woodford:

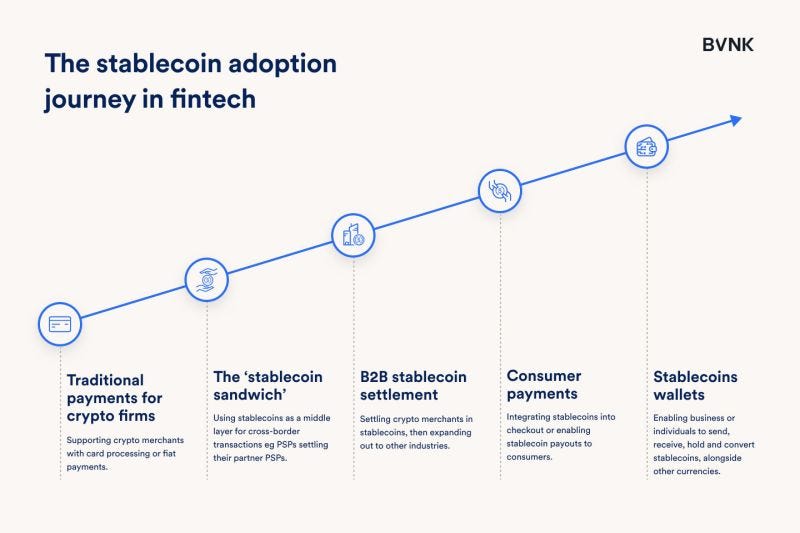

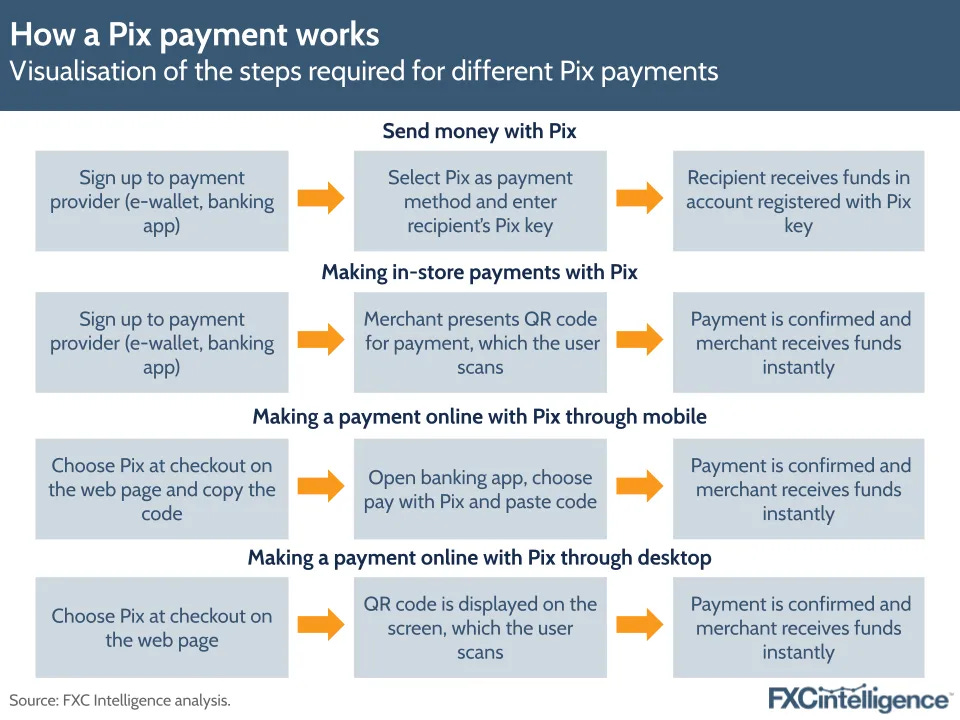

Yeah, absolutely. So, I think there's often this mindset that just because you can, people will, just because people can pay with stablecoins or can pay with Bitcoin, they will. Again, it goes back to value proposition. Actually, if you look, you know, customers don't care that the interchange rate is 3%. They get their points and they're happy. So, I think you have to unlock true value for the user, not only for the merchant. So maybe in terms of I'll just focus on pay ins or what we call pay-ins, which is effectively I think what most people view as the payments use case. And then I'll go broader. The fundamental point with pay-ins right now is it's clunky and to expect a customer to think not only in terms of assets. Right? USDC, USDT, RLUSD, Bitcoin. But not only that, but in terms of chains. So USDC is now on 20 different chains. That is an unusable UX. And so, what we've really been talking about for the last seven years is distributing this infrastructure, solving the complexities from a technical and regulatory perspective. I believe that the next seven years will actually be focused on usability. And that's where we're diving in pretty deeply to allow a customer to think more in terms of account-to-account transfers.

