Hi Fintech Architects,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

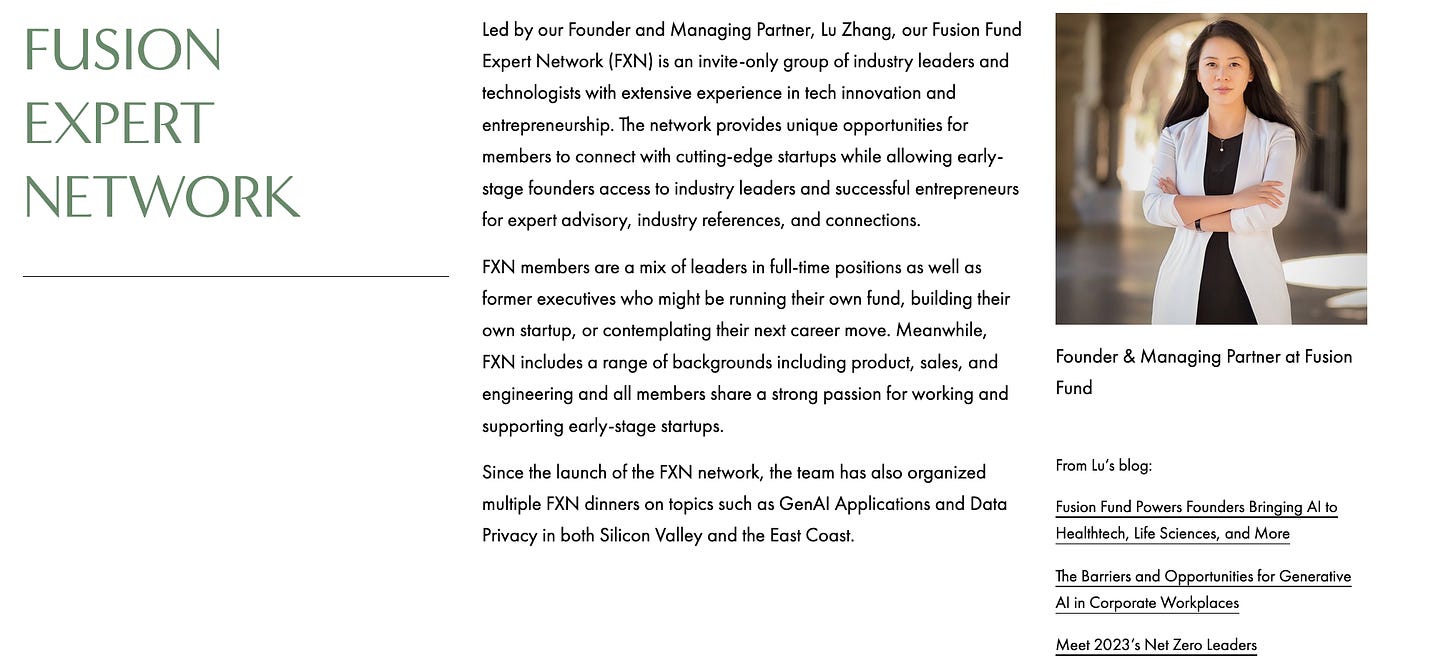

In this conversation, we chat with Lu Zhang - Founder and Managing Partner of Fusion Fund, is a renowned Silicon Valley-based investor, a serial entrepreneur, and a Stanford Engineering alumna. With a strong technical background, Lu has extensive experience bringing a broad range of technologies to commercialization and deep domain expertise in AI in healthcare, Enterprise AI/Networks, Edge Computing, and Data Privacy.

Prior to starting Fusion Fund, Lu was a serial entrepreneur and materials science researcher. Lu is a first-generation immigrant originally from Inner Mongolia. At the age of 21, she built a medical device company for Type II Diabetes diagnosis based on her graduate school research in Stanford University. Following the acquisition of her startup by a leading public medical device company, Lu began investing in and supporting early-stage entrepreneurs. This eventually led her to create Fusion Fund in 2015. Since then, Lu has built a distinguished eco system and established her reputation in the VC industry. She was honored as Young Global Leader by World Economic Forum (Davos), Silicon Valley Women of Influence, Best 25 Female early-stage investor by Business Insider, Featured Honoree of VC of Forbes 30 under 30 and Town & Country 50 Modern Swans - Entrepreneurship Influencer.

Lu frequently speaks at high-profile tech conferences such as World Economic Forum(Davos), Future Investment Initiative (FII), Web Summit, SuperReturn, etc., and she is a guest lecturer at Stanford University. Lu serves as a board member of many portfolio companies, the Board and Chairwomen of the Youth Council of Future Science Award, and Jury Board of the Cartier Women Initiative and Young Leader Award. She holds an M.S. in Materials Science and Engineering from Stanford University.

Topics: Venture Capital, VC, Innovation, Artificial Intelligence, Startup, Infrastructure, LLM, Decentralized AI, Healthcare

Tags: Fusion Fund, OpenAI, IBM, Microsoft, Nvidia, AMD

👑See related coverage👑

AI: Could the next generation of OpenAI and Google AI Agents be financial?

[PREMIUM]: Long Take: What would AGI do to the economy and financial industry?

[PREMIUM]: Long Take: The difference between Generative AI and Machine Learning for Finance

Timestamp

1’30: From Entrepreneur to VC: Insights from Building and Exiting a Successful Healthcare Startup

5’50: Navigating Startup Challenges: Overcoming Obstacles and Embracing Growth in My Entrepreneurial Journey

9’56: From Founder to Investor: Experiencing the Transition and Learning to Say No

15’16: Fusion Fund’s AI Investment Thesis: Identifying Trends, Opportunities, and Challenges in Artificial Intelligence

23’03: Comprehending Enterprise AI: Ensuring Startups Thrive Without Being Captured by Big Corporates

26’48: The Challenges and Opportunities in Selling Large AI Models to Enterprises: Fine-tuning The Sales Process and Building Strategic Partnerships

30’31: Exploring AI Infrastructure Investments: Paths to Acquisition and IPO in a Competitive Landscape

36’24: AI Infrastructure Gaps: Identifying Opportunities and Challenges in the Evolving Value Chain

40’53: The Future of Decentralized AI: Commercial Opportunities and Economic Dynamics in a World of Personal AI Models

47’07: Key Opportunities in AI: Unmet Needs and Ideas for Future Startups

48’08: The channels used to connect with Lu & learn more about Fusion Fund

Illustrated Transcript

Lex Sokolin:

Hi, everybody, and welcome to today's conversation. I'm really excited to have with us today, Lu Zhang, who is the founder and managing partner at Fusion Fund, a venture fund that invests across deep technology, including artificial intelligence, healthcare, as well as industrial technology, and we are going to explore the various investment themes across artificial intelligence and learn about how a venture fund works. Lu, welcome to the podcast.

Lu Zhang:

Thank you for having me. Very glad you're joining the discussion today.

Lex Sokolin:

My pleasure. You were an entrepreneur very early on and then had an exit. Can you tell us about what that felt like, what that experience was like, building a company and then being able to get it to the end of the road to get it to the conclusion?

Lu Zhang:

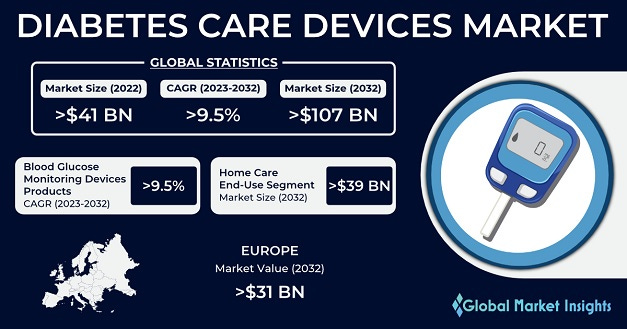

As you mentioned, I was an entrepreneur before I started my own VC firm. I still joke about it with my founder friend that when you're a founder, your life is kind of miserable, but on the other side, the whole founder journey is super rewarding in terms of the personal growth and also, working on something really creative and be able to bring value to the industry. My company was focused on healthcare, so it was a medical device company solving the problem for early diagnostic of type two diabetes. Market size was huge, and my technology was very unique, and I really learned from the scratch to understand how to not only build a product, but also navigate within this very complicated healthcare system to build up partnership, to deliver their solution and also, have a sustainable business model and make good revenue. Definitely, it's an amazing learning experience.

Also, all this operational skill set enabled me to become a better investor after I sold my company. When I realized, okay, what is really critical for founder to launch a product and also how to engage with different party, including venture capitalists, the capital and also talents and a large corporate as a partnership to make it work. I do want to highlight one thing. I launched my company more than 10 years ago. At that time, there are no such a hot buzzword about AI, but we started to utilize the data we collected, try to push for more personalized diagnostic result. Later on, people start calling it as AI in healthcare. I think from that moment we already start to realize, I already start to realize the true value is within the data, but how we find the effective tool to understand the data better and also be able to turn it into something really personalized, really powerful and also low-cost solution for every single user and patient.

