Hi Fintech Architects,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Matthew Watson - co-founder and CEO at Origin where he is working to solve employees’ number one source of stress: money.

Prior to Origin, Matt was a founder at Indio Technologies, a software platform for commercial insurance which was acquired by Applied Systems in 2019. Matt started his career in Citigroup’s investment bank trading high yield credit in the power and mining industries. He is an alumnus of Johns Hopkins University.

Topics: fintech, AI, artificial intelligence, PFM, personal financial management, embedded finance

Tags: Origin, Origin Finance, Mint, Mint.com, Plaid, LearnVest, Column Tax, Intuit, Yodlee, ChatGPT

👑See related coverage👑

Fintech: Mercury Expands Orbit with Launch of Personal Banking

[PREMIUM]: Long Take: An obituary for Mint.com, which inspired a fintech revolution

[PREMIUM]: Long Take: Stripe will drink your embedded finance milkshake

Timestamp

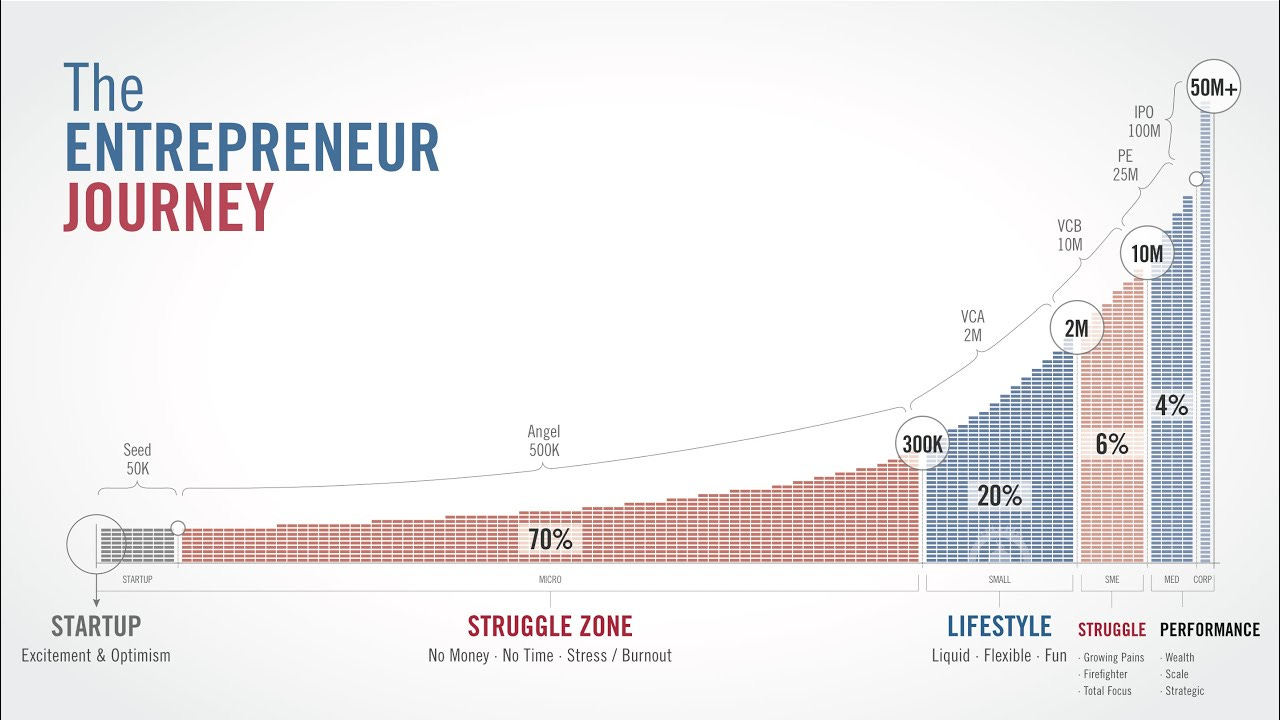

1’07: The Entrepreneurial Journey: From Family Influence to Fintech Ventures

3’55: Building the Go-to-Market Function: Penetrating and Innovating in the Insurance Agency Software Market

7’55: Challenges in Financial Vertical Software: Entrenched Systems and High Switching Costs

10’08: Exploring Origin: Addressing the Financial Services Gap for the Mass Affluent

18’16: Evolving Data Aggregation in Fintech: Addressing Costs and Open Banking Trends

22’30: Origin’s Business Model and Market Dynamics in Mass Affluent Financial Services: Lessons from Lead Generation Giants

26’01: Building Financial Solutions In-House: Origin's Approach to Planning, Investing, and Tax

29’24: The Collapse of Mint: Catalyzing Opportunities for Origin in B2B and B2C Markets

31’26: Leveraging Generative AI in Financial Planning: Enhancing Guidance and Managing Challenges

35’47: Understanding the Demand for AI Financial Planning: Challenges and Consumer Behavior

40’22: The Future of Financial Data Control: Consumer-Driven Analysis and Insights in a Tokenized World

41’07: The channels used to connect with Matthew & learn more about Origin

Illustrated Transcript

Lex Sokolin:

Hi everybody, and welcome to today's conversation. I have with us today, Matt Watson, who is the founder and CEO at Origin. Origin is a comprehensive money management platform for the modern workforce. And I'm really excited to learn about where the wealth tech and investment space is today. So, with that, Matt, welcome to the conversation.

Matthew Watson:

Lex, thank you so much for having me.

Lex Sokolin:

My pleasure. Let's jump into it. What pulled you into being an entrepreneur? What happened?

