Hi Fintech Architects,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Luke Voiles - CEO and Board Member of Pipe, a position he started in February 2023. Prior to this, Luke was the GM of Square Banking at Block where he led the global team responsible for managing, launching, and scaling small business banking and lending products. Before Square, he was at Intuit, where he led the team in building out the small business lending unit, QB Capital, from scratch. Luke made the switch from private equity to fintech after more than a decade as a distressed asset and credit special situations investor at top-tier funds, including TPG Capital and Lone Star Funds.

He has a JD and an MBA from SMU and a BA in Computer Science and Economics from Austin College.

Topics: Fintech, revenue-based finance, embedded finance, unicorn, SaaS, entrepreneur, lending, capital

Tags: Pipe, Square, Stripe, PayPal, Intuit, OnDeck, Alloy, Increase

👑See related coverage👑

Fintech: CFPB takes aim at one of fintech’s most popular products, again

[PREMIUM]: Long Take: Getting paid now for future performance with Pipe's $150MM raise and BitClout's $200MM of Bitcoin

[PREMIUM]: Long Take: The evolution of embedded finance to $7T in flows, and the OCC's mandate to derisk it

Timestamp

1’07: From Distressed Credit to FinTech Leadership: Luke's Journey from Sixth Street Partners to Intuit and Beyond

7’17: Square Banking and the Evolution of Leadership: Navigating Single-Threaded and Functional Structures

14’53: Pipe's Transformation: Joining and Steering one of the Fastest Unicorns in History

18’46: Understanding Revenue-Based Financing: Defining Factoring, Merchant Cash Advances, and More

26’39: The Power of Storytelling: How Pipe's Vision and Innovation Led to Unicorn Status

28’39: Pivoting Pipe: Adapting Strategy and Overcoming Growth Challenges

37’25: The Future of Small Business Banking: Embedded Finance and SaaS Vertical Platforms

41’35: Navigating Regulatory Challenges: Pipe's Embedded Finance and Compliance Strategy

46’23: The channels used to connect with Luke & learn more about Pipe

Illustrated Transcript

Lex Sokolin:

Hi everybody, and welcome to today's conversation. I'm super excited to talk to Luke Voiles, who is the CEO at Pipe. Pipe is one of the original revenue-based financing FinTechs, and we'll talk to Luke about his experience across other FinTech players and in the industry. With that, Luke, welcome to the conversation.

Luke Voiles:

Thanks, happy to be here.

Lex Sokolin:

So how did you get your start in the industry? You transitioned from being an investor to FinTech, isn't that right?

Luke Voiles:

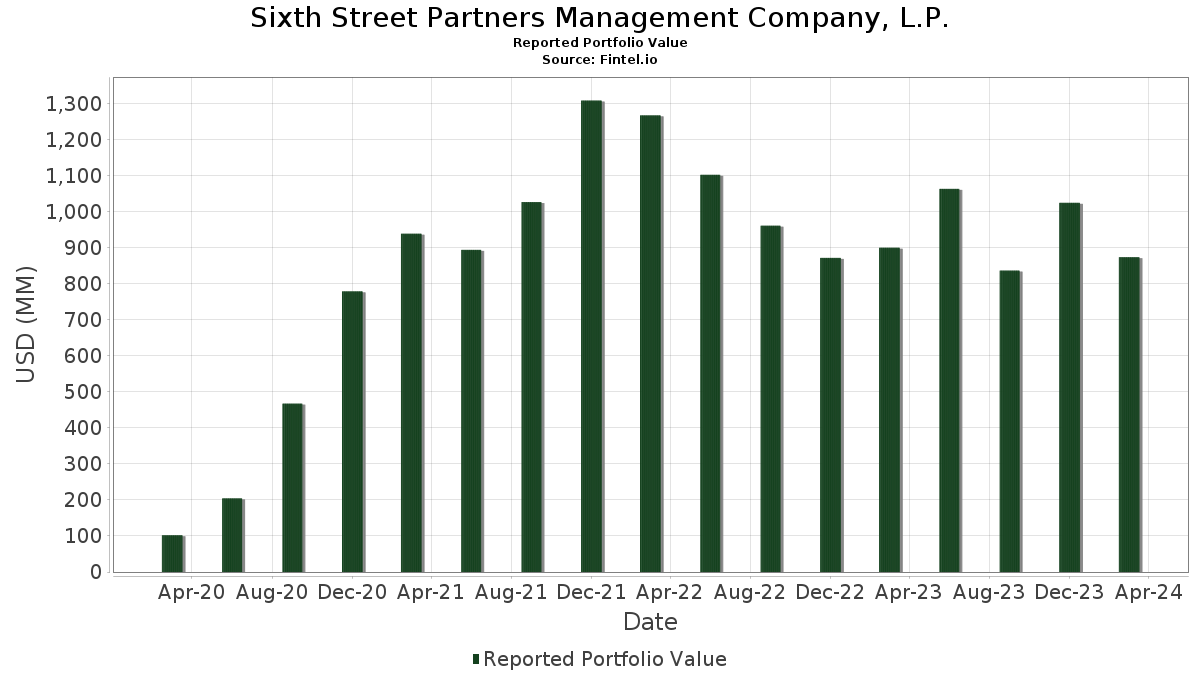

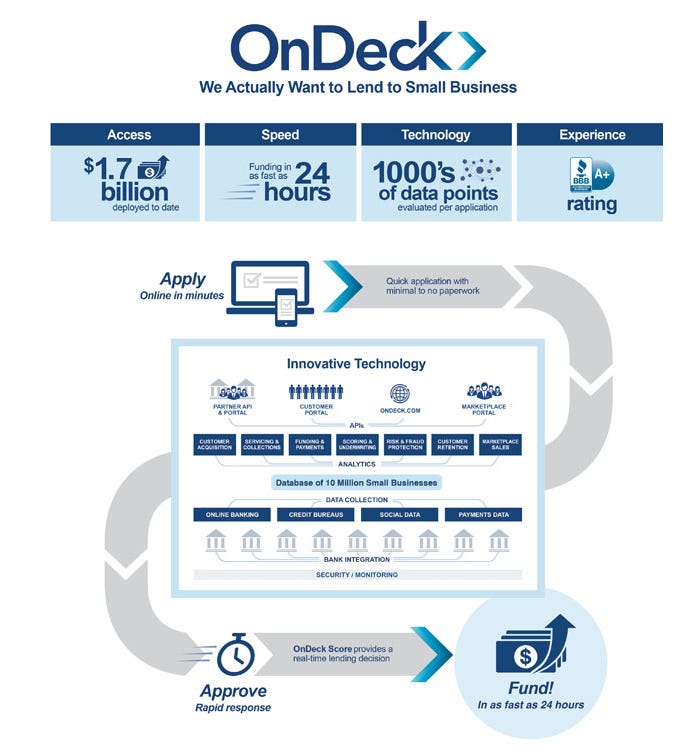

I did, yeah, it's an interesting story. I'll try to tell a quick version. So, Alex Chriss actually is the one that pulled me out of distressed credit investing. So, I was working for Sixth Street Partners, which is part of TPG Capital at the time, and I'd been trying to lend money to lenders. We bought a bunch of bad loans from banks for years and that trade in the US went away, so it was focused very much on trying to lend money to other lenders like old school factoring in MCA companies, all kinds of consumer and small business lenders. The old ones with 50 person call centers, everything manual and all the new ones like Prosper and LendingClub and OnDeck and BlueVine and Funding Circle.

Lex Sokolin:

Can I ask what that distressed trade was and why it went away?

Luke Voiles:

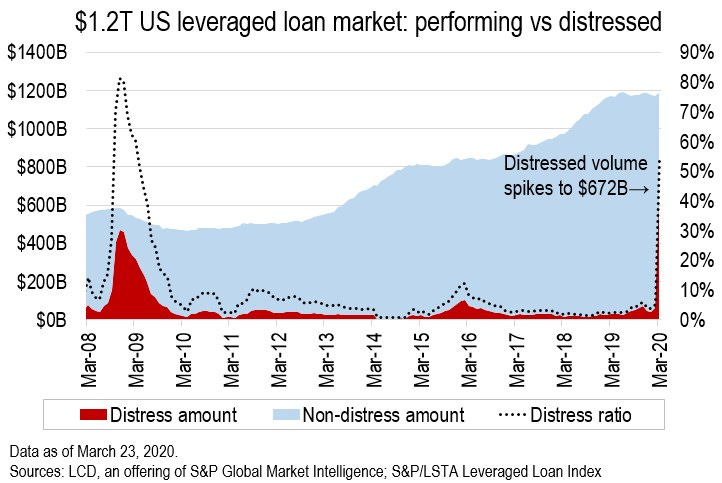

Yeah. So, after the global financial crisis, the banks had tons and tons of loans on their books that they needed to get rid of, and so I did not have a Thanksgiving or Christmas where I wasn't working for years because all the banks had to get the stuff off their balance sheet by the end of the year. And so, they were selling pools of residential mortgages and commercial real estate loans and CNI loans, all the stuff they had originated during the boom times that many of them went bad and they just didn't have the staff to work those loans out. And so many of the funds distressed or private equity funds were buying those assets and helping work them out and transition to make everything okay again so banks could start lending again.

Lex Sokolin:

Got it. So, you were very deep in the details of bank lending and that asset class. So, what happened next?