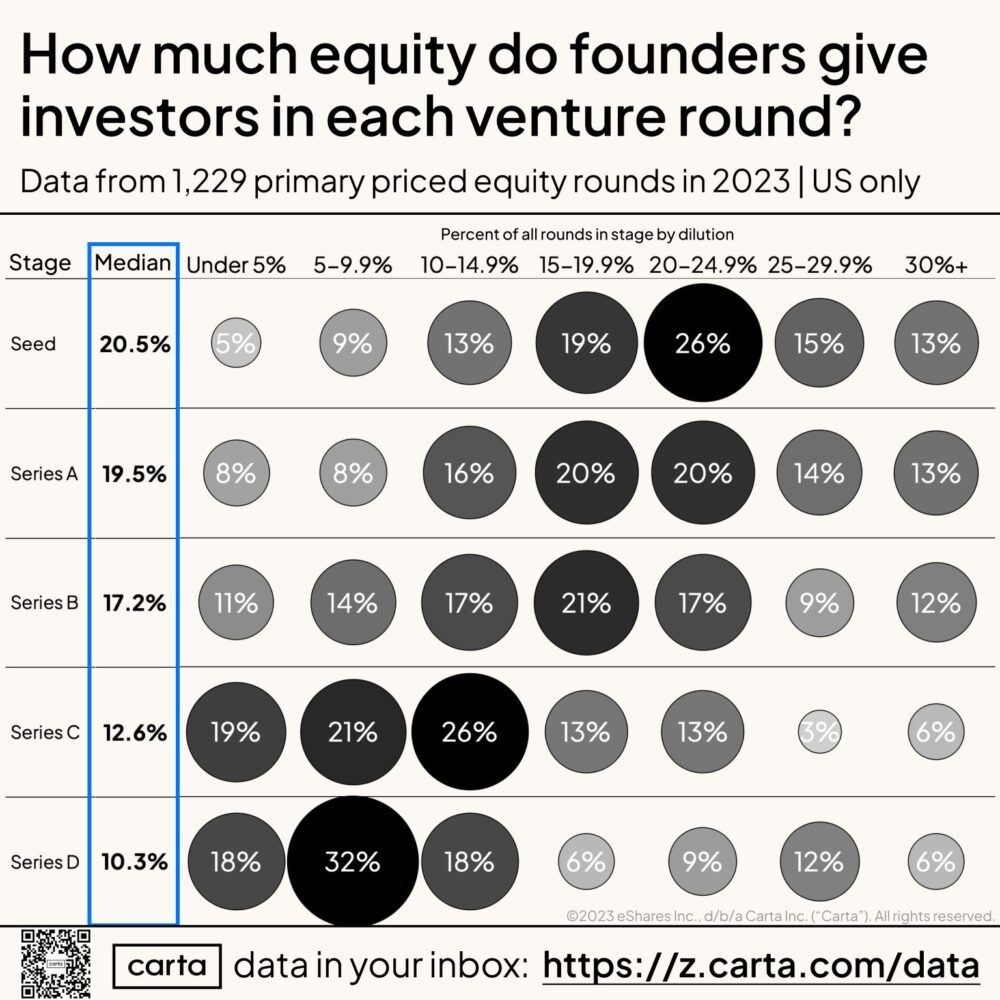

That's really later translated into our sector focus within healthcare is also AI in healthcare, and meanwhile, we'll be investing enterprise AI in general for both application and also AI infrastructure. It's a great journey. Lots of things happened for a reason. I didn't realize when I was a founder and after I sold my company, start a VC firm, I'm like, "Oh, I see. That really helped me." Another thing I also want to highlight is when I sold my company, my ownership was 72%, and I have many founder friends who was impressed by that, including investors saying that "Oh, you control such a high ownership of the company. How did you do that?" The reality was I had a harder time to raise capital. I was not entitled to easily raise a bunch of capital just to spend as much as I want. I raised limited capital and I have to really focus on generating revenue and early partnership to make sure the company survive and eventually, become successful.

When I start to do negotiation of the merge acquisition, I found this high ownership really gave me strong leverage power. Everything have two sides, that's one thing I always share with the founder. Another thing is that's also a unique experience for me to realize, okay, venture capital is really just a catalyst to help founder to grow faster. The fundamental of the business is still how to build a useful product and generating good revenue. Although you have such a great product, you don't want to raise so much money, you only need to raise very minimum capital needed for extension of the cash flow, runway out, maybe just help you in terms of the business expansion and later having this high ownership and control of the company going to give loss of edge. That's also another thing we've been helping our founder doing right now. We invest in early stage and then we really partner up with the founder, maintain their ownership and control over the company.

Lex Sokolin:

There's a lot to unpack in there. Going back to your entrepreneurial journey, you've touched on the positive sides of the experience, but you also called it a can of misery, which of course, is I think pretty accurate. What were some of the hardest parts? What was the things that went wrong or some of the plans that didn't quite happen? What were the hardest parts of your entrepreneurial journey?

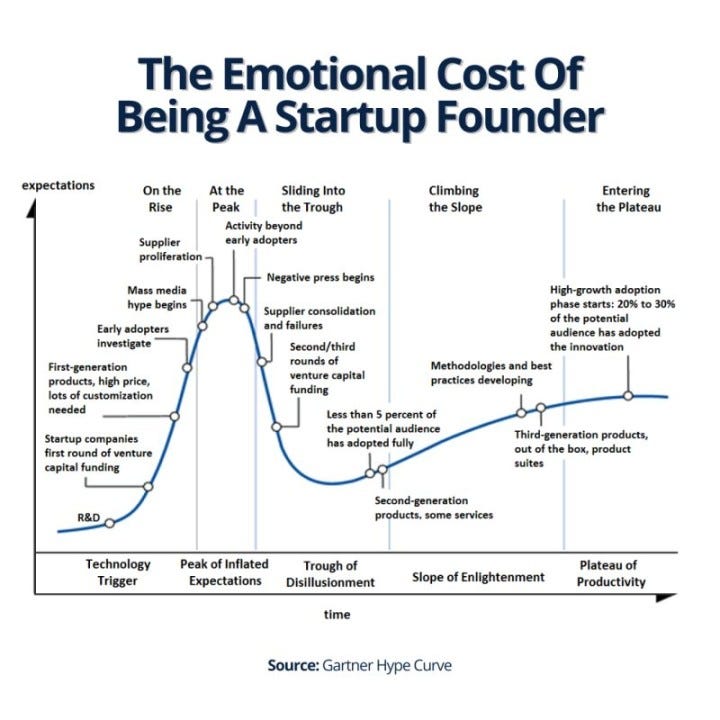

Lu Zhang:

Probably it's not only me. If you ask most of the founders, typically when you're running a startup at early stage, nothing go with the plan. There is always a surprise, surprise might be a nice word to describe that. There are always surprises happening. There are always things you have to quickly adapt into and also, doing adjustments, evolution of the product, evolution of the structure, upgrade of the team. Things are quickly evolving and changing every single day. I would say how to quickly adapt to the new situation every day is important for me and also, for every single founder. For me, it was a little bit more challenging because I was 21 years old when I started a company. I was a solo founder, and meanwhile, that was the second year I came to United States. I was studying in Stanford, and I was starting a company.

Lots of learning, to start with. I think that the first one year is definitely, I feel like, "Oh, my God." I am overwhelming with all the things I need to learn and also just having such a strong drive. I'll maybe also pressure, I need to grow. I'm not growing fast enough. I need to grow much, much faster because things are just hitting on me and every single day there's a new thing I need to solve, there are no time to break. That's the number one challenging thing, but I think that's true for most of the startups when they initial get started. I just have a slightly unique position because of the age and experience I had at the time. The second thing is really how to handle people saying no to you. I was too young when I was a founder, so initially, I didn't handle it too well.

I initially took it personally. I'm like, "Why people are saying no to me. Why there are so many nos? Well, my technology really good." If you remember more than 10 years ago, the major focus area, maybe the popular sector in Silicon Valley was not healthcare, was not AI, it was consumer, it was business model innovation. That's not what I was building. In order to find the investor who understand the tech and also be able to align with my vision and also be supportive to my business was very tough. It was tons of meaning. I was joking that one day out of five days single week, if I could get a yes day, that would be great. Means I got a couple of yeses in that day. For the rest of the day, I'm always getting nos. It took a while for me to realize, okay, there's a reason people say no, I shouldn't take it personally.

I also should always stay positive about the entrepreneur and really think about, look at things differently. Like okay, people are saying no for me, like why? Try to learn, try to grow, try to be better and also just take the challenge and fight back. That's when I was joking with my friend, thanks to my culture and I grew up from a place called Inner Mongolia. If you heard about the Mongolian culture, we're warriors, we'll fight a battle. I was pretty persistent and also strong, resilient, be able to continue learn and continue grow and eventually, make the company success. The journey of learning and digest the no, digest the rejection and be able to translate it into a power to encourage myself to grow, it takes some time and take some effort. It was not easy.

Lex Sokolin:

One of the things about becoming a venture investor is that you become the person saying no. Can you talk about that transition from trying to win people over and trying to sell and then starting your own investment firm? I guess you do end up fundraising for the investment firm, and so you do still have to do the entrepreneurial sort of bootstrapping. In the core business of looking at companies, it kind of flips to you being the person that has to reject 99% of the pitches. Can you talk about that transition about setting up the fund and then what you had to learn to make that work?

Lu Zhang:

I was lucky because I got very good financial return from my company exit, my previous startup company. Of almost a year, I was doing angel investing with my own personal check. Small check, 20K, 200K, and investor across 13 companies. All 13 companies, so far, I got four IPO. That's when I start to realize the power of early-stage investment and also seriously consider to make it an official career path and make it institutionalized. Launch the fund one in 2015. You're right, it's not only my personal money, I also raised money from other LP. Because our fund one was relatively smaller size, and also, I already built up a personal track record in the previous year with my personal investment. Also, I have such a unique sector focus back in the days while people start talking about consumer, I've been championing about AI, healthcare, deep tech, in general.

I was talking about fundamental tech innovation; tech application innovation is coming. Then the business model innovation of internet stage is almost done. All this methodology attracts LP who like my sister's and they really like who I am, how I do investment, so they came to support me. I did a little bit fundraising, but not really official, have relatively efficient and very fast the start of the fund one. As you said, now I'm the one saying no to founders. I still remember when I launched a Fusion Fund, I had many founders’ friend joke about saying that, "Oh, you went to the dark side. You sound like a shark now." I'm like, "I'm not a shark. Come on. Shark has very small brain, they're not that smart, and I could be dolphin. Still considered as a predator, but full of compassion. Very smart and also working as a group, so come to work with me."