Matthew Watson:

My parents happened. They're both small business owners, so from the earliest ages, that was what work was to me, starting a business, running your own business. So, growing up, I was drawn to that. My first jobs were my own small businesses that I started myself. And then, as I graduated from school and graduated from college, it was like, "Wait, I can do this full time? This can be my real job?" I had a stint working on Wall Street after college, before I ended up starting my first company. But it was just in my DNA, it's what I grew up seeing and being around and something that really excites me.

And when I talk to other people, which I do regularly, about the entrepreneurial journey, I think that's the thing that's the most important, is if you do get that excitement and that burning feeling inside of you, that's when you know it's time to go and try to do something on your own. And that's something that I have every day when I think about my job, which is, I think, a unique aspect of starting things and trying to run your own businesses.

Lex Sokolin:

What was your first fintech experience?

Matthew Watson:

Well, I guess I started my career working on Wall Street. I worked on a foreign exchange desk at Citigroup in New York, and then I traded high yield credit for a couple years. Those were my first experiences in the financial services industry. And my experience was really just knew that I wanted to start a technology company. So, I left my job in New York and moved out to San Francisco, and the goal was just start a company. Wasn't dead set on a specific idea when I got out there. Was looking at financial services, that's what I knew and what I was comfortable in and was comfortable going deeper into.

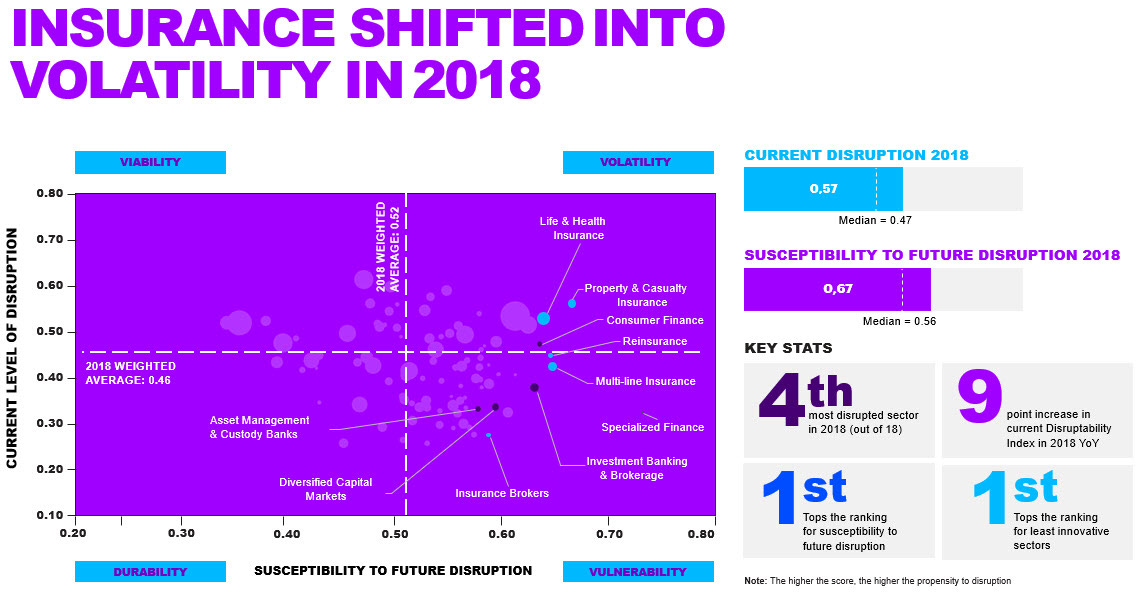

And the first business that I started was a vertical SaaS business in the commercial insurance space- I guess fintech adjacent under the broad category of fintech. At that time, insurance was a really interesting part of the financial services ecosystem that hadn't seen a tremendous amount of investment, but it really started to pick up in 2014, 2015, 2016, and really continued through some IPOs with Lemonade and some other companies.

And at that time there was this, let's say debate or two investment PCs that were floating around, which were, do you try to disintermediate the legacy providers of insurance or carriers and build your own vertical insurance products? Or do you go enable the existing channel? There've been successful businesses on both sides of the aisle. What we elected to do was say, "Look, we think that agents in the commercial insurance experience are really important. Let's go build software for them that's going to really streamline what they do and make them more tech-enabled providers of that service."

Lex Sokolin:

What was it like to build out the go-to-market function for that company? Do agents buy stuff? Where does the budget live? And what was their willingness to pay?

Matthew Watson:

I would say, at the time we built that market, most of the software that agents utilized in 2015 was back-office software. So, the biggest pieces of spend and the way that they run those businesses are in these tools called agency management systems. There's two big providers, they're Applied and Vertafore. That's where an agent, and that's where the staff at an insurance agency spend their days. That's the product that's up on their screen. Our hook into this market, how we're going to penetrate this, is by building a product that sits on top of that that is client-facing. So, we're going to enable these agencies to have a tech interface that makes them competitive with the carriers that are trying to go around them.

It's pretty low price point, relatively high velocity sale, and we were able to penetrate 40 of the top 100 agencies in the country inside of really 36 months. And from there, we had an opportunity, because we built really great relationships with them, to start building backwards into that core agency management software. So, I think our learning there was if you try to go with the jugular of some of these really big workflow management systems, it's incredibly difficult to displace them because people spend so much time there.

It's almost like trying to convince your parents to switch from a Windows computer to an Apple computer. It's a big mental undertaking. They're not going to want to do it. So, our way in was, let's build something that sits on top of that so that we can get into their workflow. And then, as we build that relationship, we can show them that we're a better builder of software and experiences for them, and they can slowly move over more of that core agency management experience into our platform.

Lex Sokolin:

What is the size market cap or enterprise value of these agency management systems? Really curious.