Luke Voiles:

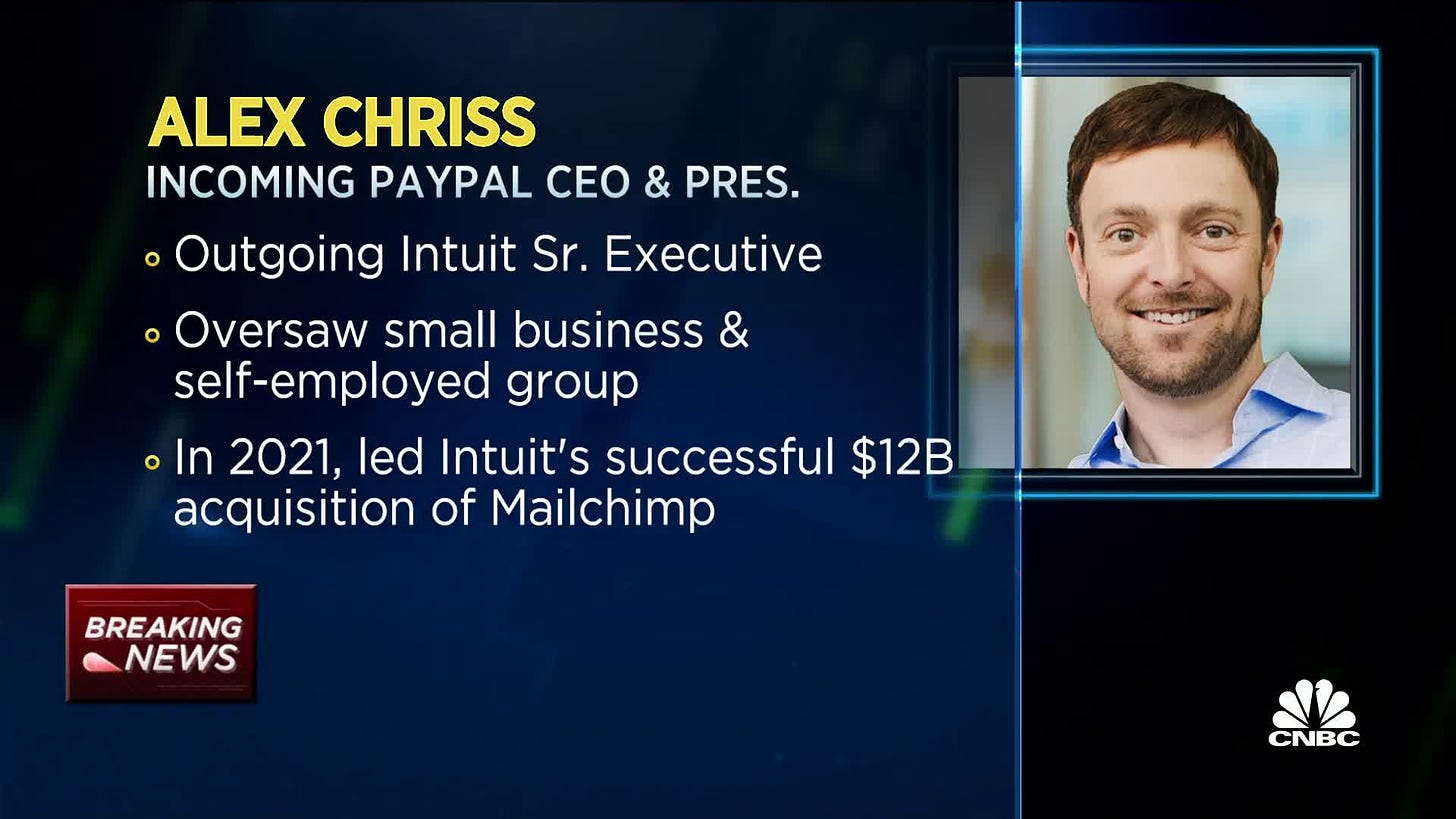

Yeah, so I guess I had folks from Ron Suber for example, was in TPG's offices. We were trying to see if we were going to lend Prosper money on their new healthcare loan business for example. And so just spent a bunch of time talking to all the folks in the space and getting to know a lot of the folks in the FinTech space. But Alex Chriss was friends with the guy that I sat next to on the desk at TPG, and so Alex was at Intuit at the time. He was actually just running the QuickBooks self-employed business before he got on his rocket ship to the CEO seat at PayPal where he is now. But he came in just to ask about what Intuit should do with all the data, all the customers, they had this, it was called Intuit Financing Marketplace at the time, or QuickBooks Financing Marketplace, I think it was at the time.

And they were just a broker where OnDeck and then Bluevine and Fundbox and Funding Circle were all making loans to the QuickBooks customers, but it wasn't growing. They didn't know what to do with it, and so he just came to ask a few questions to me. He came into TPG's offices, and we chatted about what to do. And after that conversation he started recruiting me aggressively to join Intuit to help build QuickBooks Capital.

Lex Sokolin:

And was that in your mind, an asset manager or was it a technology business, QuickBooks Capital?

Luke Voiles:

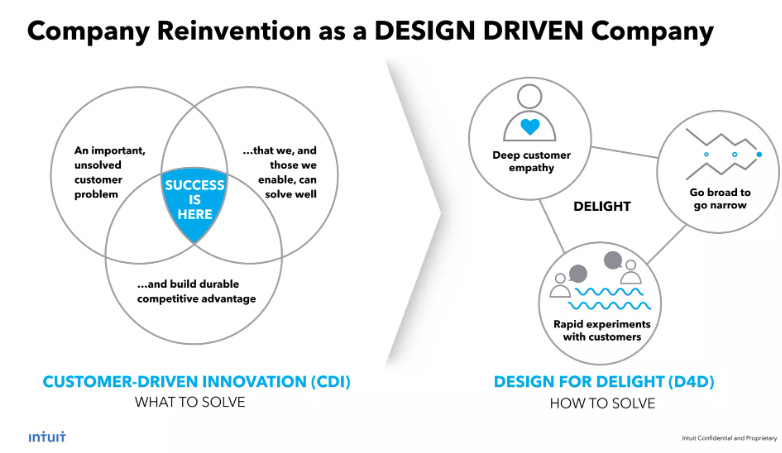

It's a technology business. It's interesting. The two hardest things for lenders are to get access to the customers and have cheap customer acquisition. And then number two, it's a consistent, unique dataset that helps you underwrite in an automated way. And so, it's both, fundamentally it's always both. If you're in the risk business, you're going to have a balance sheet of risk you have to deal with, and that's asset management. You can sell some of that risk like we did at Square, we originated 25% and kept it, we sold 75% to the capital markets where you offload that risk. But that is an asset management business fundamentally, but it is also tech enabled. You need to automate the underwriting and make an amazing, efficient customer experience. I didn't know anything about product or design or customer experience before I went to Intuit. I learned a ton in five years at Intuit about how to help customers. So, for me, that was the best education I could have gotten in tech, number one, in leadership, number two, and just how to build product.

Lex Sokolin:

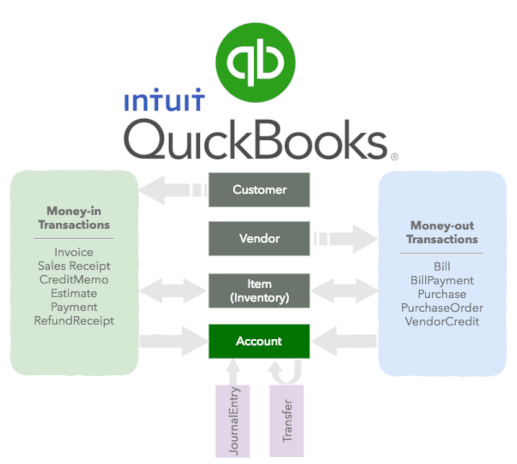

Yeah. There's a really interesting arbitrage by companies that have data and technology and are service providers with big commercial footprints of small businesses or consumers where you can do underwriting in a way that's much more accurate because you're actually connected to the flow of business data and you're also in that flow of payments because you're doing the accounting. I remember how a bunch of different companies you wouldn't expect to end up adding this kind of lending as a capability built into it, how big did it get and what did the average customer look like?

Luke Voiles:

Yeah, if you think about what Intuit's customers look like, they're mainly mom and pop, less than 10 employee companies that are just trying to make ends meet. They are the true micro merchants. I think the average loan size was 20,000 maybe. And so, the revenue, think about average revenue in the 100,000 to 300 to $500,000 range or really small businesses that just have a few employees. And so, they just don't have access to capital through normal channels. They haven't been in business for two years. They don't have audited financial statements; they don't have tax returns that they can share with the lenders. And so, they just didn't have access to capital. So, it was a pretty interesting bill, but the business now is a two billion a year business. We started it from nothing, turned it into a two billion a year business in about three and a half years, and then it was a hundred million revenue business by the time I left to join Square.

It was a situation where you have the customers, you have the data, it's just build the business and execute. And so, for me, that was my first, that's my first operating role. I was just an investor. In credit investing, you're just looking at the stuff after everything has happened and then deciding whether you deploy capital into that thing. And so, I would be a much better investor now knowing what I know about the operational side of what it actually takes to originate this stuff and scale a business like this. So, it's pretty interesting. I'm a much better fit for the operating side actually, and I love it. It's fun.

Lex Sokolin:

Okay, so then you went on to Square and Square Banking. What was the connection there and what got added to your toolkit?

Luke Voiles:

Yeah, so that one, a recruiter reached out actually. So, Jackie Reisis left to go do lead bank I guess, and they put that Square capital business together with the other businesses that were under Alyssa Henry, the debit card and checking account, instant transfer savings, all that stuff. And they had just gotten a charter, so all that stuff was put together and called Square Banking, and they went outside to find the GM to run that business. And that's the one thing I couldn't get at Intuit. So what I do with everyone on my team and everybody who reaches out, that's not even on my team, I always ask a simple question, which is think about what you want to do three to five years from now and ignore everything else and think about what role or what gaps you have or what things you might need to learn to make you qualified to get to that next role.

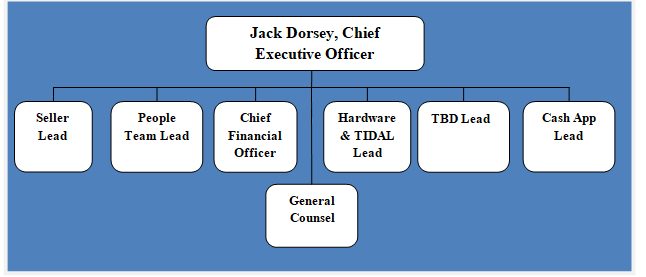

I had thought about that for myself personally. It is a basic career development question. I thought about that for myself personally, was like I think I want to be a CEO one day. I want to lead a business one day. What else do I need now on my resume to be legitimately a credible candidate to a board to be a CEO one day? And the answer to me was clear. It was I don't have true P&L or GM experience because Intuit's just not set up that way. Intuit only had three GMs. It was Alex Chriss on the small business group. It was Greg Johnson on TurboTax and then when they bought Credit Karma, Ken Lim, the founder, just stayed as CEO there. And so, they didn't have any real GM seats. Square's org structure interestingly, ignore Cash App for a minute, just think about the Square side. Alyssa Henry, who was the CEO of Square set that entire org up as a single-threaded GM structure, Amazon style.

And so, when I saw that opportunity come along, I love Intuit. Intuit, the culture's amazing. It's mission-based leadership and purpose. The people are awesome. They're there every day to help their customers. I had not planned to leave Intuit, but the role opened up and it was a true single-threaded GM role. It was a 300 million revenue business with 300 people on the team, 40% growth, and it was true single-threaded. So, there were 150 engineers on the Square banking team that reported into the GM, and there was no CTO above that. So, the only thing that doesn't report into the GMs at Square or did, Jack is changing the structure now, I can talk about that in a second, but when I was there, it was a true GM structure where HR, legal and finance were the only things that didn't report to the GMs. And so, it was a true CEO like learning experience.