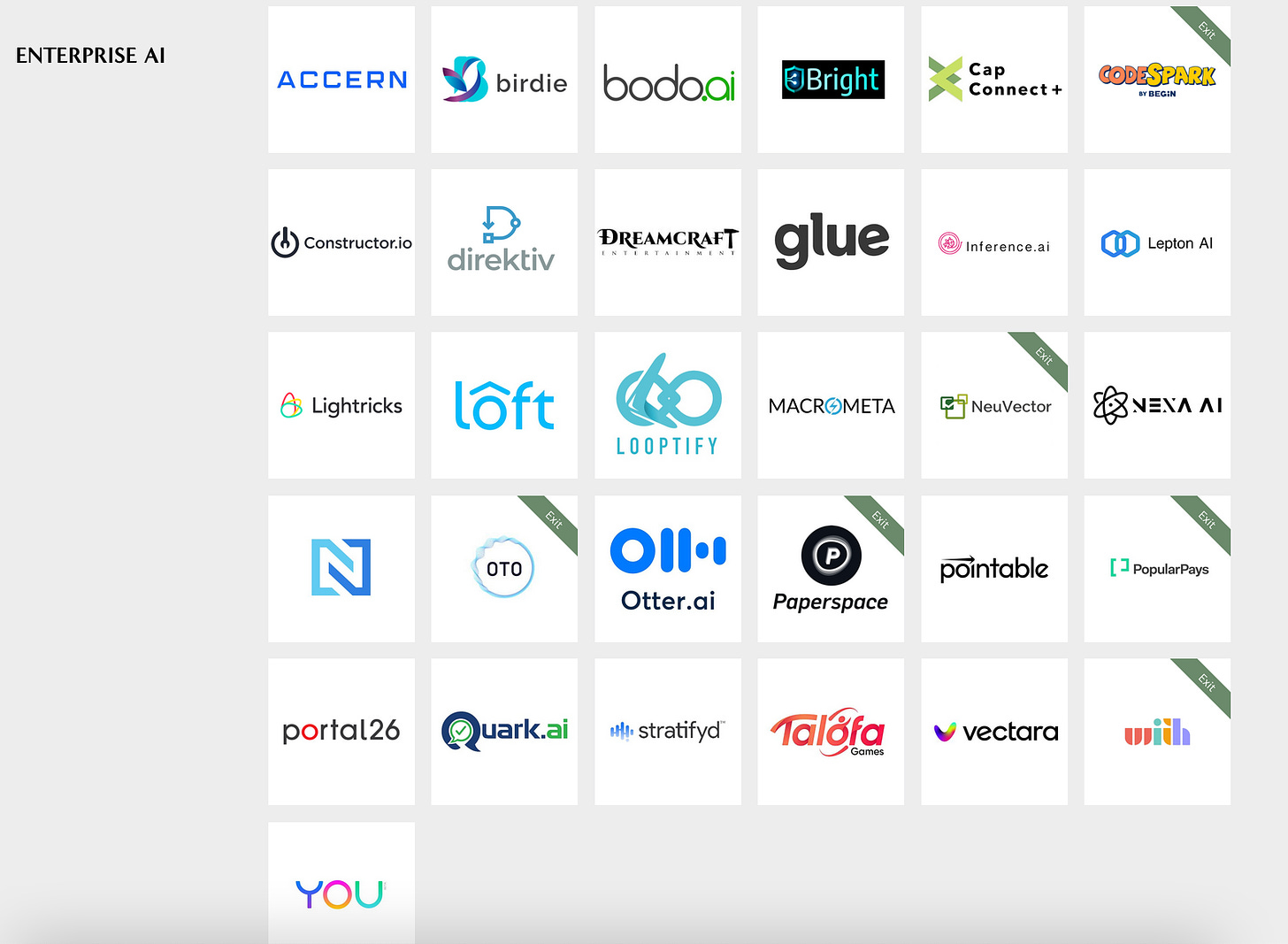

I think one thing we did very well is from day one of Fusion Fund, we start to build up different community. For the first community, we built it up, was a super founder network. Initially, all my friends who are zero entrepreneur who exit previously through much acquisition, most of them, some of them even did IPO in the past. Still driven, still passionate about doing something new, and also, they're top founder. Top founder knows top founder. They also refer good company to me. Based on that network and also extension of that network, I was able to quickly connect with the founder who fully align with our sector focus, working on something really awesome and I could support them even before they start thinking about fundraising. I think be able to create our own preparatory skill flow is important. The matching success array will be slightly higher, instead of just talking to other early-stage founder as much as possible, which going to be the result. As I said, we need to say no to 99% of the founder.

Lex Sokolin:

Why is that? I don't quite follow. If you have a network of good founders, they'll recommend companies, I guess versus just the average founder that writes to you. Can you talk about that a little bit more?

Lu Zhang:

Yeah, that's what I mean. I mean, if we don't have our own community, we just talk to other founder on the market. Lots of time investors say no, it's because mismatching of their sector. For example, I got consumer founder reach out to me, I got lots of the founder reach out to me within the sector is not in our focus area. That's an easy no, but think about that's not the best use of founders' time or our time. Versus we have this community that is already designed based on our sector focus, so the matching successor rate will be much higher. We still do both. We have founder, a super founder network as our preparatory sourcing channel. We're also talking to founders through other referral network. I think it's essential to keep doing both, to increase the successor rate of the matching.

Another thing, as I mentioned, it's really about how to say no to founder. I remember when I was a founder, I mentioned that I wanted to learn from the nos, I want to be better. We also want to offer very structured feedback to the founder when we say no. Let them know what is the reason, what is our concern. Some of them we may directly say no because of the matching or maybe certain concerns is a potential red flag for us. For other founder, we may keep monitor. We tell them it might be the timing issue, might want to see more validation. That's the way we say no to the founder. Essentially, I think to be effective and efficient during the sourcing process is very important to create our own founder network and be able to have better matching when we're doing the sourcing.

Lex Sokolin:

Let's shift to the investment thesis in particular around what today is artificial intelligence. How do you approach that? Do you have an opinionated point of view on the market around where those trends are going or is it more you look at the whole market and try to network into the different themes? What is your investment thesis on artificial intelligence?

Lu Zhang:

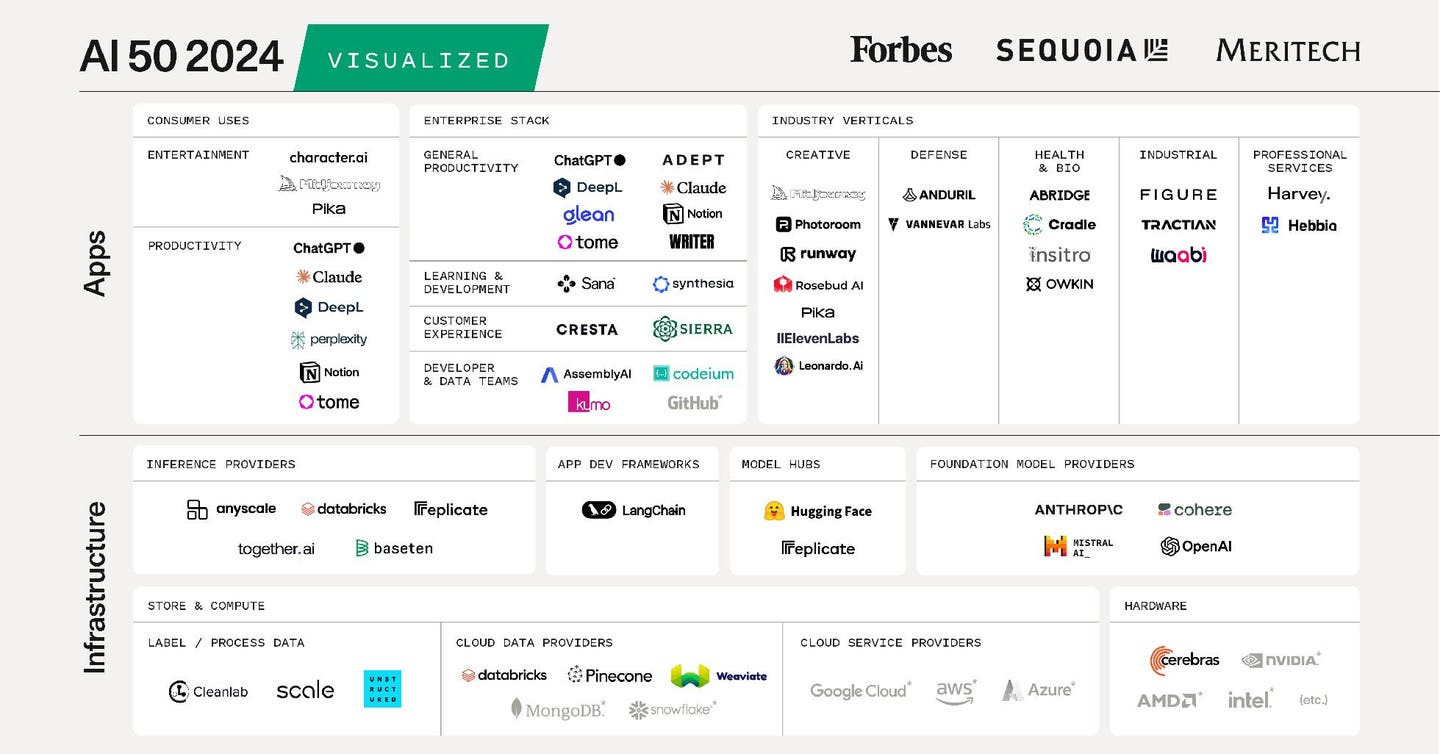

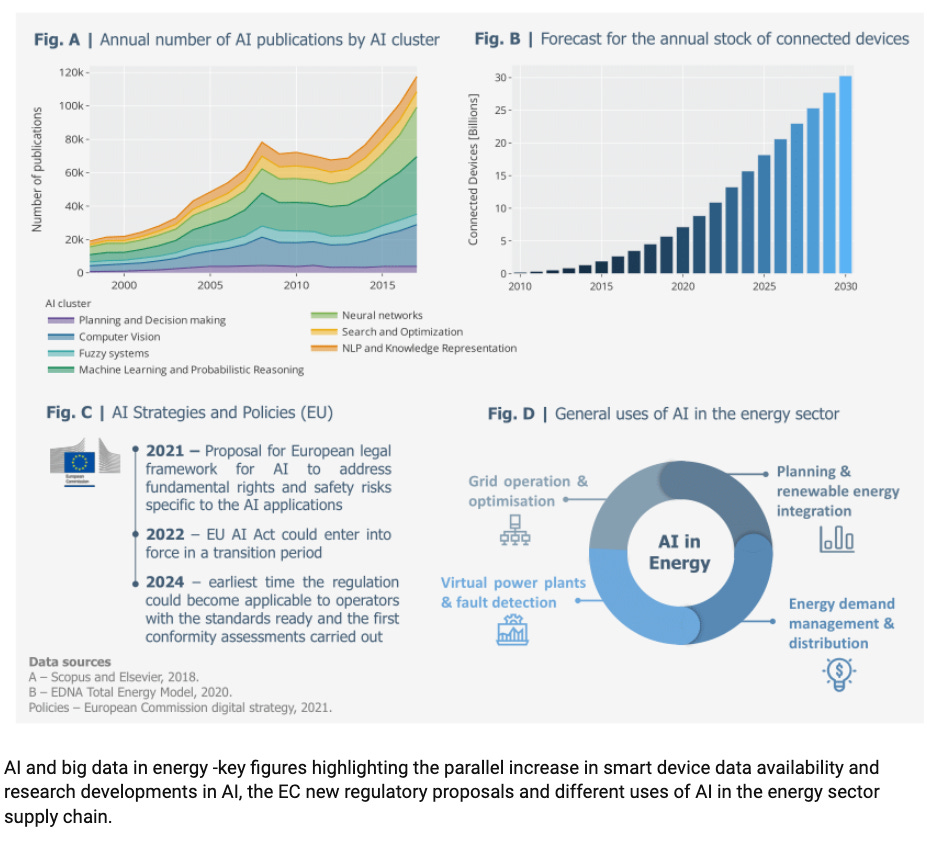

Yes, we actually have a very clear thesis around AI since 2017. 2017, we published the report on AI in healthcare. Also, another one is related to AI infrastructure, on edge computing, data privacy. We've been really championing for the investment in the sector and also being monitored and observe the growth of the evolution of the industry. Number one thing, this AI trend is real. People all see the power of the Meta gen AI and other AI algorithms. We always believe the trend of AI's local AI platform means the user of the AI tool doesn't need to learn a single line of code or write a single line of code. That's the beauty of the technology. Just open up the opportunity for everyone to benefit from the productivity improvement powered by AI. This time is not only technology industry, AI could implement with all different industry across the sector, across the region.