I am paying, you know, Equinox for something, or I'm paying Netflix for something, as opposed to I need to think about what asset is this and what chain. So, I think fundamentally, the reason that pay-ins haven't taken off largely is because of a usability challenge. And then secondly, I think it's a lot of people have been focused on the wrong areas. Allowing me in the US to pay for my Starbucks and stablecoins brings very little accretive value, both to the merchant and to myself. Where I think it makes a lot more sense is outside of the United States and largely subscription businesses. So, these are low value transactions where the margins can be pretty tight when you are moving money across hundreds of different countries and the costs of doing so. Now, the challenge with stablecoins is that they are exclusively a push payment. Right now, I have to actively log in to pay my Netflix every month. Again, that is a non-usable experience. So, we are increasingly, and we've announced that we've we're launching a subscription business payment method for people outside of the United States, which I think is incredibly exciting.

So, you've got to abstract away the complexity of chains, and you've got to abstract away the complexity of me logging in every month to pay every single one of my subscriptions. That is just not a usable, a usable, practical payment method. So, I think those are the problem sets in terms of patterns that we're pretty passionate about in terms of payments more broadly, where we're seeing exceptional demand is, for example, stablecoin payouts. So, this is for example, you can go to remote today and you can pay out people globally through Zerohash. I believe that every two-sided marketplace in the world, whether that be, for example, a content creation platform, whether it be like a Replit or an Upwork will offer stablecoin payout methods. And the reason for that is because it allows for true value for the user, which is, hey, if you're a freelancer in the Philippines, you can be paid effectively instantly. And you actually get your value, and you hold a tokenized representation of a dollar. So, we launched our payouts product at the end of last year.

We've now paid out in close to 100 different countries. And you know that business has grown very, very aggressively and people are happy to do what people sometimes term as the last mile because the value proposition is there. From a utility standpoint, it's cheaper, it's quicker. Then another payment method that's grown very, very quickly is what we call our account funding product, which I outlined before, which is effectively that you can fund your account 24/7 365 so if you're funding a gaming account, a brokerage account that has real value proposition, and then, you know, there's obviously the remittance use case, which is effectively what some people have called the stablecoin sandwich, which is, for example, US dollars to Mexican peso and using stablecoin as the intermediary hop. And there the value proposition is effectively that you're not paying the cost of capital, because that's largely how it exists. That use case, I think, continues to evolve. But those are some of the payments use cases and some of the frictions that I think have been solved or need to be solved.

What I think people miss on stablecoin payments is one thing. This is going to be an incredibly powerful APM in the last 18 months. You know, 750 million people now have access to this APM through a primary account. And what I mean by primary account is, for example, a PayPal, a Revolut, a Nu bank, a Robinhood, a place where I hold money today. And those groups have all embedded stablecoins natively. And I think you'll start to see more and more fintech such as Cash App do the same. And what's really exciting about the stablecoin bill is that every bank will be able to do the same. So, this becomes a very powerful alternative payment method from a distribution perspective. Now this technology is now distributed. But like I said, for it to be usable, there has to be this abstraction away from the concept of multiple chains and multiple assets. If I'm sending Lex USDC on ETH and you want to receive USDC or Sol, make me think about that is an unusable UX. Same thing if JP Morgan launches a coin and I'm at JP Morgan at York City and I want to send you JP Morgan coin, but you can only accept Citi Coin, that is an unusable UX.

So, I think the interoperability standpoint is a really powerful piece. And the user experience is pieces that are there. But I'm very, very bullish in terms of this distribution of technology. That's why I think we are in 2025. I think over the next 12 to 18 months, the usability story starts to get there too. And that's where you see a massive, massive uptick in the payment use cases. Hopefully powered by Zerohash.

Lex Sokolin:

I wonder what the industry structure looks like in 3 to 4 years. The reason I ask this question is irreconcilable facts in my mind about the payments industry. You know, fact number one is B2B international National cross-border flows are infinite. It's not a monopolized sector, it's just enormous. There's space for so many different players. And fact two is in every generation of fintech. And I consider blockchain and crypto and stablecoins and all of that to just be financial technology. There are good companies that try to tackle the cross-border problem using the tools of the day. You know, so TransferWise, with replicating bank accounts in every jurisdiction and then settling themselves, the risk to cut down on the time it takes to move money because, you know, the money's not actually moving, they're just moving the numbers around in the bank accounts they have.