And so that's the main reason I took it because I wanted to learn more and learn more faster and to be the true P&L owner and GM. Those are the things I just didn't have in my resume or didn't have in my toolkit so to speak, to move forward in the career that I wanted to have. And so that's why I took this role.

Lex Sokolin:

What are the trade-offs in terms of product management and business unit management? Because you touched on this a little bit and I'm interested to explore the idea of a single-threaded leader that's able to control and direct the functions of a division or a business, versus more of a matrix structure where you have many reporting lines and more complicated operations. Amazon is famously scaled up to a million people and they're still able to innovate, so they've definitely got something right in terms of the work structure. Can you talk about that trade-off space and any learnings that you have?

Luke Voiles:

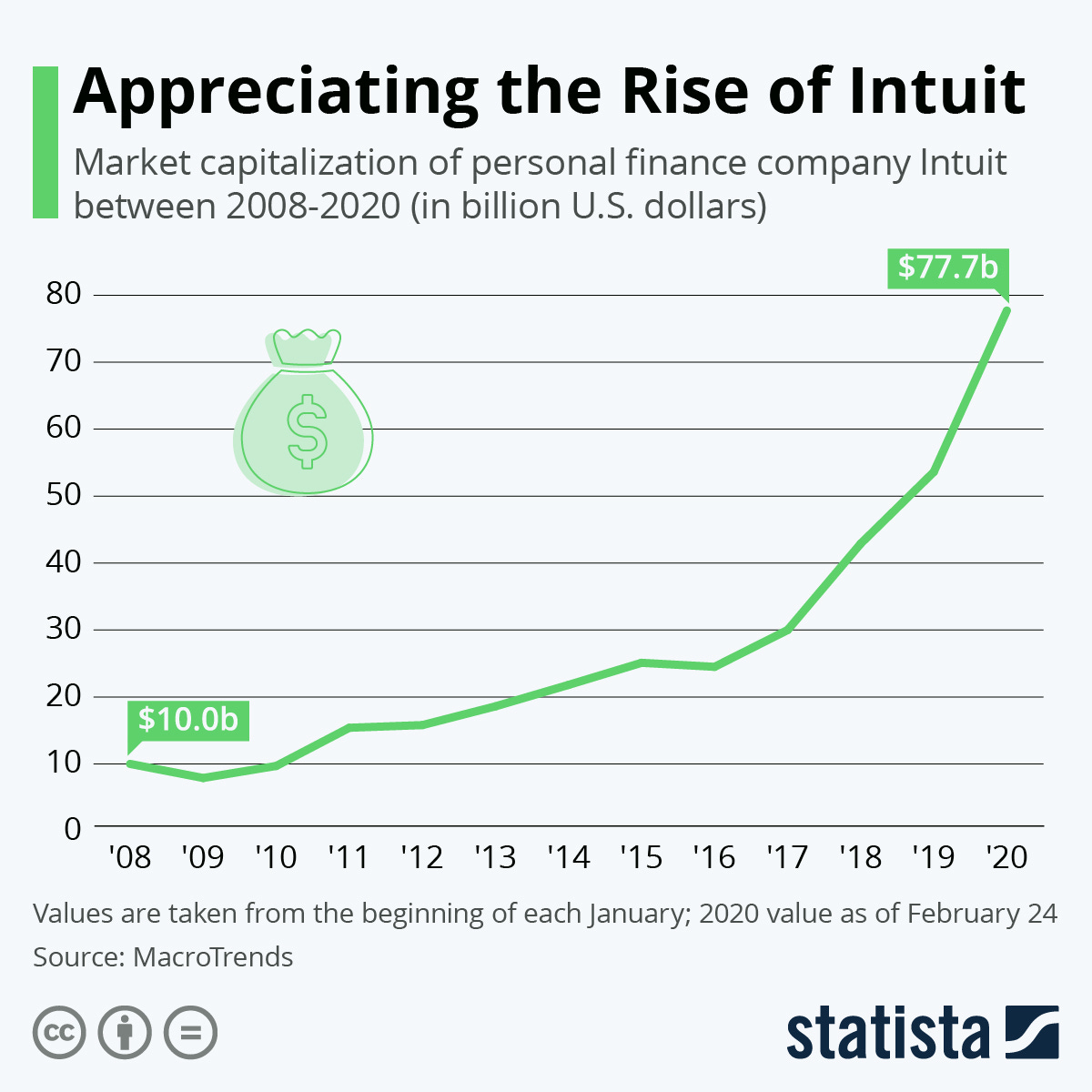

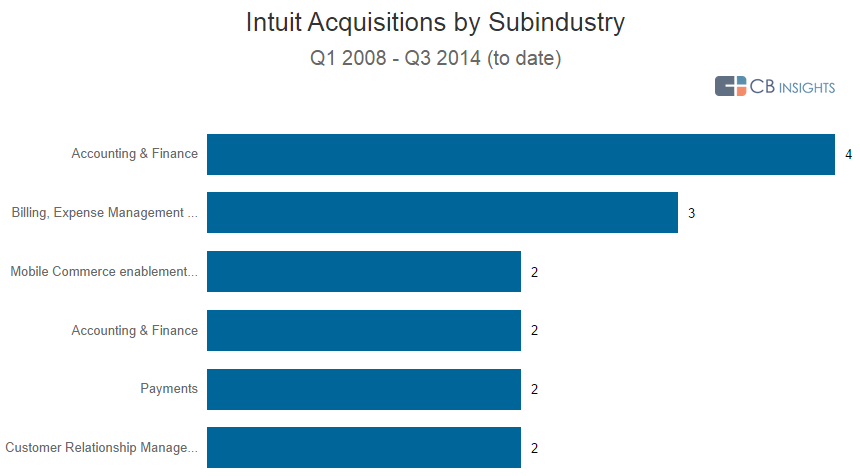

Yeah, it's almost as simple as this. If you look at Intuit, and I said this a bunch, Intuit is not good at building new businesses. Intuit is very good at mission-based leadership and culture. You can see that in Alex Chriss right now at PayPal. He is running the Intuit leadership playbook there and it's going to work. It works great. It's all about helping customers, so they've got that part nailed. Intuit also has the focus on the customer pain point nailed Scott Cook style, the old follow me home stories where Scott is watching first time use of any product that they bought. They're really good there, but they can't build new stuff. That's okay for Intuit because they buy the whole businesses to solve customer problems. They bought Credit Karma, they bought Mailchimp, TurboTax, payroll payments for all acquisitions and they use that to grow the business. It's okay.

So that functional structure works great for Intuit and I think they've thought about switching to a single-threaded structure, but they have this machine, the SaaS machine on the QuickBooks side that they don't want to mess with, and so it's too much of a risk to switch the structure. You look at Square. Square is known for real product velocity. So, the GMs at Square have ultimate control. You can just move faster. It's an autonomous unit. We had five highly regulated products with capital, debit card, checking account, savings, instant transfer, credit card in five geographies, and we were able to move really fast and build stuff really fast. We didn't have to use the risk engine on the payment side as a decision service. We'd go get our own if we wanted to. We had multiple cash reconciliation systems to reconcile stuff to the penny because these businesses were built separately and you start to align stuff, but it just lets you go super-fast.

The downside of the Square setup is that all those products I mentioned, we didn't have purview over bill pay or payroll, so we couldn't actually get the bill pay team or the payroll team to allow us to put an access point to pay bills with capital or to pay your payroll with capital. So, you end up with these siloed isolated businesses that can grow super-fast, but the stuff just doesn't work that well together, and I think you can see that on the Cash App versus Square part. It just felt like completely separate companies when I got there. Cash App was a different company. They had different offices. It was crazy until the Afterpay acquisition starts to stitch the ecosystems together, everything felt very siloed and separate. And so, there's a massive trade-off where the products actually don't work that well together.

And interestingly, after I left, and Alyssa has left, Jack is unwinding the GM structure. He is making a massive bet on getting rid of the GMs effectively, switching back to a functional unit so all the products start to work together more seamlessly again. And so, this is such an interesting case study to watch over the next two or three years to see if he can figure it out and make it work. It's a big risk to have an organizational shift that large across your entire company, but that's the trade-off, it's like speed of execution versus stuff working together well, I think it's fascinating. And what's crazy is the companies go back and forth between functional and GM and functional again. It's just depending on what they need to build at any given moment and what the outcomes are and what you want to shift, you can switch back and forth. You can have different pockets of your business doing different things too.

Intuit has tried to set up little pods that could go execute faster. That's actually how QuickBooks Capital was successful. We were just a pirate ship outside of the Intuit ecosystem. They left us alone for long enough for us to actually build this new thing. We built our own data layer because the data layer wasn't sufficient. And so, we built our own decision service. It was the first time Intuit left a small business unit alone to go build and it was successful. We got up to a hundred million in revenue business organically, and that doesn't happen at Intuit.

Lex Sokolin:

That's really interesting. It mirrors a little bit of the experience that I had at Consensus where it started out as a matrix structure and then ended up adopting the Amazon approach. And I can definitely echo what you're saying about maybe this is a strength, but you end up having no accountability between different parts of the business. So, if you're hoping that the consumer app is going to distribute your institutional product, maybe it will, maybe it won't and also vice versa, but at the same time, you can experiment much faster and probably prototype and go further. Okay. So, coming out of Square, you've joined Pipe. Tell us the stage at which Pipe was when you came on board and how far had they come on their own? What have they done before you joined?