Matthew Watson:

They've been marked up since I was most recently in that space. At the time, the market cap was, just adding those two big ones up, which are 80% of the market, was probably on the order of seven, 8 billion. I think now I would put them in the 10 to 12 billion range. I don't know where they'd get marked today, but they traded hands a couple times amongst private equity firms since then. So yeah, we call it around 10 billion. But yeah. It's a vertical play, right? I mean, I think the market, when we went after it initially it, it was quite small. The big win there was going to be... There's two ways that you can win big in that market.

One is going hyper vertical, getting a lot of those large agencies in the way that we did, and then building backwards into that agency management system. The other way, which we didn't pursue, but I think is also interesting, is... It's actually more interesting right now. If I was starting a business in this space now, this is what I would do. I would go after the BPO processes. So, all these agencies have so many people overseas that are doing things like updating policy documents, managing billing, things of that nature. Those are going to get automated out and they're pretty big line item for these agencies. So, those are the two ways you can build there and get to a billion plus market cap type of business.

Lex Sokolin:

Super interesting. I think all of the financial verticals have some version of this supply chain or middle office software, whether it's core banking for banks or whether it's portfolio management for financial advisors. You've got these five to $10 billion companies that they're not enormous. I mean, those are big companies, but they're not 100 billion plus. But they're so entrenched because you have a very splintered customer base and the go-to-market is really difficult. And then, the switching costs are really high. So, in the wealth tech space, I found that to be pretty prohibitive in terms of being able to penetrate into financial advisors. So, really interesting to hear what that looks like on the insurance side as well.

Matthew Watson:

Yeah. I agree. I mean, I think if they're using a legacy tool, could be financial advisors as well, to manage your portfolio of clients, to try to rip that whole thing out at once, even if it's 10 times better, is going to be really challenging. And it's because, like I said, you've got people in that system and that's what they've been using to manage this business for 20 years. So, it's going to take a pretty significant shift to get them to retrain their staff on that software. Definitely a tall task. I don't think that going right for the jugular there is the way to do it. I think there's a couple companies that have popped up in the investment advisory space that have approached this.

And the way that they've done it, which has been kind of interesting, is they've tacked on to this trend where you're seeing advisors go out on their own, so it's like a net new sale, that new advisor is not set up yet with any software, and they're taking that opportunity to penetrate at that point. But to your point, I think if you're going after an RIA with 50 investment advisors, they already are set up, it's going to be very difficult to get them to switch. You're probably going to have to find some sort of toehold that you can get in that sits outside of that and you can build from there.

Lex Sokolin:

Yeah. The main catalyst in that space in the last five years has actually been the blowup of TD Ameritrade and the acquisition of TD Ameritrade by Schwab, which broke the custody underneath about 300 billion of assets, I think, if not 500 billion. I forget the number exactly. And so, the other way to go around these systems is you can sit on top of them, or you can try to get yourself under them in some way. So, if they're attached to a carrier or they're attached to a custodian, there's some sort of destruction on the custodian side that can create opportunity as well. But those types of things happen once in a blue moon.

Matthew Watson:

Yeah, totally. In our current business, at Origin it's analogous to mint.com shutting down. We have this huge dislocation. But it's really hard to plan around that.

Lex Sokolin:

Yeah. So, let's talk about Origin. What does Origin do?

Matthew Watson:

As we exited that business, really was thinking about what's next. And again, sticking with what I know, financial services is where I've been excited. And I think when you look out across the personal financial services ecosystem, the products and the way they're delivered is just incredibly unequal across income levels. If you're affluent, you've worked in this space for a long time, there's a huge, huge group of people who are interested in providing you wealth management, tax advisory, investment advisory services. But that falls off a cliff once you get below, call it, $500,000 of investible assets.

And so, what we wanted to do was build a mass market private bank. It hasn't been done well. The segment of mass affluent has, in my mind, been serviced in a very fragmented way. And the investment dollars have flown to the barbells of this industry. Obviously, the neo banks have raised tremendous amounts of capital. Wealth management firms are obviously very significant. That middle market has really been serviced by point solutions.

And what we wanted to do was bring a wealth-like experience down into the mass market with both advice and services in one experience so that an individual... Let's say they made $200,000 a year, maybe household income of $4,000, they can consolidate their financial experience into one platform where they're tracking everything. So, a mint.com-like balance sheet analysis type of tool. They're investing similar to Wealthfront, filing their taxes, creating estate plans and then getting advice. And that's what we do at Origin.

Lex Sokolin:

This is a bit of a trap for you because it's a space in which I've started a previous company and spent a lot of time on. And so, I'm really interested in where things have gotten to. The promise of the mass affluent market has captured and killed an enormous amount of well-meaning businesses. I'm curious as to the current situation. So, in my mind, the previous cohort, fintech previous cohort, that tried to do this, I don't know if people remember these names, I remember them in the middle of the night in my nightmares. LearnVest famously built out a mass affluent focused data aggregation, sort of Mint for investing type of experience, and then attached financial planners to it. Was acquired by an insurance company and slowly died.