And then before that is companies like Payoneer, who maybe were a little less efficient at doing it but did exactly the same thing. You know, and companies before that or the, you know, the card networks, swift and backwards and backwards and backwards. And it feels like there is a insurmountable problem. And every cycle, they're kind of companies that come at it and build to a pretty large size. And at the same time there's like new entrants saying the problem is still not solved. Like we got to do it a different way. We got to do it a different way. With that context, what do you think the industry structure in this payments space looks like? How big can somebody get? Like whom do you replace? What's the shape of market share. And then like, are we doomed forever to repeat this like in five years? Are we going to have the quantum, you know, money balancer? Like, why does this keep happening?

Edward Woodford:

It's obviously a big question, I think. Maybe just go into first principles. What do blockchains and payments leverage in blockchains. What does it disrupt. Does it disrupt more of the space, or does it disrupt the networks? And my view is that it is more disruptive of the networks, the visa's, the Mastercard's of the world, you know, stablecoins and these distributed networks on which they're built, I think is one challenge. It's one alternative payment method. It is an alternative network to what has historically been the dominant, you know, networks. And I think that's the challenge point. But that's no different to, for example, government-built networks. So, for example, Pix, the explosion of Pix and the threat that that places on for example, visa and Mastercard is material. So, I think in terms of the disruptive nature and market structure, I think stablecoins are part of that market grab away from Visa and Mastercard. But it's not the only driver. I think. Secondly, it is a competitive threat to the Swiss of the world. And I think that the threat that it places is largely on, I would say, the downstream correspondent banks.

If you're one of the largest correspondent banks in the world such as this or, you know, like a city or a Bank of America, I think you have a major incentive to launch a stablecoin or to leverage stablecoins. And what does that do downstream? If I want to send a payment to the Philippines, I think it goes through 3 or 4 hops. And I keep mentioning the Philippines because it's a large area for us. It's a large place where we have people, so we know the pain points very well. So, I think the disruptive nature of this in terms of market structure, I think it disrupts and eats into the share of Mastercard and Visa. I think it eats into the share of Swift, and I think it potentially displaces, depending on how aggressive a group like Citi is. Downstream correspondent banking relationships And I would be very nervous if I was a partner of Citi downstream. If Citi were to launch a stablecoin, which they're rumored to be doing, because then they don't need you, then you can basically go from a multi-hop remittance through four or 5 or 6 banks to maybe two, and maybe they have entities in both those jurisdictions as well.

So that's what I think is the disruptive nature. That's what I think the market structure looks like is, you know, eating into those what is largely oligopolies in those spaces. It will compress the oligopoly of Visa and Mastercard. It will compress the oligopoly of Swift, but it may actually allow for more concentration for the corresponding banks.

Lex Sokolin:

If we now switch over to the brokerage side with the trading business and those revenue pools, and to kind of rewind back, there used to be this narrative about like, all financial products are going to be embedded and you're going to have super apps delivering you every financial product. And I think a bunch of that is true. These days, you know, Revolut and Robinhood, SoFi and a few others are multifunctional and work as your bank account, as your trading account, as your payment account. These things used to be quite separate. And I remember for Zerohash like this; the embedded finance story was a big part of the of the strategy. What's your view on that product line? Crypto brokerage.

And what do you see as the major trends? You know, we can touch on the tokenization of securities because I think a bunch of that is back. But like that's still the largest revenue pool out there. You know, how do you treat it? How do you compete in it?

Edward Woodford:

Yeah. So, I would actually say that, I mean, actually our payments business is larger than our brokerage business now. But in terms of the crypto story. In terms of crypto brokerage, again, Robinhood has been the greatest pitcher of cash because if you look at their most recent financials, they think it was 40% plus of their revenue came from crypto. That is pretty extraordinary. And so, you know, we've been saying this for years. And I think this is starting to play out that every traditional brokerage platform will have to have crypto. And every crypto platform of size will have a traditional equity, a traditional banking product. And you start to see that play out with groups like Kraken by, you know, by, for example, Ninjatrader, you know, they've obviously launched an equities product.

So, I think that this intersection is only going to increase and the unlocks for the brokerage platforms. So, if you look at who launched crypto in the United States of size, you know Interactive Brokers is one of our customers. I think there are $65 -$70 billion publicly traded, companies like Fidelity launched a crypto product natively themselves. Robinhood launched the crypto product. What is the commonality between these? None of them are bank holding companies. And what people misunderstand about banks. So, for example, Schwab or SoFi, is that even if you have a brokerage entity that is completely distinct, being a bank, which means you effectively sit within this bank holding company, the restraints and the constraints exist on all the subsidiaries under that bank holding company. And so, what's shifted with the OCC guidance that has been has come out over the past few weeks, which is effectively overturn the regulation, by implication, the wink, wink, the pretty explicit points that if you do something, we are going to make this very, very difficult for you.