Luke Voiles:

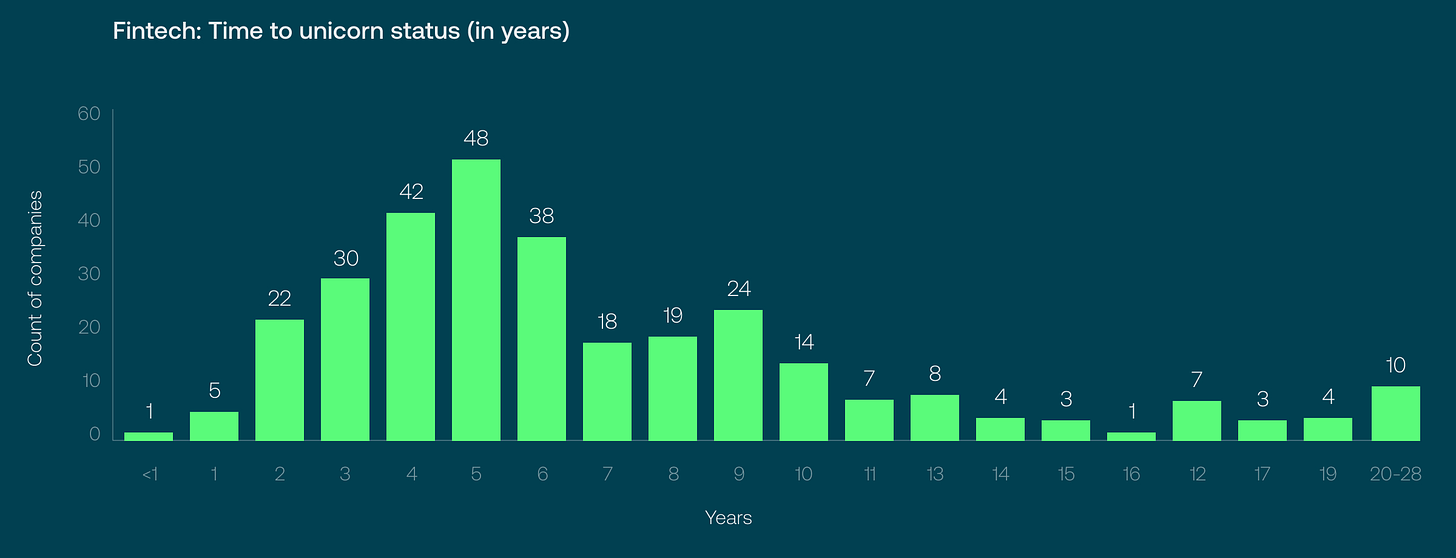

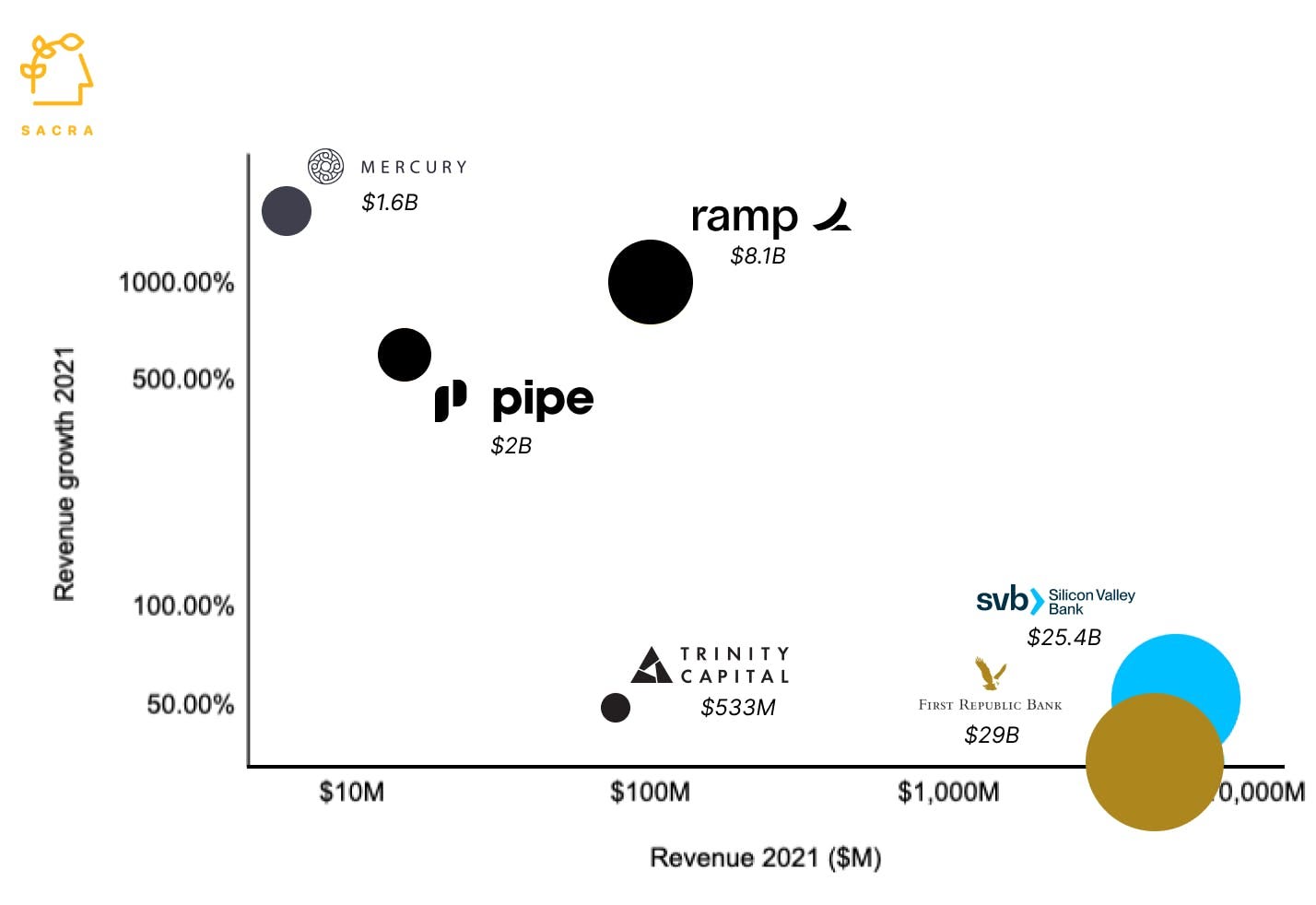

So the three founders, Harry, Josh, and Zane had raised $316 million of equity. So, it's peak VC FOMO, and March of 21 was the last round. They raised $250 million and a more than $2 billion valuation, and it was more than a 100 times revenue. It was true bubble type fundraising. They did the smart thing, they backed up the truck and raised a ton of money. And so very little dilution for them and the employees, were able to raise a ton of money and then they started trying to do everything at once. So, they were trying to build 10 things at once and not all of them were going in the right direction and going well, and to the founder's credit, they decided to bring me in after spending about a hundred million of that money, they brought me in to take it into a direction that actually made sense and worked and could execute. They decided they needed professional management, I guess.

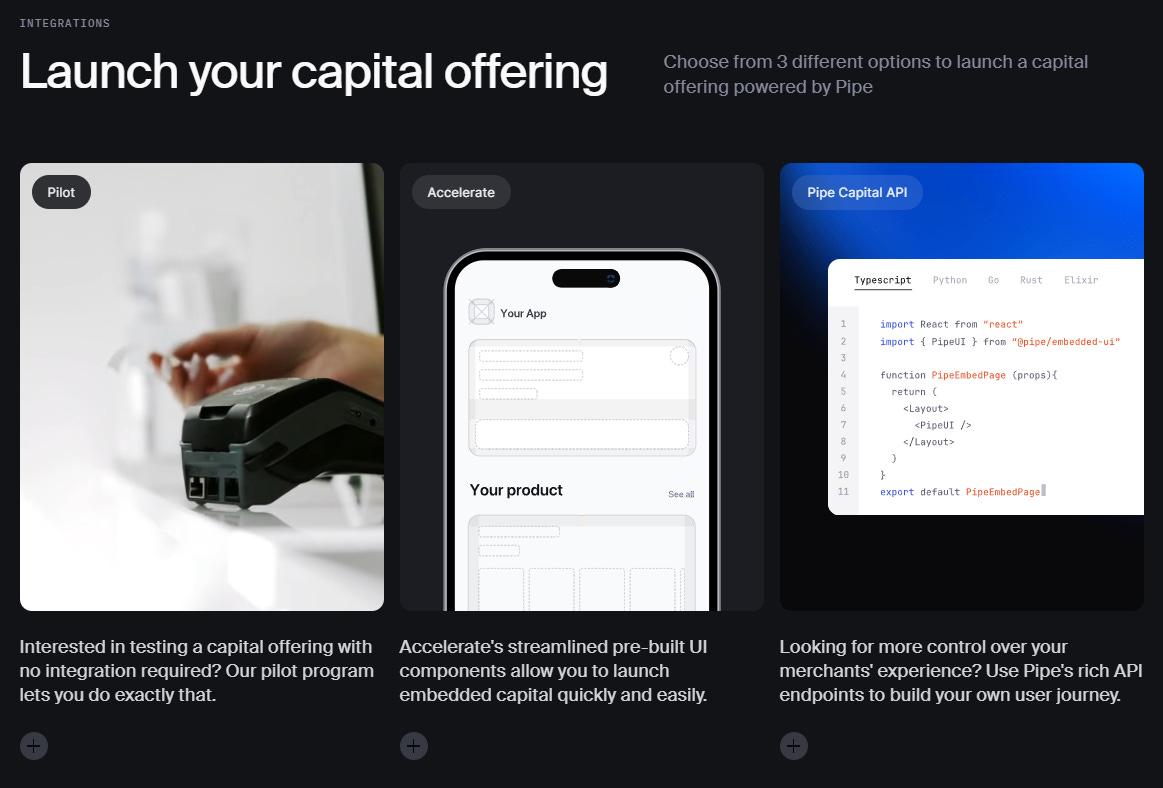

And so I came into a world where yes, they had built an engine that could deploy risk and capital, but the risk wasn't one that I loved. And so, we based on past experience, decided to wind that product down and shift to the future product, which is Pipe Capital as a service. And so when I got here, the best parts of what they built were the data infrastructure and the data connections and those pieces. And the idea of what they wanted to build hasn't really shifted. They built a business that was, the intent was to allow small businesses to get access to capital. That is the number one pain point for small businesses, it's access to capital. Their idea was to allow mainly SaaS businesses to be able to sell their future revenue on an exchange and just get capital to move on.

And so that's basically where it was. There were 112 employees and they were actively building and they were in the UK market. They had an entertainment business where in a sports business where Netflix or FIFA soccer teams were buying things from either producers or other soccer teams, like players from other soccer teams and they'd out over three years. And so just a lot of different businesses, a lot of things happening at the same time, and there were too many squads just from my perspective on how to build, but there was basically a ton of money and some really amazing engineers and really amazing talent because the Pipe story was the fastest unicorn in history. When you do that, you can recruit some very talented engineering and tech folks. And so, when I got here, there was a huge pile of resources, an amazing talented team and a huge vision. And so, I stepped into that and had to figure out how to achieve that vision basically.