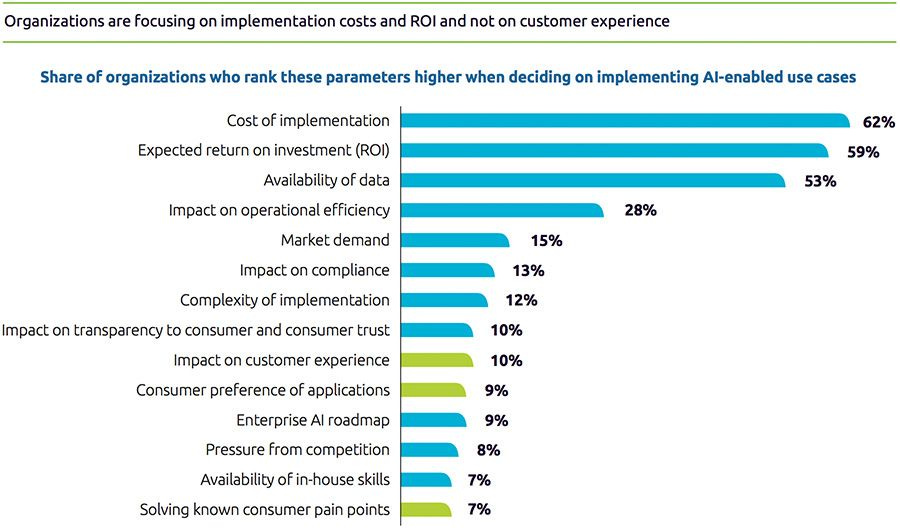

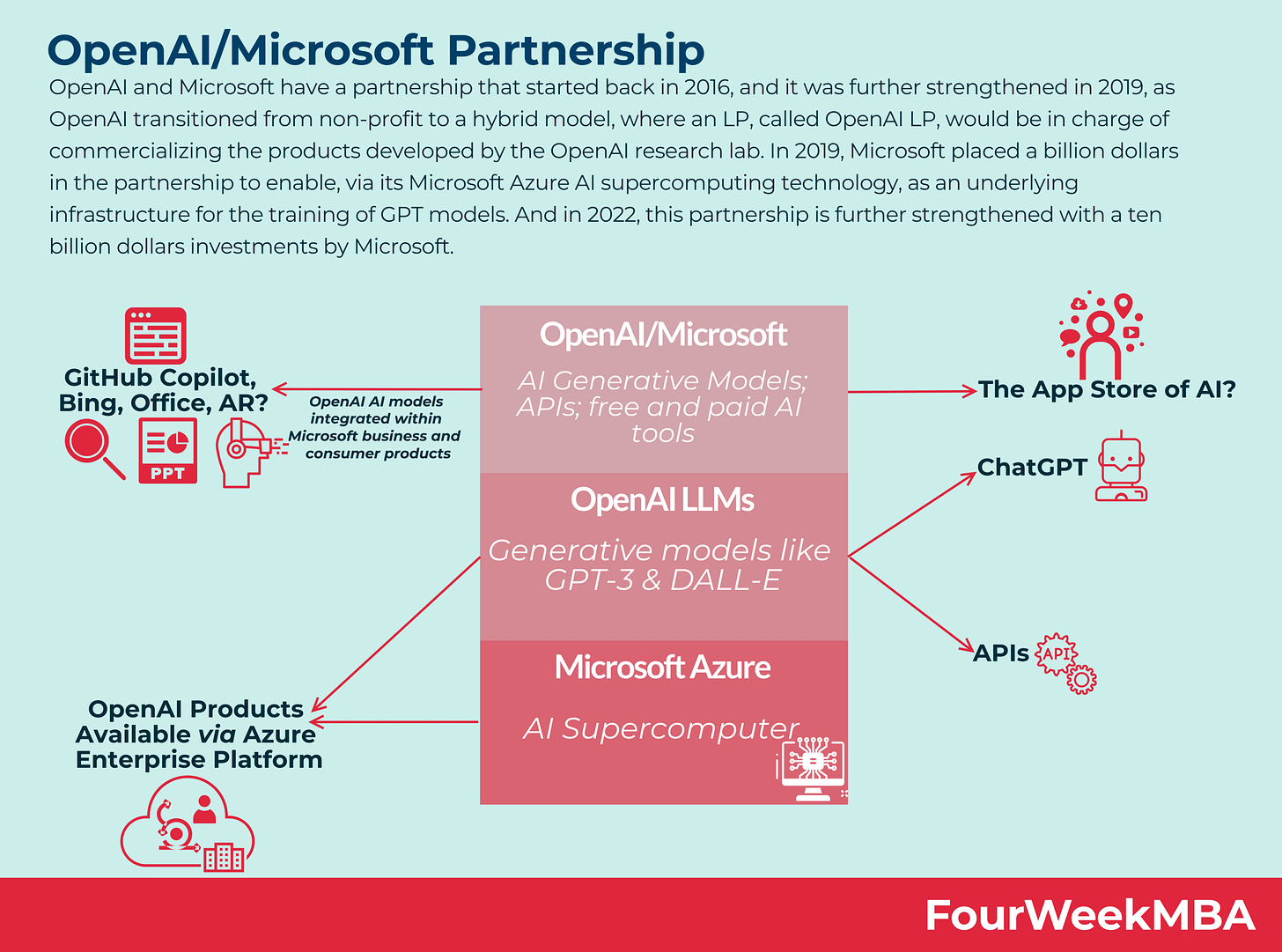

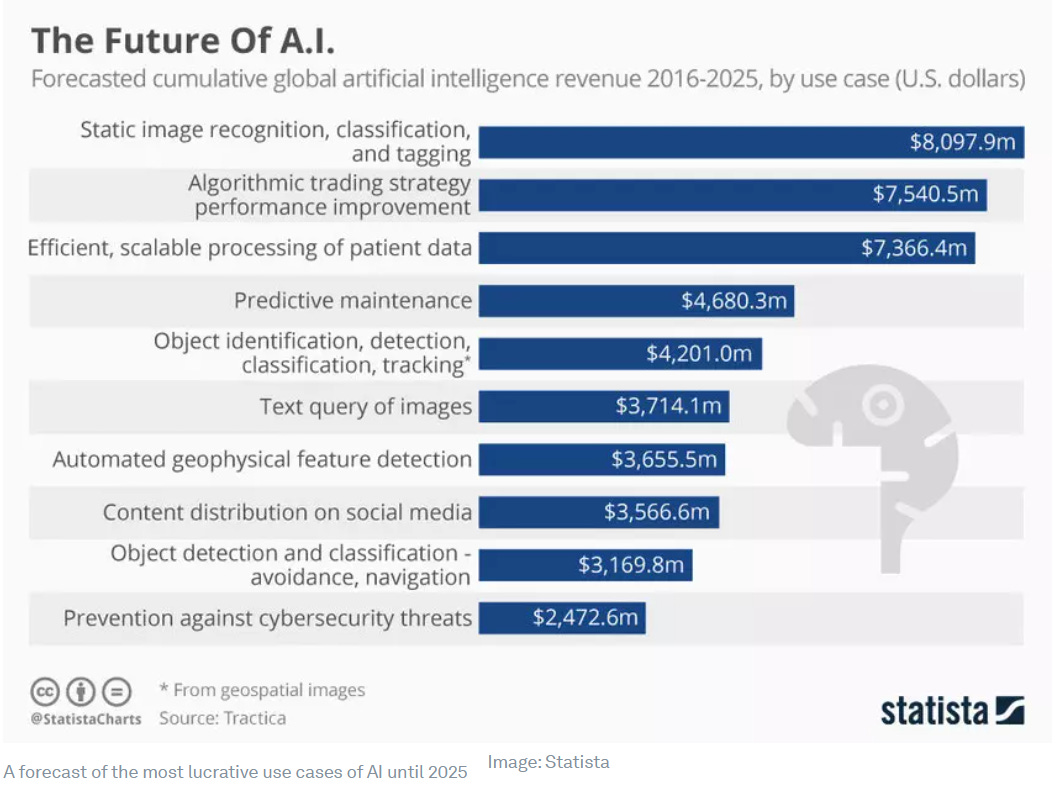

I keep telling to invest and founders since two years ago, I'm like, "This time the AI trend powered innovation might be even 10X bigger than the internet." However, there's always a, however. Who's going to benefit? The main theme of internet was a disruption. I think the main theme of the AI trend is really empowering. All the players are going to get empowered, not only just a smaller startup. The reality is maybe roughly 60, 70% of the innovation opportunity going to dominate by the large company, especially a large technology company. If we're specifically looking at consumer application and the enterprise application. For consumer application, maybe more than 90% will be dominated by the large tech company. Not only they have GPU power, they have resources, also think about in order to fine tune the solution, the quality of the data for now, it already matters more than the quantity of the data. Who has the highest quality of the consumer data in the market right now? It's not public data, it's all this large tech company.

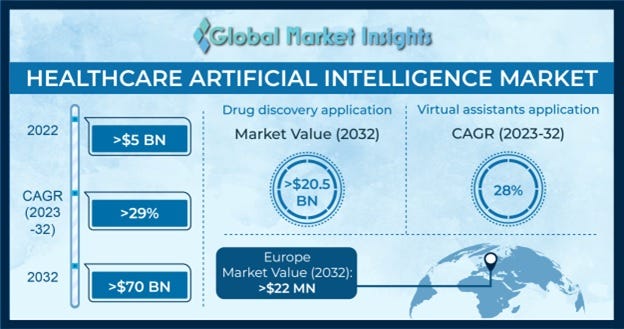

They could use higher-quality data with a very lower cost, a very efficient way to fine-tuning their AI algorithm, their AI product. There's opportunity for consumer AI startup, but it's just harder for startup company to quickly competing with all this larger player, not to mention OpenAI and smart play, backing by all this large tech company. That's number one thing. The sense looking at enterprise, we just feel like okay, there's also unique opportunity here. I always mention about data when I mention about AI. We need to look at which industry has a huge amount of high-quality data who really showcase the capability of AI. Healthcare is number one, that's also the reason why since 2017 we've been promoting for AI in healthcare. Also, we've been looking at other industry, like insurance, financial, logistics, even space industry, who are generating huge amount of high-quality data, but they don't have bandwidth or don't have the talent of AI to utilize the value of the data.

