Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS. If you enjoy it, throw us a rating here — it helps spread the word!

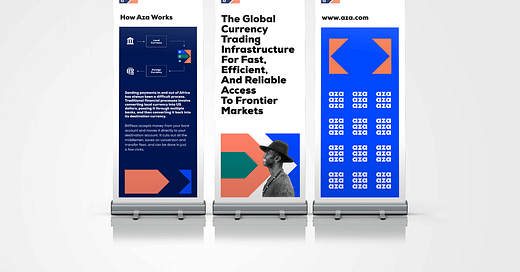

In this conversation, we chat with Elizabeth Rossiello – the CEO and founder of AZA, an established provider of currency trading solutions which accelerate global access to frontier markets through an innovative infrastructure. Elizabeth founded the company in 2013 in Nairobi, Kenya and has expanded it to 10+ markets across Africa and Europe.

Before founding AZA, Elizabeth was a rating analyst for microfinance institutions across sub-Saharan Africa, consulting for Grameen Foundation, Gates Foundation and the Acumen Fund, as well as working with regulators and policy-makers on legislation for financial innovations. Elizabeth co-chairs the World Economic Forum's Council on Blockchain and holds an M.A. in International Business and Finance from Columbia University.

More specifically, we touch on ratings agencies and the activity of rating intitutions, M-Pesa and how it influenced the thinking towards a crypto-centric future, Africa’s banking landscape and some of the outstanding issues it faces, Bitpesa and how it became Aza, banking infrastructure in Africa, and so so much more!

Go deeper in Fintech and DeFi by upgrading below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?

Sneak Peek:

Elizabeth Rossiello:

…we were called BitPesa for any OGs listening in. We changed to AZA a few years ago because Pesa is a Swahili word and similar to east Africa, and we moved heavy into west Africa and other markets that didn't associate with that word. And also, it was one of our products. So, we kept it as that, instead of just the brand name. But when we started, the idea was why can't we take what's successful here in Kenya and share it with the rest of the world? And what's successful was instant ability to pay. Ability to pay when you're not in person, almost like a PayPal like ability to pay, but connecting to all of your banking needs with your phone. And then how do you do that internationally?

Because PayPal at the time, and I just saw Dan Schulman last week and he was like, we're in Kenya. They were not in Kenya in 2013. There was no way to access PayPal. There was no way to access American Express or Swift would take two weeks. So, we wanted that technology to be used, which now seems very old fashioned, but wasn't available then. And if you wanted to…

More? So much more!

Subscribe to our podcast on Apple Podcasts or Spotify

What did we miss? Reach out here anytime.

Stop by our Discord!

Like it? Share it!