Lex Sokolin:

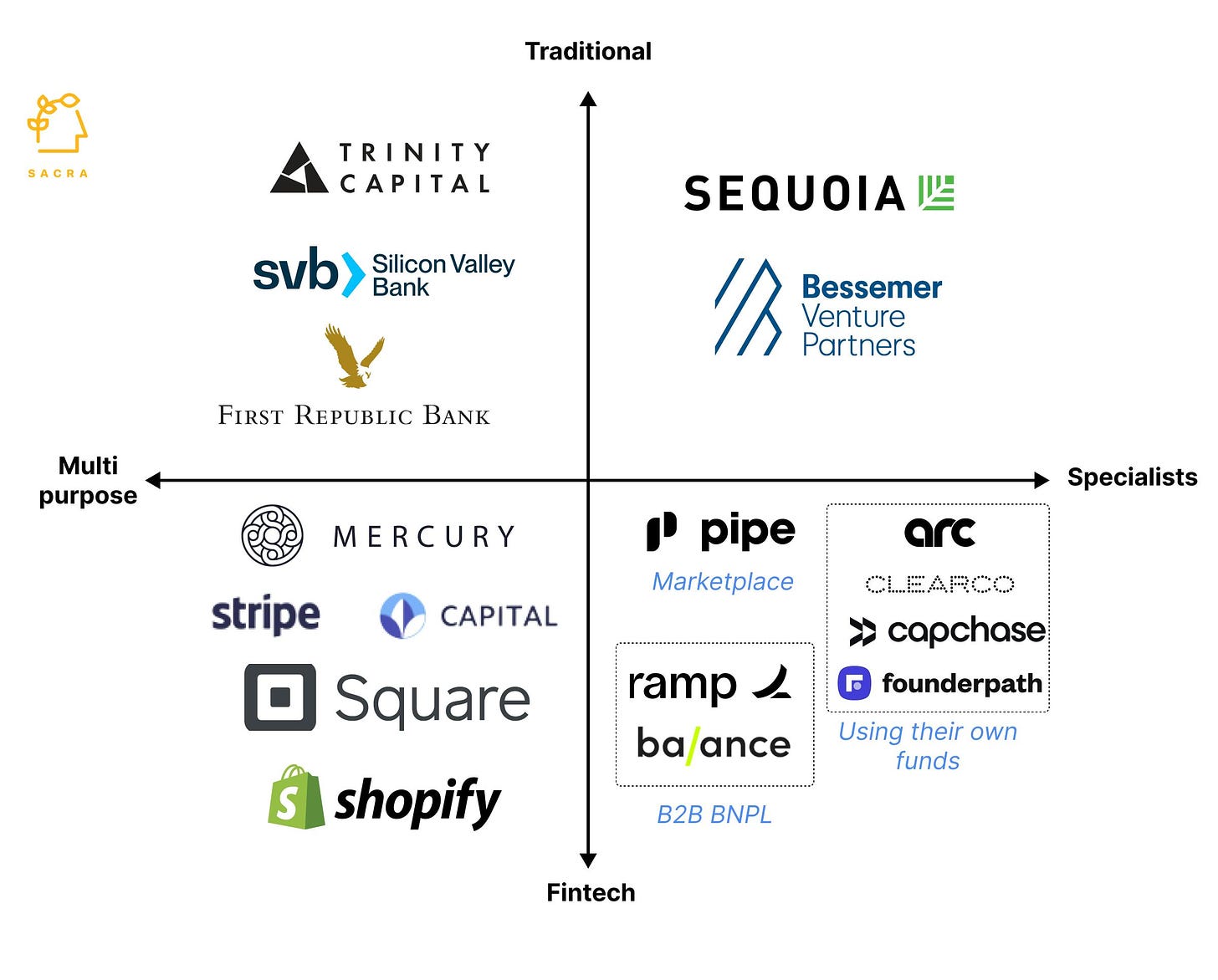

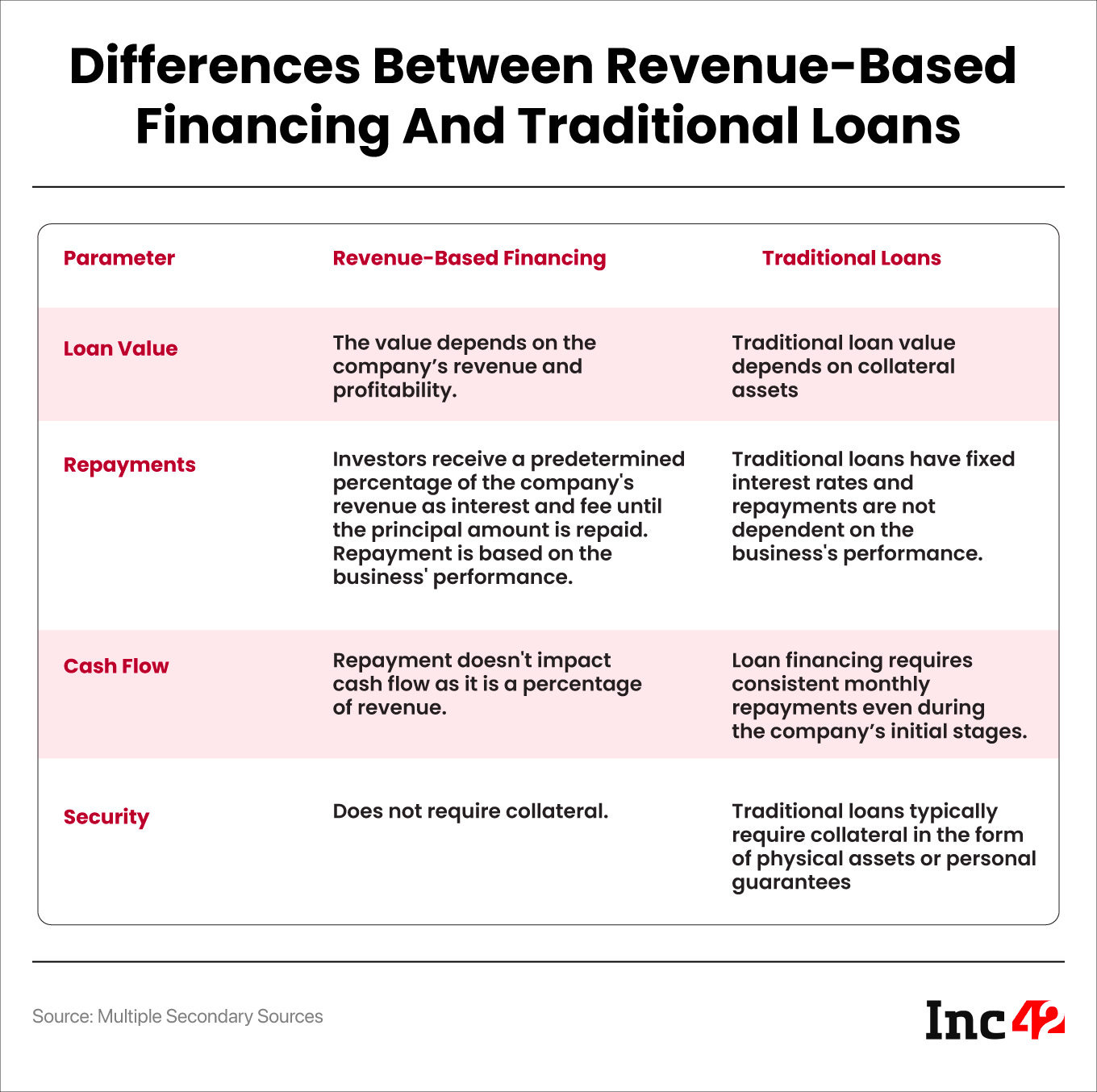

Can we talk about the core concept? Maybe you can help us understand the differences between things like revenue-based financing and invoice factoring and other fixed income instruments that have this similar shape. Can you just lay out the landscape for us?

Luke Voiles:

Yeah, there's really only three ways to do it from a risk perspective. Let's start with factoring. That's money coming in. So, let's start with the definition of revenue-based financing actually. If somebody says revenue-based financing, it basically just means you're not relying on the profitability of the business to help pay you back. You don't have a debt service coverage ratio where they're making enough excess cashflow every month to make the loan payment. That's a traditional underwrite. When we were Intuit, we had a true debt service coverage ratio underwrite minimum of 1X debt service coverage ratio. The business had to be able to afford to pay you every month and have some cushions, so you'd want to be 1.5. So if their revenue dropped by 50%, they still had enough money to pay you back. That's a very basic way to de-risk a cashflow type loan product.

On the revenue-based financing side, there's a bunch of different categories. Venture debt is one where you're relying more on the cash in the account and the runway timing to make sure they can pay you back before they run out of money. That's what SDB did at scale and very large size. You have factoring. And factoring is very specific. Factoring let's use a Lockheed Martin invoice for example. So, a business sends an invoice to Lockheed Martin to get paid a $100,000. The old school factoring companies would have a call center of 50 people. The first thing they would do would be reach out. They take that invoice, they reach out to Lockheed, they call them the accounts payable department and say, hey, we got this invoice. Here's the PO number. Is this invoice real, number one? So, you validate and they say, yeah, it's real. It's like, okay, great. Give me your address Lockheed. I'm going to send you a legal letter that says you now have to pay me instead of the person you thought you were paying.

So that notification to pay somebody else is a critical part of factoring. So that factoring is not a loan product. You're literally just buying that cashflow that's expected to come in from Lockheed. And the risk there is fraud. It's not credit. You know what the ratings of Lockheed are. You know they're a good payer. So there may be some performance risk if the good wasn't shipped and the invoice isn't going to get paid in full or the timing may shift, but if you know it's real and it's validated and you notify, then it doesn't matter if the small business actually goes into bankruptcy because Lockheed's going to pay the lender instead of the company that went into bankruptcy. So that's why factoring risk is so good. You isolate the risk to the payer and that's why factoring works so well.