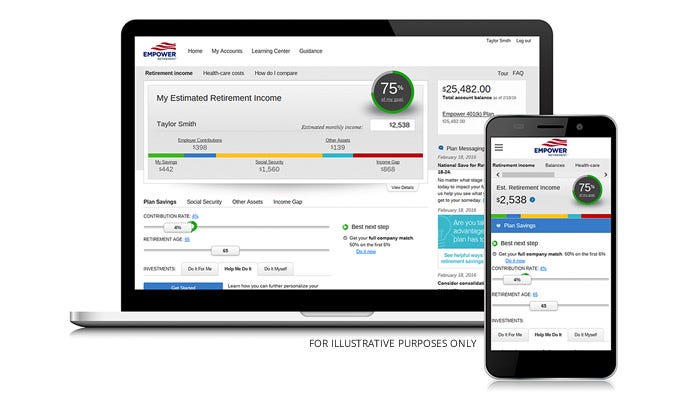

Personal Capital raised 15 or 50 million right out of the gate, was founded by a former PayPal CEO, combined pretty deep data aggregation with financial planning. Spent, I think, seven or eight years building that thing out. Was a really beautiful website, super interesting. At certain wealth levels you would get access to services and financial advisors and hand-holding, again, focused on the mass affluent market. Ended up being acquired by a retirement focused company. I forget the name.

Matthew Watson:

Empower.

Lex Sokolin:

Empower. Yeah, exactly. Empower. And then there's a bunch of other stuff at the edges as well. And then, meanwhile, the incumbents have all launched both retail quality, digital wealth, and then more upmarket digital wealth where they have services sitting on top of robo advice. And then, of course you have other attempts at this from Bloomberg with Bloomberg Black, which was there for a few years. And then, I believe LPL might've done this for two or three years. Again, thinking that, look, we're going to have this core automation and add human service on top and it's going to be fantastic. And I'd say that's the wave somewhere between 2012 to 2018. And so, we are in 2024. Can you give us an update on where the market has moved, and where you see the opportunity? And maybe, what are the lessons of that prior generation?

Matthew Watson:

Yeah. Absolutely. I mean, just going through this [inaudible]. All really good observations on your part. And obviously, you know this space very well. I think there is something to be learned from each of those, and those have really informed the way that I see the world and the opportunity. And I guess I'll caveat all of this by saying so much respect for all of the founders who built those companies and how they ultimately exited them and the service they deliver for their clients. So, LearnVest exited to Northwestern Mutual, I can't remember the exact number, maybe $3 million.

I think when you looked at those businesses and businesses like that, the concept is there, I think what's tough is if you're providing a predominantly human experience, a certified financial planner is the core delivery. It's expensive. And the market you're going after there doesn't have as much appetite to pay what you need to pay in order to have reasonable margins there. And so, without having first-hand knowledge of that, I think that business is tough to scale because appetite to pay, call it, 50 to $100 per month is quite low for the segment that we're talking about.