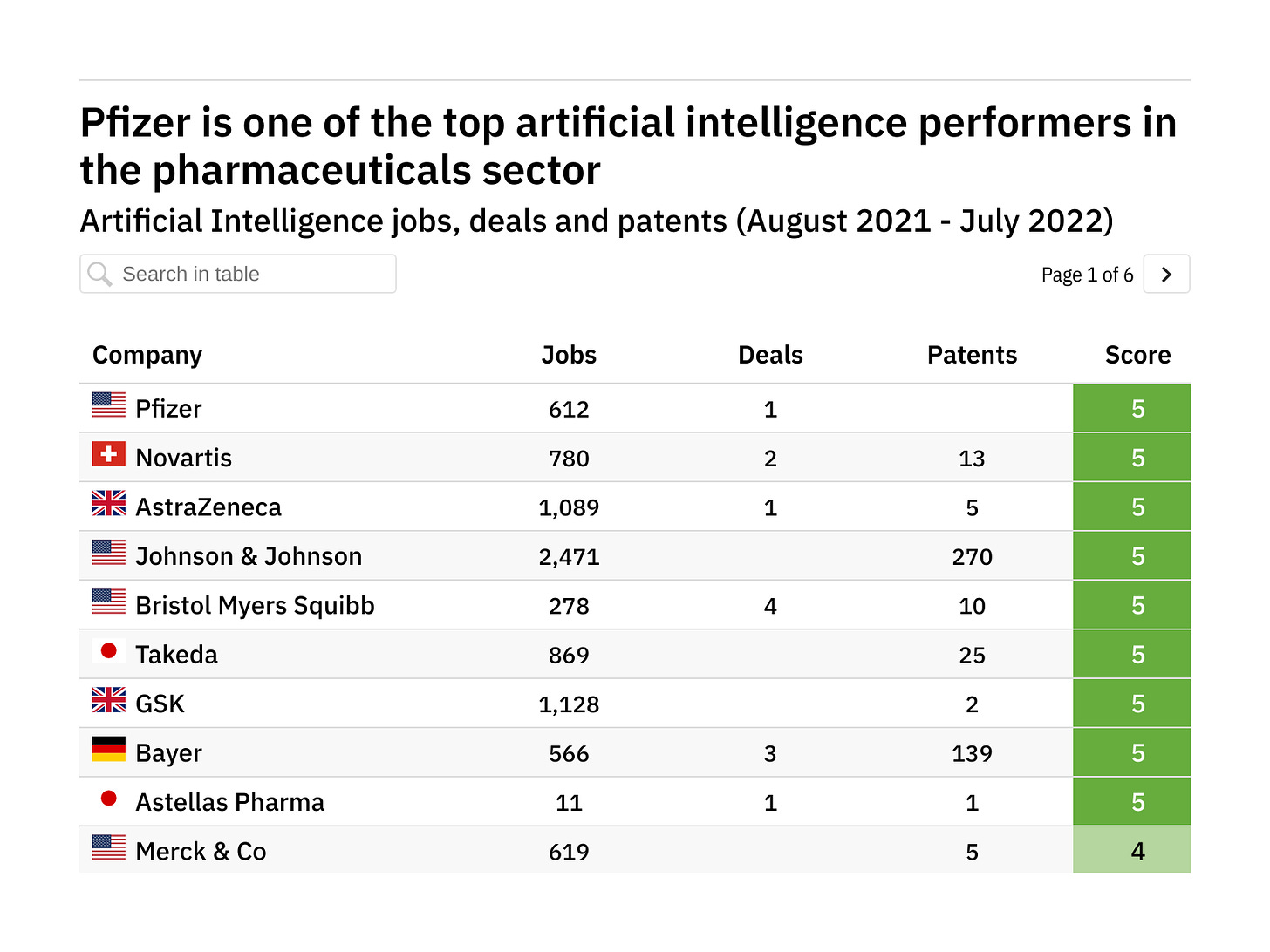

That's the interesting opportunity for startup. Another good news is company like Pfizer, company like Novartis, all this large corporate who have valuable internal data, I don't think they will want to share their internal data with company like Microsoft or Google. They would have a more preference to work with a smaller startup, be able to enable lots of the vertical AI application. Overall, our assist is around AI, number one. For AI application, it's important to identify the good or maybe the right industry and application for startup to working on, because there's tons of application every industry should integrate with AI. Doesn't mean every industry going to be able to dominate by the start of a drive innovation. Based on what I mentioned, which industry has high quality, huge amount of data, which industry lack of productivity, which industry also won't share the data with large tech company. That will be the opportunity for the smaller startup. That's application layer.

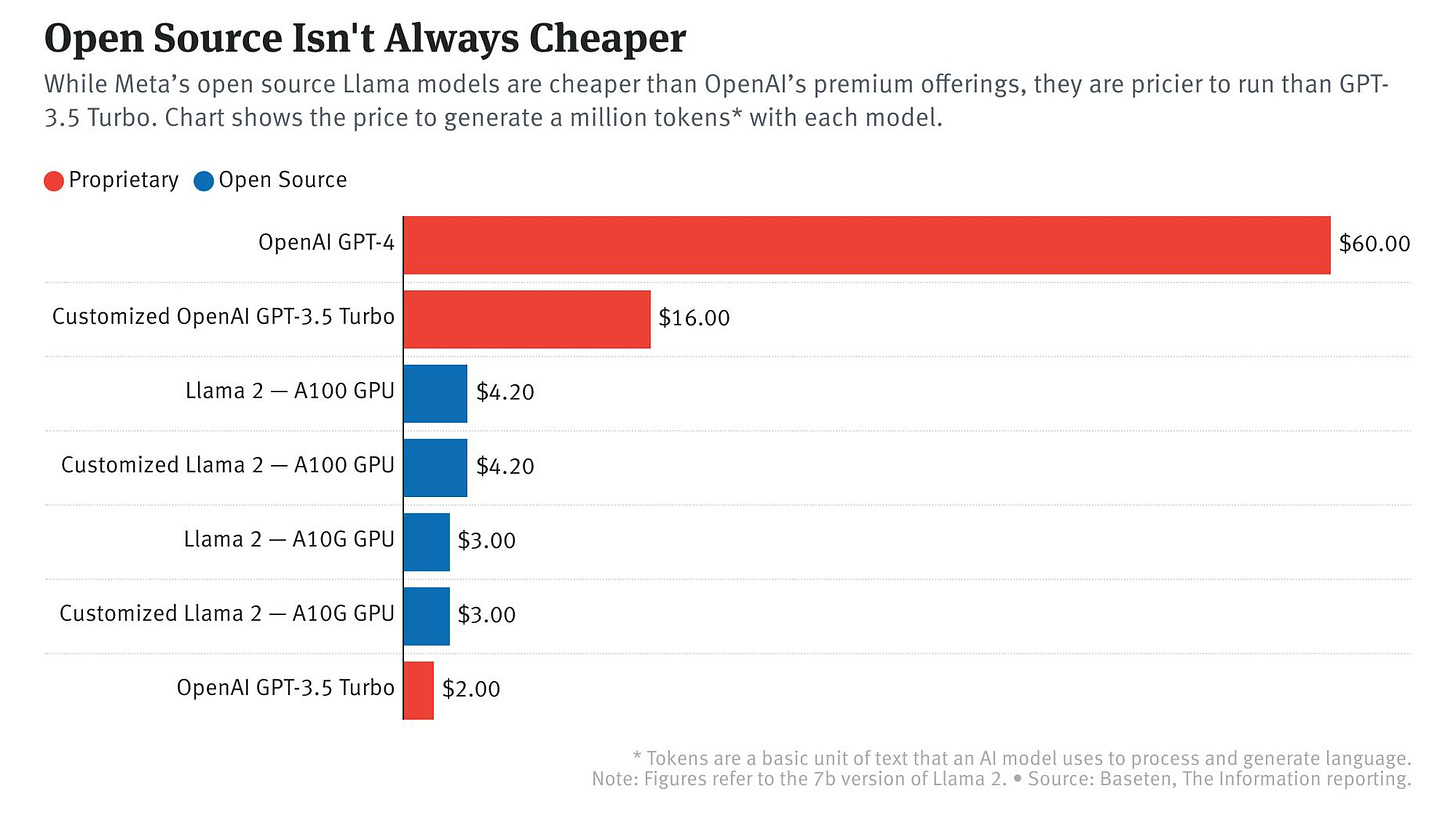

Another layer is really important is AI infrastructure. I shouldn't call it one layer, it's the ecosystem. AI infrastructure, including from chip layer hardware to the software, like a cloud infra to the security to add eventually to the application data layer. The whole ecosystem have so many different technology evolve and it's essential to have new innovation there to solve a fundamental problem right now. Our challenge of the increment of AI, which is the cost. AI is so expensive. First, is the GPU consumption is way too high. Everyone knows about it already. Second thing, people talk about it more and more is energy consumption. Very quickly we're going to realize the limitation, the bottleneck of AI is not necessary, only chip and algorithm, it's actually the energy.

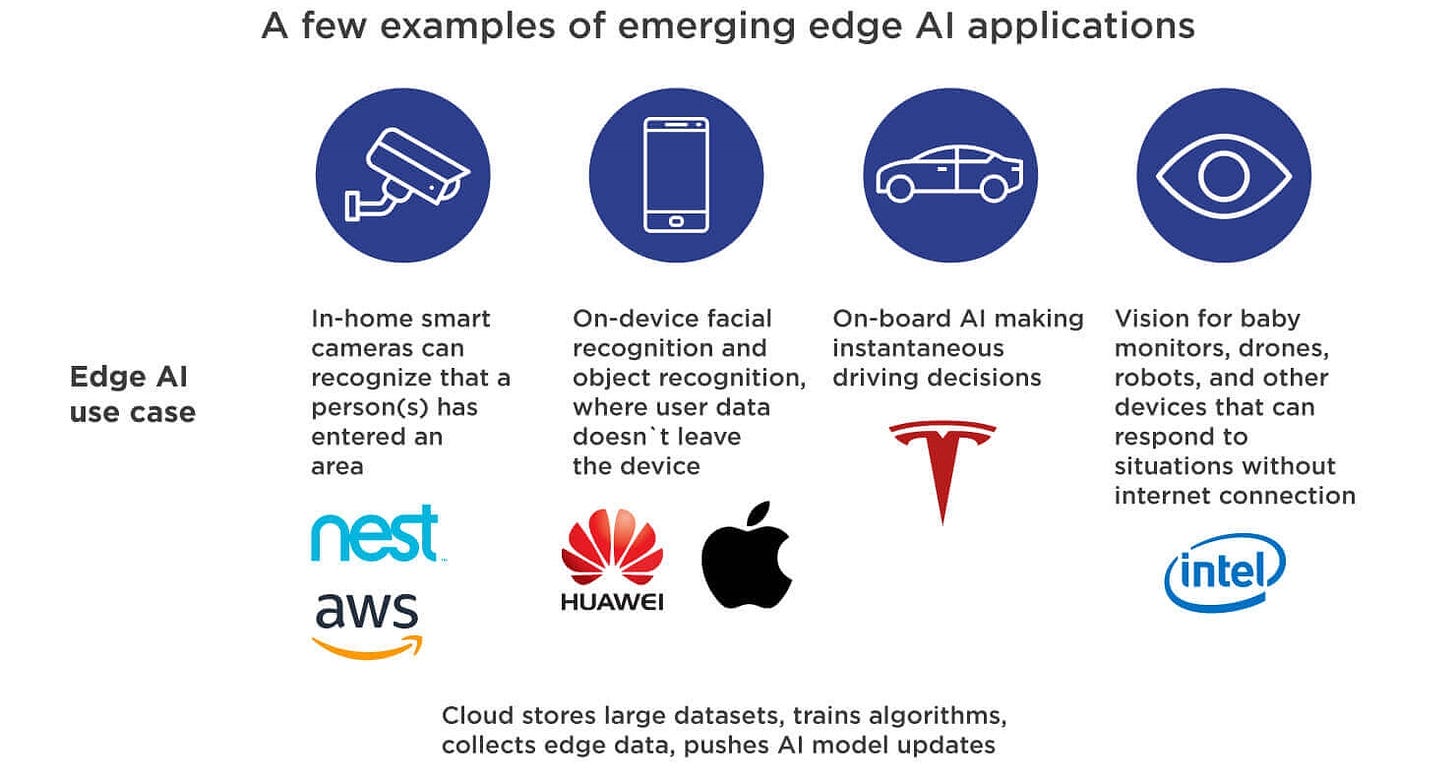

We don't have enough electricity. The third is really the latency, and we want to see much faster respond and reply when you implement an AI solution. We've been investing edge computing since 2018, and now the future of AI is very clear. AI on the edge device, how to really have low latency and no latency on edge device when you're using AI is important. The last is data privacy is huge. It's not only just the simple data privacy on the application layer, but also the whole security of the AI chip, the AI security, AI model, and AI infrastructure. That's what I call opportunity of AI infra. Solve all these four major challenges we're facing right now and make AI not only better, faster, but also cheaper.