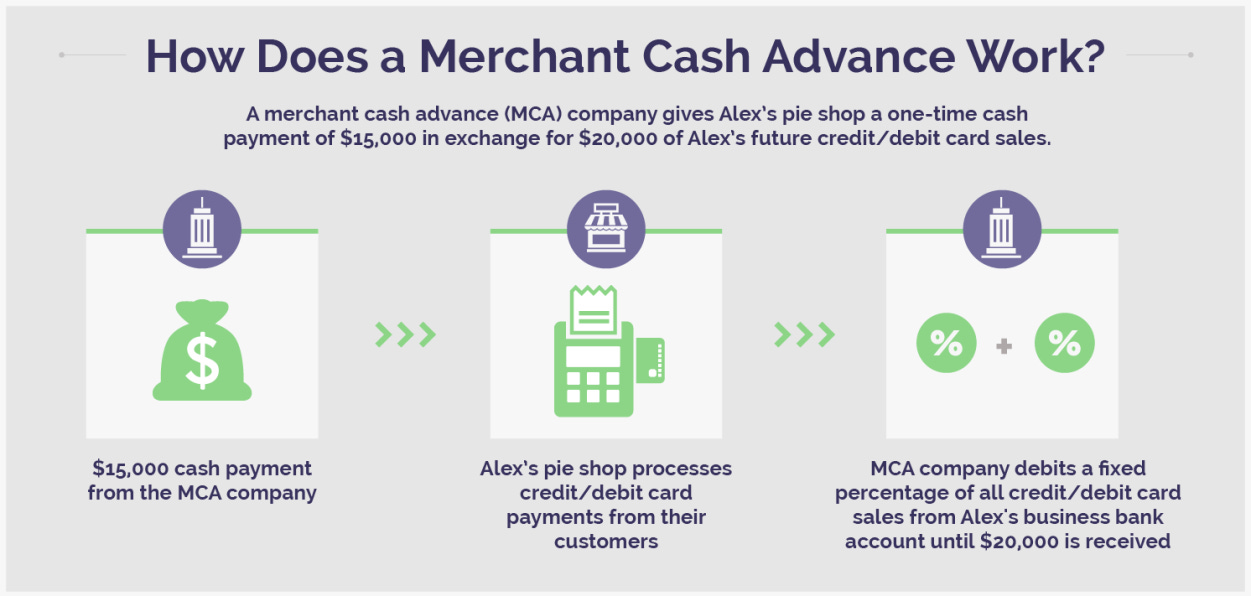

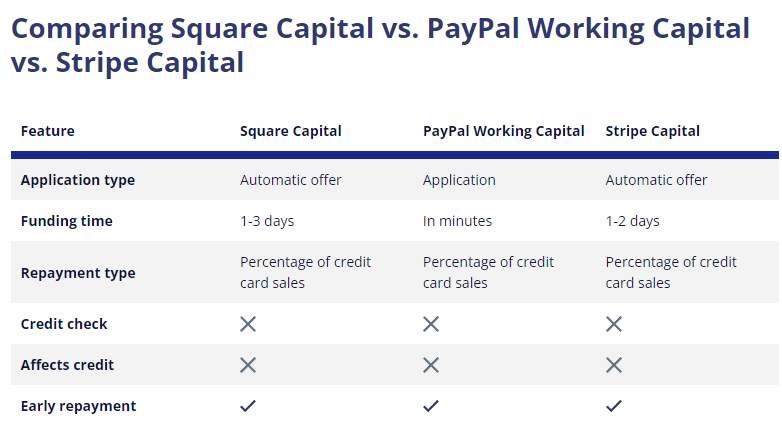

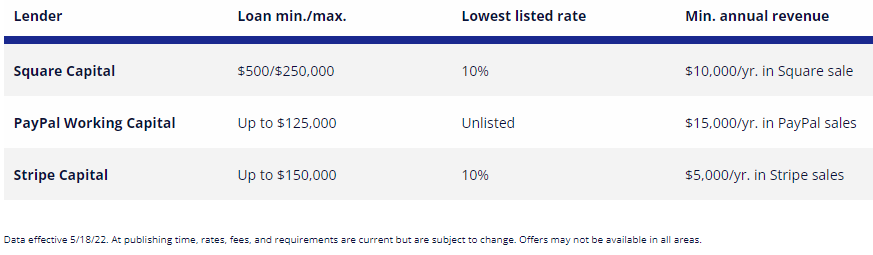

The next one is merchant cash advance or a cash advanced style product. The cash advanced style product, it's similar to factoring, but you're actually securing against all future revenues coming in from a single channel, usually card processing or ACH money coming in. So like Square Capital, Stripe Capital, PayPal Working Capital, Toast Capital are all versions of that cash advance product. Some of them are wrapped in loan paper, so ignore whether it's a loan or an advance just for a second, just let's talk about the underlying construct of what's happening for a, let's use Square as the example. A coffee shop that is using a Square POS terminal is going to sell a thousand coffees a day and with the data, the perfect data on the last six months of history on that single coffee shop, just the one stream of revenue coming in through that one terminal, you're able to with machine learning models to very accurately predict what the next 12 months is going to be.

You can advance or lend about 10% of what that is. So if that coffee shop's going to make a million bucks next year in revenue, you can lend them or advance them a 100,000 and then they agree to pay you back a 100,000 plus a fee, call it a 110,000 over 12 months, and the way you get paid back is you're first in line on the cashflow, you're the processor like Square, the money comes into the Square FBO account, Square holds 10% of every transaction coming in until that loan is paid back. It's a revenue-based financing product where you're secured against the future cashflow streams coming in through that one source. So that's MCA actually narrows the problem to having perfect data on a cashflow stream, lending against that cashflow stream and then getting paid back first in line on that same cashflow stream, so it narrows the risk, like a special situation style risk. You just narrow the risk to just that cashflow stream.

It almost doesn't matter what the expenses are because you're getting paid back first in line and if you only hold 10%, it's a very affordable loan for that underlying small business. If the business has a slow six months after that, you're taking less payment. So, it's actually a pretty friendly product. So that's the MCA version. So factoring MCA, there's a whole category of factoring light where people try to fund invoices without doing the stuff of factoring and the risk is just very different and very much higher. The risk is really high. And so, if you try to underwrite the business using bank data and give them the line of credit and just say, Hey, you can advance every invoice you send and you try to secure against those invoices, that risk is hard. You're back to just a true cashflow based or line of credit style underwrite. It's very difficult.

So those are really the only three categories of risk that makes sense. On the venture debt style one that SVB did. Those are highly nuanced, highly structured, very specific deals. And to do those right, you have to have a whole deal team and a ton of attorneys in to write 150 or even 300-page agreement to make sure you're controlling for all those edge cases in those scenarios. That venture debt style thing people tried, that's what Pipe was trying to do. That's what Capchase did, and some others are doing. It's just I don't think you can automate that one. The true venture debt where you're giving larger advanced sizes to startups or other companies that have cash and funding, that's just too bespoke. I don't think you can actually automate that business. Same thing on factoring. I've yet to see an example of anyone who's automated a factoring business and made it work.

There's so much manual connection points with the payers and the small businesses hate it because they don't want you to talk to their customers. So factoring is a really tough one to automate as well. So, the only one that actually scales in a 100% automated way from a credit perspective is what Square Capital does, Stripe Capital does, PayPal Working Capital, Toast Capital. That's why there's billions and billions of dollars happening. At Square we did five billion a year in volume to more than 120,000 customers, $7,000 average loan size, and you can just sell that risk and just get it off the balance sheet. There's a huge depth of buyers that want to buy that risk because it makes so much sense. So, you have perfect data and you're in the flow of the money. That's a truly scalable business. So, everything I just described to you is the reason why we landed on Pipe Capital as a service being a Square Capital like product, it's the only one that I know scales.

Lex Sokolin:

That's a super helpful breakthrough. Thank you. I really like the idea of narrowing down your risk and really focusing on the types of risks that you can measure and that you can control, and then getting the exposure specifically that you actually signed up for. When you had just met the Pipe team and were thinking about joining, what was their one big insight? What was the secret and the innovation they brought into this? Because to get to a unicorn status, you have to have something that takes you from zero to one, so what do you think was the heart of it for Pipe?

Luke Voiles:

They told a good story. Fundamentally, all we do is storytell. We tell stories to the capital markets about what the risk is going to look like. You tell stories to the underlying small business that's going to take capital from you to help them understand what other businesses have used this for and how it's good. We have a different story like storybook for the partners to explain to them how easy it is to integrate and how we can help them solve their customer's problems. We tell stories and talk about our customers to our employees. All of this is just storytelling. The vision and story that Harry and team were talking about was a whole new asset class. You're going to be able to sell your future revenue on this exchange and it's going to be like the NASDAQ, and you can use all the data for other use cases.

That vision was the most amazing piece. It sounds amazing, but for the grizzled credit veterans like me that look at it from the side saying, that's awesome, I want to get there. But the question is how? And when I got there, we shifted the how pretty dramatically to be more like the Square capital type business? They're just fantastic storytellers I think is the right way to put it. They had this amazing vision, they wanted to go build it. They raised more than 300 million dollars to go do it. This timed everything right and smartly brought in someone who hopefully will be successful in executing on their vision. I think that's it.

Lex Sokolin:

Yeah, it was a interesting moment, 2021, '22 in venture land where a lot of investors were putting a hundred X revenue multiples on pretty much lending revenue and creating these enormous valuations, and now there's all this pressure to grow into the valuations, which I'm sure you're feeling. And now that you've come into it and pivoted the execution, can you talk about what the pivot looks like and what do you think are the biggest levers there?

Luke Voiles:

Yeah, so we talked about the first, which is what risk are you going to take? How are you going to deploy capital as an asset manager, make the risk make sense? And then fundamentally, you have to get to a balance sheet light setup. I advise Nyca partners, Hans Morris is the guy who started Nyca Partners. The only advice he gave me when I was going to take this Pipe role is, hey man, you got to get the balance sheet light or you'll never get the scale you want and you'll never get the multiple you want. And so that's the other major reason why the Square Capital style of product makes sense. And so that solves the first of five things you need to figure out. Okay, we're going to just originate in the flow of money attached to payments, money in payments to get in the flow and get paid back first in line. That's the biggest thing you have to get right.

You can't scale, many or almost all of our competitors and even the old school alt lenders, they all have the same problem. If they can't get to a true whole loan sale where they can originate risk in the morning and then turn around and sell that risk into the capital markets completely and not take any future risk, if you can't get to that setup, you'll forever have to stick, put equity into every dollar you deploy. You may get a 95% advance rate from a warehouse lender. And so, when you loan a $100 to a customer, you can pull down 95 of that from your deadline, but you still have to put $5 of equity in there. And the faster you scale, the more equity it eats. And so, there's this escape from earth's gravity type of journey for every alt lender. If you don't get to whole loan sale, you'll never be able to truly break out and scale in an unlimited way. And I don't think any of our competitors have been able to get to the whole loan sale setup.

And you go back, there's stories about Prosper doing only whole loan sales too, by the way, where the whole loan buyers walked, I think it was 2013 where the whole loan buyers backed up for a second and they didn't have their own warehouse on balance sheet to protect themselves and make it through. So, if you're getting to whole loan sale, you still have to have a backup plan. And if you're a distressed credit person, you're constantly thinking about plan A, B, C, D, E, but you need to have some balance sheet and some whole loan sale. So, the product type itself, so the Pipe Capital as a service was pretty easy to pick, that's number one. Then you say, okay, how the heck do you acquire customers for cheaply? So going to the number one problem, going direct, I do not think works. Spending a ton of money on direct digital marketing to go straight to small business customers is way too expensive. The best example there from a public company was OnDeck. They spent 40% of revenue to go acquire customers directly.