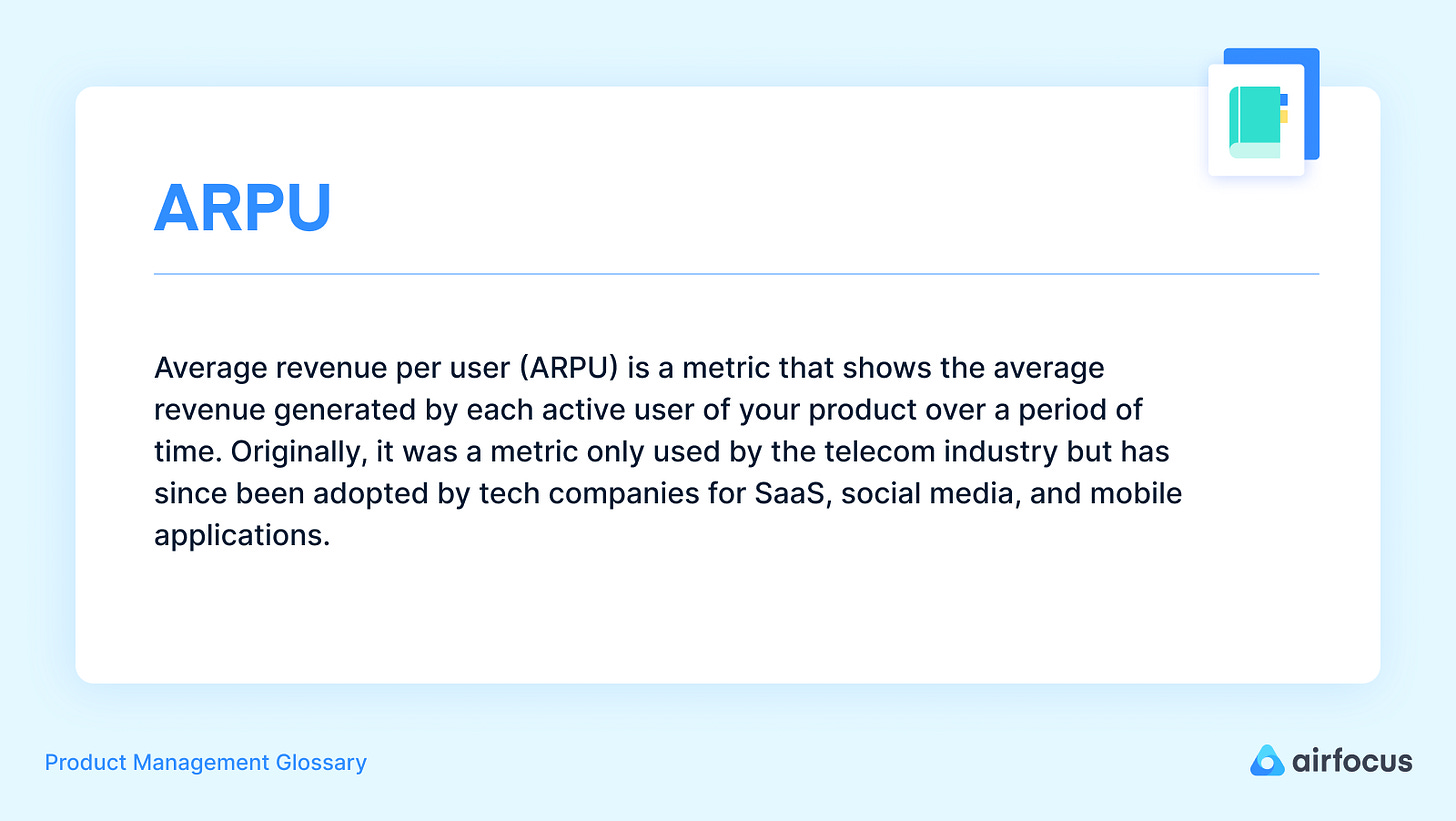

I think if you go up to Personal Capital, I think they had like a billion-dollar outcome to Empower. I don't know how their investors did, but reasonable outcome there. I like some of what they did, they used a core PFM software as lead generation. And then, they're segmenting out to folks who come in. If you have more than 100 grand, that's a client that they're going to pursue from a wealth management perspective. So, they're going to make 90 basis points on 100 TAC. They start at 900 bucks of revenue per year.

And I think that that business was more successful because they went with a traditional wealth strategy. So, their minimum ARPU is going to be right around a grand, as compared to a LearnVest, which might've been 200 bucks a year. So, I think from a business model perspective, it was more sound and I think their TAC was quite a bit lower because of the PFM tool that they utilize.

Lex Sokolin:

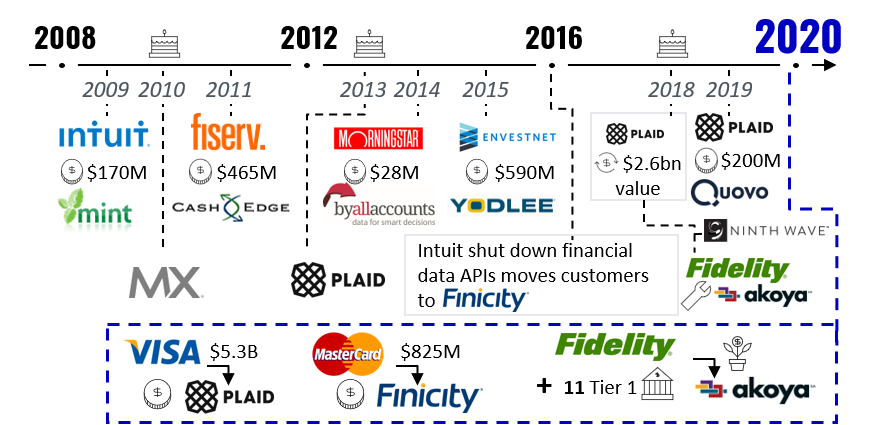

And again, things must have moved quite a bit, but what I remember at the time, in the before times, is Plaid wasn't delivering its own data aggregation yet, and so you only had Yodlee to choose from. There was also a couple of investment focused aggregators like ByAllAccounts. The banking one was Finicity, which is now sitting, I think, inside of SoFi. It was difficult to glue together the data aggregation, and most likely you were getting it from Yodlee, which was underneath Mint. Yodlee now is part of in Envestnet and powers a whole bunch of advisor desktop stuff. And the pricing on the data aggregation was wildly unaffordable, and I think it was something like $2 per account per month.

So, if you're a user and you've got a bank account, another bank account and a brokerage statement, that's costing your aggregator $6 per month. And so, six times 12 per year is... Just on the data aggregation, you're going to be losing 70 bucks per person. And so, take the personal capital model, which is, let's get a million users onto our free layer. And so, you've got a million users times 60. So, that's a pretty big annual cost that's going into creating the candy that you're giving out to people. And on the other side, yes, you get the 900 or 1000 per user ARPU, but the conversion rate to break even and justify the candy you're giving out with data aggregation has to be unreasonably high. How do you think about those unit economics and in that model, and have any parts of that meaningfully changed?

Matthew Watson:

Yeah. I think every point you make is a good one. Stuff that we talk about all the time. That's why our PFM is not free, because the data aggregation stuff does cost money. Everything you said is true. I think that when you get into the brass tacks of how you manage the costs on that business, when people disengage, you're going to stop paying the account. So okay, if someone hasn't logged in 45 days, you're going to cut the account. They're obviously not going to be a good target to reach out to for wealth management services.

Again, I didn't run the business, but my guess is there's correlation between active usage, how proactive someone is managing their own finances and the propensity to convert into a wealth customer. But you're right, there's definitely a lot of cost embedded in that business. For us, we have similar costs, definitely less than the numbers that you quoted, significantly less, but they're definitely there. I think that those are parts of the reasons why we charge for every tier of our product to help combat that. And then, you have services on top of that that you can utilize to monetize the individual.

So, something we constantly think about... When you think about 1033 and open banking, yeah, I think that that's pretty clear that we're moving in that direction. A lot of banks have created their own API's. And as you hit scale, we'll see what the pricing looks like. If 1033 passes as written today, the price of that would fall precipitously at the banks. At Origin, bank account connections constitute 55% of our connected accounts. So, if you block that out of your expenses, you start to get into pretty high margin business on that PFM.

Lex Sokolin:

Just for our listeners, what's 1033 and what's the timeline around it?

Matthew Watson:

1033 is a proposal, as a part of Dodd Frank, to make open banking a part of the regulatory environment in the United States. This is effectively rules that promote more competition amongst banking customers. Banking customers are super, super locked into their banks today. Lex, being in the UK you're probably pretty familiar with this, being in the fintech scene over there. The UK has already implemented such rules to open up the banking environment. The timing on this, the first written proposal came out October, November of 2023. So, call that five or six months ago. Comments were taking, they received 10,000 comments on the proposal through the end of the year.