Lex Sokolin:

Fascinating stuff, and I think again, there's quite a couple of different topics to unpack. Starting with the application layer, which is you drew the line between consumer and enterprise and suggested that consumer is a very expensive, capital-intensive war and the large, big tech companies are likely to park there. That gives you, enterprise and these different industry verticals, and especially, looking at places where enterprises are more likely to work with small companies rather than the Microsofts and Oracles and IBMs. The question I have for you there is actually, are there companies that want to work with startups instead of the big tech companies? Because I know especially in financial services you have this trap.

The trap is you build, you come out and you say, okay, we're going to do machine learning for underwriting of loans or we're going to do machine learning for insurance claims or we're going to do some sort of artificial intelligence within risk assessment on payments within fraud. What happens isn't that you build a product that lots of companies use but rather that whatever bank you are providing this to ends up capturing the startup. Because the data is on premises, the startup has to deploy their software on premises, they can't reuse the data, it's difficult to productize and then you're trapped in an endless commercial selling process and you've got one big customer that owns you. Can you describe the go-to-market dynamics in what you talked about? What are the examples where an enterprise would prefer a startup but then would also allow the startup to breathe and to build product and not be captured internally?

Lu Zhang:

You're very right that all this large corporate, especially when they own the data, they always want a startup, only work with them instead of working with their competitor, and also be able to potentially buy this company later on with a cheaper price. That's also a strategy for startup founders to consider at the beginning that you never want to sign an exclusive deal with a one major customer. You could work with them, getting them as a paying contract, but no exclusivity. Always keep that in mind because large corporate, of course, they want to take advantage of the smaller startup innovation as well. They know it's harder for them to do it internally so they're looking for a third-party external help. Number one thing is a strategy in terms of negotiation. Second thing is when you design your product, also make it very clear that only working with one company not necessarily make the solution optimized the best.

It's always important to get a diverse, the data source, in order to further optimize the solution. If the customer start saying that, okay, the version upgrade of the product because you are getting more and more customers and also developing more and more use cases, they'll start to also say the value of having this startup working with multiple customers. Of course, you have to show them both sides. If you don't negotiate at the beginning that you take an exclusive agreement, they'll for sure take advantage of that. Everyone knows the key value is within data, they don't want to let go of the data. On the other side, everyone knows they only have limited amount of data within their company, even if it's huge, in order to really make AI solution continue to evolve and also deliver better.

Not only just a huge amount, but also AI need more diverse data, be able to really train model in a different way to make it more capable and cover all different type of use cases. Another thing is really for founder to understand how to fine tune the model. As you said, lots of solution this large corporate looking for is on prem. They don't want you to carry back of their data for your training, but meanwhile, how to really fine tune a model effectively with the customer data and also carry that knowledge over to other training. That's the benefit startup could potentially have when working with large corporate. We already have a couple of successful stories with our portfolio company.

We have a company focused on no-code data platform for financial and insurance industry. Their customer, including millennials, including large bank, also including some large insurance company. While they keep evolving their solution in use cases, customer realize, "Wow, while you are having bigger customer and diverse customer, I'm benefiting also by having new functionality which we didn't think about when you initially work with us." It's definitely a power play. It also involves lots of the negotiation, but I think the education in the market is making customer become more open-minded, and meanwhile, they also realize the value of working with the startup. It's not necessarily just buy them for cheap, eventually. They just enable each other and that they benefit from the solution and also enable the startup company to grow and become a major player in the industry.

Lex Sokolin:

I definitely agree with the point that the large models, the LLMs and the foundational models that have been built are actually quite a lot more performant than the narrow models that have been built on industry information, and so you do need to be able to integrate lots of things from other sources. It is a difficult sales process, it's quite hard to navigate well, but maybe things are changing as well.

Lu Zhang:

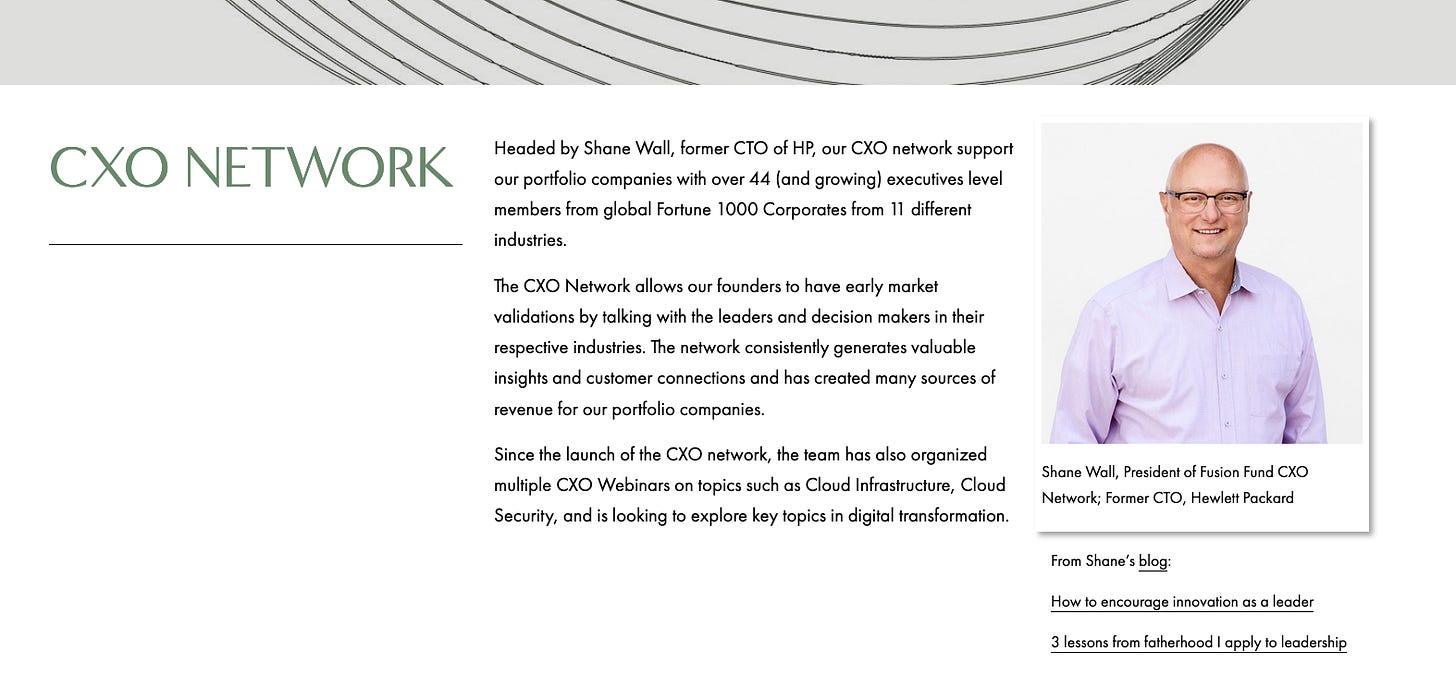

I totally agree with you. It's not an easy sell cycle, and there are lots of pre-education need to be done. Another thing is identify who is the right champion or cheerleader for the startup companies inside a large corporate. Some of the startups directly go with CIO who's in charge of IT, try to get a piece of IT budget. Sometimes it works, sometimes it could be very difficult because there's a cap of IT budget. For us, we are also focusing on part of our portfolio support effort is building up another community to help founder with corporate sales. We know all of our company are doing B2B, they're doing corporate sales, and the challenging part is now part of building, they're awesome at building a really great product about how to identify the right people to start engaging and especially people who are making financial decisions. We built this network called Fusion CXO Network.

One of my partners, Shane, he was a former CTO at HP. We, together in 2018, build this network. Now we have over almost 44 CTO from global 1,000 company. Why CTO? Because CTO typically have technical background. CTO's functionality in large corporate is really identify new technology and also champion for digital transformation, push for digital transformation internally. Their budget is dedicated to working and trying new things. The good news is we heard their budget is keep growing and getting bigger because all the large corporate want to build up their own data strategy. They want to show that not only they're a leader in the industry, but they also have lots of valuable data. They could build different type of productivity improvement to internally, and even just realize the value of the data for the company future growth. They want to implement with new technology. We have this community built up, then we'll be able to feature our founder in front of all the CTO who have budget ready, who are looking for solution directly making the matching.

That's one thing we'll offer to the founder. I would suggest to founder when you are working with investor, also looking for investor have strong industry connection and industry understanding, then they will be your very good partner to help you shorten and also make the corporate sales cycle much, much faster. We have lots of company be able to recently have AI. It's also a company using AI for the financial industry to close the contract with one of the top Fortune 500 company, and it's a huge contract size, but the team, it's only team of seven. That's how we really help founder, but also, we see founder explore different creative approach to get a conversation start. You're right, it's hard. It's always hard but it could be better and it's getting better.

Lex Sokolin:

You mentioned also infrastructure as a place to invest, and of course, there's lots of layers of infrastructure within artificial intelligence. I'm curious as to the industry landscape and the value chain on the AI infrastructure side, especially as you invest. Are companies being built to be acquired? There's a handful of large tech companies that can acquire things, or are they being built to go IPO? Like today, in a world where Nvidia is 3 trillion in market cap and where Meta is open sourcing its models in order to suffocate everybody else, what is today the capital path of an enterprise AI company that's trying to build infrastructure?

Lu Zhang:

First, the AI infrastructure is different from AI model. We're not looking at a company building models. For AI infra, yes, it's evolved, chip, but on the other side, I don't think we are not looking at any company try to directly competing with Nvidia. I was a material scientist at Stanford, so I know the technology within chip very well. I don't think in the near term it's easy to challenge both Nvidia, AMD, on their position to dominate the silicon. There are lots of things could really work alongside with their chip, with their innovation to make, as I said, not only the compute cheaper and better and faster, but also, cheaper. That's opportunity for startup. Meanwhile, because there's a system, this is an ecosystem surrounding the whole AI infra, how to really solve one problem, how to solve other problem is now based on only one technology. Each layer needs a solution.