You end up break even and trying to scale at the same time. If you slow down spend on marketing and try to become profitable, then you slow your growth. And so, you can't and you get stuck on this treadmill. It just doesn't work to go direct. So, I was very spoiled into it and at Square because we had all the customers and we had all the data to try to think about that next problem, how do you go acquire all these millions of small businesses? The answer is it has to be B2B2B. We have to go acquire a partner that has 100,000 small business customers. And so, you can shift your direct marketing spend and all of your marketing spend going to find another partner. And if you find a partner that has a 100,000 or a million customers, there's 20 million or 30 million in revenue in that easily.

And so, if you think about, let's compare it to the enterprise focus FinTechs like Ramp and Brex, they both go very much up market to the enterprise customers because each customer has millions of potential revenue in them. And so, if you take that back to where Pipe is, yes, we're targeting the micro merchants and there's 30 million of them or 33 million of them in the US, but we're doing it through another partner where the small business spends their time, and so the business is using this software, and we partner with that software provider. And so that actually solves the customer acquisition problem. We only pay our partners when we know we're going to book revenue. When an advance is made to a small business, we do a rev share back to the partner. So, the unit economics of the business actually works way better when you're doing B2B2B because you can partner.

A firm takes the same approach, all the buy now pay later companies takes the same approach. You have to partner with a business that serves consumers. It's the same setup. Okay, that solves problem number two. Okay, great. We have a risk setup that we think is going to work. We have a way to acquire customers. Now how do you actually acquire the partners? You have to make it super seamless and easy. And when you start messing with cash reconciliation and trying to get a partner to split payment for you on the payment side, it really, really slows everything down. I watched reconciliation and reporting get messed up in the past based on just changing things in the flow of the money on the payment side. So, we came up with a way to solve that as well, which is let's just create a neobank in the background to when the customer, underlying customer accepts the advance, they'll also agree to have the payments routed into the new bank account that they just agreed to open. Then we're in the flow of the money. We didn't mess with payments, payments is done at the partner.

The reporting is there, all the payments reporting go to the account and it all works. The money then steps for just a day into this FBO layer where Pipe can hold our loan payment or our advanced payment back and then the money goes into the customer's Bank of America account. It is just a pass through. So that solves the partner's problem. It makes the integration take less than a week because there's nothing to do. It's just change the deposit account and figure out how to get the data to us for the application and the data to us for the preapproval. So, it becomes a very, very much simplified thing on the partner side. That was the last aha was okay, this is how to simplify the partner connections. And so, here's how to think about it. All the constituents we have, we have to solve their problems. We solve the capital markets problem with the risk product. The underlying small business customer, they just want to line of credit, they want a security blanket.

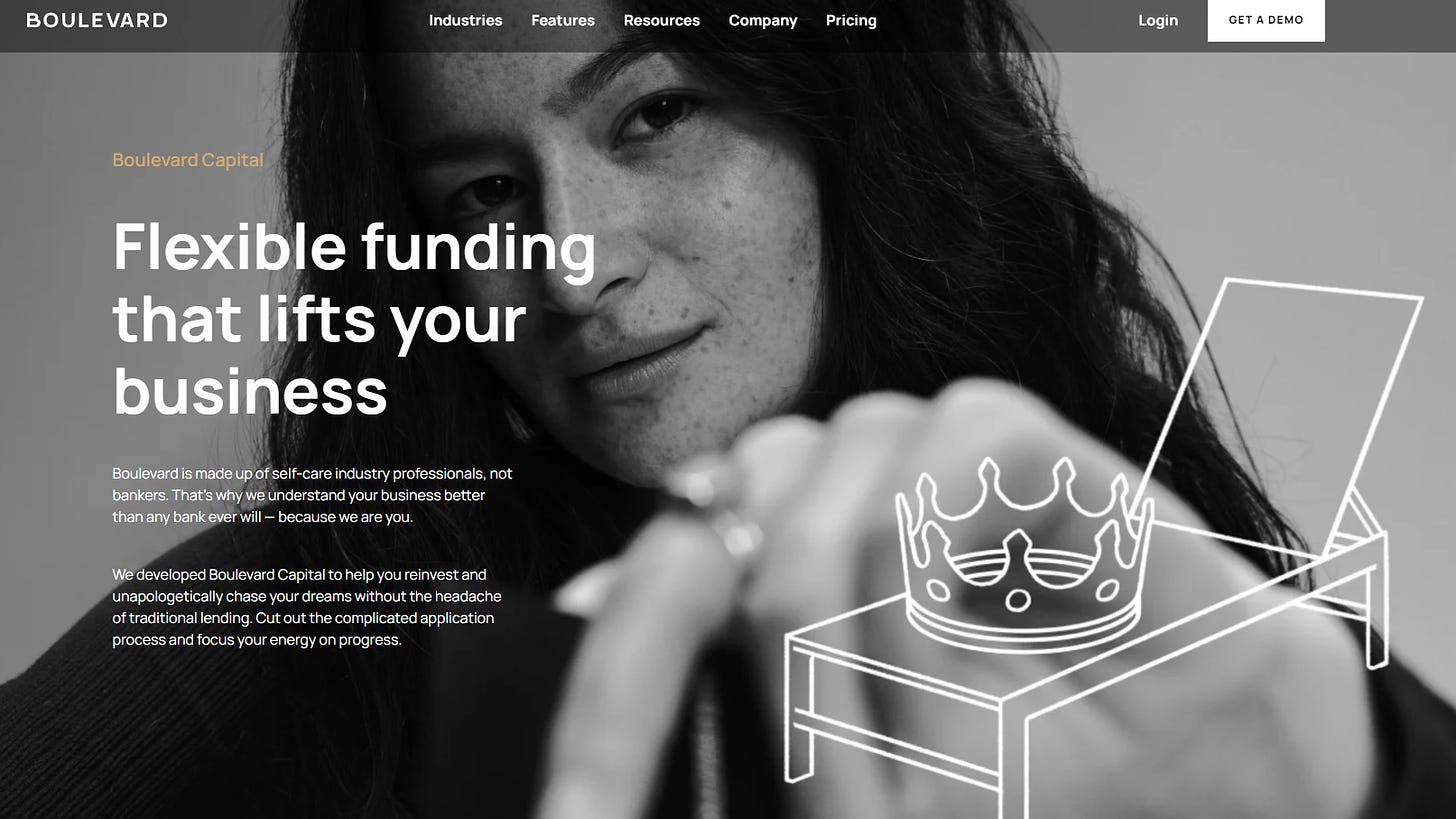

And so this is what I love so much about FinTech. We're able to offer a recurring offer line of credit like thing to the underlying small business. They get qualified for a 100,000 or pre-approved for a 100,000. They can draw 10 if they want or 25 tomorrow and 30 the next day. But it's still generating an individual advance that the capital markets likes. So, the small business gets what they want with the security blanket. The capital markets get individual draws that they understand the risk on. The partners get a super-fast seamless integration where we're not interfering with anything in their business. It makes it super-fast and easy, and we can white label it for them. We have an amazing design team. We're using Figma in ways that I haven't seen before to where we can white label an entire experience in a day to make it perfectly match the partner's flow. And so, when a brand like Boulevard launches Boulevard Capital powered by Pipe, people didn't even notice that it was Pipe because it matches Boulevard so perfectly and it's all in a fully hosted white label experience by Pipe.

You basically just take, okay, what's the next big thing? What's the next big problem? What's the next big problem? You start knocking those off the list and you end up where Pipe is now with Pipe Capital as a service. And so that solves the number one pain point and it actually is the highest lifetime value product. It solves the biggest pain point, highest lifetime value. It's going to get us to break even by next year. That's the play

Lex Sokolin:

There's so much in there. I'm going to take little bits and pieces just to clarify on my side. So, the way that I understand it is that Pipe Capital is an embedded finance type of approach similar to how you would embed payments or how you would embed buy now pay later, which is that you distribute through platforms. And then the question is, okay, why platforms? Because platforms are the service or product provider that aggregates things at a very large scale, and they tend to empower their own customers. And so, you are a financial feature set within that platform. So, can you just refresh us on an example of what a platform is? In my mind it's Shopify or WooCommerce or something like that. What are the types of platforms that you work with?

Luke Voiles:

Yeah, I think your head's going to e-commerce or commerce type stuff. I think it's all mom-and-pop small businesses. And so, I've talked about the future of banking. The future of banking is not a small business owner going into their local Wells Fargo branch and depositing checks anymore and getting cash and talking to the loan officer that's in the bank hoping to catch people when they come in and cross-sell them. It's about task completion. Where are the business owners going to complete the tasks that they have to do to run their business every single day? And the answer is actually SaaS vertical. It's software. They go in, Boulevard is a nail salon, hair salon focused and spa focused software products, SaaS vertical. Toast was the first best example of doing it for restaurants. You have Slice now narrowing even more in the restaurant space to just pizza shops.

You have WorkWave dominating the pests control businesses. You have several different versions of service-based business software that help and fundamentally, these are just appointment software in a lot of cases. On the pest control business side, you just book appointments to send techs out to houses. On the service base, plumbers and electricians, it's the same. For a nail salon or hair salon owner, it's also just appointments to serve consumers and that's the core of the software. But they also all first embedded payments to where you can accept payments and make it super easy to book appointments and then pay for those appointments once they're done. That's the future of how small businesses are going to run their businesses. Square, I would argue, and Intuit I would also argue are both horizontally focused. Yes, Square has Square for restaurants because they're trying to catch up with Toast, but it takes too many resources to solve the end-to-end pain points of every specific industry.

This is why small business is so hard. Consumers are like a single industry from my perspective. They all have FICO score consistent data or they may be thin file, but they all look very similar. There's either W2 or 1099 income coming in and they have certain expenses that they pay with rent being the highest. That is a single industry, and it's huge. It's the biggest one. All of small business is huge too, but it's all kinds of different industries. And when Intuit treats a landscaper and a restaurant the same way without individualized experiences for them, the business owners are going to go somewhere else to run their business. Square was very much a retail horizontal, 10% of physical retail use Square just because they could easily swipe beautiful little POS terminals, swipe a card, move on, reconcile into QuickBooks, keep going, but if you're a nail salon and you're using something like Boulevard, it does everything you need.

You go into one software offering and do everything you need to do. That's the future here. And so, Pipe is doing the hard stuff though, capital and lending is the hardest business I've ever seen to try to run through a cycle. And so, the SaaS verticals that are focused so much on the individual tasks and pain points of those individual industries, they'll narrow the focus. Nobody's going to serve a pizza shop better than Slice because that's all they do all day long. They focus on that, the end-to-end needs of that business. But it's too difficult for Slice or someone like that to go build their own lending business. It doesn't make sense. They can plug in an embedded payments offering, but now they have the opportunity to plug in an embedded lending offering from us, and that's just the first offering from us, but that's the basics. It's about SaaS vertical software.