And then, the current timeline for proceeding with actual legislation is Q3, Q4 this year. That doesn't necessarily mean that this gets rubber-stamped this year, still has to go through Congress, which can take more time. But what you're seeing in anticipation of this is all the banks creating these APIs. All of them have made them in anticipation of this rule being set. Obviously, there's ambiguity around pricing and how much banks will be required to make open and at what fees they'll charge people. But I would say the direction of the industry is to make APIs for consumer financial data much more available than it was, say, three to five years ago.

Lex Sokolin:

Let's go back and talk about the business model and the lessons learned in the mass affluent market, because I think that's really core. One of the things that also frustrated me about this part of the industry is that you have stuff like Credit Karma or Nerd Wallet, which, without doing the hard work of the data aggregation and PFM, is able to attract attention and users into their apps, and then generate hundreds of millions of revenue from selling lead generation into financial products.

And I could never square why it was so difficult for a company like Personal Capital to make money, and they had to do so much in order to get to the revenues that they built. While a simple credit score plus comparison shop was often making more revenue per user and doing it with a lot less cost and heartache. Is there something about the market structure there or the incentives there that are responsible for that outcome?

Matthew Watson:

It's a good question. I mean, I think those two companies just dominated SEO. I'm not as familiar with the Credit Karma origination story, but on the Nerd Wallet side, they're just cranking content from... I think Jake started that company right around the financial crisis or something. And they understood SEO and the value of it and ranking highly, and really capitalized on that. And then, of course the fees that are paid by credit card companies for lead generation are quite high.

So, I think just strong businesses... I do wonder about the future of SEO with AI and AI content and how search will change, but I think you make good points. Solid businesses that really capitalize on SEO, where maybe there's less of an opportunity to do that if you're providing the vertical service in an investment management firm. I don't know, I'd have to think a little bit more about that.

Lex Sokolin:

Got it. Okay. So when you look at Origin, what is your go-to-market and maybe characterize the ideal customer, what it is that they're looking for?

Matthew Watson:

So historically, our go-to-market has been through employers. So, we work with thousands of employers to provide out services to their employees as an employee benefit, and that has enabled us to really eliminate a lot of the CAP challenges that are presented in the direct consumer financial services space. We're also working with third parties to go to market as well. The Hartford, which is a really large insurance company in the United States, they insure one in nine working Americans has selected Origin as their financial wellness partner. So, we're a part of their go-to-market package as well. So, a ton on the B2B and the B2B2C distribution aspect of our business.

Also, we've recently launched a D2C offering as well. Really the intention of that is to introduce our brand to the world, and then also for employees to know that there's continuity with their services if they do leave an employer or they're receiving this through an out-of-work benefit. And in terms of our target, we're targeting mass affluent. So, folks who are making 80 to $150,000 a year. These are folks that, in our purview, just are not serviced well by the traditional investment advisory industry. And there's an opportunity to build a big business, not focused specifically on investment advisory fees, which are quite thin already. We think the opportunities to build digital services that these folks are already executing on in disparate locations.

Examples of this for us are tax filing, estate planning. In the future, we'd like to get into lending and insurance as well to really be that core destination for that target segment. And the monetization strategy is not on investment management at all, it's more on the services that these folks are utilizing and that's where we believe the market size exists for this sub-wealth segment. I think it's also a big reason why wealth advisors can't come down market because their model breaks, right? They're making everything off investment advisory fees. So, if they're looking at someone with 50 or $25,000, and that's their monetization strategy, they're underwater from the first meeting.

Lex Sokolin:

Are the products in those categories products that you're building? Or are you aggregating the customers and then you have partners for planning, investing and tax and so on?

Matthew Watson:

Mostly building. It's vertical, so when you come into our experience, it's native. We build, we buy, we partner, but mostly build or buy. So, we build the vast majority of that. We work with a partner called Column Tax to power the tax, but that's an experience that sits inside of our product. Like the estate planning as an example, that's fully our product end-to-end, trust and wills, investment management. That's us. We have a custodian in the background, but the user experience is us. If we get into insurance, I'd be in a brokerage capacity, so we wouldn't underwrite our own products, but we would be an agency effectively and we would sell those products.

But our goal is to make it as native an experience as possible so you're sitting within our ecosystem. And I think that that lends itself really well to guidance insights from AI. So, when we have all that user's data, we're able to start to give them really good guidance directly in our platform based on what we know about them. That product is live today as well. So, as you connect your information, provide your information to our product to use it for budgeting or investing or tax filing or state planning, we are able to leverage your data, bring it into our AI, and give you guidance that you would traditionally be paying hundreds of thousands of dollars to an investment advisor for.

Lex Sokolin:

Before we jump into that, can you talk about, on the regulatory side, what licensing you need? And then, what entities you interact with? Who's the custodian? Is there a deposit account, some sort of bank account on the brokerage? What's the shape of all of these components?