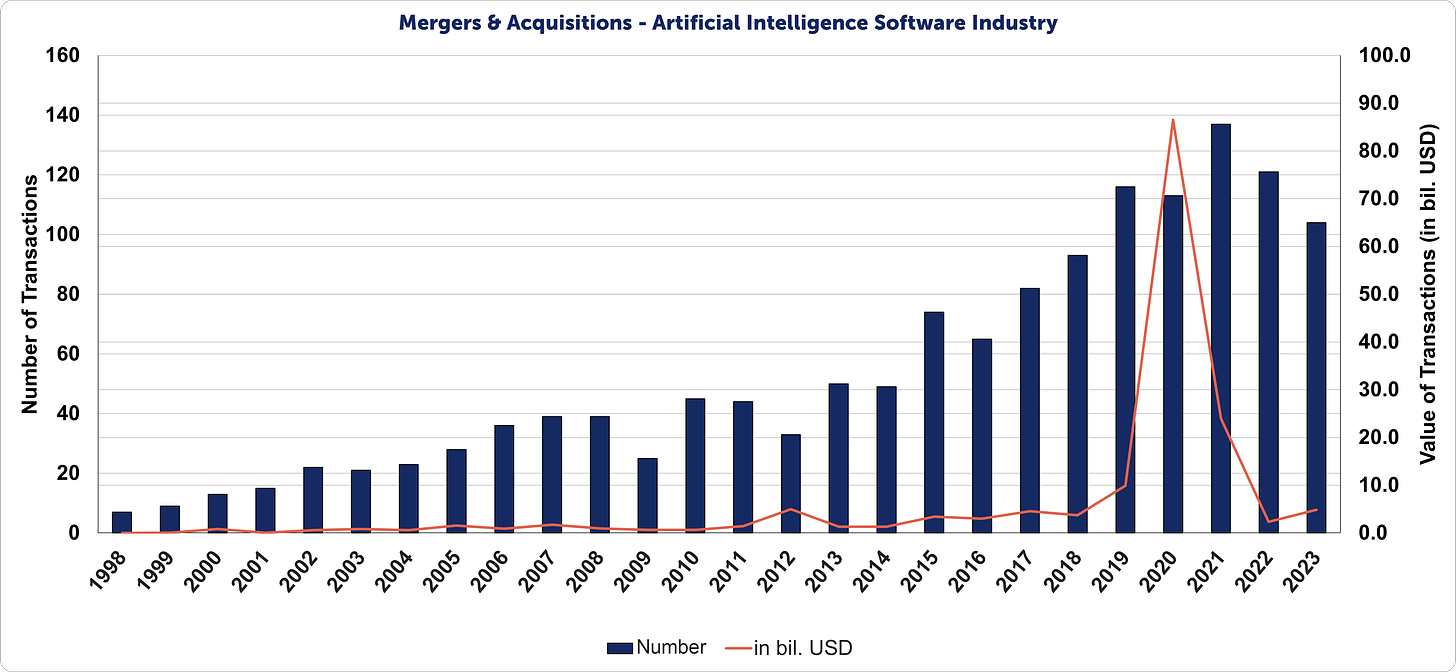

You initially asked whether a merge acquisition or IPO is. I think for both there's tons of M&A opportunity right now. We're looking at the data for the upcoming M&A. There's more and more buyer between 0.5 billion to $1.5 billion range. That's very different from the past. When I sold my company back in 10 years ago, couple of hundred million dollars is considered as a really good merge acquisition size. Because most of the buyer won't pay such a high price to acquire a company. Nowadays, it's different. If the merge acquisition price could go up to a billion-dollar mark for early-stage investor, even for a startup founder, that might be a really good exit already compared with waiting for a small cap IPO, two to $3 billion IPO, which are not performing very well in the market. Meanwhile, IPO market continue going to be opened up and also providing us of opportunity to infra because AI infra solution is across industry.

We talk about application first. As I mentioned, we're looking at application more like vertical-focused application because you don't want to use one big model for every application which is not cost-efficient. You want to have vertical-specific model to solve specific use cases, and that vertical potentially could grow certain unicorn and become market opportunity. If you look at AI infrastructure, one solution is not only focused on one area, it's focused across all different areas. If you could reduce the energy consumption by 100X, 200X, if you could reduce the GPU consumption dramatically, that is huge. Also, then definitely creating not only just 10, $20-billion company to up to 50 billion or even higher. Another area I really, really focus on is really another two area, edge computing and also the data privacy. Now, for lots of the large corporate, before they implement any AI solution, they have to implement some data privacy solution in place to make sure there's no liability concern.

Lots of the industry we just mentioned, the healthcare, insurance, financial, they have something in common as they're highly regulated industry in history. Now with this new AI play, they want to make sure they're not a liability concern before the implementation. Network security, data privacy, is number one thing to consider, and then follow that is edge computing. As I said, the future of AI is AI on edge devices. If you talk about edge devices, oh, my God, there's so many edge devices. It's not only just cell phone, car is edge device, speaker is edge device, projector is edge device. We have so many edge devices in our life, and we want to empower all of them with a small model AI in the future. One of our companies just launched an open-source model two weeks ago. It's the first open-source model could run on edge devices, it's super, superfast and surpass the performance of GP4 and also 37X faster than Llama 2.

The latest one they launched; the token size is only less than a billion. Think about the Llama 3 launch, they still have 7, $8 billion token. Think about the GPT4, there's trillion tokens in training. They only need less than a billion token, which is very low-energy consume, and also, it's very low-GPU consume. They'll do some major announcement today, I forgot, I don't know whether they launched it yet, but it's quite amazing they could run it on such a small device, including like Raspberry Pi. Basically, you could run AI on any different type of smaller devices. That's the future and think about that future. That's definitely big enough to supporting IPO company. For us, as an investor, we're pretty flexible.

Not only me, all the partner I recruited, we're a former entrepreneur. We either sold our company in the past, our supporting company go IPO. We are very flexible and also always supporting founder to make decision, pro and con, which stage, whether you should take much acquisition offer, I'll continue to go with IPO. That's the beauty of this market. We still expected not all company going to go IPO. For the company we invested, probably 70% of them going to exist through Merge acquisition. The top 30%, they'll go for billion marks and the potential aiming for IPO. Merge acquisition could give us good return as well, same thing for the founder. That's a really nice dynamic to have in this financial market.

Lex Sokolin:

There is a lot of flexibility of being able to run your capital in these different ways. When you look at AI infrastructure today, in the value chain, what are the places where you see gaps? I think on the application side it's doing the use cases better, but on the infrastructure, where do you see gaps that are not well-served?

Lu Zhang:

I think all the four, although we're very passionate about company we invested, but we're still hoping to see more company coming into solve all this potential challenge with the AI infrastructure. Even before we talk about AI infra, even for the model side. I think now all this large language model, standby, OpenAI, all this company backing by the large tech company was huge amount of capital. The competition is still within, okay, who delivered the better performance? I wonder, we also need to start thinking about who can create a model with the lowest cost and to make it really cost-efficient and also energy sustainable. Maybe compromise performance a little bit, but it's more practical.

For large scale AI deployment, we need to be practical of the cost of technology and also the energy consumption. Coming to the AI infrastructure, if the model is not evolving to that direction, then we need to do more on the AI infra side just to fundamentally make it cheaper and affordable and also easy to scale for people to leverage. Edge computing being there for a long time, we've been investing edge computing since 2018. I think now there's more opportunity within edge computing right now and want to see more innovation happen there. I think there's lots of good innovation within data privacy already, but this is also a sector keep evolving, like Kubernetes, container security, edge security. There is always a gap, there are always opportunity for founders to potential focusing on.

Lex Sokolin:

What does the world look like where all edge computing devices have a fully functional Llama model that is able to do GPT4, GPT5-level performance? Does that mean all of our phones are going to have a local sort of private model that we train in our data or is it going to be the Amazon speakers or is it the toaster in the fridge are going to have a robot voice? What is it going to look like in your view?

Lu Zhang:

Yes, that could all be possible. The number of fun thing as you mentioned that you'll be able to have a local private model and the train on top of your data. The benefit of it also partially solves the data privacy issue. Everything is local, it's on the edge devices, and also, the response will be much faster because the latency issue won't be that big or even just a no latency or low latency. Also, the AI solution could be small model and also more versatile based on different application use cases. Sometimes when we use AI, it doesn't mean it has to have a voice or a robot voice interact with you. It's more about we want to enable the edge device not only collecting data, but also process the data, locally respond to you right away. It could be just showing on the screen, and you could type in information and got the information right away.

It could be just a very quick personalized calendar management. That's all possible. I think that's a big opportunity in front of us, and the number one thing we need to make sure when you're running that AI on your local device, you are now just burn out your battery right away. Going back what I keep highlighting why we need to focusing on not only the GPU consumption, but also the energy consumption. You want to make sure it's a sustainable and also it could last for a certain amount of time when you're using AI on the edge devices. Meanwhile, another thing is our car. Car is another potential big edge devices for us when you implement AI.

Lex Sokolin:

How do you think about the economy that will emerge between models and AI agents as the next step? We're going from this world of supercomputers to lots of personal computers, in the same way we have right now these supermodels that are gigantic structures to anybody will be able to carry around in AI in their pocket, if not dozens of AIs or hundreds of AIs in their pocket. What kind of commercial activity happens when that world is there, and that decentralization is possible?

Lu Zhang:

I really believe the coexisting of the large model and the small model, we don't need to, and also, I don't think it's really cost-efficient to just try to use one model, solve all the problem. There'll be tons of vertical models, smaller model for a specific application, and they will work very well. You could fine tune this model for specific tasks and application will work much better than the large model. It'll be coexisting of the large model and small model. As you said, you potentially could carry your own model on your edge devices and go with you, it will serve you very well.