Lex Sokolin:

Really one of the assets you're building out is this go-to-market motion of integrating into vertical SaaS providers. If you abstract it even further, these platforms are attention platforms. It's where these businesses spend all their time, but also, they have connectivity into the financial flows and that gives you visibility as well. One last question around the bank account that you mentioned. So, the money makes a pit stop in a bank account that you control or that you have access to so you can split the cash. Who's the underlying provider there and how does it work?

Luke Voiles:

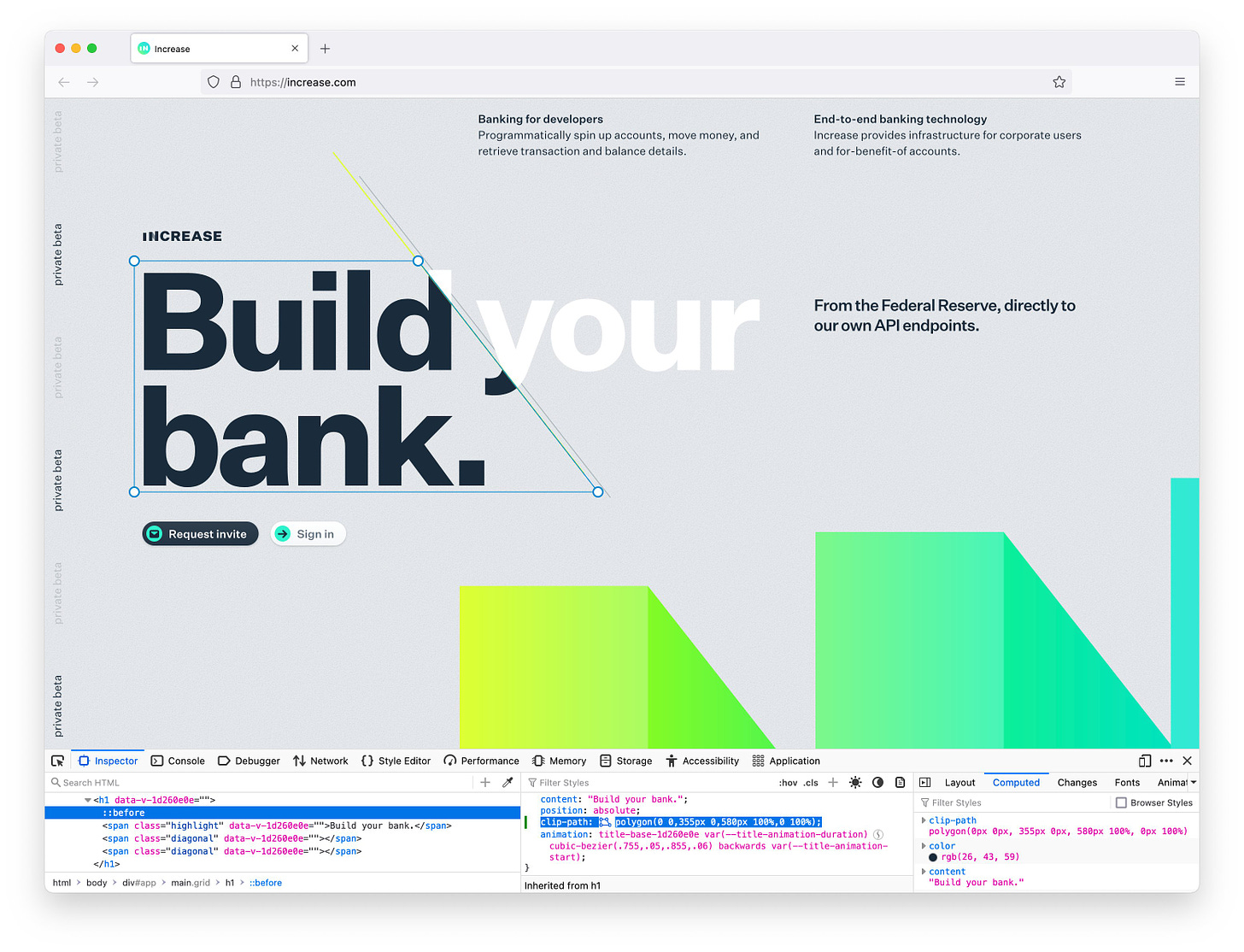

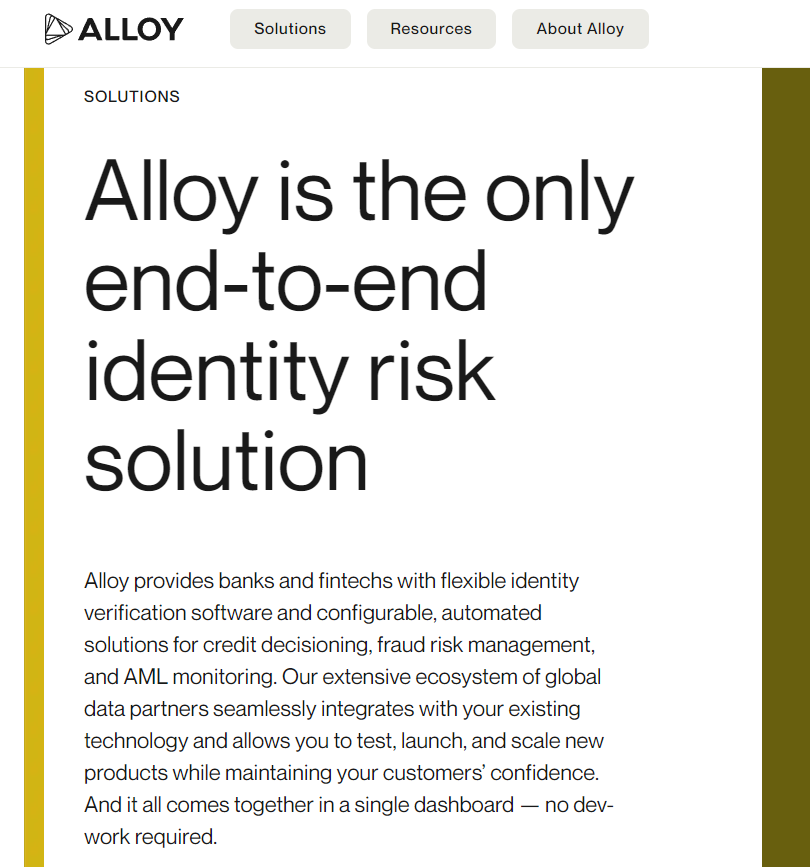

Yeah, let's just talk about regulatory for a second. So, our BaaS partner is Increase, so it's Darragh Buckley. He was a famous early Stripe engineer that made Stripe work. Most of the engineers in his team are at Stripe. They built Stripe Issuing. He's got direct connections into Visa, MasterCard and the Fed. This is the difference. Other BaaS layers will send a NACHA file to a bank and then the bank sends it into the Fed. Increase is a technology vendor for a bank, and the bank has hired just like they hire NCR or Q2 or Jack Henry, the bank has hired Increase to send NACHA files to the Fed on their behalf. In the same way the bank has hired Pipe to apply their BSA policy as a technology vendor. And so what we do is use a software called Alloy, which is a known scalable KYC, KYB, BSA policy orchestration layer that plugs into Middesk and ThreatMetrics and LexisNexis and all the other stuff you need like Emailage, all that other stuff you need to do KYC in an automated way.

Pipe applies the BSA policy of the bank using Alloy. The bank can look directly over our shoulder real-time at every decision in Alloy and they have rule control. We won't change or can't change the rules in Alloy unless the bank approves those changes. We are a tech partner for that bank. The underlying small businesses are opening bank accounts at the bank. It's first internet bank, they're opening accounts there and we're a technology partner or a vendor of that bank. And so, the nuance of these setups is so critical giving everything that's happening with Synapse. We are directly and separately vendors of the bank. And we, Pipe, also have a separate agreement with Increase to call the API to move the money and send the data to open the accounts, all of that stuff. And so that's how we do it. So, we're a neobank in the background just to open that account.

So, all that stuff I said earlier about here are the problems to solve to go. The other big one is reducing friction. And another mistake a lot of folks make is to try to become the primary checking account of a small business. If they already have a checking account, they will not take yours. No one took, at Square, no one took Square Checking if they already had a small business checking account, they just wouldn't do it. And so, we're not going to try to become the bank account. We're going to just use these features, use these underlying features to offer products that the customers love. We could turn on auto savings for tax in this FBO layer and say, Hey, the money's routing through here. We can hold 8% of every transaction in a 5% or 4% APY savings account for you at First Internet Bank, so you have the money to pay taxes at the end of the quarter. That secondary feature business owners love and will take.

They won't change all of the spend that's happening in their outside bank account. The work it takes to switch all your bill pay set up just means they'll never switch. It just limits. So, you have, again, narrowing the focus to reduce the friction. That's our setup and it works. Our head of compliance, so our chief compliance officer at Pipe, I'll just say it, she was the chief compliance officer at Varo when they got the charter, 35, 40-year veteran in traditional banking and in tech. And so, we show up like a bank when we show up from a compliance perspective. The tone at the top here and me is we will never do anything that even is slightly aggressive on any of the stuff. If you just do it the right way, and set it all up the right way, you can still scale rapidly as a FinTech. That's what a lot of these other, I don't know, fly by the seat of their pants FinTechs that are influenced by VC to just go fast, screw up, and they screw it up a lot and it makes the rest of us look bad.

It's possible to do this the right way and it's possible to still scale fast. That's what I'm frustrated to no end watching all these stories of all these FinTechs that screwed up. It's not that hard to get right.

Lex Sokolin:

I love the fact that you're leading with value, which is to give the small businesses the thing they need, which is credit. And there has been so much talk and ideas around how do we get to self-driving money and the tax saving feature you described or the automated investments, lots of things that are floating around, but so many times it's disconnected from the primary thing that either the businesses or the consumers need. So, I think it's very clever to start with that large value proposition and then do all the rest of the things to make it sticky. This has been a fascinating discussion and there's so much more to talk about, but we're up on time. If our audience wants to learn more about our either you or about Pipe, where should they go?

Luke Voiles:

The easiest way to find me is on LinkedIn. Just reach out and connect. And then for Pipe, it's just go to pipe.com. We actually won a Webby honoree award for the website because of our design team, so go check it out. We're pretty proud of it.

Lex Sokolin:

Fantastic. Thank you so much for joining me today.

Luke Voiles:

Thank you.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

![What Percent of Startups Fail? [Success Advice from Founders] What Percent of Startups Fail? [Success Advice from Founders]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2eb51e8b-c365-4e8f-95c8-6525b372c601_1074x697.png)

Podcast: Pipe's Pivot from Revenue Exchange to Digital Lending, with CEO Luke Voiles