Matthew Watson:

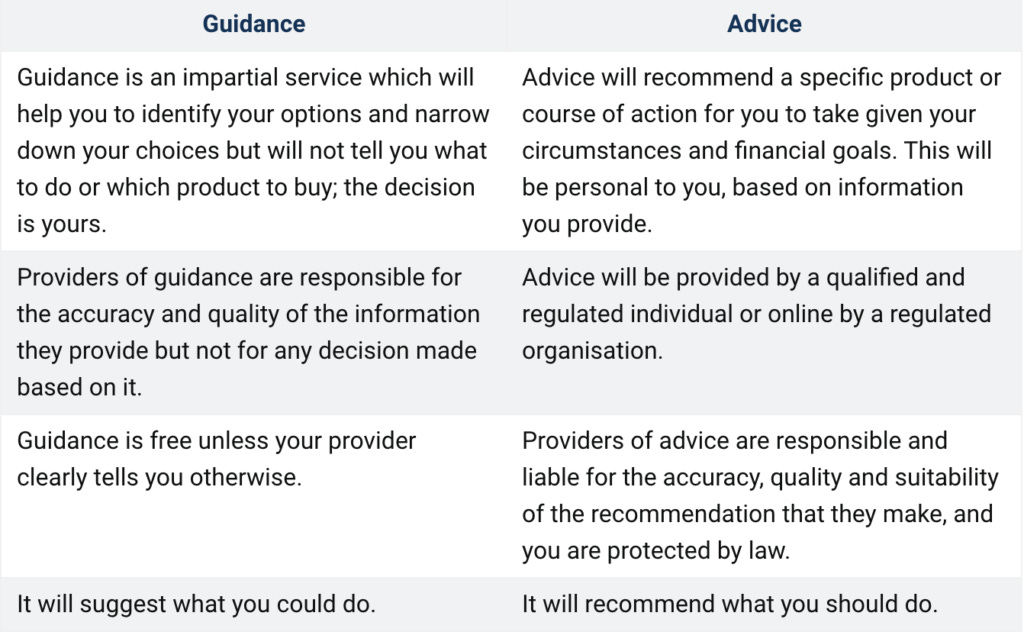

Yeah. We're licensed as an investment advisor in 50 states. That's the predominant regulatory constraint that we face today. We're not brokering insurance today, but if you would be, you'd be licensed as an insurance brokerage in each state that you operate in. As it pertains to AI, that'll be an interesting one to see how that evolves. Really the side that you have to stay on is on the side of guidance, as opposed to advice, meaning it can't be like, "Lex, we love NVIDIA. Go add that to your portfolio." But what we could say to someone is like, "Hey, based on your income, based on your family structure, based on your financial goals, these are the tax advantage of accounts that would impact you most significantly, and this is how you could implement an investment strategy." So, things like that.

In terms of the folks that we work with to power some of these services, obviously on the PFM side we use a number of different aggregators. As you mentioned, there's not one that covers the totality of all financial institutions, so you really need to have multiple there. We work with Plaid and Finicity today, adding MX. On the investment management side, Drive Wealth is the custodian. Today, it's taxable investment accounts. In Q2, we'll move into IRAs joint accounts, things of that nature, looking at a high-yield account as well through them. So, we'd be expanding that suite of services. On the estate planning business, that's all us internally, fully vertical end-to-end. So yeah, that's the way that we power the business.

Lex Sokolin:

Got it. And you had mentioned the collapse of Mint as a big opportunity. Can you talk about that? I mean, Mint was all B2C, and it sounds like your distribution is first through employers, and then B2C is the next leg. How do you interpret the collapse of Mint? And where do you see the opportunity for you?

Matthew Watson:

Even in the B2B space, it helps our B2B motion. This is a major brand name household, or household name, in the consumer financial services industry that's gone under. So, seeing a ton of engagement through the employer space due to that, which is exciting. And then, it really catalyzed our move into the D2C space knowing that there'd be a lot of movement from people looking for new services, and a lot of conversation around where to go and what to do. So, it was just a nice moment for us to start to get the brand out there on the consumer side. And it also catalyzed more engagement on the employer side of the business.

I think what it moved in terms of... I guess you're seeing this across a lot of subscription businesses right now, but payment for services. I think we are in an era of free investment tracking or budgeting tracking, whatever you want to call it. That era, I would say, is sunset with the closing of Mint, and it's led to more of an expectation on the consumer side that there would be a subscription fee for these types of services, which is helpful to us given our business model.

Lex Sokolin:

Let's talk about the AI components and try to narrow in on where you think generative AI is helpful in the planning or guidance experience. Because that's a legitimate additional arrow in the quiver that wasn't available a decade ago, and is an enormous lever that can help automated services, because you can get personalized and you can access the vast sum of human knowledge and get some sort of compressed version of that knowledge about on any particular topic. But at the same time, it's also janky and weird and misfires and can often deliver a hallucination that makes for a strange user experience. So, can you talk about how you have gone about applying generative AI, and in what capacity so far?

Matthew Watson:

Yeah, absolutely. I think everything you said is spot on there. I think there's going to be a huge, huge shift in the investment advisory industry due to generative AI. It'll be interesting to see users' comfort level at different income levels with taking guidance from AI. For most of the time, it's pretty impressive stuff, especially when it has the appropriate data on you as an individual. But I think the next 12 months, until there's another unveiling of the next leg of generative AI, will be more empowerment of the financial planner.

So, if you really want to get deep into a user and avoid a poor user experience, I think it's more about asking and gathering the information to create some sort of guidance for that individual, and then having a human look over that and then send it out. So, you'd see a collapse in the cost of delivering financial guidance or advice. That's probably the next leg of the stool. And then, to the extent that the AI continues to improve, I could definitely see a world one, two, three, four years from now where you have much more consumer motivation to aggregate your data in one experience so that you can get incredible tier one investment advice or financial planning advice from this type of software.

I think that will lead to more consolidation in financial apps than this kind of disparate experience today. But today, I think, to answer your question directly, it's more of an empowerment of financial planning experience. And then, what you do have on the consumer side is going to be ring-fenced quite a bit. So, you're not going to get into the detailed stuff, you're going to say, "Hey, you should talk to a financial advisor about this."

Lex Sokolin:

So, how is that being done practically? Is that a ChatGPT API with some prompts on top and tuning on a financial corpus? What does a developer do today in order to build that experience?