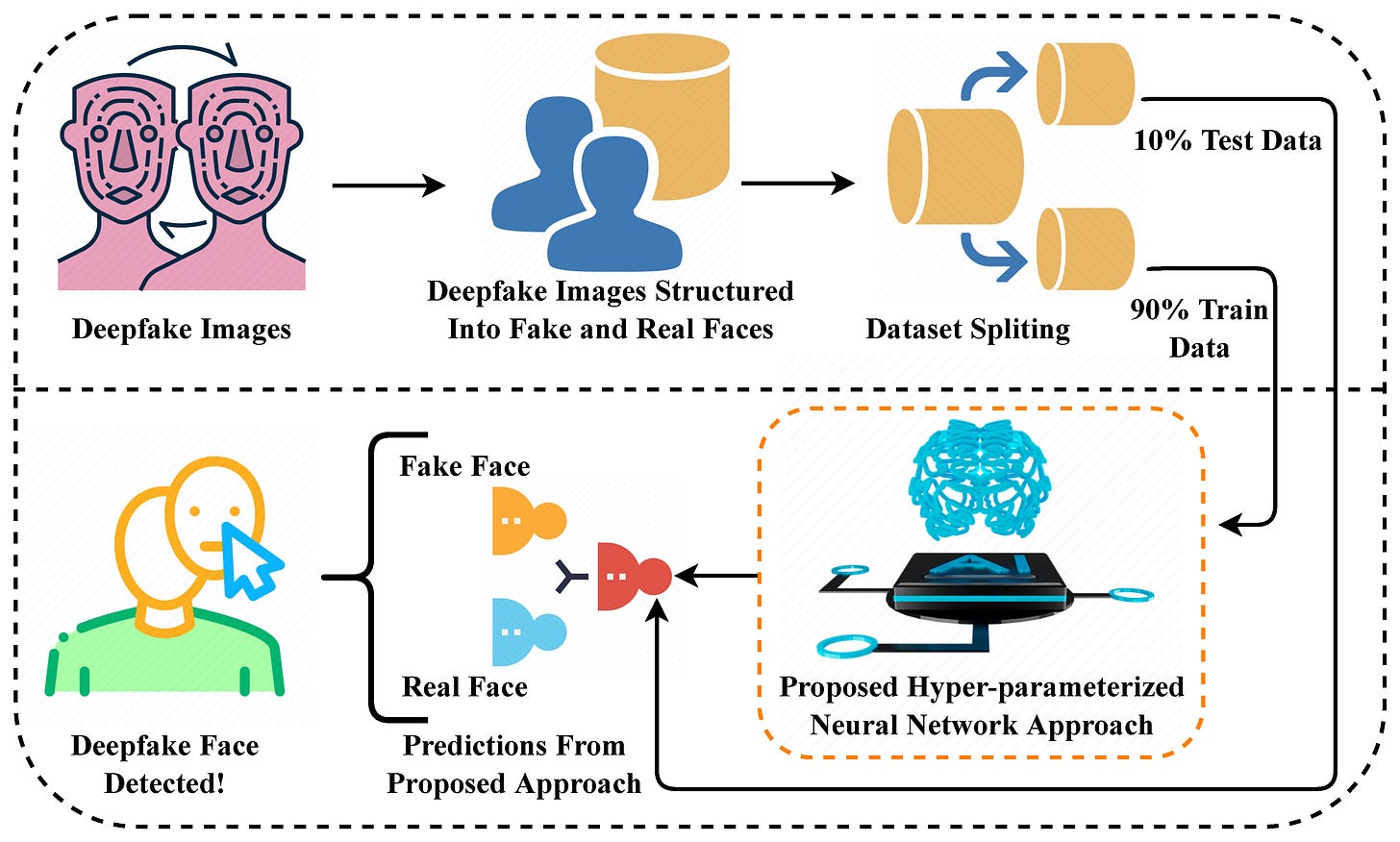

That's happening and I truly believe that will be the future of the language model. Meanwhile, another thing is we need to think about how to handle this private model and the open-source model. We're a big supporter of the open-source model, but meanwhile, regulation is coming for the AI. Maybe, essentially, I think also regulation coming for the data, and open-source model definitely is very powerful. Meanwhile, we really always need to keep the regulation in mind and how to make sure we have the genie is in the bottle, but once we open it up, make sure it will continue to serve as well instead of going to the other direction. We actually are looking at some company also using AI model to detect the fake information generated by AI. There's a two-way to look at it.

Lex Sokolin:

When you look at revenue pools for AI companies, and I guess this is more on the application layer and enterprises that are willing to pay for AI services, how do you think about the available revenue pools? What's the process by which buyers of machine intelligence allocate capital to say, this is how much we're going to spend, and then what's the size of the economic opportunity for these enterprise AI companies? How much do they get on average from a customer? I know you don't have access exactly to this data, but I'm sure you think about the economic revenue pools. In part, the context for my question is it's taking a bit of time for many enterprises to understand really the value proposition. I'm curious as to what the market size is and how productized things can get versus how services-oriented they are, and if you can share any examples from your portfolio that would be great.

Lu Zhang:

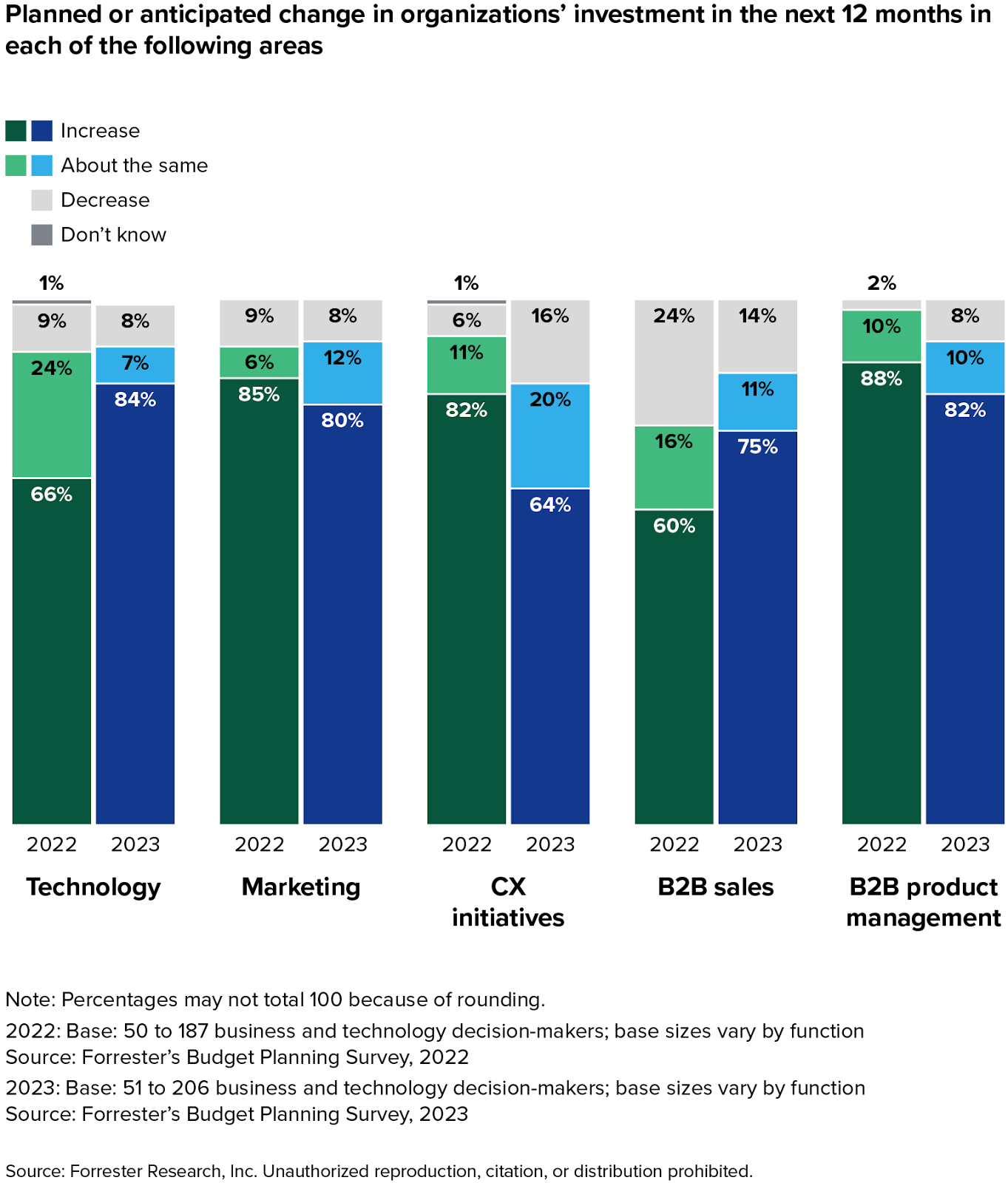

We couldn't share the specific name of the customer, but I could give a generic summarization of the momentum we saw there. The number one thing we found is loss of the CTO of the large corporate. Their budget used to be smaller, couple of hundred million dollars. Now some of them their budget increased $2-billion mark. When they have a billion-dollar mark type of budget, which also means a majority part of it going to allocated to the AI focused solution that they want to give contract on much acquisition. That's kind of the rough number within the company. They're increasing awareness in order to understand how to implement with it. Another thing I heard from many CTO from large corporate, I mean Fortune 100, of Fortune 500, is the CTO are getting questions from the board, and not just quarterly based on the board meeting, even monthly, checking what is new in AI, what should we do in terms of implementation, which also means awareness is strong right now.

Also, they could keep learning and also educate themselves. They also worry about their competitor, how much their competitor= is spending on AI, how much their competitor is with new technology integration. One major customer, one benchmark culprit in certain industry start to utilize AI since we'll move much faster for the rest of the company. Internally, I think lots of the founder-specific positions themselves coming in saying that I'm going to help you save the cost. It will work, but it's not working the best. We always found company came in using a solution to justify both their generating revenue and also saving the cost would easily getting a budget allocated to try out the new solution. Education is still ongoing. I know lots of large company are doing their internal education program, understanding how to use AI even for their employee, like employee on the front end understand all these different AI too.

We're seeing lots of interesting data point here or there. Of course, it's not happening like all industry already open up want to really embrace the AI and be able to quickly implement. It's not happening yet, but it's evolving and lots of discussion on the board level and they're trying the solution already. We do have many AI application company serving the traditional sector. They're signing contract up to even $6, 7 million as a seed-round startup. It's always insurance industry. I could give you that context. Insurance industry is now known for open-minded, but they have lots of data. They need productivity improvement, and they can quickly see the value of the AI when they start to integrate it. The startup company be able to set up to $7, 8-million contract even before they consider series A round, so things are happening. Another one I mentioned too is the AI for financial industry. We also have AI for logistic industry. The contract figure is already double-digit, over $10 million. The one small company, as I mentioned, the contract they're signing, the total potential upsell value is like a billion-dollar mark, which is crazy.

Lex Sokolin:

We're coming up on time, but I want to leave you with one last question, which is in this space that we've been discussing in detail, what companies do you want to see get started and built that you haven't seen yet? If you wanted people to pitch your ideas, what it's like the top idea that you think you'd love to see companies in but just haven't yet?

Lu Zhang:

You mean within AI in general or just a specific AI infra?

Lex Sokolin:

Broadly in your AI investment thesis.

Lu Zhang:

Broadly in our AI investment thesis, to be honest, I think other sector were interesting. We're seeing some company pitching to us already. It's hard to pick one sector we haven't seen any, which is also a good time. Lots of company are working on different type of innovation. If you ask me which sector I want to see more, I would say I really want to see more company focus on the reduced energy consumption of the AI. It's a huge market, it's a big market and also, it's an important problem to solve before we could really implement the AI across the industry. Another thing, we've been talking about ESG for a long time, and people was hoping that AI would make the sustainability better. In reality, it's making it worse. I really hope to see more company focusing on that.

Lex Sokolin:

Absolutely. Well, Lu, thank you so much for taking the time today to share your insights with us. If our listeners want to learn more about you or about the fund, where should they go?

Lu Zhang:

If you want to connect with me, feel free to find me on LinkedIn and connect with me. If you want to directly email us, go to our website. We'll have contact form that you could fill up to be in touch with us. Another thing is we also have a happy hour, we're hosted for the founder by my team. It's not for founder to pitch, it's for answer any questions you may have. We want to really offer this back to the community, helping founder figure out some initial questions they have working with VC or just running the startup.

Lex Sokolin:

Fantastic. Thank you so much for joining me today.

Lu Zhang:

Thank you for having me.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Podcast: What makes a successful AI investor, with Fusion Fund Founder Lu Zhang