The banks are now entering the space, and that's what's going to fundamentally dictate the evolution of the brokerage space is pretty much every bank has a brokerage business. Morgan Stanley has E-Trade. So, if I have a brokerage product, what they call their invest product, and those groups publicly have stated that they're going to launch crypto. And so, the brokerage business is only going to go one way. A lot of brokerage businesses are looking at the revenues that Robinhood makes, and it's a very significant potential lever. If you're the CEO of a brokerage business or a bank, how you know, if you can get half the success of Robinhood, you can grow your revenue by 20%. There are very few other opportunities out there. So, I think those are the driving factors and the unlocks that have happened have been obviously, the SEC will draw in their actions against groups like Coinbase. Obviously, the OCC guidance that has come out that has unlocked the bank holding companies and then the repeal and overturn of SAB 121 with SAB 122. And that's what has driven the acceleration of the brokerage space and which will continue.

Lex Sokolin:

You know, it's interesting that this generation of financial companies are building effectively bank holding companies that are multiline financial products and, you know, manufacturers, they just find a way to do it in a modern way, which moves the risk off into different places. And I think blockchain based finance collapses everything, every single product, into a single market venue that you can then in a pretty seamless way, integrate, you know. So, like a super app like Citigroup is a super app. It just has to make everything and manufacture everything using the old steam engine ways rather than, you know, using electricity, the way that a Robinhood Hood can bring that to bear. Is that right? And do you think the regulatory gap can close to sort of refresh the older generation?

Edward Woodford:

Look, I think when people talk about stablecoins as, for example, a global banking network, I think that there's some there is some truth to that. But also, you know, you mentioned Payoneer. Payoneer offers accounts to people in hundreds of different countries. And there is obviously a difference between holding a stablecoin versus, for example, holding a dollar in a bank account or in a brokerage account. It's not FDIC insured. It's not SIPC insured. Often you don't earn interest on stablecoin balances. So, there are these differences and nuances. So, I think it depends on the market that you're looking at. If you are in the US today, does it make sense for you to hold stablecoins as a store of value? My argument would be largely no. Does it make sense in the US to use stablecoins as an alternative payment method? Yes, significantly so. I think in terms I think less in terms of these binary distinctions between old and new. I think it's going to be a blend. And that's obviously where Zerohash sits, which is effectively this, this bridge between old and new and providing those services. So I think it's less of a binary piece in terms of the future of how we think about financial services.

Lex Sokolin:

Yeah, I definitely hope so. And I think there's going to be an adoption curve for everybody to come to the table. When you look at the big banks. There's also been kind of a reshuffling as to who's the most innovative and is interested in being on the frontier here. You know, we know kind of the asset managers, right, that have products to offer. So, the BlackRock's, Franklin Templeton's, Wellington's, Wisdomtree’s,, those kinds of companies. We know the market makers are there. So, everyone from Citadel to jump and so on. If you look at the banks. Who do you think is the most risk on in terms of getting into market?

Edward Woodford:

I think if you look at right now, the banks that are most risk on are the banks that have brokerage businesses. It's a very defined application, right. Customers want to have bitcoin in their portfolio. We want to offer that. We see the outflows from the bank today to that's what's ultimately shifted. When I talk to execs at banks, they say what really shifted for you.

And often it's actually looking at the data about how much outflow there is into a Robinhood or a Coinbase, etc. And, you know, once those customers experience those other pieces, people start to consolidate their, their banking and kind of other services. Again, I don't necessarily know if it's risk on. You know, I think they can launch this in a, in a way that is very applicable. And these bank partners that we're, you know, that are either customers that we haven't announced yet or that we're talking to, they're obviously very conscious of the risks that they're taking and the mitigations that need to be placed. But I would say that they're the most maybe I'd use the word bullish around this space. And then I think in terms of the stablecoin application piece, I think there is a little bit of an element of wait and see. But to your questions to me earlier, what are the applications of stablecoins that really matter? Some of these groups are asking those questions. And, you know, there's a less defined business use case right now.

People can look at Robinhood and say 40% of their revenue is generated from Bitcoin, buy and sell. We need to do the same. Whereas they can't look around and say, you know, X is making Y from stablecoins. So, I think they're in a much more strategic discussion right now on stablecoins. But like I said, I think the banks that will be much more maybe at the tip of the spear versus Rascon will be the correspondent banks just because they have so much to win there.

Lex Sokolin:

That makes a lot of sense and really insightful. I learned a lot from our conversation today and glad that we got to reconnect. If our listeners want to learn more about Zerohash or about you, where should they go?

Edward Woodford:

Yeah. So, you can follow us on X which is just ZerohashX. You can follow us on LinkedIn. And then my personal X is e_Woodford.

Lex Sokolin:

Fantastic. Thanks so much for coming on today.

Edward Woodford:

Thank you.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Share this post