Matthew Watson:

Yeah. We sit on top of GPT, and then we take the tens of thousands of financial plans that we've created. We pipe those in to train it. We have done a ton of internal testing to guide it, put ring fences on what we would like it to say or not say, and pull back from getting anywhere near the advisory component of that, pushing the user to speak with the financial planner as you approach more complexity.

And then, the other thing that we have a unique advantage on is that we have all the data that the user has provided to us and the guidance improves when they provide more data to us. So, if we can see your portfolio or we can see your spending history, the way that people use us today is on prompt to asking about spending experience, portfolio concentration, tax advantage opportunities, things of that nature.

Lex Sokolin:

The guardrails, I assume it's just written text that tries to direct the model not to get too chatty.

Matthew Watson:

Yeah. The predominant goal of that is to eliminate the delivery of advice. People try to jailbreak it. We don't want it to ever recommend buying specific single-make stock or something like that.

Lex Sokolin:

A question that I have, that is much more a rhetorical question than anything else, is whether people even understand what financial planning is, broadly speaking. Whether there is demand for financial planning, and that conversational experience translated into a conversational interface. Because so much of financial planning that people do today is watching YouTube or TikTok and consuming that as financial advice for their life.

And so, I'm really curious as to the persona, the type of person who would have a real-world planner, and then would switch to a chat experience with an automated AI financial planner, rather than somebody who's like, "I'm not sure what to do. Let me read financial Twitter or go find a YouTube." And I asked this question because I think the behavioral profiling is so tough. It's easy to imagine the ideal client, but I think in practice it's really quite frustrating. So, I'm curious as to your thoughts on that.

Matthew Watson:

Yeah. Definitely different users, 100%. I mean, I think that you replace the YouTube type of thing because you can get a much more specific answer based on your unique construct if your data is attached to the AI already. So, instead of going to YouTube to learn about what type of mortgage you should take out, you have an AI that has your data associated with it and can guide you specifically based on the financing available to you and the other price of the home and your income, et cetera. So, I could see that getting displaced.

I think financial planning, we don't talk about it that way internally. It's much more people have a problem they want to solve right now and they want to get an answer to it. And that is a differentiation between someone who's coming in for a long form financial plan. I think that generative AI will be really impactful for people who are coming in with a question right now that they need answered. So really, I guess similar to the use case that you described, where people are going to social media to get some sort of financial advice or financial education.

Lex Sokolin:

An adjacent question is, who owns the data? And you've talked about the banking regulations and trying to open up banking data in the US to look like what it looks like in Europe. And then, of course, we've got the aggregators who've spent a lot of capital on being able to pull that data out and then process it and push it back into user experience front ends like the one that you're running. And then, of course, from a consumer perspective, you show up to an app and you're like, "My data is my data. Why is it so expensive to get it through? And why is it so hard to get my data into an AI engine that can give me advice on it?" What's your view on what happens to that, to how and if the consumer is empowered with their data, with the AI recommendations? Are we going to continue in the current industry structure where everything is really intermediated? Or is there an evolution on the horizon?

Matthew Watson:

Yeah. I think every business is going to try to lock that data up. That's why you need regulation from the government to get banks to cough it up. It's the same thing with what we open the combo up on with these workflow management tools that are utilized. They lock the data down so tightly because they know as it opens up, it's easier to switch and move into adjacent services. So, I think that incumbent holders of data are heavily incentivized to continue to make it difficult for people to get access to that data for competitive reasons. So, I don't know. I'm not sure. I don't know how much power the consumer has to really change that.

I mean, I think we've been talking about these banking changes for a decade. It was part of Dodd-Frank, and it's taken quite a long time to materialize. It's a good question, but unfortunately, if I had to guess, I would say the data remains informed, difficult to attain, though there may be window dressing or an appearance that incumbents make it easier. There's always friction, and that friction could be technological, it could be cost, it could be figuring out even where it is, frequency of delivery. So, I feel like there's so many ways that incumbents try to limit the outflow of user data.

Lex Sokolin:

It's a topic I've been thinking a lot about because I think just a couple of days ago was announced that BlackRock has launched its first tokenized US dollar fund through Securitize, which is a tokenization platform. And so, we are entering a paradigm where we do have a large open source infrastructure for hosting data where people can have full control over it in their crypto wallets. And so, it's really interesting for me to imagine a world where your service, either at the employer or at the consumer level, is around analysis, value add, insights, and then products as attached to those insights.

But then, when you interact with customers, they're bringing their own data and deciding how much they will contribute into the machine and what they will get out of it. And it's very frustrating that in the fintech world we're still a decade behind on those concepts.

Matthew Watson:

Yeah. It'll be interesting. I mean, I think there's definitely a consumer education challenge as well that, I think, persists. One very common one is AUM fees and folks... Those concepts are so commonly exchanged when you operate in financial services. But a lot of our customers don't understand that at all, and the impact of fees. I feel like it'll be really interesting to see how we educate consumers on something like moving data or ownership of data, like you just mentioned. That sounds like the product could really facilitate that if there are users who are really interested in it.

Lex Sokolin:

Absolutely. Okay. If our listeners want to learn more about you or about the company, where should they go?

Matthew Watson:

Yeah. Come visit us. We'd love for you to check our product out. Useorigin.com. U-S-E-O-R-I-G-I.N.com. Love for you to give some feedback on the product.

Lex Sokolin:

Matt, thank you so much for coming on and sharing this really interesting market update, as well as the story of your company. Really excited to see where it goes from here.

Matthew Watson:

Amazing. Thank you so much for having me. Great chatting with you this morning.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions

Share this post